Climate-driven food inflation is increasingly shaping global economic outcomes as climate shocks, supply disruptions, and policy responses interact across food markets. However, unlike past price spikes, current food inflation pressures are persisting across regions. As a result, governments face rising fiscal stress, while central banks confront inflationary pressures that are difficult to neutralize. Moreover, food supply stability is emerging as a critical determinant of macroeconomic resilience heading into 2026.

Executive Snapshot

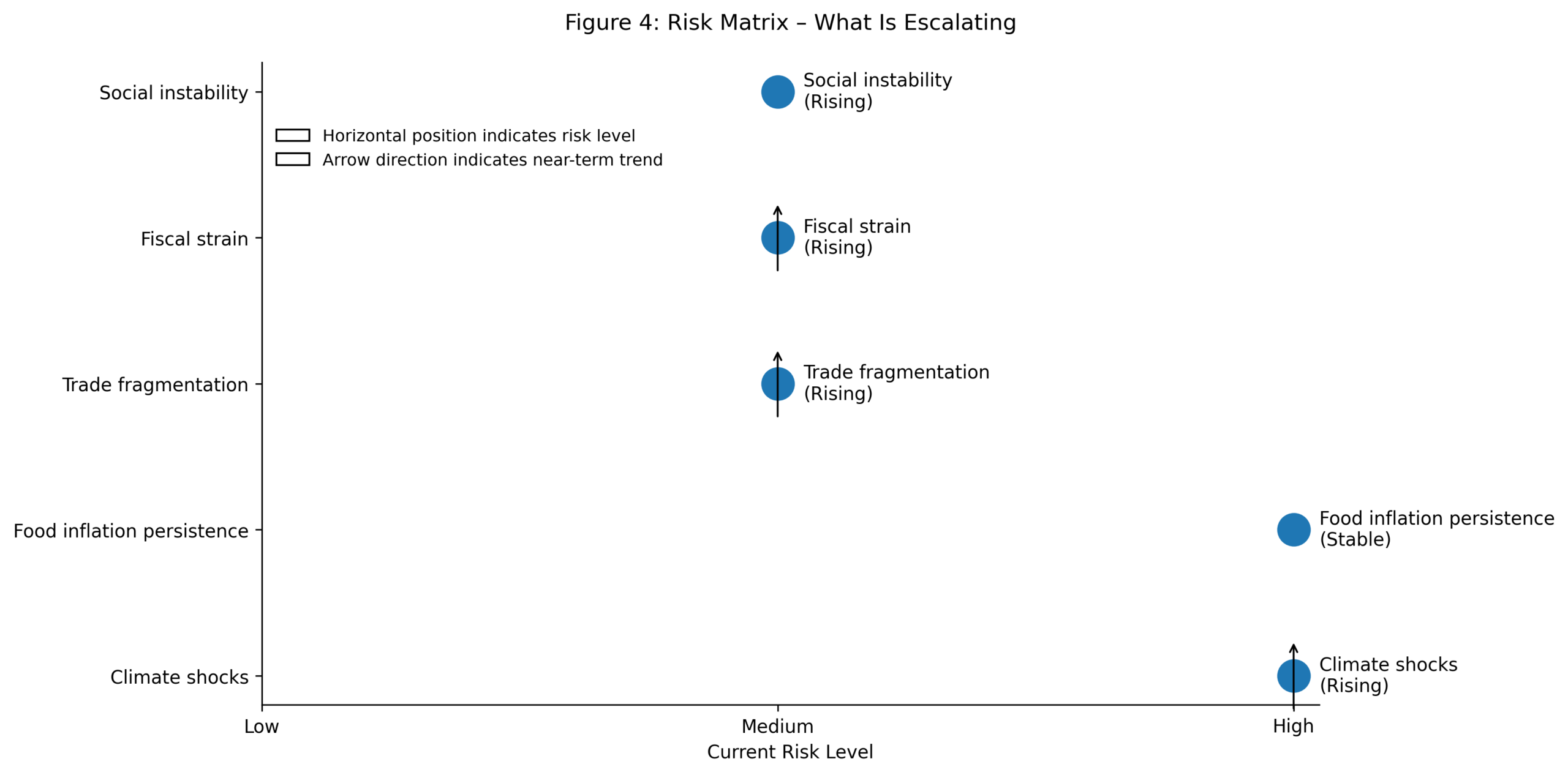

Climate-driven food inflation has shifted from a temporary supply shock into a structural macroeconomic constraint. Climate events are becoming more frequent and synchronized. At the same time, trade responses are fragmenting markets, while fiscal buffers are weakening. As a result, food inflation remains elevated in emerging economies even as headline inflation moderates globally. This divergence is limiting the effectiveness of conventional monetary policy and increasing social and fiscal risks.

