Explore how the $100 Billion Carbon Dividend is reshaping global climate finance—driving net-zero growth, fiscal innovation, and transparent carbon governance that redefine prosperity for a sustainable future.

The $100 Billion Turning Point in Global Carbon Economics

A new economic paradigm is transforming the 21st century: carbon is now monetized, altering the manner in which nations finance climate initiatives. In 2024, worldwide earnings from carbon taxes and emissions-trading systems (ETS) exceeded $100 billion for the first time, signifying a historic milestone in climate financing (World Bank, 2025). What began as fragmented policy experiments in the early 2000s has transformed into a fundamental element of fiscal strategy, industrial policy, and global governance.

Over 70 countries, including the European Union and China, already implement direct carbon pricing, including roughly 28 percent of global greenhouse gas emissions (IMF, 2025). This increase indicates both legal advancement and an evolving economic transformation: the monetization of emissions is converting environmental externalities into financial assets that stimulate investment in innovation, clean technology, and sustainable growth (OECD, 2024).

However, underlying the milestone is a more profound inquiry—where does the money go? Notwithstanding increasing carbon revenues, a small subset of governments disseminates open information on the allocation of these funds or the resultant effects (World Resources Institute, 2025). Numerous countries use income towards consumer rebates or fiscal consolidation instead of actively financing decarbonization efforts. The efficacy of carbon pricing relies not alone on the cost per ton but also on the judicious use of each carbon dollar.

