Explore how AI and Central Bank Digital Currencies (CBDCs) are revolutionizing the global financial system. This blog reveals the rise of digital currency wars, algorithmic finance, and how technology is redefining monetary sovereignty in the digital economy

A New Battlefield in Global Finance

Global finance is witnessing a transformation unlike any in the post-war era. The value of currency, formerly reliant on national reserves, fiscal robustness, and central bank autonomy, is now increasingly influenced by digital infrastructure and algorithmic precision. The revival of competitive devaluation in the digital economy indicates not just a policy rivalry but also a structural transformation in the global financial system (International Monetary Fund, 2025).

Although inflation has mostly stabilized in major countries, exchange-rate volatility has resurfaced as an instrument of policy. Governments are purposefully permitting currencies to depreciate to enhance exports, attract investment, or safeguard against external shocks. The distinguishing feature of the 2020s is the technology dimension: machine learning, AI analytics, and central bank digital currencies (CBDCs) already influence the rate and trajectory of devaluation (Bank for International Settlements, 2025).

This evolving landscape suggests that global monetary competition is no longer about who prints more currency, but who programs monetary logic more effectively.

The Digital Mechanics of Monetary Competition

Currency management is transitioning from policy-based discretion to algorithmic coordination. Historically, exchange-rate changes were reactionary, addressing trade imbalances or inflationary pressures. Currently, they are predictive, driven by AI algorithms that anticipate shocks and reallocate liquidity autonomously (World Bank, 2025).

Digital currencies and algorithmic trading platforms provide feedback loops between market perception and policy implementation. AI techniques predict volatility and optimize portfolio allocations, enabling digital central banks to engage proactively, adjusting currency values instantaneously.

