This blog explores the rise of green metals like lithium, nickel, and copper, and their critical role in the global transition to clean energy. As the demand for essential minerals and sustainable metals soars, nations are reshaping economic power and policy through critical minerals like cobalt and copper. It delves into the environmental, geopolitical, and industrial shifts driving this new era of resource competition, where sustainable metals are central to achieving net-zero goals.

Executive Summary

Mining has become central to the climate change movement due to the green metals boom of 2025. As countries pursue net-zero objectives, the demand for essential minerals such as lithium, copper, nickel, and cobalt is inciting a worldwide competition akin to previous oil booms.

The objective of the energy transition is to decrease carbon emissions, while also highlighting our reliance on resources and the associated trade-offs. This blog discusses how the clean energy revolution has resulted in a new extractive economy characterized by resource nationalism, industrial diplomacy, and environmental irony.

“Every revolution extracts its price”

The question is to whether the green entity would just extract from the planet or also compromise our integrity

From Oil Barons to Ore Diplomats

Wealth is being clandestinely dispersed in the twenty-first century. Countries are transforming previously undervalued resources, such as those from Chile’s lithium triangle and Indonesia’s nickel belt, into tools for economic sovereignty through critical minerals.

The International Energy Agency (IEA, 2025) asserts that achieving global net-zero objectives requires a six-fold escalation in essential minerals by 2040. This significant increase has integrated mining into climate industrial policy, altering the manner in which governments reconcile sustainability, growth, and energy, with a focus on sustainable metals.

“Yesterday’s wealth was drilled. Tomorrow’s will be dug—and every tonne extracted carries both danger and potential”

