Russia–Ukraine commodity shock continues to escalate as war and sanctions disrupt global supplies of energy, grains, fertilizers, and strategic metals. This blog explores how supply chain fractures, export controls, and geopolitical fragmentation amplify inflation, widen fiscal deficits, and threaten global economic stability.

Introduction

The intensifying Russia–Ukraine commodity shock has become one of the most consequential economic disruptions of the decade. As the conflict stretches into its fourth year, sanctions, counter-sanctions, and wartime production losses continue to destabilize global markets. The shock has spread far beyond Europe—fueling sharp increases in energy, grain, fertilizer, and metal prices worldwide. Consequently, many economies are grappling with worsening debt, inflation, and global fiscal stability at a time when post-pandemic vulnerabilities remain unresolved. Moreover, supply chain fragmentation, trade rerouting, and resource weaponization have turned commodities into geopolitical levers.

In today’s interconnected economy, the Russia–Ukraine conflict is no longer a regional war—it is a global commodity upheaval shaping the trajectory of markets and fiscal systems worldwide.

1. Geopolitical Drivers of the Russia-Ukraine Commodity Shock

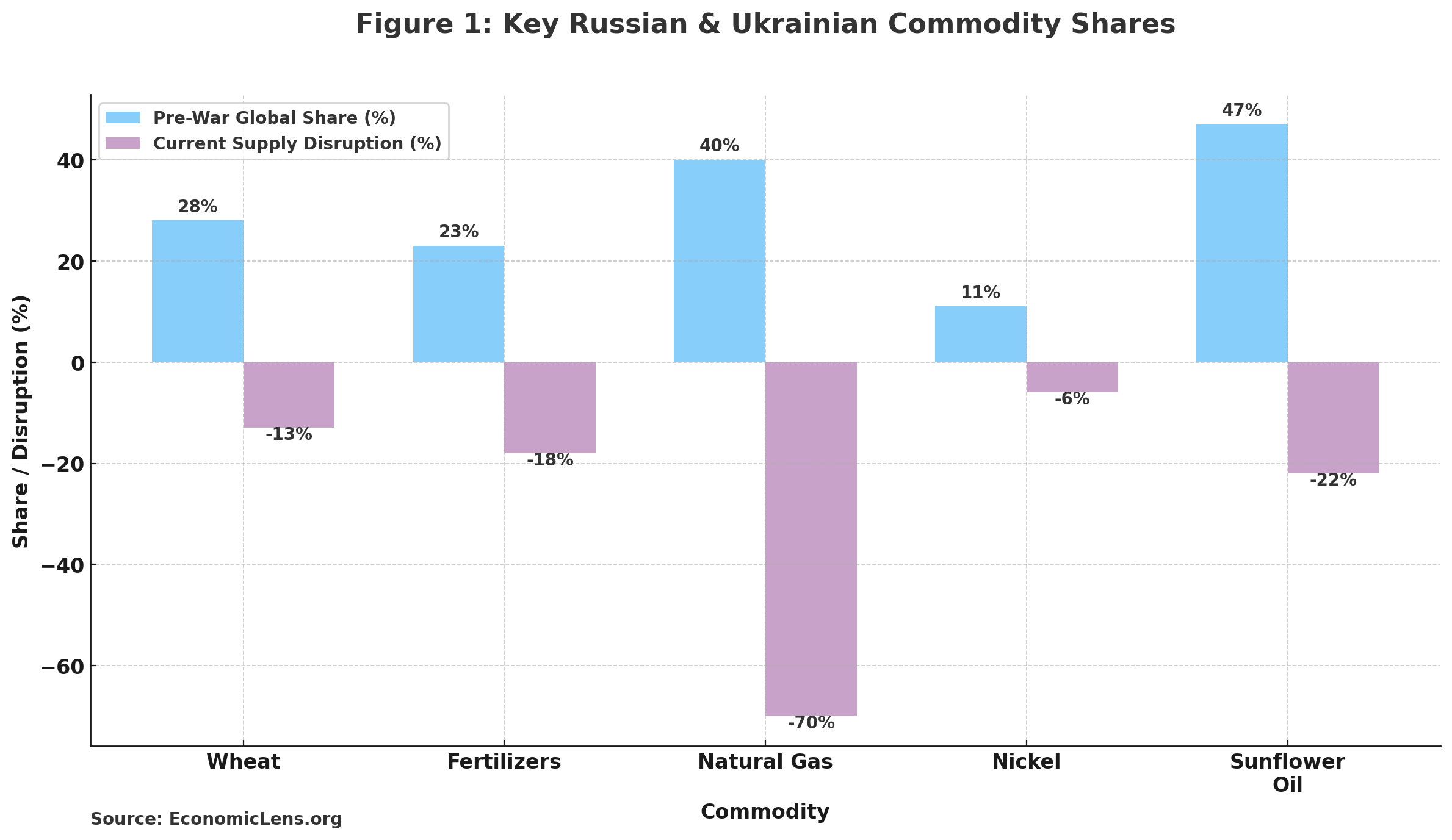

The Russia–Ukraine war remains a defining driver of international commodity instability. Russia is a major exporter of oil, natural gas, wheat, fertilizers, and industrial metals, while Ukraine accounts for significant shares of global grain and sunflower oil markets. Consequently, wartime disruptions, military blockades, and sanctions have collectively reshaped supply routes and reduced global availability. Additionally, geopolitical uncertainty magnifies volatility, as markets react sharply to each escalation. Thus, the war has transformed commodities into instruments of geopolitical influence.

According to the IMF, “The Russia–Ukraine war has triggered the largest commodity shock since the 1970s,” emphasizing that sanctions and logistics barriers will sustain volatility for years. The World Bank adds that nearly 45% of global wheat price increases in 2022–2024 were directly attributable to supply disruptions from the conflict.

The table illustrates the scale of disruption across essential commodities. Europe’s dependence on Russian energy has been dramatically reduced, but at the cost of higher prices and accelerated energy restructuring. Food and fertilizer shortages have hit emerging markets particularly hard, driving up production costs and food insecurity.

“When two major food and energy producers go to war, the shock doesn’t stay at the front line—it shows up in supermarket aisles and power bills worldwide.”

