Middle East oil volatility continues to escalate as regional conflict disrupts supply routes, increases risk premiums, and drives global energy insecurity. This report examines how rising tensions, chokepoint disruptions, and geopolitical instability amplify inflation, worsen debt burdens, and threaten global fiscal stability.

Introduction

The resurgence of Middle East oil volatility has become one of the most disruptive forces shaping global economic conditions in 2025. As regional tensions escalate, disruptions to shipping routes, energy infrastructure, and maritime security are increasingly affecting global supply chains. Consequently, rising geopolitical instability feeds directly into inflation pressures, higher subsidies, and wider fiscal deficits—deepening challenges around debt, inflation, and global fiscal stability. Since many economies still struggle with post-pandemic vulnerabilities, volatile energy prices now intensify financial fragility and constrain policymaking. Moreover, elevated risk premiums and logistical disruptions further magnify existing structural weaknesses.

In this shifting environment, understanding the energy warfront is essential. The following analysis explores how Middle East escalation reshapes oil markets, alters macroeconomic trajectories, and threatens the foundations of global economic stability.

1. Geopolitical Drivers of Middle East Oil Volatility

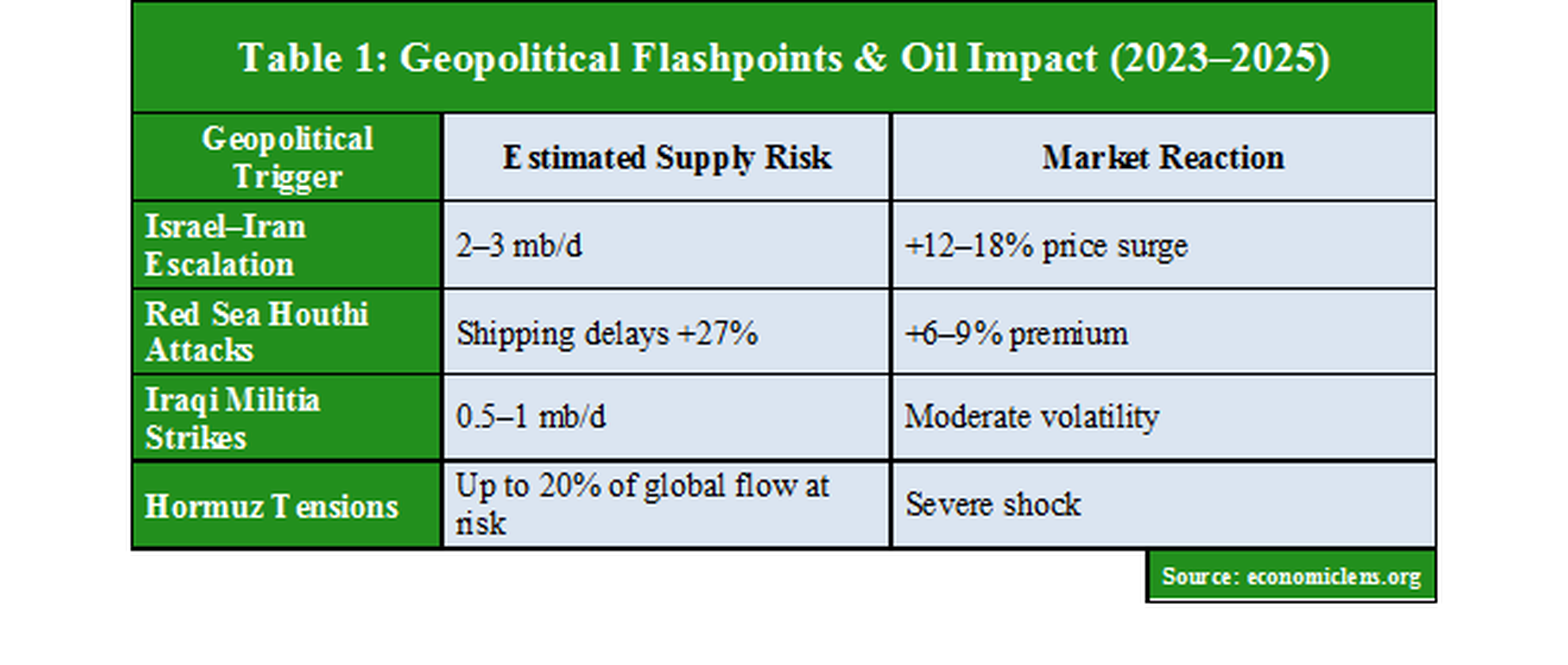

Geopolitical tensions remain the primary catalyst behind rising Middle East oil volatility, and the rapid escalation in regional hostilities has triggered intense market uncertainty. Conflicts involving Israel, Iran, and proxy groups across Yemen and Lebanon have placed essential energy corridors at heightened risk. Because global oil markets respond instantly to geopolitical threats, even small incidents can generate sharp price reactions. Moreover, energy-producing nations must navigate both production risks and political instability, creating additional strain.

Therefore, the region’s geopolitical dynamics continue to exert powerful and immediate influence on global price stability.

The International Energy Agency (IEA) notes, “Geopolitical stress in the Middle East remains the strongest upward force on oil prices,” warning that escalation could remove up to 4 million barrels per day from global markets. Furthermore, the World Bank finds that geopolitical shocks have triggered more than 60% of historical oil spikes since the 1970s, emphasizing the structural link between conflict and energy volatility.

This data highlights how interconnected geopolitical flashpoints are with global energy prices. Because the Strait of Hormuz moves nearly a fifth of the world’s crude, even temporary instability can trigger severe price surges. Meanwhile, disruptions in the Red Sea and Iraq contribute to systemic uncertainty across supply chains.

“In today’s world, a single drone strike can shift global inflation forecasts—because energy security has become global economic security.”

