Climate finance has become one of the most decisive tools in addressing global food insecurity. As climate change intensifies droughts, floods, and heat stress, food systems face growing instability. Therefore, sustainable finance must shift toward agriculture to protect yields and stabilize prices. Without targeted funding, food insecurity will worsen, especially in climate-exposed regions already facing supply chain breakdowns and export restrictions documented in the global food security crisis

https://economiclens.org/global-food-security-crisis-climate-shocks-export-bans-supply-chain-breakdown/.

Feeding a Hotter World and Rising Hunger

Global food systems face mounting pressure. Although production remains high, hunger continues to rise. According to the Food and Agriculture Organization, climate variability is now a leading cause of yield instability

https://www.fao.org/climate-change/en/.

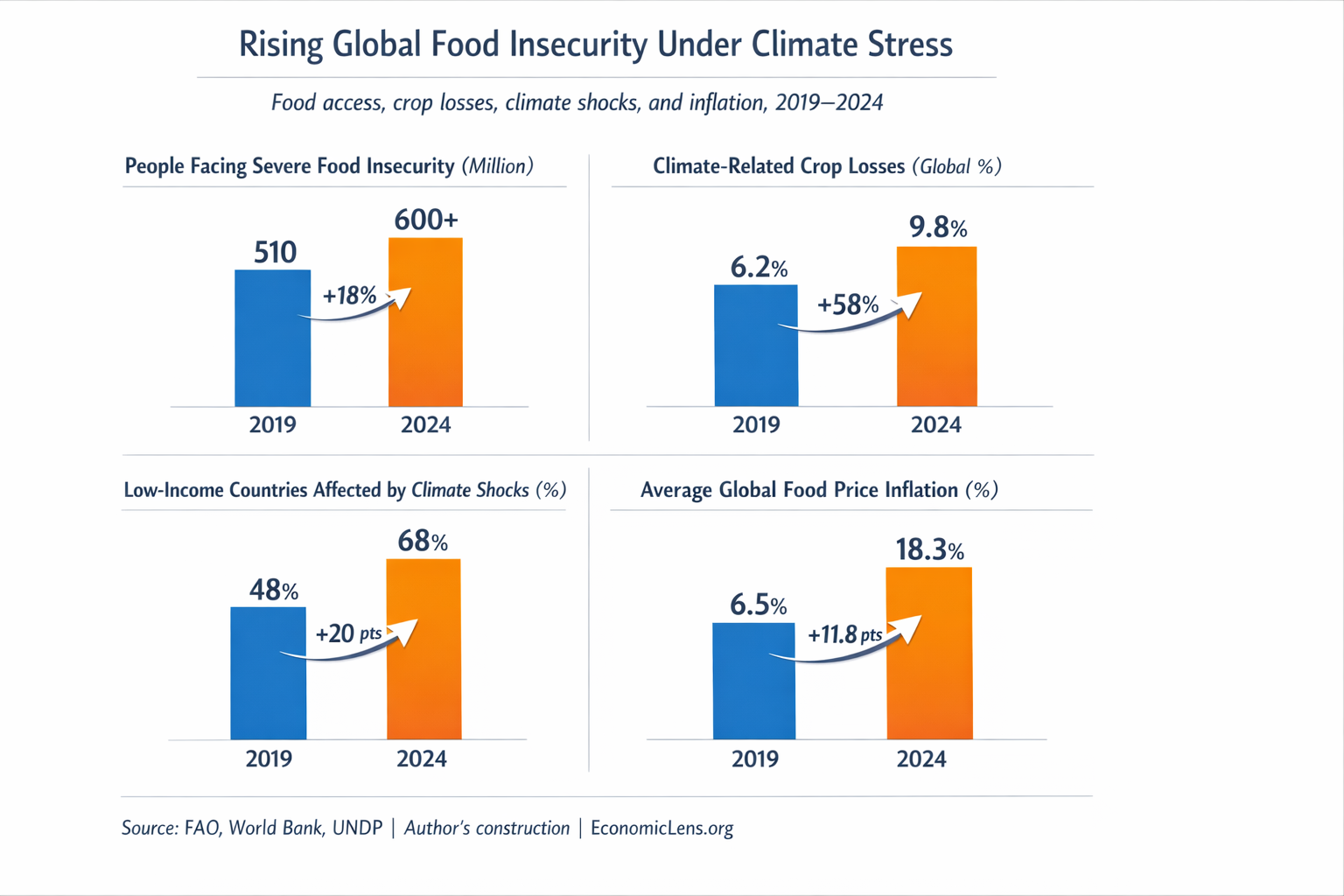

The data shows a sharp rise in hunger alongside accelerating climate stress. Crop losses and food inflation have increased faster than incomes in vulnerable economies. This gap explains why sustainable finance must prioritize agricultural resilience rather than short-term relief.

At the same time, more than 600 million people faced severe food insecurity in 2024. This increase reflects worsening fertilizer shocks and rising food prices expected to persist into 2025

https://economiclens.org/global-food-insecurity-2025-hunger-trends-costly-diets-the-fertilizer-shock/.

However, green finance remains poorly aligned with food system risks. Agriculture receives less than five percent of global finance despite supporting billions of livelihoods, as highlighted by the International Monetary Fund https://www.imf.org/en/Topics/climate-change.