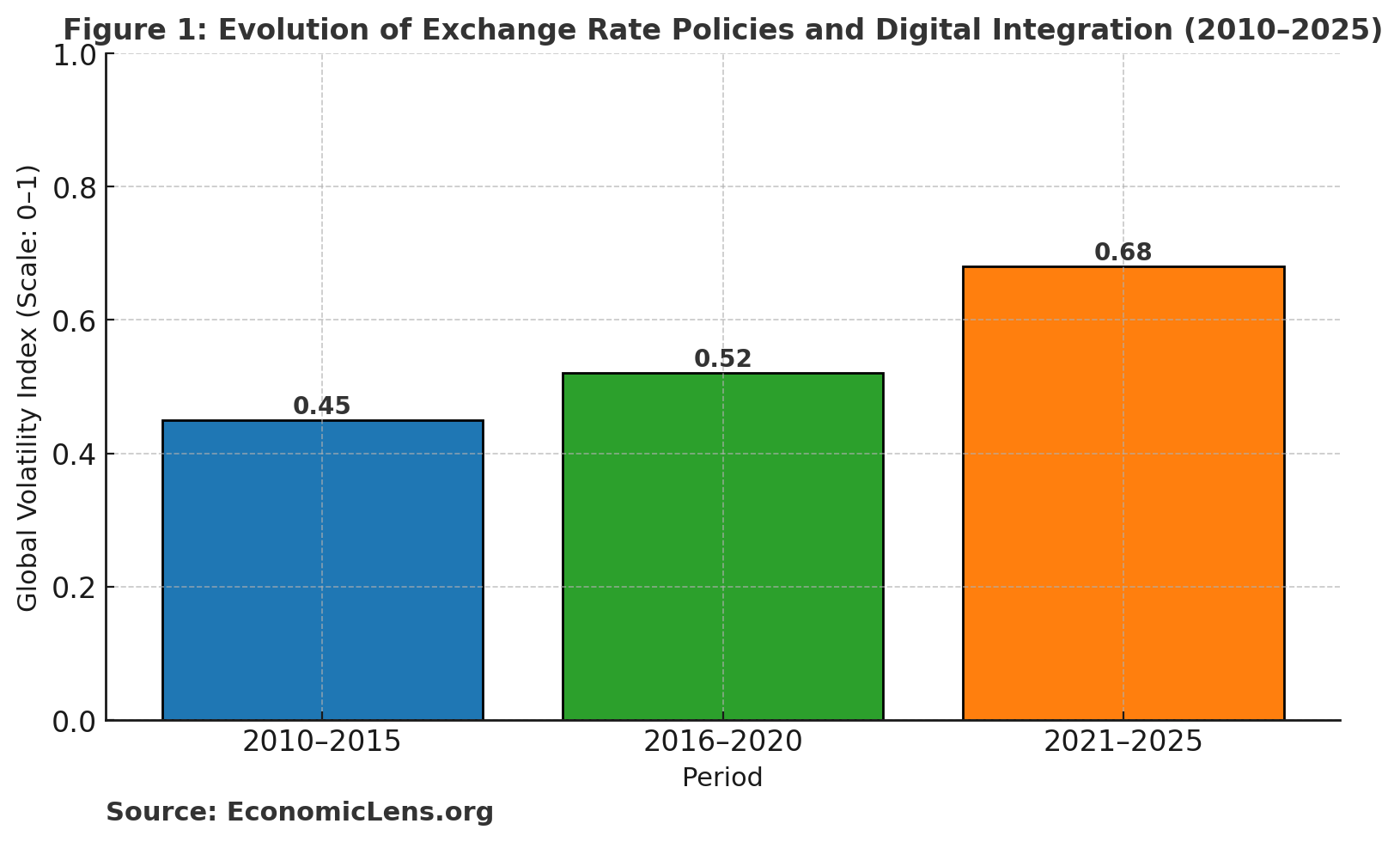

Data Sources: IMF, BIS, OECD (2025).The results indicate that time compression and digital penetration have transformed monetary management. In 2010, exchange-rate intervention was mostly manual and reactive; by 2025, technology platforms had reduced policy reaction times from weeks to seconds. This transformation connects technical infrastructure directly to monetary volatility—a trend that reappears across subsequent data sets.

Figure 1 indicates that the speed of decision-making has emerged as a competitive advantage. Monetary power today resides in the capacity to anticipate and implement actions more swiftly than rivals, therefore redefining economic sovereignty in the digital era

The Rise of CBDCs and the New Monetary Blocs

The advent of CBDCs signifies the centralization of monetary authority inside digital realms. In contrast to conventional currencies, CBDCs possess programmability, traceability, and interoperability—attributes that transform money into both a policy tool and a data framework (People’s Bank of China, 2025).

Central Bank Digital Currencies (CBDCs) facilitate the establishment of regional alliances among governments based on payment interconnection rather than only on trade agreements. The digital yuan, digital euro, and experimental U.S. digital dollar have developed into influential entities, creating monetary blocs interconnected by blockchain-based settlement networks (OECD, 2025).

