Global Food Insecurity intensifies as hunger levels remain uneven, food inflation outpaces general prices and healthy diets become increasingly unaffordable. This blog explains how Fertilizer shocks, gas market volatility, climate risks and conflict disruptions interact to elevate global food stress across vulnerable regions.

Introduction

Global Food Insecurity continues to intensify as uneven hunger trends, rising diet costs and sustained Fertilizer and gas shocks reshape global nutrition realities. In the Global Food Insecurity landscape of 2025, hunger declines observed in some regions contrast sharply with worsening levels in others, demonstrating that progress remains highly uneven despite earlier improvements.

Additionally, food prices outpace overall inflation for a sixth consecutive year, while the cost of a healthy diet increases faster than household incomes. Consequently, millions face profound affordability challenges. Meanwhile, Fertilizer markets remain volatile due to supply chain disruptions, gas price instability and post conflict imbalances. As a result, Global Food Insecurity returns as a central global risk with significant policy implications.

This blog explains how hunger trends, food inflation, diet affordability pressures, energy shocks and Fertilizer spikes collectively intensify Global Food Insecurity in 2025.

1. Global Food Insecurity 2025: Uneven Global Hunger Trends

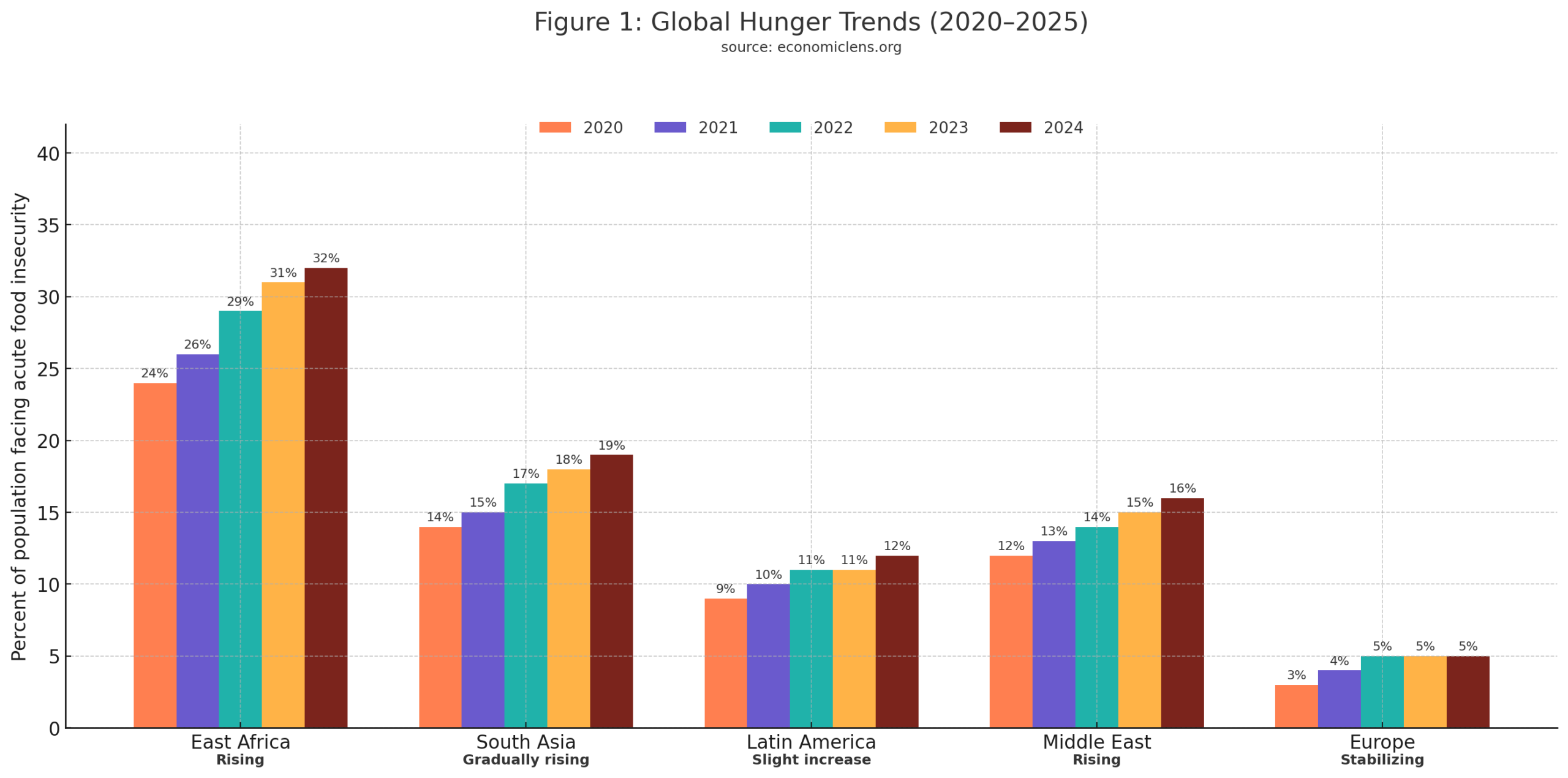

Global Food Insecurity remains structurally uneven across regions due to climate shocks, conflict, weak agricultural productivity and price instability. According to the FAO, hunger levels declined between 2022 and 2024 in parts of Asia and Latin America. However, severe setbacks re emerged in East Africa, the Middle East and conflict affected zones. Consequently, global progress remains fragile and divergent.

Furthermore, demographic pressures intensify food demand while supply constraints persist. As a result, many countries face difficulty stabilizing hunger outcomes despite temporary improvements. This section assesses these divergences with grounding from global reports and regional indicators.

Expert Insight & Global Report Signals

