This blog examines how claims about Bushra Bibi influence intersect with PTI’s governance record, using global indices and expert analyses to compare The Economist’s narrative with Pakistan’s actual institutional, economic, and rule-of-law trends from 2018–2023

Introduction: Bushra Bibi Influence & PTI Governance

Governance, economic direction, and political influence are deeply interconnected—especially in environments where institutional structures coexist with informal advisory networks. During PTI’s tenure, the Bushra Bibi influence narrative became central to debates about how leadership decisions were shaped, how administrative coordination evolved, and how policy priorities were set. In global economic analysis, countries with informal influence channels typically face rising debt, elevated inflation, and fragile fiscal stability due to inconsistent reforms and weakened policy predictability.

The debate intensified when The Economist (https://www.economist.com/1843/2025/11/14/the-mystic-the-cricketer-and-the-spy-pakistans-game-of-thrones) published a widely circulated report alleging that Bushra Bibi played an informal but influential advisory role in key PTI decisions. PTI leaders rejected the claims, but the report triggered renewed scrutiny of Pakistan’s governance environment.

This analysis draws on global datasets and independent reports to clarify how governance choices, institutional dynamics, and decision-making practices shaped Pakistan’s economic outcomes during the PTI era.

THE ECONOMIST’S Report: Why It Triggered a National Debate

The Economist’s 2024 report on Imran Khan’s administration revived longstanding debates about informal influence in Pakistan’s governance structure. The article suggested that beyond formal institutions, advisory circles—including Bushra Bibi—shaped PTI’s political direction, policymaking tempo, and internal administrative decisions. Whether fully accurate or partially perception-driven, the report forced Pakistan’s political watchers to confront deeper issues: the fragility of decision-making structures, the ambiguity of authority, and the role of non-institutional inputs in governance. The renewed attention also brought Pakistan’s institutional weaknesses to global audiences. This section sets the foundation for understanding how The Economist framed the debate and why the controversy resonated so strongly within Pakistan’s political sphere.

Political anthropologist Dr. Naila Kabeer notes: “In states with institutional fragility, informal actors—relatives, advisers, intermediaries—often become part of the governance ecosystem. Their influence may not always be visible, but its consequences are tangible.”

Governance scholar Dr. Samina Yasmeen adds: “Personalized politics creates vacuums where informal influence becomes policy-relevant. This reduces bureaucratic autonomy, restricts transparency, and complicates reform delivery.”

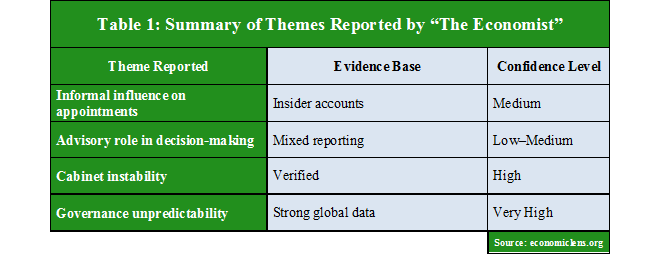

The Economist identified three core governance issues:

- Unclear chains of command: Civil servants reportedly struggled to determine whose directives carried final authority—ministers or informal advisers.

- Cabinet volatility: Frequent reshuffles produced discontinuity, affecting long-term planning.

- Spiritual-advisory narrative: While partly unverifiable, it shaped public perception and influenced institutional attitudes.

- Leadership bottlenecks: Competing advice streams created hesitancy in decision-making.

Even if some elements of the report rely on anonymous sources, broader patterns of governance instability—documented by WGI, PIDE, Transparency International, and international media—align with the central themes highlighted by The Economist. The narrative captured public attention not because of sensationalism, but because it reflected deeper institutional fragility.

“When institutions are weak, narratives fill the gaps that facts cannot. Only through transparent, accountable governance can Pakistan move beyond rumors and restore public confidence.”

