US China trade war 2025 triggers sharp tariff escalation, supply chain shifts and global inflation pressures as manufacturing, logistics and currency markets absorb renewed uncertainty. This blog explains how tariff shock spreads through production networks, reshapes trade corridors and accelerates strategic decoupling across major economies.

INTRODUCTION

The US China trade war 2025 marks a turning point in the global economic landscape as tariff escalation, supply chain disruptions and technology restrictions reshape the foundations of international commerce. The renewed confrontation intensifies uncertainty across financial markets, inflation pathways, and manufacturing systems. Consequently, the trade shock generates ripple effects reaching far beyond the two largest economies, influencing every major region.

The global reaction to the US China trade war 2025 illustrates the scale of vulnerability embedded within modern supply networks. As tariffs rise, production shifts, lead times extend and prices adjust unevenly across sectors. Meanwhile, firms accelerate diversification strategies, yet new hubs struggle with cost pressures and capacity constraints. Therefore, the unfolding conflict does not represent a short term disruption but a structural realignment of global trade architecture.

This blog examines the evolving dynamics of tariff escalation, global transmission channels, sectoral disruptions and emerging market risks. Additionally, it interprets the data, expert perspectives and policy implications shaping global economic outcomes through 2025 and beyond

1: Crisis Trigger and Strategic Escalation in the US China Trade War 2025

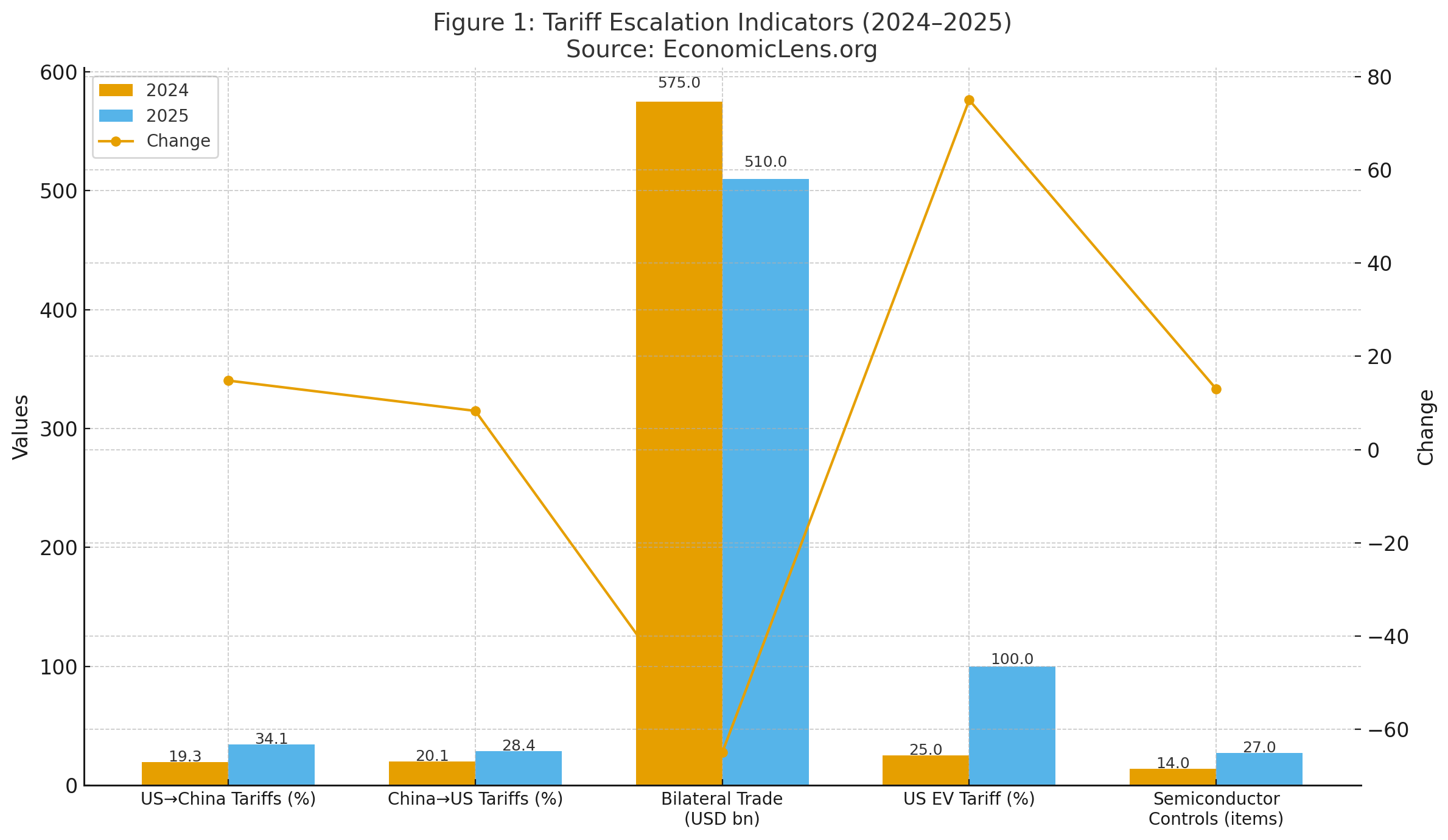

The escalation of the US China trade war 2025 marks a decisive shift in the global economic order as tariff layers expand across EVs, semiconductors, electronics, solar components and intermediate goods. The renewed confrontation raises structural risks for production networks and accelerates the fragmentation of trade architecture. Consequently, economies face rising input costs, slower manufacturing output and sustained pressure on logistics and trade flows. The crisis no longer reflects tactical bargaining but a long-term realignment driven by technology controls, industrial policy and geopolitical rivalry.