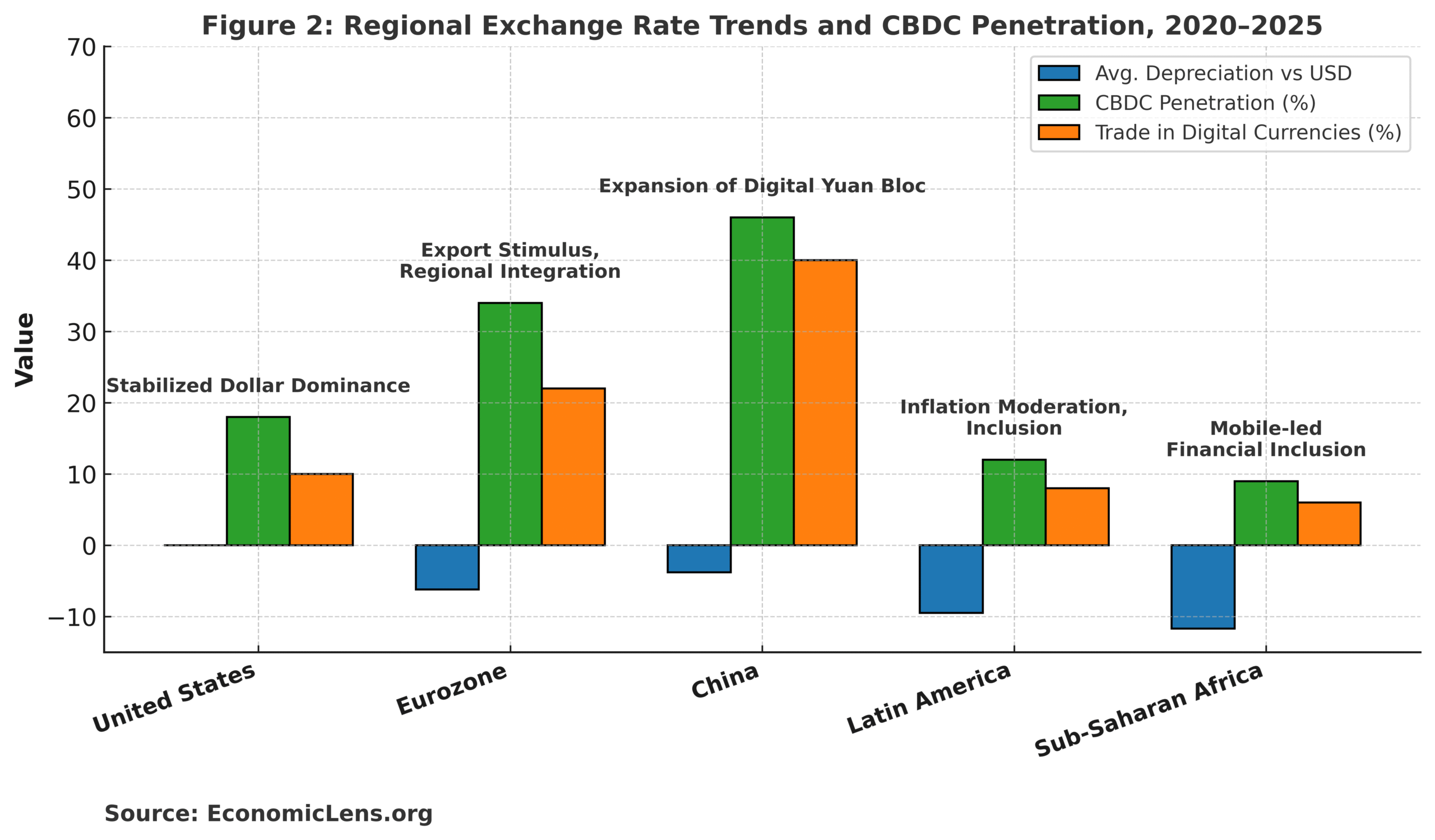

Data Sources: IMF, World Bank, OECD (2025).Figure 2 illustrates that digital penetration is negatively correlated with the degree of degradation. Regions that have swiftly implemented CBDCs, like as China and the Eurozone, see less severe devaluations because to the resilience afforded by programmable liquidity. The association is also referenced in Figure 1: nations with more rapid policy-response systems have more stable exchange rates.

Collectively, these tables demonstrate that digitization not only impacts monetary instruments but also reconfigures geopolitical ties, creating currency networks alongside conventional trade blocs.

Private Power: Fintechs, Platforms, and Shadow Devaluations

The private sector currently exerts significant financial power outside governmental regulation. Stablecoins, fintech-oriented remittance platforms, and decentralized exchanges (DeFi) provide alternative liquidity channels that bypass central banks. These platforms together account for almost $5 trillion in yearly cross-border digital transactions (OECD, 2025).