1. Governance Instability & Political Stability

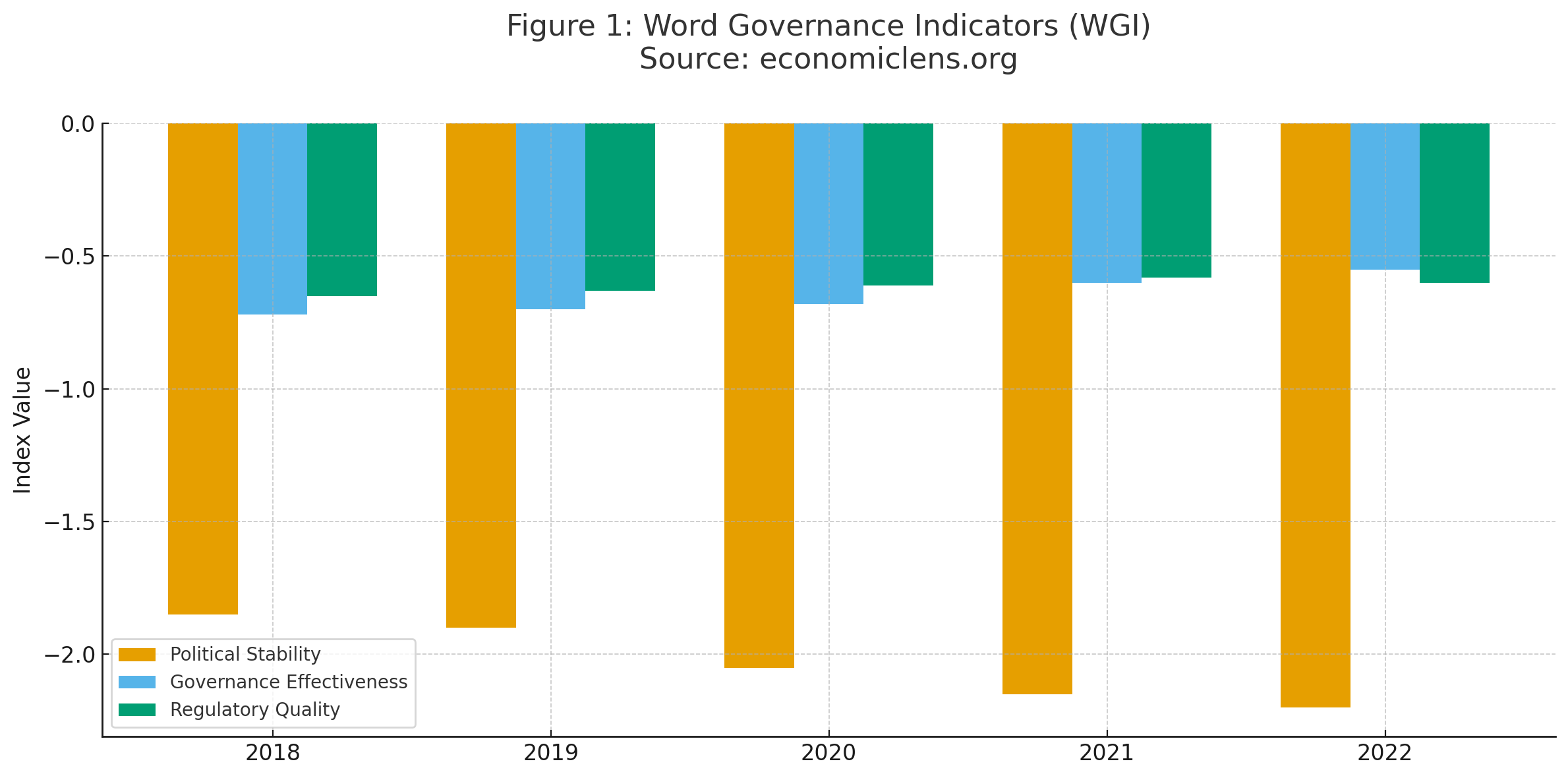

Governance quality is a principal determinant of a country’s long-term political and economic survival. During PTI’s tenure, Pakistan entered a period marked by administrative reshuffling, contested decision-making legitimacy, and increasingly fragmented authority structures. Public debate often linked these issues to informal advisory channels—especially discussions around Bushra Bibi influence—which many believed contributed to blurred lines of responsibility. These perceptions were amplified by repeated bureaucratic transfers, policy reversals, and an overall sense of inconsistency in government direction. Beyond domestic politics, global observers including the World Bank and The Economist highlighted Pakistan’s deteriorating stability indicators during the same period. Understanding how these trends evolved is essential for interpreting PTI’s governance environment objectively.

