The AI stock market bubble 2025 accelerates as big tech concentration, investor speculation and high valuations reshape global equity markets. This blog explains how AI hype, liquidity cycles, earnings distortion and macro uncertainty interact to create systemic risk across US, European and Asian markets.

INTRODUCTION

The AI stock market bubble 2025 reflects one of the most aggressive valuation expansions in modern financial history as a handful of AI mega-cap firms dominate global equity performance. Investor enthusiasm, rapid technological breakthroughs and unprecedented capital inflows push valuations far beyond earnings fundamentals. Consequently, financial markets become increasingly dependent on the performance of a small cluster of AI-driven companies, creating systemic concentration risk.

In the AI stock market bubble 2025 landscape, US equity indices rely heavily on the top ten AI firms for more than half of total market returns. Meanwhile, Europe and Asia experience parallel surges in semiconductor, cloud, robotics and AI-infrastructure stocks despite uneven earnings visibility. Additionally, ETFs and passive funds intensify concentration by allocating disproportionately toward the same AI leaders, reducing diversification across global markets.

This blog analyses the underlying forces driving the AI stock market bubble 2025 through valuation data, expert commentary and real-time market indicators. It examines market concentration, liquidity cycles, earnings expectations, systemic risk transmission and policy implications shaping global stability.

1. Megacap Domination and the Structure of the AI Stock Market Bubble 2025

The AI stock market bubble 2025 is defined by unprecedented concentration in a handful of US megacap technology firms that dominate global index performance. Market capitalization accelerates due to investor prioritization of AI infrastructure, cloud compute, advanced chips and foundation model platforms. Consequently, equity returns become increasingly skewed, diminishing diversification and amplifying systemic sensitivity to tech sector volatility.

For a broader view of how AI-driven structural shifts affect global employment and economic stability, see our analysis “Global Youth Unemployment 2025: AI Disruption, Skills Gaps & the Gen Z Jobs Crunch” (https://economiclens.org/global-youth-unemployment-2025-jobs-skills-outlook/).

Expert Insight & Global Report Signals

Goldman Sachs Equity Strategy highlights that the top ten AI firms contribute over 60 percent of S&P 500 gains. Meanwhile, JP Morgan Quantitative Research warns that concentration levels exceed those seen during the dot-com bubble. Additionally, BlackRock Investment Institute notes rising liquidity distortions as passive flows automatically allocate toward mega-cap AI firms regardless of fundamentals.

The IMF Global Financial Stability Report 2025 identifies AI megacap concentration as a primary risk to global financial stability. Meanwhile, the OECD Capital Markets Review notes that value divergence between AI leaders and the rest of the market has reached historic extremes. Furthermore, BIS Financial Fragmentation Metrics show rising correlation risk across global indices. The IMF Global Financial Stability Report 2025 (https://www.imf.org/en/Publications/GFSR) identifies AI megacap concentration as a major vulnerability in global markets.

Concentration metrics rise sharply as AI megacaps dominate global indices. Consequently, market stability becomes increasingly dependent on a narrow group of firms, heightening systemic exposure.

AI Mega-cap Market Strain

AI infrastructure leaders report record capital inflows as investors reposition portfolios toward compute and model-training assets. NVIDIA’s valuation surpasses historical semiconductor multiples, while Alphabet’s AI divisions attract scaled institutional interest. Additionally, firms tied to foundation model development experience rapid market capitalization growth despite limited profitability. Consequently, global markets rely heavily on AI sentiment, intensifying the AI stock market bubble 2025.

“When a market depends on a few names for most of its gains, resilience becomes an illusion built on concentration.”