The Economic Toll of Climate Shocks on Food Systems

Climate shocks now threaten national balance sheets. The World Bank estimates that climate-related agricultural damage reduces economic growth in highly exposed economies https://www.worldbank.org/en/topic/climatechange.

Regions most dependent on agriculture experience the largest proportional losses. These shocks reduce employment and strain public finances. Green finance that bypasses agriculture therefore amplifies macroeconomic risk.

These patterns mirror recent climate disaster food crises that caused infrastructure damage and fiscal stress across developing regions https://economiclens.org/climate-disaster-food-crisis-global-economic-loss-and-infrastructure-collapse/.

Green Climate Finance Gaps in Agriculture

Despite its importance, agriculture remains underfunded. Most climate finance flows toward energy and transport infrastructure, leaving food systems with limited support. This imbalance is confirmed in IMF climate finance reviews. https://www.imf.org/en/Publications/WP

Agriculture receives a disproportionately small share of green finance relative to its exposure. This imbalance increases food price volatility and crisis frequency. Redirecting finance toward food systems offers high returns in stability.

World Bank evidence shows that every dollar invested in climate-resilient agriculture generates multiple dollars in avoided losses. https://www.worldbank.org/en/topic/agriculture/brief/climate-smart-agriculture

Sustainable Climate Finance and Climate-Smart Agriculture

Climate finance agriculture strategies increasingly focus on Climate-Smart Agriculture. CSA integrates productivity, resilience, and emissions reduction. FAO evidence shows that CSA improves yields while conserving ecosystems https://www.fao.org/climate-smart-agriculture/en/.

