Explore the economic cold war 2025, where supply chains and strategic resources are reshaping global power and trade dynamics

“In the 21st century, the weapons of war are no longer just tanks and missiles; they are supply chains, trade routes, and capital flows.”

Executive Summary: New Economic Cold War

In 2025, the global economy is shifting from traditional globalization to global economic conflict, where tools like supply chain resilience, sanctions, and resource control have emerged as vital sources of power. Countries are using these economic strategies to achieve dominance, leading to disruptions in trade and global supply chains. As regional trade blocs like the EU, USMCA, and RCEP consolidate, nations outside these coalitions face increasing challenges.

This blog examines the onset of a new economic Cold War, emphasizing the effects of sanctions, trade barriers, geopolitics, and supply chain vulnerabilities on international trade. It highlights the risks for businesses and people, while offering strategies for governments and companies to sustain competitiveness in this fragmented economic landscape.

“Economic power, like military might, is often about who controls the flow of resources, and in the modern world, it’s the supply chain that holds the greatest strategic weight.”

Setting the Scene: What is an Economic Cold War?

The early Cold War centered on ideology, divisions, and military engagements. The ongoing conflict is more intricate: it pertains to economic interdependence and the possibility of using such dependence as leverage. Globalization created supply chains that enable the transportation of goods across continents; yet, this interdependence also produces strategic vulnerabilities. When one country depends on another for vital resources, disruptions serve as a kind of leverage.

“The Cold War of the 20th century was about ideologies; the Cold War of the 21st century is about interdependence—and how to weaponize it.”