Key numbers this week

- Emerging market food inflation: 9.6% YoY

- Countries with active food export restrictions: 26%

- Climate-related crop loss events in 2025: 56

- Food subsidy spending in emerging markets: 2.1% of GDP

Climate-Driven Food Inflation and the Global Signal

Climate-driven food inflation is increasingly shaping global economic outcomes as climate shocks, supply disruptions, and policy responses interact across food markets. However, unlike past price spikes, current food inflation pressures are persisting across regions. As a result, governments face rising fiscal stress, while central banks confront inflationary pressures that are difficult to neutralize. Moreover, food supply stability is emerging as a critical determinant of macroeconomic resilience heading into 2026.

Recent research (https://economiclens.org/climate-induced-food-inflation-climate-shocks-food-price-surge-global-risk/) shows that climate-induced food inflation is no longer limited to weather-related supply losses, but is increasingly shaped by the interaction of market behavior, trade restrictions, and fiscal interventions under stress.

Why Climate-Induced Food Inflation Is Not Adjusting

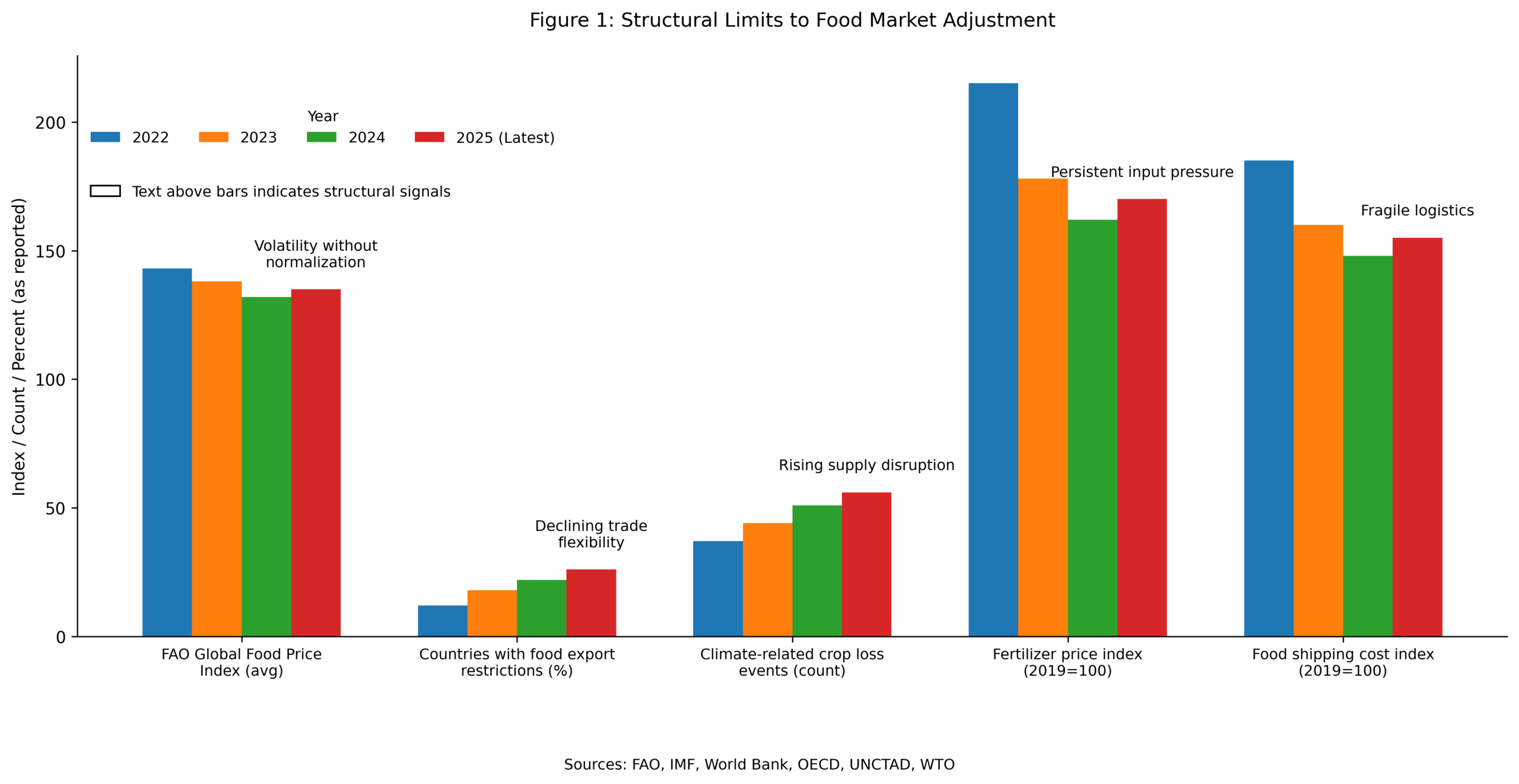

Historically, global food markets adjusted through supplier diversification, inventory buffers, and open trade flows. These mechanisms are weakening simultaneously. Climate shocks now affect multiple producing regions at the same time rather than remaining localized. Consequently, substitution across suppliers is becoming more difficult.

Export restrictions interrupt cross-border reallocation precisely when supply flexibility is most needed. At the same time, fiscal interventions dampen price signals and delay adjustment. As a result, food markets are no longer self-correcting. Instead of stabilizing prices, traditional buffers are amplifying volatility.

A broader system-level assessment (https://economiclens.org/food-security-stress-test-agriculture-under-climate-and-conflict-strain/) indicates that global food systems are under simultaneous pressure from climate volatility, conflict disruptions, and fragmented policy responses, weakening overall resilience.

Evidence of Global Food Supply Disruption

Multiple constraints are tightening at once. Supply shocks are increasing, while the system’s capacity to adjust through trade, logistics, and pricing is weakening. Evidence from recent climate disasters (https://economiclens.org/climate-disaster-food-crisis-global-economic-loss-and-infrastructure-collapse/) demonstrates that food crises increasingly transmit through infrastructure damage and logistics breakdowns, magnifying economic losses beyond agriculture alone.