2. Sanctions, Counter-Sanctions & Global Supply Chain Disruptions

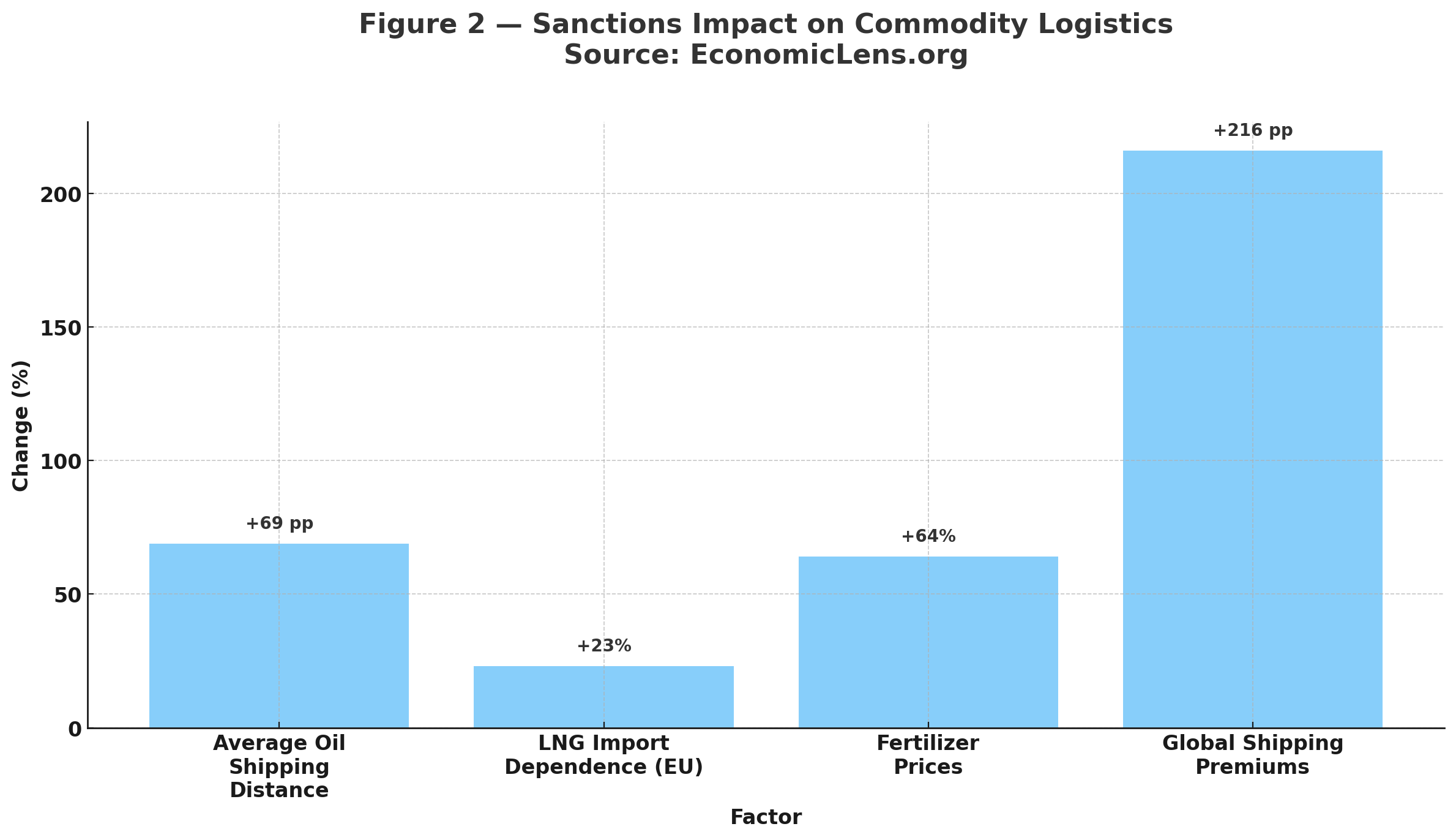

Sanctions imposed on Russia—and Russia’s counters—have transformed global supply chains into contested territory. Energy rerouting, shipping restrictions, payment barriers, and frozen assets have redefined trade patterns in oil, gas, grain, and metals. Moreover, logistical bottlenecks at ports, rail corridors, and pipelines have reduced supply flexibility. Consequently, global markets must adjust to new trade corridors spanning Asia, the Middle East, and Africa, often at higher cost and longer transit times. These structural shifts reinforce long-term volatility and deepen global supply uncertainty.

The OECD reports that sanctions on Russian commodities have redirected nearly $260 billion in annual trade flows toward non-Western economies. The IEA further finds that Russian oil now travels 70% farther on average than before the war due to sanctions-driven rerouting, adding to freight costs and emissions.

Sanctions have reshaped the geography of commodity flows. Longer routes increase costs, delay deliveries, and intensify competition for alternative suppliers. Higher fertilizer prices, in particular, threaten future agricultural yields and global food security, especially in low-income regions.

“Sanctions may target states, but their shockwaves hit ships, farms, factories—and ultimately, households everywhere.”