2. Oil Supply Chain Disruptions & Chokepoint Turbulence

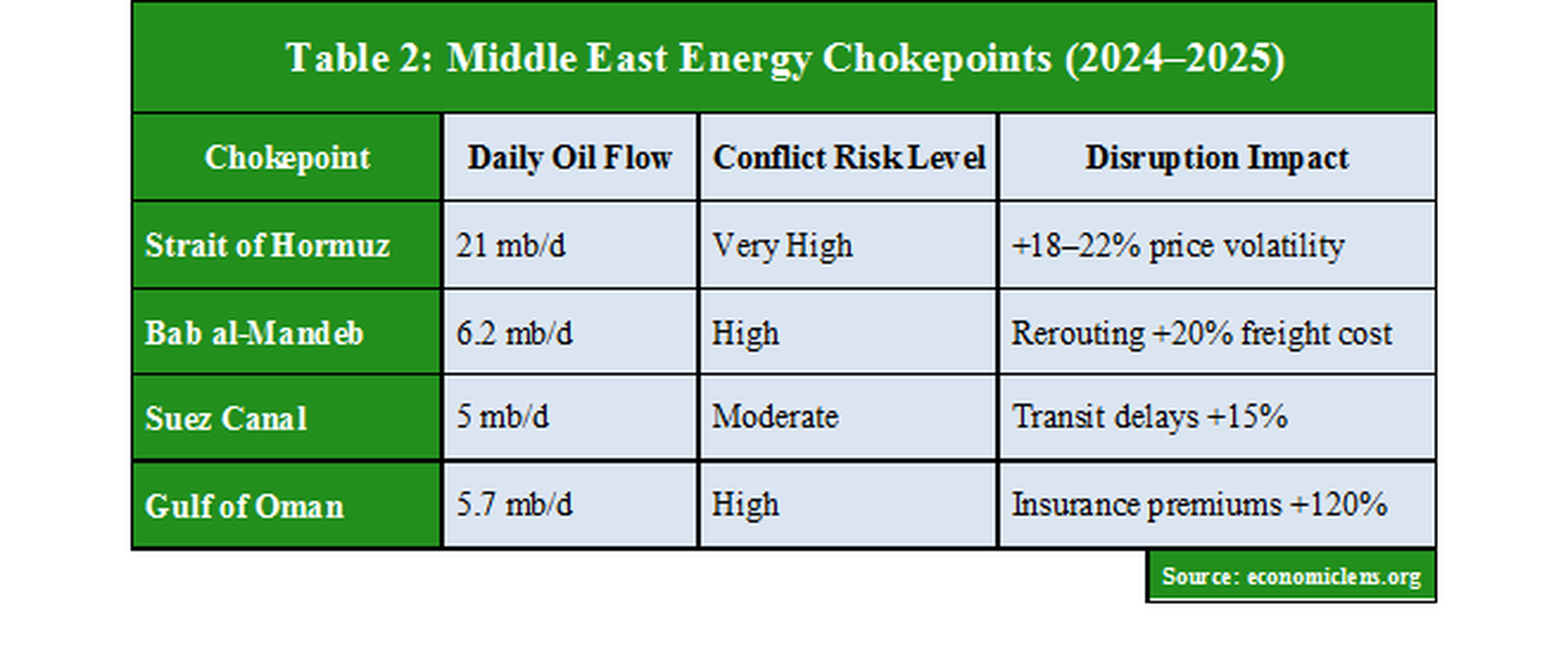

Beyond direct conflict, Middle East oil volatility is amplified by disruptions to vital supply chains. The region’s major maritime chokepoints—Hormuz, Bab al-Mandeb, and the Suez Canal—carry a massive share of the world’s oil flows. As tensions rise, energy transport becomes more costly and less predictable. Additionally, rerouted shipments and longer transit paths increase freight costs, extend delivery times, and reduce global supply resilience.

Consequently, oil markets remain on edge, and price spikes increasingly reflect logistical as much as geopolitical risk.

Lloyd’s Market Association reports that war-risk premiums for tankers in conflict zones surged more than 250% between 2024 and 2025. The OECD further notes that Red Sea disruptions alone increased global shipping costs by 34%, with secondary inflationary effects spreading through food and manufacturing supply chains.

Because so much oil passes through these narrow channels, even moderate risk amplifies global uncertainty. While Hormuz is the most sensitive artery, disruptions in Bab al-Mandeb have begun redirecting tankers around Africa, significantly extending delivery times.

“When chokepoints strain, economies tremble—because every blocked route sends shockwaves across global markets.”

3. Inflationary Pressures from Global Oil Market Volatility

Rising energy prices translate rapidly into wider economic inflation. When global oil market volatility increases, transportation, manufacturing, food production, and electricity all become more costly. Consequently, central banks struggle to maintain inflation targets, and governments must respond with policy tightening or subsidies. Since many nations entered 2025 with fragile inflation control, new oil shocks create immediate economic strain.

Therefore, Middle East oil volatility is now a direct macroeconomic threat, not just a geopolitical one.

