This analysis explains how weaker global demand, shipping disruption, trade policy uncertainty, and supply chain stress slowed exports. Specifically, it examines macroeconomic pressure, employment risks, balance of payments stress, and lessons for export-dependent emerging economies.

Introduction

The Bangladesh export crisis highlights how fragile export-led growth becomes when global trade slows across demand, logistics, and policy channels at the same time. In recent years, as inflation reduced consumer spending in advanced economies, Bangladesh’s export engine weakened sharply. In particular, the dominance of the garments sector meant falling orders, delayed contracts, and tighter margins across export industries.

As the crisis deepened, foreign exchange inflows declined steadily. As a result, reserve buffers fell as inflows weakened. Consequently, balance of payments pressure intensified. Over time, what initially appeared as a cyclical demand slowdown evolved into broader macroeconomic stress. In turn, export weakness spilled into growth, employment, and fiscal management.

Alongside these pressures, the export shock unfolded amid global food inflation, shipping disruption, and rising trade policy uncertainty. Taken together, these global forces reshaped the trade environment and amplified risks for export-dependent economies.

Why the Bangladesh Export Shock Matters for Emerging Economies

The Bangladesh export crisis matters because it reflects a structural risk shared by many emerging economies that rely heavily on exports. Historically, export-led growth delivers strong results during global expansions. However, during downturns, it exposes economies to sharp reversals when demand weakens simultaneously across major markets.

In Bangladesh’s case, heavy dependence on garment demand from Europe and North America increased vulnerability. As inflation squeezed consumers, discretionary spending declined. In response, retailers reduced apparel orders. Subsequently, inventory accumulation followed. As a consequence, export momentum slowed across multiple quarters.

Meanwhile, food and commodity price shocks weakened global purchasing power. At the same time, these pressures reduced import demand in key markets. These dynamics are discussed further in Global Food Security Crisis: Climate Shocks, Export Bans, and Supply Chain Breakdown

https://economiclens.org/global-food-security-crisis-climate-shocks-export-bans-supply-chain-breakdown/