1. Supply Chains as Strategic Instruments of Economic Cold War

1.1 The Supply Chains Vulnerabilities

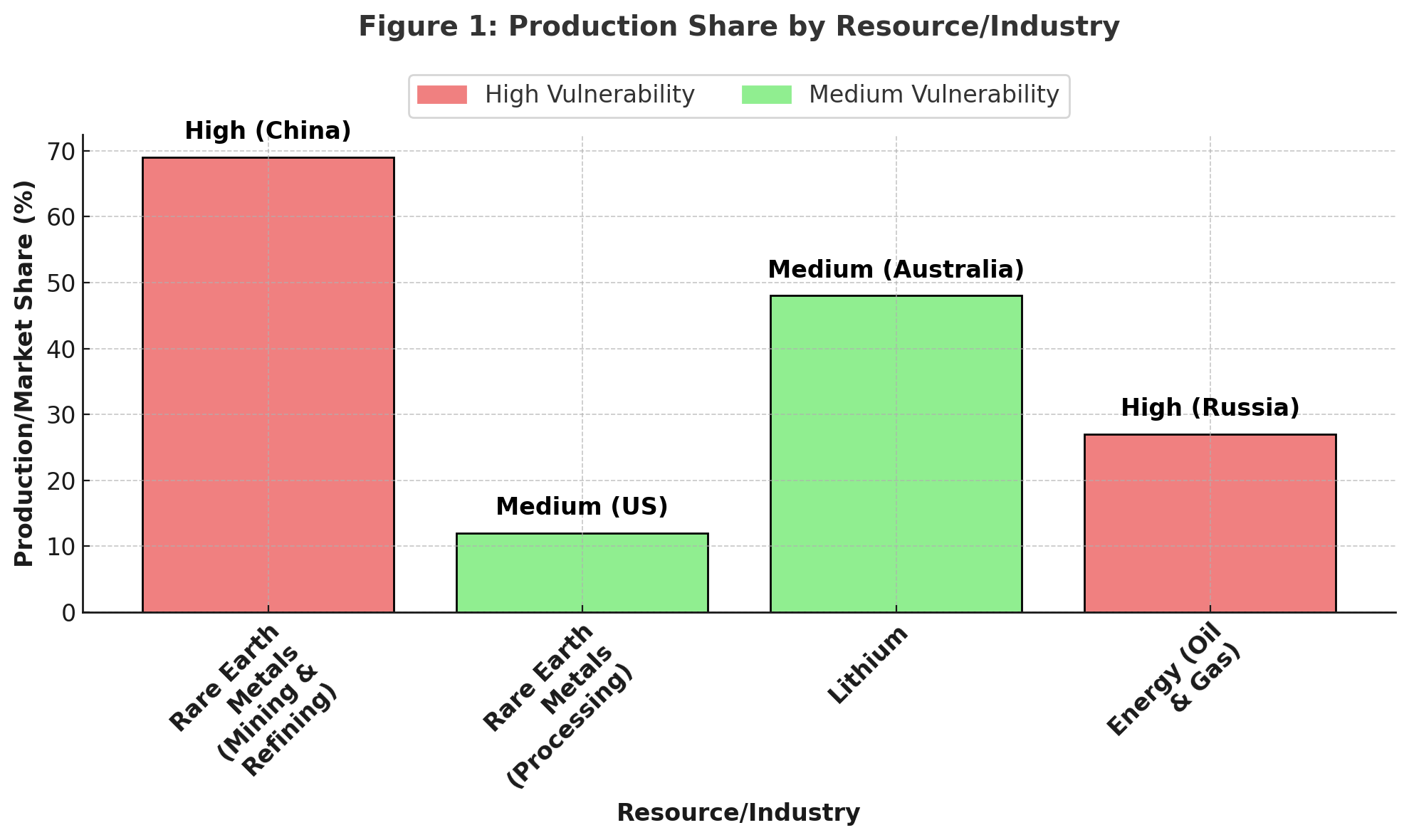

Critical areas, such as semiconductors, rare earth metals, and energy resources, have considerable concentration. A disruption in one node may have worldwide consequences. For example:

- China dominates the manufacturing of rare earth metals. China constitutes around two-thirds of global production (Mining Technology, 2025).

- The United States is striving to revive domestic rare earth production (Visual Capitalist, 2025).

This figure underscores the strategic advantage of countries that control substantial quantities of critical inputs, along with the leverage and risk linked to supply chain concentration. Countries that maintain substantial control over critical resources such as rare earth metals and energy may impact global markets, while others endeavor to rebuild their domestic supply chains to mitigate these vulnerabilities