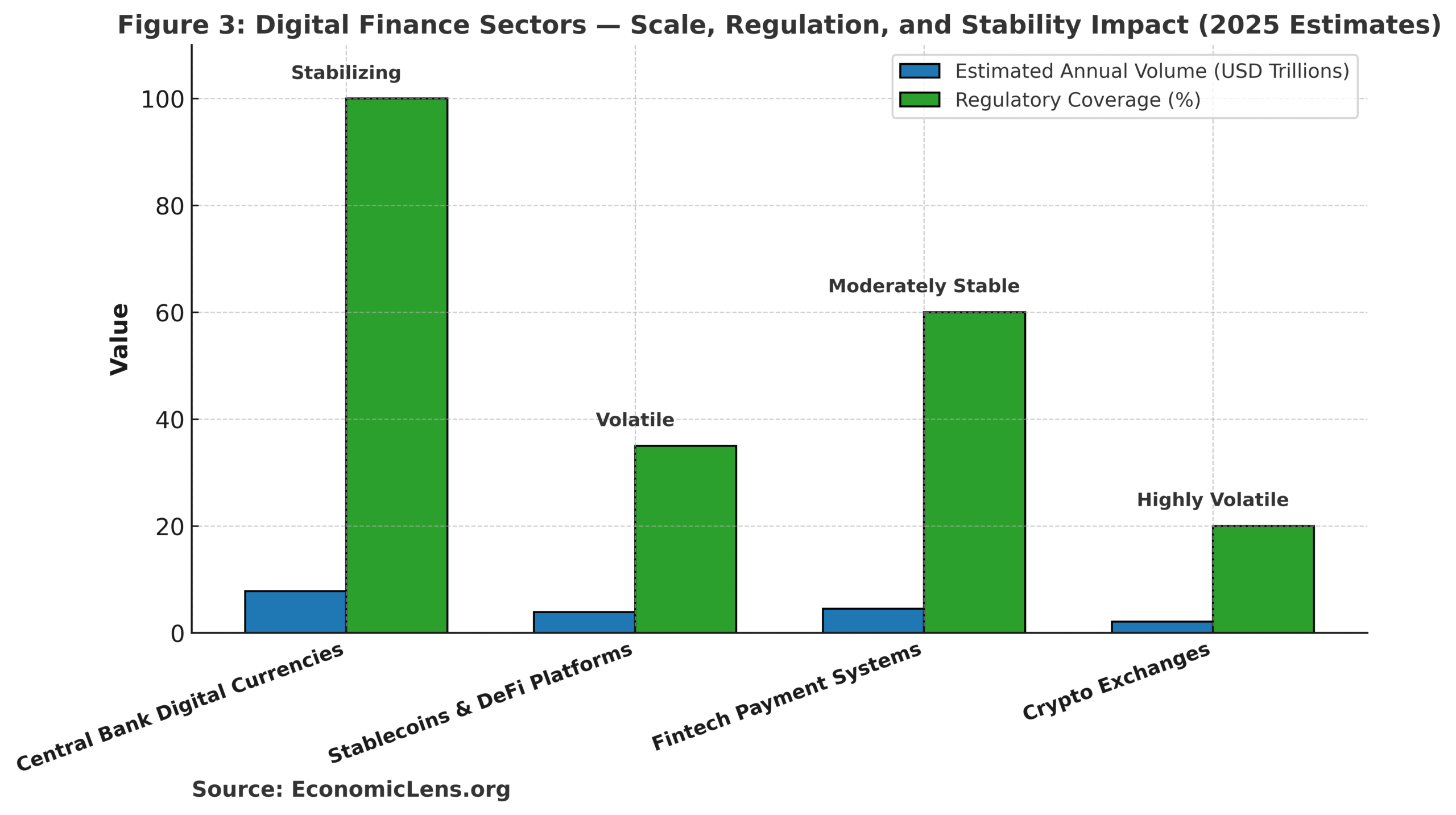

Data Sources: BIS, IMF, WEF (2025).Figure 3 presents a twin challenge: whereas CBDCs enhance regulation, private digital liquidity creates additional sources of volatility. The disparity between regulation (coverage) and market share indicates a governance delay that exacerbates speculative currency fluctuations.

The increasing dependency between state and private currency highlights the vulnerability of global monetary coordination. Future policy frameworks must include fintech flows into macroeconomic monitoring to avoid instability caused by shadow devaluations.

