The PIA privatization reform deal marks a turning point in Pakistan’s handling of loss making state owned enterprises. Years of mounting deficits made incremental fixes ineffective, as explained in EconomicLens’ analysis of why persistent losses ultimately forced the sale of Pakistan International Airlines (https://economiclens.org/pia-privatization-reform-shows-why-losses-forced-the-sale/).

This visual story explains the PIA privatization reform deal through its causes, fiscal impact, spillovers, and reform outlook.

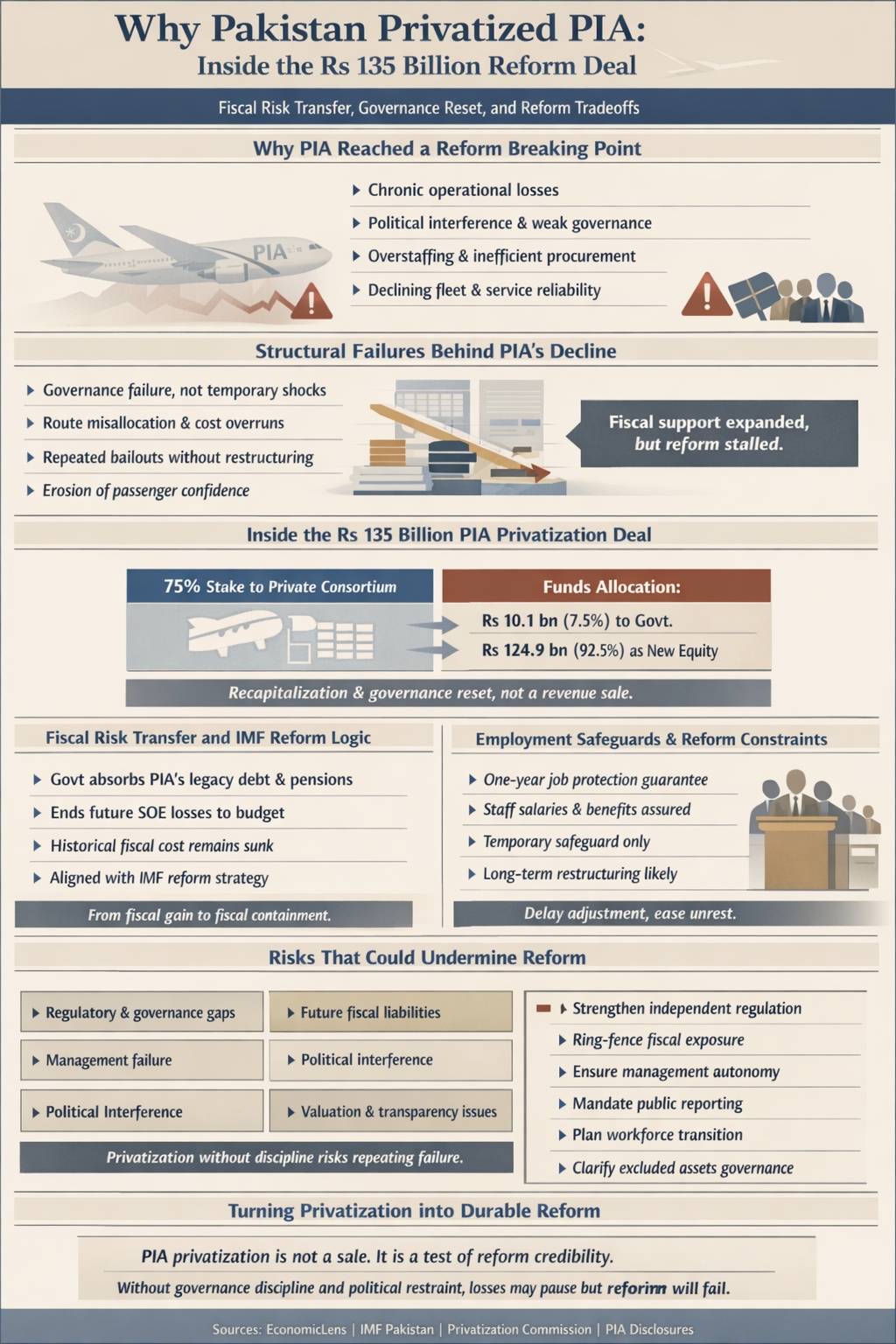

Pakistan Airline Privatization as the Reform Trigger

Pakistan airline privatization became unavoidable after sustained operational decline. PIA accumulated losses year after year. Political interference weakened accountability. Overstaffing increased costs.

