BRICS expansion is accelerating global de-dollarization as new members diversify reserves, restructure settlement systems, and reduce dependence on the U.S. dollar. This blog explores how expanded BRICS membership transforms trade, energy flows, digital payments, and monetary governance—shifting the world toward a multipolar financial system.

Introduction

The accelerating pace of BRICS expansion is reshaping global finance. What began as a coalition of five emerging economies has now transformed into a wider alliance of energy exporters, logistics hubs and large demographic markets. As the bloc expands, BRICS de-dollarization efforts are also intensifying. Therefore, a long-term shift in monetary power is becoming more visible through reserve diversification, yuan-settled oil trades and local-currency agreements. Moreover, the rise of a multipolar financial system reflects structural changes in growth centers, digital payment systems and geopolitical alignments. Because of this, understanding the quantitative landscape of BRICS expansion is essential for investors, policymakers and global institutions.

This blog provides a comprehensive analysis backed by data, expert insights, structured trio sections, and quantitative evidence to map the global financial transition underway.

1. BRICS Expansion & Global Power Dynamics

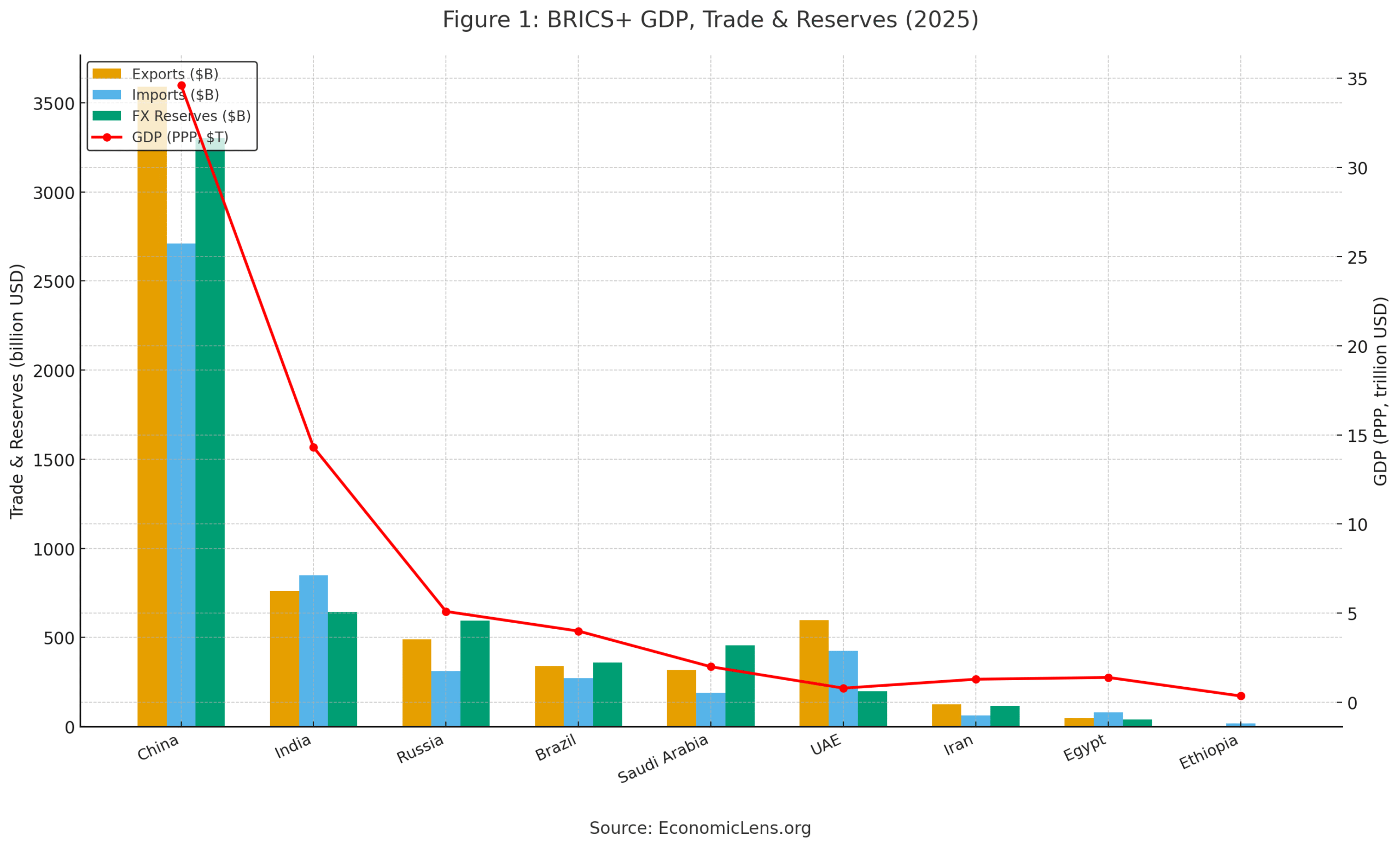

The latest BRICS expansion marks a major shift in global economic power. Countries from the Middle East, Africa and North Africa now increase the bloc’s share of global output, reserves and population. As a result, BRICS holds more leverage than many Western alliances. These new members also add energy capacity, trade-route control and demographic scale. Therefore, the expansion strengthens the bloc’s geopolitical influence.

Geopolitical analyst Dr. Parag Khanna notes that BRICS expansion reflects a structural redistribution of economic power toward emerging regions. The IMF Global Power Shifts 2025 highlights that expanded BRICS economies now account for 36 percent of world GDP in purchasing power parity terms and nearly 45 percent of global population. This broader redistribution of financial power connects directly with the dynamics outlined in our analysis AI Capital Frenzy: The 2025 Global Power Shift (https://economiclens.org/ai-capital-frenzy-the-2025-global-power-shift/), which examines how investment flows and geopolitical transitions reinforce global power changes.

BRICS+ GDP, Trade and Reserves 2025Quantitatively, the expanded BRICS bloc is a diversified economic giant that brings together fuel exporters, manufacturing hubs, logistics nodes and large consumer markets. This aggregation forms the structural base upon which global de-dollarization efforts are being built.

“When economic mass converges with strategy, global finance shifts.”