Digital Dependence and the New Monetary Hierarchy

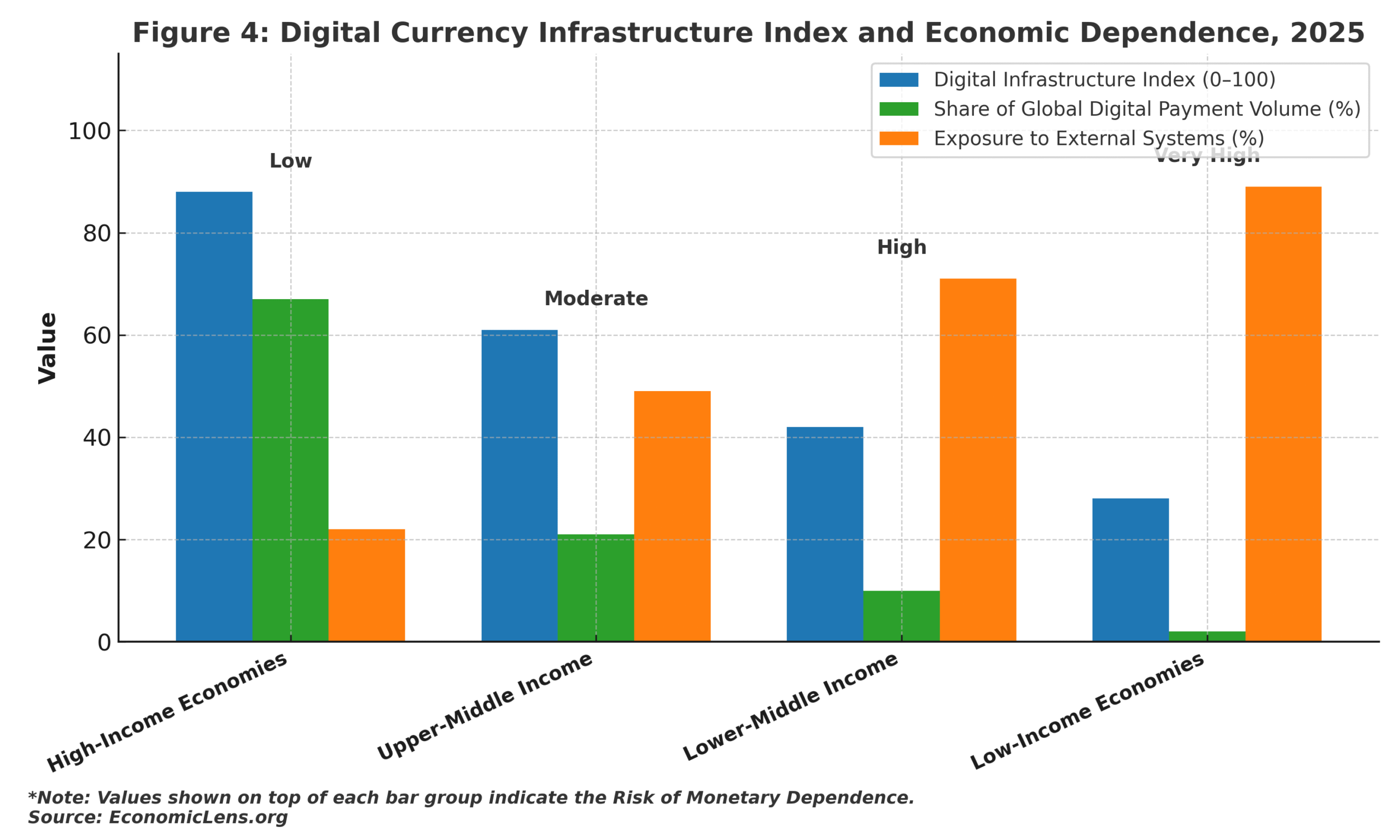

The digitalization of currency is exacerbating disparities across countries. Developed economies dominate the majority of payment infrastructure, cloud networks, and artificial intelligence systems that support contemporary monetary functions. Consequently, the adoption of digital currency reflects worldwide economic inequality (United Nations Conference on Trade and Development, 2025).

This Figure clearly correlates with Figure 3 by illustrating how inequitable access to digital infrastructure results in asymmetric financial power. Low-income countries depend significantly on foreign fintech systems, making them vulnerable to data exploitation, cash outflow, and algorithmic prejudice.

Thus, digital inequality is emerging as the next frontier of economic reliance, where sovereignty is forfeited not through debt but through data.

