Examines Trump’s 2025 tax legacy—an economy revived by stimulus but strained by debt and inequality. Analyzes how fiscal populism fuels short-term growth, weakens middle-class stability, and amplifies global financial risk

Executive Summary

Donald Trump’s tax legacy in late 2025 exists at a volatile crossroads of politics and economics. The administration’s revised tax policy has resulted in increased corporate profits and heightened market confidence, while simultaneously exacerbating the government debt and intensifying class disparities. The purported American rebound seems superficially appealing; but, it is underpinned by a fiscal stream driven by historic levels of borrowing.

This blog elucidates three interconnected aspects of Trump’s legacy:

- The engineered boom built on fiscal adrenaline,

- The middle-class mirage concealing inequality, and

- The debt time bomb ticking beneath America’s global financial dominance.

“Even prosperity must pay its bills — and America’s economic resurgence may prove its most expensive victory yet”

1. A Legacy Revisited: Growth Or Gamble

Upon Donald Trump’s return to office in January 2025, he assumed leadership of a country fluctuating between resilience and fatigue. Inflation has decreased from its epidemic highs; yet, public confidence in fiscal governance has declined. The One Big Beautiful Bill Act, enacted in March 2025, reinstated the fundamental elements of the 2017 Tax Cuts and Jobs Act (TCJA): enduring corporate rate reductions, prolonged household deductions, and incentives for domestic manufacturing.

Proponents lauded it as a second “Reagan moment”—a proclamation of capitalist confidence. Critics see it as populism disguised as policy: a strategy to purchase growth with borrowed funds.

The question persists—has America’s growth engine been revitalized, or just accelerated by credit reliance?

“Every boom built on credit ends with a bill — the applause fades, but the repayments persist. America’s resurgence may be real, but it’s financed by tomorrow’s taxpayers”

The Economic Boom Narrative

The White House asserts that the 2025 growth exemplifies how tax relief “unleashes American greatness.” Corporate profits reached unprecedented levels in Q3 2025; consumer spending recovered; and the S&P 500 had its greatest valuation-to-earnings ratio since 2000. However, underneath this confidence exists a more fragile structure—one sustained by unprecedented fiscal deficits and speculative capital flows.