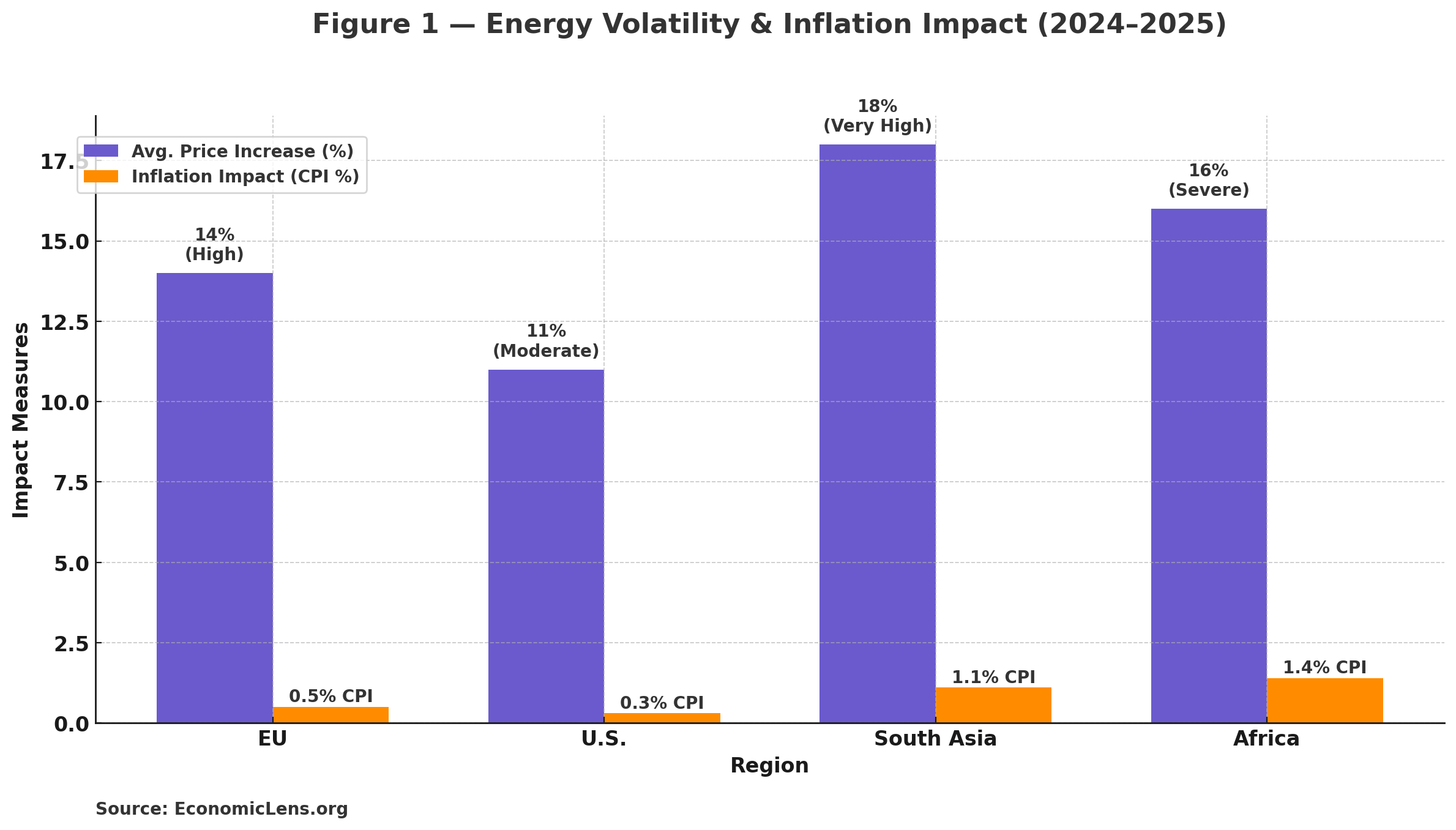

The IMF’s 2025 Global Outlook warns: “A sustained $10–$15 rise in oil prices could raise global inflation by 0.4 percentage points.” OECD research adds that energy inflation accounted for nearly one-third of rising living costs in developing nations over the past two years.

Emerging markets suffer the greatest inflationary shock because energy forms a larger share of household consumption. Meanwhile, developed nations face monetary challenges as central banks attempt to maintain credible inflation targets.

“When oil rises, inflation follows—and every household feels the consequences before the numbers appear in official reports.”