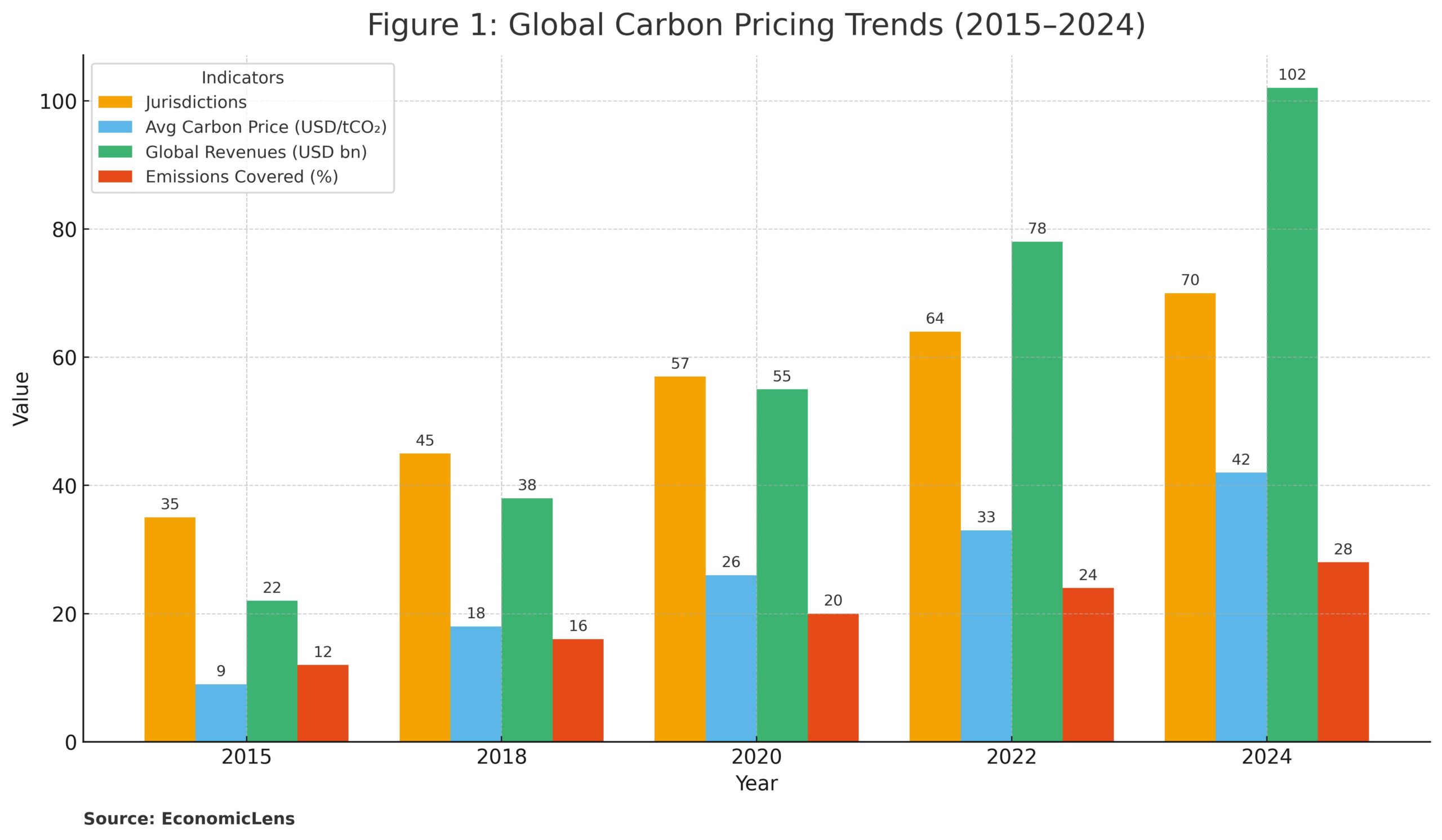

Global Carbon-Revenue Growth, 2015–2025

Carbon pricing has swiftly transitioned over the last decade from a specialized policy instrument to a fundamental component of global economic governance. The diagram below monitors its growth from 2015 to 2025.

Global carbon revenues have increased five-fold over the last decade, while average prices have more than four-fold. The scope of emissions coverage has increased two-fold, establishing carbon price as a pivotal fiscal tool for the transition to net-zero (IEA, 2025). This expansion demonstrates how pricing systems may swiftly expand when synchronized with global objectives outlined in the Paris Agreement. As carbon markets develop, governance and transparency must advance to avoid fiscal leakage and policy fatigue (UNEP, 2025).

