Climate adaptation fiscal risk is emerging as a central challenge for emerging economies. This policy note examines how rising adaptation spending pressures public budgets, interacts with debt sustainability, and reshapes fiscal policy choices, while outlining strategies to manage climate risks without undermining macroeconomic stability.

Introduction

Climate adaptation financing is becoming a defining challenge for public finance in emerging and developing economies. As climate-related shocks intensify, governments face rising pressure to finance disaster response, infrastructure repair, social protection, and resilience investments. These expenditures are increasingly recurrent rather than exceptional, placing sustained strain on public budgets and fiscal frameworks.

Unlike mitigation spending, which can often be planned and phased, climate adaptation spending is frequently reactive, urgent, and politically unavoidable. As a result, Climate adaptation financing emerges not only from the scale of spending but also from its unpredictability and weak integration into medium-term fiscal planning. This policy note examines how climate adaptation spending affects fiscal sustainability, why climate shocks are reshaping budget risks, and which policy frameworks can help governments manage adaptation needs without undermining macroeconomic stability.

Importantly, Climate adaptation financing compounds existing fiscal pressures, particularly in economies already constrained by energy subsidies, weak revenue mobilization, and limited fiscal space. In this sense, climate adaptation challenges reinforce the urgency of broader fiscal reforms, including energy subsidy reform and improved expenditure targeting.

Policy Context: Climate Adaptation and Public Finance

Climate change is fundamentally altering the risk profile of public finances. IMF analysis shows that climate-related disasters increase fiscal deficits, raise public debt, and weaken growth prospects, particularly in climate-vulnerable economies https://www.imf.org/en/Topics/climate-change

Adaptation spending now includes flood control, heat-resilient infrastructure, water management, coastal protection, health system reinforcement, and emergency relief. World Bank Climate Change Development Reports show that these costs are rising faster than revenues in many low- and middle-income countries, increasing long-term fiscal exposure.

In this context, Climate adaptation financing reflects the interaction between rising expenditure needs, limited fiscal space, and weak shock absorption capacity.

Climate Adaptation Fiscal Risk in Practice: Domestic and Sectoral Evidence

Recent experience shows that Climate adaptation financing is no longer theoretical but already materializing on the ground. Pakistan’s flood crisis demonstrates how climate shocks translate directly into fiscal stress when adaptation systems and climate finance fail to deliver at scale. As analyzed in EconomicLens’ assessment of Pakistan’s floods, repeated climate disasters force governments into emergency spending, reconstruction outlays, and expanded social protection, all of which strain budgets and increase debt when financing remains ad hoc and reactive https://economiclens.org/pakistan-floods-show-why-climate-finance-must-deliver-now/

Climate adaptation fiscal risk also operates through food systems. Climate shocks reduce agricultural productivity, raise food prices, and increase pressure on governments to expand subsidies or imports. EconomicLens’ analysis on climate finance and climate-smart agriculture shows that underinvestment in resilient farming amplifies fiscal exposure by increasing food import bills, social protection costs, and political pressure for price controls https://economiclens.org/feeding-the-future-how-climate-finance-and-climate-smart-agriculture-can-stop-the-next-global-food-crisis/

Together, disaster response and food system vulnerability illustrate how Climate adaptation financing cuts across multiple expenditure channels simultaneously.