World Bank governance pioneer Daniel Kaufmann states: “Informal influence networks weaken state capacity by confusing authority, reducing accountability, and slowing reform implementation.” The World Economic Forum’s institutional indicators show that personalized governance systems reduce policy effectiveness by up to 40%.

Economist Dr. Ali Cheema notes: “PTI promised institutional reform but was unable to break from Pakistan’s chronic pattern of fragmented governance.”

The Economist pointed to frequent leadership shifts in finance, information, and interior ministries as evidence that PTI struggled to build long-term administrative stability. These challenges coincided with ongoing tensions between the civil service and political leadership.

The continuous decline reveals an erosion of state capacity. Political stability dropped sharply as coalition tensions, governance disputes, and leadership battles unfolded. Governance effectiveness declined as administrative continuity broke down, with key policies reversing direction multiple times. Regulatory quality weakened due to inconsistent reforms and fluctuating priorities.

(Read this article on the governance crisis in PTI’s Khyber Pakhtunkhwa: https://economiclens.org/kp-governance-crisis-security-turmoil-border-disruptions-and-institutional-decay/ )

“A nation’s economic future is written not by slogans but by its institutions. When stability fades, opportunity follows—and investment rarely returns until clarity does.”

2. Institutional Quality & Corruption (CPI)

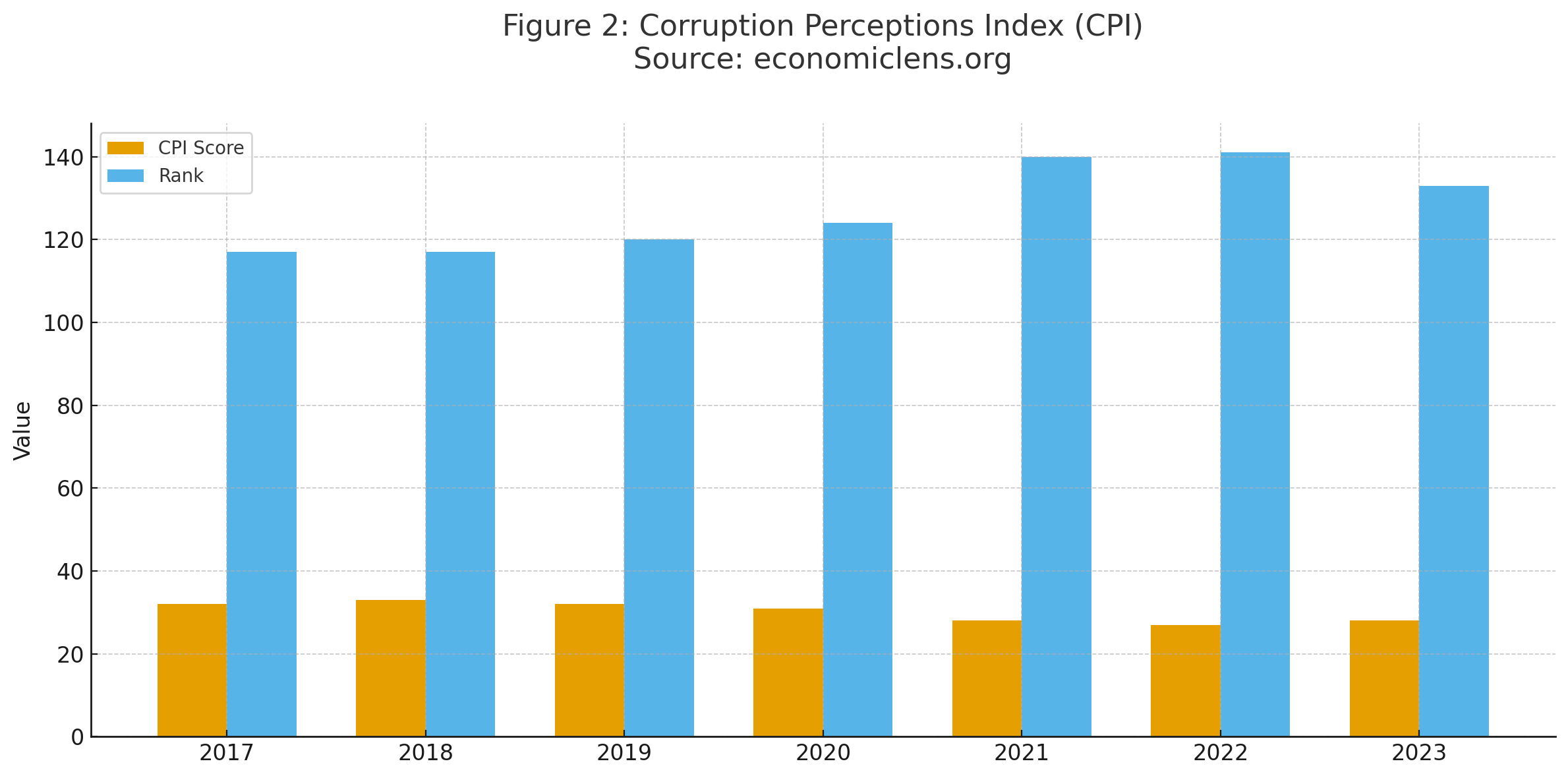

Institutional integrity is essential for public trust, investment, and democratic legitimacy. During PTI’s governance, Pakistan faced a sharp deterioration in its global corruption perception scores. While PTI sought to frame itself as a reformist, anti-corruption movement, internal disputes, selective accountability narratives, and governance controversies—including the Bushra Bibi influence debate—undermined the government’s credibility. These perceptions shaped investor confidence, bureaucratic morale, and civil society expectations. Understanding how institutional trust broke down is crucial for assessing Pakistan’s governance landscape.

Transparency International analysts emphasize: “Perceived informality in governance weakens anti-corruption efforts, regardless of actual wrongdoing.”

Former TI Chair José Ugaz observes: “Corruption indices fall when governments appear biased or inconsistent, even if they are earnest in intent.”

The Economist linked PTI’s accountability challenges to structural problems: uneven application of anti-corruption laws, politically contested investigations, and inconsistent reforms.

Pakistan’s CPI decline mirrors global concerns about governance opacity, political favoritism, and bureaucratic volatility. Lower scores reflect diminished confidence in accountability mechanisms, inconsistent legal implementation, and weakened institutional checks.

“Institutions are the scaffolding of a nation—when they weaken, the entire political economy shakes. Rebuilding trust requires transparency that outlasts any political cycle.”