Experts Opinion and Reports Analysis

According to Alicia Garcia Herrero, Natixis, tariff escalation has turned into a structural pivot away from China-dependent supply lines, with firms relocating production faster than previously anticipated. Furthermore, Chad Bown, Peterson Institute, notes that the tariff cycle of 2025 spreads across new sectors that were not directly targeted in earlier rounds, resulting in wider price transmission across manufacturing hubs. Additionally, Goldman Sachs Global Economics warns that tariff-linked inflation is sticky and forces central banks to maintain restrictive conditions.

The IMF External Sector Report 2025 identifies renewed tariff escalation as a key driver behind weaker trade elasticity and lower global growth prospects. Meanwhile, OECD Trade Outlook 2025 warns of a steep decline in intermediate goods circulation, particularly in EV batteries and advanced electronics. In contrast, UNCTAD’s Supply Chain Stress Index shows a 22 percent rise in routing delays due to tariff uncertainty and diversified shipment corridors. The WTO Trade Outlook 2025 (https://www.wto.org/) provides detailed evidence on declining global trade elasticity and weakening goods flows due to tariff escalation.

The data illustrates a significant widening of tariff exposure in 2025, with EV and semiconductor duties contributing to sharp declines in trade volumes. As a result, firms face rising costs, deeper strategic uncertainty and expanding global inflation pressures.