2. BRICS De-Dollarization Trends Accelerating Across the Expanded Bloc

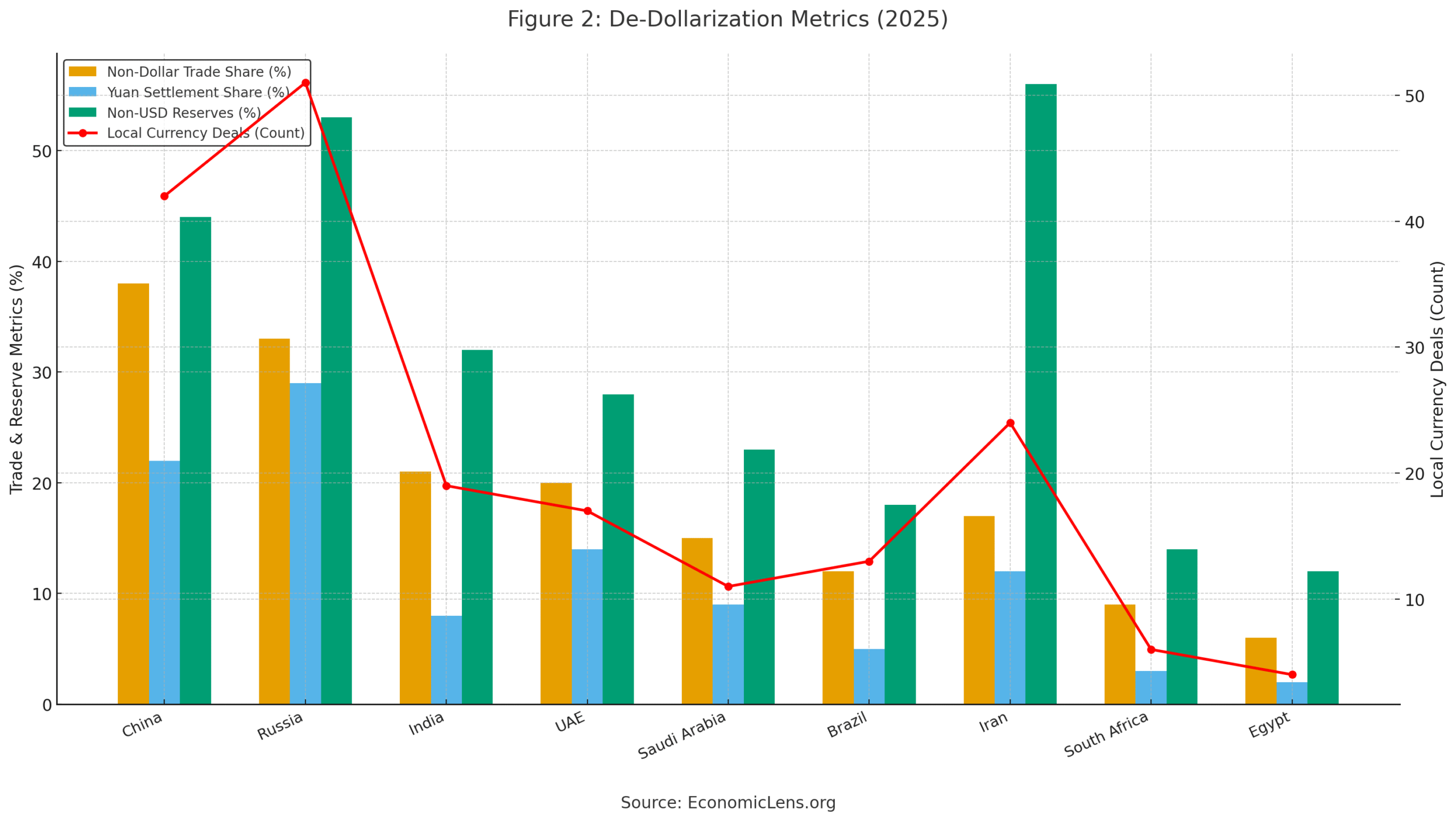

BRICS expansion is also accelerating de-dollarization. It now includes reserve shifts, local-currency trade and new digital settlement systems. In many cases, members face dollar-linked vulnerabilities such as sanctions risk, interest rate exposure and transaction dependency. For this reason, they are adopting alternative financial pathways at a faster pace.

Economist Justin Lin remarks that de-dollarization is driven by economic vulnerability and strategic necessity. UNCTAD estimates that non-dollar intra-BRICS trade has more than doubled over the past decade. The UNCTAD Global Trade Update 2025 (https://unctad.org/publication/global-trade-update-2025) supports this trend and highlights that currency diversification is accelerating across emerging economies as reliance on the dollar becomes more expensive and less strategically reliable.

China and Russia dominate de-dollarization due to established payment alternatives and geopolitical drivers. Gulf states are transitioning gradually, while African and Latin American members show early but rising diversification.

“Currencies follow incentives; and incentives are changing fast.”