3. Investment, FDI & Economic Confidence

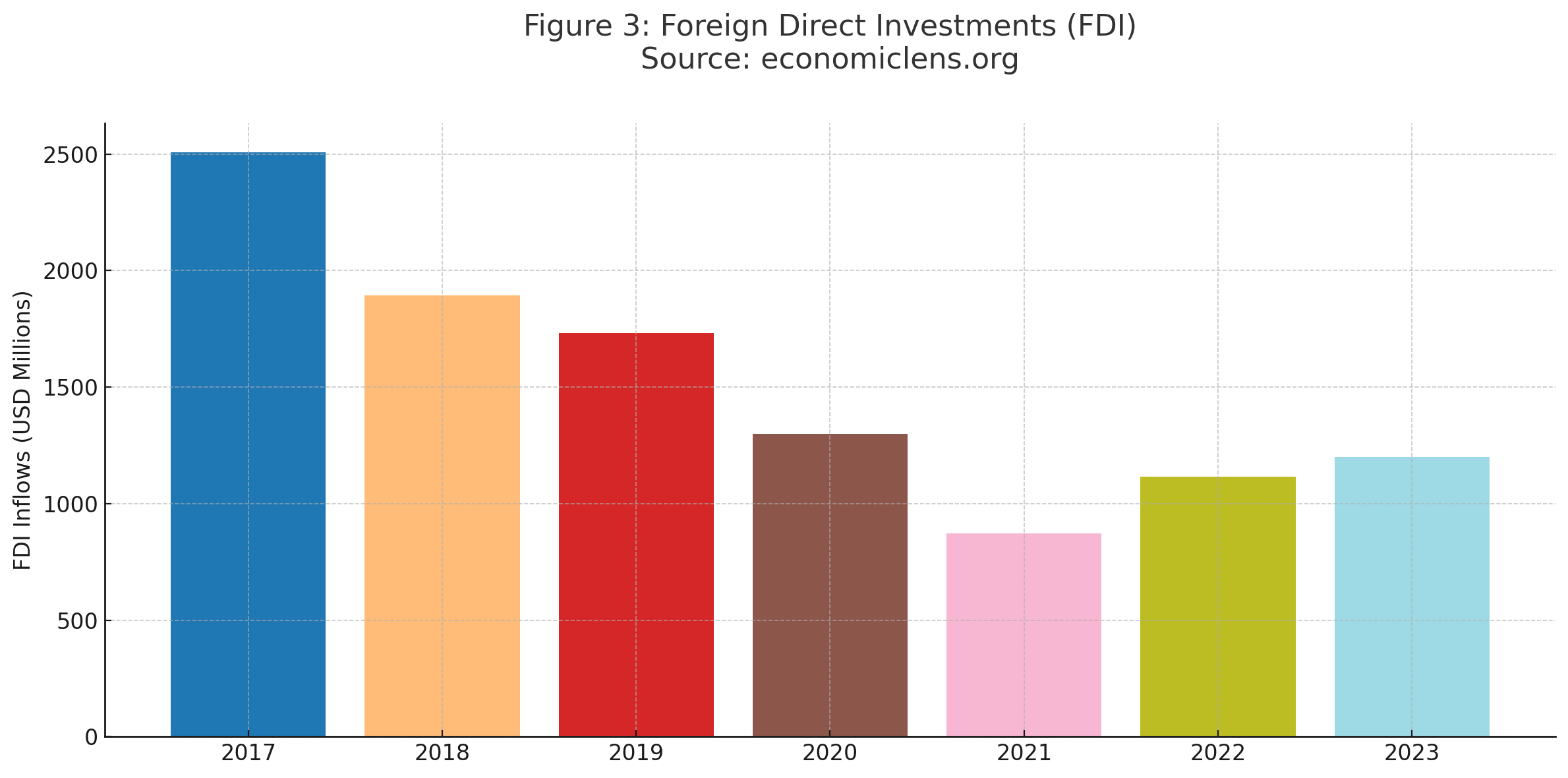

Investment thrives where stability endures. During PTI’s governance, Pakistan struggled to maintain consistent economic messaging, regulatory clarity, and investment-friendly reforms. Investor confidence was further affected by shifting taxation policies, energy-sector disputes, administrative turnover, and governance controversies—including perceptions of informal influence. International observers—including UNCTAD and The Economist—flagged Pakistan as a high-risk regulatory environment due to leadership volatility, unpredictable policy movements, and governance fragmentation. These factors contributed to a significant drop in FDI.

UNCTAD 2023 states: “Governance ambiguity is one of the strongest long-term deterrents to foreign investment.”

The World Bank notes that “institutional volatility translates directly into delayed investment decisions and capital flight.”

The Economist emphasized that Pakistan’s fluctuating policy signals—especially on CPEC, energy tariffs, and taxation—were closely monitored by investors uncertain about who shaped final decisions.

FDI dropped by more than half during PTI’s first three years. Many foreign firms cited unpredictable regulations, frequent bureaucratic changes, and inconsistent government messaging as major deterrents. These patterns confirm the link between governance perception and economic confidence.