The Metallization of Climate Capitalism

Demand and Material Intensity

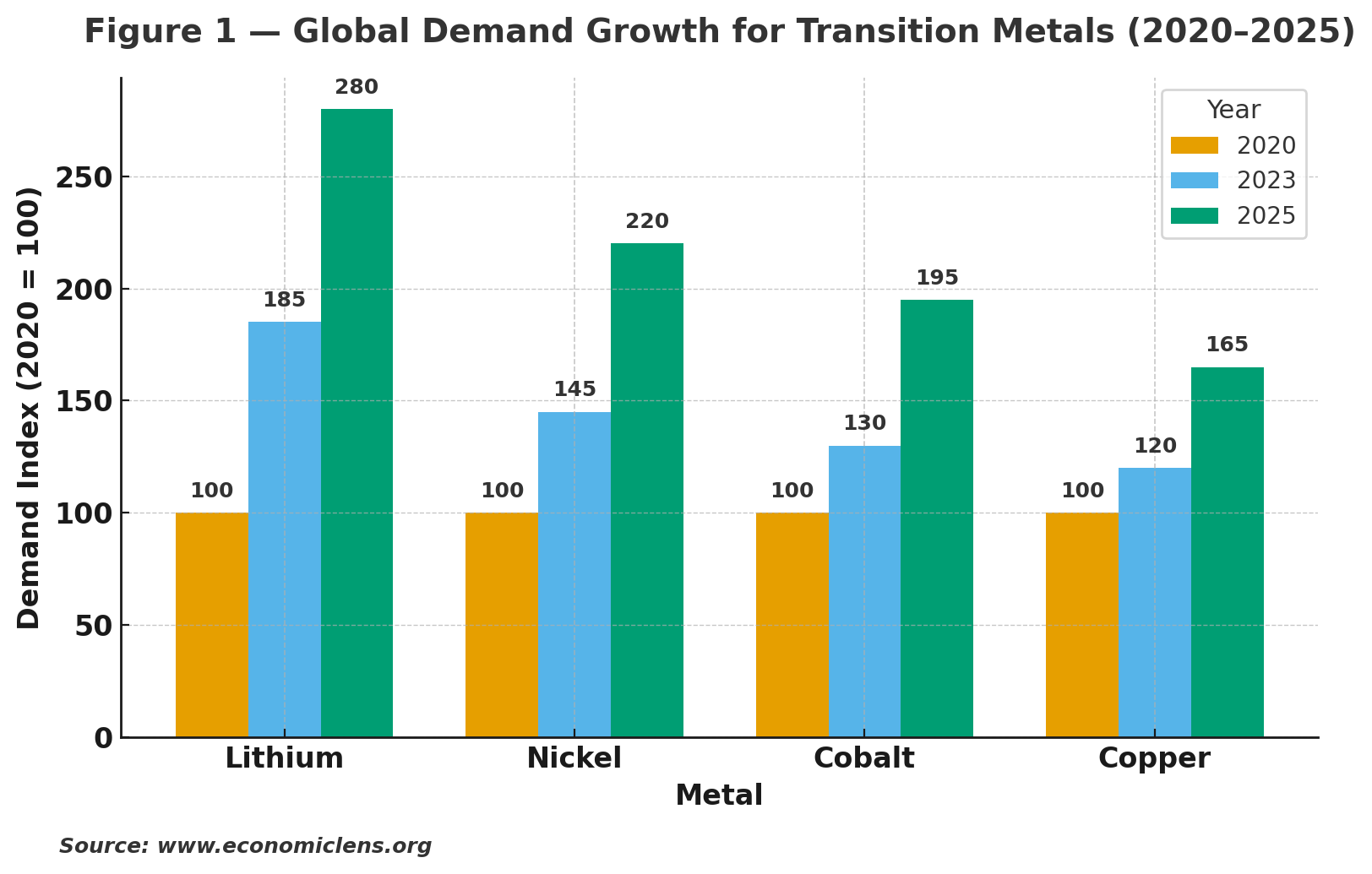

Surprisingly, renewable energy requires substantial amounts of metal. The Organization for Economic Co-operation and Development (OECD) states that every $1 billion spent in renewable energy generates around $350 million in mineral demand. This amount is thrice more than that of the fossil fuel sector.

Sources: IEA (2025); World Bank (2025)Lithium is the fundamental metal for batteries, used in electric vehicles and energy storage systems. Copper facilitates electrical conductivity, while nickel and cobalt are essential for the electric vehicle supply chain.

Despite discussions around sustainability, the energy revolution is exacerbating extraction rather than supplanting it. The clean-tech economy mostly remains a mining sector, however it is depicted as environmentally beneficial (World Bank, 2025).

“Growth headlines sparkle, but beneath every chart of soaring demand lies a quieter graph of depletion”