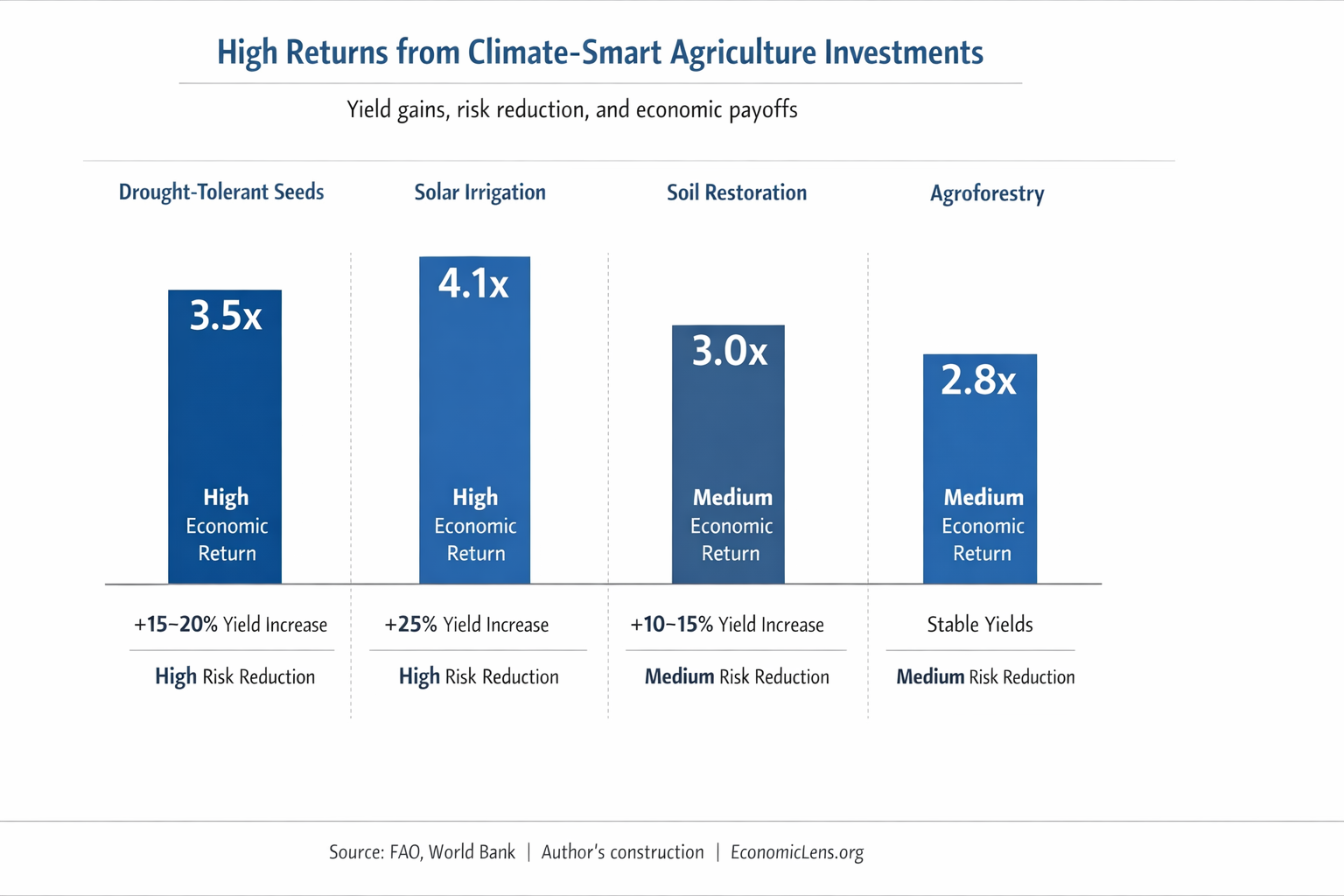

CSA investments consistently raise yields and lower climate risk. Returns exceed costs across regions. This confirms that green finance in agriculture functions as productive investment rather than subsidy.

Green Climate Finance That Pays Back

From an economic perspective, climate adaptation pays dividends. According to the Asian Development Bank, scaling climate-smart farming could add hundreds of billions to global agricultural output.