4. Fiscal Stability Risks for Oil-Importing Nations

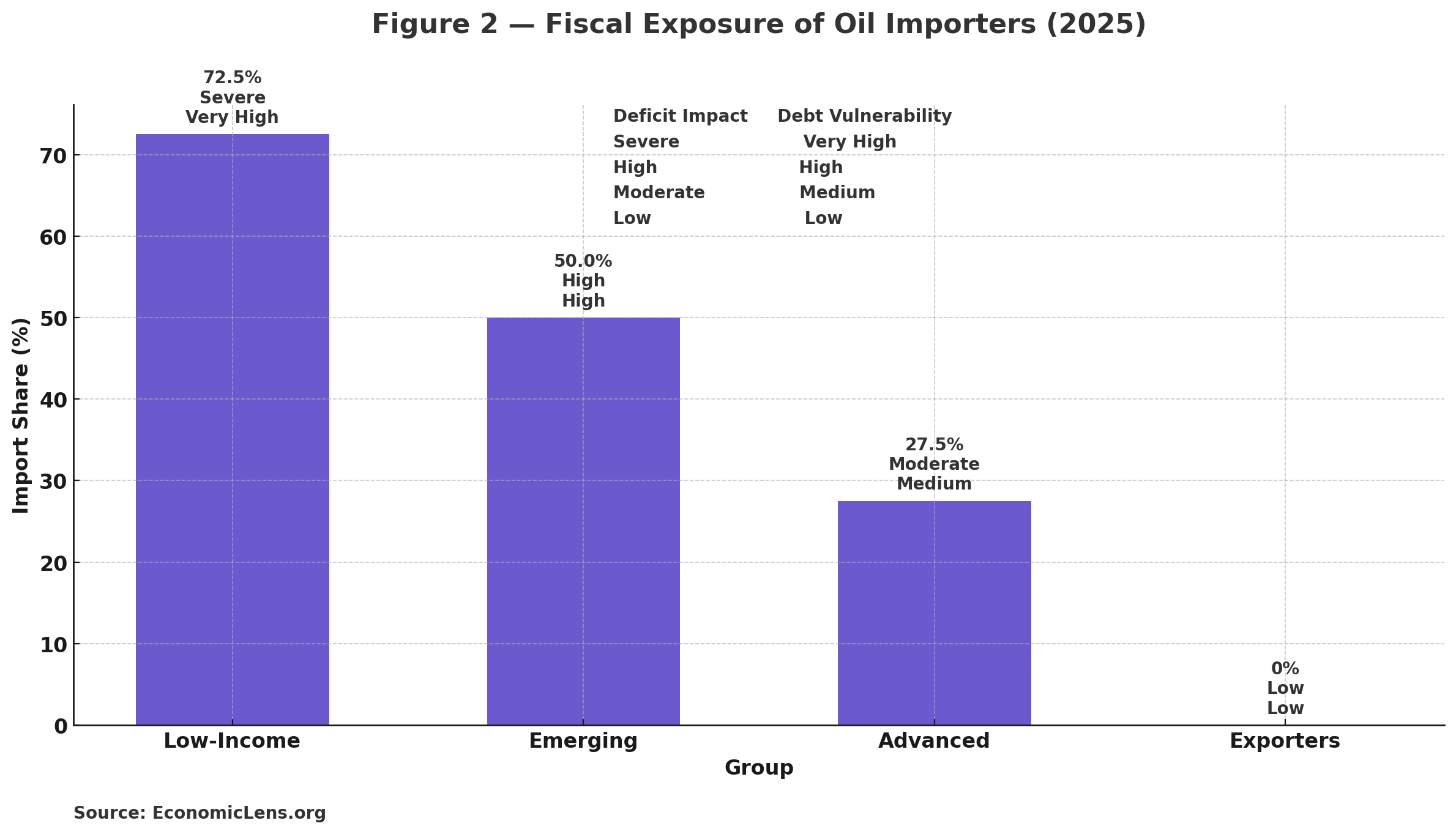

As energy prices climb, governments must either absorb higher costs or pass them to consumers—both options carrying major fiscal consequences. In import-dependent nations, rising oil costs widen deficits, increase subsidy spending, and pressure public finances. Since many countries already face high debt burdens, volatility further restricts policy flexibility. Consequently, Middle East oil volatility intensifies fiscal instability across emerging and low-income economies. Therefore, energy shocks increasingly intersect with debt sustainability concerns.