3. Currency Systems & the Shift Toward a Multipolar Financial Architecture

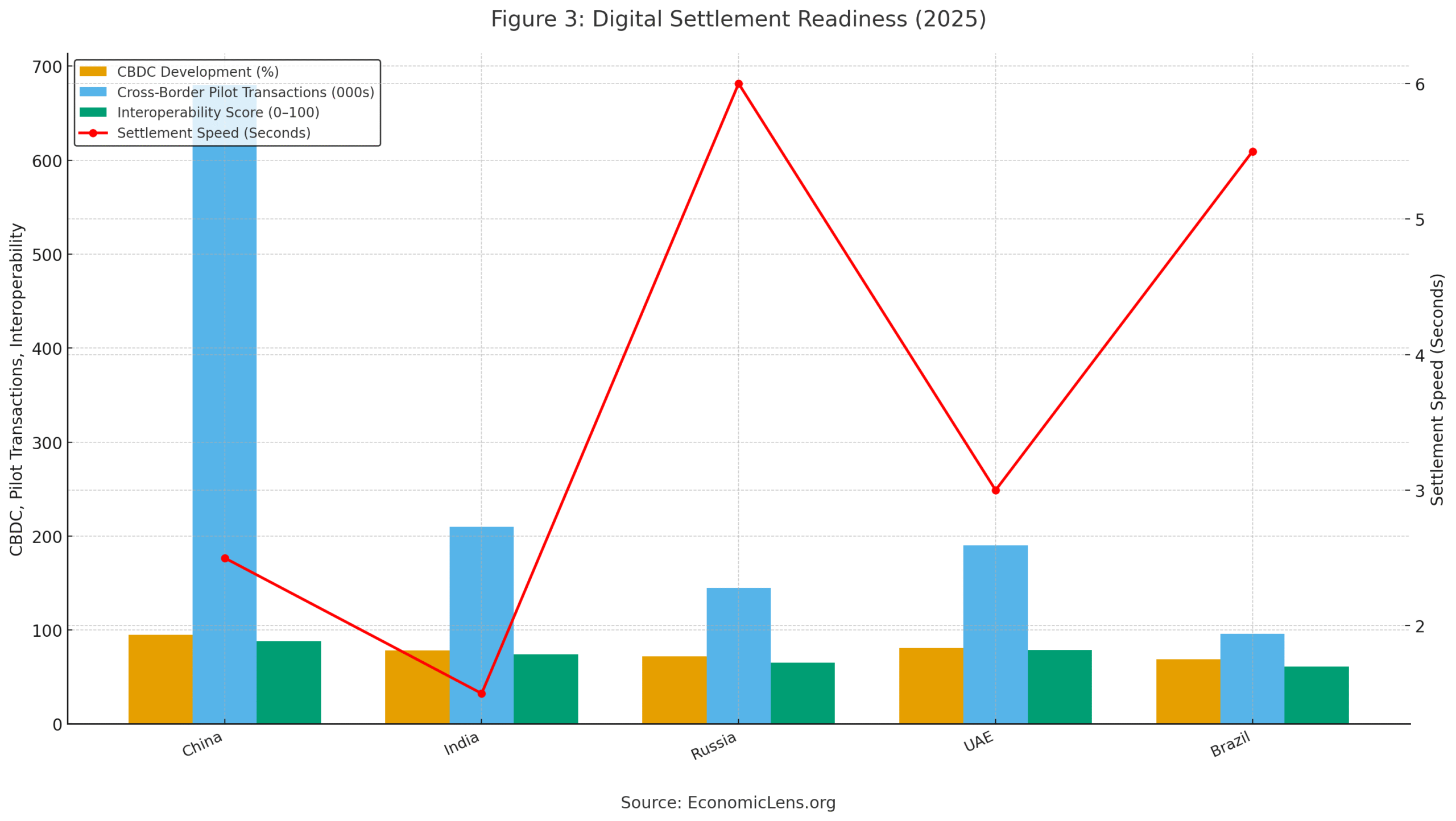

BRICS expansion alone cannot reshape global finance. Instead, success depends on interoperable currency systems that support a multipolar financial structure. Consequently, member states are accelerating central bank digital currency development, digital linkages and cross-border settlement pilots.

BIS economist Hyun Song Shin observes that the currency of the future is the one that moves seamlessly across borders. The BIS cross-border CBDC report (https://www.bis.org/publ/othp44.htm) highlights that multi-country digital settlement systems can reduce transaction costs, shorten settlement time and lower reliance on the United States dollar. The World Bank Global Currency Trends 2025 report (https://www.worldbank.org/en/research/brief/global-currency-trends-2025) also notes that emerging economies are enhancing digital settlement frameworks to strengthen financial autonomy.

The numbers show clear technological divergence. China leads significantly. India and the United Arab Emirates are rising quickly. Russia progresses steadily but remains constrained. Brazil continues to advance at a moderate pace.