https://www.adb.org/what-we-do/agriculture-and-food-security

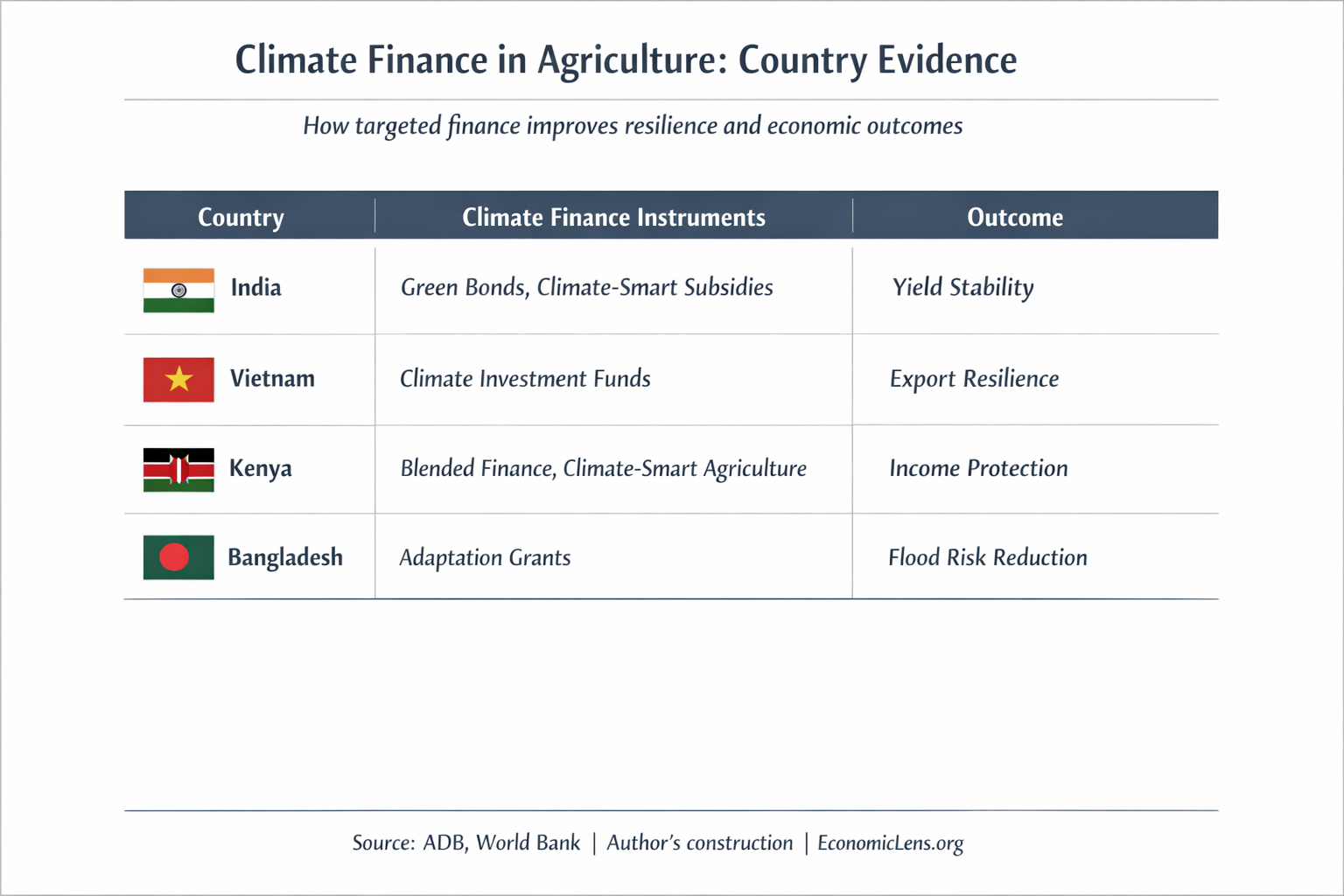

Countries that align sustainable finance with agriculture achieve stronger food system resilience. These outcomes contrast with crisis-driven models. Policy design, not income level, explains the difference.

Delayed smart-agriculture finance has fueled repeated food inflation shocks that now reshape politics and fiscal choices worldwide https://economiclens.org/global-food-crisis-how-food-inflation-is-reshaping-economies-and-politics-in-2025/.

