Climate-induced food inflation is accelerating as climate shocks damage crops, disrupt supply chains and raise global food prices. This blog explains how heatwaves, droughts, floods and logistical breakdowns deepen shortages, intensify inflation and transform food markets into global risk hotspots across vulnerable regions.

INTRODUCTION

Climate-induced food inflation has emerged as one of the defining global economic pressures of the 2020s. As a result, extreme weather accelerates volatility: crops fail, yields shrink, transport routes falter and prices surge. Moreover, heatwaves, droughts, floods and storms now disrupt production cycles simultaneously, turning climate shocks into worldwide inflation events.

Throughout 2024–2025, climate disruptions hit major food producers across continents. Consequently, international institutions including the World Bank, IMF and FAO warn that climate-driven disruptions now contribute heavily to rising retail food prices. Therefore, as production becomes unpredictable, markets respond with volatility, import bills rise and vulnerable regions face growing food insecurity.

1. Origins and Drivers of Climate-induced Food Inflation

Climate shocks have become structural inflation accelerators. For example, when extreme weather hits major crop belts, production declines sharply, supply tightens and prices rise. Consequently, climate-induced food inflation begins with direct shocks to planting cycles and harvest windows.

In 2024, multiple breadbasket regions were hit simultaneously. India’s delayed monsoon caused severe rice stress, the U.S. Midwest faced extreme heat during corn pollination and Brazil’s soybean regions suffered record drought. East Africa entered its sixth failed rainy season, reducing maize and sorghum yields. These overlapping climate disasters forced global traders to adjust supply forecasts upward, triggering sharp jumps in wheat, maize, rice and soybean prices worldwide. This convergence of climate shocks signaled a new era: weather volatility is now a central inflation driver.