Financialization and ESG Investing

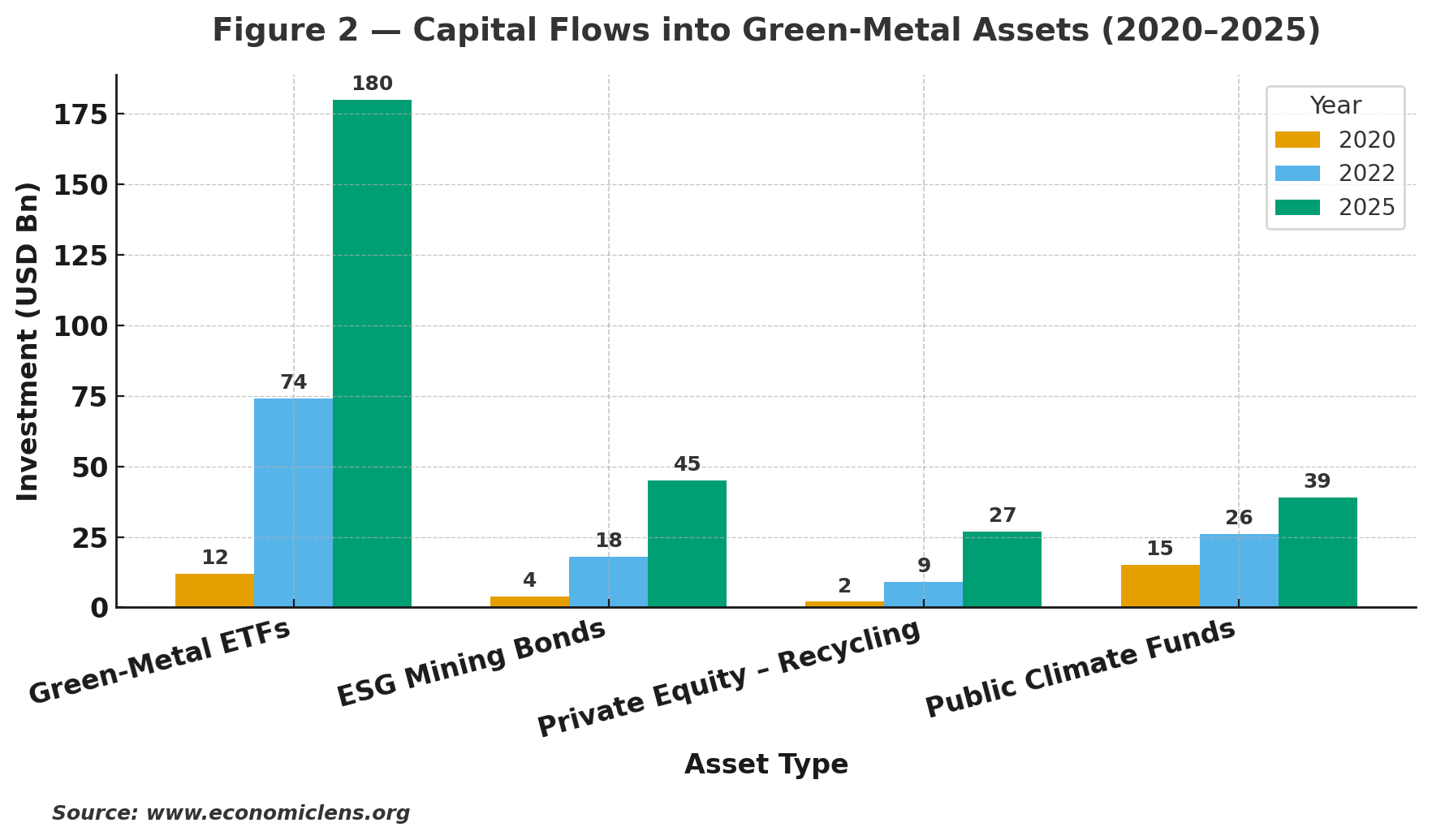

Investment in global capital has rapidly allocated funds to green-metal assets, which are expanding at a rate surpassing that of physical mining (Bloomberg New Energy Finance, 2025).

ESG funds and climate-related ETFs (i.e. Exchange-Trade Funds) have transformed essential minerals into financial assets, merging environmental sustainability with speculative behavior.