According to the World Bank, a 10% rise in oil prices widens fiscal deficits by an average of 0.4% of GDP in import-dependent economies. The BIS warns that nations with high debt-service ratios could face destabilizing fiscal pressures if energy prices remain elevated.

The fiscal consequences are clearest among low-income countries, where heavy reliance on imports and limited buffers amplify risk. Moreover, emerging markets face rising debt costs and reduced fiscal space, compounding broader economic instability.

“When oil shocks strain national budgets, fiscal crises evolve from distant threats into immediate realities.”

5. Global Energy Realignment Amid Oil Market Turbulence

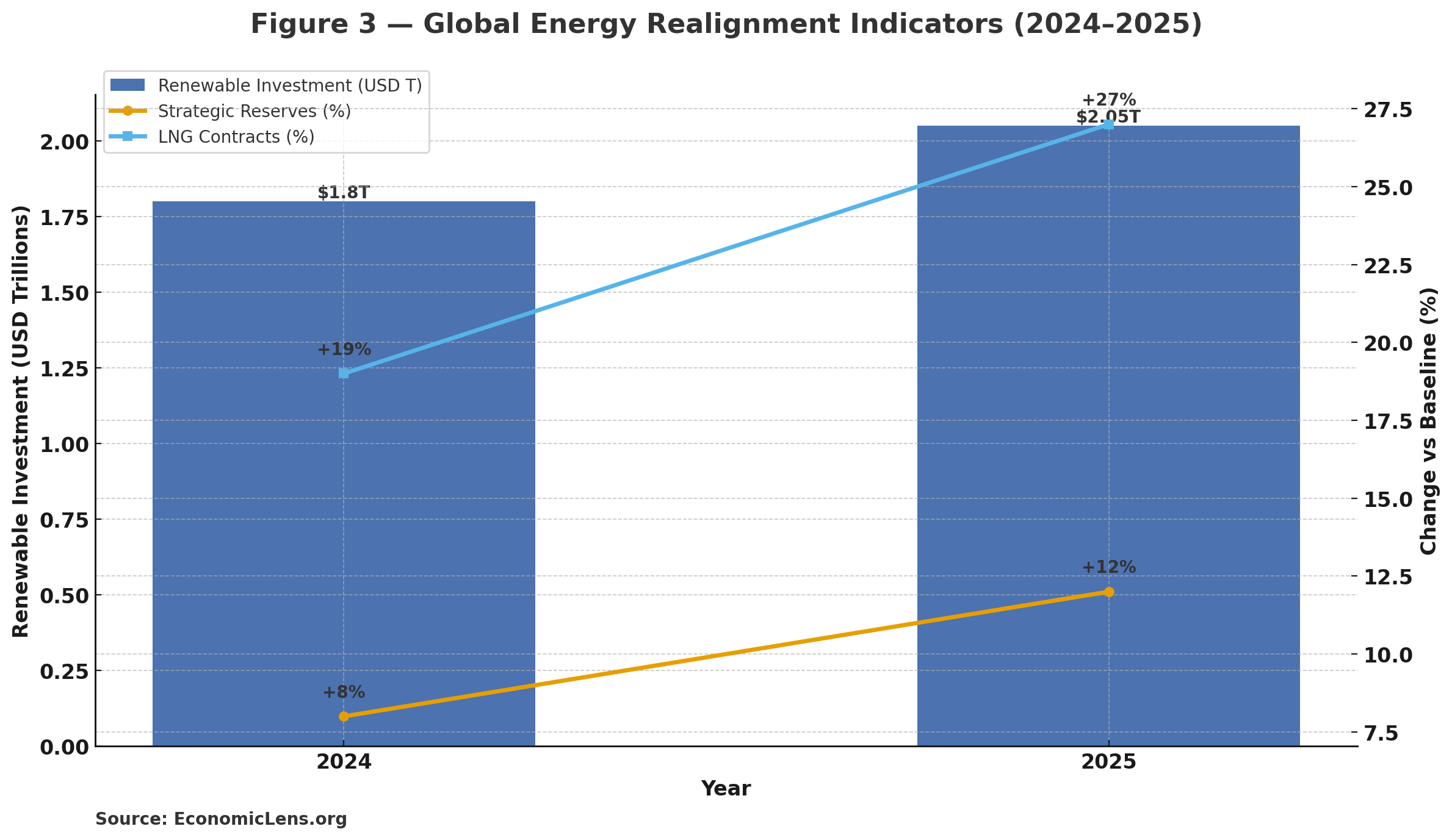

As energy volatility intensifies, nations are rapidly reassessing their energy strategies. The combination of geopolitical instability and supply-chain disruptions has accelerated efforts to diversify energy sources, expand LNG capacity, and invest heavily in renewable transitions. Meanwhile, global competition is rising to secure long-term supply contracts and strategic reserves. Consequently, energy security has become a defining dimension of global power.

IRENA reports a 21% increase in global investment toward energy diversification between 2024 and 2025. Additionally, the IMF warns that energy trade fragmentation could raise global energy costs by up to 15% over the next decade.

Although renewable investment is growing, the structural dependence on Middle Eastern oil remains significant. As a result, global diversification efforts, while meaningful, will not eliminate short-term volatility.

“As nations race to secure their energy futures, the geopolitical map is being redrawn—one supply route at a time.”