1.2 Reconfiguring the Chains: Reshoring, Friend-shoring, Decoupling

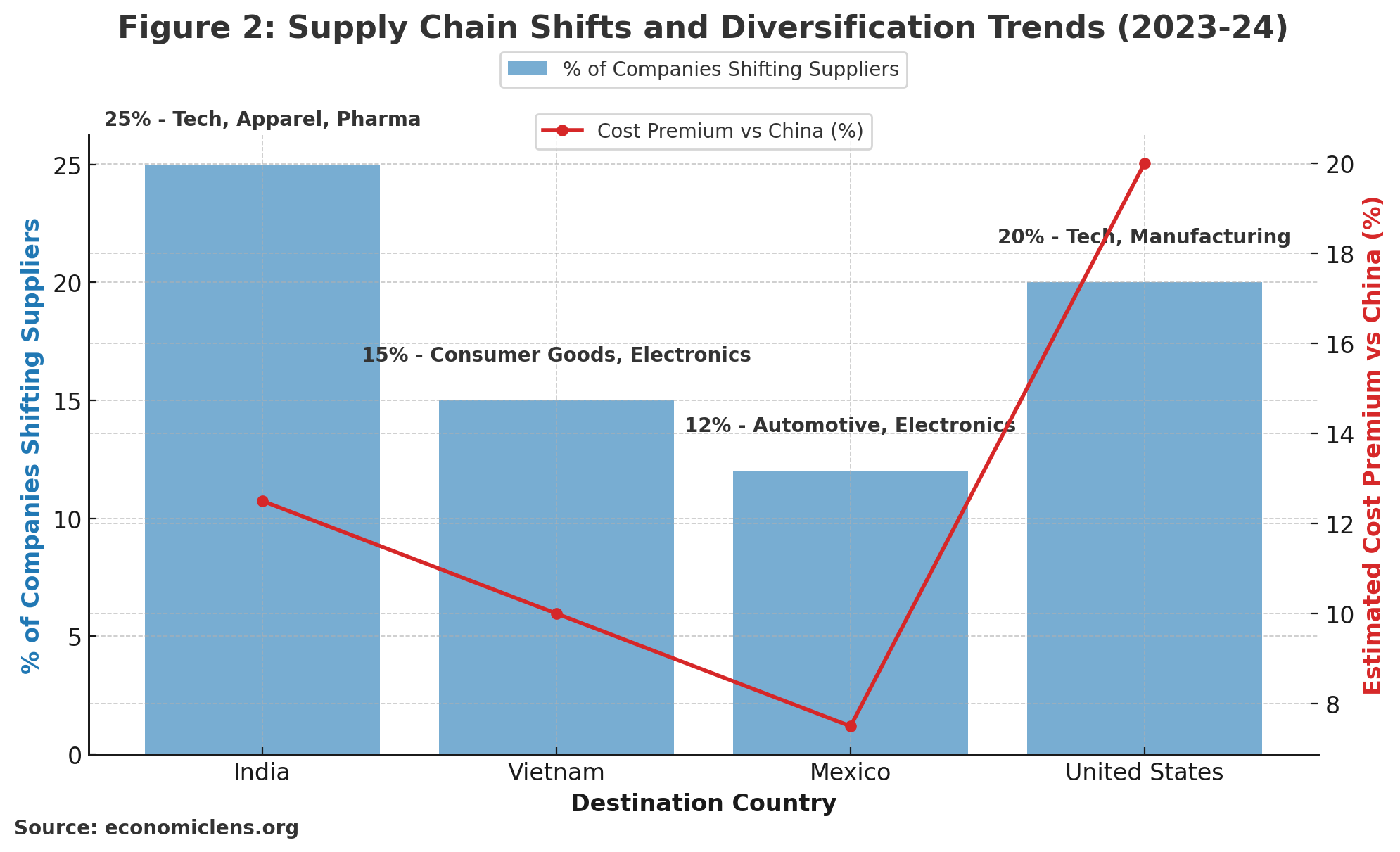

In response to rising risks, many firms and governments are rethinking dependencies: reshoring manufacturing, friend-shoring to trusted nations, diversifying away from single hubs. But these changes carry costs—higher wages, longer lead times, more complexity.

This shift towards reshoring and friend-shoring aims to reduce geopolitical risk imbalances and mitigate the vulnerabilities in global supply chains that have been exposed by the economic cold war.

This figure illustrates the shift of firms from high-risk supply chains, mostly centered on China, to more varied but costlier options. As the global landscape changes, companies are increasingly investing resources in regions like India and Mexico to reduce risk, notwithstanding the related costs. The shift towards variety highlights the growing importance of resilience above cost-efficiency in the modern interconnected environment.

“The future of global trade is not in openness, but in resilience. Countries must build more secure and diversified chains to weather future storms.”

