The AI Regulation Backlash is accelerating worldwide, creating a Big Tech crisis, market volatility and rising compliance pressures. Governments tighten rules, investors pull back and global supply chains face new risks. This analysis explores how regulatory shifts reshape innovation, productivity and digital competitiveness across major economies.

INTRODUCTION

The AI Regulation Backlash is rapidly turning into a global economic concern as countries tighten AI laws to protect privacy, limit synthetic misuse and strengthen security. However, Big Tech firms warn that the speed and intensity of new rules may slow innovation, weaken competitiveness and disrupt investment flows. As compliance demands rise, export controls intensify and political debates escalate, markets are entering a new phase of uncertainty. This blog explains how the AI Regulation Backlash is fueling a Big Tech crisis, triggering market shock and reshaping global economic dynamics.

1. The Rise of the AI Regulation Backlash

Across 2024 and 2025, governments introduced some of the most sweeping AI regulations in modern history. The European Union moved forward with its high-risk AI rules but recently delayed full enforcement after intense pushback from several Big Tech companies. In the United States, policymakers paused a planned federal executive order on AI to avoid conflicts with state-level initiatives. At the same time, China updated its rules on data, training inputs and synthetic content. These dynamic changes created a powerful shift in how AI is governed across regions.

The acceleration of regulation is reshaping the entire AI value chain. Companies must track compute usage, classify model risks, prove dataset transparency and meet stricter deployment standards. The AI Regulation Backlash grows stronger as firms argue that regulation is now moving faster than technological evolution.

AI regulation expert Dr. Maria Santos notes that firms face an unusually fragmented policy environment. She explains that inconsistent rules between regions force companies to rebuild systems, slow deployment and dedicate more resources to compliance, thereby increasing friction across the global AI economy. The OECD Digital Policy Review highlights that regions with high regulatory pressure face slower model deployment, rising compliance costs and delayed innovation cycles. The report warns that if regulatory divergence continues, countries may experience significant productivity losses.

In Europe, policymakers announced a simplification package to reduce digital regulation complexity for AI firms, signaling that even regulators acknowledge the burden of the current framework.

