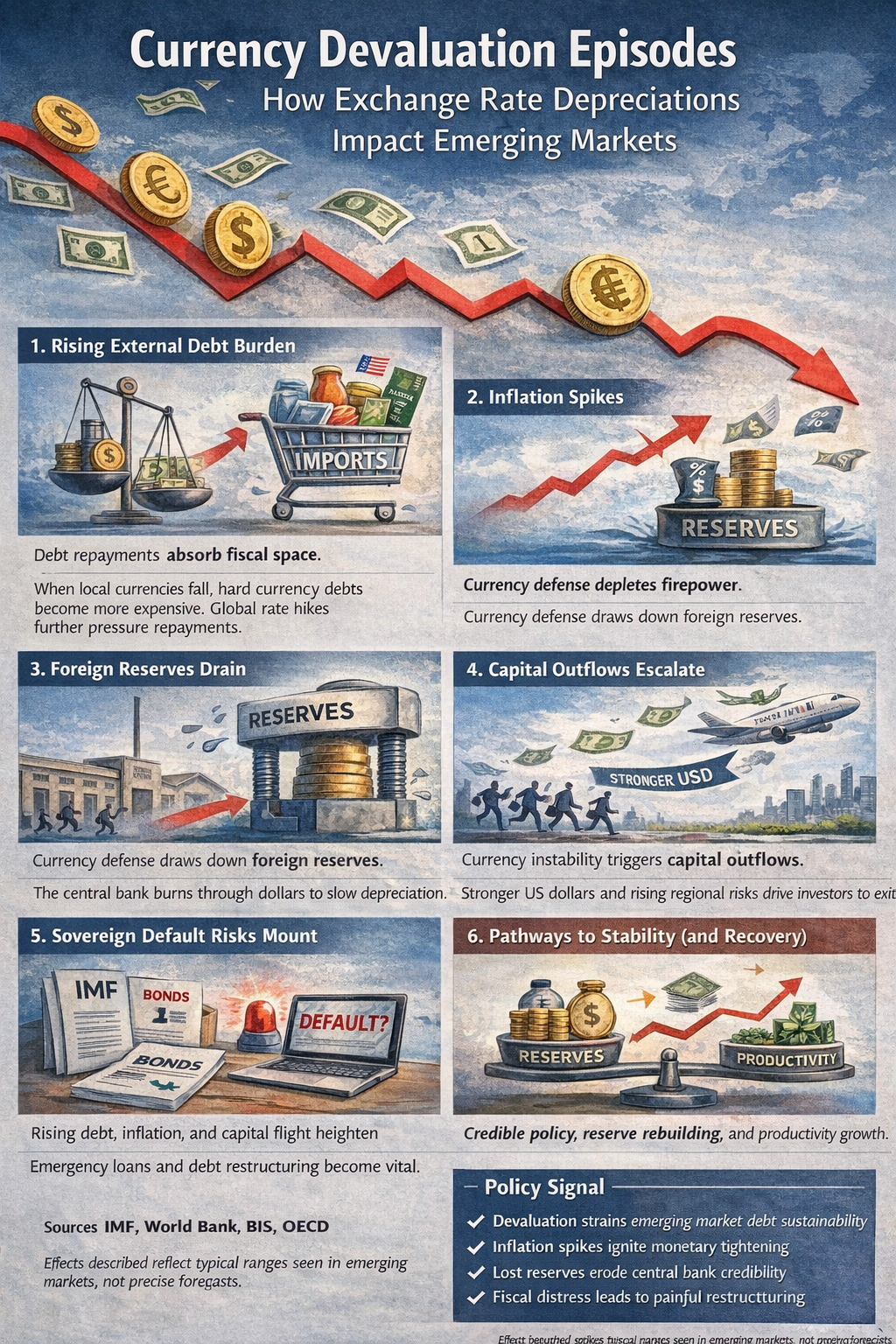

Currency devaluation episodes show how exchange rate depreciation spreads across emerging markets. External debt burdens rise, inflation accelerates, reserves fall, and capital outflows increase. This visual story explains the cause, impact, spillover effects, and policy outlook behind recurring currency crises.