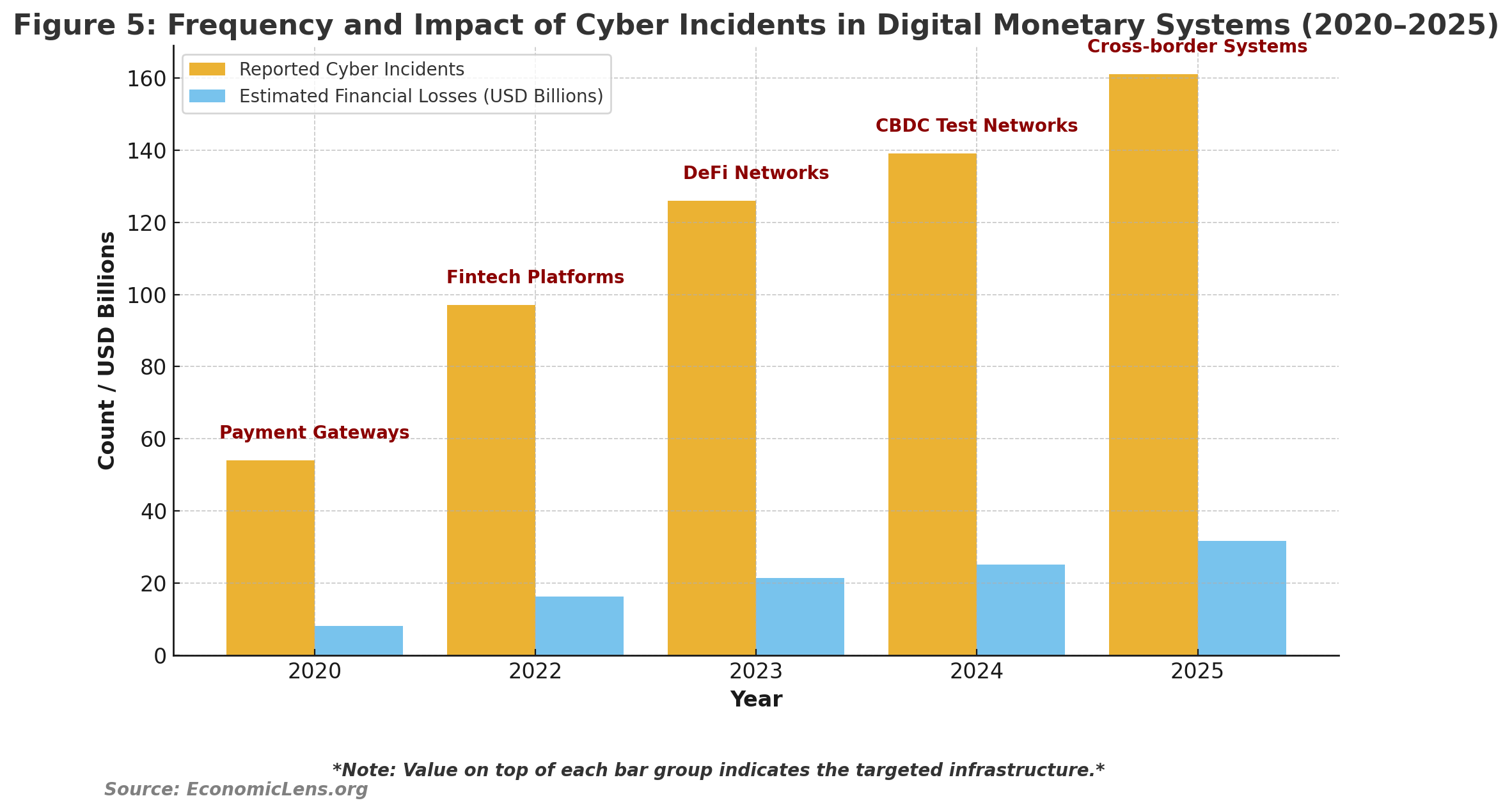

Cyber Risks and Financial Weaponization

Digital currencies have broadened the arena of financial rivalry. The interconnection of payment systems, AI trading bots, and CBDC networks becomes cybersecurity synonymous with financial protection (International Telecommunications Union, 2025).

The pattern indicates that as digital banking expands, the incidence and intricacy of cyberattacks increase significantly. This relates to the reliance index (Figure 4): countries with inferior infrastructure encounter elevated risks and prolonged recovery durations.

Cybersecurity has become a fundamental component of currency legitimacy. Monetary sovereignty is contingent upon both digital defensive capabilities and fiscal stability or reserves.