“The future of global money is digital—and BRICS wants to write the code.”

4. Energy & Trade Realignments Driving BRICS Expansion and De-Dollarization

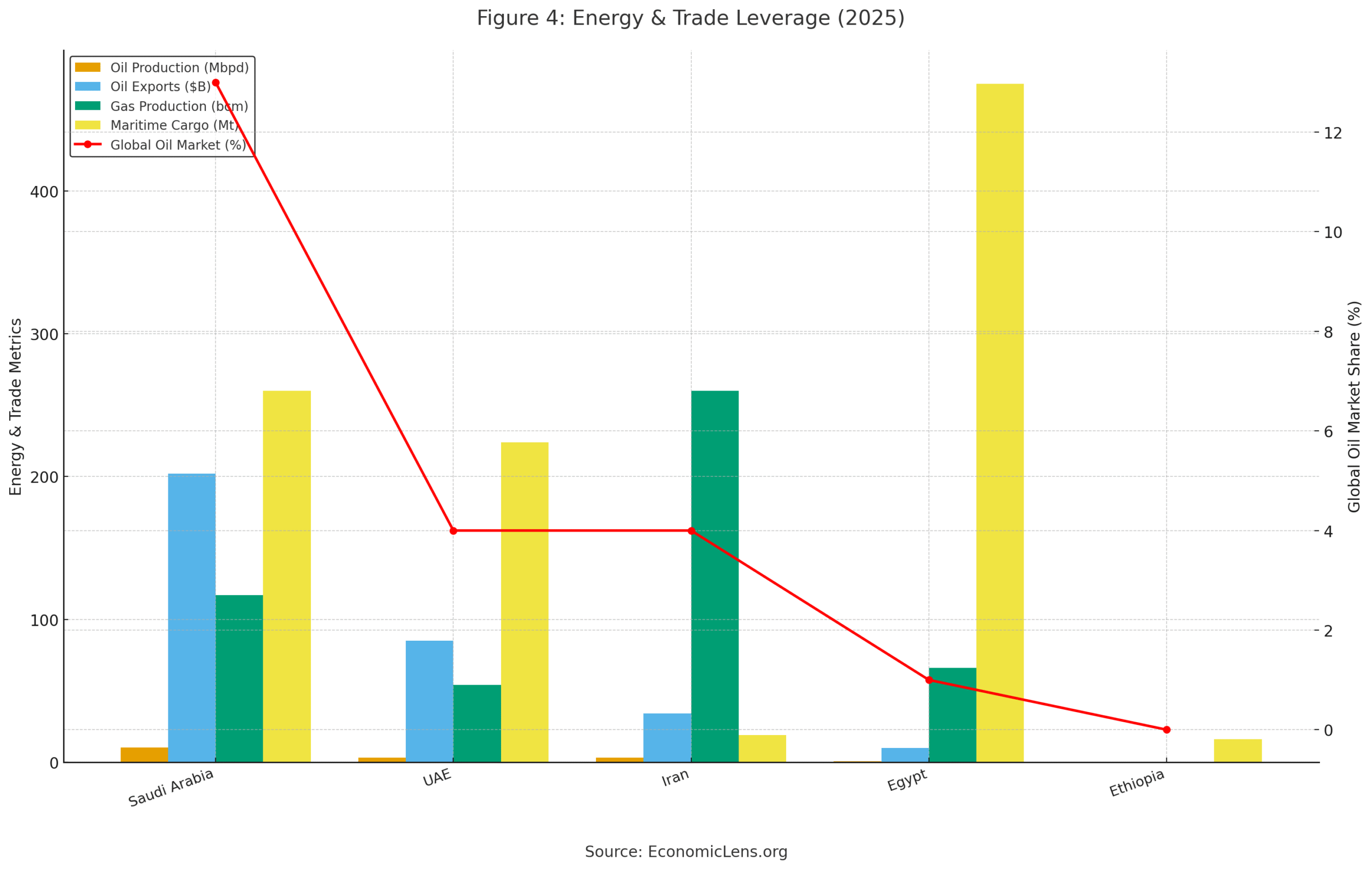

The inclusion of Saudi Arabia, the United Arab Emirates, Iran, Egypt and Ethiopia transforms the expanded BRICS into a powerful energy and logistics bloc. Global finance is anchored in energy markets. Therefore, changes in oil settlement mechanisms can weaken the dollar’s long-standing dominance.

