Explores how the U.S.–China Tech Cold War is reshaping global power as AI export controls, semiconductor restrictions, and diverging digital standards disrupt supply chains, investment flows, and security dynamics—accelerating technological fragmentation and redefining the future of global technology.

Introduction: U.S.–China Tech Cold War

The U.S.–China Tech Cold War has become the most defining geopolitical and technological rivalry of the 21st century. As AI surpasses traditional military and economic tools in shaping national power, the tech rivalry between the U.S. and China is accelerating across semiconductors, cloud infrastructure, advanced compute, and dual-use technologies. This U.S.–China technology conflict is no longer limited to strategic competition—it is reshaping global supply chains, investment flows, and technological standards.

1. Why the U.S.–China Tech Cold War Is Intensifying

The Sino-American tech rivalry is intensifying as both nations race to secure dominance in AI, quantum, semiconductors, and cyber capabilities. Washington seeks to restrict China’s access to advanced compute, military-grade AI models, and critical semiconductor tools. Meanwhile, China is accelerating domestic innovation, investing heavily in indigenous chips, and expanding civil-military AI integration. This escalating cycle fuels global uncertainty and technological fragmentation.

The CFR Task Force on Economic Security (2025) states: “Sustaining U.S. leadership in foundational technologies—AI, sensing, quantum—is essential to maintain strategic advantage amid rising geopolitical competition.” The 2025 CFR report confirms export controls now aim to preserve U.S. technological edge, secure sensitive supply chains, and constrain China’s military AI modernization.