The FAO State of Food Security and Nutrition Report 2025 (https://www.fao.org/publications) highlights that global hunger declined modestly but remains significantly above pre pandemic levels. Additionally, the IFPRI Global Food Security Index 2025 (https://www.ifpri.org) notes that food access disparities widened during 2024–2025 due to inflation and climate extremes.

For broader context on how food inflation reshapes economic stability and political risk, see our analysis “Global Food Crisis: How Food Inflation Is Reshaping Economies and Politics in 2025” (https://economiclens.org/global-food-crisis-how-food-inflation-is-reshaping-economies-and-politics-in-2025/)

FAO data shows that global undernourishment stands at 735–745 million people in 2025. Hunger improved moderately in South Asia but deteriorated in East Africa due to drought and conflict. Meanwhile, fragile states experienced heavy setbacks due to supply chain disruptions and high food import costs.

Additionally, UN WFP assessments suggest that climate linked production declines affected cereal supplies across the Horn of Africa and Yemen. Therefore, regional volatility continues to be the defining feature of hunger outcomes.

Hunger levels show strong regional divergence as conflict and climate volatility intensify stress in East Africa and the Middle East. Meanwhile, improvements in South Asia demonstrate how stabilizing prices and harvest cycles reduce Global Food Insecurity.

East Africa Spotlight: Climate Stress and Rising Global Food Insecurity

East Africa remains one of the most affected regions in 2025 as prolonged drought cycles, climate variability, currency depreciation and high import prices reduce food availability. According to UN OCHA data, cereal production fell more than 18 percent due to water scarcity and crop failure. Additionally, conflict in Somalia and Sudan restricts humanitarian access, further worsening Global Food Insecurity. Consequently, millions remain dependent on emergency food assistance as structural vulnerabilities intensify regional hunger.

“Food security improves only when stability, climate resilience and affordability intersect to protect vulnerable households.”