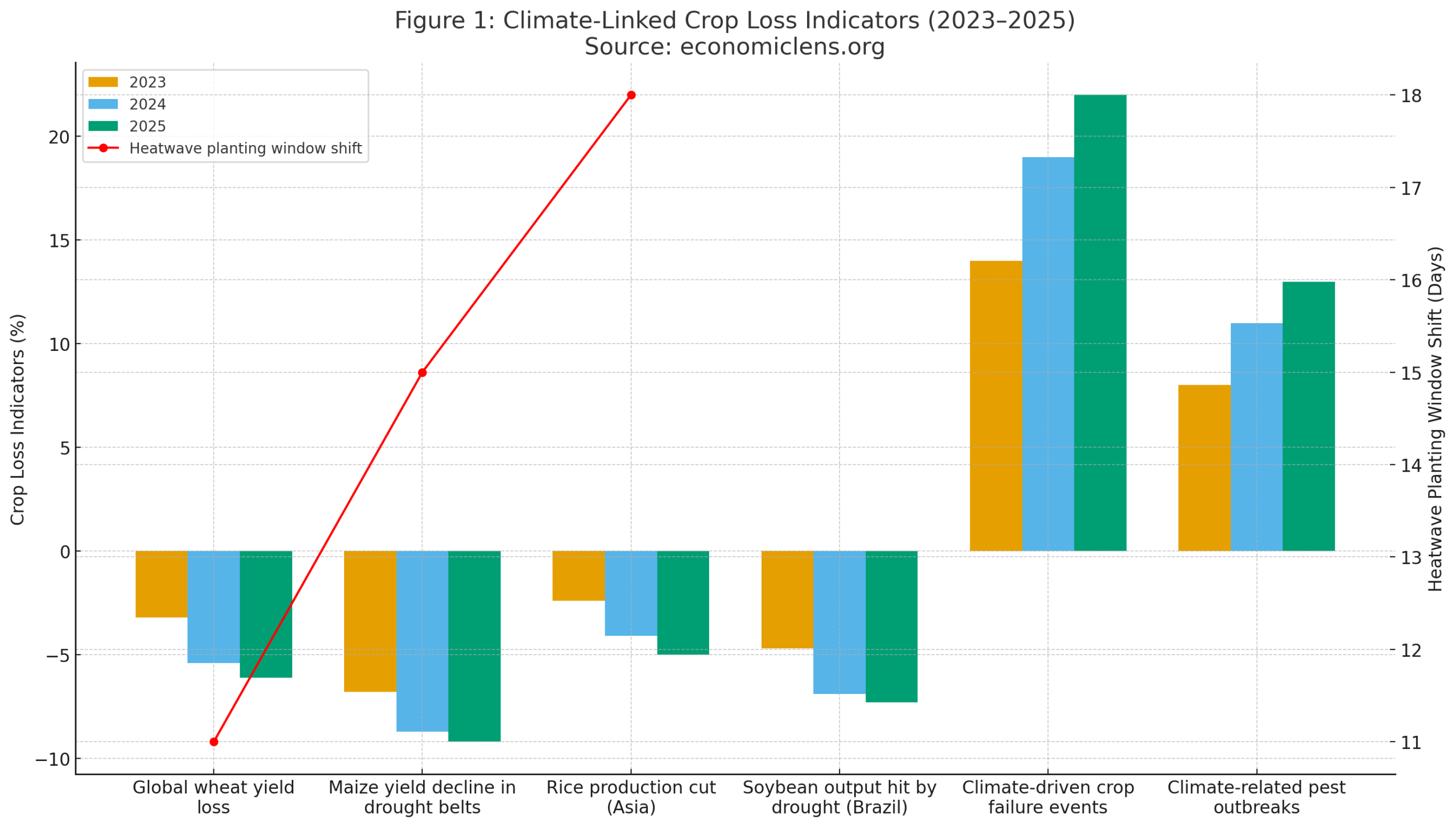

Expert View and Report Analysis on Crop Losses

Agricultural economist Dr. Amina Rahman notes that temperature volatility shortens crop windows and reduces yields even before drought is visible. Analysts highlight that tight markets magnify the inflationary effect of small climate disturbances because global buffer stocks have declined over the last decade. World Bank’s 2025 Commodity Outlook estimates climate shocks accounted for 35–45 percent of food price increases in import-dependent economies. The Global Food Supply Crunch report (https://economiclens.org/global-food-supply-crunch-climate-shocks-export-bans-and-inflation-risk/) provides detailed evidence on how climate shocks, export restrictions and trade disruptions deepen food inflation pressure. FAO reports a 6 percent decline in wheat yields and up to 9 percent decline in maize yields due to extreme heat and drought. IMF inflation assessments show persistent climate-driven supply shocks embedding long-term price pressures.

Climate-linked crop losses and disrupted planting cycles are tightening global food supply, embedding climate-induced food inflation into long-term price patterns.

“When climate becomes unstable, food prices reveal the system’s deepest vulnerabilities.”

2. Structural Breakdown Behind Climate-Driven Food Inflation

Climate-driven inflation intensifies when extreme weather disrupts transportation, storage, distribution and export systems. For instance, once logistical bottlenecks form, costs rise across the chain and inflation accelerates.

Europe saw major grain-storage damage after floods hit Germany, Poland and the Netherlands in 2024. Simultaneously, Panama Canal water shortages slowed food shipments from Latin America to Asia, while Australian fires cut barley export volumes. Southeast Asian rice exporters imposed restrictions after heatwaves damaged crops, further tightening supply. Together, these combined disruptions moved climate shocks from fields to ports, roads and global supply chains, amplifying food inflation.