3. Inflationary Pressures Across Energy, Food & Metals

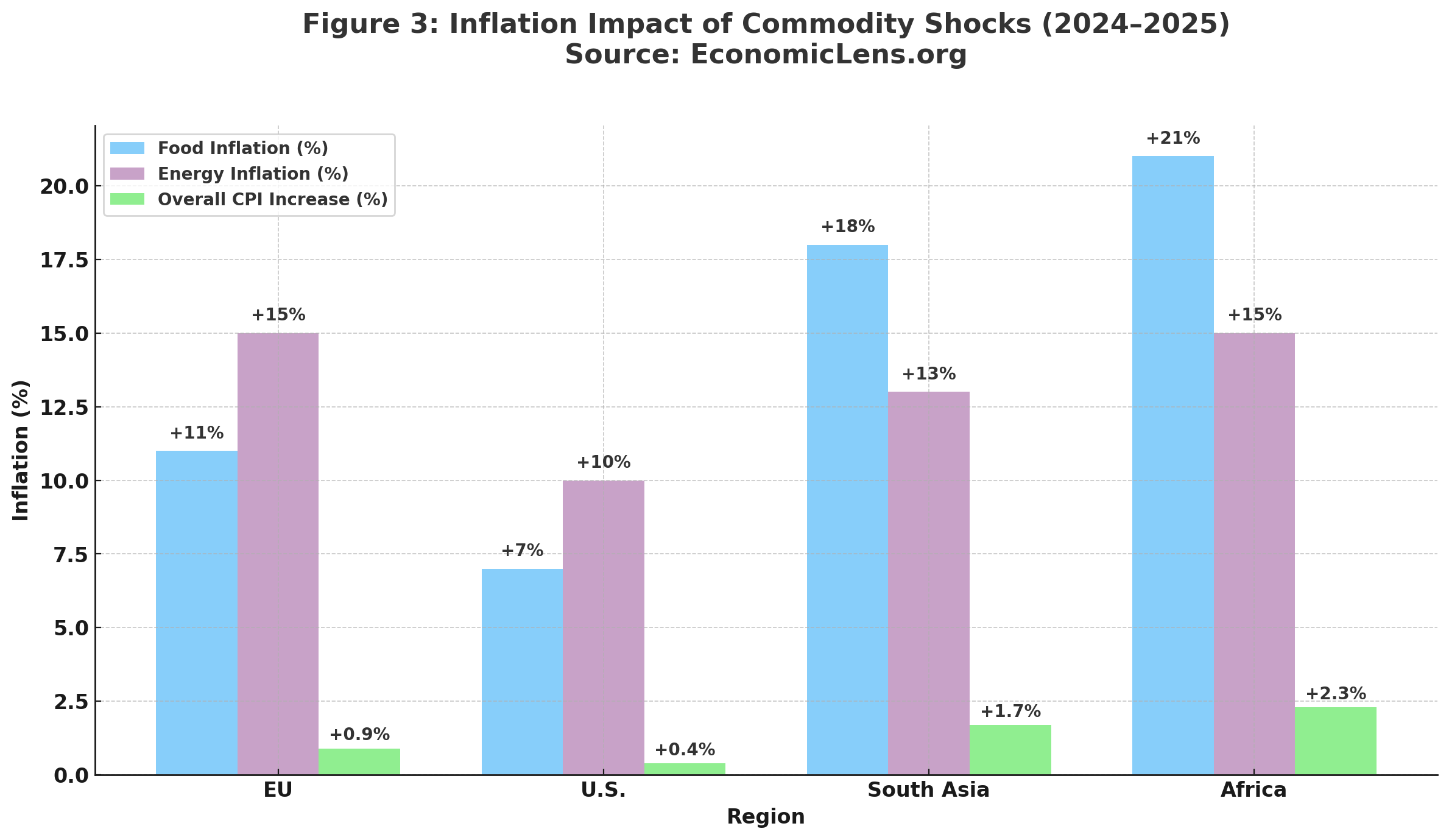

The Russia–Ukraine commodity shock has become a central driver of global inflation. Higher prices for oil, gas, wheat, fertilizers, and industrial metals have raised production and transportation costs across nearly every sector. As a result, central banks face persistent inflationary pressures despite aggressive interest rate hikes. Food and energy inflation, in particular, hit lower-income households hardest, increasing inequality and social tension. Thus, war-driven commodity volatility is not just a market problem—it is a societal pressure point.

The IMF states that commodity price spikes related to the war contributed to “up to 1.6 percentage points of additional global inflation” between 2022 and 2024. The FAO warns that rising fertilizer and grain costs could push an additional 50–70 million people into food insecurity if shocks persist.

Emerging and low-income regions bear the greatest inflationary burden. With higher shares of income spent on food and fuel, households in South Asia and Africa feel the impact most, while limited fiscal space constrains targeted relief.

“When commodities become weapons, the first casualties are price stability and purchasing power.”

