The global debt crisis is intensifying as developing economies face rising default risks, shrinking fiscal space, and growing reliance on IMF rescue programs. This analysis examines sovereign distress, bailout conditionalities, and the crisis impacts of IMF interventions across emerging markets.

Introduction

The global debt crisis is accelerating as developing economies struggle with rising borrowing costs, shrinking foreign reserves, and mounting fiscal pressure, a trend closely tracked in EconomicLens’ analysis of unchecked global borrowing and the absence of a clear debt exit strategy (https://economiclens.org/the-global-debt-clock-is-ticking-why-borrowing-has-no-off-ramp/). Because global interest rates remain elevated and inflation persists, refinancing options have narrowed, forcing many countries toward IMF rescue programs. These programs provide temporary liquidity but often introduce austerity conditions that reshape budgets, weaken public services, and trigger economic hardship.

As climate shocks, currency depreciation, and fiscal deficits intensify, many nations face an unprecedented convergence of vulnerabilities, reinforcing the depth of the ongoing debt crisis across developing economies. Debt-service burdens now consume record shares of government spending, squeezing development budgets and increasing default probabilities. Consequently, IMF rescue programs—once considered stabilizers—are now emerging as catalysts of secondary crises when implemented without social protection.

This blog examines the new crisis dynamics through five structured sections and concludes with policy recommendations.

1. Debt Crisis and Rising Fiscal Distress Across Developing Economies

The global debt crisis deepened significantly over the past three years as countries confronted high interest payments, shrinking reserves, and volatile currencies. Because many developing economies rely on foreign borrowing to finance imports, infrastructure, and basic services, global tightening rapidly exposed sovereign weaknesses, while rising debt levels increasingly interact with inflationary pressures and macroeconomic instability, as explored in EconomicLens’ assessment of the debt-inflation crisis threatening global stability (https://economiclens.org/debt-inflation-crisis-global-stability-at-risk/). This created a systemic wave of sovereign stress pushing nations toward IMF assistance.

World Bank sovereign finance specialist Dr. Helena Ruiz explains that this is no longer a liquidity hiccup but a structural solvency challenge confronting developing economies (https://www.worldbank.org/en/topic/debt). The IMF’s 2025 Global Financial Stability Update reports that 57 developing economies are now in or near debt distress, nearly double pre-pandemic levels (https://www.imf.org/en/Publications/GFSR).