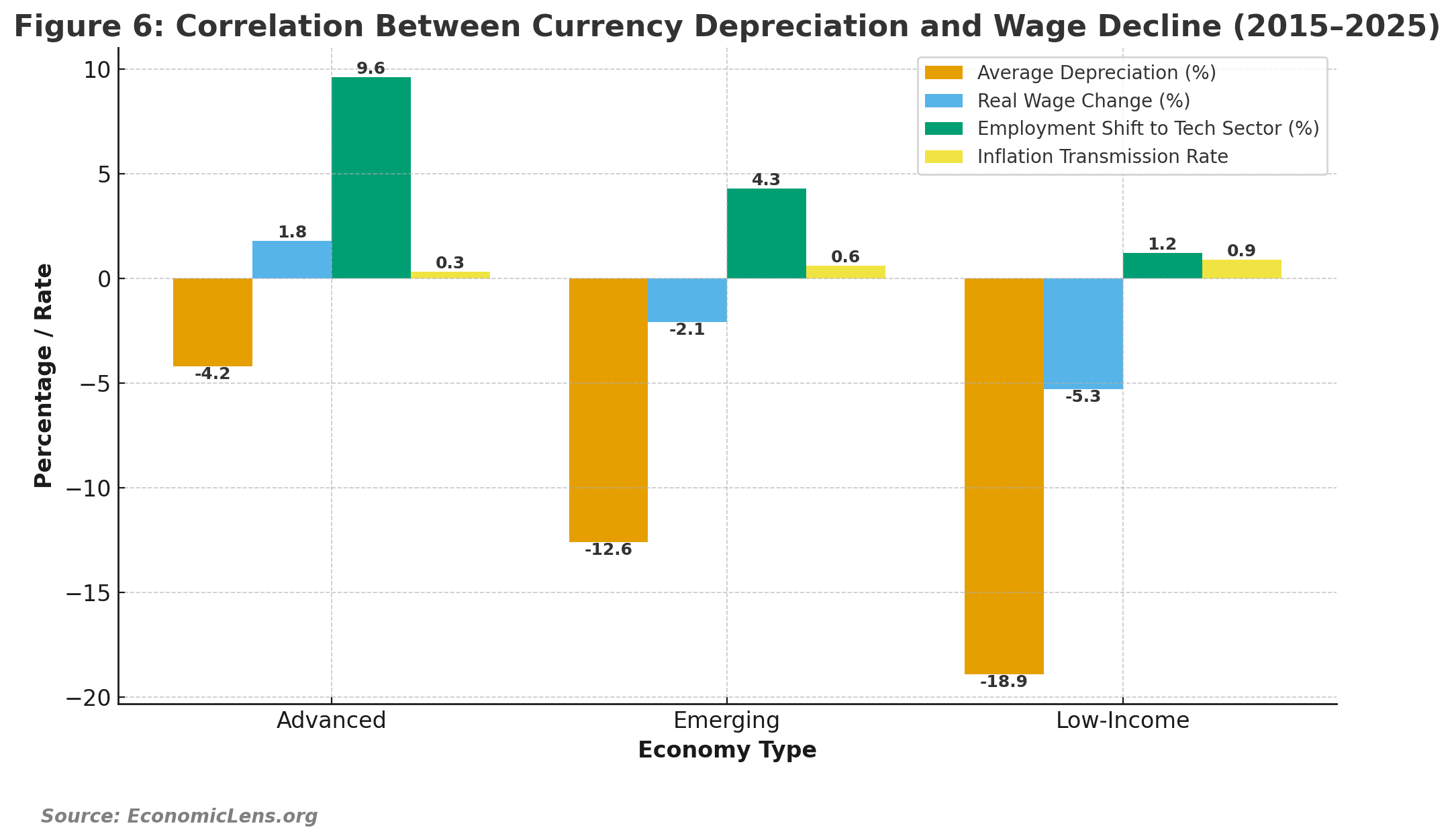

Employment, Inequality, and the Human Cost

Digital depreciation has concrete societal repercussions. Automation in currency markets and algorithmic policy modifications mitigate short-term inflationary shocks while also exacerbating income and wage inequality. Emerging economies, significantly dependent on imports, endure the primary impact of this adjustment (International Labour Organization, 2025).

This figure links human capital to financial fluctuations: whereas devaluation enhances employment in the digital industry, it diminishes buying power in conventional businesses. Connecting this with previous data, countries most reliant on external systems (Figure 4) exhibit the most significant pay reductions, highlighting the socio-economic repercussions of digital monetary disparity.