2. Excess and Liquidity Cycles Driving the AI Tech Bubble 2025

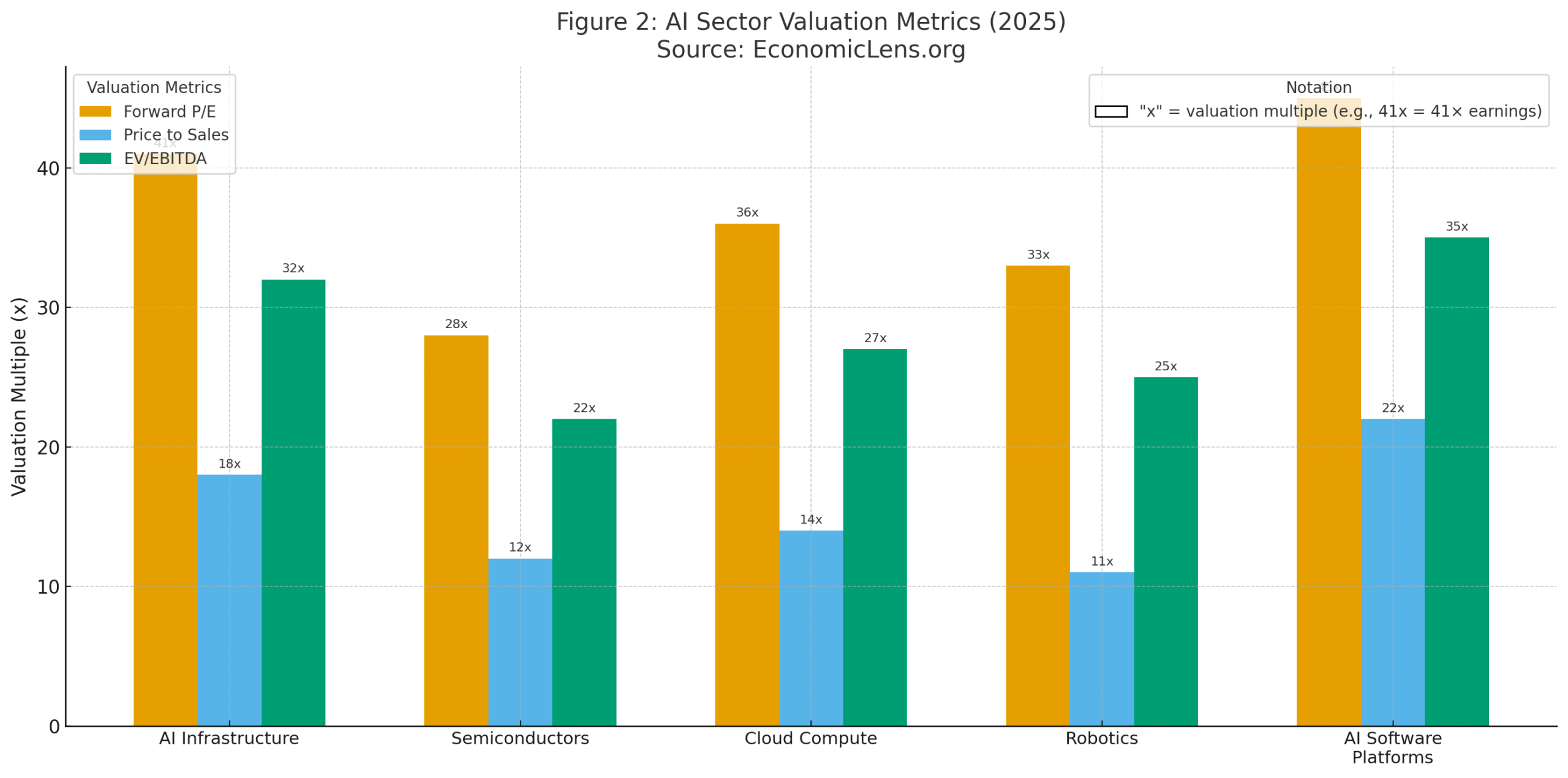

Valuation excess becomes more pronounced in the AI stock market bubble 2025 as price to earnings ratios across key AI sectors reach historic extremes. Investors increasingly rely on long term technological optimism rather than near term earnings visibility. Meanwhile, liquidity driven rallies push prices upward even as revenue expansion slows in segments of the industry. Consequently, markets face widening divergence between expectations and deliverable fundamentals. A connected assessment of global risk conditions is provided in “Global Economic Outlook 2025–2026: Slow Growth, Sticky Inflation & Rising Debt” (https://economiclens.org/global-economic-outlook-2025-2026-slow-growth-sticky-inflation-rising-debt/).

Expert Insight & Global Report Signals

Morgan Stanley Global Strategy identifies AI valuations more stretched than biotech peaks in 2000. Meanwhile, Citi Equities Research warns that AI revenues are often double-counted across multiple value chains, inflating growth projections. Additionally, UBS Macro Quant emphasizes that liquidity cycles correlate strongly with AI stock surges, amplifying volatility.