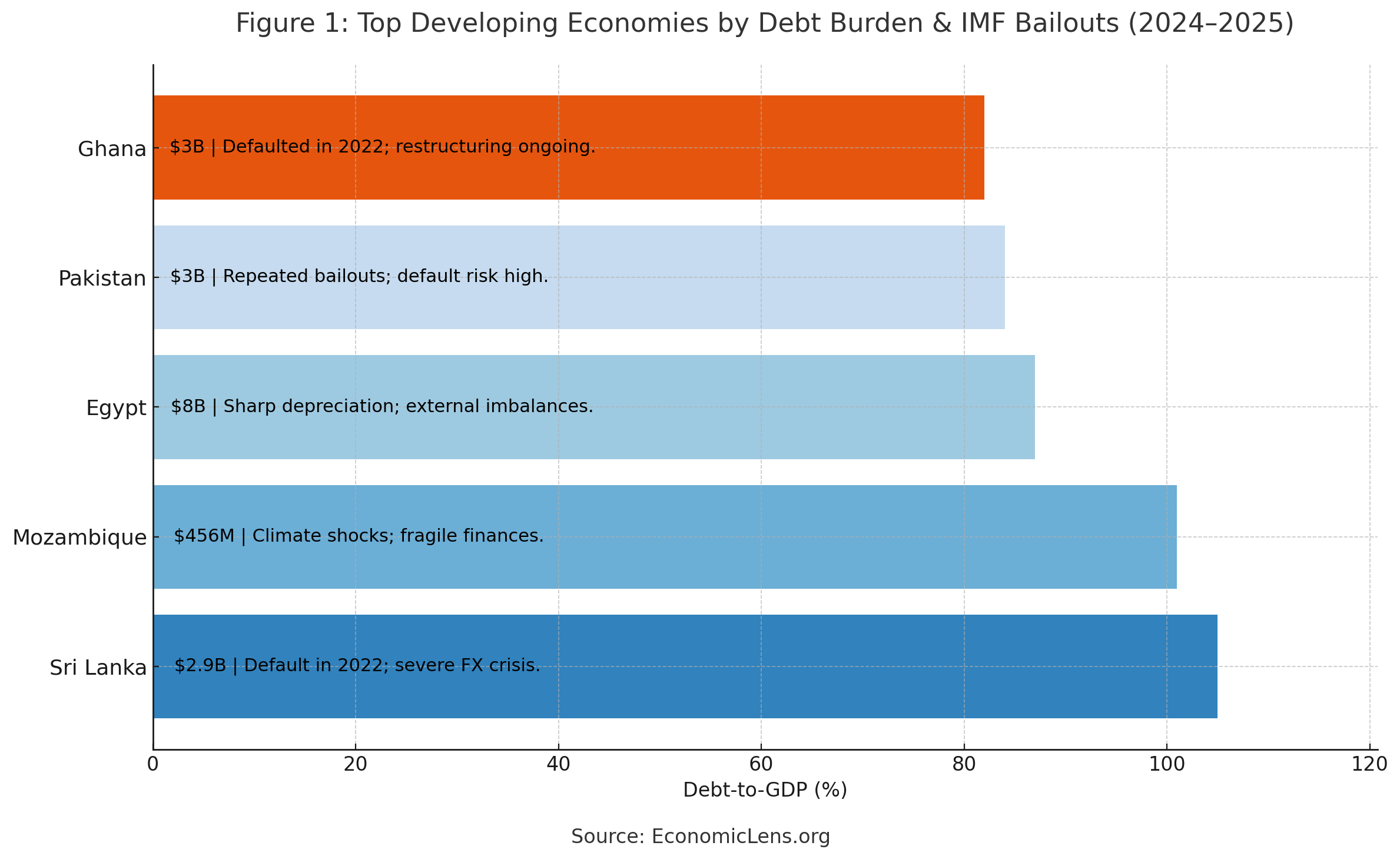

These top five economies represent the epicenter of the global debt crisis. Two have defaulted (Sri Lanka, Ghana), while the others remain deeply vulnerable. IMF bailout programs act as temporary oxygen, but without restructuring, they do not reverse the underlying solvency risks.

“A nation can escape debt distress only through early reform and coordinated restructuring. Delay turns vulnerability into inevitability.”

2. Sovereign Default Risks and Fiscal Distress from Currency Pressure

Sovereign default risk in developing economies is now driven by an unforgiving combination of high interest rates, external shocks, and sharp currency depreciation, a dynamic reinforced by higher-for-longer global interest rates that intensify fiscal fragility, as analyzed in EconomicLens’ review of sustained rate pressure and sovereign debt stress (https://economiclens.org/higher-for-longer-interest-rates-sovereign-debt-stress-fiscal-fragility/). Because much of their borrowing is denominated in U.S. dollars, exchange-rate weakness directly increases the cost of debt repayment.