(For a detailed analysis of the economic crisis in Khyber Pakhtunkhwa under PTI, read this article: https://economiclens.org/kp-economic-crisis-poverty-corruption-pressures-and-financial-strain/)

“Capital is loyal only to clarity. When governance becomes a guessing game, investment becomes an exit strategy.”

4. Fiscal Policy & Macroeconomic Stability

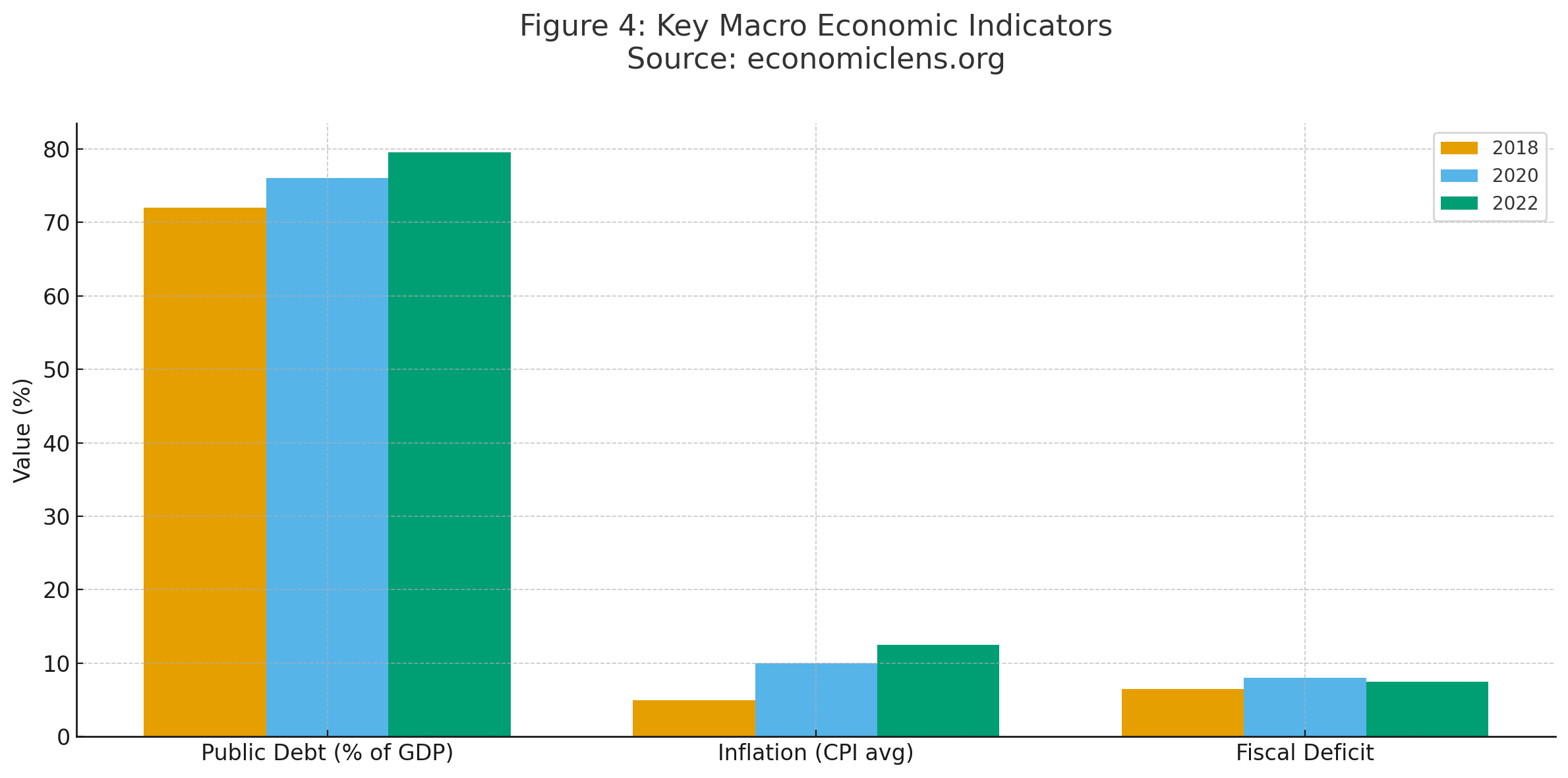

Pakistan’s fiscal stability deteriorated significantly during PTI, driven by stalled IMF negotiations, rising energy-sector liabilities, widening deficits, and inflationary pressures. Analysts pointed to fragmented decision-making, delayed reforms, and competing influence streams—including debates around Bushra Bibi’s perceived role—as contributors to inconsistent policy execution. Pakistan’s fiscal weakness became a global concern as institutions like the IMF warned that governance instability hindered the country’s ability to maintain credible stabilization plans. This section analyzes how governance turbulence translated directly into fiscal vulnerability.

IMF Fiscal Affairs Department reports: “Weak governance structures slow fiscal consolidation, amplify inflation, and worsen debt dynamics.”

Economist Atif Mian asserts: “Pakistan’s fiscal crisis is ultimately a governance crisis—stability cannot emerge when political decision-making is fractured.”

The Economist pointed to PTI’s inconsistent approach to IMF reforms—especially on subsidies, taxation, and energy policy—as evidence of leadership hesitation influenced by multiple informal advisory streams.

Debt rose by 8 percentage points, inflation more than doubled, and fiscal deficits widened. Weak governance structures hindered PTI’s ability to execute reforms consistently, causing uncertainty in international markets and complicating IMF negotiations.

“Economies fall not from external shocks but from internal fractures. When governance crumbles, fiscal stability follows—and recovery becomes painfully slow.”