The OECD Valuation Assessment 2025 shows AI infrastructure firms trading at more than 40 times forward earnings. Meanwhile, S&P Global Earnings Tracker highlights that consensus forecasts for AI revenue may be overstated. Furthermore, the IMF Liquidity Monitor reports increased sensitivity of AI stock performance to global financial conditions. The OECD Capital Markets Review 2025 (https://www.oecd.org/finance/) highlights extreme valuation divergence between AI leaders and broader equity markets.

Valuation metrics indicate extreme multiples across AI segments, surpassing historical averages. Consequently, even minor earnings disappointments could trigger significant market repricing.

AI Valuation Bubble Stress

Global venture markets create dozens of AI unicorns in 2025 despite minimal revenue generation. According to Crunchbase, more than 35 firms surpass USD 1 bn valuations within months of founding. Meanwhile, early stage investors prioritize compute infrastructure access and model training capacity over monetization. Consequently, speculative valuation acceleration feeds into public markets, raising systemic concerns.

“A bubble forms when belief in future potential rises faster than evidence of present performance.”

3. Global AI Valuation Risk: Spillovers and Cross-Regional Market Exposure

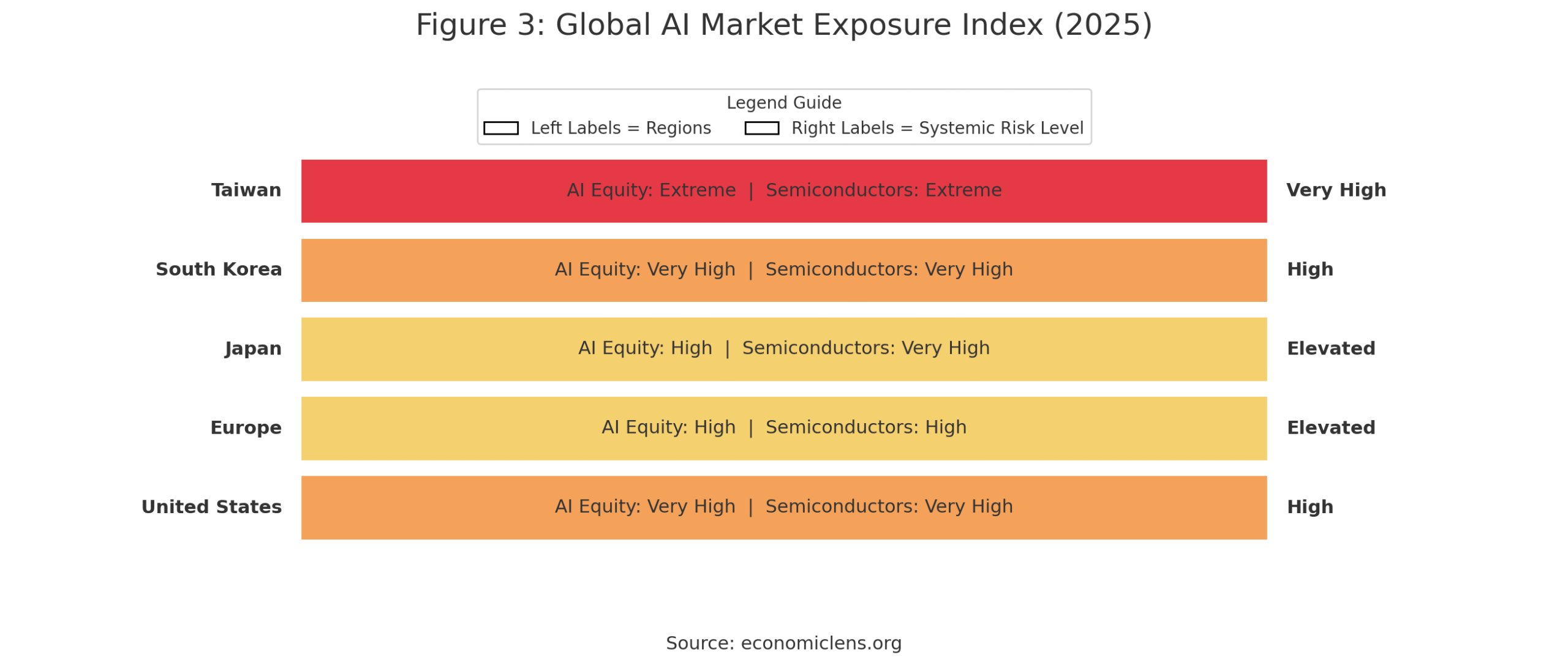

The AI stock market bubble 2025 transmits risk beyond the United States as Europe, Japan, South Korea and Taiwan experience parallel surges in AI related equities. Semiconductor supply chains, robotics clusters and computing manufacturers become tightly correlated with US megacap performance. Consequently, global markets become synchronized to AI sentiment cycles, increasing volatility.