Technology, Innovation, and Climate Resilience

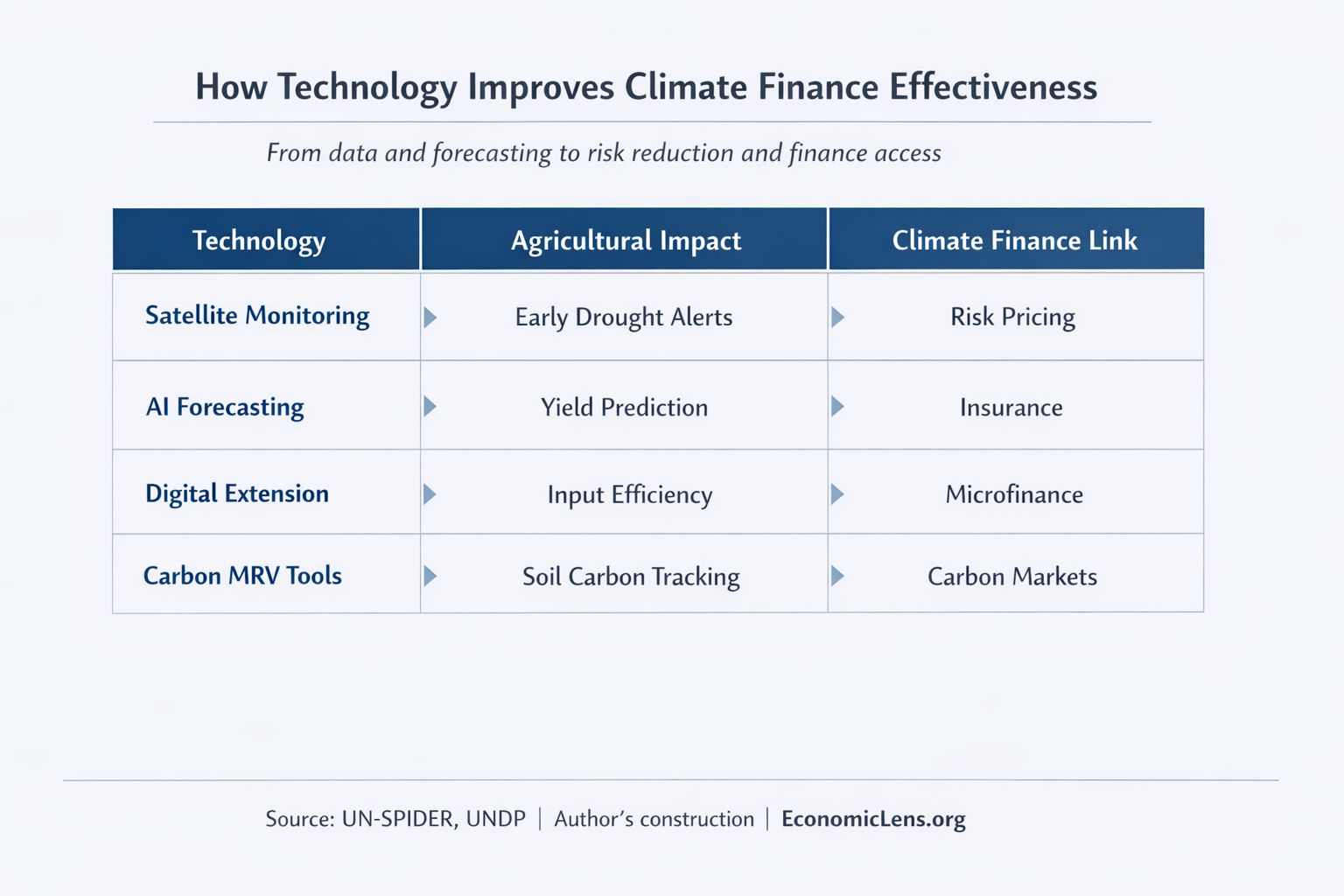

Technology strengthens climate finance outcomes. Satellite monitoring, early warning systems, and AI tools reduce agricultural risk. UN-SPIDER supports these climate data systems globally https://www.un-spider.org/.

Technology converts climate risk into measurable data. This enables insurance, carbon markets, and blended finance. As a result, climate finance becomes scalable and bankable.