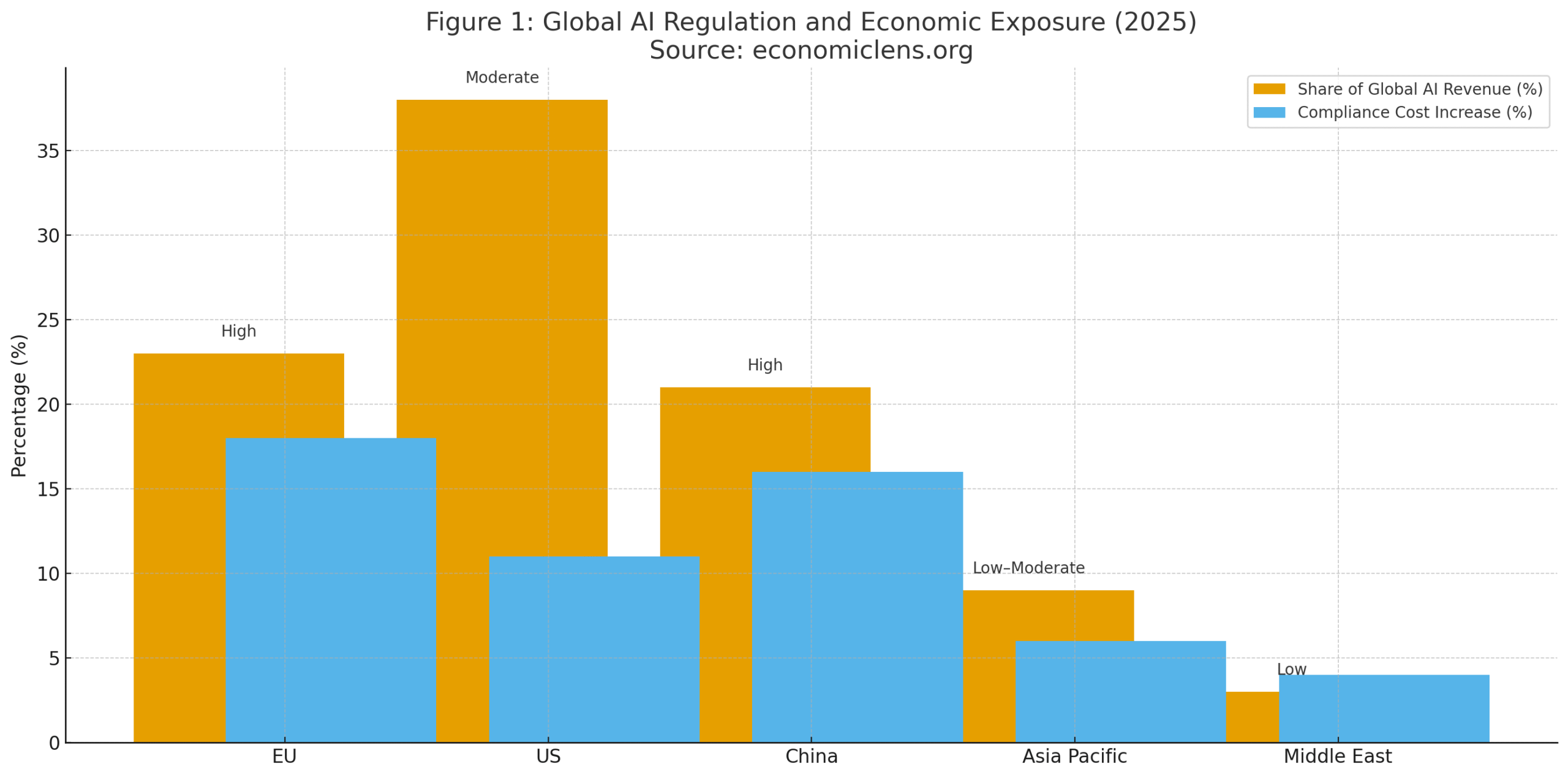

The European Union and China show the highest regulatory intensity, increasing compliance burdens and slowing deployment. The United States balances moderate oversight with market risks, while smaller regions face barriers due to limited infrastructure and uneven model access.

“If regulation runs ahead of innovation, the economy loses momentum. The world must learn how to build balance before the gap becomes too wide to close.”

2. Big Tech Crisis and Economic Friction

The AI Regulation Backlash places heavy pressure on Big Tech companies. Mandatory transparency, model reporting, algorithmic accountability and oversight obligations raise operating costs. Delays in releasing high-risk AI tools and new compliance phases push R&D timelines further. Smaller AI startups struggle even more, often pausing development due to financial constraints.

Economist Dr. Liam Walker argues that regulatory waves encourage industry consolidation. The cost of compliance, he explains, creates structural advantages for tech giants while weakening smaller innovators, resulting in reduced market diversity. The World Bank Digital Economy Outlook reports that tighter AI regulation may reduce global productivity gains by slowing model diffusion and discouraging investment in advanced technologies.

In the United States, the Senate rejected a proposed 10-year moratorium on state-level AI regulation, meaning Big Tech will now face a patchwork of potentially conflicting state laws, further complicating compliance and increasing legal exposure.