Data-Driven Snapshot of the Bangladesh Export Slowdown

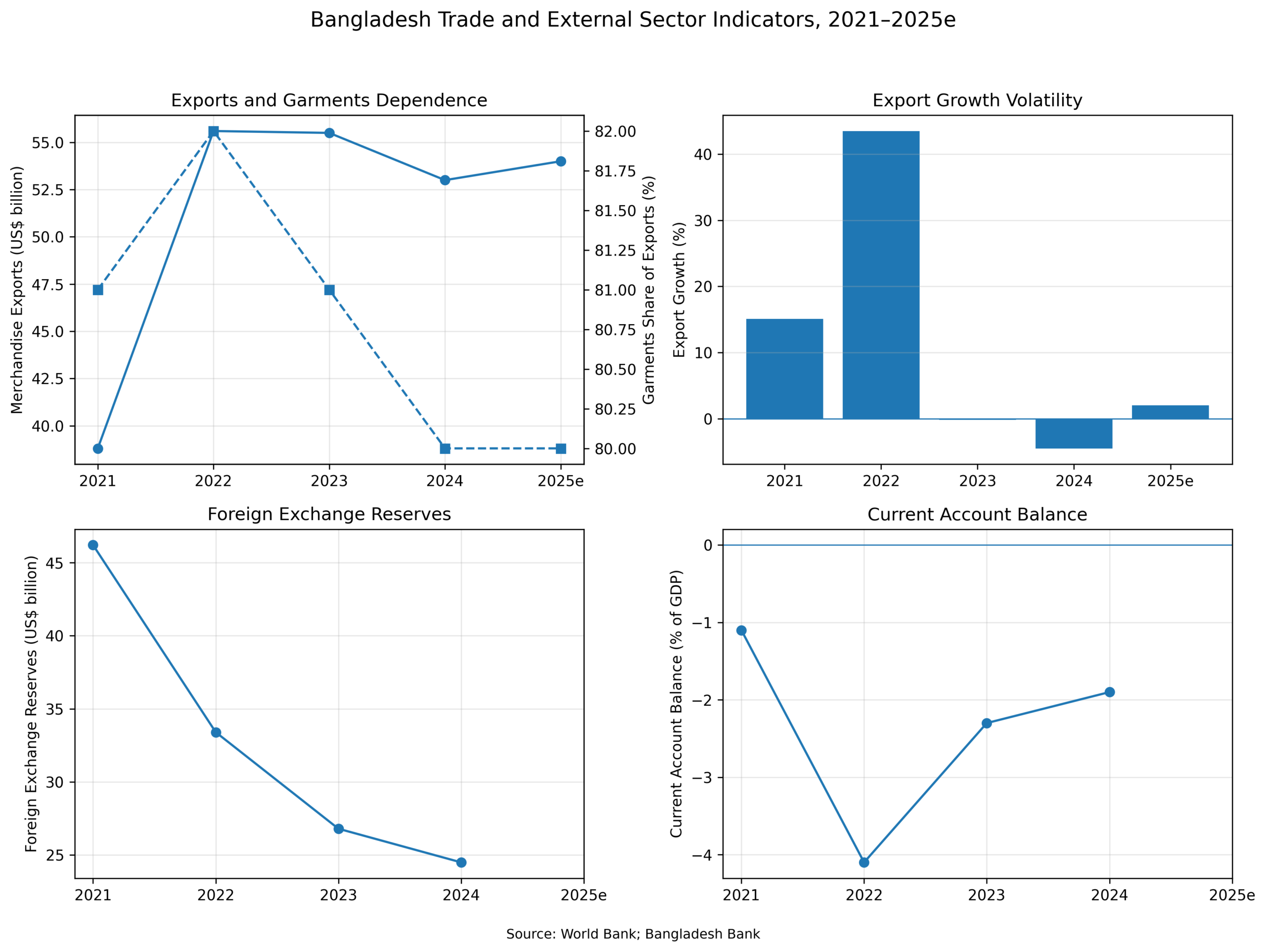

The data below illustrate how the Bangladesh export shock translated into slower growth, declining reserves, and rising external vulnerability.

Source’s Links: https://www.worldbank.org, https://www.bb.org.bd

According to the figures, export growth stalled after 2022. Over time, reserve buffers weakened steadily. At the same time, external vulnerability increased as exposure grew. Taken together, this pattern confirms that the Bangladesh export shock reflects a structural adjustment rather than a short-lived fluctuation.

Global Trade Slowdown Impact on Bangladesh

The global trade slowdown affected Bangladesh first through weakening demand in advanced economies. Initially, high inflation reduced household purchasing power. As a result, spending on apparel declined. Consequently, retailers delayed new sourcing decisions.

Across major export markets, order volumes fell. At the same time, pricing power weakened in response. As firms adjusted, production cycles shortened. Under these conditions, exporters faced rising uncertainty. Ultimately, these demand-side pressures reduced foreign exchange inflows and weakened growth momentum.

Beyond trade, broader macroeconomic tightening also contributed to demand stress. In particular, monetary policy remained restrictive. Meanwhile, credit conditions tightened. These developments align with global inflation risks discussed in Debt–Inflation Crisis: Global Stability at Risk (https://economiclens.org/debt-inflation-crisis-global-stability-at-risk/)

Red Sea Shipping Crisis and Bangladesh Export Delays

Supply chain disruption further amplified the Bangladesh export shock through the logistics channel. For example, shipping routes became unstable. As a consequence, freight costs increased. In addition, delivery schedules grew increasingly unpredictable.

Disruption from the Red Sea shipping crisis affected established trade corridors. For garment exports, timing remains critical. When delays occurred, penalties followed, orders were cancelled, and buyers diversified away from Bangladesh.

Further analysis appears in Red Sea Shipping Crisis: Global Trade Fallout, Inflation Pressure, and Supply Chain Turmoil (https://economiclens.org/red-sea-shipping-crisis-global-trade-fallout-inflation-pressure-and-supply-chain-turmoil/).