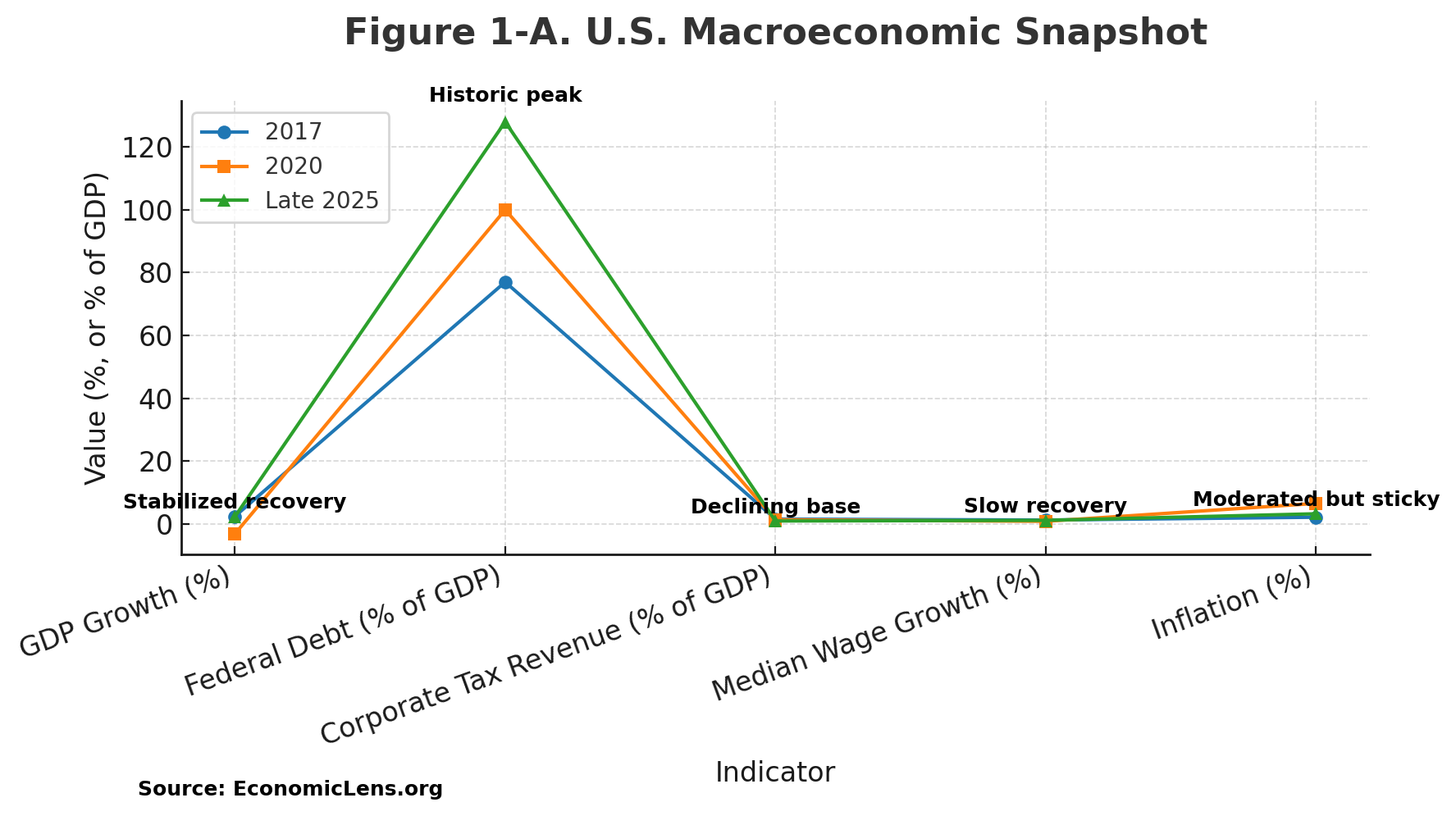

To comprehend the anatomy of the “Trump boom,” it is crucial to examine the progression of fundamental indicators from pre-pandemic stability to the current overstretched equilibrium.

Data Sources: CBO (2025); BEA (2025); IMF (2025)

The headline figures obscure underlying structural disparities. In 2025, GDP growth is supported by consumption driven by stimulus rather than by productivity improvements. Federal borrowing compensates for revenue deficits resulting from tax reductions, while inflation persists above pre-pandemic levels. The United States currently incurs around $1.30 in new debt for every dollar of new production, establishing a historic ratio that reinterprets the concept of “growth.”