Introduction: Why currency instability matters

Currency devaluation episodes are a recurring source of macroeconomic instability in emerging markets. When currencies weaken sharply, pressures spread across inflation, debt, and investor confidence.

In many cases, depreciation amplifies imported inflation. These dynamics mirror the inflationary transmission mechanisms observed during the global food inflation crisis, where currency depreciation raised import costs after 2020, as explained in https://economiclens.org/global-food-inflation-crisis-why-food-prices-reset-higher-after-2020/.

As a result, currency devaluation episodes rarely remain confined to foreign exchange markets.

Rising external debt pressures after exchange rate depreciation

Currency devaluation episodes immediately increase the local currency cost of external debt. Governments and firms with dollar-denominated liabilities face higher repayment burdens.

Moreover, this pressure intensifies during periods of tight global monetary conditions. Higher interest rates raise refinancing costs and reduce fiscal space. These risks are examined in EconomicLens’ analysis of sovereign debt stress under prolonged tight monetary policy at https://economiclens.org/higher-for-longer-interest-rates-sovereign-debt-stress-fiscal-fragility/.

Consequently, exchange rate depreciation crises often weaken debt sustainability.

Inflation transmission under an exchange rate depreciation crisis

An exchange rate depreciation crisis feeds directly into inflation. Import prices rise quickly, especially for food, fuel, and industrial inputs.

Therefore, consumer prices accelerate even when domestic demand is weak. Central banks respond with tighter policy, which slows growth further. The International Monetary Fund documents similar inflation pass-through effects in its analysis of global inflation dynamics at https://www.imf.org/en/Topics/inflation.

In practice, currency devaluation episodes often lock economies into inflation persistence.

FX instability in emerging markets and reserve losses

FX instability in emerging markets forces central banks to defend currencies. Foreign exchange intervention drains reserves.

As reserves fall, market confidence weakens. This loss of buffers raises vulnerability to speculative pressure. The IMF highlights the importance of reserve adequacy in preventing balance of payments crises in its external sector assessments at https://www.imf.org/en/Topics/external-sector-assessments.

Thus, reserve depletion becomes a key spillover of currency devaluation episodes.

Emerging market currency shocks and capital outflows

Emerging market currency shocks trigger capital outflows. Portfolio investors exit local markets, while domestic savings move offshore.

At the same time, global risk aversion amplifies these flows. Capital flight reinforces depreciation and tightens financial conditions. These dynamics are clearly visible in countries facing repeated currency adjustments, including Egypt’s recent experience, analyzed in https://economiclens.org/egypt-currency-devaluation-and-inflation-spiral-explained/.

Therefore, capital outflows deepen the macroeconomic impact.

Devaluation-led macroeconomic stress and default risk

Devaluation-led macroeconomic stress combines inflation, debt pressure, reserve losses, and capital flight. Together, these forces raise sovereign default risks.

Market access deteriorates. Financing gaps widen. In severe cases, governments turn to IMF programs or debt restructuring. The World Bank documents this transition from currency crisis to debt distress in its sovereign debt sustainability analysis at https://www.worldbank.org/en/topic/debt.

Hence, currency devaluation episodes often precede broader financial crises.

Outlook: Breaking recurring currency crisis cycles

Stabilizing after currency devaluation episodes requires credible policy action. Monetary discipline helps anchor expectations. Fiscal consolidation restores confidence.

In addition, structural reforms that boost exports and productivity reduce future vulnerability. International experience summarized by the OECD shows that institutional credibility shapes recovery outcomes after currency crises at https://www.oecd.org/economy/.

Ultimately, reducing exposure to recurring currency devaluation episodes depends on correcting underlying macroeconomic imbalances.

1 thought on “Currency Devaluation Episodes in Emerging Markets”

Highly valuable for students and researchers