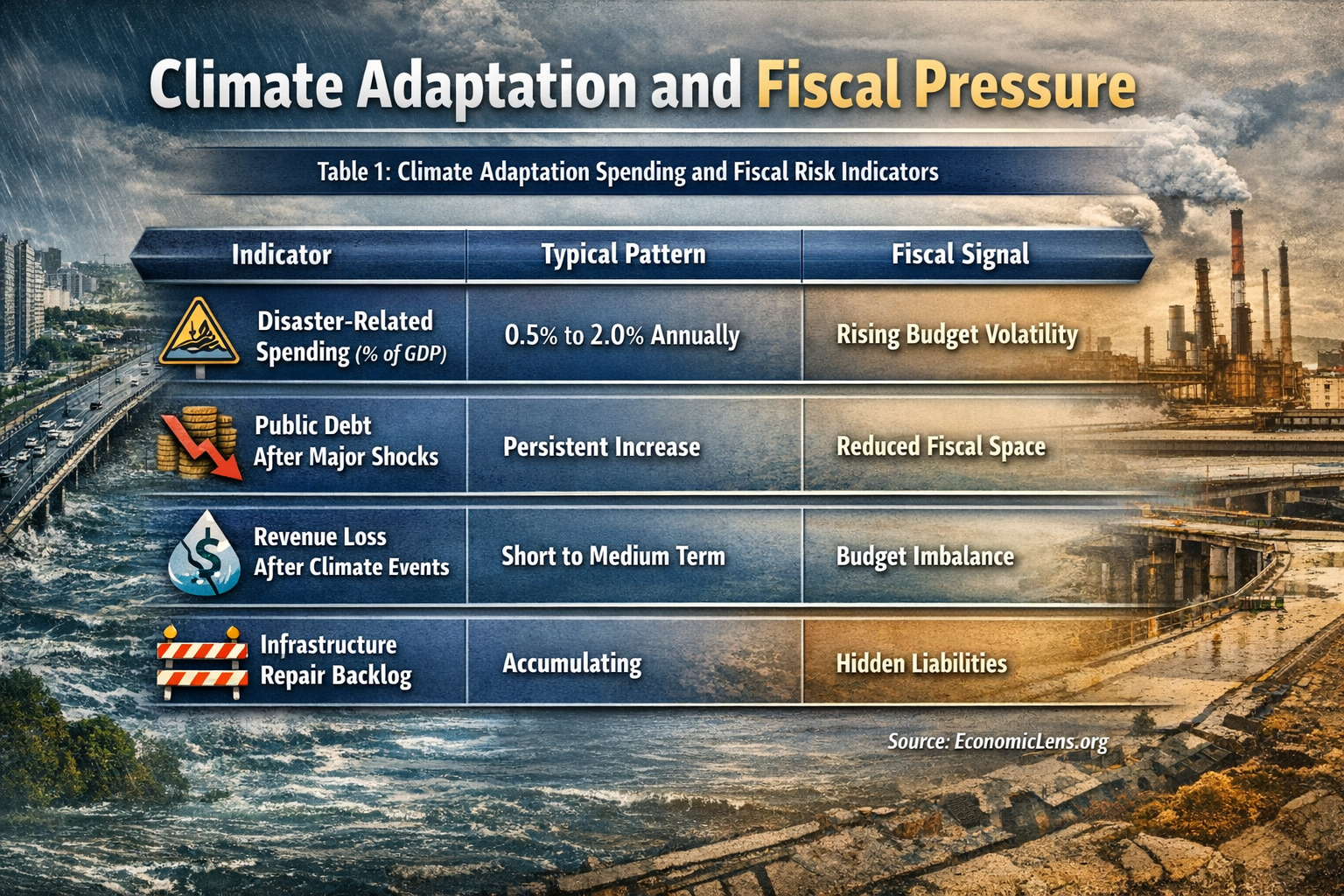

The Fiscal Mechanics of Climate Adaptation Fiscal Risk

Budget volatility from climate shocks

Climate disasters trigger sudden spending surges for relief, reconstruction, and social assistance. These shocks disrupt budget execution and force governments to reallocate funds away from development priorities. IMF research shows that disaster-related spending increases deficit volatility and complicates fiscal forecasting.

Debt accumulation and contingent liabilities

Repeated climate shocks increase borrowing needs and create contingent liabilities through public utilities, infrastructure guarantees, and state-owned enterprises. Over time, this raises debt servicing costs and constrains fiscal flexibility.