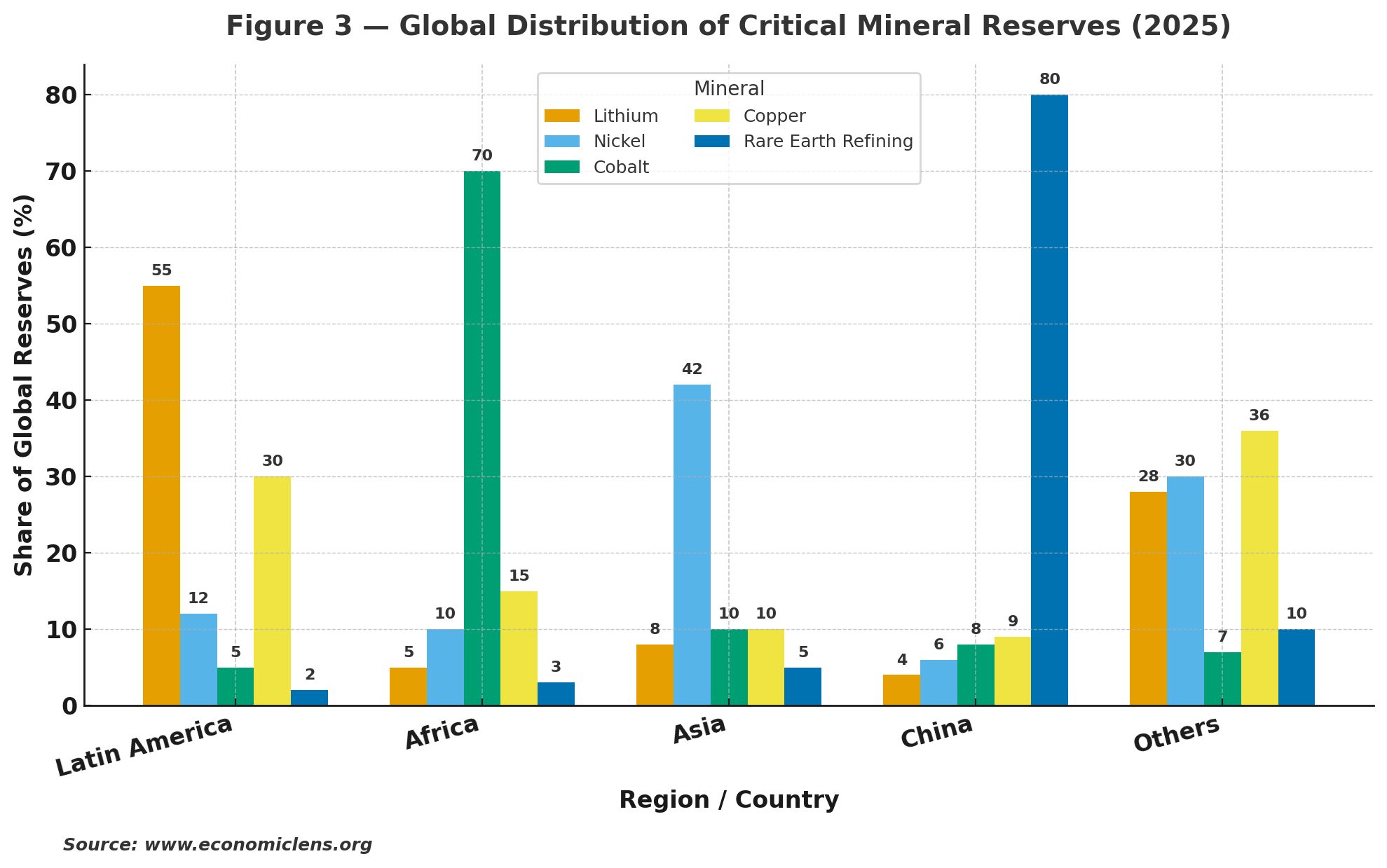

Currently, influence derives more from the ability to enhance resources and financial capital than from the possession of assets. China dominates mineral processing, over 80% in rare-earth refining, while the Global South supplies ores, and the West finances the ecosystem, recreating asymmetric dependencies (IMF, 2025).

“Capital once priced risk; now it prices righteousness—and the market rarely audits morality”

The Geography of Scarcity

A New Map of Resource Power

The distribution of critical minerals is much more concentrated than that of petroleum. Latin America is the premier source of lithium, Africa is the foremost supplier of cobalt, and Asia is the optimal region for nickel extraction. China processes around 80% of the global rare earth elements and battery materials, establishing itself as the pivotal component in the clean energy supply chain (UNCTAD, 2025).

This emphasis transforms commodities into a strategic power. Oil diplomacy defined the twentieth century, whereas ore diplomacy characterizes the twenty-first.

“Control the mine and you gain leverage; control the refinery and you rewrite the rules”