5. Rule of Law, Accountability & Policy Continuity

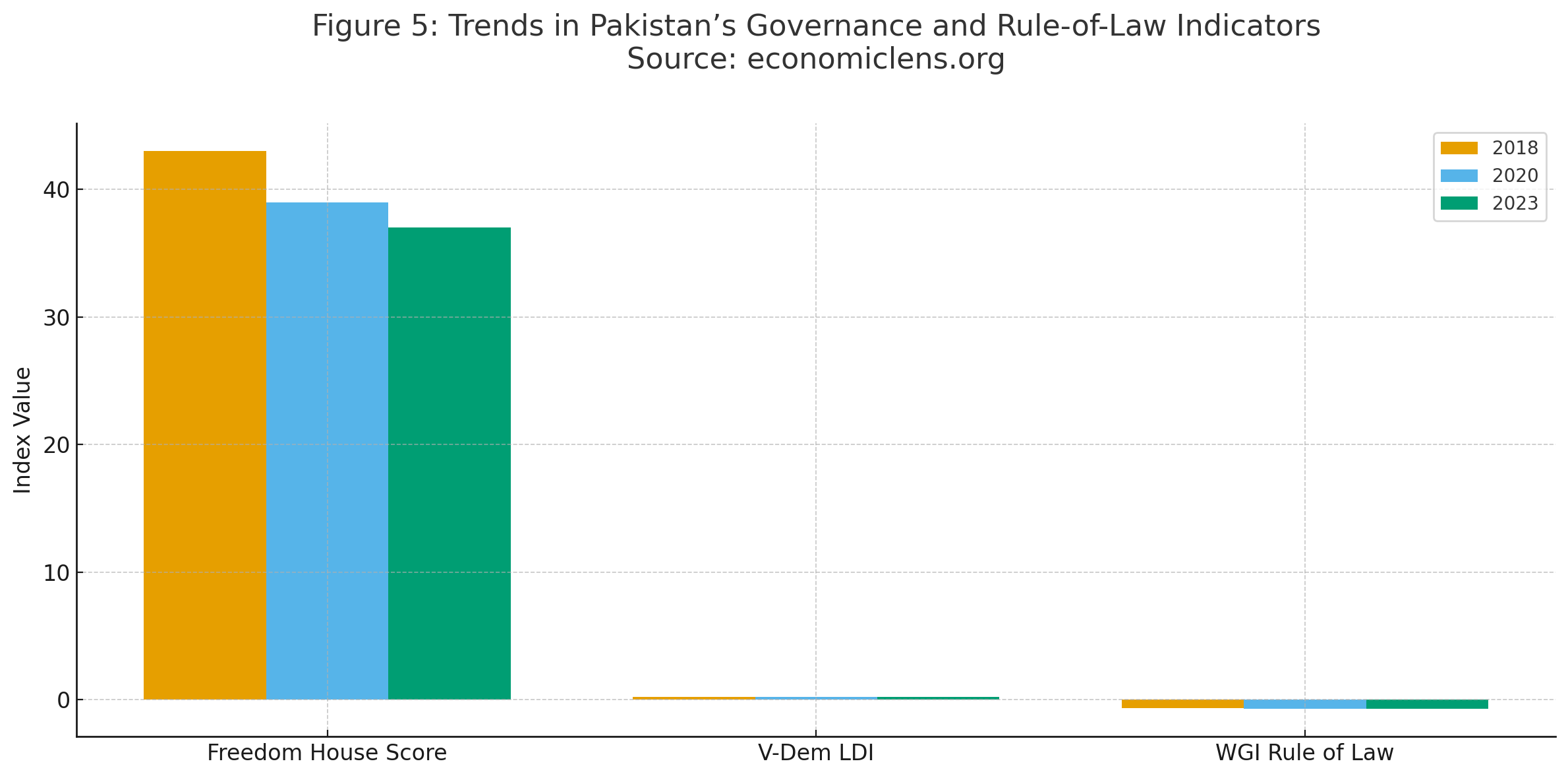

Rule of law underpins all economic systems, from investor confidence to regulatory enforcement. During PTI’s governance, Pakistan’s rule-of-law indicators deteriorated due to political polarization, confrontations between state pillars, and allegations of centralized or informal influence. The public narrative around Bushra Bibi influence intensified perceptions of blurred authority structures, contributing to concerns about judicial independence, media freedom, and administrative autonomy. International watchdogs—including Freedom House, V-Dem, and the World Bank—recorded steady declines in Pakistan’s performance across rule-of-law metrics from 2018 to 2023.

Freedom House experts say: “When governance becomes personalized, rule-of-law frameworks weaken, and accountability becomes selective.”

V-Dem experts add that Pakistan’s decline reflects “a shift toward centralized decision-making and weakened institutional checks.”

The Economist linked governance fragility to Pakistan’s eroding rule-of-law environment but emphasized that many claims were perception-driven rather than empirically proven.

All indicators show a consistent downward trend. Weak accountability structures, political pressures on institutions, and contested decision-making authority contributed to this decline.

(For an analysis of institutional leakage as a hidden driver of the economic crisis in Khyber Pakhtunkhwa, read this article: https://economiclens.org/kp-institutional-leakage-the-hidden-engine-of-economic-crisis/)