2. Sanctions and Counter-Sanctions: Economic Weapons

2.1 Evolution of Sanctions

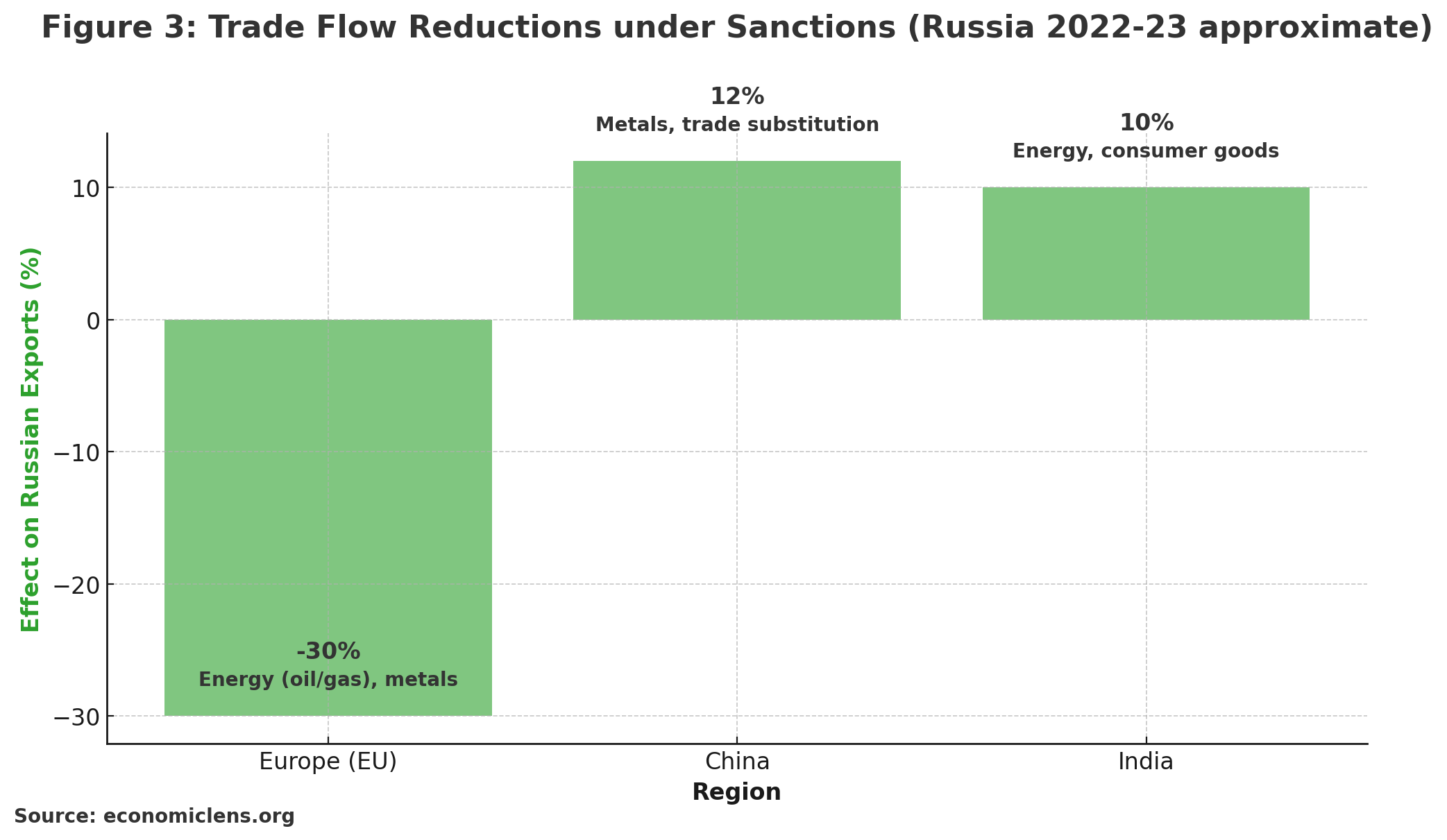

Sanctions have transformed from simple repercussions into strategic instruments. When major countries impose sanctions on others, they disrupt supply chains, trade dynamics, and economic alliances. Sanctions imposed on Russia after 2022 have extensive ramifications for the global oil, metallurgy, and logistics industries.

“Sanctions have become the modern-day equivalent of an economic sword, capable of cutting through the very fabric of national economies.”

2.2 Impact on Trade and Supply Chains

Sanctions hurt not just the target country—but also trading partners and global supply chains.

This table demonstrates the global ramifications of sanctions, impacting not just Russia but also its economic allies, such as China and India. Sanctions imposed on Russia led to a reduction in exports to Europe; nevertheless, countries like China and India swiftly engaged, diverting trade and mitigating shortages. It underscores how sanctions modify global trade patterns, with repercussions that reach far beyond the targeted nation.

“Economic sanctions can be the most effective tool a state can use to bring its adversary to the negotiating table, but they come at a price.”