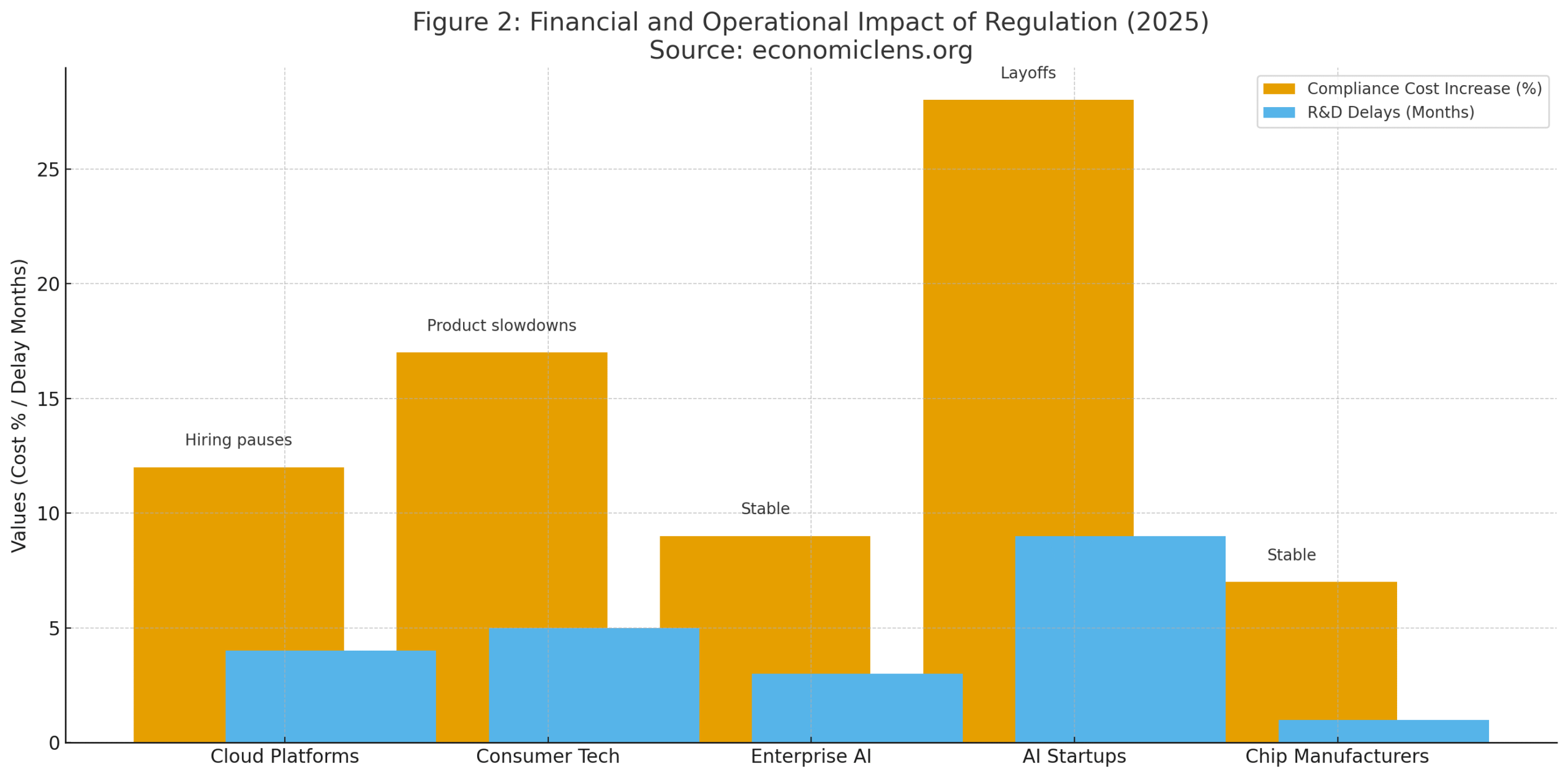

AI startups face the sharpest pressures, with high compliance costs and long development delays. Larger firms absorb these shocks more easily, but the overall slowdown in deployment creates friction across global supply chains and slows momentum in AI-enabled industries.

“When pressure rises, resilience becomes strategy. The firms that survive today’s regulatory wave will define tomorrow’s technological order.”