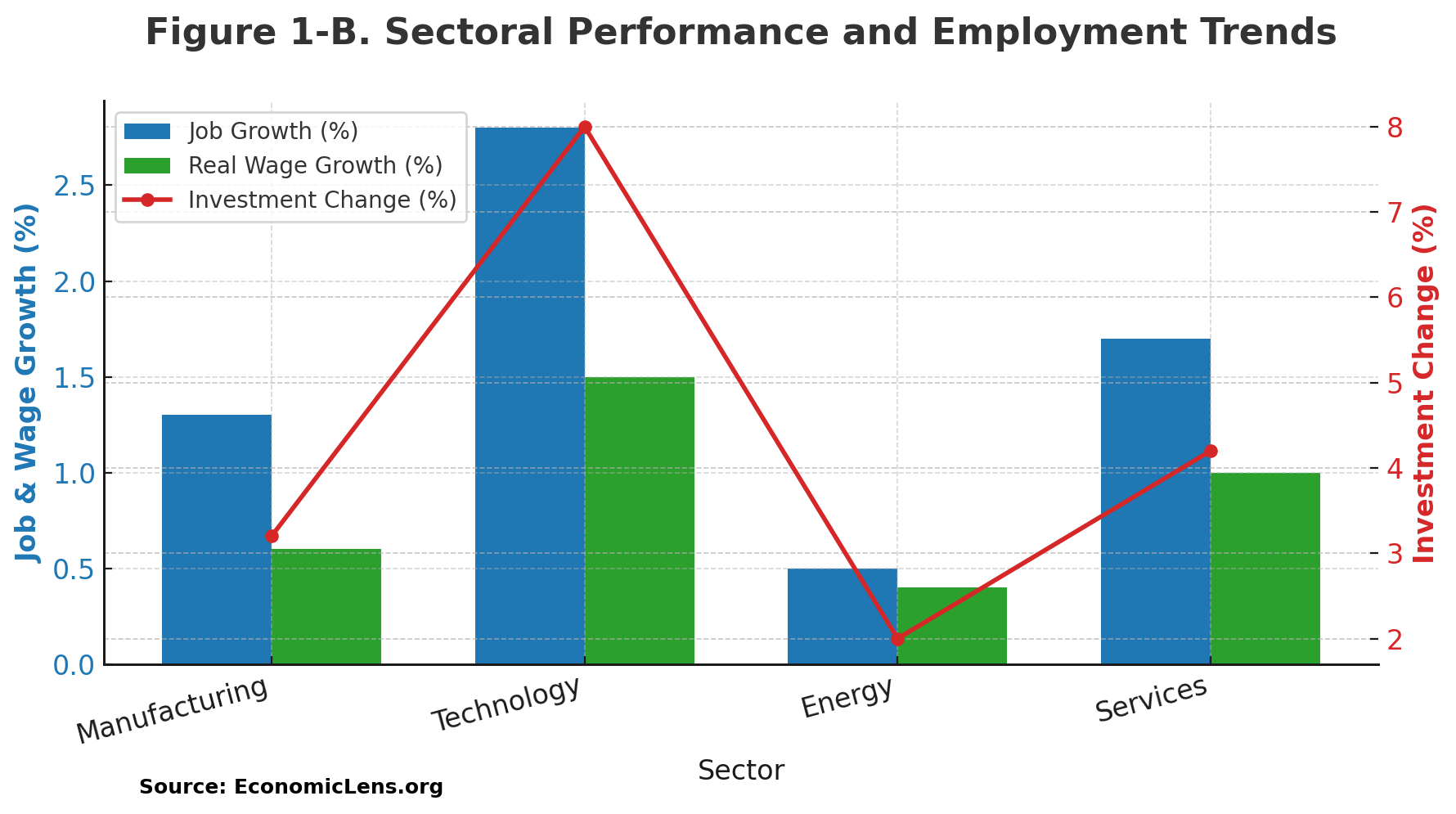

Sectoral study indicates an economy driven by automation, artificial intelligence, and capital-intensive businesses, while becoming further detached from wage workers and local manufacturing ecosystems.

“Growth headlines are seductive. But beneath every chart of rising GDP lies a quieter graph of rising debt — a reminder that prosperity and prudence rarely coexist for long”

Technology and AI infrastructure constitute a predominant share of private investment, representing around 45% of overall capital creation. However, automation inhibits job creation: industrial production increases while employment stagnates. The result is a bifurcated recovery—shareholder prosperity with stagnating wages.

“An economy can sprint on credit, but it cannot sustain the race. Growth without discipline is velocity without direction”

Fiscal Populism: Politics as Economics

Trump’s economic paradigm flourishes on populist paradox: advocating fiscal restraint in discourse while implementing fiscal growth in practice. His rallies promise “freedom from government,” while his budgets depend on unprecedented government borrowing.

The politics of performance overshadow the economics of prudence. Tax cuts are framed as ethical victory—symbols of American self-sufficiency—yet they sustain the fiscal dependence they claim to eliminate.

In 2025, the Treasury issued $3.4 trillion in new securities, resulting in yearly debt-service payments above $1 trillion. Each “victory lap” in employment expansion is accompanied by a corresponding trajectory of interest payments.

“Populism is cheap when it’s financed by tomorrow’s taxpayers. Fiscal showmanship creates the illusion of empowerment, but it replaces structural reform with spectacle. The tax cuts may win applause today—but they mortgage tomorrow’s flexibility”

2. Middle-Class Mirage – Growth without Inclusion

The Trump administration’s discourse focuses on the “neglected middle class.” However, by late 2025, the typical American family confronts the contradiction of seeming wealth and genuine insecurity. Escalating credit card debt, housing unaffordability, and healthcare inflation have negated the majority of the advantages derived from personal tax cuts.