As a result, fleet availability deteriorated and service reliability suffered. Therefore, the PIA privatization deal emerged as the only credible reform break.

These pressures align with the International Monetary Fund’s assessment that state owned enterprises in Pakistan have posed rising fiscal risks and required repeated budgetary support, as noted in IMF country program documents for Pakistan (https://www.imf.org/en/Countries/PAK).

PIA Governance Reset and Structural Failure

The core issue was governance rather than demand. A PIA governance reset became necessary because route allocation and cost discipline failed under state ownership. Bailouts continued without business model correction.

Consequently, fiscal support expanded while reform stalled. This institutional pattern mirrors weaknesses identified in World Bank diagnostics on state owned enterprise governance and performance (https://www.worldbank.org/en/topic/stateownedenterprises).

The PIA privatization reform deal therefore represents structural intervention rather than short term crisis management.

PIA Deal Recapitalization and Transaction Design

The visual clarifies that PIA deal recapitalization is the central policy objective. A 75 percent controlling stake was transferred to a private consortium led by the Arif Habib Group, following a competitive auction documented in EconomicLens’ coverage of how the Rs 135 billion bid was secured (https://economiclens.org/pia-privatization-arif-habib-wins-rs135-billion-bid/).

Only Rs 10.1 billion flows to the government. The remaining funds are injected as new equity. As a result, the PIA privatization reform deal prioritizes recapitalization and governance change over fiscal extraction.

Fiscal Risk Transfer Privatization Logic

The fiscal impact of the PIA privatization reform deal lies in containment rather than recovery. The government absorbs legacy debt and pension liabilities that are already sunk. However, future operational losses stop accumulating on the budget.

This approach reflects fiscal risk transfer privatization and aligns with IMF guidance that emphasizes limiting contingent liabilities from state owned enterprises, as outlined in IMF discussions on SOE reform frameworks (https://www.imf.org/en/Topics/State-Owned-Enterprises).

EconomicLens’ assessment of the fiscal reality behind the Rs 135 billion transaction explains why this structure matters for medium term budget stability (https://economiclens.org/pia-privatization-deal-at-rs-135-billion-fiscal-reality-and-reform-risk/).

PIA Employment Safeguards and Spillover Effects

The PIA employment safeguards included in the deal provide one year of job protection. Salaries and benefits remain covered during this period. This reduces short term political friction.

However, restructuring pressures remain after the protection window. International experience summarized by the OECD shows that employment guarantees in SOE reforms often delay adjustment rather than eliminate it (https://www.oecd.org/corporate/state-owned-enterprises/).

Thus, the spillover effect of the PIA privatization reform deal is temporary social stability, not permanent labor protection.

Post-Privatization Reform Risks in Airline Restructuring

Privatization alone does not ensure success. Post-privatization reform risks include weak regulation, political interference, and management failure. Asset governance and transparency remain critical.

If oversight weakens, fiscal risks may reappear through guarantees or regulatory forbearance. Therefore, the PIA privatization reform deal remains conditional on institutional discipline.

SOE Reform IMF Alignment and Outlook

The SOE reform alignment of the transaction with IMF objectives is evident. The ownership change is intended to strengthen governance and reduce fiscal risk. However, the credibility of this reform now depends on effective enforcement.

Independent aviation regulation, genuine management autonomy, and transparent financial reporting will shape the final outcome. If these conditions are upheld, the PIA privatization deal can support operational stabilization and limit future losses. If they weaken, reform momentum is likely to fade, repeating past failures where losses continued despite policy commitments.