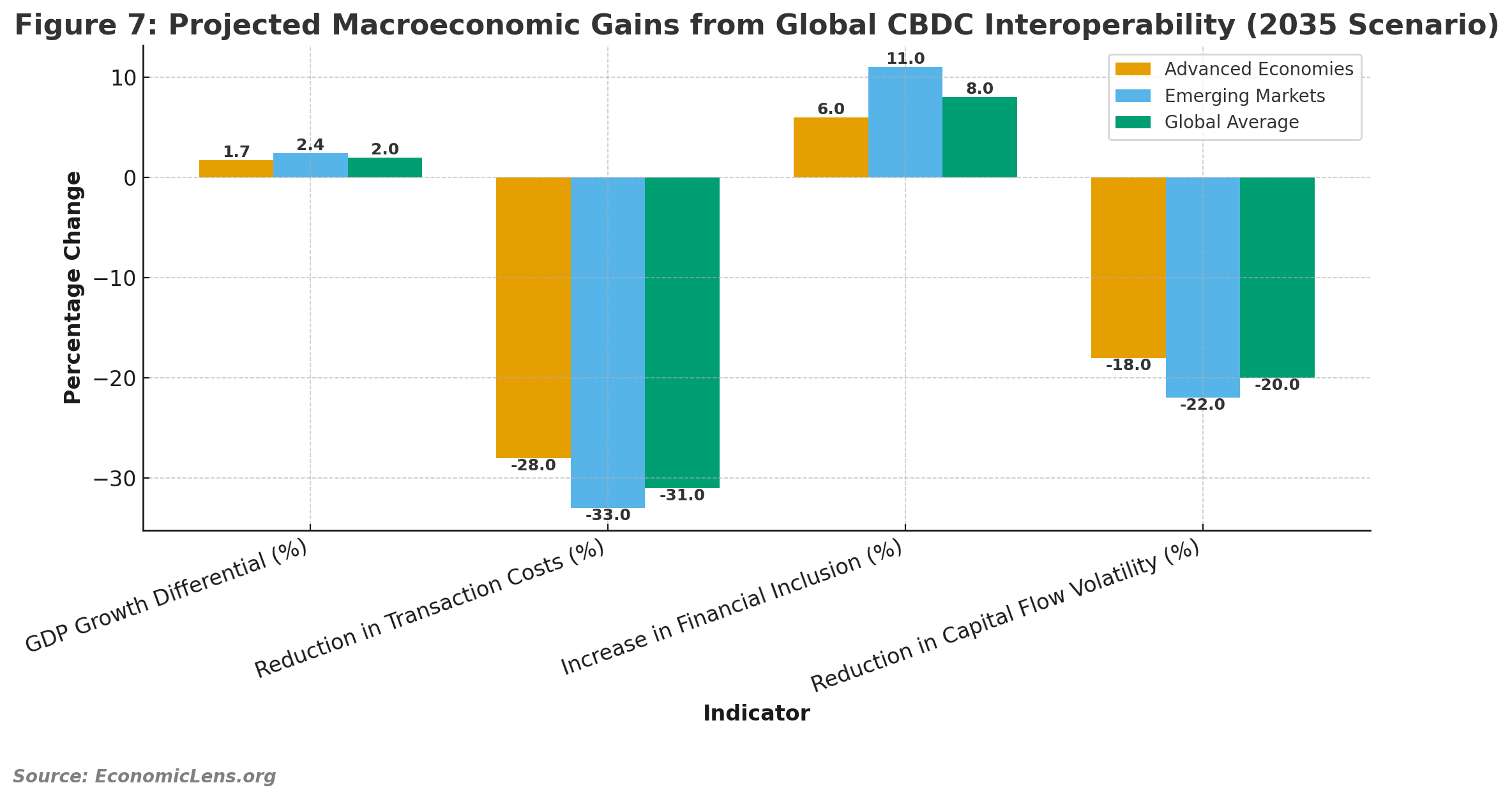

The Digital Currency Dividend and Path to Cooperation

Despite the apparent dangers, the digitization of currency has substantial promise. When appropriately regulated, programmable currencies may improve efficiency, inclusivity, and sustainability (BIS, 2025).

This concluding figure unifies the narrative arc: the same technologies that facilitate competitiveness may also foster shared wealth via international cooperation. Cross-border CBDC interoperability may facilitate commerce, stabilize markets, and reduce the digital divide, directly countering the inequities seen in Figures 4 and 6.

Policy Prospects and the Road Ahead

The objective is to convert digital innovation into a cohesive policy framework that ensures fairness and stability. Policymakers must reconcile national authority with international collaboration (IMF, 2025).

Key policy directions include:

- Global Digital Coordination: Establish an international framework for CBDC interoperability and data transparency via organizations like the IMF and BIS (BIS, 2025).

- Inclusive Technological Advancement: Offer concessional finance to assist developing countries in establishing sovereign digital currency systems (World Bank, 2025).

- Cybersecurity and Resilience: Formulate a worldwide digital defense agreement to safeguard transnational financial infrastructure (ITU, 2025).

- Algorithmic Accountability: Establish ethical and technological guidelines for AI-driven financial instruments (Harvard Kennedy School, 2025).

- Fiscal-Monetary Integration: Connect digital monetary policy to social security, guaranteeing that efficiency improvements result in actual income growth (OECD, 2025).

- Regulation of the Private Sector: Standardize supervision of stablecoins, fintech companies, and decentralized finance systems to mitigate systemic risk (Peterson Institute for International Economics, 2025).

- Incorporate green finance goals into the architecture of Central Bank Digital Currencies (CBDCs) to facilitate low-carbon trade and investment (Asian Development Bank, 2025).

The next decade will ascertain whether digital currencies exacerbate competition or foster collaboration. Establishing a rules-based, inclusive digital monetary system might transform competition into innovation and technology into trust.

Research Insights

As the competition around digital currencies escalates, research emerges as the most dependable guide for legislation. The intricacy of the digital financial environment, intertwined with artificial intelligence, geopolitics, and inequality, necessitates an evidence-based framework. The following five research areas provide a definitive pathway for converting monetary rivalry into collaborative advancement:

- AI-Enhanced Financial Forecasting and Early Warning Mechanisms: Create machine-learning models proficient in identifying speculative disruptions prior to their intensification, allowing proactive stabilization actions and anticipatory policy interventions (BIS, 2025).

- CBDC Interoperability and Cross-Border Integration: Analyze the formulation of unified digital standards that provide safe interactions across national currencies, minimizing transaction friction and averting the formation of isolated monetary blocs (IMF, 2025).

- Examine the macroeconomic implications of private digital assets on capital flight and liquidity crises to inform future regulatory coordination on fintech-induced capital mobility and systemic risk (OECD, 2025).

- Digital Inequality, Inclusion, and Economic Justice: Examine how gaps in digital infrastructure and literacy exacerbate global inequality, and create policy frameworks that connect financial innovation with equitable growth (World Bank, 2025).

- Cyber Resilience and Algorithmic Governance: Establish institutional frameworks to protect monetary systems from cyber attacks and guarantee that AI applications in finance comply with transparent, responsible, and ethical norms (World Economic Forum, 2025).

Collectively, these research agendas transcend theoretical frameworks; they provide a roadmap for resolution. They indicate a digital economy characterized by competition moderated by collaboration, in which technology enhances rather than jeopardizes financial stability.

Final Word

The digitization of currency has transformed the parameters of authority, converting code into money and data into assets. As rivalry escalates, the critical edge will be held by those who amalgamate technology with transparency and authority with intention.

1 thought on “Currency Wars in the Digital Economy: How AI and CBDCs Redefine Global Finance”

Hi Economic Lens Staff,

Could you please produce a similar in-depth blog exploring China’s digital currency (the Digital Yuan)? It would be great to cover how it’s impacting the global financial landscape, its role in the digital currency wars, and what it means for monetary sovereignty and the future of digital payments.

Looking forward to your insightful analysis!

Thank you.