Time value of money lies at the heart of Riba. This article explains why Islam rejects profit from delay, using Riba al Nasiah, bayatayn fi bay, and al kharāj bil damān to show why modern and Islamic banking violate Prophetic economics.

Introduction: Why the Time Value of Money Is the Real Issue

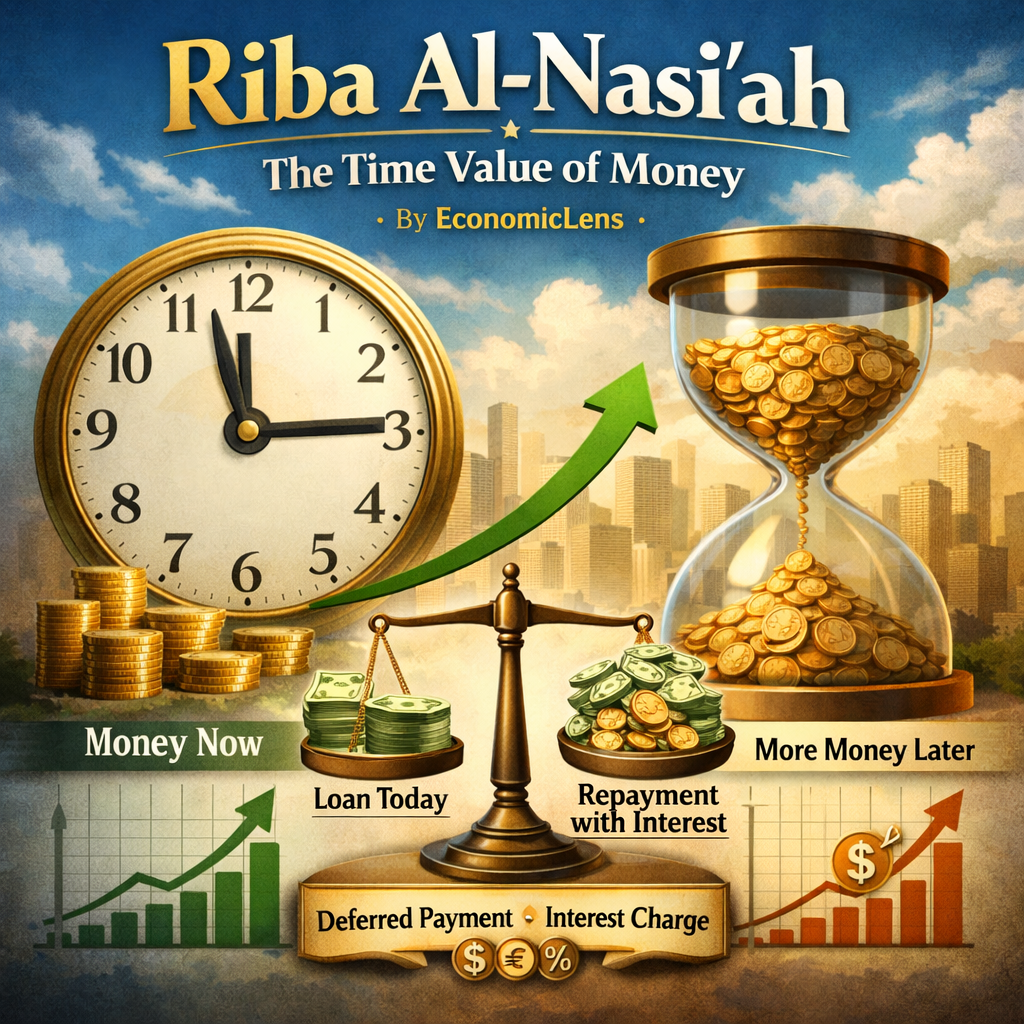

The time value of money is the foundation of modern finance. It claims that money today is worth more than money tomorrow, so anyone who gives money now deserves more later. This idea drives interest, banking, bonds, and almost every financial contract in the world. Yet Islam challenges this assumption at its root. Islam does not oppose wealth, trade, or profit. What Islam rejects is the idea that time itself should generate income.

In Islam, money becomes productive only when it enters real economic activity. It must be transformed into trade, labor, ownership, or risk. If nothing productive happens, nothing should be earned. Therefore, the Islamic prohibition of Riba is not hostility to profit. It is a rejection of the time value of money as an independent source of wealth. When money grows merely because time has passed, someone gains without contributing, and someone else pays without receiving additional value.

Modern finance treats time as a rent-producing asset. Banks lend money and demand more later simply because time passed. This creates income without labor, ownership, or exposure to loss. Islam considers this unjust because it allows wealth to grow without contributing anything to society. This is why critiques such as Islamic Banks as Artificial Legal Persons (https://economiclens.org/islamic-banks-as-artificial-legal-persons/) show that many institutions labeled Islamic still replicate conventional banking logic beneath Islamic terminology. The true question is not what contracts are called. The true question is whether time is being sold. Once this principle is understood, the entire Islamic position on interest becomes logically clear.