Policy Implications

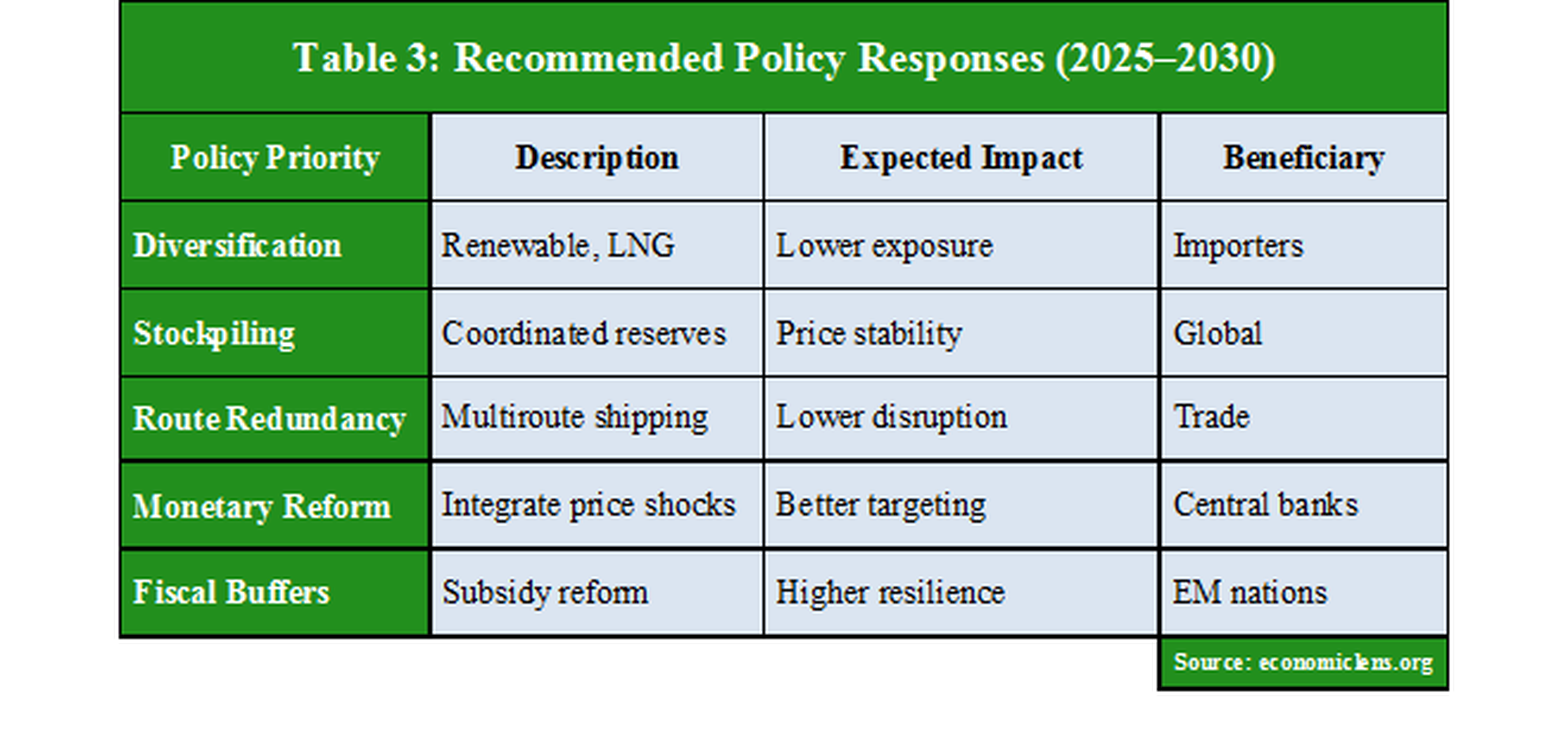

Since Middle East oil volatility is now structural rather than temporary, policy frameworks must adapt accordingly. Governments can no longer assume stable oil markets; instead, they must mitigate risk through diversification, reserves, and financial resilience. Moreover, prolonged volatility complicates inflation management and increases debt burdens, making coordinated policy responses essential. Therefore, strategic reforms are required to protect economies from recurring shocks.

The IMF notes: “Energy security is now macroeconomic security,” urging policymakers to incorporate oil volatility into inflation targeting. The IEA emphasizes the need for coordinated reserve management and diversified supply routes. OECD findings show that countries with mixed energy portfolios experienced up to 60% lower inflation impacts during recent oil shocks.

No single policy can sufficiently mitigate volatility. Instead, resilience requires parallel efforts in logistics, fiscal policy, and energy transition. Emerging markets need the most support due to limited fiscal space.

“Energy security is now a policy battlefield. Nations that adapt early will safeguard their economic stability.”

Future Outlook

Middle East oil volatility is likely to continue shaping global inflation, debt burdens, and fiscal pressures. If conflict escalates further, oil prices may remain elevated, complicating monetary policy and widening deficits. Emerging markets remain especially vulnerable due to limited reserves and heavy import dependence. Ultimately, global economic stability will depend on the world’s ability to navigate recurring geopolitical energy disruptions.

Conclusion

Middle East oil volatility is no longer a periodic risk—it is a defining force reshaping global economic stability. Rising energy prices amplify inflation, widen fiscal deficits, and worsen debt challenges. Moreover, heavy reliance on vulnerable energy chokepoints means geopolitical tensions can instantly disrupt debt, inflation, and global fiscal stability. The energy warfront will shape economic outcomes for years, testing global resilience and forcing governments to rethink their long-term strategies.

“Nations that adapt quickly will strengthen their economic foundations, while those that delay may face deeper instability.”

Call to Action

In a world shaped by recurring geopolitical energy shocks, vigilance is essential. Policymakers, businesses, and individuals must adapt to persistent volatility by strengthening resilience, improving financial planning, and understanding the global forces influencing markets.