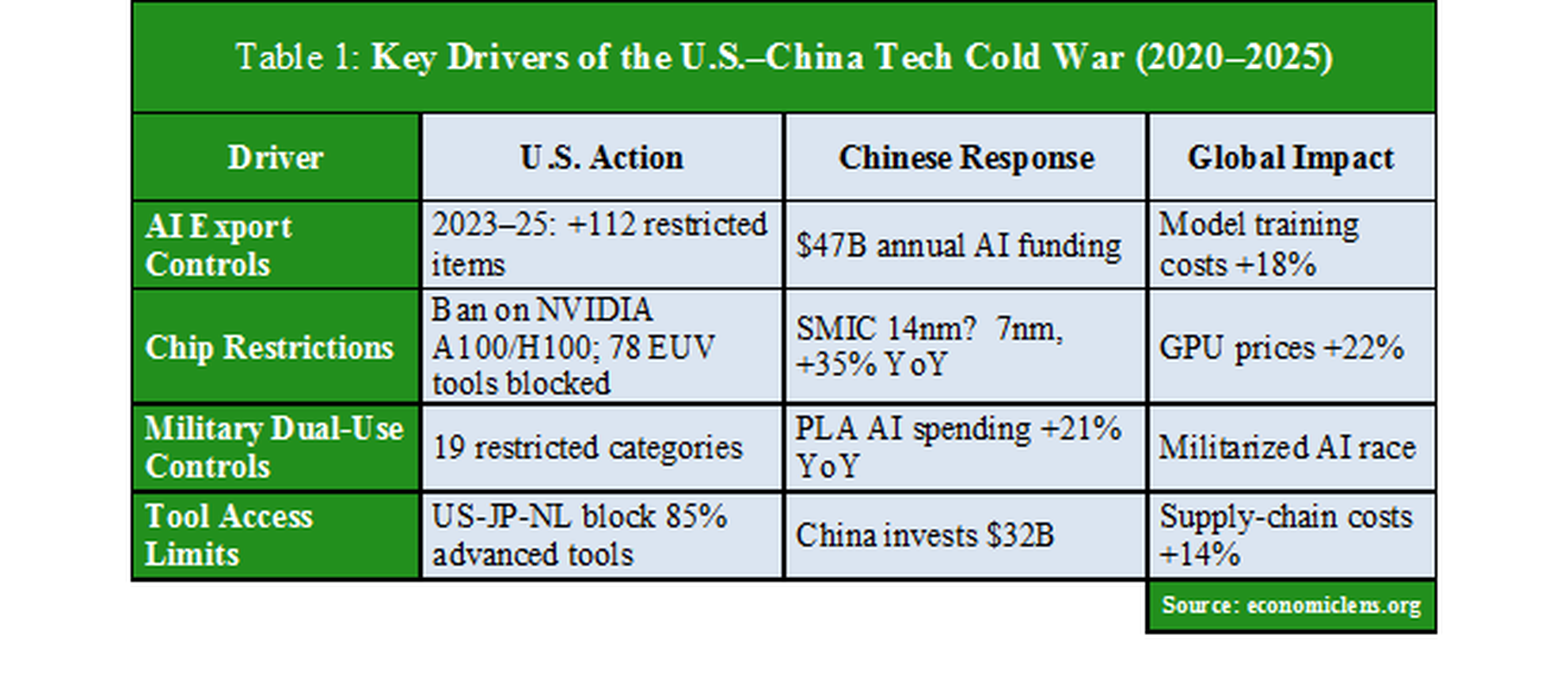

This table illustrates a mutually reinforcing escalation: U.S. controls trigger Chinese investment surges, which in turn provoke additional restrictions, widening the global tech divide.

“In a world where technological power dictates national strength, those who understand the stakes will write the rules—and those who don’t will be forced to follow them.”

2. Economic Consequences of this U.S.–China technology conflict

AI export controls are reshaping global markets. By restricting access to high-end GPUs and advanced compute, the U.S. is forcing companies to redesign supply chains and recalibrate AI strategies. This fragmentation increases costs, slows innovation cycles, and triggers market bifurcation across cloud, hardware, and digital services.

The Information Technology & Innovation Foundation (ITIF, 2025) warns: “Overly broad semiconductor controls may weaken U.S. chipmakers more than China by undermining revenues critical for innovation.” ITIF estimates that full decoupling could cost U.S. chipmakers $77B in first-year losses and reduce R&D spending by up to 24%—slowing future competitiveness.