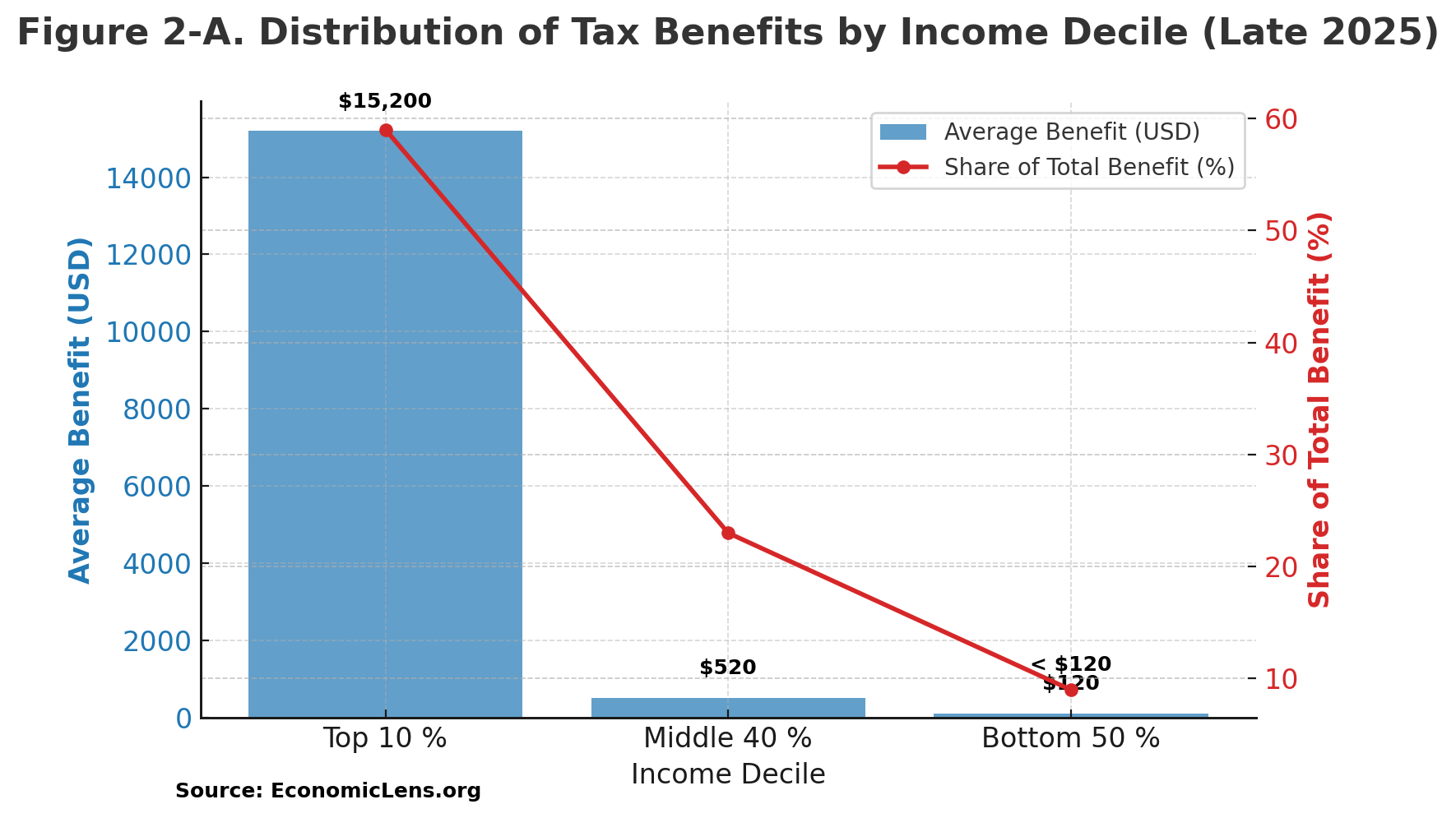

To assess the impact across income brackets, we analyze the distribution of benefits from the 2025 tax amendments. The results indicate a consistent bias favoring high-income families and capital owners.

Despite assertions of equality, the financial structure remains top-heavy. The top decil, consisting of asset owners and executives, accounts for roughly 60% of the benefits. The central 40%, although being politically sought after, see little alleviation consumed by rising living expenses. This disparity undermines consumer confidence and exacerbates political skepticism.

The broader impact is both cultural and economic: middle-income households increasingly see the tax system as a tool of exclusion rather than opportunity. For many, the prospect of “trickle-down growth” seems as an illusory vision on the periphery of family finances.