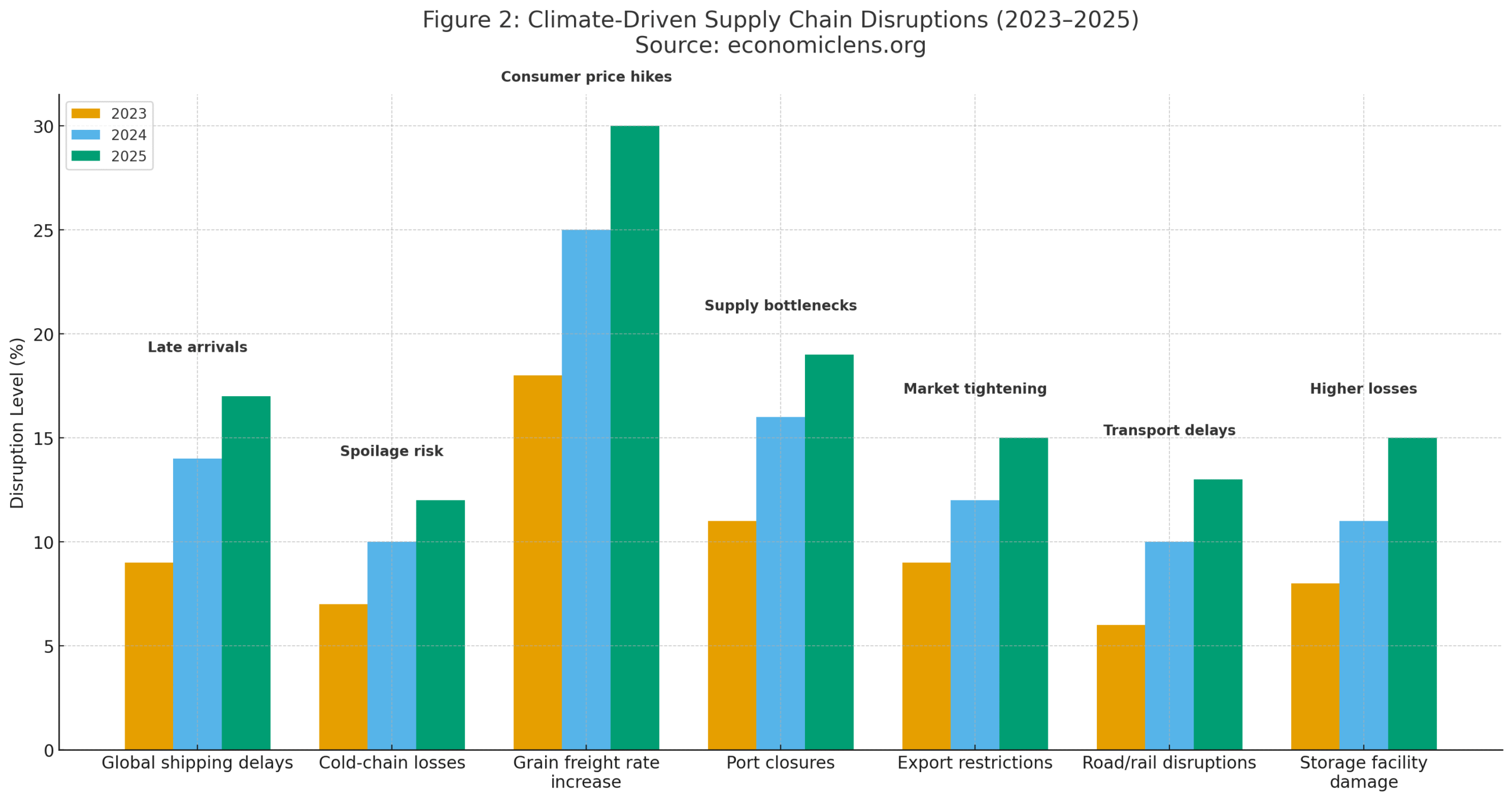

Expert View and Report Analysis

Supply chain analysts argue that climate shocks now disrupt multiple nodes: storage facilities, cold-chain systems, port operations and inland transport. Economist Daniel Percival emphasizes that even modest climate disruptions ripple through markets because global supply systems operate with little spare capacity. UNCTAD’s 2025 Maritime Review shows climate-related shipping delays rising 17 percent. The FAO Climate Impact on Agriculture portal (https://www.fao.org/climate-change/en/) provides assessments on climate-induced yield losses, drought stress and food system volatility. OECD finds logistics bottlenecks increased 22 percent in climate-sensitive supply chains, while S&P Global reports a 30 percent jump in grain freight rates due to weather-related port closures.

Multi-layered climate disruptions are raising transport, storage and freight costs simultaneously, accelerating climate-induced food inflation worldwide.

“Inflation spikes when fragile supply chains collide with climate extremes.”

3. Global Market Fallout From Climate-Linked Food Price Surge

Market reactions to climate shocks are immediate. As a result, futures surge, retail prices rise and import bills expand. Furthermore, volatility spreads across commodities

In late 2024, global grain futures experienced their sharpest monthly surge in a decade. Importers rushed to secure supplies after consecutive climate shocks hit India, Brazil and Australia. Demand for stockpiling increased in Asia and Africa, pushing up warehouse and freight costs. European retailers reported price hikes in vegetables and grains, while livestock producers across Asia faced higher feed costs. This global chain reaction shows climate shocks rapidly converting scarcity into price spikes.

