Red Sea shipping inflation has become a structural driver of global price pressures. Prolonged maritime disruptions, higher freight rates, and elevated insurance premia are feeding into energy, food, and import inflation. This weekly brief explains why these pressures persist, how markets have normalized disruption, and what the implications are for emerging economies and global trade stability.

Introduction

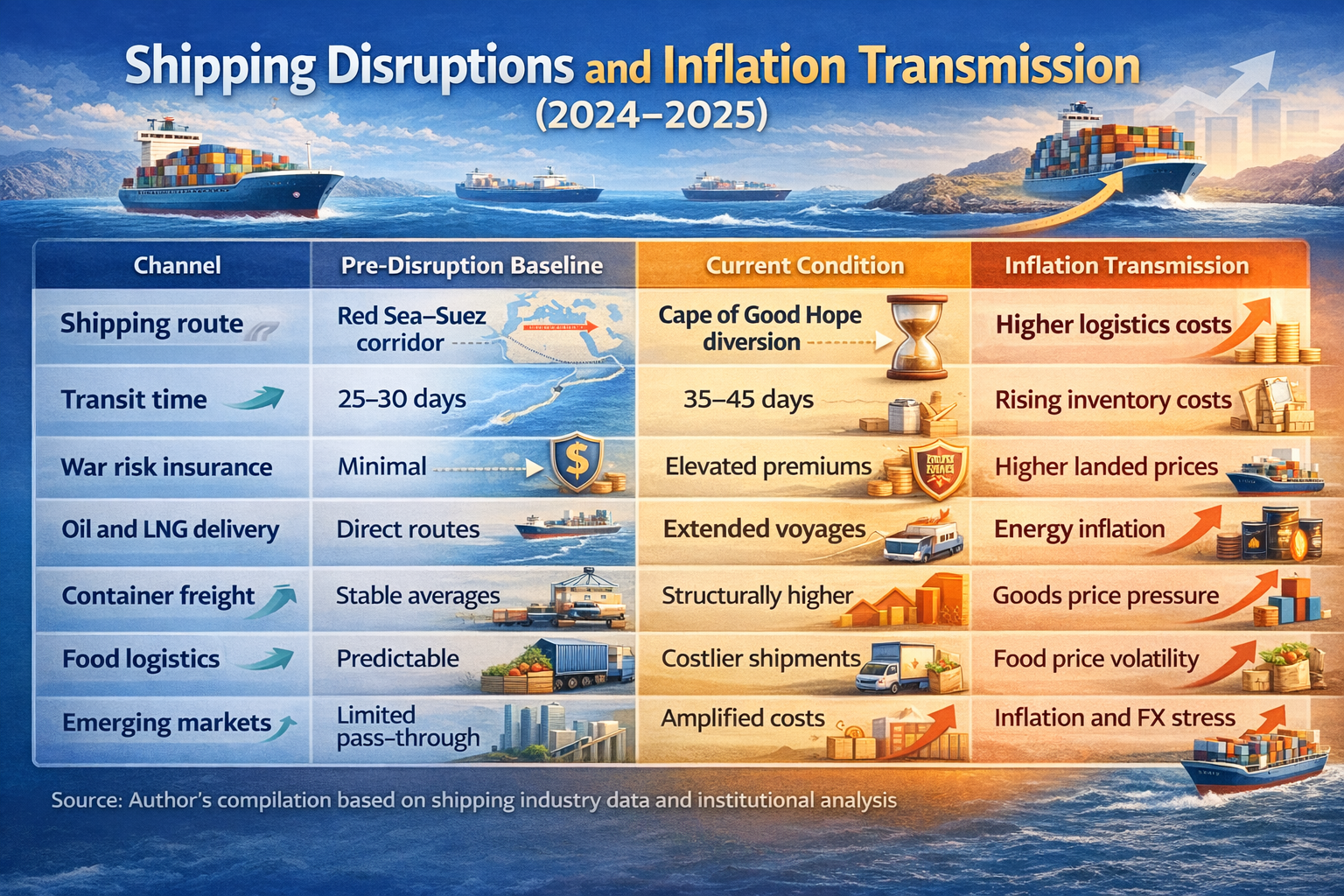

Maritime inflation pressures has evolved from a temporary geopolitical shock into a persistent feature of global trade dynamics. As documented in earlier EconomicLens analysis (https://economiclens.org/red-sea-shipping-crisis-global-trade-fallout-inflation-pressure-and-supply-chain-turmoil/), sustained avoidance of the Red Sea corridor has altered shipping routes, raised logistics costs, and reshaped inflation transmission across energy and goods markets.