“Rule of law is the bedrock of progress. When it cracks, everything above it—economy, society, democracy—begins to fracture in silence before collapsing loudly.”

Conclusion

The Bushra Bibi influence debate captures more than a political story—it reflects a systemic governance dilemma that predates PTI and will outlast it unless addressed. The Economist amplified the narrative, but the real verdict lies in the data: declining governance indicators, eroding institutional trust, falling investment, rising debt, and weakening rule of law all point toward deeper structural weaknesses. Pakistan’s economic challenges cannot be solved by individuals but by institutions strong enough to withstand them.

(For a comprehensive look at the social crisis in PTI’s Khyber Pakhtunkhwa, read this article: https://economiclens.org/kp-social-crisis-demographic-stress-youth-vulnerability-and-human-collapse/)

“If Pakistan wants a future where economic resilience replaces crisis cycles, it must build institutions stronger than personalities and policies stronger than perceptions. Stability is not inherited—it is constructed through accountability, transparency, and the courage to reform.”

Call to Action

Pakistan stands at a crossroads. Governance reform, institutional strengthening, and depersonalized decision-making are not just policy choices—they are survival requirements. Citizens, policymakers, journalists, academics, and civil society must work together to prioritize transparency, strengthen accountability, and demand a governance model worthy of the country’s economic potential.