Sector Spotlight

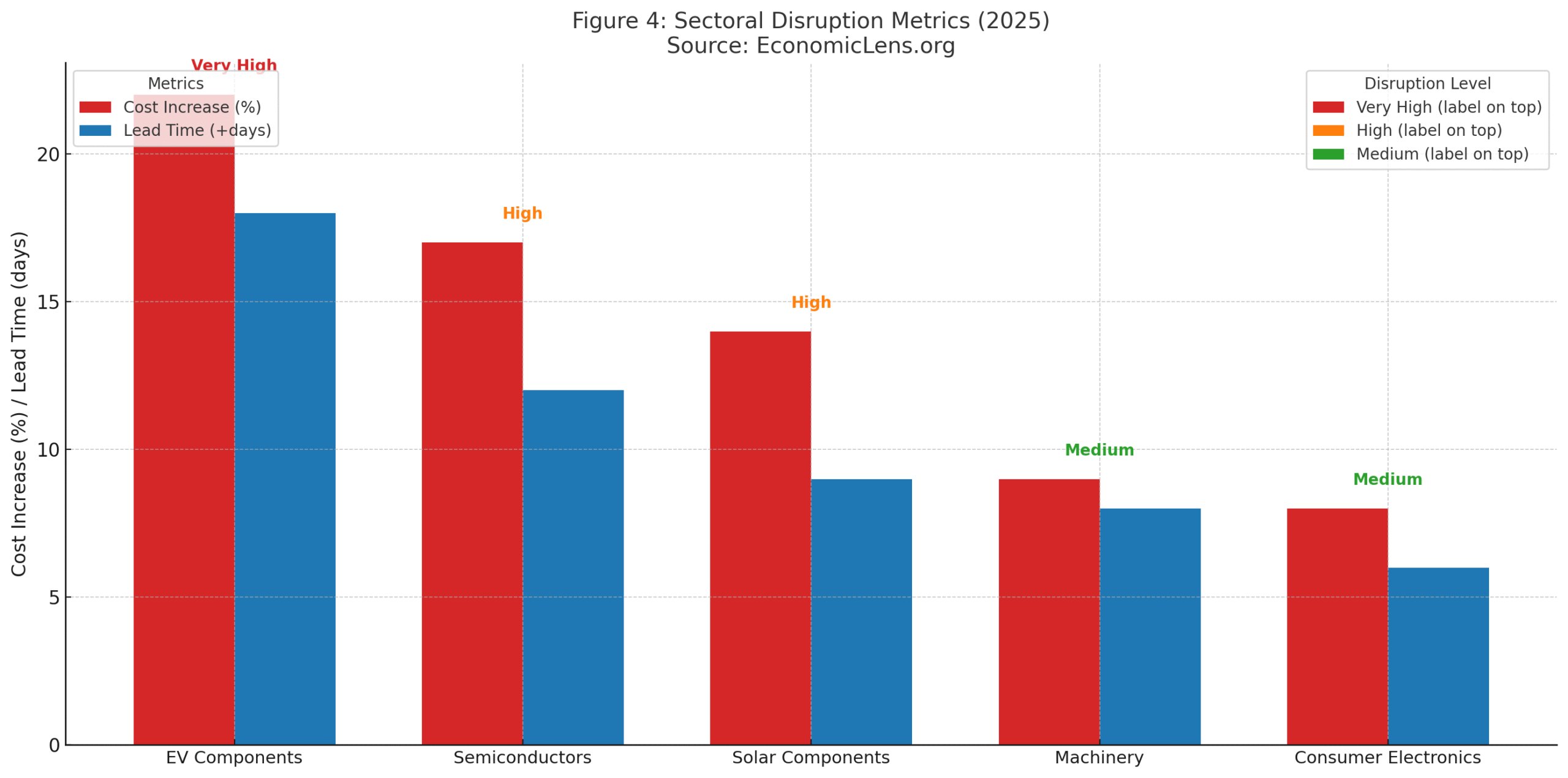

Global EV manufacturers are reporting unprecedented cost pressure as the US China trade war 2025 adds triple digit tariffs on Chinese EV imports. Consequently, firms are rushing to secure new assembly bases in Mexico, Thailand and India to mitigate the immediate cost surge. Analysts at S&P Global highlight that the sudden diversification has increased average production lead times by 18 to 25 percent due to factory onboarding delays, new supplier contracts and compliance requirements. Additionally, European EV makers face dual exposure since they rely heavily on China for cathodes, anodes and battery-grade minerals. This structural shift will likely recalibrate the competitiveness of EV markets for several years.

“A tariff shock does not simply raise prices; it rebuilds the architecture of global trade one sector at a time.”

2. Global Transmission Channels and Economic Exposure in the US China Trade War 2025

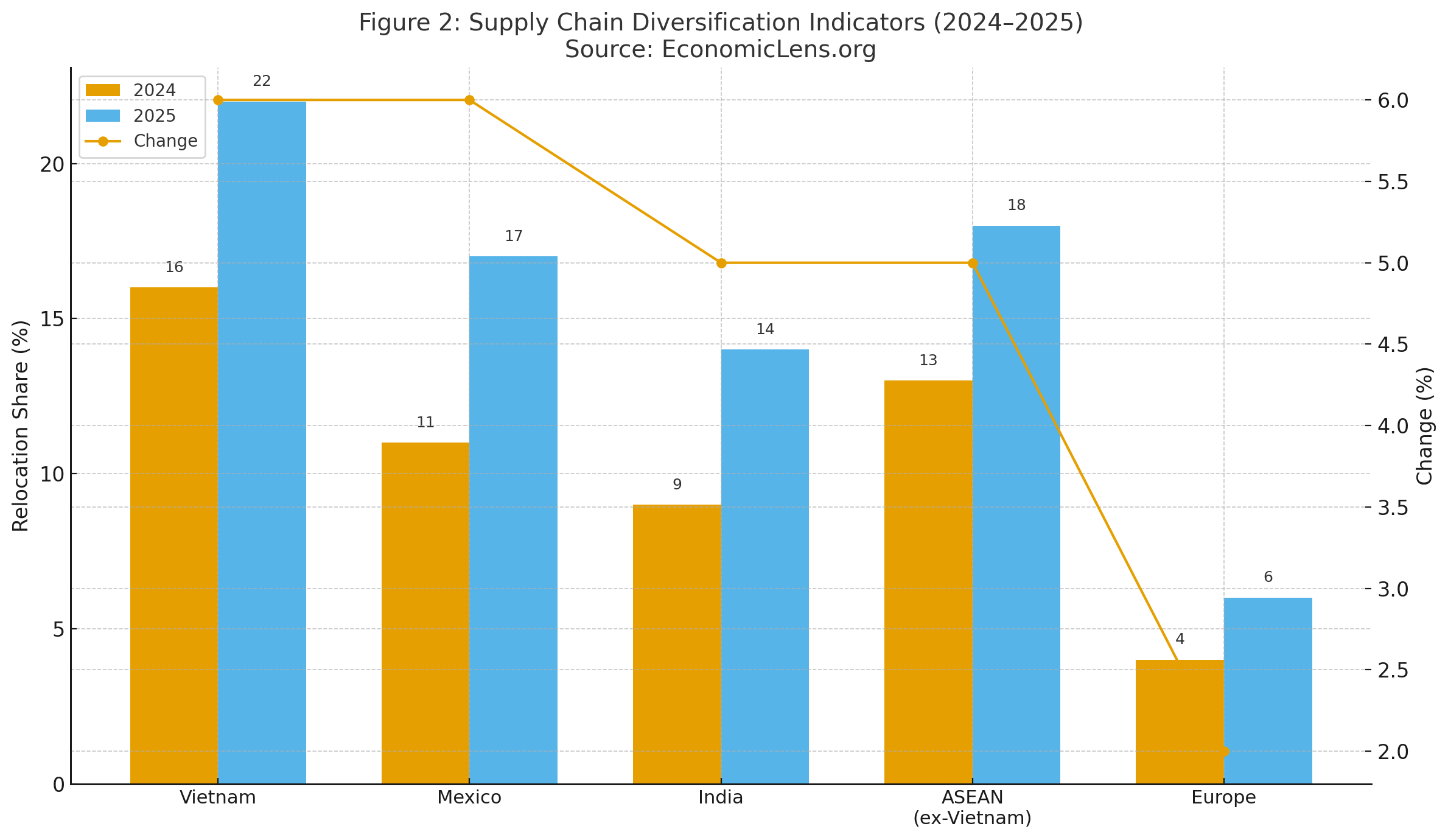

The spread of the US China trade war 2025 through global transmission channels creates inflationary pressure across manufacturing, logistics and currency markets. Price effects originate in intermediate components and extend into consumer electronics, EVs and heavy machinery. Additionally, emerging markets face currency volatility that amplifies import inflation. Meanwhile, global supply chains become more segmented as buyers shift procurement from China toward Vietnam, Mexico and India. These dynamics generate uneven exposure across economies, creating winners, losers and sectors that face persistent operational stress.