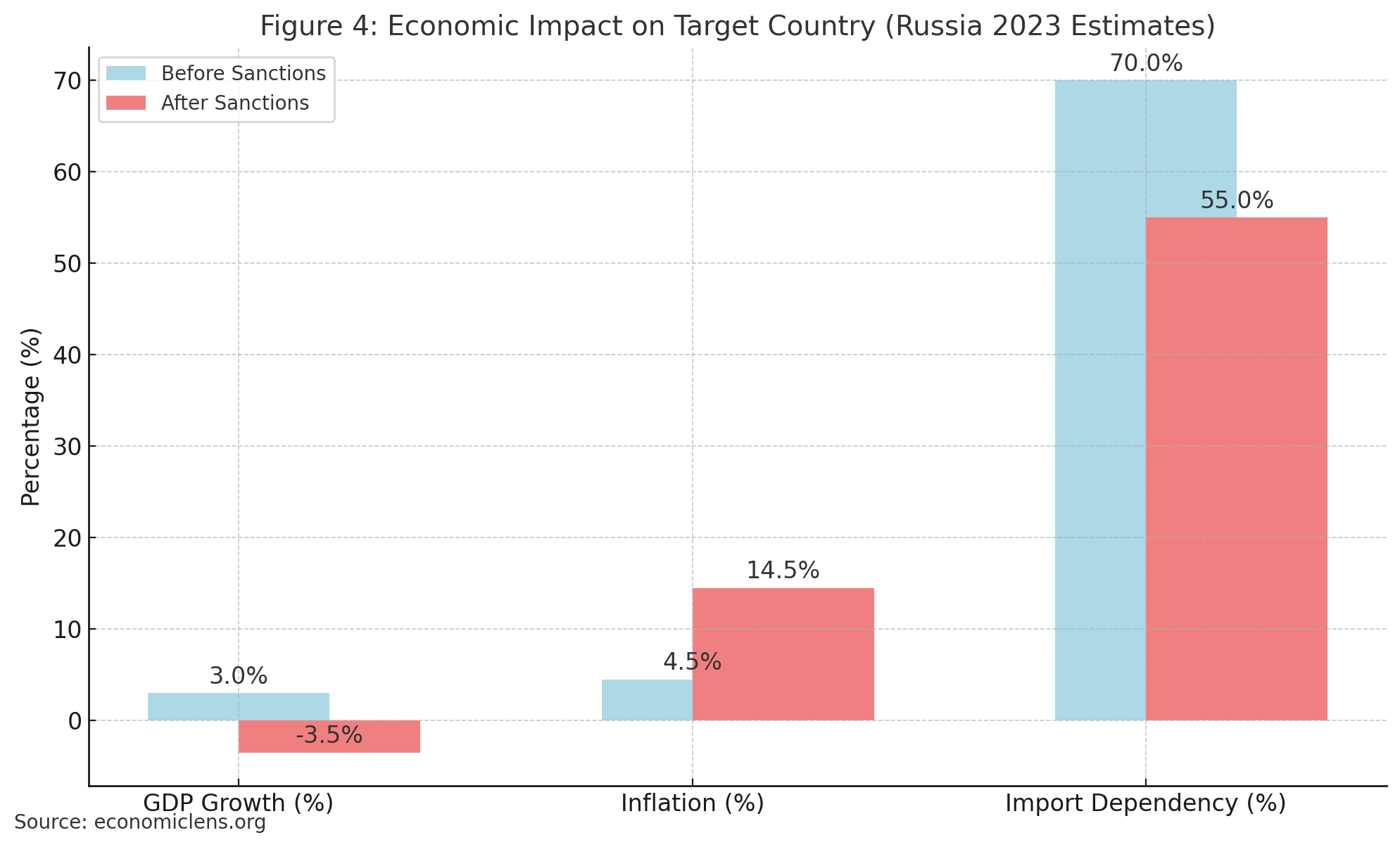

2.3 Case Study: Russia & Energy / Technology Sanctions

These figures demonstrate the disruption of daily life in the target country—reduced growth, heightened inflation, and restricted access to imports. It demonstrates the cascading effects of sanctions on economies, including both direct and indirect repercussions on the economy, population, and imports.

3. The Price of Power: Winners, Losers & Systemic Risks

3.1 Who Gains?

In the current economic cold war, nations with rare earth metals, energy resources, and critical technology yield significant power. These governments exert geopolitical power by controlling the delivery of vital commodities necessary for global companies.

“In the new world order, those who control the supply of critical resources don’t just hold economic power—they hold geopolitical leverage.”