Expert Insight & Global Report Signals

Nomura Asia Strategy notes that semiconductor markets are hypersensitive to US AI flows. Meanwhile, European Central Bank economists warn that AI valuation distortions spill into EU tech indices. Additionally, Taiwan Institute of Economic Research highlights increasing dependency on AI server demand.

The UNCTAD Technology Market Report 2025 confirms rising AI exposure across Asia. Meanwhile, BoJ Financial Review notes increased leverage in Japan’s tech sector. Furthermore, OECD Cross-Regional Risk Assessment identifies rising correlation risk between AI and non-AI markets.

Global exposure indicators reveal a synchronized market structure driven by AI sentiment. Consequently, volatility in US AI equities rapidly transmits across global indices.

Taiwan Semiconductor Exposure Spike

Taiwan experiences rapid valuation expansion in semiconductor firms supplying AI compute infrastructure. According to the Taiwan Stock Exchange, tech sector valuations rise by 23 percent in 2025 despite cyclical risks. Meanwhile, export dependence on AI servers deepens vulnerability to global demand shifts. Consequently, Taiwan becomes a central node in the AI stock market bubble 2025.

“Spillovers spread quickly when global markets depend on the same narrative for growth.”

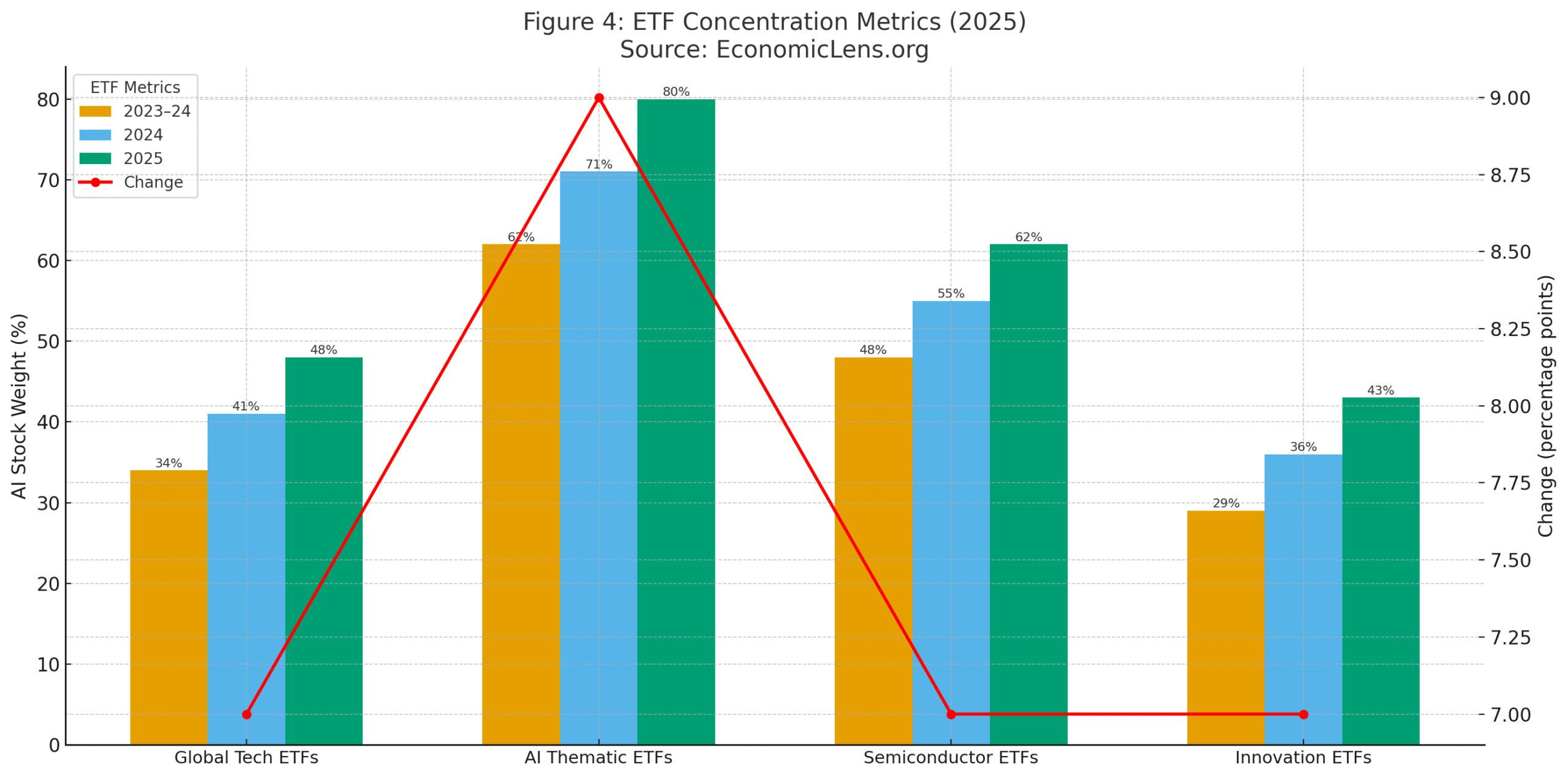

4. How ETF Concentration Amplifies the AI Stock Market Bubble 2025