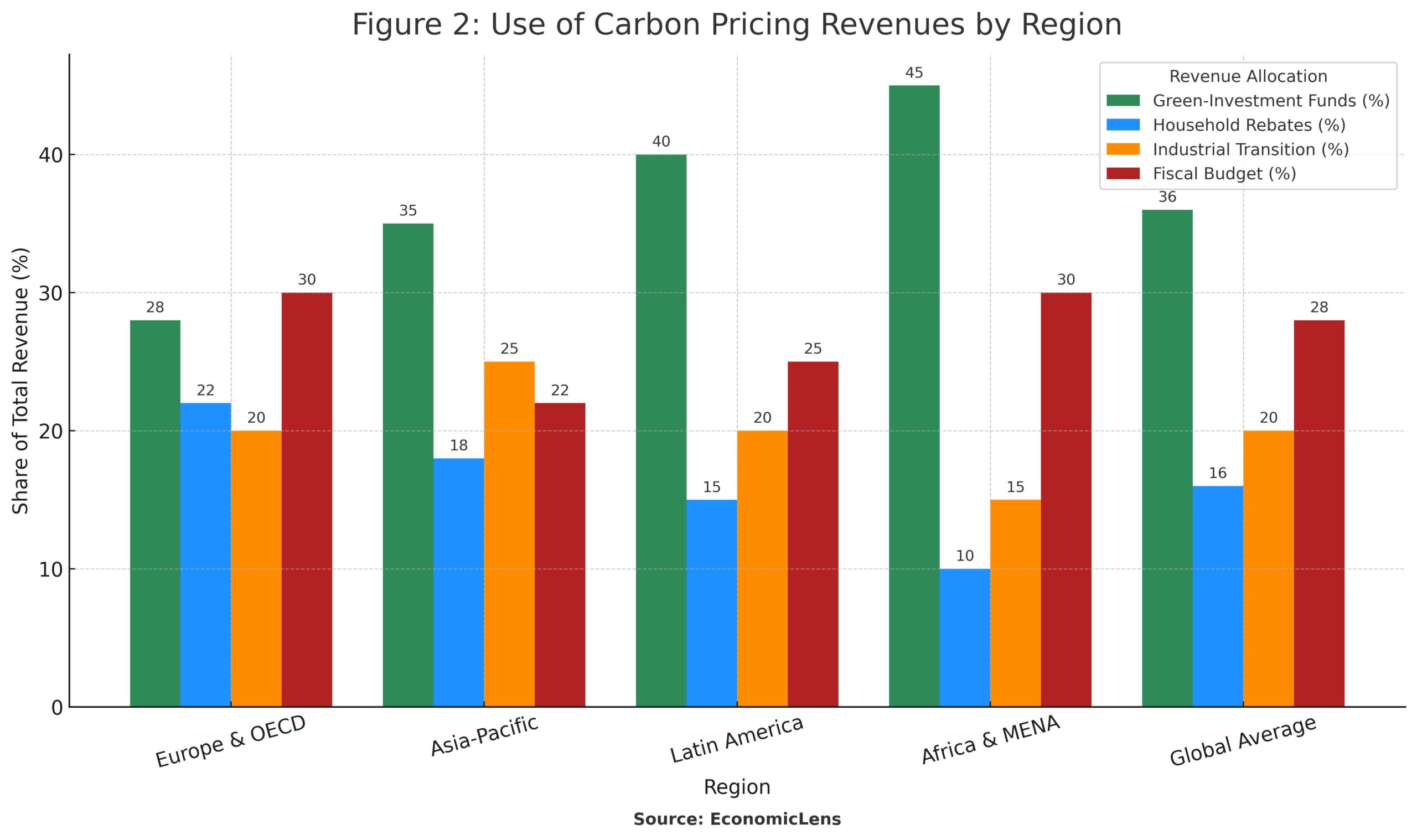

Regional Distribution of Carbon-Revenue Use, 2024

The distribution of carbon revenue differs throughout areas, indicating varying economic conditions and political agendas. The following table contrasts the deployment of carbon revenues across key regions.

Regional disparities illustrate the intricacies of financial decisions. European and other OECD nations use carbon revenue for fiscal consolidation and innovation subsidies, while Asia-Pacific and emerging areas emphasize renewable energy development and local adaptation (UNDP, 2025). In Africa and Latin America, a greater proportion of earnings supports resilience and green infrastructure—demonstrating that carbon financing, when appropriately allocated, may function as both a climate and development instrument (Independent Evaluation Group, 2024). However, disparities endure: affluent economies generate more carbon money while accounting for a smaller proportion of global emissions (World Economic Forum, 2025).