3.2 Who Loses?

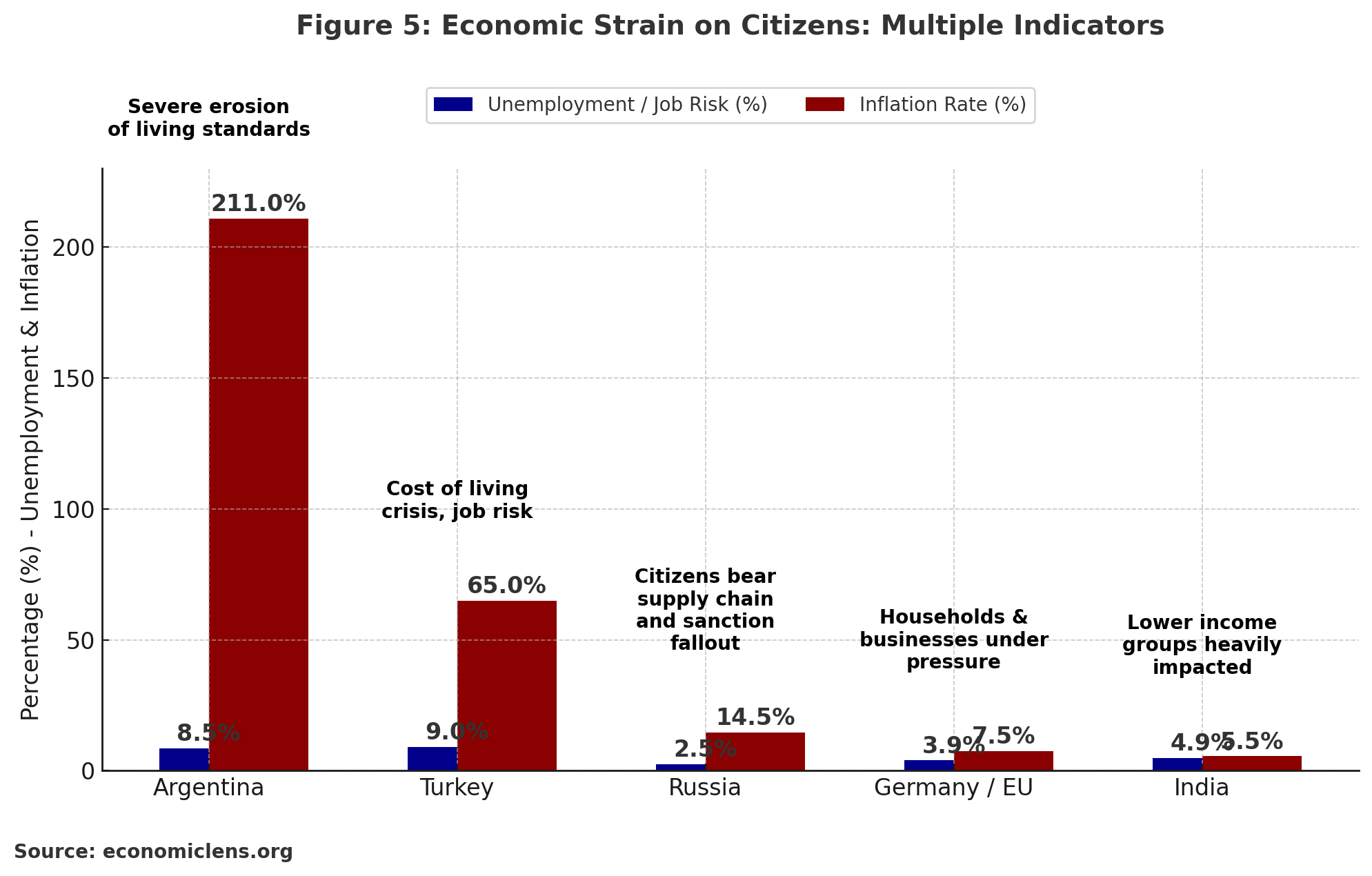

The weight of economic power is often borne by those who did not want it. Rising inflation, unemployment, and supply chain disruptions disproportionately affect lower-income demographics, as governments emphasize maintaining or obtaining power via economic warfare and sanctions.