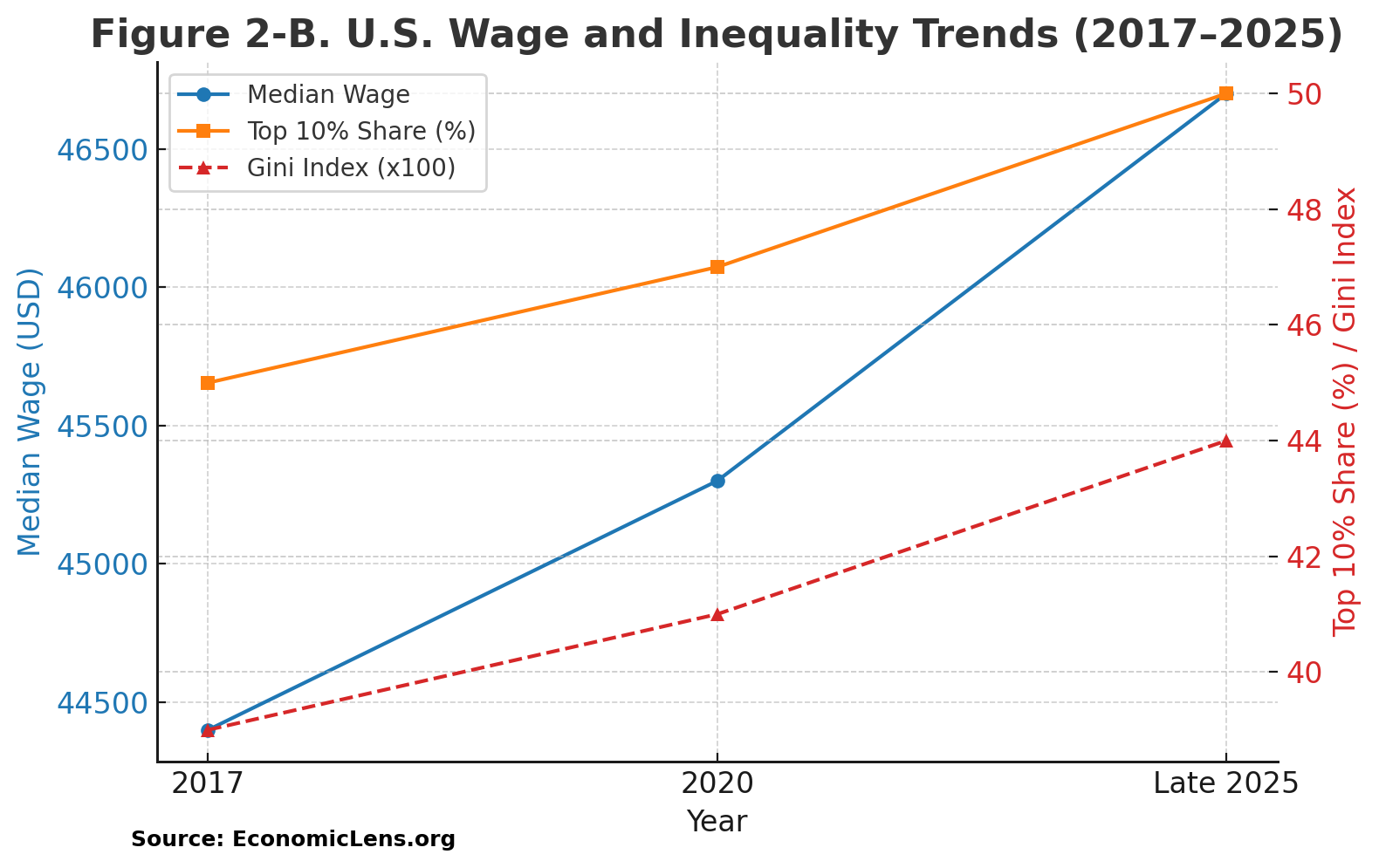

To quantify this widening fault line, we examine wage patterns and inequality trends.

The labor market in late 2025 exhibits a paradox: unemployment is low, yet real wage gains barely outpace inflation. The richest 10% currently get 50% of all labor income, and the lowest 50% collectively earn less than the top 1%. The formerly lauded “middle-class comeback” is revealing itself to be a statistical illusion— visible, measurable, yet hollow in experience.

“Tax relief without wage relief is an illusion of prosperity. When income increases are allocated to capital, the middle class becomes an observer of growth rather than a recipient. Fiscal equity without wage reform is inherently contradictory”