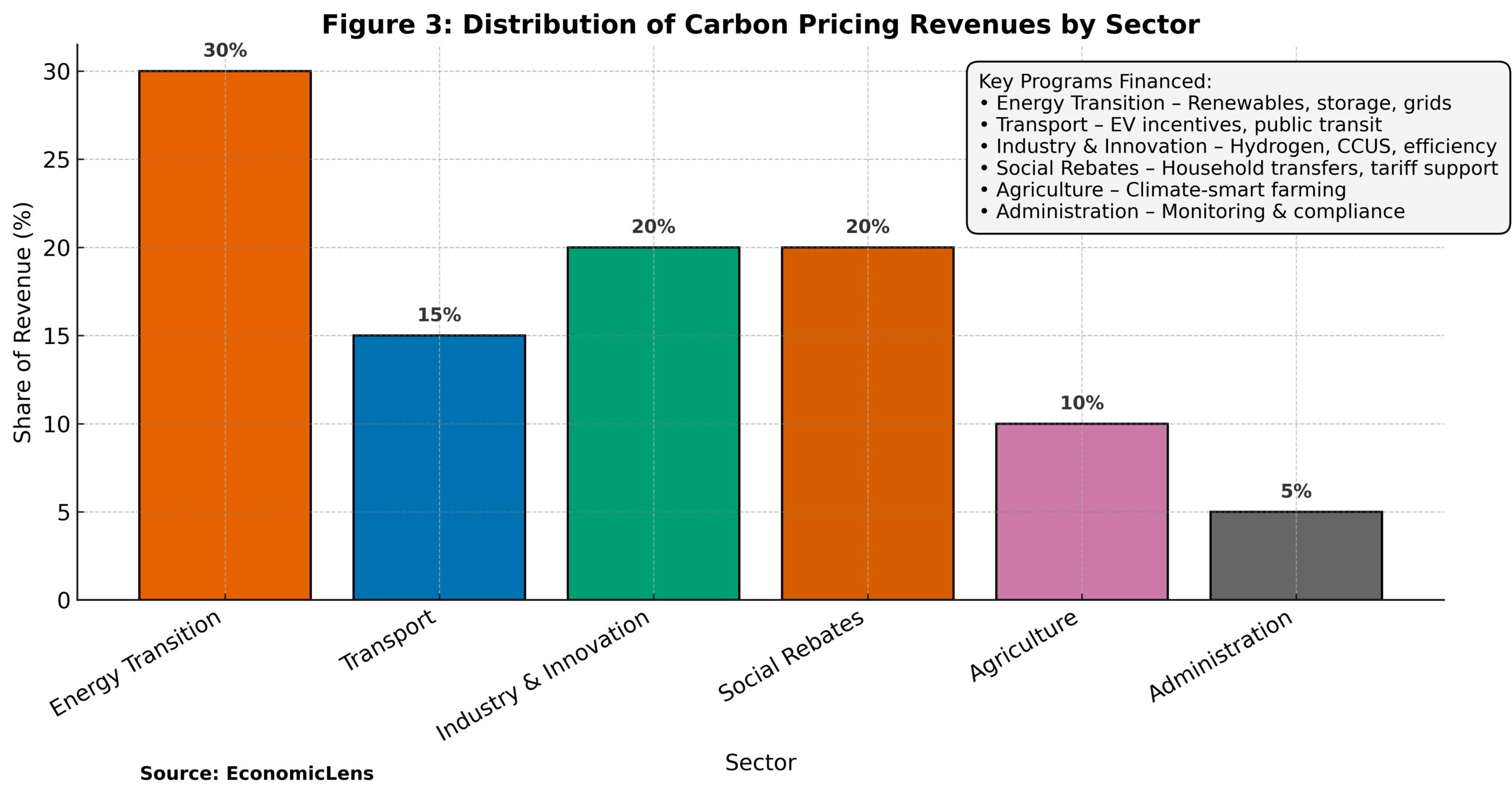

Sectoral Allocation of Carbon Revenues

An analysis of the sectoral distribution of carbon expenditures illustrates the efficacy with which governments connect fiscal policy to climatic results.

Currently, two-thirds of all carbon revenues are allocated to energy, industry, and transportation, indicating a transition towards structural decarbonization (IEA, 2025). The 20 percent designated for social rebates indicates the ongoing need for political legitimacy under carbon price frameworks (ILO, 2025). Policymakers confront the persistent issue of reconciling immediate affordability with long-term emissions reduction and innovation (Carbon Pricing Leadership Coalition, 2025).