Resource Nationalism as Industrial Diplomacy

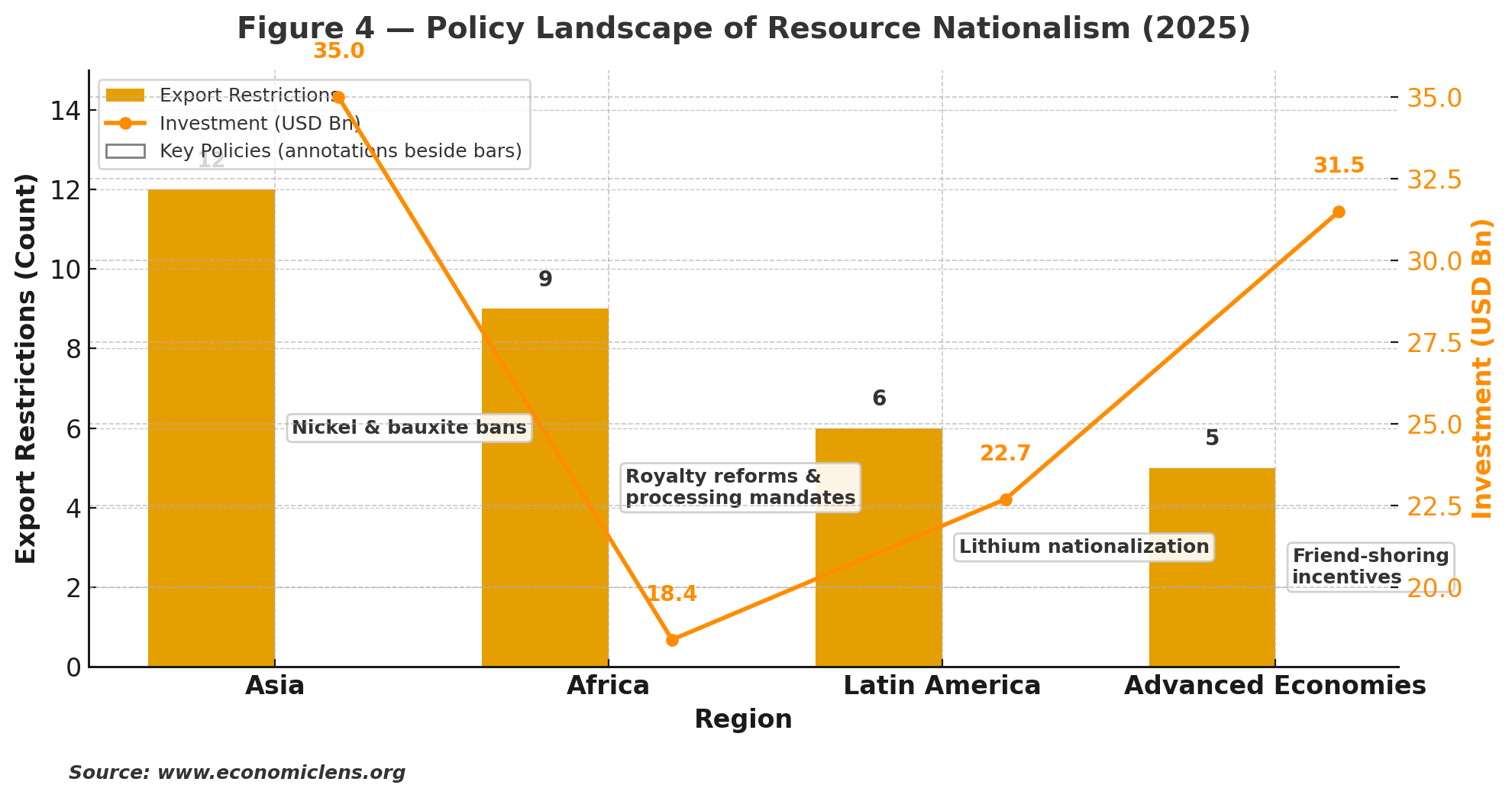

Resource nationalism has emerged as a means for enterprises to generate profit. Emerging nations have transitioned from simple exporters to actively formulating sustainable mining policies to enhance local value retention (OECD, 2025).

Indonesia’s nickel legislation attracted $35 billion in investments in the electric vehicle industry, whilst Chile’s lithium policy established a regional standard for sustainable business practices (World Bank, 2025). This indicates a transition from dependence on extraction to strategic autonomy, or from laissez-faire to regulated capitalism.