3. The Debt Time Bomb

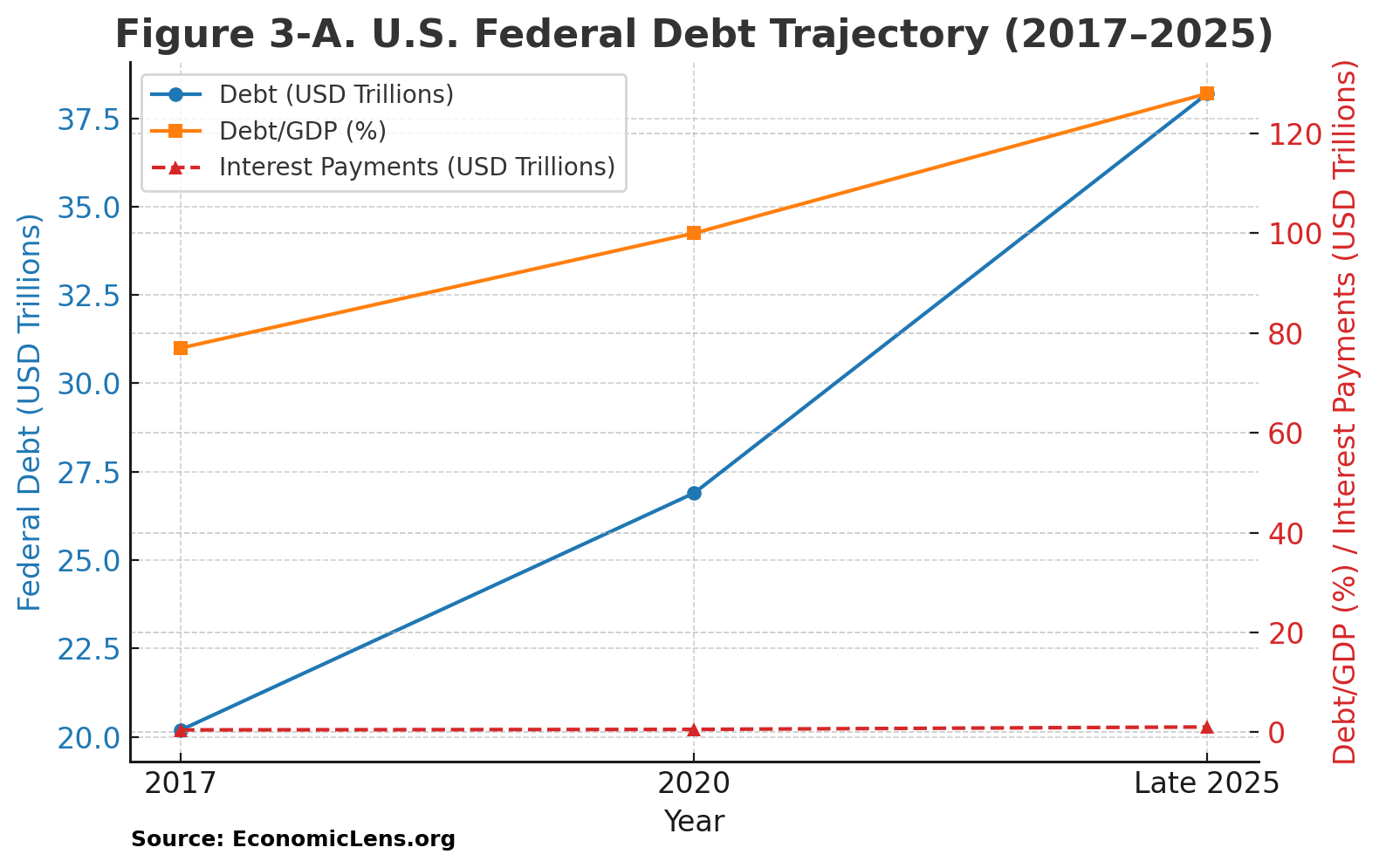

The first half of Trump’s fiscal narrative pertains to growth, while the latter segment focuses on arithmetic. Behind each assertion of economic revival exists an increasing ledger of liabilities. By late 2025, the U.S. government debt had reached USD 38.2 trillion, or 128% of GDP—the largest peacetime ratio in contemporary history.

The government now allocates more funds to debt interest than to Medicaid and military combined. A formerly transient stimulation has evolved into a structural addiction. Fiscal prudence is no longer a constraint; it has become the collateral.

The trend is evident: a decline in tax income, increasing entitlement commitments, and populist expenditures converge to create a self-perpetuating debt cycle. The U.S. Treasury’s borrowing cost averaged 4.4% in 2025, an increase from 1.8% in 2020. A 1% rise in interest rates approximately increases future obligations by USD 370 billion each year.

“Every tax cut carries an interest bill — and when that bill comes due, it isn’t Wall Street that pays it. It’s the public educational institutions, healthcare facilities, and future generations deprived of investment”