2. Global Food Insecurity and Food Inflation: Diet Affordability Crisis Deepens

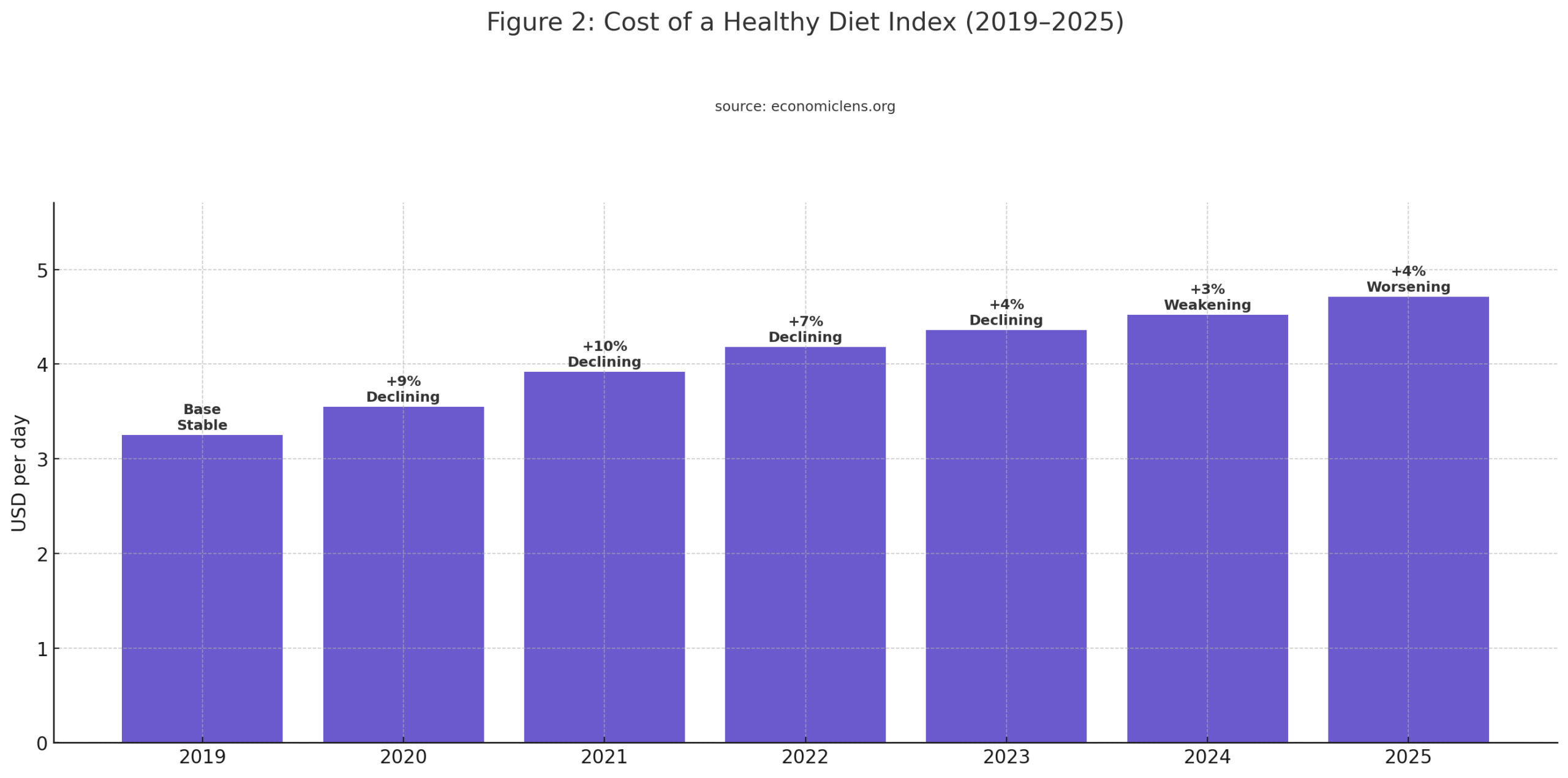

Global Food Insecurity intensifies as food inflation outpaces general inflation across advanced and developing economies. Since 2019, global food prices have risen more sharply than non food items due to supply disruptions, energy volatility and higher input costs.

Meanwhile, the cost of a healthy diet continues to increase faster than wages in most regions. As a result, affordability remains the most acute barrier to nutrition. This trend challenges policymakers as they attempt to balance subsidies, trade measures and fiscal constraints.

Expert Insight & Global Report Signals

The World Bank Food Price Dashboard 2025 (https://www.worldbank.org) confirms that real food prices remain elevated despite modest corrections in global commodity markets. Additionally, the WFP Market Monitor (https://www.wfp.org) highlights widespread price acceleration in grains, dairy, protein and vegetable oils.