“For some nations, the green boom is not extraction—it is emancipation”

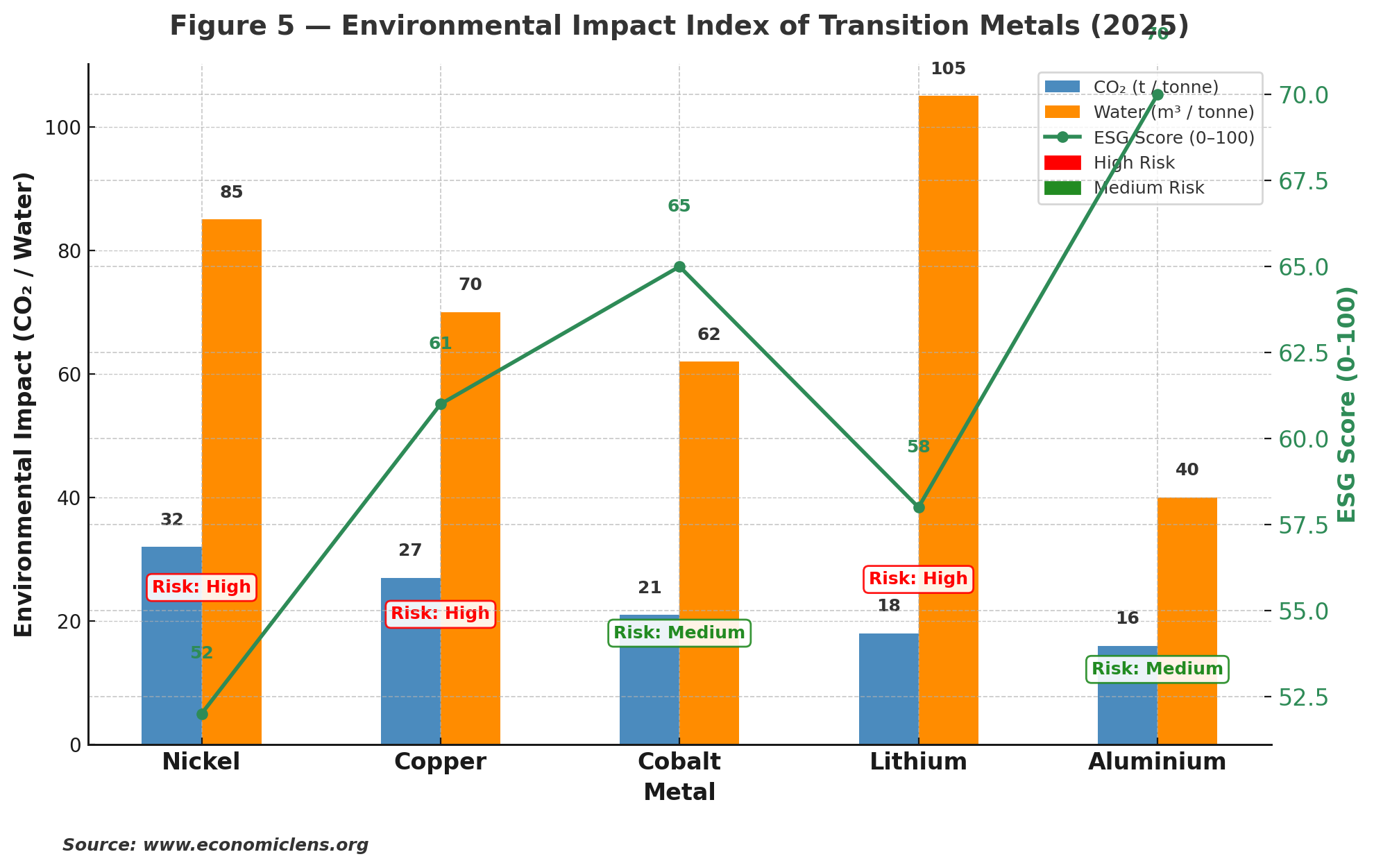

The Environmental Irony of Clean Mining

The green transition continues to exhibit a dark stain. Extracting battery metals from the earth continues to need significant amounts of carbon and water (United Nations Environment Programme, 2025).

The carbon costs associated with “green mining” might negate up to 8% of the emission reductions achieved by electric vehicles (UNEP, 2025). The extraction of lithium brine in Chile consumes 500,000 gallons of water per ton, jeopardizing indigenous populations and arid environments (World Bank, 2025).