Money, Time, and the Origin of Riba

In the time of the Prophet Muhammad ﷺ, money was not paper or electronic balances. It was dinar, made of gold, and dirham, made of silver. These were real commodities with intrinsic value. When people borrowed money, they were borrowing actual gold or silver. When they repaid, they returned actual metal. If they were required to return more, they were being charged purely for the passage of time.

Islam identified this practice as Riba al-Nasīʾah (ربا النسيئة), which literally means increase due to delay. The legal cause of its prohibition is al-ijāl maʿa al-iḍāfah (الأجل مع الزيادة), meaning an increase that exists only because time passed. Time is not a commodity in Islam. It is only a medium in which human effort and economic activity take place. When time is priced, injustice enters the transaction.

This principle is reinforced by al-kharāj bil-ḍamān (الخراج بالضمان), which means that profit belongs only to the one who bears risk. A lender who waits for repayment bears no market risk, no business risk, and no ownership risk. Yet interest gives him guaranteed profit. Islam rejects this because it separates reward from responsibility. This is why analyses such as Islamic Bank as Artificial Person: A Critical Review (https://economiclens.org/islamic-bank-as-artificial-person-a-critical-review/) demonstrate that institutional banking struggles to fit Islamic law. The core problem is not contractual technique. The problem is that time is being converted into profit without exposure to real economic loss.

Exchange Law and the War on Time

Islam did not only ban interest on loans. It also regulated the exchange of money itself. Since gold and silver were money, their exchange rules were strict. Gold for gold and silver for silver had to be equal and immediate. Gold for silver could differ in quantity, but it still had to be immediate. Delay was forbidden in all cases. This is known as Riba al-Faḍl (ربا الفضل).

Why did Islam impose such rigidity? Because delay opens the door to hidden time-based profit. If exchange is delayed, the value of gold or silver can change. Bargaining power can shift. One party may gain an advantage simply because time passed. Islam blocks these possibilities through sadd al-dharāʾiʿ (سدّ الذرائع), which means closing the paths that lead to injustice before harm occurs. Even a small delay can transform a fair exchange into a vehicle for exploitation.

This shows that Islam rejects the time value of money not only in loans but also in exchange. Money must not grow because time passes. It may only grow when it is placed into productive activity that involves risk. By enforcing immediate exchange, Islam ensures that money remains a medium of trade rather than a tool of extraction. The same moral logic that governs exchange also governs credit. Time must never become a source of income. It must remain only a measure within which real economic value is created.

Two Prices, Four Forms, and the Prophetic System

The Prophet ﷺ built a complete legal system to block the sale of time. He said: «مَنْ بَاعَ بَيْعَتَيْنِ فِي بَيْعَةٍ فَلَهُ أَوْكَسُهُمَا أَوِ الرِّبَا»

(Sunan Abī Dāwūd 3461, https://sunnah.com/abudawud:3461)

He also said: «نَهَى رَسُولُ اللهِ ﷺ عَنْ بَيْعَتَيْنِ فِي بَيْعَةٍ»

(https://sunnah.com/muslim:1513)

And he gave the foundational economic rule: «كُلُّ قَرْضٍ جَرَّ نَفْعًا فَهُوَ رِبًا»

(Classical formulation cited by Ibn Taymiyyah in Majmūʿ al-Fatāwā, https://al-maktaba.org/book/31615/113)

These three narrations form one legal architecture. Two prices in one deal mean time is being sold. A deferred higher price is a loan plus a benefit, which is Riba. From this emerge four forms of Riba al-Nasīʾah (ربا النسيئة): different cash and credit prices, deferred sales with built-in markup and no genuine spot option, late-payment penalties known as ṣafqatayn fī ṣafqah, and the compound form combining both. All four monetize delay.

Later jurists allowed two prices if one is chosen before separation. However, this only removes contractual uncertainty. It does not remove time-pricing. The Sunnah targets the cause, not the paperwork. Islam forbids selling time even when the form looks like a sale. The rule is economic, not merely procedural.

Banking, Islamic Finance, and the Final Verdict

Modern banking exists to sell time. Money is given now and more is taken later. Whether the increase is called interest, markup, or rent does not change the reality. It remains compensation for waiting. That is Riba al-Nasīʾah (ربا النسيئة) in institutional form.

This structure produces three major harms. First, it exploits the poor. Those who borrow usually do so from necessity. Time-based profit guarantees that wealth flows from need to power. Second, it violates al-kharāj bil-ḍamān (الخراج بالضمان). Banks earn guaranteed income without bearing business risk. Third, it destroys markets. Capital flows into debt instead of real production, which distorts prices and creates financial crises.

This is why detailed critiques such as Mudarabah ki Khilaf Warziyan (https://economiclens.org/mudarabah-ki-khilaf-warziyan/) and Mudarabah in Name or in Practice (https://economiclens.org/mudarabah-in-name-or-in-practice-the-reality-of-islamic-banks/) show that many Islamic banks do not truly share risk. They replicate time-based profit under different labels.

Final Verdict

Islam did not ban interest rates.

Islam banned the time value of money.

Money may grow through trade, ownership, risk, and effort.

It may not grow by waiting.

Riba is not a number.

It is the crime of selling time.