For a broader assessment of how climate shocks and infrastructure stress intensify food system fragility, see “Climate Disaster Food Crisis: Global Economic Loss and Infrastructure Collapse”

(https://economiclens.org/climate-disaster-food-crisis-global-economic-loss-and-infrastructure-collapse/)

Food prices rose by 14 percent annually between 2019 and 2023, compared with 5–6 percent for general inflation. Diet cost inflation remained high due to transport expenses, Fertilizer shocks and climate related production declines.

Moreover, countries dependent on imported protein and dairy experienced sharper inflation. Consequently, diet affordability disparities increased significantly across regions.

The cost of a healthy diet increases steadily due to rising protein and dairy prices, limited supply growth and input cost pressures. Consequently, Global Food Insecurity worsens as households allocate a larger share of income to essential foods.

South Asia Spotlight: Protein Inflation and the Global Diet Affordability Crisis

South Asia faces severe diet affordability pressures as protein inflation accelerates due to higher feed, Fertilizer and logistics costs. According to WFP regional assessments, egg, poultry and dairy prices increased by more than 22 percent in 2025. Additionally, climate related feed shortages raise production costs. Consequently, protein affordability deteriorates, intensifying Global Food Insecurity among low income households.

“When prices rise faster than incomes, affordable nutrition becomes the first casualty.”