Energy strategist Dr. Helima Croft explains that if oil pricing shifts into multiple currencies, global finance will adjust with it. The IEA notes a steady increase in non-dollar invoicing discussions among Middle Eastern exporters, especially toward Asian buyers. Energy exporters hold the keys to de-dollarization and logistics hubs like Egypt consolidate control over vital trade routes. A similar pattern of supply-route leverage is examined in our analysis Global Water Stress: Canal Bottlenecks, Hydropower Losses and Supply Chain Risk (https://economiclens.org/global-water-stress-canal-bottlenecks-hydropower-losses-supply-chain-risk/), which shows how canal chokepoints and maritime corridors shape global trade dependencies.

Energy exporters hold the keys to global de-dollarization, while logistics giants like Egypt amplify trade-route control. Together, they add economic weight and strategic leverage to BRICS expansion.

“Control the energy; and you influence the currency.”

5. Structural Risks & Constraints to BRICS Expansion and Dollar-Dominance Decline

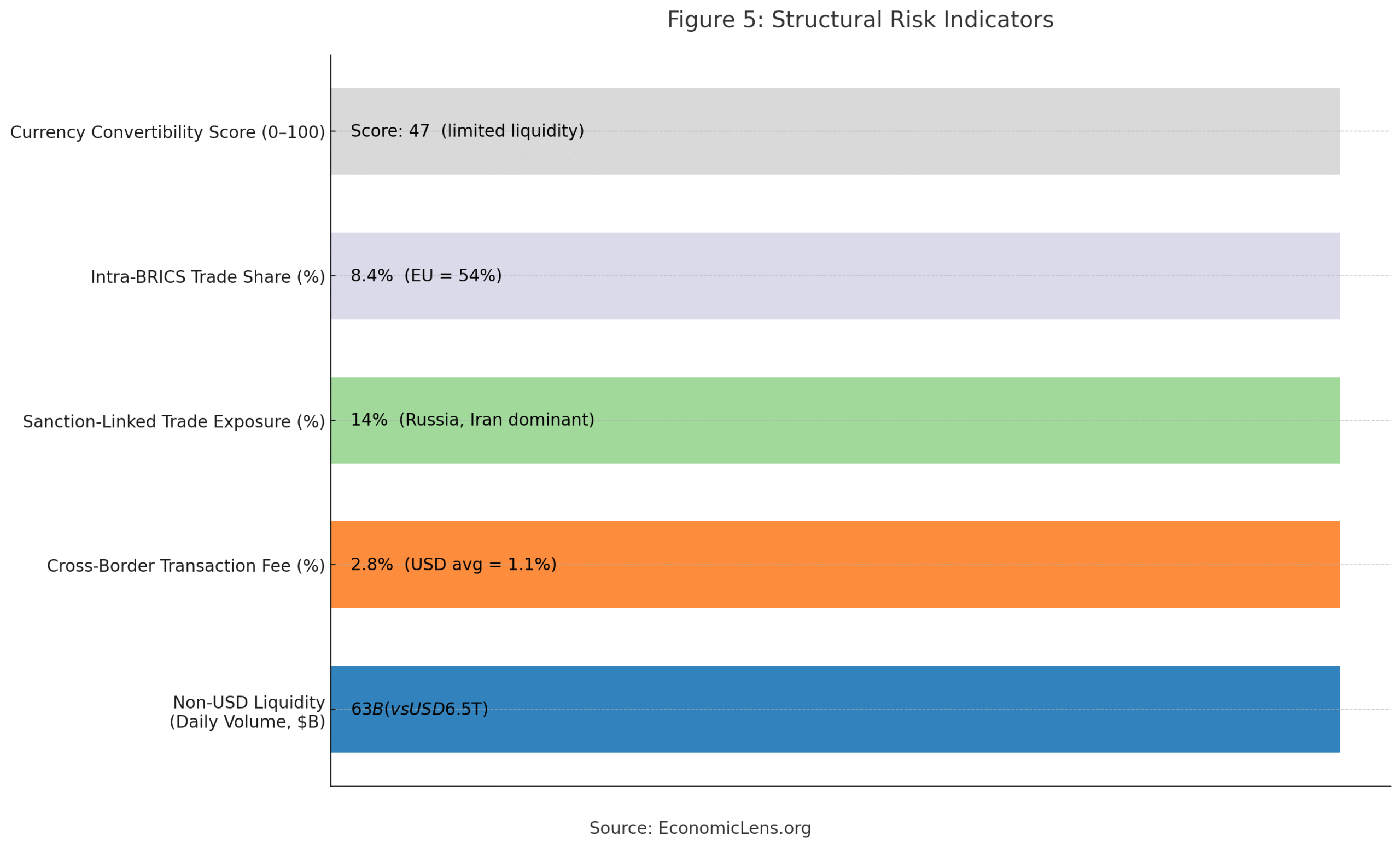

Despite momentum, BRICS expansion faces structural constraints. Integration depends on liquidity, policy alignment, and resilience against geopolitical shocks.

Analyst Ian Bremmer notes: “Multipolarity brings new opportunities—but coordination challenges multiply as well.” The OECD emphasizes that intra-BRICS trade remains low relative to potential, creating friction for currency settlement.

This table underscores that while the BRICS vision is strong, operational capacity is still evolving. Liquidity, interoperability, and alignment remain bottlenecks.

“Ambition must be matched by structure; or it remains ambition.”