Equity and Redistribution Effects

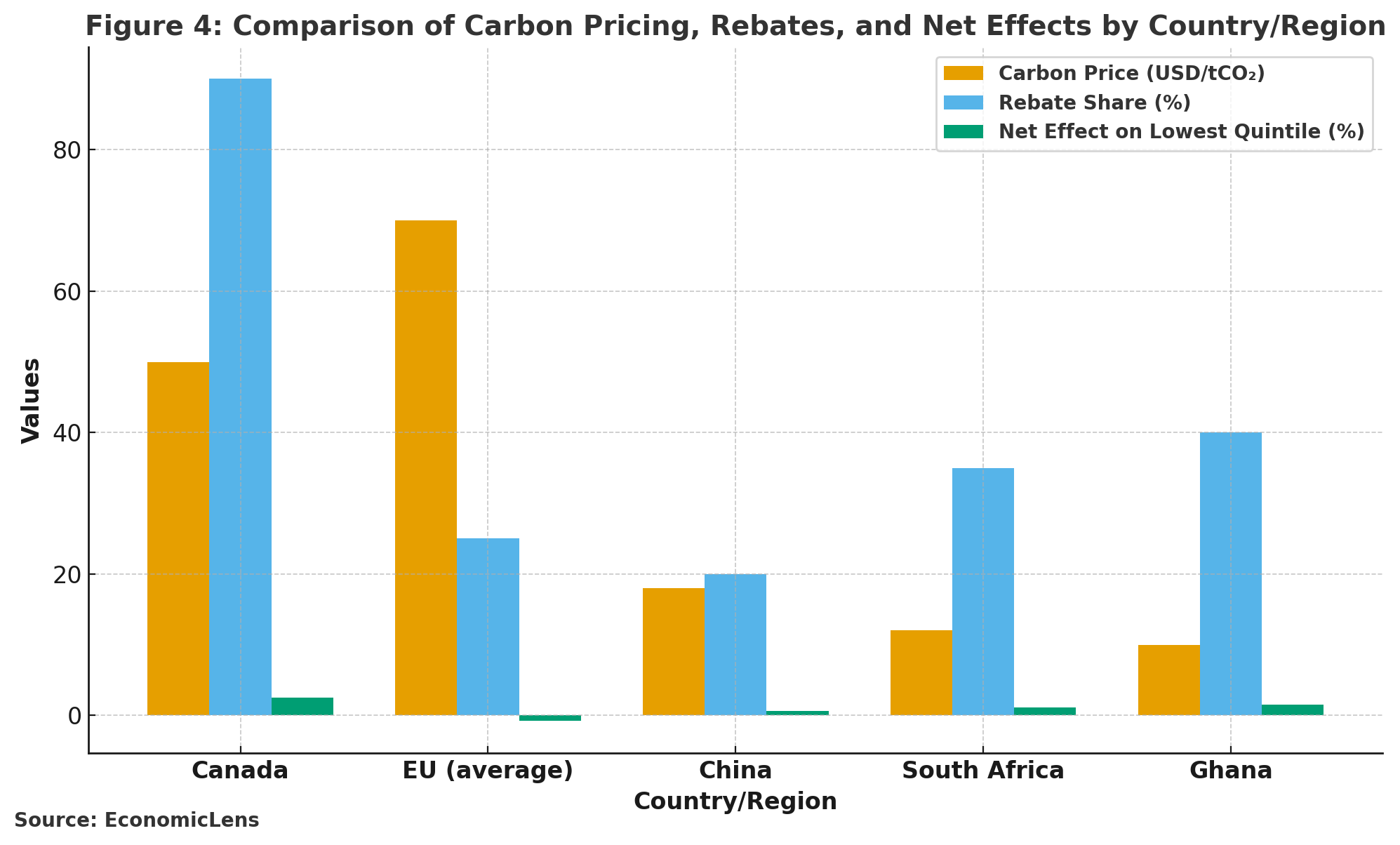

The political viability of carbon pricing hinges on its perceived fairness. The diagram below delineates the impact of carbon-revenue recycling on income distribution across several areas.

Effectively structured carbon-revenue regimes may mitigate inequality. Canada’s household rebates make its system advantageous for low-income demographics, while the EU’s industrial reinvestment framework emphasizes competitiveness over redistribution (OECD, 2024). In developing economies like Ghana and South Africa, associating carbon revenues with adaptation and rural electricity has shown social progressiveness (UNDP, 2025). In the absence of justice, public opposition may jeopardize the long-term sustainability of climate policy (Climate Policy Initiative, 2024).

The Global Race for Carbon Accountability

With the expansion of carbon price, transparency has become the paramount criterion for climate governance. Less than 40 percent of participating nations provide detailed information on the allocation of carbon proceeds (WRI, 2025). This disparity erodes public trust and diminishes the legitimacy of international climate-finance frameworks.

A new competition for responsibility is now emerging. Chile and South Korea have used blockchain-based fiscal monitoring, while the European Union is creating open-access budget dashboards that connect ETS revenues to quantifiable results (UNFCCC, 2025). Transparency has transcended administrative functions and has become a competitive need. In a realm where financial credibility delineates leadership, carbon responsibility has emerged as a criterion for assessing state capability (IMF, 2025).