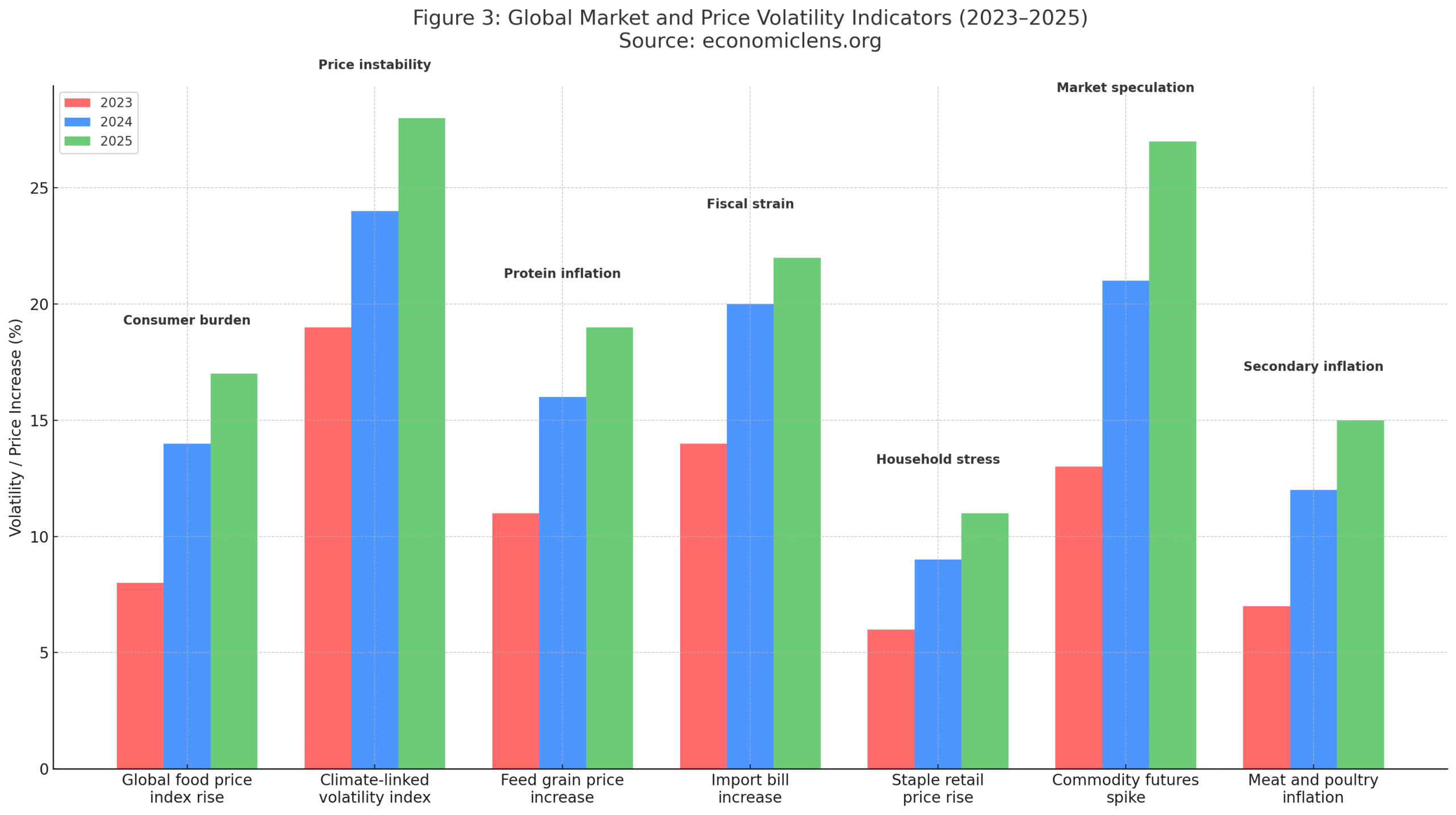

Expert View and Report Analysis

Analyst Teresa Lin highlights that markets are operating on thin margins, making them highly sensitive to climate disturbances. Food system experts note that rising feed costs quickly propagate into dairy, poultry and livestock pricing, turning climate shocks into broad inflation drivers. IMF reports climate shocks contributed to over 58 percent of emerging market food inflation in 2024–2025. The Global Economic Outlook 2025–2026 analysis (https://economiclens.org/global-economic-outlook-2025-2026-slow-growth-sticky-inflation-rising-debt/) examines how climate-linked supply shocks amplify global inflation, fiscal strain and commodity volatility. The World Bank report 2025 (https://www.worldbank.org/en/research/commodity-markets) confirms a 14 percent increase in global food prices, while FAO links volatility in wheat, rice and maize markets directly to climate disruptions.

Climate-sensitive markets are experiencing sharp cost increases as climate shocks tighten supply and elevate global inflationary pressures.

“When climate shocks shake markets, inflation becomes a global force.”

4. Sectoral Impact of Climate-Related Food Crisis on Industries

Climate-induced food inflation affects sectors linked to protein, dairy, feed, retail logistics and energy crops. The ripple effects extend beyond agriculture.

Heatwaves reduced dairy yields in Europe, shrinking milk supply. Fires cut Australia’s barley output, raising livestock feed prices. Japan suffered retail delays after storms damaged cold-chain systems. African bakeries reduced product sizes due to surging wheat costs. The U.S. poultry industry faced rising mortality during heat surges, limiting protein availability. These sectoral stress points reveal the depth of climate-induced food inflation.

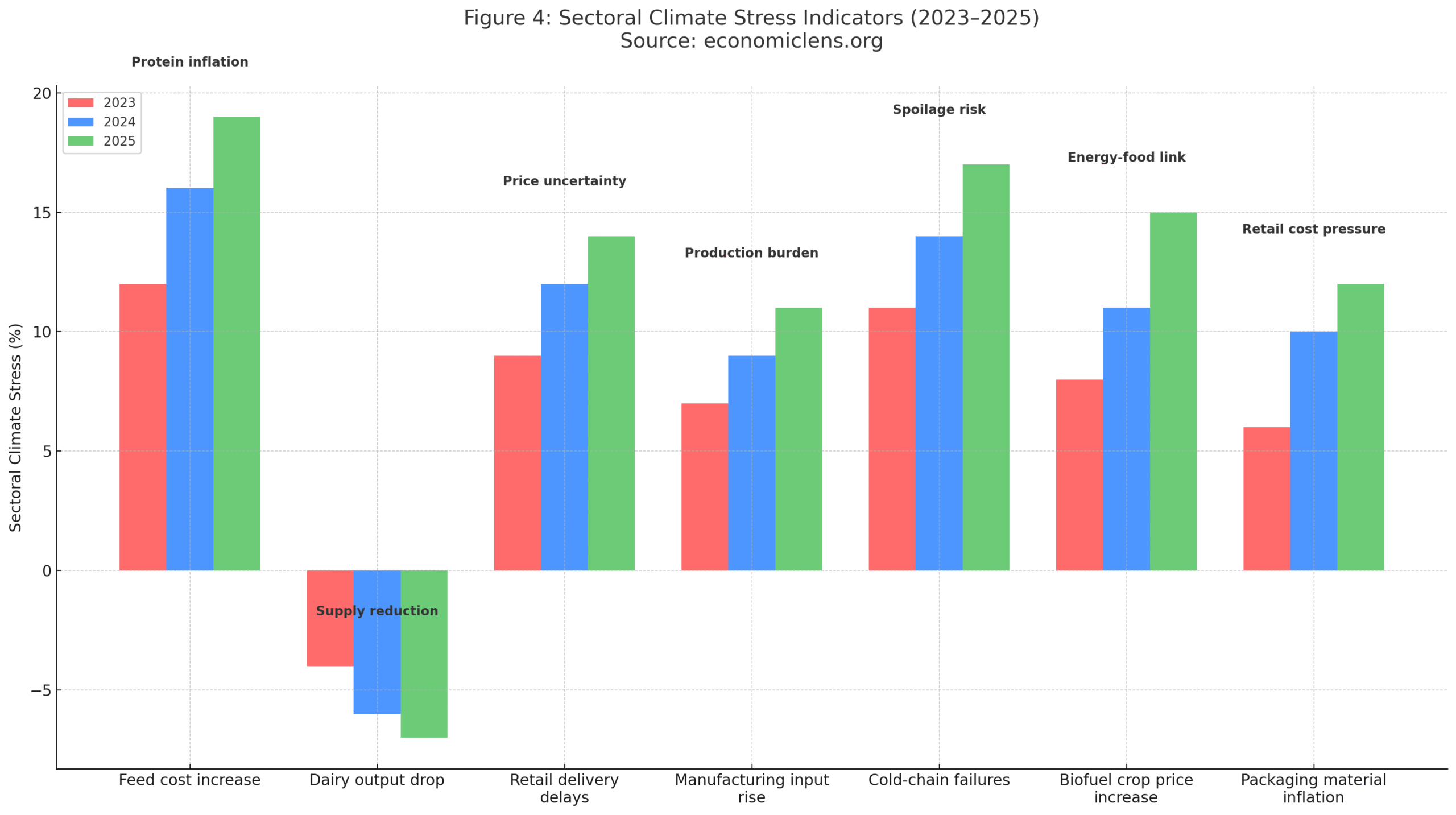

Expert View and Report Analysis

Sector analysts emphasize that industries dependent on feed grains, temperature-sensitive crops and cold-chain transport are the most exposed. Dr. Paul Rivlin notes that rising agricultural prices quickly transfer to processing, packaging and retail. OECD’s 2025 Sectoral Review shows climate-sensitive industries saw 12–18 percent cost rises. FAO finds rising feed prices elevated protein inflation across Asia and Latin America. World Bank highlights biofuel crops as highly climate-volatile.