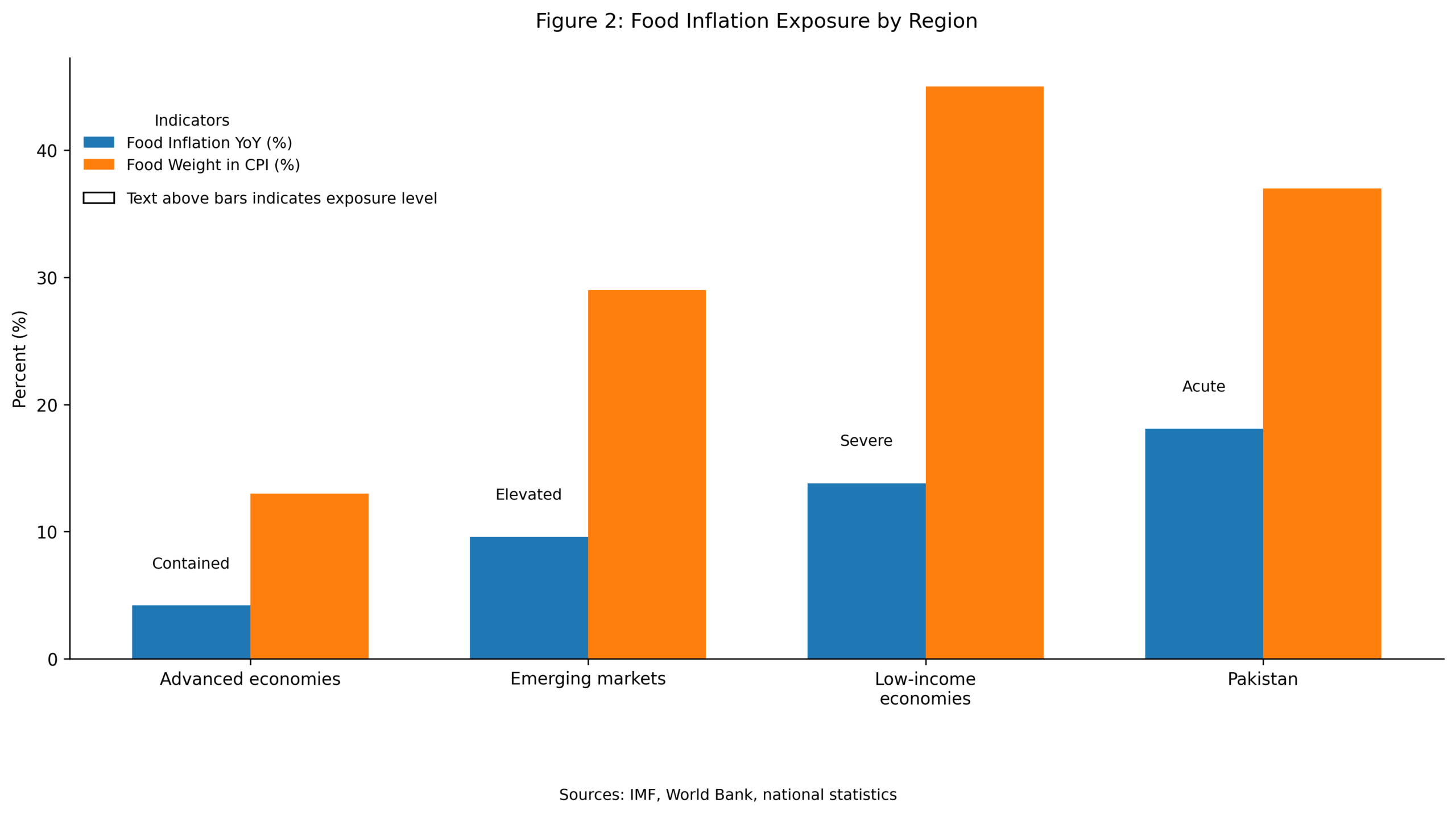

Regional Exposure to Climate-Driven Food Inflation

Advanced economies face limited consumer impact due to lower food weights in inflation baskets. In contrast, emerging and low-income economies face direct welfare stress. Pakistan’s recent experience (https://economiclens.org/pakistan-floods-show-why-climate-finance-must-deliver-now/) illustrates how delayed climate finance and weak adaptation mechanisms intensify food inflation, import dependence, and fiscal vulnerability following major climate shocks.