Fiscal Innovation and Emerging Mechanisms

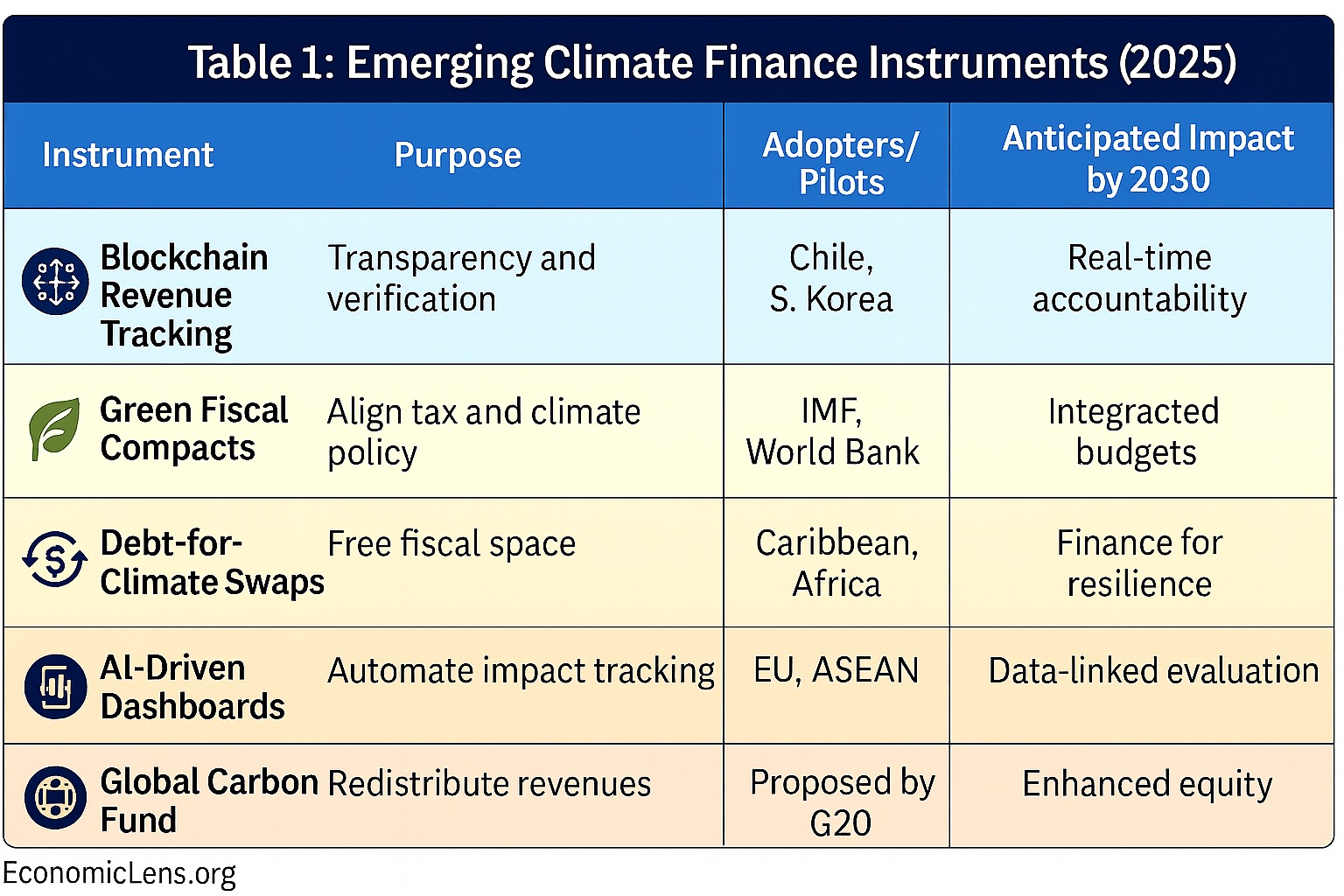

Fiscal innovation is reshaping how governments manage, verify, and redistribute carbon revenues. The following table outlines the most promising instruments.

These methods indicate the transformation of carbon pricing from a tax into a financial governance framework. Blockchain augments traceability, whilst AI and digital auditing boost data verification (IEG, 2024). Debt-for-climate swaps are transforming fiscal equity, and the suggested Global Carbon Fund may formalize large-scale redistribution (G20, 2025). Collectively, these tools illustrate the convergence of economics, technology, and justice in facilitating transparent climate governance.