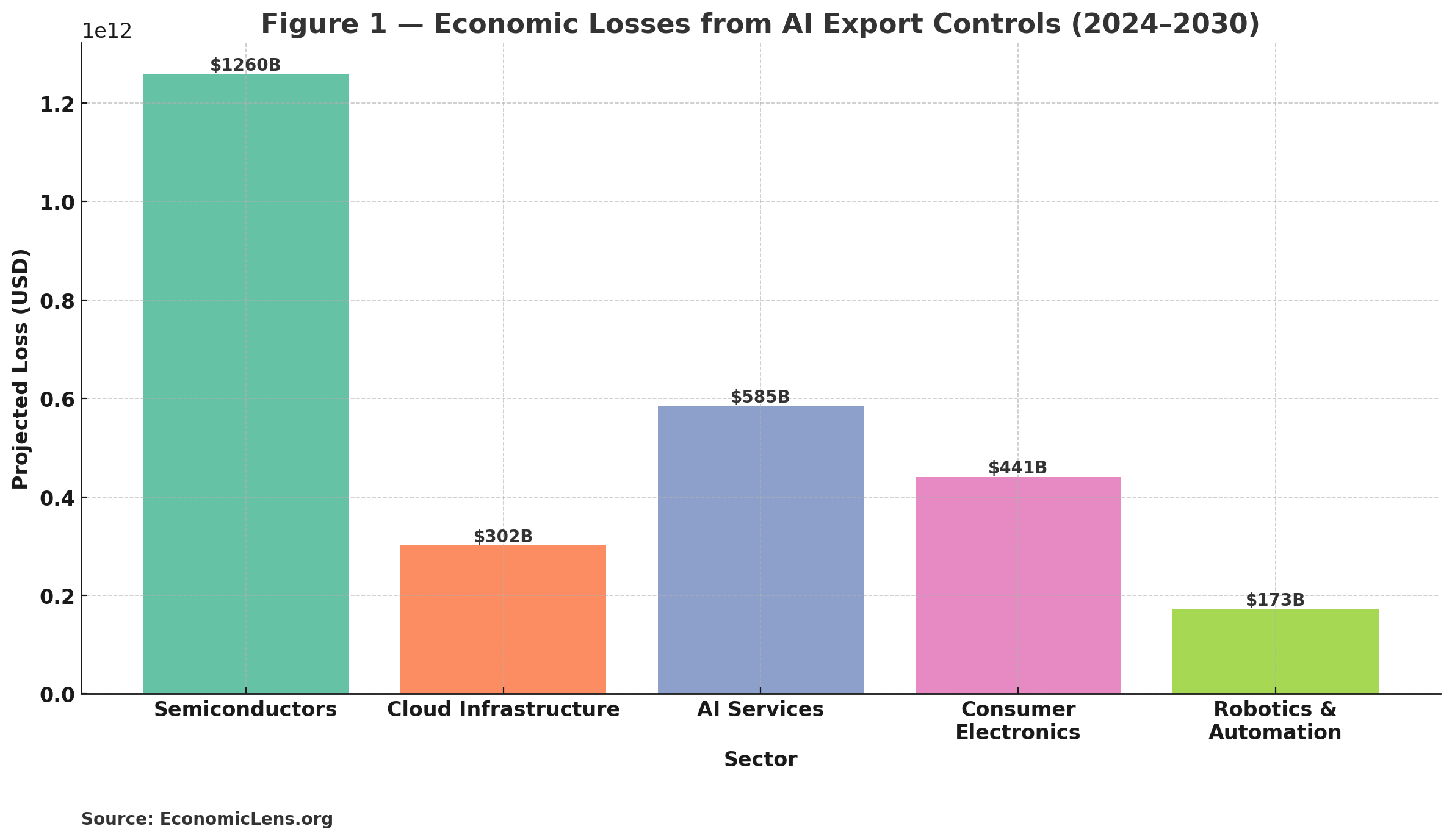

Losses are highest in semiconductors and AI services—industries that rely on cross-border innovation and access to specialized compute resources.

“Technology barriers built today become economic barriers tomorrow. Economies that anticipate disruption will lead—those that don’t will fall behind.”