3. Global Food Insecurity Exposure to Energy Markets and Gas Supply Strain

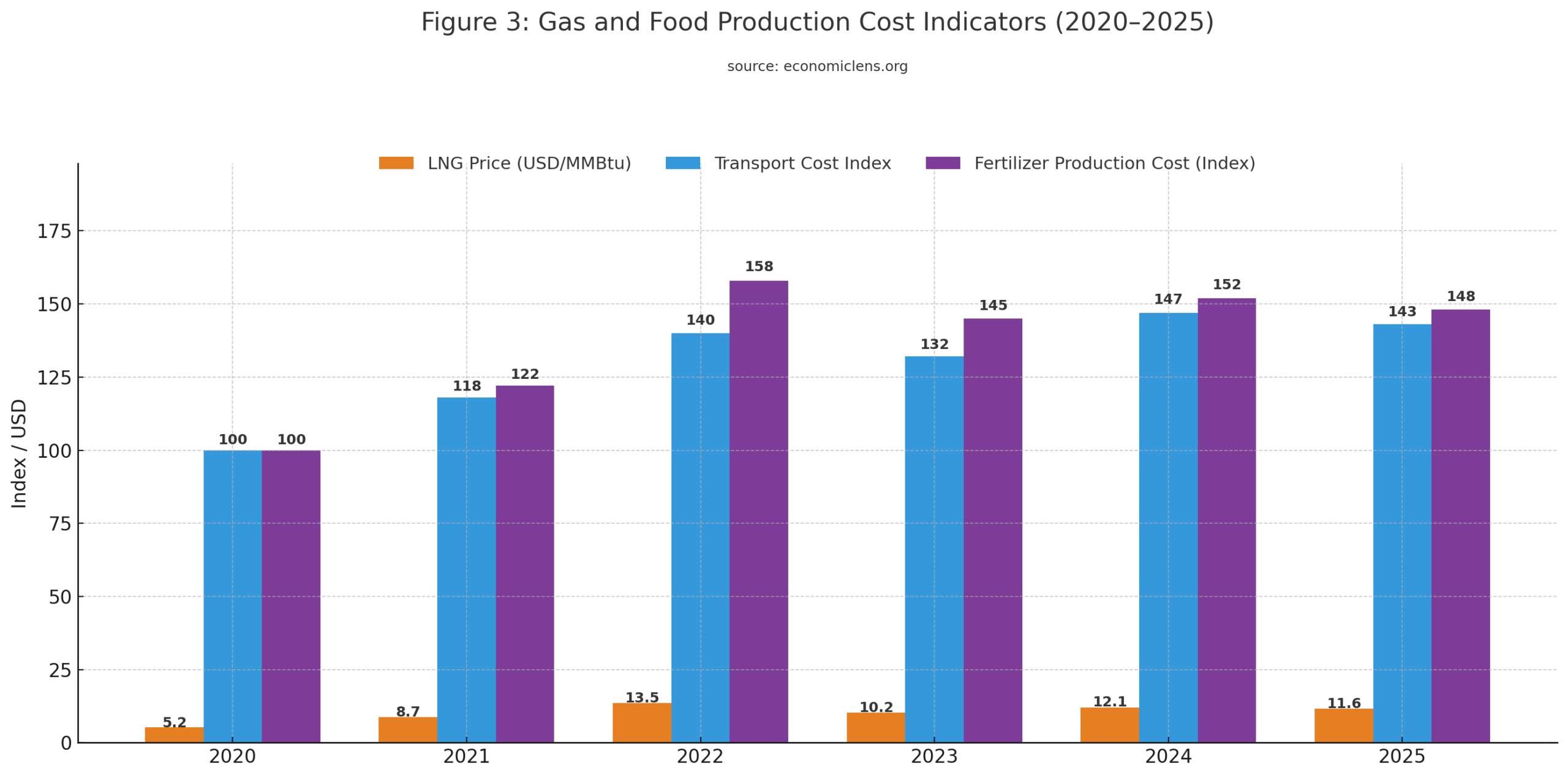

Global Food Insecurity is closely linked to energy markets, particularly natural gas prices. Gas is a key input for nitrogen Fertilizer, transport, cooling chains and processing industries. Consequently, gas price spikes drive broad based increases in food production costs.

Since 2023, heightened geopolitical tensions, OPEC supply adjustments and infrastructure disruptions have caused recurrent surges in gas markets. Therefore, this section assesses how energy volatility influences food systems.

Expert Insight & Global Report Signals

The IEA Gas Market Update 2025 (https://www.iea.org) highlights renewed volatility due to Middle East disruptions and LNG supply constraints. Additionally, the IMF Energy Commodity Update 2025 (https://www.imf.org/en/Publications) indicates persistent pressure in gas markets despite demand moderation.

For labour market vulnerabilities linked to energy driven inflation, see “Global Youth Unemployment 2025: AI Disruption, Skills Gaps and the Gen Z Jobs Crunch” (https://economiclens.org/global-youth-unemployment-2025-jobs-skills-outlook/)

Food supply chains remain heavily exposed to gas price fluctuations. Transport costs rose sharply in 2024 due to elevated LNG benchmarks and shipping rerouting. Meanwhile, Fertilizer production disruptions increased input stress for farmers.

Additionally, Europe experienced heightened gas sensitivity due to storage limitations and reduced pipeline flows. Consequently, gas volatility continues to spill into food inflation across regions.

Gas linked production costs remain elevated as LNG markets fluctuate and supply security concerns persist. Consequently, food producers face sustained input inflation that contributes directly to Global Food Insecurity across vulnerable regions.

Europe Spotlight: Energy Cost Volatility and Global Food Price Pressure

Europe experiences significant exposure to gas price volatility due to reduced Russian pipeline flows and increased reliance on LNG imports. According to Eurostat, industrial energy costs rose nearly 19 percent in 2025. Meanwhile, food processors face sustained price pressure due to higher cooling, drying and transport expenses. Consequently, consumers experience continued food price inflation, worsening Global Food Insecurity in lower income households.

“Energy security is food security when every aspect of production depends on stable fuel markets.”