“The cost of power is often borne by the people who never asked for it—citizens who face inflation, job losses, and the erosion of their savings.”

This detailed figure depicts employment risks, energy and food cost limitations, and the total economic pressure on citizens in many countries, transcending just inflation factors. This underscores your argument: in this economic Cold War, it is often the general people that suffer the repercussions.

4. Policy & Corporate Strategy: How to Navigate This Landscape

For States:

Governments should prioritize reshoring, reduce dependence on aggressive or unreliable trade partners, and diversify supply chains via friend-shoring strategies. They must also evaluate the implications of economic sanctions and trade barriers that might destabilize the global economic environment.

“Nations must prepare for the economic Cold War not just by building military defenses, but by fortifying their economies, creating self-reliant and secure supply chains”

Pragmatic Strategies:

- Diversify critical resources and reduce dependence on single trade partners by creating regional processing hubs and fostering cross-regional collaborations. Frameworks like the Critical Minerals Partnership (IEA, 2025) may illustrate cooperation on vital resources.

- Strengthen partnerships and trade links, particularly with trustworthy nations in Asia, Africa, and Latin America.

- Build resilience in essential sectors, such as rare earth minerals and energy, by fostering local production via incentives.

For Businesses:

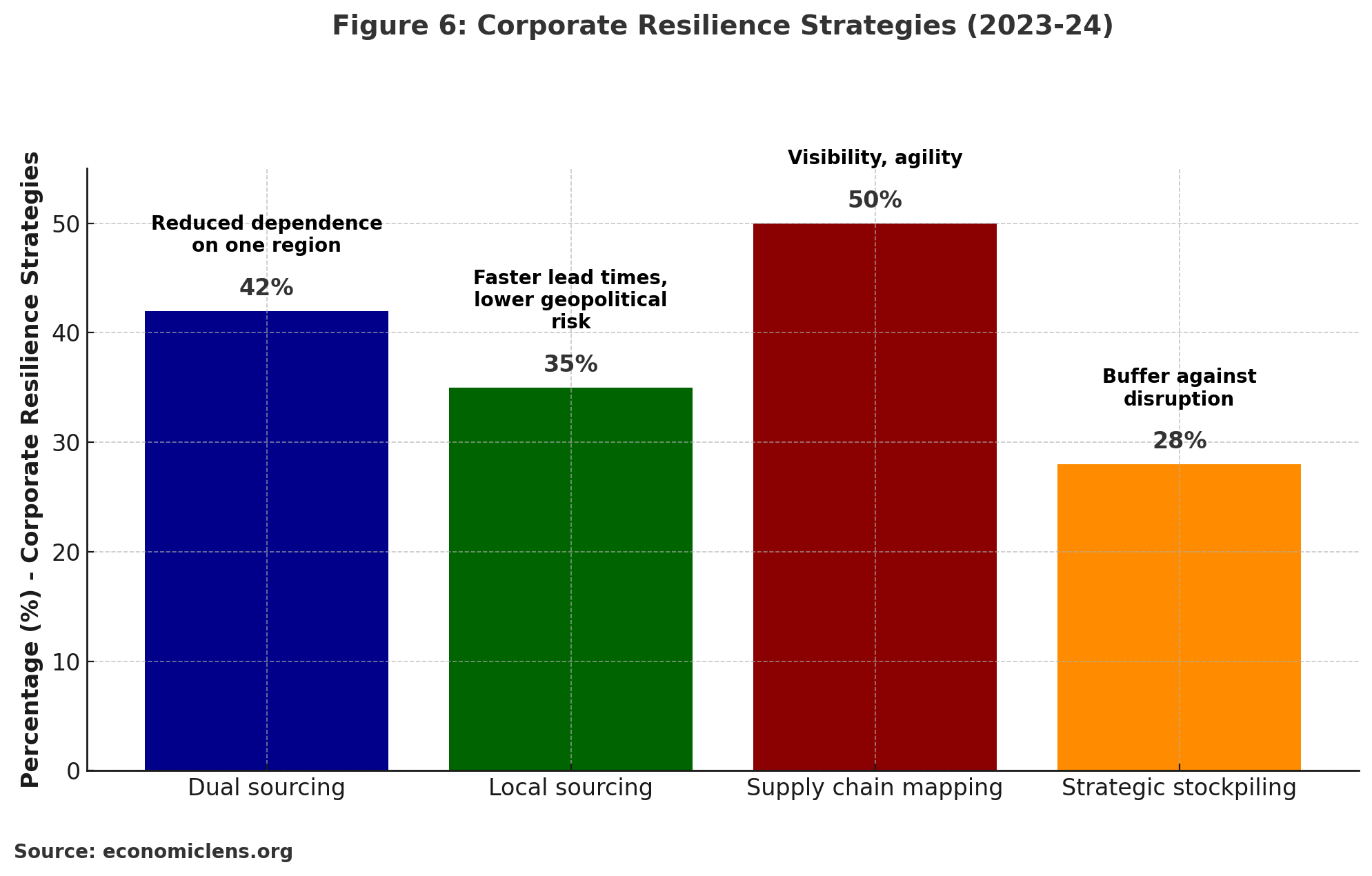

Business must develop more resilient supply chains to reduce risks. Adopting localized, varied, and sustainable supply chain models—such as reshoring and friend-shoring—ensures lasting stability amid turbulence caused by economic warfare and sanctions.

“In the age of uncertainty, businesses are not just competing for market share—they’re competing for resilience.”

Pragmatic Strategies:

- Establish risk management systems that continuously monitor geopolitical and supply chain threats in real-time.

- Shift to diversified supplier chains. Companies may replicate the supply chain strategies of India and Vietnam as they transition away from China-centric operations, although at a higher cost.

- Establish dual-source suppliers and cultivate local sourcing strategies, particularly from dependable locations like Mexico and Vietnam, to mitigate risk and enhance resilience.

This figure demonstrates how businesses are using strategies to bolster resilience against global disruptions. The shift to dual sourcing, local sourcing, and supply chain mapping highlights how firms are mitigating risk via supplier diversity, despite rising costs and complexity.