Climate-driven pressures on feed, dairy, transport and manufacturing are accelerating food inflation across multiple interconnected sectors.

“When climate hits one sector, every dependent industry absorbs the shock.”

5. Regional Exposure to Climate-Induced Food Inflation Worldwide

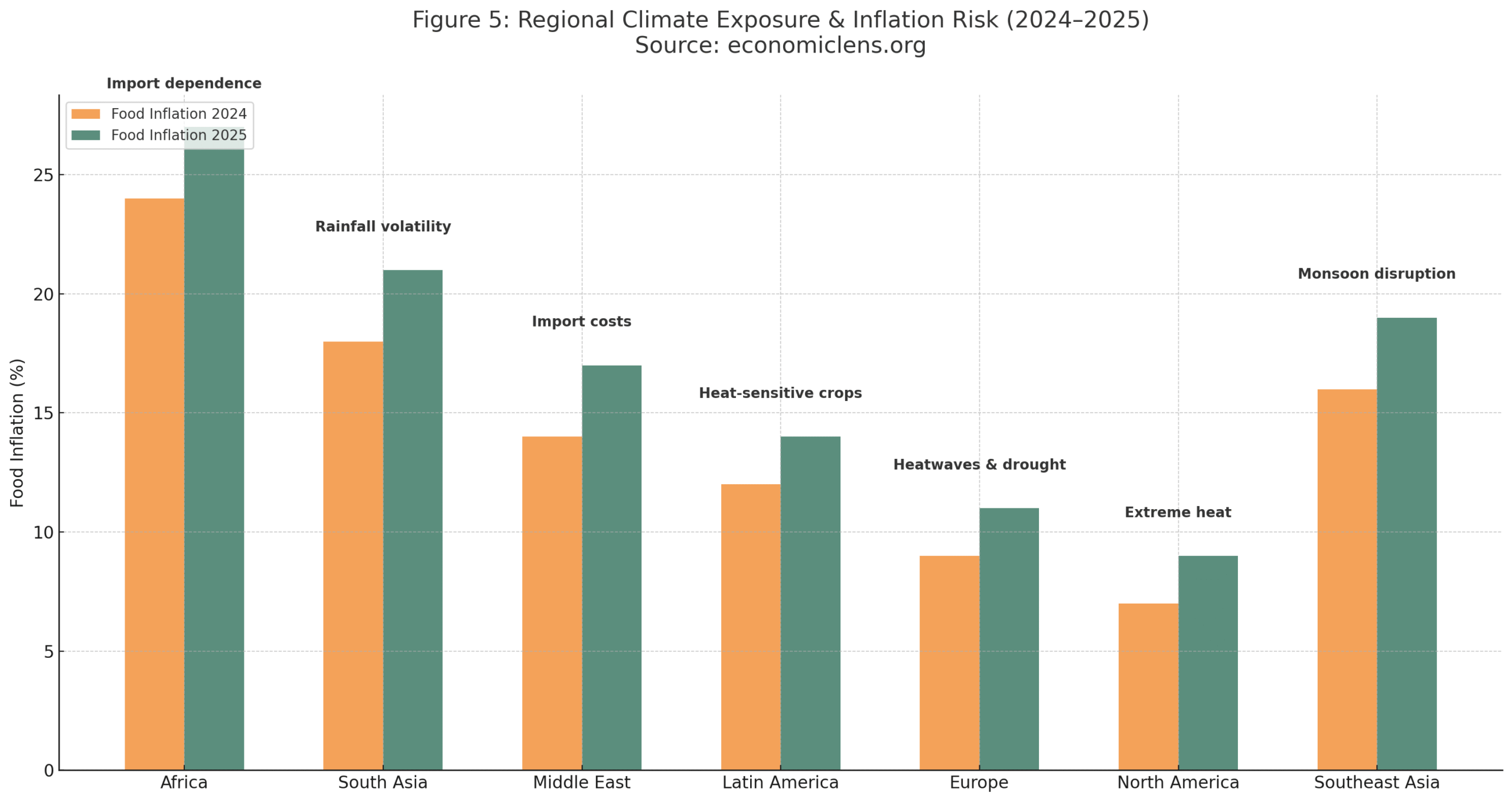

Climate-induced food inflation affects regions differently depending on climate sensitivity, import dependence and currency exposure.

East Africa faced maize shortages as drought conditions persisted. South Asia imposed rice export restrictions after erratic monsoons. Europe endured vegetable and grain losses due to heatwaves. Latin America’s coffee and cocoa belts faced extreme temperature fluctuations. Middle Eastern states saw rising food import bills. These crises demonstrate how climate variations intensify regional inflation pressure.