4. Fertilizer Market Shock and Global Food Insecurity Risks

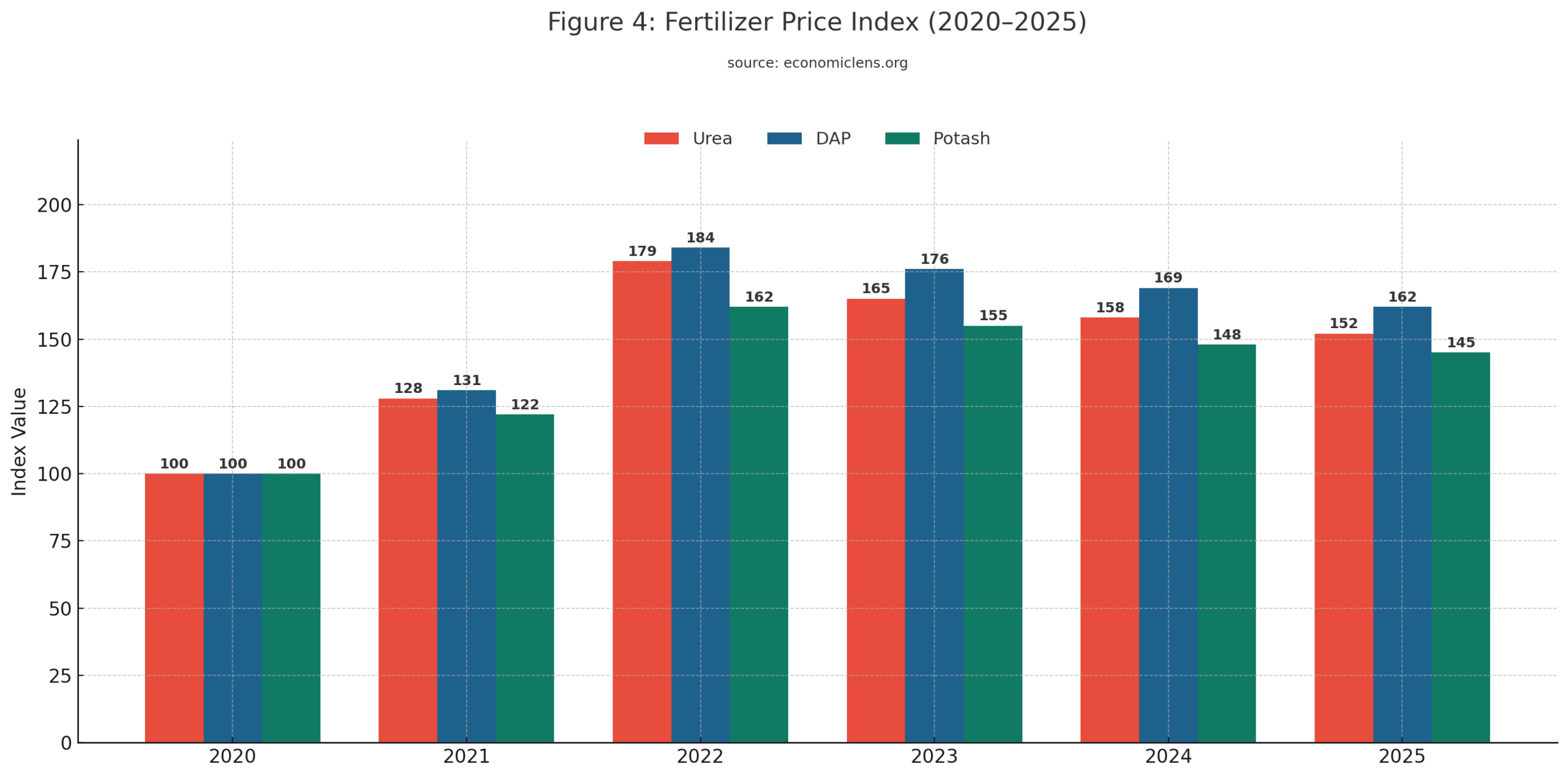

Global Food Insecurity intensifies as Fertilizer markets remain volatile due to tightening supply, restricted exports and persistent logistics disruptions. Fertilizer is one of the most critical agricultural inputs. Therefore, sharp price increases transmit quickly to food production and consumer prices.

Since 2022, Fertilizer markets have struggled to stabilize due to the Russia–Ukraine conflict, high gas prices and export restrictions from major producers. Consequently, farmers face higher costs and reduced application rates, which depress yields.

