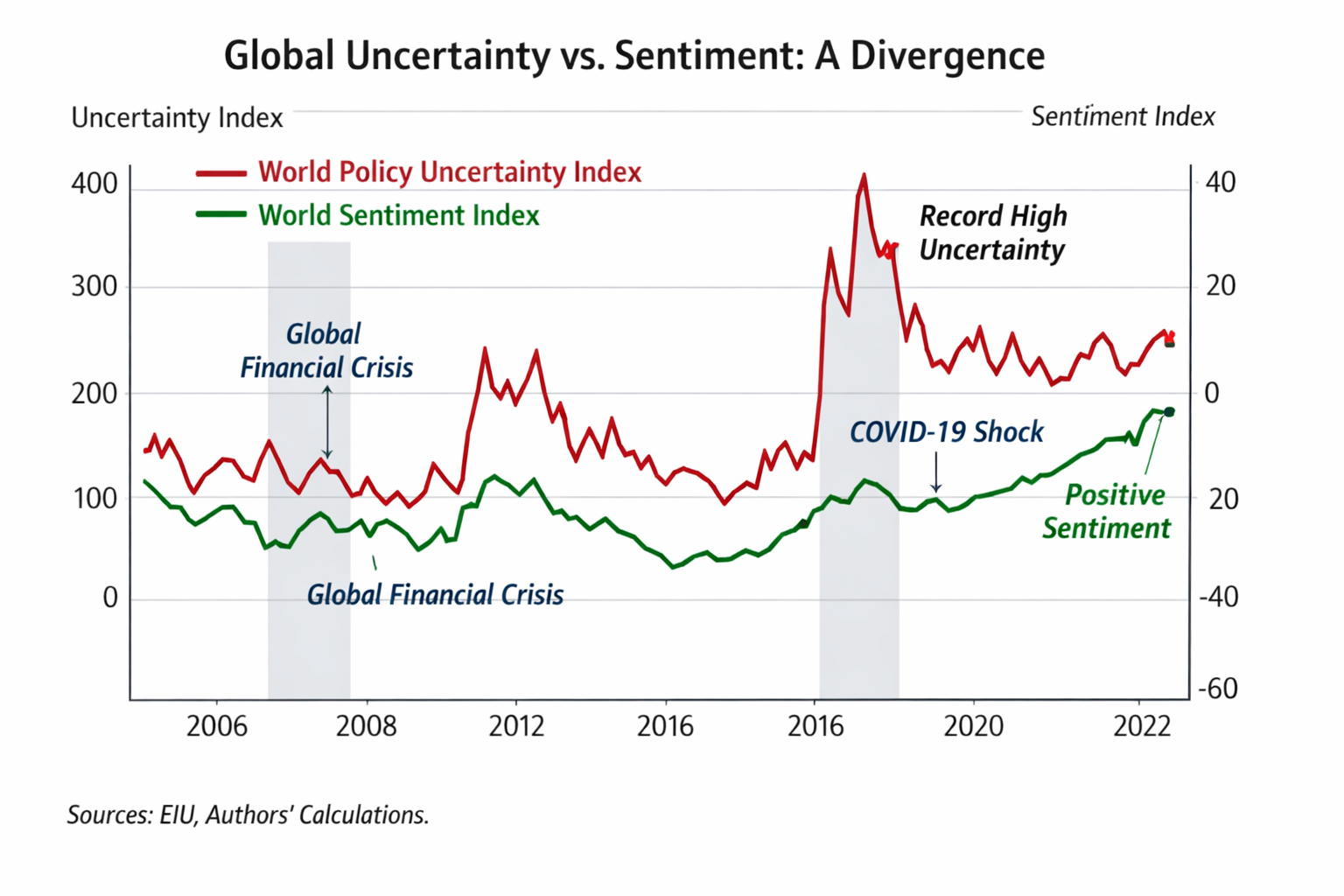

Global policy uncertainty and economic sentiment show a widening gap since 2008. Policy risk surges during global shocks, yet economic sentiment recovers faster. This chart-based visual story explains the causes, spillovers, and outlook behind resilient confidence in a volatile policy environment.

Introduction

Global policy uncertainty and economic sentiment have increasingly followed different paths since the global financial crisis. While repeated shocks have raised institutional risk, confidence has shown notable resilience.

This chart-based visual story examines global policy uncertainty and economic sentiment from 2008 to 2025. The divergence mirrors broader shifts in global financial power and policy coordination discussed in EconomicLens analysis of how digital currencies are reshaping global finance and payment systems within the evolving international monetary order: https://economiclens.org/digital-yuan-vs-swift-the-race-to-redefine-global-finance/.

Rising world policy uncertainty index as the core cause

Global policy uncertainty and economic sentiment begin to diverge during major disruptions. The upper panel shows the world policy uncertainty index rising sharply during crisis periods.

The global financial crisis and euro area debt stress produced early spikes. However, the most dramatic surge occurs in 2020. Emergency fiscal packages, unconventional monetary policy, and trade restrictions expanded rapidly. The International Monetary Fund notes that crisis-era interventions often elevate policy uncertainty even after economic activity begins to recover: (https://www.imf.org/en/Topics/uncertainty).

Impact on global economic sentiment trends

Global policy uncertainty and economic sentiment do not respond symmetrically. The lower panel shows global economic sentiment trends weakening during crises but recovering quickly afterward.

Although sentiment turns negative during severe shocks, the declines are short-lived. After 2020, confidence rebounds faster than uncertainty declines. This suggests that firms and households adjust expectations once growth signals and liquidity conditions improve.

Spillovers to investor confidence under uncertainty

The spillover from uncertainty to sentiment operates mainly through investment and risk perception. Higher uncertainty raises financing costs and delays capital spending. However, sentiment improves when policy direction becomes clearer.

This helps explain why investor confidence under uncertainty can recover even when institutional risk remains elevated. OECD analysis shows that expectations depend more on credibility and forward guidance than on uncertainty levels alone: (https://www.oecd.org/economy) .

Outlook for global macroeconomic uncertainty

Global policy uncertainty and economic sentiment are likely to remain decoupled. Elections, geopolitical tensions, and regulatory shifts will continue to generate policy risk.

Yet sentiment may stay positive if inflation stabilizes and growth holds. In this environment, credibility and communication matter more than the absence of shocks. These dynamics are consistent with broader EconomicLens assessments of structural change in global financial governance and cross-border monetary influence.

Conclusion

Global policy uncertainty and economic sentiment now send different macroeconomic signals. Uncertainty reflects political and institutional risk, while sentiment captures adaptive expectations about growth and income.

This chart shows that confidence can remain resilient even as uncertainty becomes structural. Understanding this divergence is essential for interpreting global economic momentum in an increasingly volatile policy landscape.