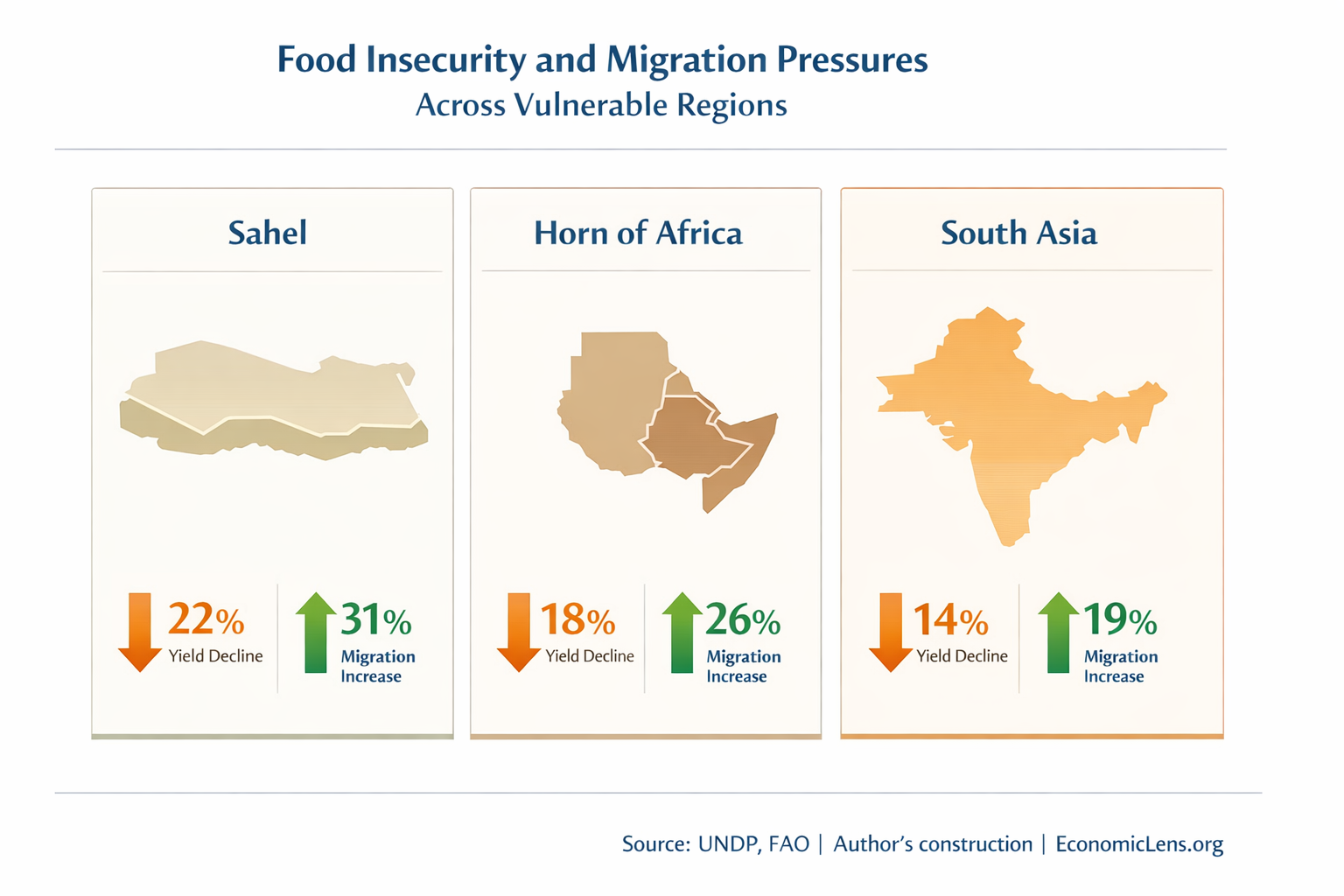

Climate Finance, Food Insecurity, and Migration

Food insecurity increasingly drives migration. The United Nations Development Programme links climate-related hunger to rising rural-urban displacement: https://www.undp.org/climate-change

The data confirms a strong link between yield decline and migration pressure. Without climate finance, food shocks translate into social instability. Adaptation investment reduces both hunger and displacement risk.

Winners and Losers in Sustainable Smart Agriculture Finance

A global divide is emerging. Kenya, India, and Vietnam mobilize green bonds to finance agricultural resilience. Meanwhile, fragile states remain dependent on aid. Access to climate finance now shapes food sovereignty and long-term economic stability.

Policy Pathways for Sustainable Finance

Effective climate finance requires coordination.

- Integrate adaptation indicators into national budgets

https://www.worldbank.org/en/topic/agriculture - Expand climate-smart agriculture through research incentives

https://www.fao.org/policy-support/en/ - Mobilize private capital using green bonds

https://www.imf.org/en/Topics/climate-change -

Scale digital finance for smallholders: https://www.undp.org/financing

-

Strengthen regional frameworks such as Feed Africa: https://www.afdb.org/en/topics-and-sectors/initiatives-partnerships/feed-africa

Final Word

Sustainable climate finance now defines the future of global food security. Data confirms that the costs of inaction are rising, while returns to adaptation remain strong. Finance supplies capital. Climate-smart agriculture delivers resilience. Together, they can stabilize food systems, reduce hunger, and support sustainable growth.

The choice is clear. Invest in climate finance today or face deeper crises tomorrow.