Expert Insight & Global Report Signals

The World Bank Fertilizer Market Bulletin 2025 (https://www.worldbank.org) shows urea and NPK prices remain 24 percent above pre crisis averages. Additionally, the IFPRI Fertilizer Market Review 2025 (https://www.ifpri.org) indicates that supply remains heavily concentrated among a few exporting countries.

Global urea and potash prices soared in 2022 and remained persistently high. Export restrictions from major suppliers reduced market liquidity while shipping bottlenecks increased delivery times. Meanwhile, farmers in Africa, South Asia and Latin America reduced Fertilizer use, resulting in lower cereal yields.

Consequently, Fertilizer shortages amplify productivity risks and deepen Global Food Insecurity in 2025.

Fertilizer prices remain significantly above pre crisis levels due to high gas costs, exporting restrictions and supply chain delays. Consequently, farmers reduce application rates, lowering yields and worsening Global Food Insecurity.

Brazil Spotlight: Fertilizer Import Dependence and Global Food Insecurity

Brazil, one of the world’s largest agricultural exporters, depends heavily on imported Fertilizer for soybean, maize and sugarcane production. According to the Brazilian Agriculture Ministry, Fertilizer import costs rose 17 percent in 2025 due to shipping disruptions and tighter global supply. Consequently, production margins narrow and domestic food prices rise, exacerbating Global Food Insecurity.

“When input costs rise faster than yields, food systems lose their resilience.”