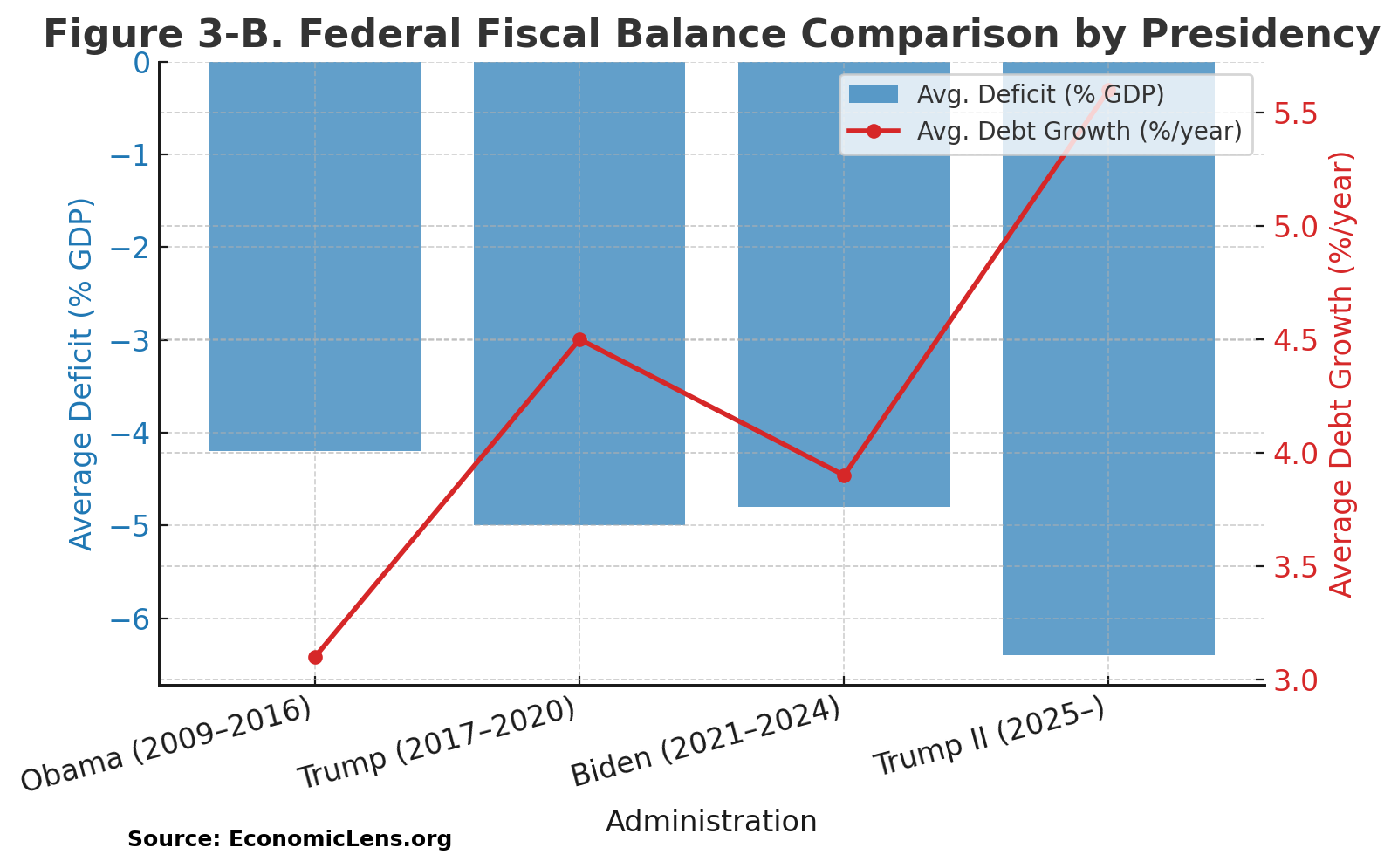

Fiscal Drift Across Administrations

Historical comparison highlights the transition from controlled deficits to routine debt increase. Every administration since 2009 has pledged consolidation, however, each has delivered expansion.

The Trump II government diverges from all other administrations in both speed and intent. Deficits have transitioned from “crisis management” to a policy tool—a deliberate gamble on perpetual borrowing as growth insurance. However, the prolonged perception of debt as a strategic tool by the U.S. further narrows its budgetary flexibility.

“When leaders measure prosperity by quarterly numbers, they trade fiscal truth for political theater. The result is applause today and austerity tomorrow”

Global Fiscal Ripple Effects

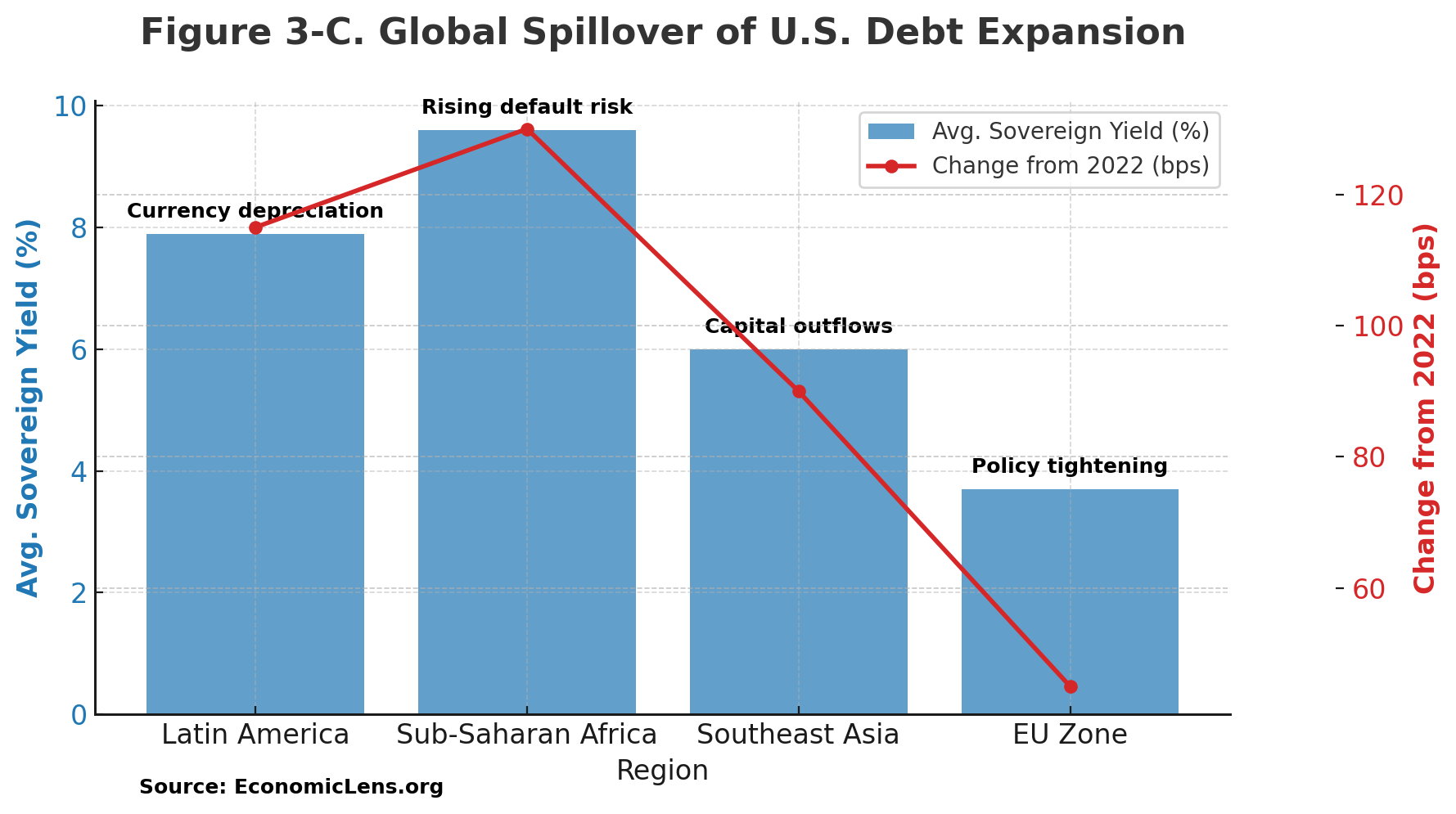

The economic policy of America has far-reaching effects beyond its borders. The global economy is now chained to the United States. Treasury rates serve as the standard for borrowing costs globally. As of November 2025, the average 10-year U.S. yield is 4.9%, diverting cash from developing countries and constricting credit globally.