Policy Trade-Offs Under Food Inflation Persistence

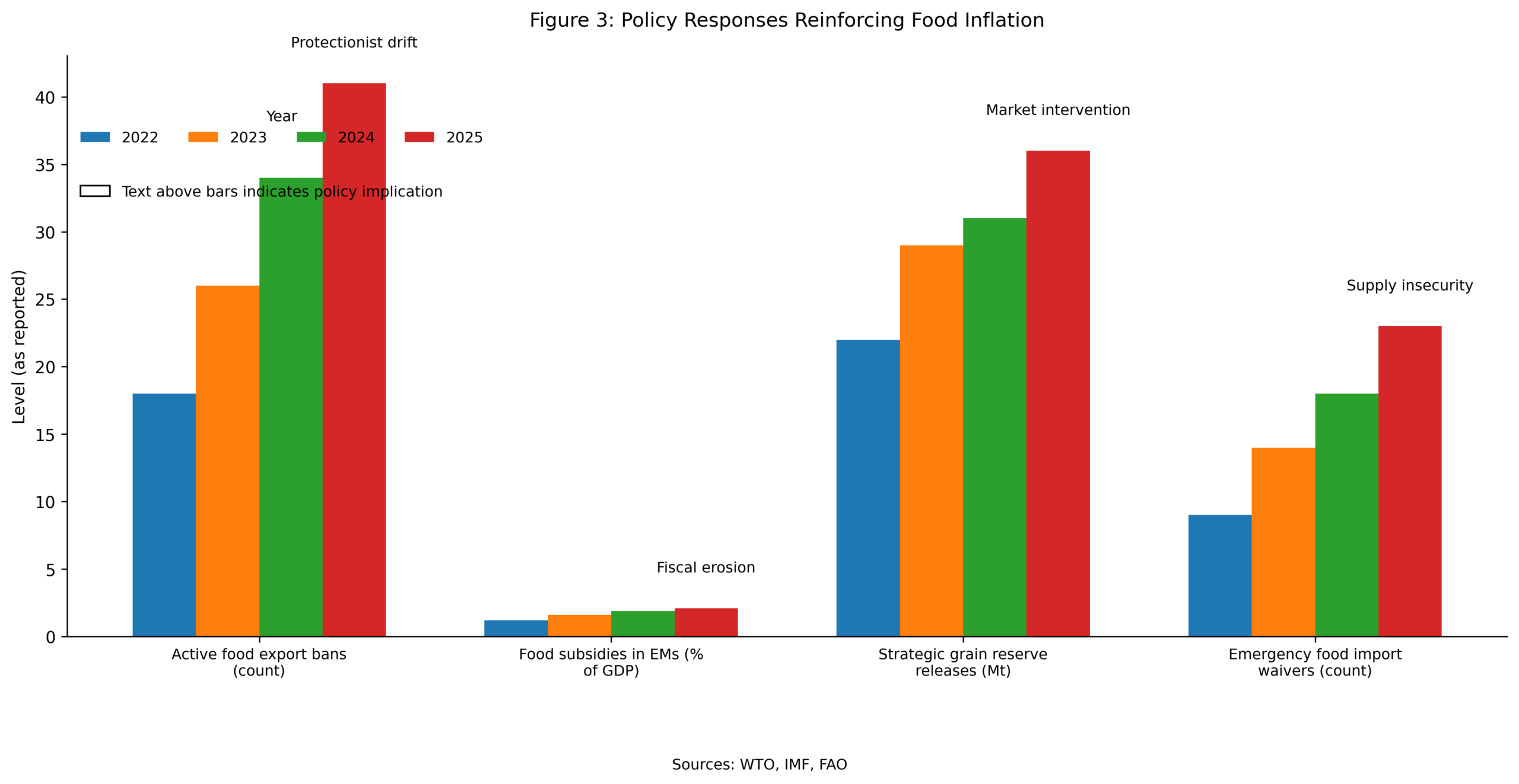

Governments are expanding subsidies, price controls, and export restrictions. These measures stabilize domestic prices temporarily. However, they weaken global supply conditions and increase fiscal costs. Consequently, trade fragmentation is deepening.

Central banks face constrained choices. Tightening policy does little to resolve supply-driven food inflation. At the same time, inaction risks unanchoring inflation expectations. Therefore, policy space is narrowing across both fiscal and monetary domains.

Scenarios: The Next 12 Months

Baseline scenario

Food inflation remains elevated, with periodic spikes driven by climate events and trade responses.

Downside scenario

New climate shocks trigger wider export bans. As a result, food inflation accelerates and fiscal stress intensifies.

Upside scenario

Improved logistics coordination and targeted climate finance ease supply constraints. Consequently, food price volatility moderates.

Second-Order Effects of Climate Risk and Inflation

Persistent food inflation feeds into wage pressures, fiscal deficits, and political stability. These pressures reinforce protectionist behavior and reduce trade openness. Over time, food inflation increasingly becomes a governance and stability risk rather than a cyclical price issue.

Institutional Signals on Food Inflation Risks

Global institutions are converging on a common assessment. The FAO (https://www.fao.org/worldfoodsituation) highlights rising food price volatility driven by climate stress. The IMF (https://www.imf.org/en/Topics/inflation) warns that persistent food inflation complicates monetary credibility, particularly in emerging markets. The World Bank (https://www.worldbank.org/en/topic/food-security) underscores the fiscal strain created by expanding food subsidies in climate-exposed economies. The OECD (https://www.oecd.org/trade) emphasizes that export restrictions amplify global food price volatility during supply shocks.

The Forward Curve for Food Inflation Pressures

Key indicators to monitor:

- Overlap and frequency of climate-related crop losses

- Expansion or rollback of food export restrictions

- Fiscal outlays on food subsidies

- Household food inflation expectations

- Logistics stress in major food trade corridors

Bottom Line

Climate-driven food inflation is no longer a temporary disturbance. It is a structural constraint shaping inflation dynamics, fiscal stability, and social outcomes. As climate volatility intensifies and policy responses fragment markets, climate-driven food inflation will remain a defining macroeconomic risk throughout the decade.