5. Climate, Trade and Conflict Pressures Driving Global Food Insecurity

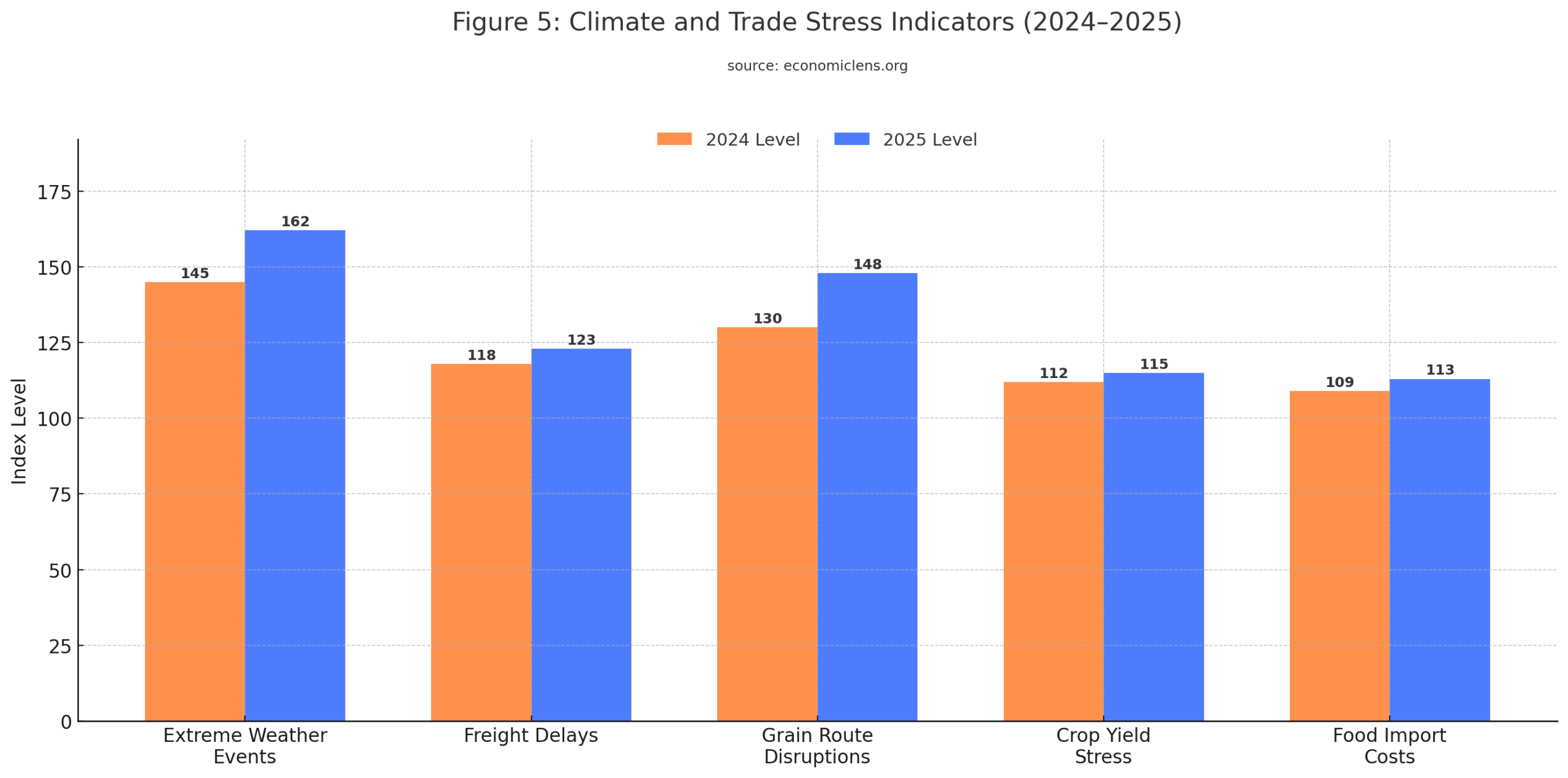

Climate impacts, conflict disruptions and fragile trade corridors collectively reshape Global Food Insecurity in 2025. Heatwaves, erratic rainfall, El Niño events and drought cycles reduce yields across major agricultural regions. Meanwhile, geopolitical tensions disrupt grain routes and increase freight costs.

Therefore, building resilient and diversified food systems becomes a policy priority as vulnerabilities intensify.

Expert Insight & Global Report Signals

The UN WFP Climate and Hunger Brief 2025 (https://www.wfp.org) highlights that extreme weather events drove significant reductions in cereal production across Africa and Asia. Additionally, the UNCTAD Trade Logistics Report 2025 (https://unctad.org) indicates rising freight delays due to conflict and port disruptions.

Climate linked crop losses occurred across Africa, South Asia and parts of the Middle East. Meanwhile, conflict disruptions in the Red Sea increased shipping costs by more than 30 percent for grain shipments. Additionally, poor infrastructure and limited storage capacity intensified post harvest losses.

Consequently, climate and conflict pressures continue to deepen Global Food Insecurity in vulnerable regions.

Climate extremes, rising freight delays and conflict disruptions intensify food system instability. Consequently, many countries face higher import dependency and rising vulnerability, deepening Global Food Insecurity.

Middle East Spotlight: Trade Disruptions and Rising Global Food Insecurity

Middle East grain imports face significant disruptions due to conflict linked shipping restrictions in the Red Sea. According to UNCTAD, average transit times increased by 38 percent in 2025 due to rerouting and maritime security concerns. Consequently, import reliant economies experience higher food prices and reduced availability, worsening Global Food Insecurity.

“Food systems cannot thrive when climate impacts and conflict reshape every link in the supply chain.”

Conclusion

Global Food Insecurity has reemerged as a defining global challenge due to intersecting pressures from hunger volatility, rising food prices, increasing diet costs, persistent Fertilizer shocks, gas market volatility and climate related disruptions. Although some regions experienced moderate improvements in hunger outcomes, progress remains highly uneven and easily reversed due to conflict, inflation and supply chain stress.

Furthermore, increased dependency on imported foods, volatile energy markets, and reduced Fertilizer application push many regions toward heightened vulnerability. Climate extremes, demographic pressures and geopolitical instability compound these challenges. Consequently, policymakers face urgent choices regarding agricultural investment, climate adaptation, input affordability and trade stability.

Sustainable progress will depend on integrated strategies that strengthen domestic production, improve storage capacity, foster resilient supply chains and expand targeted safety nets. Ultimately, addressing Global Food Insecurity demands coordinated responses that combine economic stability, climate resilience and inclusive food system reform.

Call to Action

Governments, institutions and communities must prioritize nutrition access, climate resilience and agricultural capacity building to safeguard long term food stability. Strategic investment, smart policy coordination and resilient supply chains remain essential for reducing Global Food Insecurity.