A related analysis of global supply shocks and inflation pressures appears in “Global Food Supply Crunch: Climate Shocks, Export Bans and Inflation Risk” (https://economiclens.org/global-food-supply-crunch-climate-shocks-export-bans-and-inflation-risk/).

Experts Opinion and Reports Analysis

WTO Chief Economist Ralph Ossa stresses that the trade war reshapes sourcing decisions by influencing long-term investment patterns and pushing companies to decouple from China. Additionally, Morgan Stanley’s Asia Economics Team highlights that currency depreciation across import-dependent emerging markets worsens domestic inflation. In contrast, HSBC Global Supply Chain Advisory notes that although diversification offers opportunities, it introduces new risks for countries unprepared for rapid scaling.

The World Bank Global Economic Prospects 2025 attributes nearly one third of projected global trade slowdown to tariff-induced uncertainty. Furthermore, UNCTAD’s Global Freight Outlook confirms rising container rerouting through Southeast Asia. Meanwhile, the Asian Development Bank warns that South Asia faces intensified inflation pressure due to concentrated dependence on Chinese industrial inputs.

Relocation data shows rapid diversification away from China, particularly toward Vietnam, Mexico and India. Consequently, emerging manufacturing hubs must manage scaling challenges while balancing new investor expectations and infrastructure constraints.

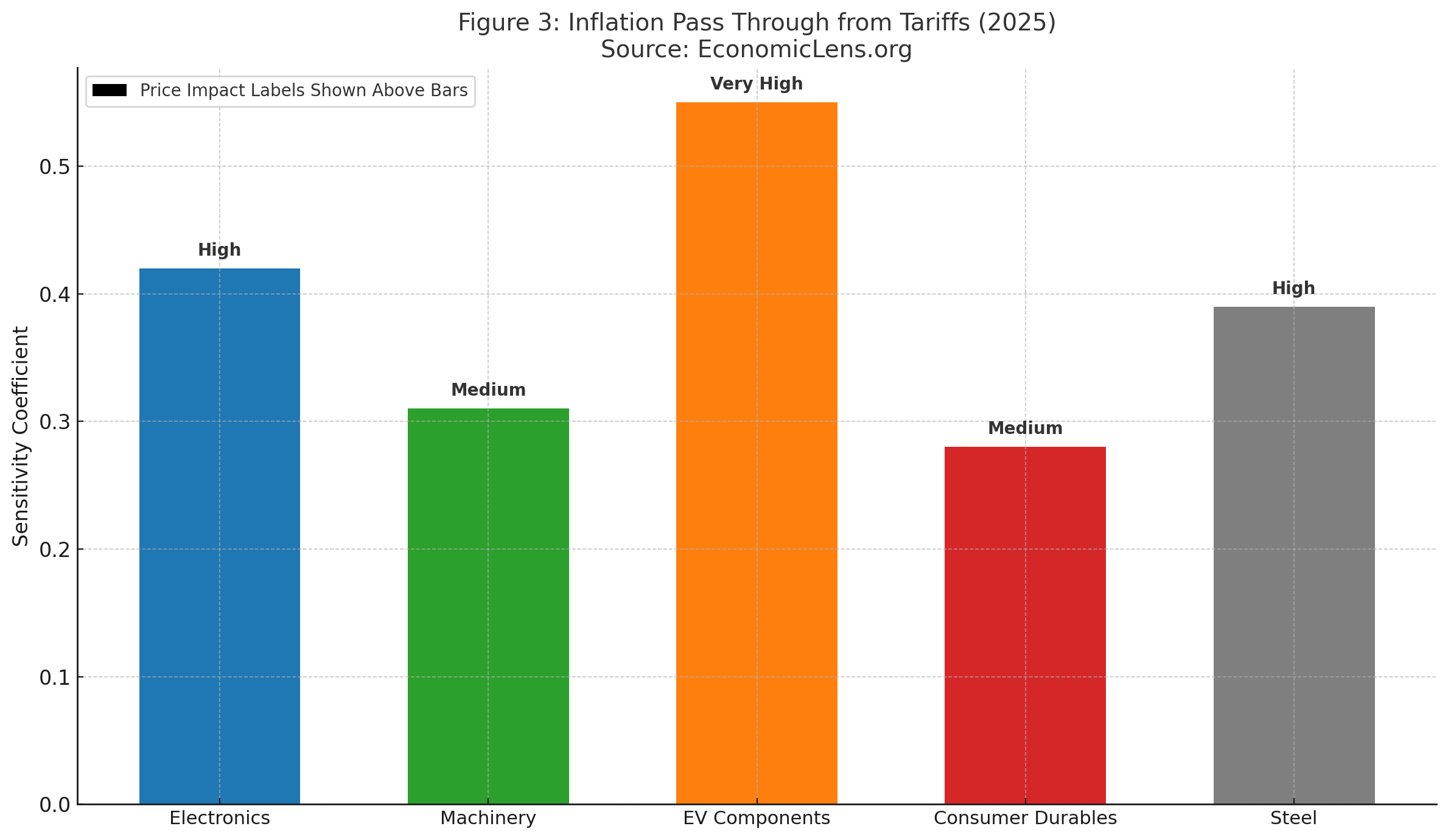

Tariff inflation sensitivity is highest in EV components and electronics, which magnifies consumer price volatility. Additionally, manufacturers experience increased cost burdens that reduce competitiveness and investment appetite.

