The fragmented global economy is no longer an emerging trend. It has become the operating system of the contemporary world economy. Cross-border trade, finance, and supply chains continue to function,

A Gateway to Understanding the Global Economy with Clarity, Depth, and Real Insights

The fragmented global economy is no longer an emerging trend. It has become the operating system of the contemporary world economy. Cross-border trade, finance, and supply chains continue to function,

Climate finance has become one of the most decisive tools in addressing global food insecurity. As climate change intensifies droughts, floods, and heat stress, food systems face growing instability. Therefore,

The global debt crisis has intensified as public and private borrowing exceeds $315 trillion. This analysis explores sovereign risk, market credibility, climate vulnerability, and how transparency, AI oversight, and sustainable

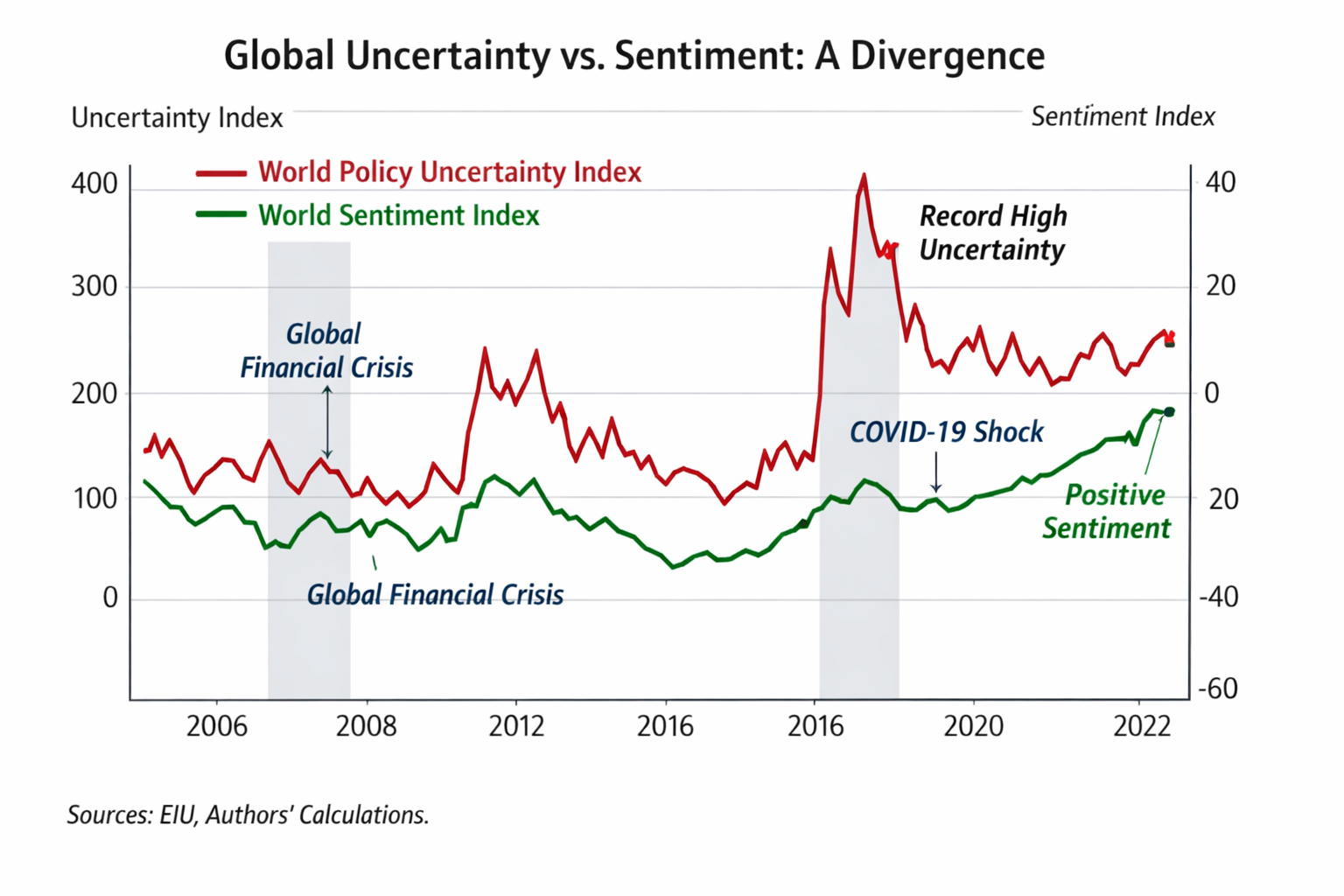

Global policy uncertainty and economic sentiment show a widening gap since 2008. Policy risk surges during global shocks, yet economic sentiment recovers faster. This chart-based visual story explains the causes,