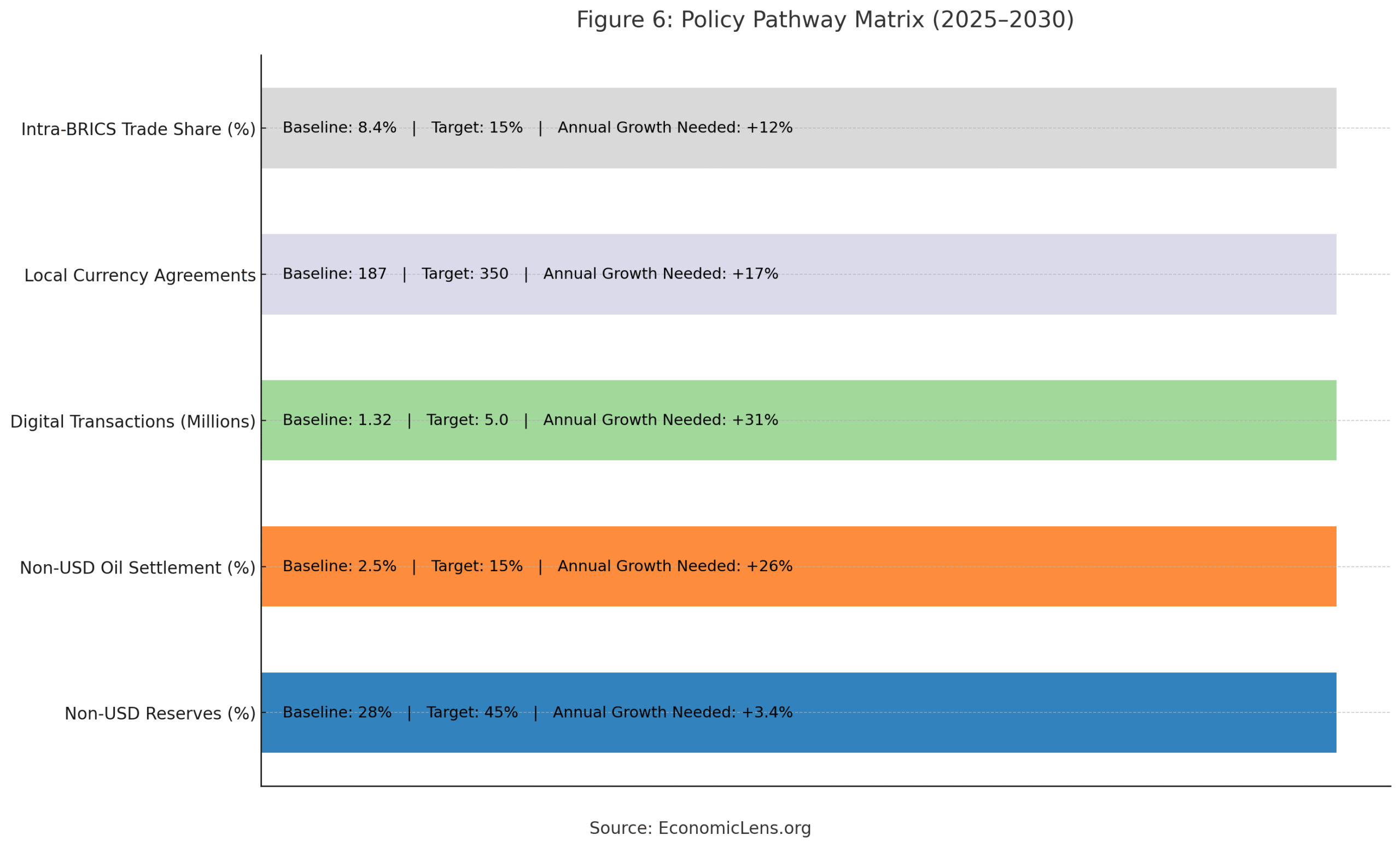

6. Policy Pathways to Strengthen BRICS De-Dollarization and Financial Integration

For BRICS expansion to evolve into a lasting global financial force, policy alignment is essential. Coordinated frameworks can accelerate currency diversification, strengthen digital infrastructure, and deepen trade integration.

Diplomat Kishore Mahbubani notes: “If BRICS wants to shape global finance, it must first harmonize its internal financial rules.” The OECD’s Governance Outlook 2025 stresses that consistent regulatory coordination is the missing link in de-dollarization.

Each quantitative target reflects a realistic, data-driven pathway for BRICS expansion to influence global financial governance.

By 2030, BRICS could represent nearly half of global GDP (PPP). If digital integration accelerates, energy settlement diversifies, and reserve structures evolve, global finance will move decisively toward a multipolar financial system. The pace will be gradual but irreversible.

“Policy alignment turns economic potential into economic power.”

Conclusion

The latest wave of BRICS expansion represents a turning point in global finance, creating a bloc large enough to influence currency settlement norms, reserve composition, and trade flows. With powerful energy exporters, logistics gatekeepers, and rising economic giants now inside the coalition, the foundations of BRICS de-dollarization are stronger than ever. Although structural constraints remain—especially liquidity shortages and governance gaps—the long-term implications point clearly toward a decline of U.S. dollar dominance in several strategic sectors. The global financial system is transitioning from a single anchor to a distributed architecture. Whether BRICS institutionalizes these gains will determine the speed and depth of this transformation. The next decade will define how currency power, financial trust, and geopolitical alliances evolve in a world no longer centered around one reserve currency.

Call to Action

Investors, policymakers, and institutions must prepare for a world where BRICS expansion shapes monetary flows, settlement systems, and reserve strategies. It is essential to diversify risk, integrate digital payment capacity, and monitor shifts in energy settlement currencies. Governments must adapt regulatory frameworks to a rapidly changing environment, while businesses must anticipate new trade corridors and currency dynamics.

3 thoughts on “BRICS Expansion: De-Dollarization and the Shift in Global Finance”

Applaused!! 👏

Well explained and an authentic blog based on analytical views…

Highly recommended!!

Wonderful!!

Well explained and an authentic blog based on analytical views…

Highly recommended!!

Think you for Dr Minhaj Din sir Guide to Students great job Sir 👍👏