ETF concentration accelerates systemic vulnerability within the AI stock market bubble 2025 as passive vehicles allocate heavily to megacap tech firms. Consequently, market flows become increasingly procyclical, amplifying price swings during both rallies and corrections. Additionally, algorithmic trading systems intensify feedback loops by reacting instantly to valuation signals tied to AI companies.

Expert Insight & Global Report Signals

Vanguard ETF Strategy warns that passive vehicles magnify concentration risk. Meanwhile, State Street Global Advisors note that AI equities dominate thematic ETFs to an unprecedented degree. Additionally, BIS Market Microstructure Research highlights that liquidity fragmentation increases due to disproportionate flows toward megacaps.

The IMF Market Microstructure Update 2025 indicates that AI heavy ETFs drive more than 18 percent of global equity flows. Meanwhile, the OECD Passive Investment Review stresses that diversification benefits weaken as AI firms dominate index weights.

ETF concentration rises sharply, making passive vehicles a key transmission channel for volatility. Consequently, small corrections in AI equities can trigger outsized market reactions.

AI ETF Concentration Pressure

Retail investors pour billions into AI ETFs as social media narratives amplify hype around foundation models, robotics and compute infrastructure. According to Bloomberg, AI themed retail inflows exceed USD 68 bn in 2025. Meanwhile, concentration risk grows as most ETFs allocate disproportionately to the same five megacap AI firms. Consequently, retail exposure magnifies systemic fragility.

“When passive flows move in the same direction, markets lose the balance that protects them from shocks.”