The repercussions are quantifiable and immediate: emerging nations are incurring an extra 0.8 to 1.2 percentage points on average to repay their loans relative to 2022 levels. This is not only financial contagion; it is fiscal transmission.

The world’s poorest countries endure the cost of America’s prosperity. As the dollar appreciates and global liquidity diminishes, vulnerable nations face rising default risks and slowing developmental investment. U.S. budgetary excess manifests as a global externality—a paradox in which domestic populism triggers worldwide austerity.

“When America borrows without restraint, the world pays the interest — in currency depreciation, capital flight, and fragile recoveries derailed across continents. The U.S. debt clock does not tick alone; it reverberates the balance sheet of every emerging economy”

Research Insights

The Trump administration has rekindled essential discussions in fiscal economics. The 2025 experience exemplifies the conflict between populism and policy rigor. The current task is to transform anecdote into evidence —converting political narratives into research that guides transformation.

Key Research Priorities

- Thresholds for Debt Sustainability: Evaluate long-term debt-to-GDP thresholds at which market confidence diminishes. Current forecasts suggest a U.S. barrier of 130–135%, above which risk premiums increase exponentially (IMF, 2025).

- Inequality and Tax Responsiveness: Assess the impact of rate decreases on wealth concentration. Data indicates that a 1% reduction in top marginal tax rates results in a 0.4% rise in the income share of the top decile over a three-year period (OECD, 2025).

- Corporate Repatriation Conduct: Assess if tax reduction results in domestic investment or stock repurchases. By the fourth quarter of 2025, almost 70% of repatriated earnings had been allocated to shareholder payouts rather than to manufacturing operations (Harvard Kennedy School, 2025).

- Artificial Intelligence and Financial Transparency: Establish digital audit tools that can monitor real-time tax compliance, decreasing evasion by as much as 20% (WEF, 2025).

- Global Spillover Analysis: Assess the impact of U.S. fiscal cycles on the financial vulnerabilities of developing countries, particularly with dollar-denominated liabilities (World Bank, 2025).

“Research is not resistance—it’s accountability. In a political age of slogans, data remains the last form of honesty”

Collectively, these study demonstrate that governance, rather than mathematics, delineates the boundary between growth and instability. Fiscal sustainability now pertains not to the amount of debt a country carries, but how credibly it manages and communicates it.

Policy Prospects and The Road Ahead

The objective today is not to dismantle Trump’s legacy, but to regulate it. Fiscal populism must evolve into fiscal realism—economic development must coexist with solvency. The next government, irrespective of political affiliation, will inherit a paradoxical mandate: to sustain America’s growth without letting it drown in its own credit.

Key Policy Directions

- Revenue Optimization: Reassess the business tax reductions implemented post-2017, ensuring alignment with global norms around 25% while expanding the tax base (IMF, 2025).

- Realignment of the Middle Class: Broaden earned-income and family tax credits to reinstate buying power for median families, hence enhancing consumption-driven growth (World Bank, 2025).

- Debt Brake Mechanisms: Implement a legislative limit that correlates spending growth with long-term GDP potential, automatically initiating corrective measures upon violation (CBO, 2025).

- Artificial Intelligence-Enhanced Financial Supervision: Implement machine-learning audits for the immediate identification of tax irregularities and expenditure discrepancies (WEF, 2025).

- Integration of Green Taxation: Utilize carbon-adjusted incentives to reallocate subsidies towards sustainable sectors and low-emission infrastructure (UNEP, 2025).

- Bipartisan Fiscal Commission: Establish a permanent, autonomous fiscal council to remove political influence from budget management and provide openness across administrations (OECD, 2025).

“True prosperity requires discipline as much as ambition. Without reform, America risks turning its fiscal policy into a revolving credit line for political promises”

Policy must pivot from performance to prudence—converting economic theatre into lasting architecture.

Final Word

Trump’s tax legacy is both a success and a trap—a dazzling demonstration of short-term effectiveness undermined by long-term fragility. The 2025 boom has presented the optics of robustness but planted the seeds of constraint.

“The boom may fade, but the bill always remains. History will judge this era not by how high the markets soared, but by how deep the debts ran”

History will not remember this age for the height of the stock market, but for the depth of the liabilities it bequeathed. Whether America’s fiscal model evolves or implodes will depend on one question: can a nation addicted to tax cuts learn the virtue of restraint?