Revenue erosion and growth impacts

Climate shocks weaken tax bases through production losses, supply chain disruptions, and income declines. The combination of higher spending and lower revenue intensifies Climate adaptation financing, especially in economies with narrow tax capacity.

The evidence shows that climate adaptation spending creates recurring fiscal pressure rather than one-off costs. These dynamics explain why climate adaptation fiscal risk must be treated as a structural public finance issue.

Institutional and Policy Constraints

Managing climate adaptation fiscal risk is complicated by institutional gaps. Many countries lack climate budget tagging systems, integrated fiscal risk statements, and disaster risk financing strategies. As a result, climate-related liabilities remain partially hidden within public accounts.

In addition, adaptation spending competes with existing development priorities. Without prioritization frameworks and project appraisal standards, governments risk inefficient allocation and politically driven spending rather than resilience-enhancing investment.

Policy Options to Manage Climate Adaptation Fiscal Risk

Integrating climate risk into fiscal frameworks

Embedding climate risk assessments into medium-term fiscal frameworks improves preparedness and reduces reactive spending. Climate stress testing and explicit recognition of disaster-related contingent liabilities strengthen fiscal credibility.

Pre-arranged disaster risk financing

Contingency funds, insurance schemes, and catastrophe bonds help smooth fiscal shocks. World Bank experience shows that countries with pre-arranged financing respond faster and with lower fiscal disruption https://www.worldbank.org/en/topic/disasterriskmanagement

Prioritizing adaptation investment efficiency

Not all adaptation spending yields equal fiscal returns. Investments in resilient infrastructure, early warning systems, and climate-smart agriculture reduce future repair costs and limit long-term fiscal exposure.

Leveraging concessional climate finance

Grants and concessional financing reduce reliance on costly debt. However, access remains uneven, reinforcing climate adaptation fiscal risk in vulnerable economies.

Global Signals Reinforcing Climate Adaptation Fiscal Risk

Global trends are intensifying fiscal exposure to climate adaptation needs. IMF World Economic Outlook analysis shows that tighter global financial conditions have reduced fiscal buffers, limiting governments’ ability to absorb climate shocks https://www.imf.org/en/Publications/WEO

World Bank assessments indicate that climate-vulnerable economies face adaptation costs far exceeding current public investment levels, widening the gap between needs and financing capacity https://www.worldbank.org/en/topic/climatechange

These signals confirm that climate adaptation fiscal risk is rising rather than diminishing.

Risks and Trade-offs

Ignoring climate adaptation fiscal risk increases exposure to disorderly fiscal adjustment after shocks. However, excessive borrowing for adaptation without prioritization can also undermine debt sustainability. The central trade-off lies between proactive, planned adaptation spending and costly, reactive fiscal responses.

Conclusion

Climate adaptation fiscal risk is reshaping public finance in emerging and developing economies. As climate shocks intensify, governments face rising and recurrent spending pressures that strain budgets, increase debt, and weaken fiscal predictability. Treating adaptation as an ad hoc expenditure rather than a core fiscal challenge magnifies long-term costs.

Effective management of climate adaptation fiscal risk requires integrating climate considerations into fiscal frameworks, prioritizing high-return adaptation investments, and strengthening access to concessional finance. When adaptation spending is planned, transparent, and institutionally embedded, governments can enhance resilience without undermining macroeconomic stability.

In sum, climate adaptation fiscal risk is no longer a peripheral environmental concern. It is a central determinant of fiscal sustainability, development outcomes, and economic resilience in a climate-constrained world.

Policy Takeaways

- Climate adaptation fiscal risk is structural, not temporary, and must be embedded in fiscal planning

- Reactive disaster spending is costlier than planned adaptation investment

- Weak fiscal space and energy subsidies amplify climate-related budget stress

- Institutional tools such as climate budget tagging and disaster risk financing improve resilience

- Managing climate adaptation fiscal risk strengthens both fiscal sustainability and development outcomes