5. Forward Risks and Policy Lessons for Managing the AI Tech Bubble 2025

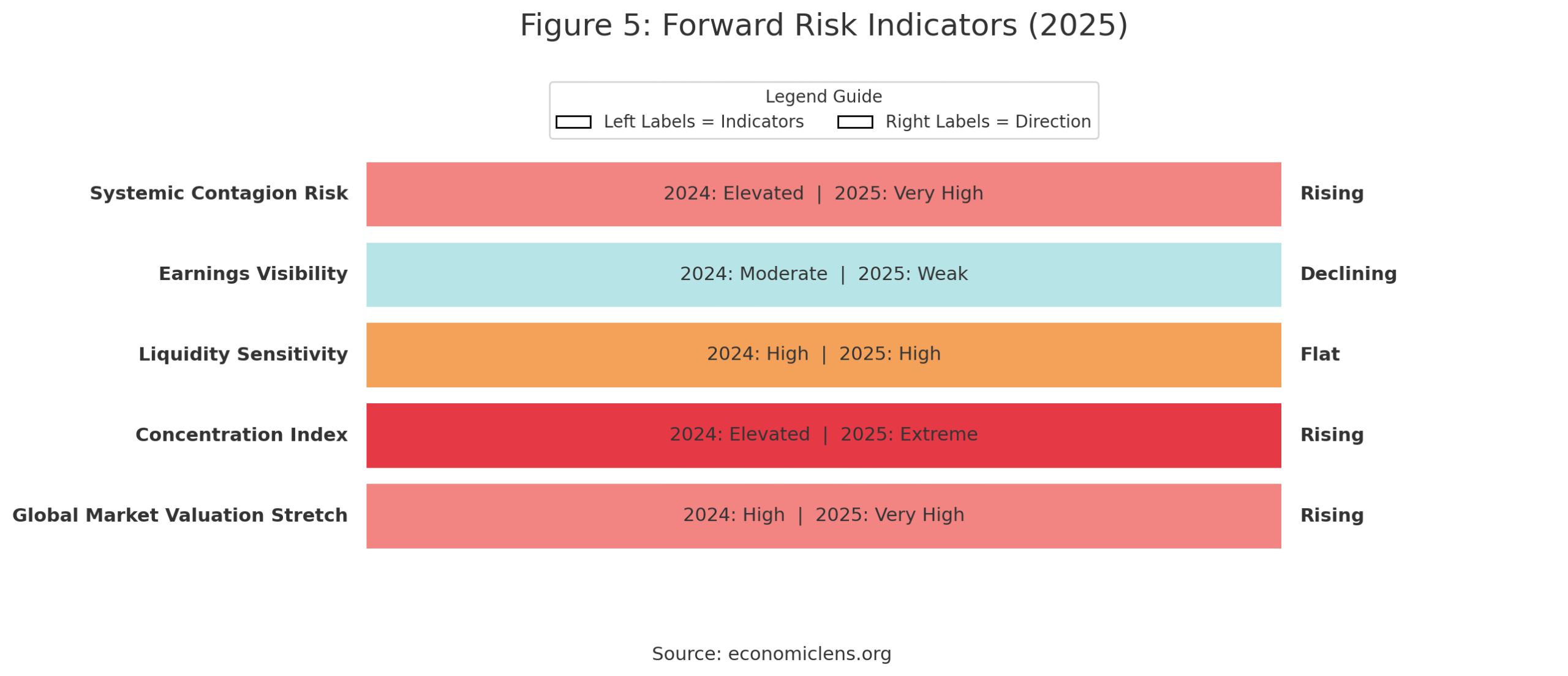

The forward trajectory of the AI stock market bubble 2025 reveals significant systemic risks as valuation excess, market concentration and liquidity distortions converge. Policymakers confront the challenge of managing financial stability without stifling innovation. Meanwhile, investors navigate an environment dominated by narrative driven capital flows and rapid technological change.

Expert Insight & Global Report Signals

Federal Reserve Financial Stability Analysts caution that AI equity concentration increases vulnerability to macro shocks. Meanwhile, European Systemic Risk Board warns that high valuations elevate risk of abrupt corrections. Additionally, OECD Technology Policy Unit emphasizes the need for transparency around AI business models.

The IMF 2025 Systemic Risk Map assigns high alert status to AI driven markets. Meanwhile, World Bank Capital Flow Diagnostics detect rising sensitivity of global liquidity to tech valuations. Furthermore, UNCTAD Technology Governance Review highlights gaps in regulatory frameworks.

Forward looking indicators suggest rising systemic fragility due to high valuations, weak earnings visibility and escalating concentration. Consequently, financial stability risks intensify.

US AI Market Oversight

US regulators intensify monitoring of AI driven equity concentration amid concerns that valuations deviate from fundamentals. According to the SEC, stress testing frameworks may incorporate AI sector specific risk assessments. Meanwhile, policymakers debate disclosure standards for AI model costs and profitability. Consequently, regulatory scrutiny becomes a defining feature of the AI stock market bubble 2025.

“The future of markets depends on whether innovation drives value or speculation drives volatility.”

Conclusion

The AI stock market bubble 2025 highlights a historic divergence between technological optimism and underlying financial fundamentals. As AI megacaps dominate global indices, market behavior becomes increasingly dependent on the performance of a narrow cluster of firms. Meanwhile, valuations climb to levels difficult to justify through earnings projections alone. Additionally, global spillovers, ETF concentration and liquidity driven rallies magnify systemic vulnerability. The combination of high valuations, weak diversification and strong investment narratives creates conditions reminiscent of previous financial bubbles. Although AI technology promises transformative long term benefits, the pace of market repricing exceeds realistic adoption and monetization trajectories. Consequently, policymakers must strengthen monitoring frameworks, while investors must adopt more disciplined approaches to risk assessment. Over the medium term, market normalization may occur as earnings visibility stabilizes, yet short term volatility remains elevated.

Call to Action

Investors, regulators and institutions must address concentration risk, valuation excess and systemic fragility embedded within AI driven markets. Strategic risk management, transparency and disciplined investment will be essential for stability during the next phase of AI transformation.

2 thoughts on “AI Stock Market Bubble 2025: Big Tech Concentration & Global Market Risk”

Great

Great job Sir 👏👏