3. Semiconductor Vulnerabilities in the Tech Rivalry

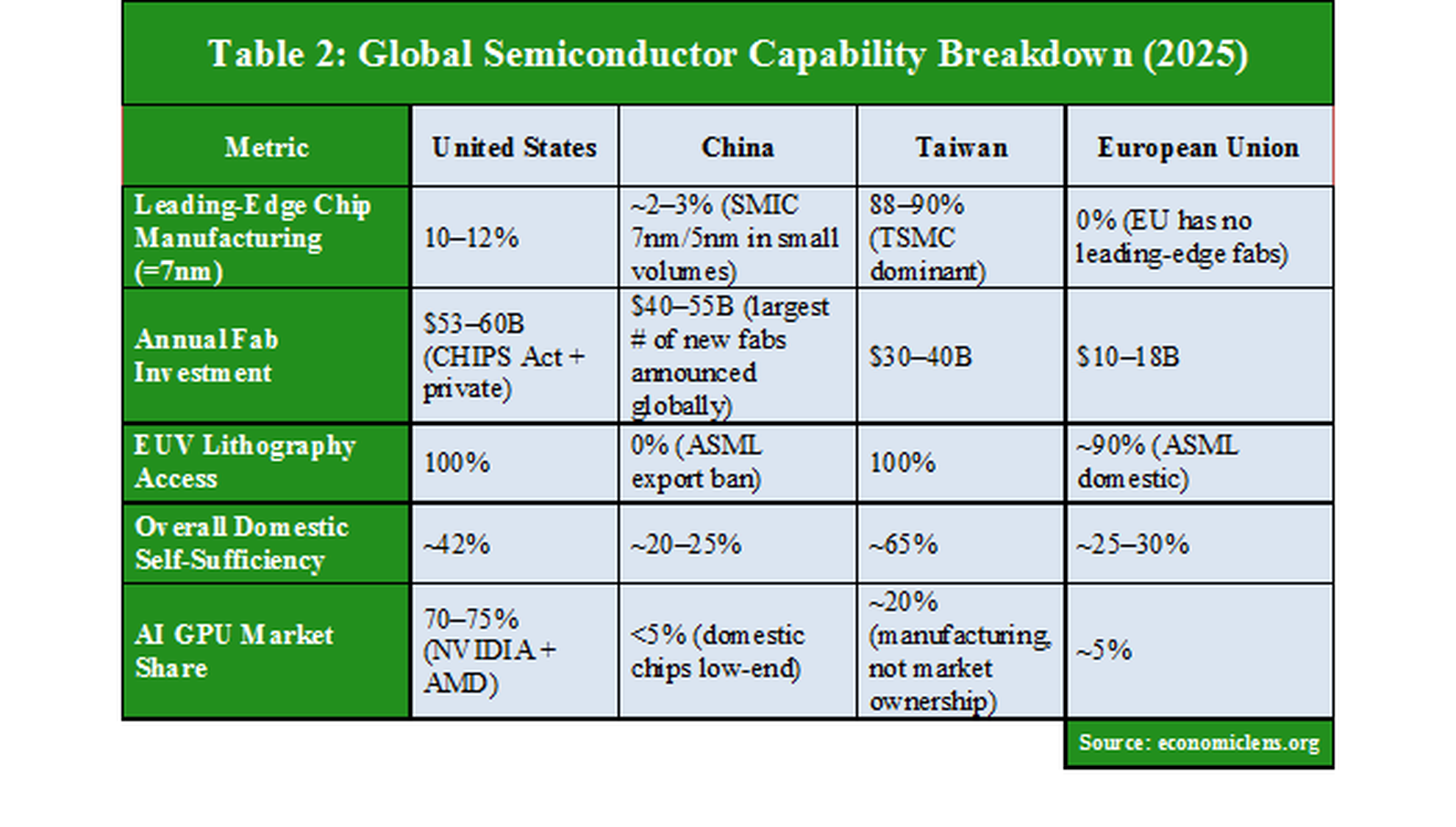

Semiconductors are the backbone of the great-power AI competition. Taiwan’s dominance in leading-edge chips, combined with China’s lack of EUV access, creates systemic vulnerabilities. As Washington restricts China’s tool imports, Beijing intensifies domestic fabrication efforts, widening technological bifurcation.

ASML CEO Peter Wennink cautions: “Advanced chips are turning into geopolitical leverage—yet overuse risks splitting the world into incompatible technology blocs.” MIT’s 2025 semiconductor review confirms China remains 8–10 years behind in the most advanced nodes due to lack of EUV lithography equipment.

The semiconductor gap demonstrates why the U.S.–China Tech Cold War increasingly revolves around silicon: whoever controls advanced chips controls the future of AI.

“Chips are the new geopolitical currency. Nations that secure them will shape the next era—those that fall behind will inherit vulnerabilities they cannot afford.”