4. Fiscal Stress & Debt Risks for Import-Dependent Nations

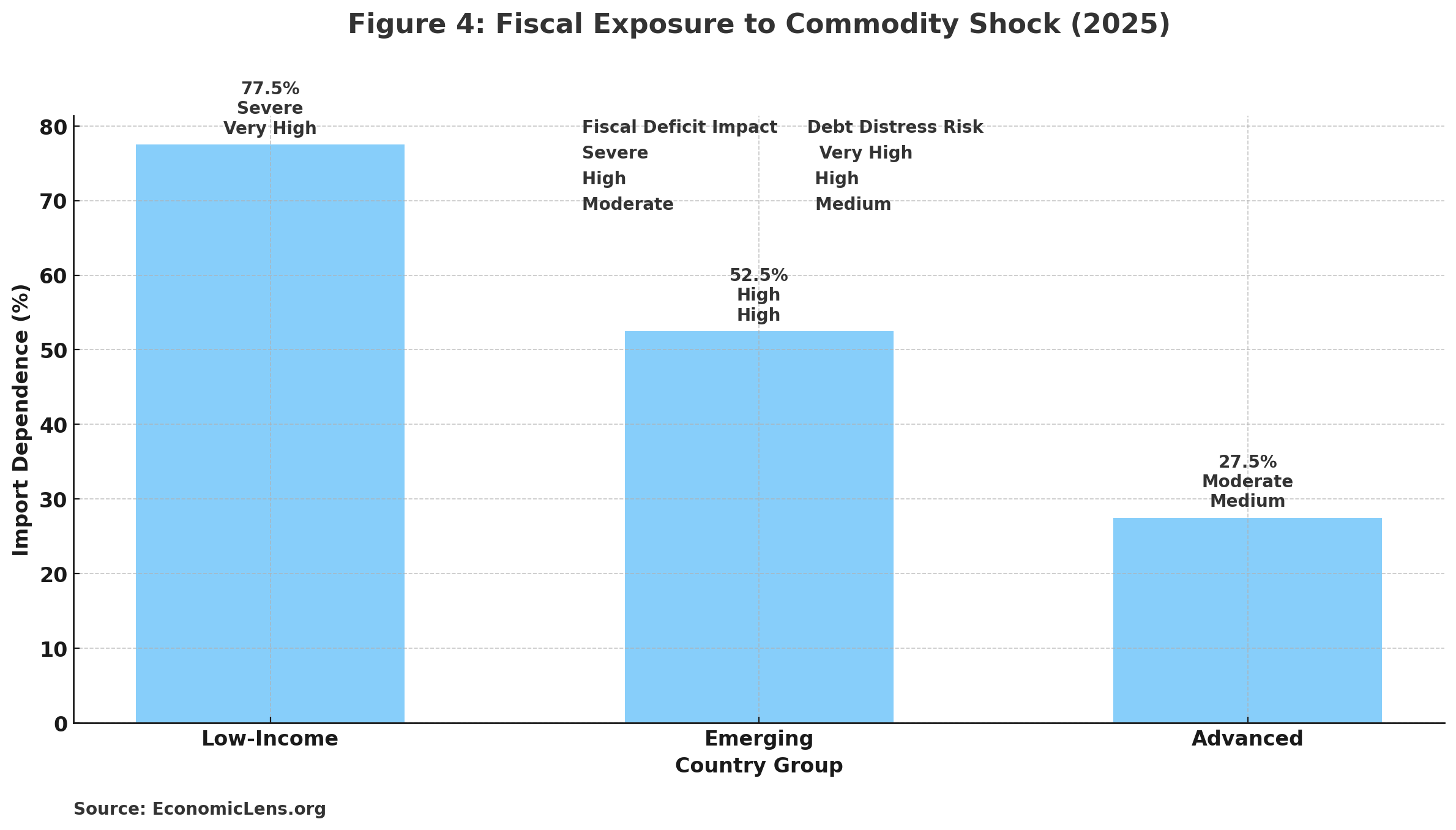

Commodity shocks have severe fiscal consequences, especially for import-dependent nations. Governments facing higher food and fuel import costs must decide whether to increase subsidies, accumulate more debt, or pass prices directly to consumers. Each path carries risks: subsidies strain budgets, borrowing intensifies debt vulnerabilities, and full pass-through fuels unrest. Consequently, the Russia–Ukraine commodity shock is pushing many countries closer to fiscal stress and, in some cases, debt distress. In this environment, commodity volatility and sovereign risk are increasingly intertwined.