Despite naval patrols and diplomatic engagement, commercial shipping has not returned to pre-crisis routes. Earlier warnings highlighted in EconomicLens coverage (https://economiclens.org/red-sea-turmoil-suez-canal-disruptions-and-the-global-shipping-shock/) already indicated that rerouting via the Cape of Good Hope would persist longer than initially expected.

As a result, maritime inflation is no longer episodic. Instead, it has become embedded in baseline price dynamics across import-dependent economies.

This Week’s Takeaway

This week’s key signal is persistence rather than escalation. Maritime inflation pressures remains embedded as freight rerouting, insurance premia, and longer transit times continue without resolution. While markets show limited volatility, cost pass-through into energy and import prices is ongoing. For emerging economies, especially energy importers, inflation risks remain active even in the absence of new shocks.

1. Why Red Sea Shipping Inflation Remains in Trend This Week

Extended voyage times and altered routing decisions are reinforcing inflationary pressures across global shipping markets. As disruption becomes embedded rather than temporary, cost escalation is no longer limited to freight rates alone.

1.1 Freight rerouting and Middle East shipping inflation

Most global container lines and energy carriers continue to bypass the Red Sea route. Consequently, Cape of Good Hope diversions add roughly 10 to 14 days to Asia–Europe shipping lanes.

This extension raises fuel consumption, crew costs, and vessel utilization pressures. As shipping schedules adapt, disruption has shifted from exceptional to expected. These developments reinforce cost dynamics already observed in EconomicLens freight analysis (https://economiclens.org/red-sea-shipping-disruptions-drives-global-freight-costs/).

According to UNCTAD, longer maritime distances and port congestion have become persistent contributors to global trade costs, particularly for developing economies (https://unctad.org/topic/transport-and-trade-logistics).

1.2 Insurance premia and Red Sea shipping inflation persistence

War risk insurance premiums for Red Sea transits remain well above historical norms. Even vessels willing to transit the region face elevated coverage costs.

Meanwhile, rerouted shipments incur higher fuel expenses and congestion charges at alternative ports. As a result, these costs are increasingly passed through contract pricing rather than absorbed temporarily.

The International Monetary Fund notes that supply chain risks now feature directly in baseline inflation forecasts rather than tail risk scenarios (https://www.imf.org/en/Publications/WEO).

The OECD confirms that transport and insurance now account for a larger share of final import prices than before the pandemic (https://www.oecd.org/trade/).

2. Energy Markets and Red Sea Shipping Inflation

Oil, LNG, and refined fuel shipments remain highly exposed to longer routes and elevated freight risk. As shown in EconomicLens analysis (https://economiclens.org/middle-east-oil-shipping-vulnerability-and-2026-price-risks/), extended transit times tighten effective energy supply even when benchmark prices appear stable.

Consequently, maritime inflation continues to transmit into energy prices despite moderation in crude markets. The International Energy Agency highlights that physical delivery risks increasingly shape end-user energy prices (https://www.iea.org/reports/world-energy-outlook).

Middle East Shipping Inflation and Emerging Economies

For import-dependent economies, shipping disruptions translate directly into macroeconomic stress. Higher energy import bills widen trade deficits. At the same time, elevated food import costs raise domestic inflation.

In Pakistan’s case, where energy imports dominate external payments, maritime inflation amplifies price volatility even during periods of commodity price moderation. The Asian Development Bank identifies logistics and freight costs as a growing inflation channel in South Asia (https://www.adb.org/what-we-do/economic-research).

Why Markets Have Normalized Red Sea Shipping Inflation

Markets have adjusted expectations rather than demanding resolution. Shipping firms now price risk into contracts. Insurers maintain elevated premia. Policymakers prioritize containment over elimination.

As a result, volatility has declined. However, higher cost structures have become entrenched. This normalization explains why maritime inflation continues to shape global price dynamics.

Outlook

Looking ahead, maritime security conditions are unlikely to normalize quickly. Therefore, logistics-driven inflation will remain embedded in global trade costs.

For policymakers, inflation management can no longer rely solely on demand restraint. Instead, resilience will depend on diversified supply routes, fiscal buffers, and risk-aware trade policy.

1 thought on “Red Sea Shipping Inflation and Global Trade Stability”

Everything is very open and very clear explanation of issues. was truly information. Your website is very useful. Thanks for sharing.