4. Corporate Exposure in the U.S.–China Technology Conflict

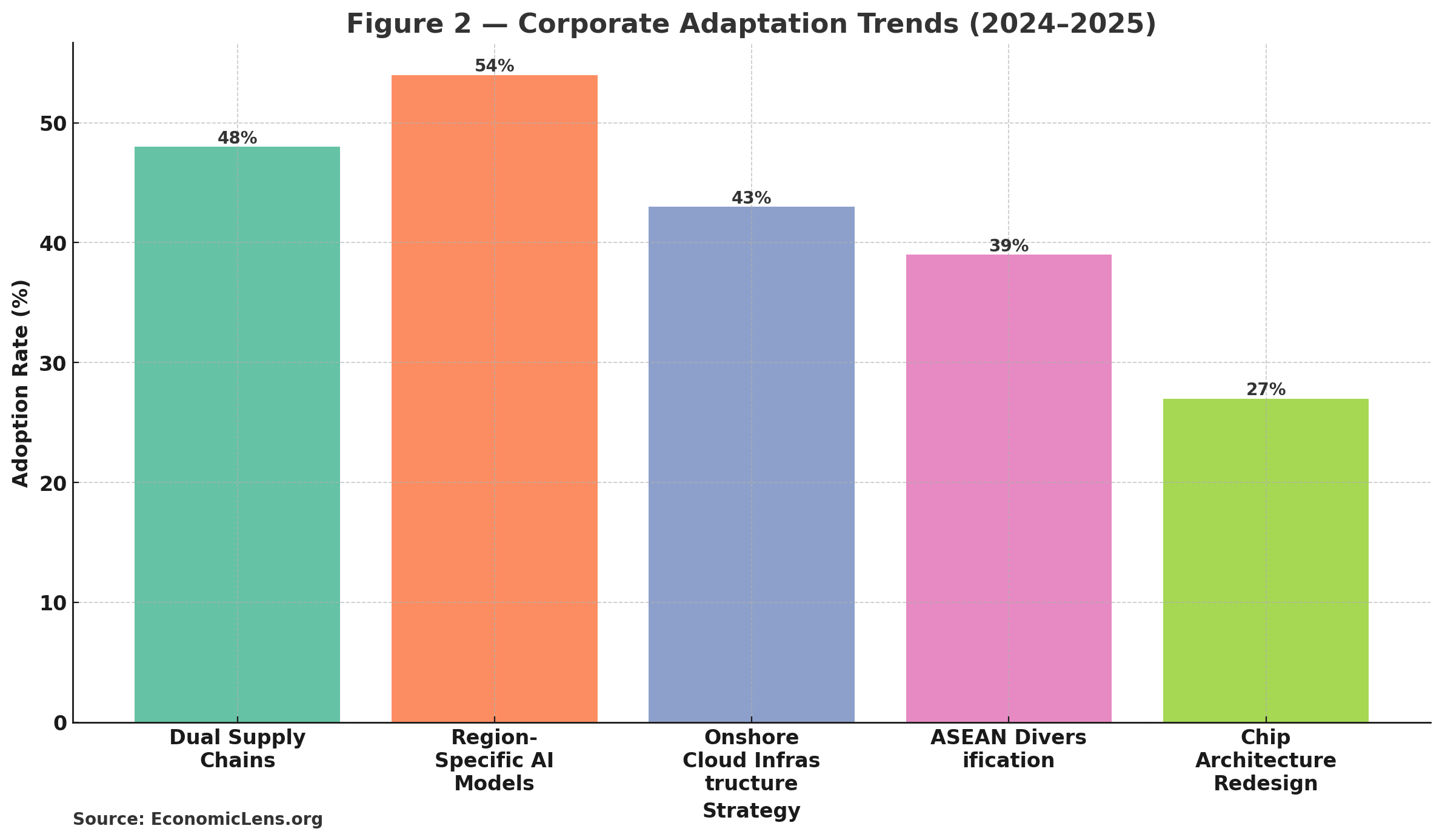

Companies are now forced to navigate divergent AI standards, data laws, and compliance risks. Many firms operate dual product lines—one compliant with U.S. rules, another with China’s ecosystem. This transition increases operational costs and strategic uncertainty.

A McKinsey strategist remarks:“This is not a simple supply-chain shift—it’s a full-scale architectural reset of global technology operations.” Deloitte’s 2025 Tech Survey reveals over 60% of global firms anticipate long-term market bifurcation, driving aggressive restructuring.

Global firms are restructuring technology stacks, supply chains, and market strategies—accepting higher costs to ensure compliance and continuity.

“In a divided tech world, agility becomes the strongest corporate advantage. Firms that evolve rapidly will thrive; those that hesitate may disappear.”

5. Geopolitical Fallout of the AI sanctions and export controls

AI is now central to cyberattacks, autonomous weapons, intelligence operations, and global influence campaigns. Both the U.S. and China are rapidly integrating AI into military strategy, raising the stakes of digital confrontation.