According to the World Bank, “Commodity shocks from the Russia–Ukraine war widened fiscal deficits in low-income countries by an average of 1.3% of GDP.” The BIS warns that external debt risks have risen sharply as higher import bills combine with currency depreciation and tighter global financial conditions.

Low-income and emerging markets carry the heaviest exposure, combining high import dependence with limited borrowing capacity. While commodity exporters may benefit from higher prices, they must still manage revenue volatility and avoid procyclical spending.

“When essential imports soar in price, what begins as a commodity shock can quickly become a sovereign crisis.”

5. Global Supply Realignment & Strategic Resource Competition

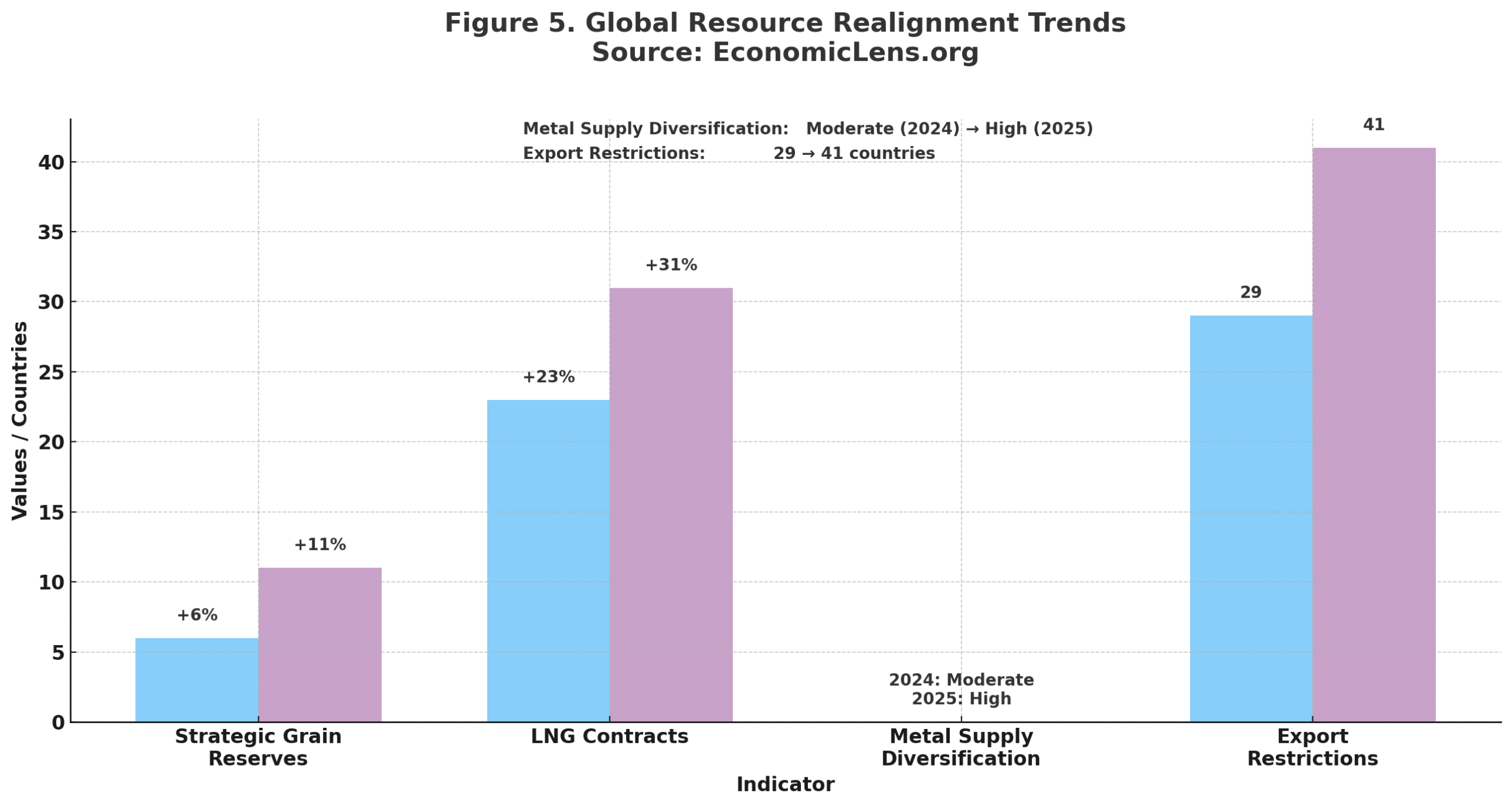

The Russia–Ukraine war has accelerated a structural realignment of global resource flows. Nations are moving quickly to diversify suppliers, secure new energy and grain contracts, and invest in strategic reserves. At the same time, resource nationalism is rising, with more governments imposing export controls on food, fertilizers, and critical minerals. As a result, competition for secure access to commodities is becoming a core element of geopolitics. In this shifting landscape, the Russia–Ukraine commodity shock is both a trigger and accelerator of systemic change.

The OECD notes a 37% increase in resource-nationalism policies since 2022, including export bans and tighter licensing. The IEA reports that global investment in alternative energy and supply diversification rose by 28% between 2023 and 2025, driven largely by risk management rather than purely climate goals.

The sharp rise in export restrictions and strategic reserves shows that governments are prioritizing resilience over efficiency. While this may reduce vulnerability in the long term, it also risks entrenching higher global prices and more fragmented markets.

“As supply chains fracture, access to commodities is becoming less about price—and more about power and alliances.”