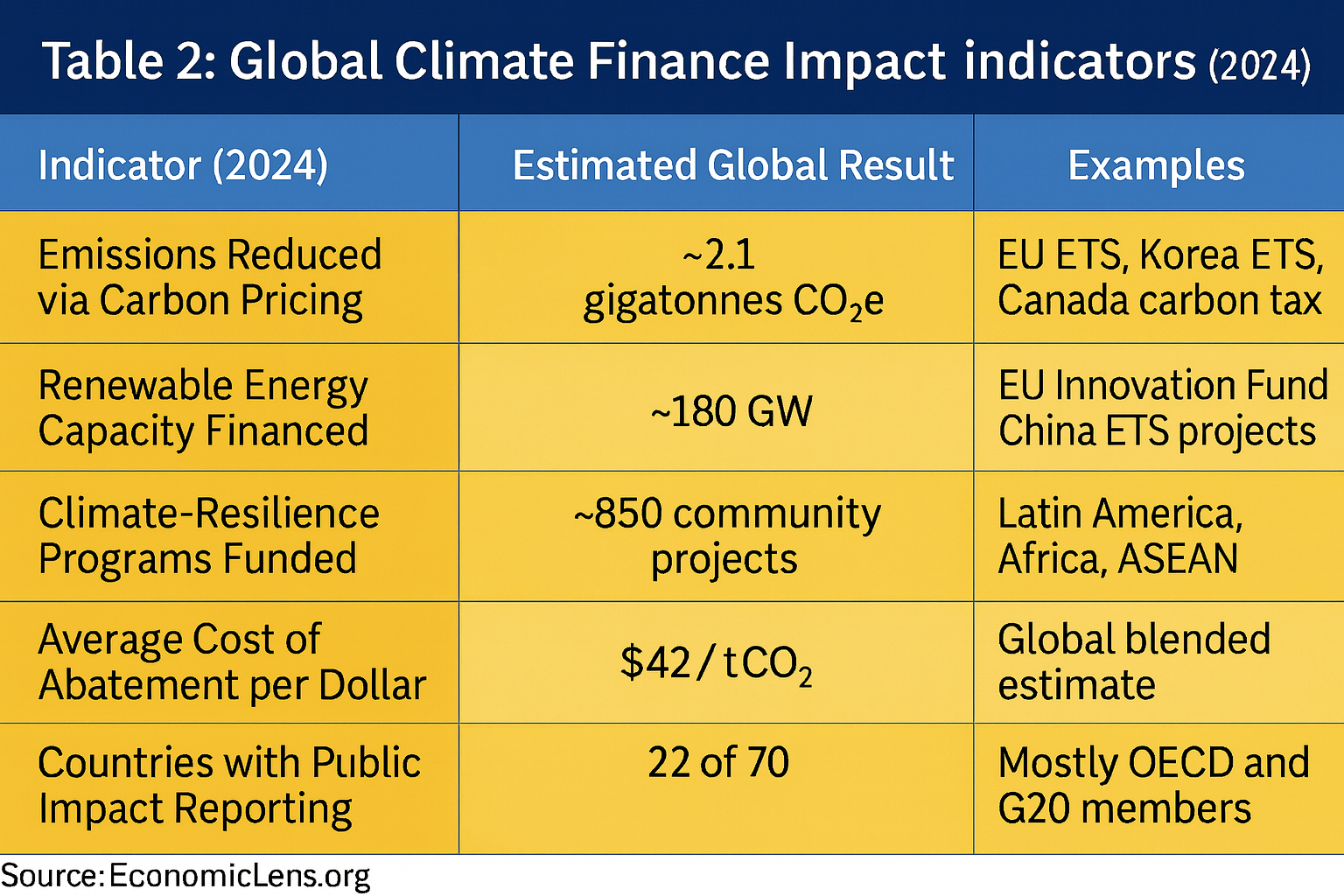

Measuring the Carbon Dividend’s Impact

Although $100 billion in carbon earnings signifies a financial achievement, the true evaluation of the carbon dividend depends on its environmental impact. A limited number of nations provide reports correlating income use with carbon reductions, renewable energy growth, or adaption results (World Bank, 2025).

The findings suggest that carbon pricing is starting to have quantifiable consequences; nevertheless, transparency and impact assessment are still inadequate. Every gigaton of averted emissions signifies concrete advancement; but, in the absence of established criteria, the international community is unable to assess the return on investment of these earnings (UNEP, 2025). The development of a cohesive carbon-results framework that amalgamates fiscal and environmental data should represent the forthcoming advancement in global climate financing (CPLC, 2025).

Policy Pathways and the Road Ahead

As carbon pricing gets integrated into budgetary frameworks, three policy trajectories are shaping the next decade.

- Governments are including carbon revenues into climate-designated national budgets, accompanied by quantifiable performance measures (IMF, 2025).

- Subnational expansion: Developing carbon markets in India, Brazil, and Indonesia are financing urban adaptation and innovation initiatives (UNDP, 2025).

- Digital accountability ecosystems: Artificial intelligence and blockchain technology provide real-time verification of emissions, income streams, and project results (UNFCCC, 2025).

Organizations like the International Monetary Fund and the World Bank are advocating for green fiscal compacts that connect taxes, debt management, and climate results (IMF, 2025; World Bank, 2025). The UNFCCC’s Global Stocktake (2025) calls on states to include openness and equality into financial reform. If executed properly, these initiatives might establish the carbon dividend as the cornerstone of an equitable and transparent net-zero economy.

Final Word

The first $100 billion in carbon taxes is not only a budgetary milestone but a crucial assessment of global climate responsibility. As carbon markets proliferate and green financing escalates, the metric of advancement will shift from the amount collected to the efficacy of its reinvestment in a just, resilient, and net-zero future.

“The carbon dividend must transcend from a financial benchmark into a revolutionary catalyst—integrating climate integrity with equitable economic development, and facilitating the global shift towards a net-zero future”.