3. Market Shock, Capital Flight and Global Investment Strain

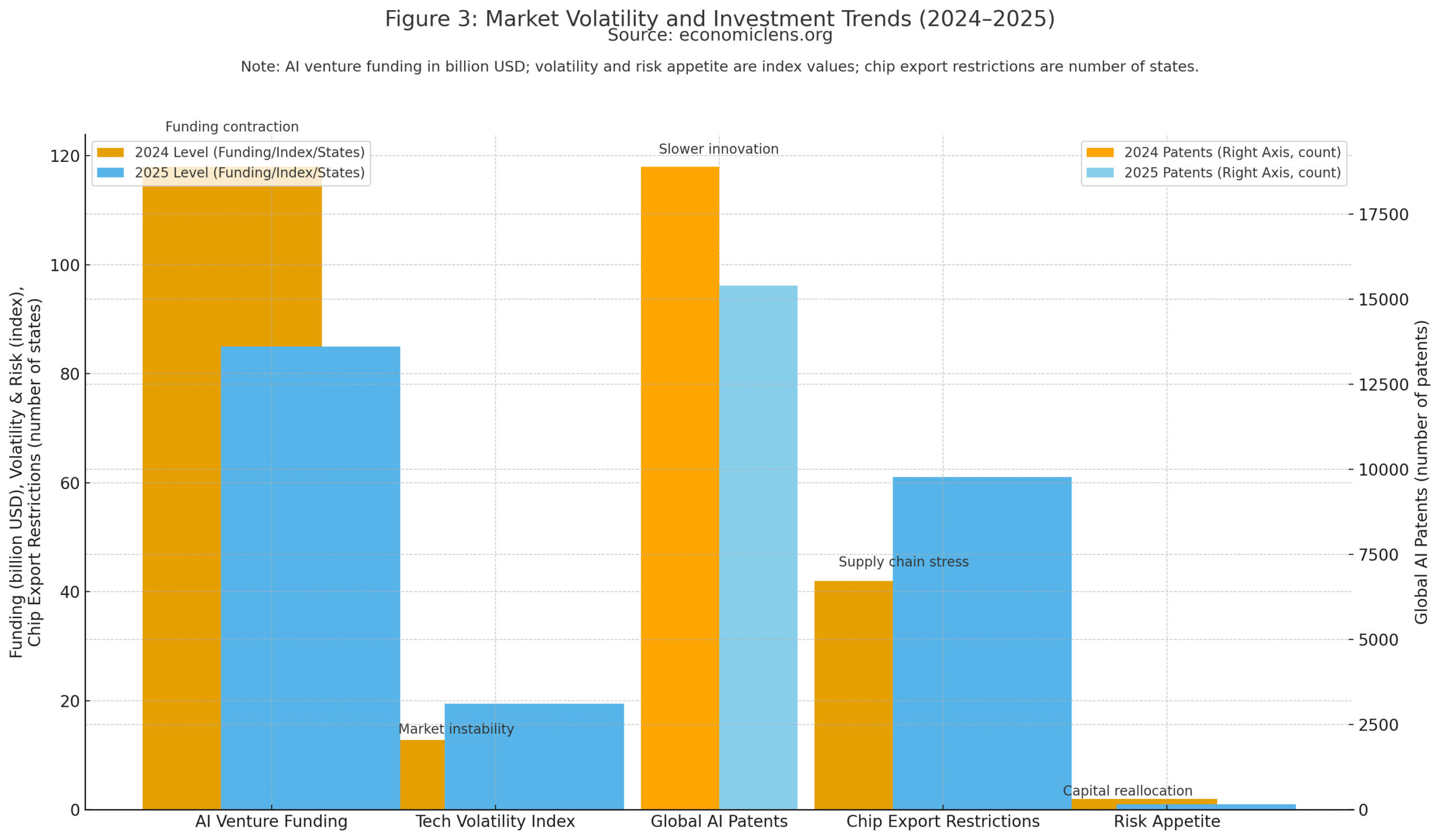

The financial markets have reacted significantly to the AI Regulation Backlash. Tech stocks exhibit sharp volatility, while investors shift funds toward safer sectors. Export controls on chips and compute clusters disrupt supply chains, causing uncertainty in markets that rely heavily on advanced AI systems. Venture funding continues to drop as firms anticipate more compliance phases.