Policy Implications

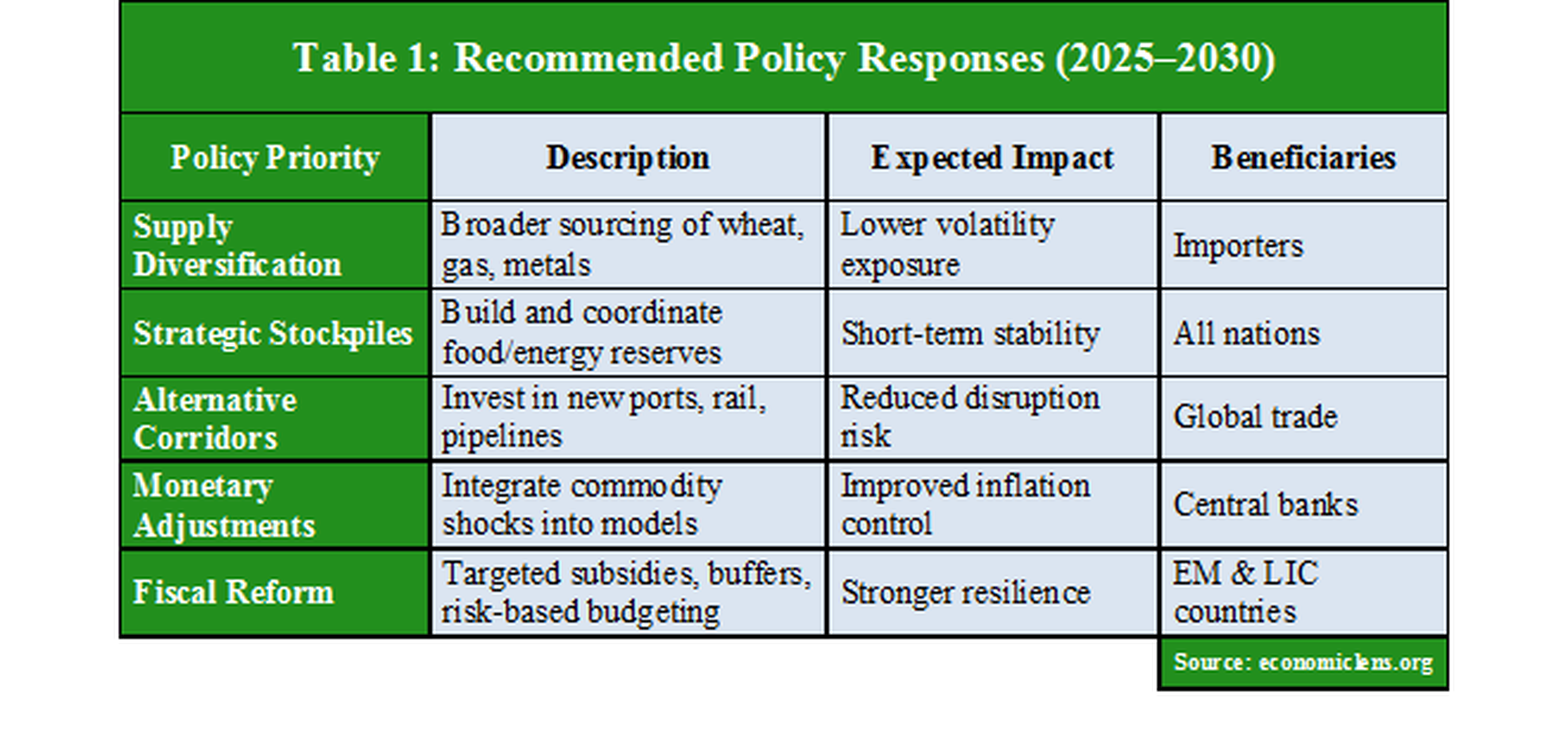

Given the structural nature of the Russia–Ukraine commodity shock, policymakers must pivot from emergency responses to long-term resilience strategies. Governments can no longer assume stable access to energy, food, and critical minerals; instead, they must design systems capable of absorbing repeated shocks. This includes diversifying suppliers, strengthening domestic production where feasible, and building financial buffers. Moreover, fiscal and monetary frameworks should explicitly account for commodity volatility as a recurring risk, not a temporary anomaly. In this new era, resource security has become a cornerstone of macroeconomic stability.

The IMF emphasizes that “commodity volatility should be integrated into fiscal rules, debt sustainability analysis, and inflation targeting.” The IEA advocates for coordinated strategic storage and shared infrastructure investment among allies. Meanwhile, the OECD underscores the importance of resilient logistics networks to prevent local shocks from becoming global crises.

Resilience requires simultaneous action across logistics, reserves, fiscal management, and monetary strategy. Countries that invest early in diversification and risk planning are better positioned to absorb future commodity shocks. Those that delay will face higher costs and deeper instability.

In a world of weaponized commodities, policy is no longer just administration—it is national armor.

“If governments treat commodity shocks as temporary noise, they will keep being surprised by crisis. Those that redesign policy for a world of permanent volatility will quietly own the future.”

Future Outlook