Expert View and Report Analysis

Food security specialist Dr. Salma Idris notes that import-dependent regions experience price shocks fastest. Currency weakness amplifies inflation, making vulnerable states more exposed to climate-driven food price changes. World Bank’s 2025 Vulnerability Index highlights Africa and South Asia as the most climate-exposed. IMF reports show climate-linked food inflation contributing up to 35 percent of total inflation in low-income states. FAO lists more than 20 countries under high hunger alerts due to climate volatility.

Regions dependent on imports or climate-sensitive crops face the sharpest inflation pressure. Climate-induced shocks spread quickly through interconnected food markets.

“When climate hits one region, households across the world feel the cost.”

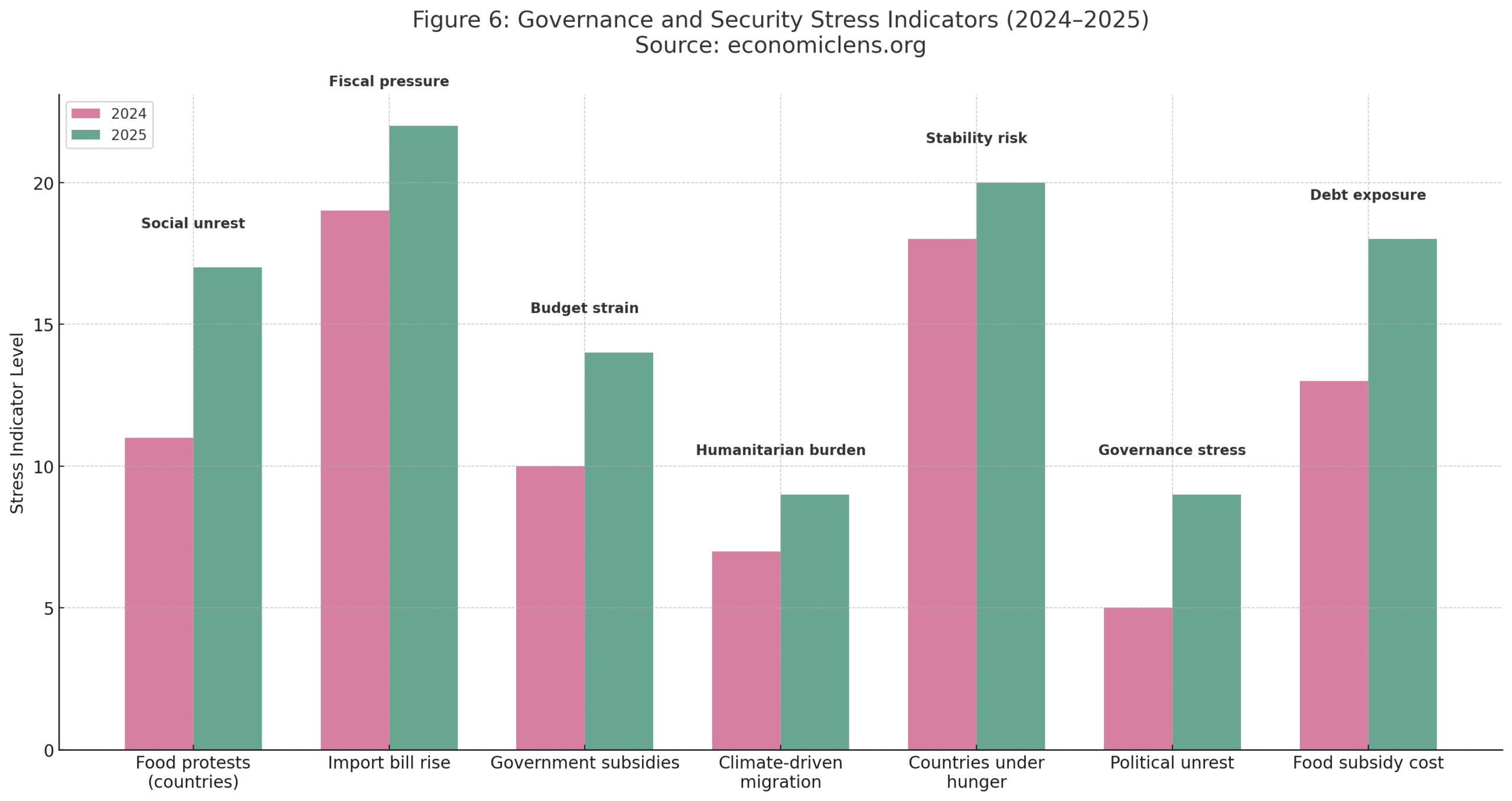

6. Governance Pressure Under Climate-Driven Food Inflation

Climate-induced food inflation is becoming a governance challenge as shortages trigger unrest and strain public budgets.

In 2024, protests erupted across parts of Africa, Asia and Latin America over rising bread, maize and rice prices. Governments struggled to maintain subsidies as import bills surged. In South Asia, erratic monsoons forced emergency imports. Central American nations saw migration pressures tied partly to unaffordable food. Climate-induced food inflation increasingly fuels political instability.

Expert View and Report Analysis

Security analysts warn that food inflation is now a geopolitical risk. Dr. Yusuf Karim notes that rising import bills threaten fiscal stability, while shortages can trigger public unrest within weeks. UN Security Council briefings identify climate-linked food volatility as a security trigger. OECD governance indicators show rising fiscal stress in countries dependent on food subsidies. IMF warns that climate-driven food inflation magnifies debt risks in vulnerable economies.

Climate-induced food inflation is straining fiscal capacity, fueling unrest and amplifying governance challenges across vulnerable states.

“Food stability is a foundation of national stability; climate is shaking that foundation.”