Regional Impact Brief

European manufacturers are caught between rising energy prices and the cascading effects of the US China trade war 2025. German machine tool producers report order slowdowns as input costs soar due to higher tariffs on Chinese components. Meanwhile, French and Italian consumer electronics firms face inventory disruptions as Chinese shipments are rerouted through Southeast Asia. According to Eurostat, supply delays increased by 14 percent in Q3 2025, undermining industrial output. Consequently, Europe’s diversification strategy has intensified, but the transition brings its own inflationary risks.

“When tariff chains tighten, inflation does not remain local; it becomes a global transmission mechanism.”

3. Sectoral Disruptions and Supply Chain Rewiring in the US China Trade War 2025

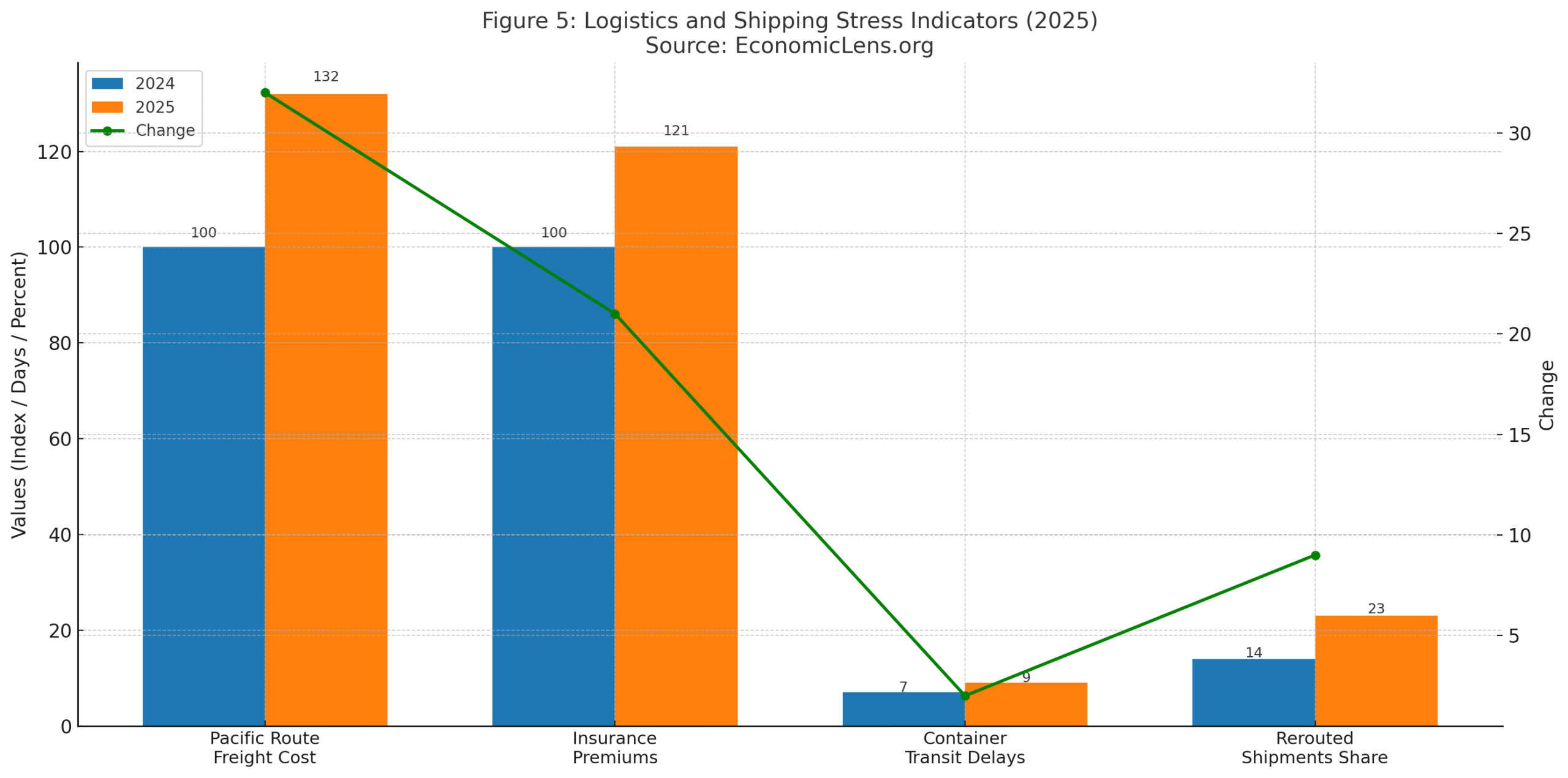

Sectoral disruptions under the US China trade war 2025 are sharpest in EV supply chains, semiconductor ecosystems, solar components and advanced machinery. These sectors rely on multi stage production networks concentrated in China, which makes them highly sensitive to tariff shocks. As a result, firms intensify diversification to India, Mexico, Eastern Europe and Southeast Asia. Additionally, shipping routes absorb new stress due to rerouting, capacity constraints and rising insurance costs. Consequently, global time to market extends, raising operating expenses and slowing capital allocation.