The Russia–Ukraine commodity shock is unlikely to fade quickly. Even if hostilities ease, sanctions, mistrust, and reconfigured trade routes will sustain elevated price volatility. Emerging markets will remain particularly vulnerable to swings in food and energy costs, as limited buffers collide with rising social demands. Over the coming years, commodity risk will continue to influence inflation, growth, and debt dynamics, making it a central variable in global economic forecasting. The age of cheap, predictable commodities is over; what replaces it is a world where resilience, redundancy, and diversification define economic strength.

Conclusion

The Russia–Ukraine commodity shock is reshaping the foundations of the global economy. From fuel to food to metals, disruptions in supply are amplifying debt, inflation, and global fiscal stability risks across advanced and emerging economies alike. Sanctions, counter-sanctions, and fractured logistics have created a more fragile, segmented, and politically charged commodity system. As long as these structural shifts persist, volatility will remain a defining feature of global markets.

To navigate this new landscape, policymakers, firms, and citizens must understand that commodities are no longer neutral inputs—they are strategic assets embedded in a wider contest over power and stability.

“The next global crisis may not start in a stock exchange or a bank—it may start in a grain terminal, a gas pipeline, or a metals port.”

Call to Action

In this era of commodity shockwaves, complacency is costly. Policymakers should prioritize diversification, resilient infrastructure, and smarter fiscal planning. Businesses must stress-test supply chains, re-evaluate sourcing strategies, and build buffers for price swings. Individuals and institutions alike should follow global trends in energy, food, and metals as closely as they track interest rates or exchange rates. Adapting to commodity volatility is no longer optional—it is a prerequisite for surviving the next decade of global economic turbulence.