5. Looking Ahead: What’s Next?

The next Cold War will not just include conventional weaponry. The contest will be for supremacy over economic resources, rare earth metals, and essential industries. Trade blocs will be crucial as countries seek to safeguard themselves against the vulnerabilities inherent in a globalized supply chain.

Key Trends to Watch:

- Countries are enacting export prohibitions on advanced technologies and essential minerals, specifically focusing on critical areas such as semiconductors and quantum computing.

- The U.S. and EU are intensifying efforts to establish manufacturing hubs for semiconductors and renewable energy, with the objective of reducing dependence on foreign suppliers.

- Trade blocs and alliances: Regional coalitions, such the EU’s Green Deal and China’s Belt and Road Initiative, will be crucial for maintaining supply chain security.

- Increasing prices for citizens: Countries dependent on critical commodities may see elevated living expenditures if supply chains are restructured.

- Corporations that fail to adapt to this evolving climate may face disruption. Entities who succeed by adopting new technologies, diversifying supply chains, and improving resilience will reap significant advantages.

6. Conclusion + Call to Action

A new economic Cold War has begun. Nations and firms must adapt by diversifying supply chains, reshoring critical areas, and enhancing connections. Economic sanctions and geopolitical dynamics will continue to shape global trade, offering both risks and opportunities for those adept at navigating this evolving landscape.

For States:

Diversifying the economy and improving critical infrastructure is crucial. Governments must implement a proactive strategy to safeguard national interests by reducing dependence on a single trading partner and anticipating the risks associated with global supply chain disruptions.

For Businesses:

Resilience represents the modern competitive advantage. Map your supply chains, diversify sources, and anticipate potential disruptions. This beyond just survival; it involves carefully positioning oneself for sustained success in an unpredictable world.

For Citizens:

Stay aware of the international factors affecting your economic opportunities. The cost of living, job stability, and purchasing power are closely connected to changes in supply chains and sanctions. Understanding these effects allows for more effective management of your financial decisions.

“The cost of economic domination is not just measured in dollars—it’s measured in the stability of nations and the livelihoods of billions.”