As a result, higher logistics costs reduced competitiveness relative to exporters with shorter supply chains and faster turnaround times.

Trade Policy Uncertainty and Protectionist Risk

In parallel, trade policy uncertainty shaped the export slowdown. Specifically, industrial policy shifts in advanced economies increased friction. Moreover, safeguard measures and compliance standards became stricter.

Even when Bangladesh retained preferential access, uncertainty reduced buyer confidence. As a result, firms avoided long-term commitments. Consequently, contract durations shortened and export planning grew more volatile.

The global trade policy environment is discussed in US Tariff Shock 2025: Global Trade Fallout, Inflation, and Supply Chain Risks (https://economiclens.org/us-tariff-shock-2025-global-trade-fallout-inflation-and-supply-chain-risks/).

For export-dependent economies, indirect protectionism can be just as damaging as direct tariffs.

Bangladesh Balance of Payments Stress

Balance of payments stress intensified as export receipts weakened. At the same time, foreign exchange inflows declined further. Meanwhile, energy and food imports remained expensive.

As reserves fell, authorities introduced import controls and payment restrictions. In the short term, these measures stabilized reserves. However, industrial inputs became constrained and production slowed.

Therefore, export weakness translated directly into macroeconomic stress. Ultimately, external adjustment became unavoidable.

Employment Impact of the Bangladesh Garment Export Crisis

The garment export crisis carries deep social consequences. In particular, millions of workers depend on the sector. Notably, a large share are women. As exports slowed, factory utilization declined. Subsequently, shorter workweeks followed widespread order cancellations. As a result, wage pressure increased across the sector. In some cases, factories closed. Consequently, household earnings fell across industrial regions.

At the same time, food inflation raised living costs. Together, these pressures created a dual burden through income loss and higher prices.

Export Concentration Risk in Bangladesh

Export concentration further magnified the shock. Currently, garments dominate export earnings. In addition, market destinations remain narrow and product diversification limited.

When a single sector weakens, the entire economy absorbs the impact. As a result, adjustment options remain constrained and value upgrading progresses slowly.

Thus, concentration increases sensitivity to global trade cycles and limits shock absorption capacity.

Political Economy Constraints on Export Reform

Export slowdowns generate political pressure. For instance, workers demand income protection while firms seek fiscal support. At the same time, governments face difficult trade-offs between competitiveness and social stability.

Because of these pressures, reform momentum slows. Consequently, investment in logistics, energy reliability, and skills development weakens. Instead, short-term relief replaces long-term strategy.

Therefore, export resilience requires sustained institutional commitment rather than crisis-driven responses.

Lessons from the Bangladesh Export Shock for Emerging Economies

Overall, the Bangladesh export shock shows that export-led growth remains highly sensitive to global demand cycles. Moreover, logistics resilience now matters as much as low production costs. At the same time, shipping disruption and trade policy uncertainty carry real macroeconomic weight.

It also shows that export concentration magnifies vulnerability when global trade slows across multiple channels.

Counterargument Acknowledgment

Some argue Bangladesh’s low-cost advantage will always protect exports. However, recent shocks show that demand weakness and logistics disruption can overwhelm cost advantages.

Expanded Policy Implication Box

Policy implication: Export-dependent economies must treat trade strategy, logistics resilience, and diversification as a single system. In practice, heavy reliance on one sector magnifies global shocks. Furthermore, climate stress, shipping disruption, and protectionism are no longer temporary risks. Therefore, sustainable export growth requires diversification, faster logistics, energy reliability, and worker protection.

Conclusion and Outlook

The Bangladesh export shock reflects structural vulnerability rather than a temporary trade slowdown. In essence, export concentration, logistics fragility, and exposure to global demand cycles reinforce each other.

Without diversification and supply chain resilience, export volatility will persist. By contrast, with credible reform, market expansion, and logistics investment, Bangladesh can stabilize exports and rebuild growth momentum even in a slower global trade environment.