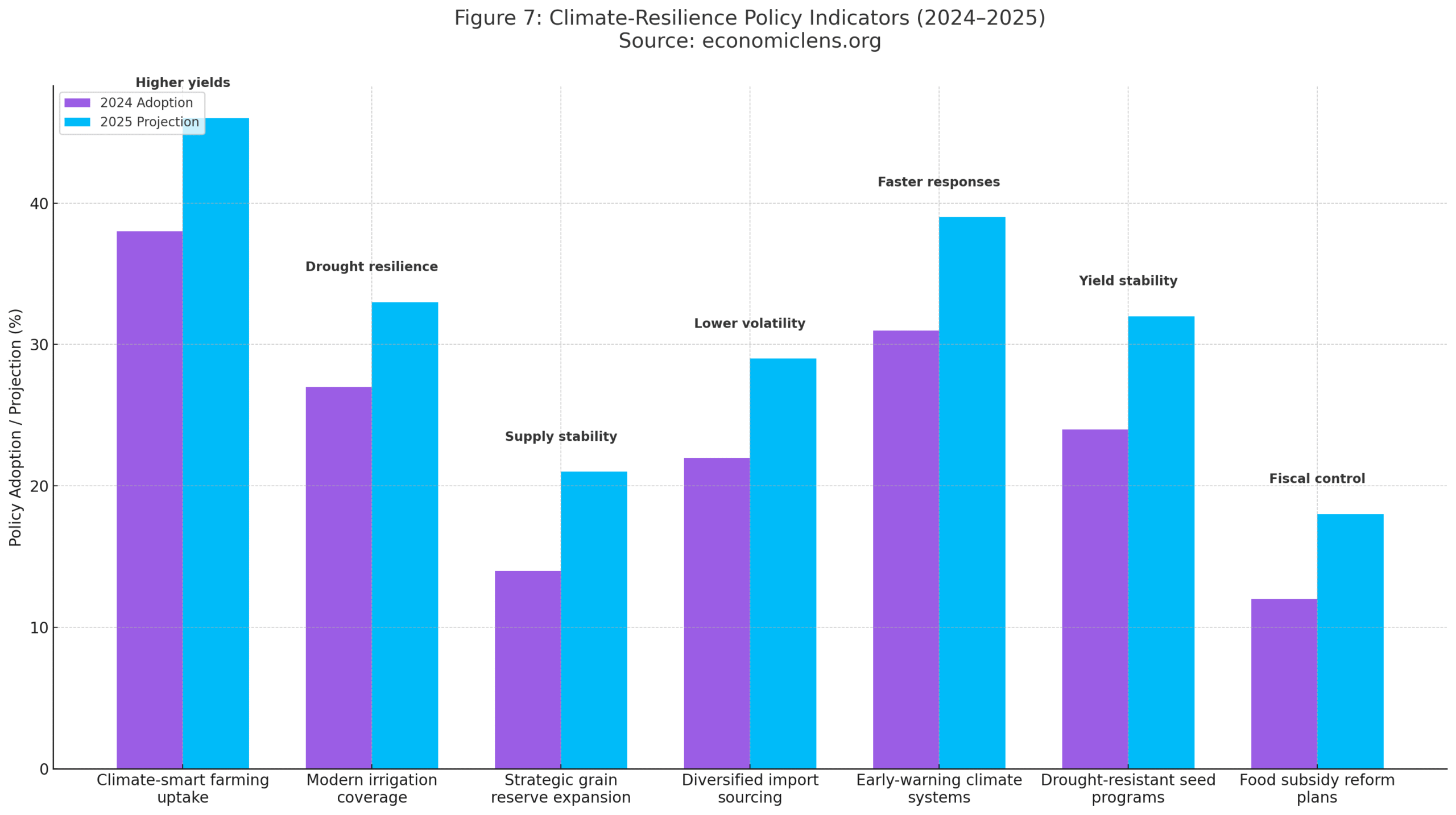

7. Policy Pathways to Manage Climate-Linked Food Price Surge

Stabilizing food prices requires coordinated climate adaptation, diversified sourcing and investment in climate-resilient agriculture.

Governments moved aggressively in 2024–2025: the EU expanded climate-resilient farming funds, Southeast Asia built strategic rice reserves, African states increased adaptive seed programs and the U.S. upgraded crop insurance. These actions reflect a global pivot toward climate-food policy integration.

Expert View and Analysis

Policy expert Dr. Helena Moritz argues that tools like drought-resistant seeds, predictive climate systems and diversified import sourcing reduce long-term inflation risk. OECD shows climate-smart irrigation can reduce yield losses by 25 percent. IMF recommends targeted subsidies to cushion households. World Bank calls digital risk-monitoring essential for climate planning.

Climate-smart farming, upgraded irrigation and diversified sourcing can significantly reduce climate-induced food inflation by stabilizing supply.

“Resilience is built before the crisis, not after prices rise.”