“We are extracting our way to salvation—and exporting the guilt with every shipment”

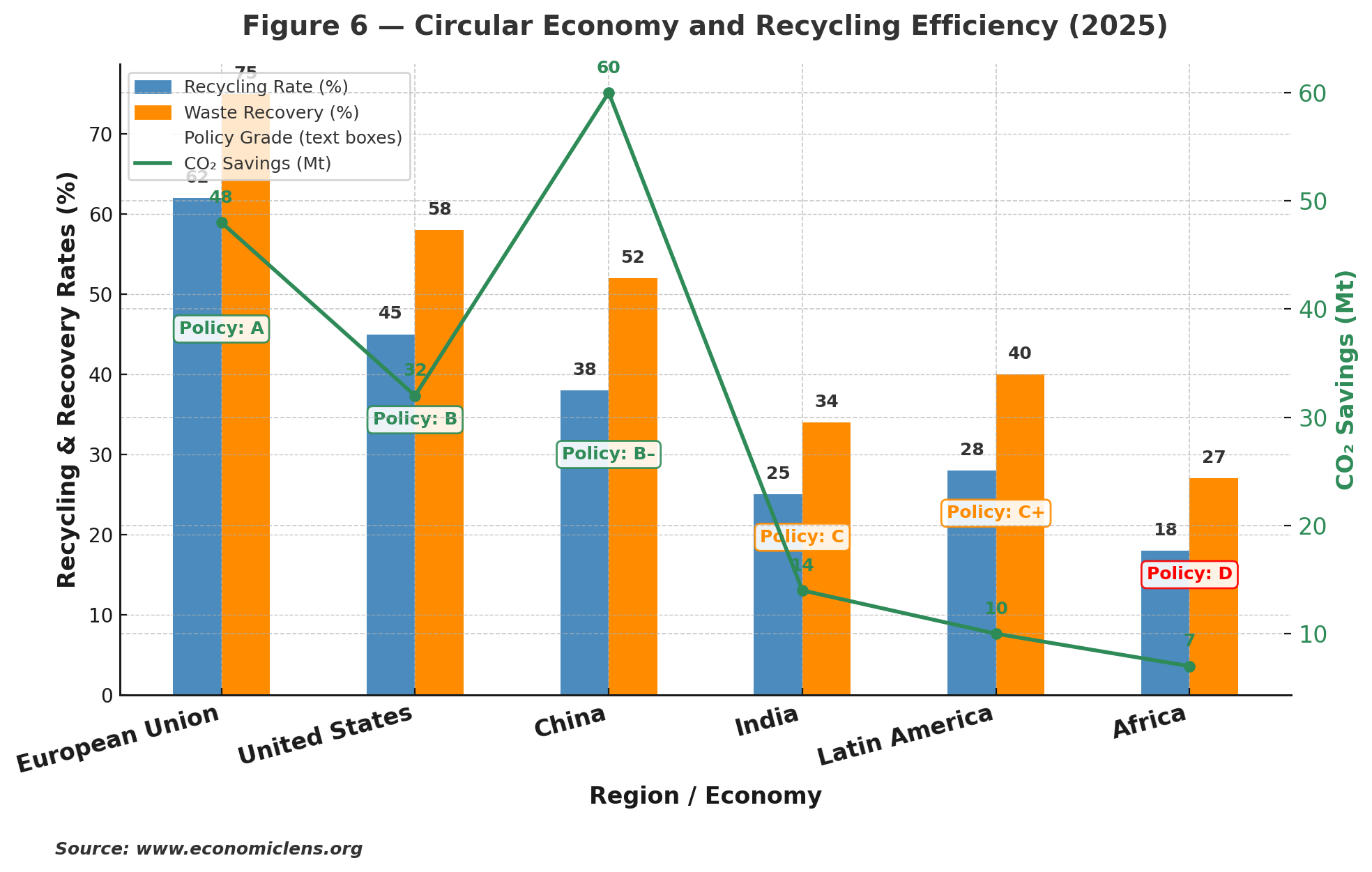

Circular Economy: Mining Our Waste

We have already dug the only sustainable mine. Urban mining, battery recycling, and metal recovery, the components of circular economy, assist us in achieving low-carbon material security (World Economic Forum, 2025).