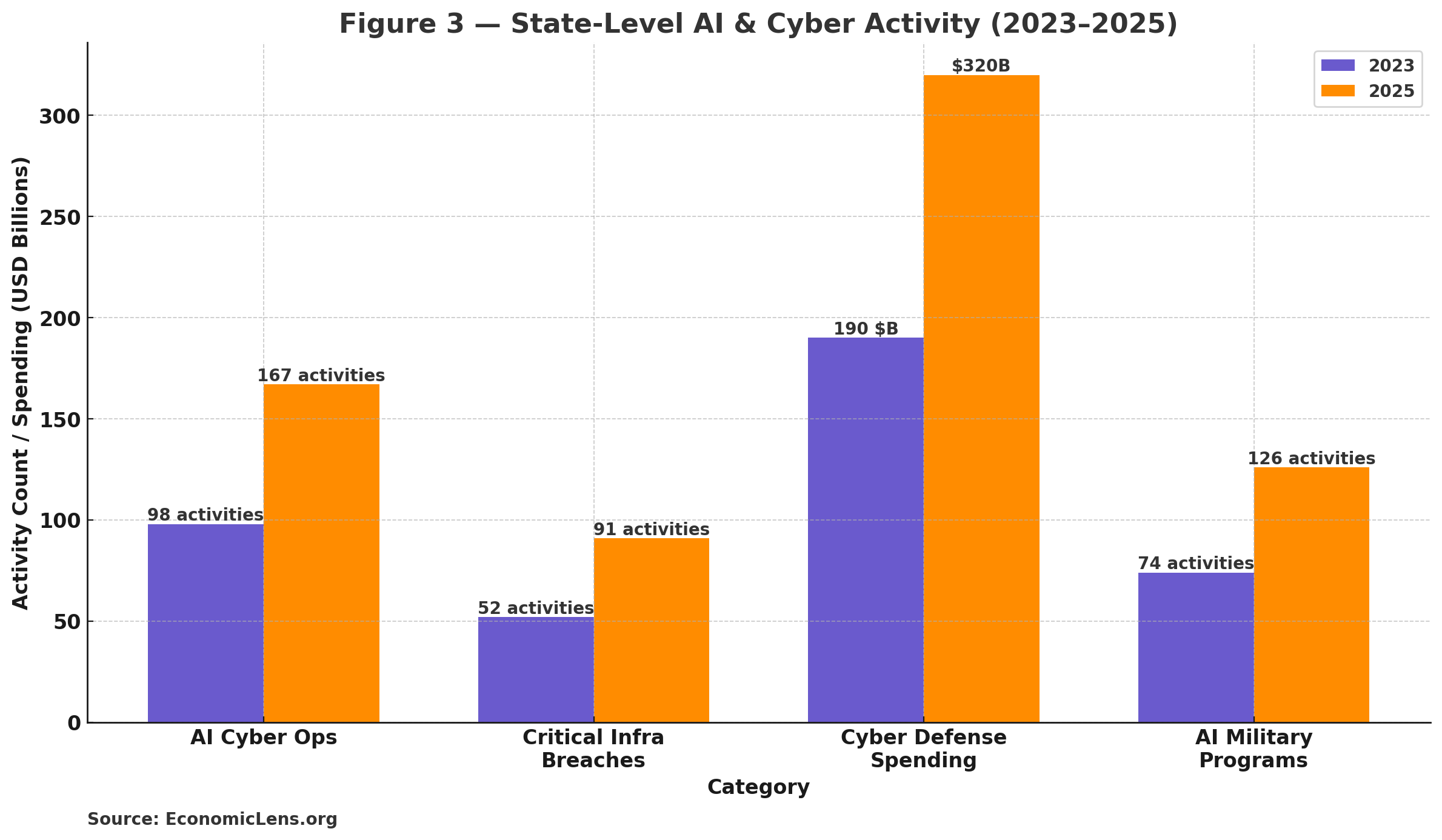

A CSIS cyber analyst states: “AI is reshaping deterrence, escalation, and conflict faster than any technology in modern history.” SIPRI’s 2025 report shows a 70% surge in state-backed AI military programs since 2023, signaling escalating digital militarization.

Rising AI-driven cyber activity shows how the U.S.–China Tech Cold War is no longer a competition—it is becoming a digitally enabled global battlefield.

“As AI becomes a tool of statecraft, understanding the digital battlefield becomes a strategic shield. Awareness is no longer optional—it is national defense.”

6. Policy Implications for the great-power AI competition

Export controls must transition from broad restrictions to precision-based, coordinated strategies. Supply chains must evolve from “just in time” to “just in case,” emphasizing redundancy and friend-shoring. A “Tech NATO” approach is needed to align semiconductor policy, AI standards, and cyber defense among allies. AI governance frameworks—testing, auditing, and safety protocols—must evolve faster than model capabilities. Nations must aggressively invest in R&D competitiveness while building “always-on” cyber readiness. Economic planning must anticipate long-term fragmentation and regulatory divergence.

“In an era where chips, code, and compute determine national strength, policy is no longer paperwork—it is the frontline of global power.”

Conclusion

The U.S.–China Tech Cold War is reshaping global systems through competing technological standards, fragmented supply chains, and accelerating AI militarization. The world is moving toward a dual digital order where technology choices determine strategic alignment. Nations that secure critical technologies, modernize governance, and build resilience will remain influential. Those that fail to act risk instability, weaker competitiveness, and diminished global relevance.

“The future will belong to those who recognize that technological power is now geopolitical power—and act before the divide becomes unbridgeable.”

Call to Action

As the U.S.–China Tech Cold War intensifies, governments and industries must strengthen digital resilience, secure foundational technologies, and prepare for deeper fragmentation. Decisions made today will determine tomorrow’s stability, competitiveness, and global leadership.