Experts Opinion and Reports Analysis

S&P Global Mobility highlights that EV battery supply chains remain overwhelmingly China centered, making them particularly vulnerable. Furthermore, TSMC senior strategists warn that semiconductor packaging and testing still rely heavily on Chinese facilities. Meanwhile, Lloyd’s Marine Insurance Market notes that increased rerouting through the South China Sea raises premiums due to uncertainty from tariff linked geopolitical tensions.

The OECD Semiconductor Market Review 2025 indicates a 7 percent decline in global chip trade due to tariff uncertainty. Additionally, UNCTAD Maritime Logistics Report shows freight delays rising by 16 percent on Pacific routes. Meanwhile, IEA’s Clean Energy Components Brief warns that the solar supply chain faces near term bottlenecks as Chinese exports slow. The OECD Supply Chain Monitor 2025 (https://www.oecd.org/trade/) highlights how tariff uncertainty and technology restrictions increase freight delays and production bottlenecks.

face severe cost escalation and delays due to concentration risk. Consequently, firms accelerate diversification, but the new networks require investment, time and operational readiness.

Freight markets reflect rising stress as rerouting becomes widespread. As a result, shipping delays and insurance costs contribute to global delivery uncertainty and pricing volatility.

Chip Supply Chain Insight

Chip manufacturers report renewed shortages as the US China trade war 2025 disrupts packaging and testing stages centered in China. Taiwanese and South Korean firms face increased costs as they shift final assembly to Vietnam and India. According to industry analysts, the transition has reduced throughput by nearly 11 percent, especially in advanced packaging nodes. Consequently, global electronics firms delay launches and adjust production cycles to manage input constraints.

“Realignment is not simply movement; it is the reengineering of a supply chain under pressure.”