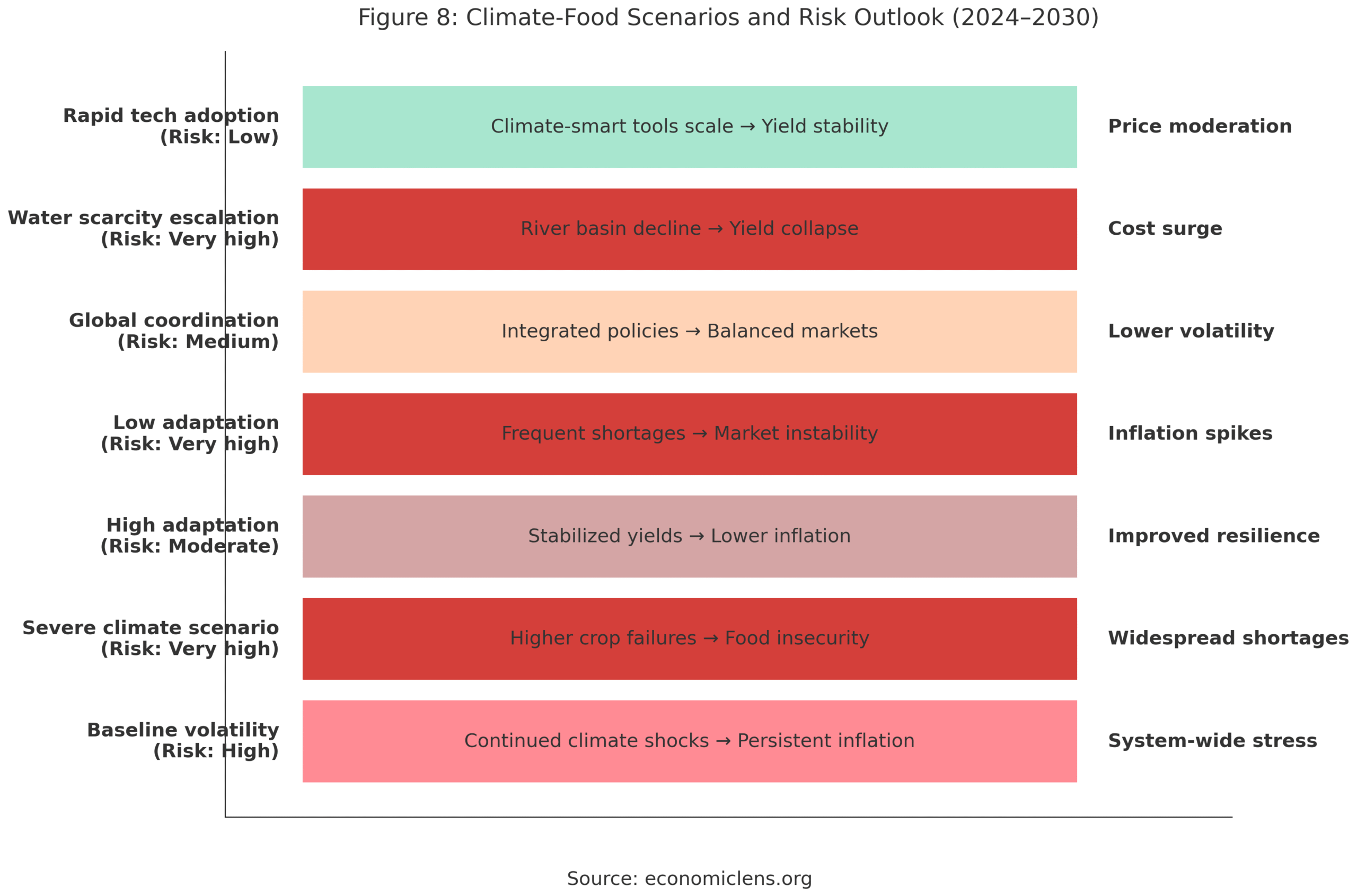

8. Future Outlook: Food Systems, Global Markets and Climate Scenarios

The next decade will depend on how quickly the world adapts to intensifying climate shocks. Insurers raised climate-risk classifications for key crop regions across continents in 2024–2025. Water scarcity in major river basins such as the Nile, Indus, Mississippi and Danube threatens long-term yield stability. FAO warns over 330 million people face rising hunger risks. Global think tanks project higher migration flows tied to food stress. These signals show the future will bring deeper climate-linked food vulnerabilities.

Expert View and Scenario

Economists like Dr. Li Zhang warn that climate and water scarcity will redefine global food maps. Without large adaptation investments, markets may normalize permanently higher food price floors. FAO projects staple prices could remain 8–15 percent above pre-2020 levels. IMF estimates one-quarter of emerging economies may face chronic food inflation by 2030. WRI warns food demand will rise 50 percent by 2050.

Future food stability depends on climate adaptation and coordinated policies. Without action, climate-induced food inflation will intensify and persist.

“The future of food depends on how fast the world adapts to climate reality.”

CONCLUSION

Climate-induced food inflation has become a structural economic force. Climate shocks now damage crops, disrupt logistics, destabilize markets and strain vulnerable regions into deeper food crises. As heatwaves, droughts, floods and storms intensify, food systems face increasing stress across production, distribution and pricing.

Global markets respond with volatility, rising import bills and persistent inflation. Vulnerable regions face the sharpest burden, while governments struggle to manage fiscal pressure. Reports from the World Bank, IMF, OECD and FAO confirm that climate-induced food inflation has escalated into a long-term global risk.

Building resilience requires investment in climate-adaptive agriculture, smarter irrigation systems, diversified trade routes and coordinated global policy frameworks. Without decisive action, the world risks entering a prolonged era of climate-driven food instability.

CALL TO ACTION

Governments, private sectors and international institutions must strengthen climate resilience across farming, logistics and global food systems. Strategic adaptation, digital monitoring and diversified sourcing are essential to protect economies from rising climate-driven food inflation.

1 thought on “Climate-induced food inflation: Climate Shocks, Food Price Surge & Global Risk”

Excellent 👌👍