Financial strategist Dr. Aisha Rahman explains that increasing regulatory uncertainty causes capital flight. Investors prefer defensive assets over high-risk AI firms, reducing available capital for early-stage innovation and increasing caution across financial markets. The IMF warns that prolonged AI policy unpredictability could reduce global tech investment by more than ten percent, affecting productivity and innovation across multiple sectors.

The White House paused a major AI executive order after concerns that it might create conflict with state-level policies, adding uncertainty to governance in the United States. Amnesty International warned that the EU’s revised digital regulations may weaken human rights protections, intensifying debates over the social impact of AI governance.

Investment declines, rising export controls and increased patent drop rates show how investor caution is reshaping the global AI landscape. The surge in volatility reflects a market searching for clarity in a rapidly shifting regulatory environment.

“Markets recover from shocks, but they struggle with confusion. The future of global AI investment depends on a steady, predictable and collaborative regulatory path.”

4. Global Fallout: Economic, Political and Innovation Consequences

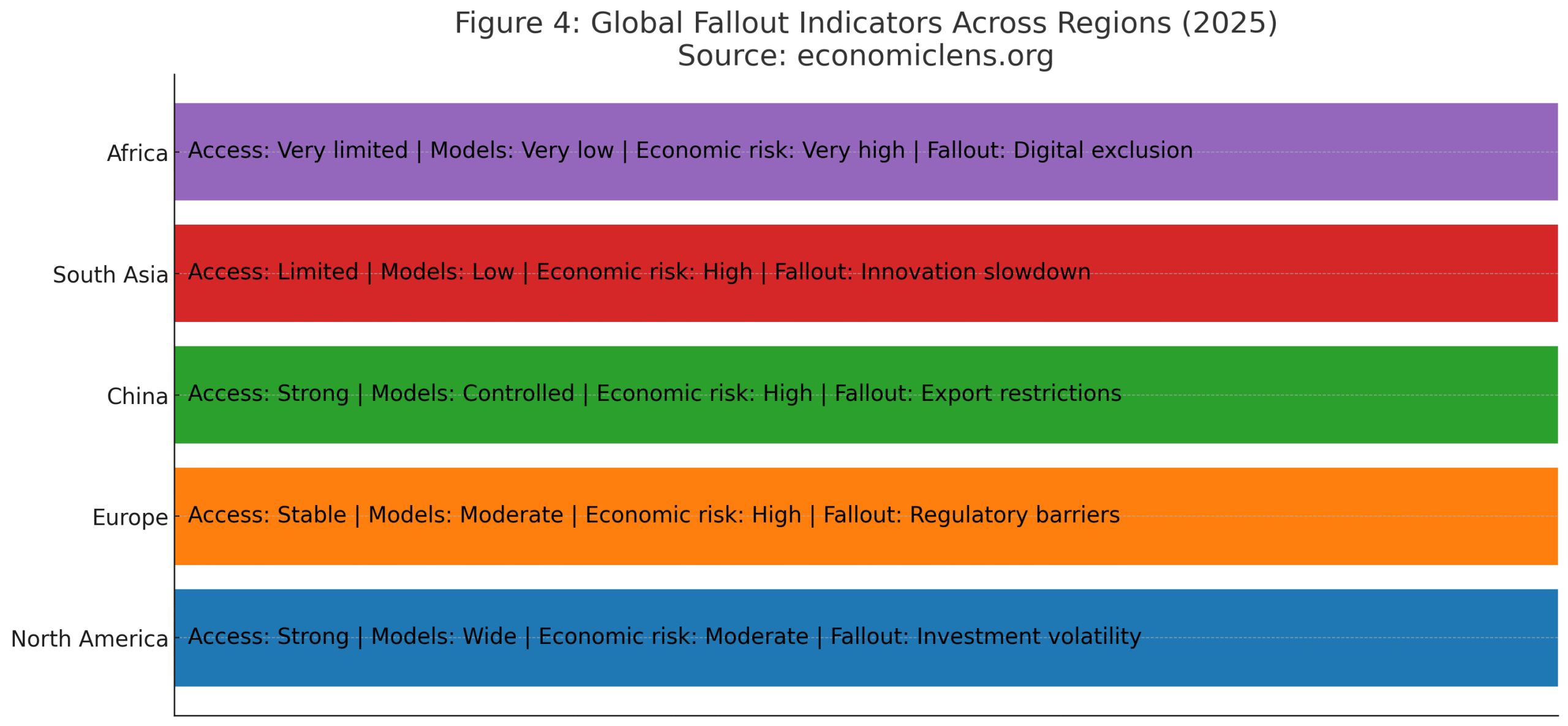

The AI Regulation Backlash is creating global fallout across political, economic and technological domains. Regulatory divergence risks splitting the world into competing AI blocs. Access to compute, model availability and technical expertise is becoming uneven, deepening the digital divide. Emerging economies face significant setbacks due to limited access to high-capacity chips, cloud clusters and regulatory expertise.

Geopolitical analyst Dr. Noor Al-Hadi notes that fragmented AI rules are turning governance into a strategic tool. She explains that inconsistent regulations weaken global cooperation and increase the risk of regional competitive tensions. A United Nations digital governance brief warns that unequal regulation may widen global inequality, reduce innovation in developing economies and increase dependency on foreign AI infrastructure.

The European Commission introduced a digital regulation simplification package to reduce red-tape for AI firms, acknowledging global criticism that Europe’s complex rules weaken competitiveness and widen the innovation gap.

Emerging regions suffer the deepest fallout with limited compute infrastructure, narrow model access and minimal investment. High-regulation regions like Europe experience slower deployment and rising economic risk, while China faces restrictions driven by geopolitical policy.

“Innovation cannot be global if opportunity is unequal. A divided AI world risks leaving millions behind as digital transitions accelerate.”