4. Emerging Market Spillovers and Monetary Stress in the

US China Trade War 2025

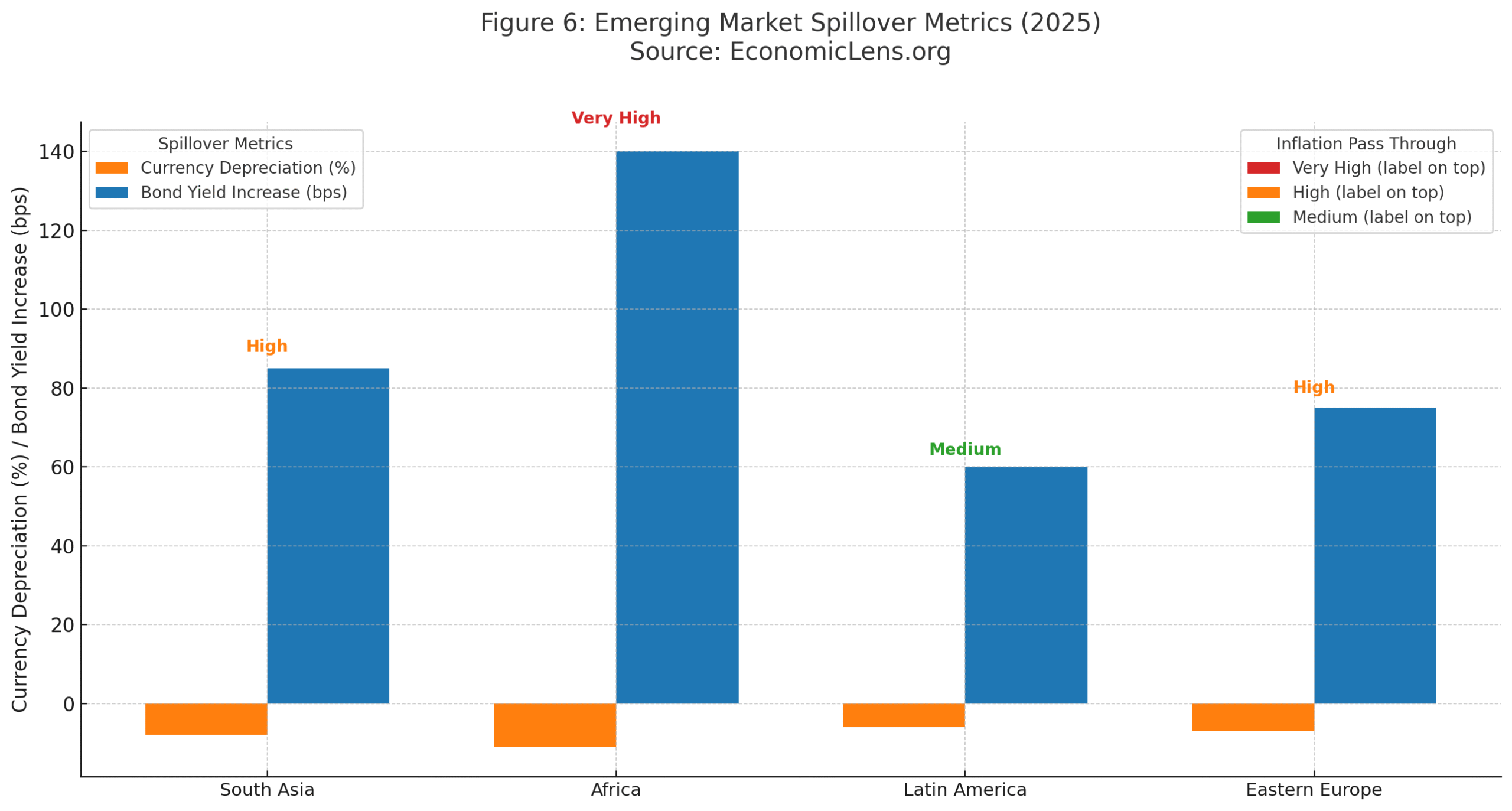

The US China trade war 2025 generates sharp spillovers across emerging markets through currency depreciation, bond yield pressure, capital outflows and inflation acceleration. Import dependent economies face heightened vulnerability as tariff driven price shocks spread into domestic markets. Additionally, countries with high external financing needs struggle as investors demand risk premiums. Consequently, fiscal space tightens, monetary policy becomes more complex and consumption growth weakens.

Expert Opinion and Report Analysis

JPMorgan Emerging Markets Research warns that tariff related shocks increase refinancing risk for frontier economies. Furthermore, Standard Chartered Global FX Desk notes that currencies across Africa and South Asia face increased volatility due to tariff induced global uncertainty. Additionally, IMF Debt Sustainability Assessments highlight rising rollover costs for countries with high exposure to imported machinery and electronics.

The World Bank EM Pulse 2025 indicates that nearly 60 percent of emerging markets have recorded currency depreciation linked to tariff uncertainty. Meanwhile, S&P Global Risk Signals show widening spreads for sovereign bonds in Africa, Latin America and South Asia. In contrast, ADB Regional Outlook warns that South Asia’s inflation will remain elevated due to tariff linked input costs.

Spillover indicators highlight widening vulnerability across emerging markets. Consequently, interest rates rise, budgets tighten and inflation remains elevated due to currency depreciation.

Emerging Market Case Insight

South Asian manufacturers face rising costs as tariffs raise prices for machinery, electronics and industrial inputs from China. Bangladesh’s apparel sector reports a 9 percent rise in input costs, while Pakistan’s electronics importers struggle with currency pressure and rising dollar demand. India remains comparatively resilient due to domestic capacity, but still faces bottlenecks in advanced components. Consequently, regional inflation dynamics become more complex, requiring tighter policy coordination.

“Shocks do not observe borders; they amplify through markets that are structurally exposed.”

5. Strategic Outlook and Policy Pathways

The forward trajectory of the US China trade war 2025 suggests prolonged uncertainty as both economies harden positions on technology, industrial policy and geopolitical competition. Consequently, the global economy enters a period of sustained fragmentation, with supply chain realignment, tariff cycles and strategic reshoring shaping investment decisions. Meanwhile, emerging markets must recalibrate industrial strategies to withstand prolonged volatility. The policy challenge is complex, requiring integrated approaches to inflation management, fiscal sustainability and sectoral planning.

Expert Opinion and Report Analysis

Chatham House Trade Researchers argue that global governance frameworks lag behind the intensity of US China conflict. Additionally, Brookings Institution analysts highlight that industrial strategy will play a decisive role in competitiveness over the next decade. Furthermore, IMF Fiscal Affairs notes that coordinated policy responses are essential to maintain stability during prolonged decoupling.