Europe leads in circular innovation, while developing nations are trapped in primary extraction. In the absence of global circular parity, the sustainability gap will persist. If every nation recycled 60% of its metallic waste, global mining emissions may decrease by 320 million tons annually (OECD, 2025).

“We speak of mining the earth, but the next frontier is mining our waste”

Policy and Global Governance

To prevent a repeat of the fossil-fuel paradox, the green metals economy must embed sustainability, transparency, and equity at its core (UNCTAD, 2025).

Key Policy Directions

- Strategic Resource Diversification: Form regional processing hubs modeled after the Critical Minerals Partnership Framework (IEA, 2025).

- Green-Royalty Reinvestment: Allocate 20% of extraction revenues to local adaptation and education (World Bank, 2025).

- Digital-Traceability Legislation: Implement blockchain-based certification for mineral exports by 2030 (WEF, 2025).

- Circular-Economy Subsidies: Offer up to 30% tax credits for secondary metal recovery investments (OECD, 2025).

- Environmental Credit Floors: Tie every tonne of mined metal to verified emission offsets (UNEP, 2025).

- Global Minerals Council: Establish a permanent UNCTAD-based council for reporting, arbitration, and sustainability compliance.

These measures can align sustainable mining with climate goals, ensuring that clean energy supply chains don’t reproduce extractive injustice.

“True sustainability demands as much restraint as innovation”

Synthesis: From Boom to Balance

Across all evidence, one reality endures: the climate transition has replaced oil rigs with excavators but not yet escaped extraction.

- Demand fuels dependency.

- Concentration breeds fragility.

- Growth drives depletion.

If the fossil age overheated the planet, the metallic age risks exhausting it. A just transition requires regenerative economics—growth that restores ecosystems and distributes value equitably (IMF, 2025).

“The measure of progress ahead is not how much we mine, but how little we must”

Research Insights

The green-metals boom has ignited one of the most complex debates in modern economics—how to reconcile growth, sovereignty, and sustainability (BIS, 2025). The transition from fossil to mineral dependency exemplifies the new challenge of metallized globalization.

Key Research Priorities

- Resource Dependency Thresholds: IMF (2025) warns that when one nation controls over 60% of refining capacity, global supply risk and price volatility triple within 18 months. Research should define safe diversification limits to stabilize markets.

- Climate–Extraction Paradox: UNEP (2025) finds emissions from lithium, nickel, and cobalt mining could offset up to 8% of EV carbon savings at peak production. Studies must refine life-cycle assessments to ensure genuine decarbonization.:

- Green Finance Efficiency: BIS (2025) reports that only 27% of green-metal bonds fund measurable sustainability outcomes. Research must assess how to align financial incentives with verified environmental gains.

- Community Wealth Conversion: World Bank (2025) data show that in Africa’s cobalt corridor, only USD 0.22 per mining dollar benefits local economies. Fiscal models need redesign to ensure equitable and lasting community impact.

- AI and Supply-Chain Transparency: WEF (2025) projects blockchain-integrated tracking could reduce ESG fraud by 25%. Future studies should explore how AI-driven systems enhance traceability and ethical compliance.

“Research is not resistance—it is responsibility. In an age of green marketing, data remains the only genuine color of truth”

These insights emphasize that the green economy’s success depends less on new minerals than on measurable accountability

Conclusion — The Moral Economy of the Green Rush

The green metals boom is the paradox of progress: a method to rectify environmental issues that relies on exploitation. However, it also provides an opportunity to reconsider the implications of modern industry.

If governments do not see this urgency as just another scramble but as an opportunity to transform their ethical standards, the critical minerals revolution might herald the inception of a truly sustainable economy.

“Every age writes its fortune in the language of what it extracts. Ours will be judged by whether we learned to extract less—and sustain more”