The Sri Lanka debt crisis shows how fiscal weakness, foreign exchange shortages, creditor complexity, and delayed restructuring led to default. This data-driven analysis explains causes, IMF-led stabilization, social costs, and

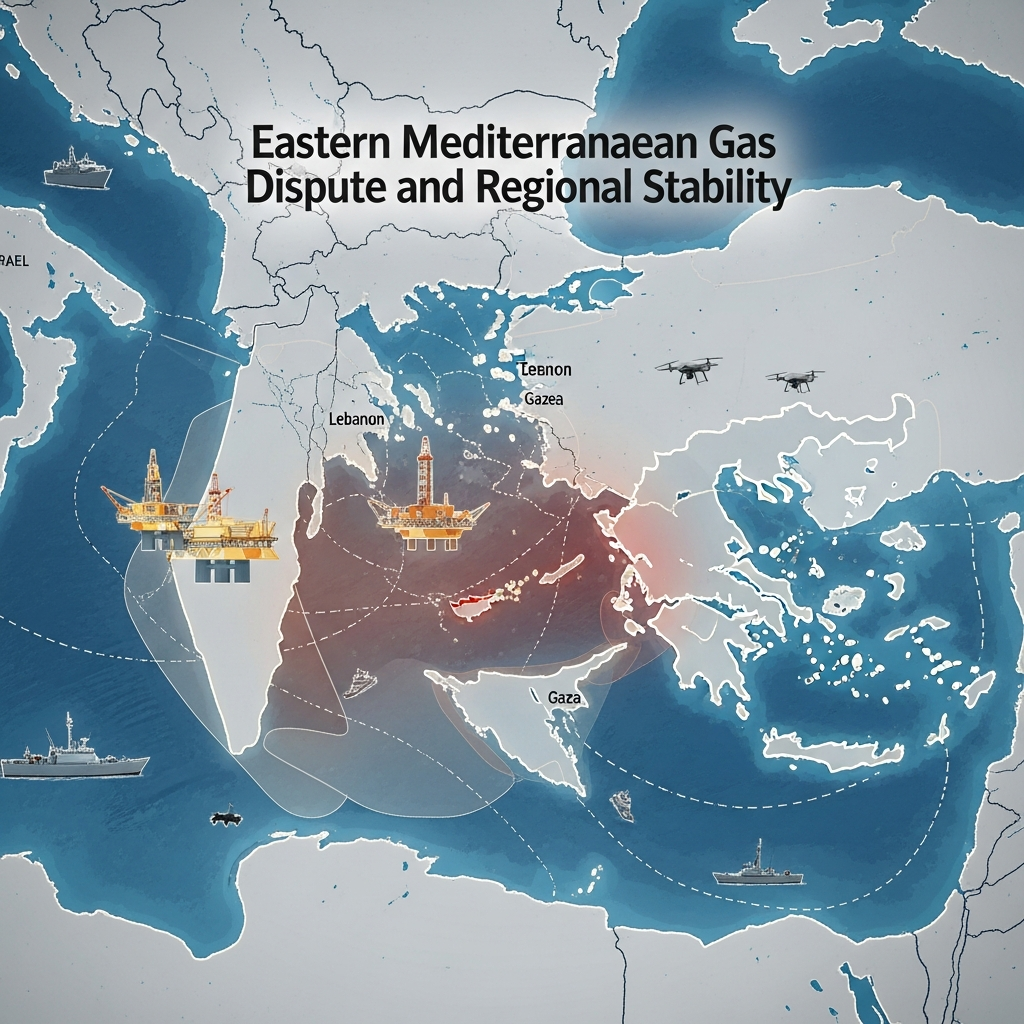

The Eastern Mediterranean gas dispute is intensifying as overlapping EEZ claims, offshore drilling, and naval deployments collide. From Israel Lebanon maritime tensions to Turkey Cyprus disputes and Gaza’s frozen gas

Indo-Pacific blue economy, blue economy geopolitics, Indo-Pacific maritime economy, maritime trade routes, Indian Ocean economics, South China Sea trade risks, blue finance Asia, fisheries economics, undersea cables, ocean governance ASEAN