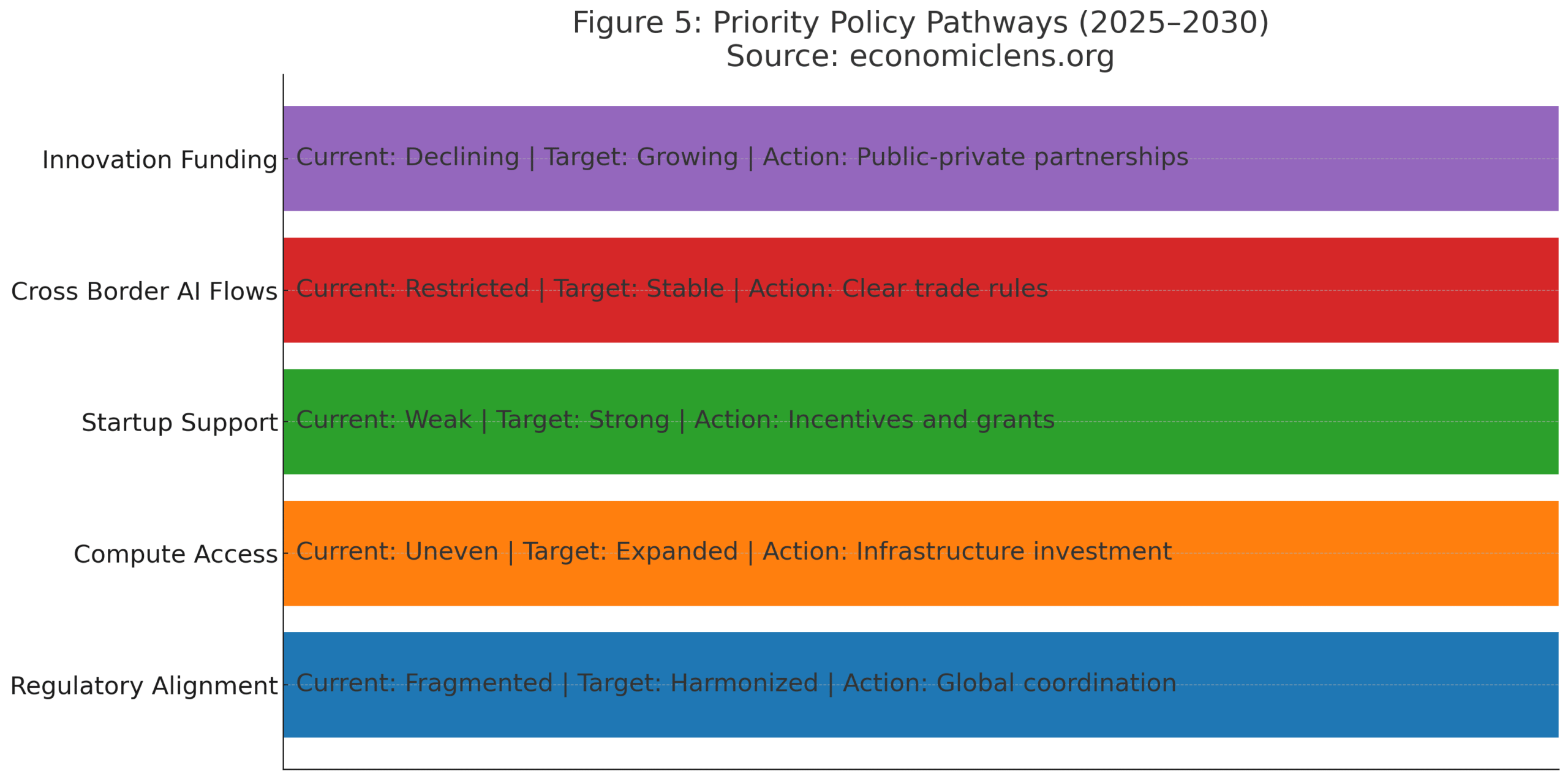

5. Policy Pathways for a Balanced Global AI Future

Balancing innovation and oversight requires coordinated policymaking. Effective policy pathways must support safe deployment while maintaining competitiveness. Regulators must harmonize rules, strengthen cooperation and improve access to infrastructure.

Policy expert Dr. Ibrahim Keller states that transparent standards, predictable timelines and support for smaller firms are essential. He argues that fair regulations unlock innovation while protecting the public interest. The World Economic Forum recommends flexible frameworks that adapt to technological change. The report encourages global alignment to reduce market fragmentation and strengthen international technology flows.

A balanced AI future requires harmonized rules, stronger startup ecosystems and expanded compute access. Coordinated policies will reduce friction, improve global competitiveness and support innovation in all regions.

“Balanced regulation can unlock global opportunity, rebuild trust and guide AI toward a more inclusive and competitive future.”

Conclusion

The AI Regulation Backlash is redefining global technology, economics and governance. It influences investment flows, reshapes innovation patterns and determines which nations will lead the next digital era. While regulation is essential, excessive pressure can slow growth. The future depends on balanced governance, stronger cooperation and a shared commitment to responsible innovation

AI Regulation Backlash is reshaping markets, rewriting Big Tech strategies and shifting the balance of global innovation. Understanding these economic and regulatory pressures is essential for policymakers, investors and technology leaders.

“In every era of disruption, those who understand the shift become the architects of what comes next.”

1 thought on “AI Regulation Backlash: Big Tech Crisis, Market Shock & Global Fallout”

Economic lens website / share topic is the best way to improve our knowledge *special thanks to dr . Minhaj ul din they think about our bright futures.