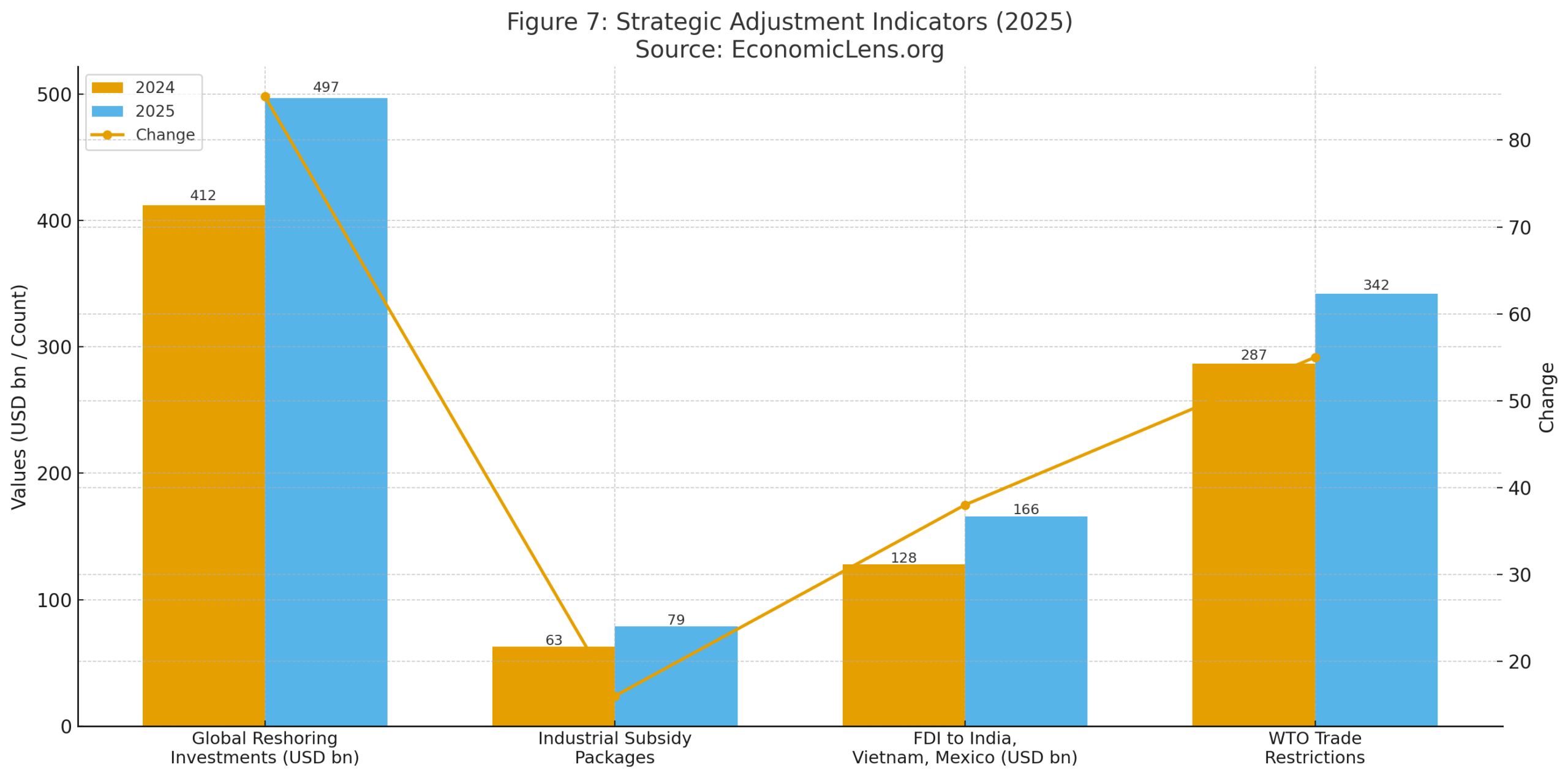

The WTO Monitoring Report 2025 records over 340 new restrictive measures within 18 months. Meanwhile, OECD Industrial Policy Review 2025 notes an acceleration in subsidy backed reshoring initiatives. In contrast, UNCTAD’s Global Investment Trends highlights that FDI flows are increasingly directed toward countries positioned as alternatives to China.

Strategic adjustment indicators show a sharp rise in reshoring commitments and subsidy backed industrial policies. As a result, global trade patterns are realigning rapidly, with long term consequences for competitiveness.

Strategic Shift Insight

The United States is witnessing a sharp rise in reshoring announcements as firms shift operations from China to Mexico, Texas and the Midwest. Incentives under the CHIPS Act and Inflation Reduction Act have catalyzed investment across automotive, semiconductor and clean energy sectors. Analysts at KPMG note that reshoring has increased by almost 31 percent in 2025 compared to 2024, reflecting a structural transition in manufacturing. Consequently, North America emerges as a critical alternative hub for industries affected by tariff escalation.

“The future of global trade will be defined not by cost efficiency alone but by strategic resilience.”

Conclusion

The escalation of the US China trade war 2025 represents a pivotal moment in the evolution of global economic architecture. Tariff expansion, technology controls and retaliatory restrictions reshape supply chains, production decisions and long term investment patterns. Consequently, economies experience higher inflation, tighter monetary conditions and increased uncertainty across manufacturing and logistics networks. The resulting fragmentation introduces both risks and opportunities, as countries positioned as alternative production hubs gain momentum while others face structural vulnerabilities. The combined impact on emerging markets is especially pronounced due to currency pressure, bond yield increases and dependence on imported industrial inputs. Moving forward, global economic stability will depend on coordinated policy frameworks, strategic industrial planning and enhanced resilience in trade corridors. The trade war marks a prolonged phase of competitive realignment, requiring adaptive responses to navigate complex economic transitions.

For broader macroeconomic context on how trade fragmentation, weak manufacturing and geopolitical tensions shape global activity, see “Global Economic Outlook 2025–2026: Slow Growth, Sticky Inflation & Rising Debt” (https://economiclens.org/global-economic-outlook-2025-2026-slow-growth-sticky-inflation-rising-debt/).

Call to Action

Governments, firms and multilateral institutions must prepare for prolonged fragmentation across global trade systems. Strategic planning, risk management and capacity building are essential for navigating tariff cycles and supply chain transitions. Resilience will increasingly determine competitive advantage in a world shaped by economic rivalry and shifting production networks.