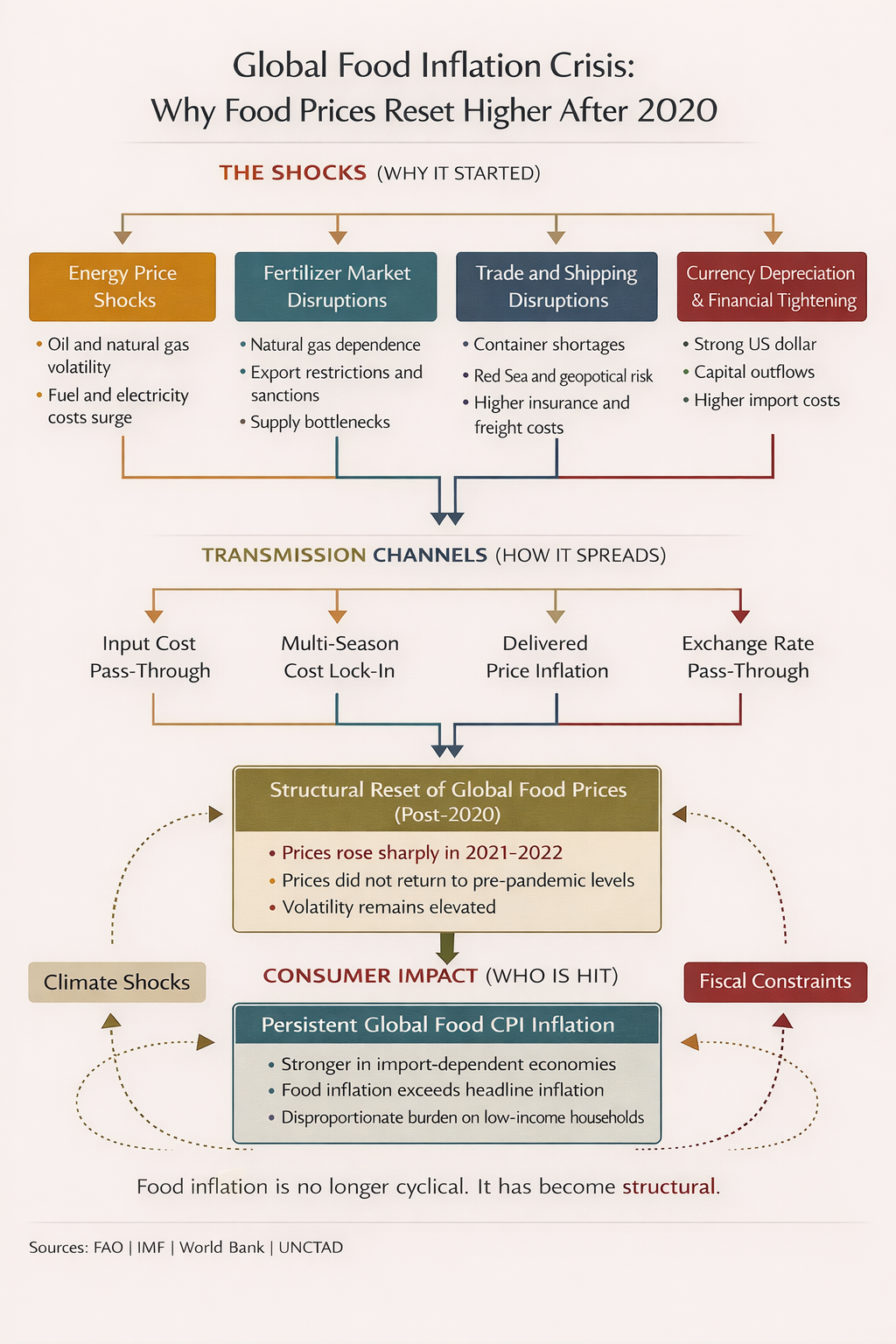

The global food inflation crisis reflects a structural reset in food prices after 2020. Energy shocks, fertilizer disruptions, trade costs, currency depreciation, and climate stress pushed prices sharply higher in

Energy subsidy reform is critical for fiscal stability and efficient energy markets. This policy note examines fiscal costs, reform pathways, and global signals shaping energy pricing reform in emerging economies,

Higher for longer interest rates 2025 deepen global sovereign debt stress as refinancing costs rise. Fiscal buffers continue to shrink, while repayment burdens expand across regions. This blog analyzes the