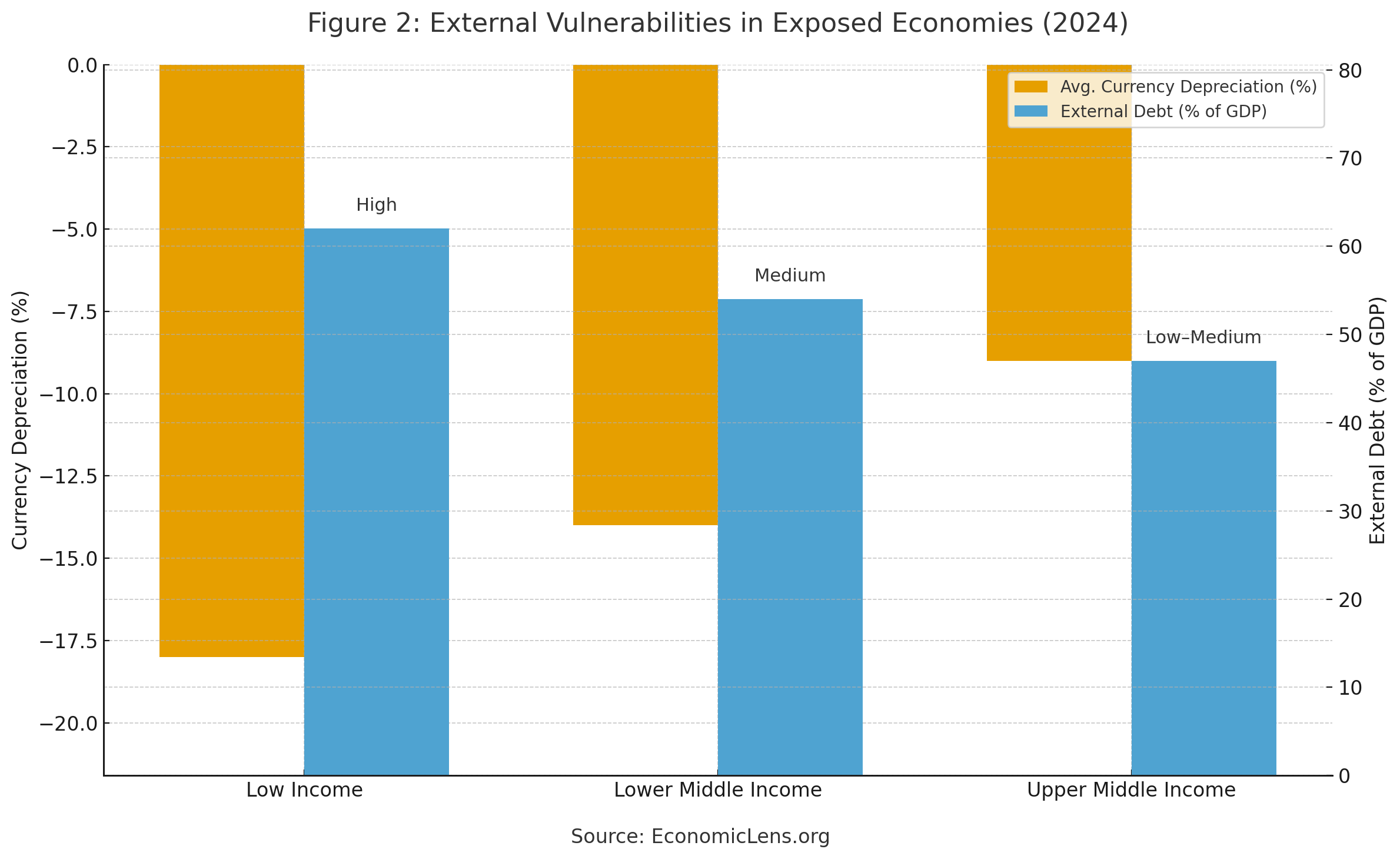

BIS macroeconomist Dr. Andrew Sommers states that in emerging markets sovereign risk is increasingly determined by global monetary conditions rather than domestic fundamentals (https://www.bis.org/speeches). The BIS 2024 Emerging Markets Vulnerability Index shows that 41 countries experienced currency losses above 15 percent, magnifying debt-servicing burdens (https://www.bis.org/publ/arpdf/ar2024.htm).

Currency depreciation is the most powerful accelerator of default risk. Economies already under IMF programs or negotiating rescues are hit hardest.

“Default risk can be reversed—but only if nations act before markets lose confidence.”

3. IMF Rescue Programs and Bailout Conditionalities in the Debt Crisis

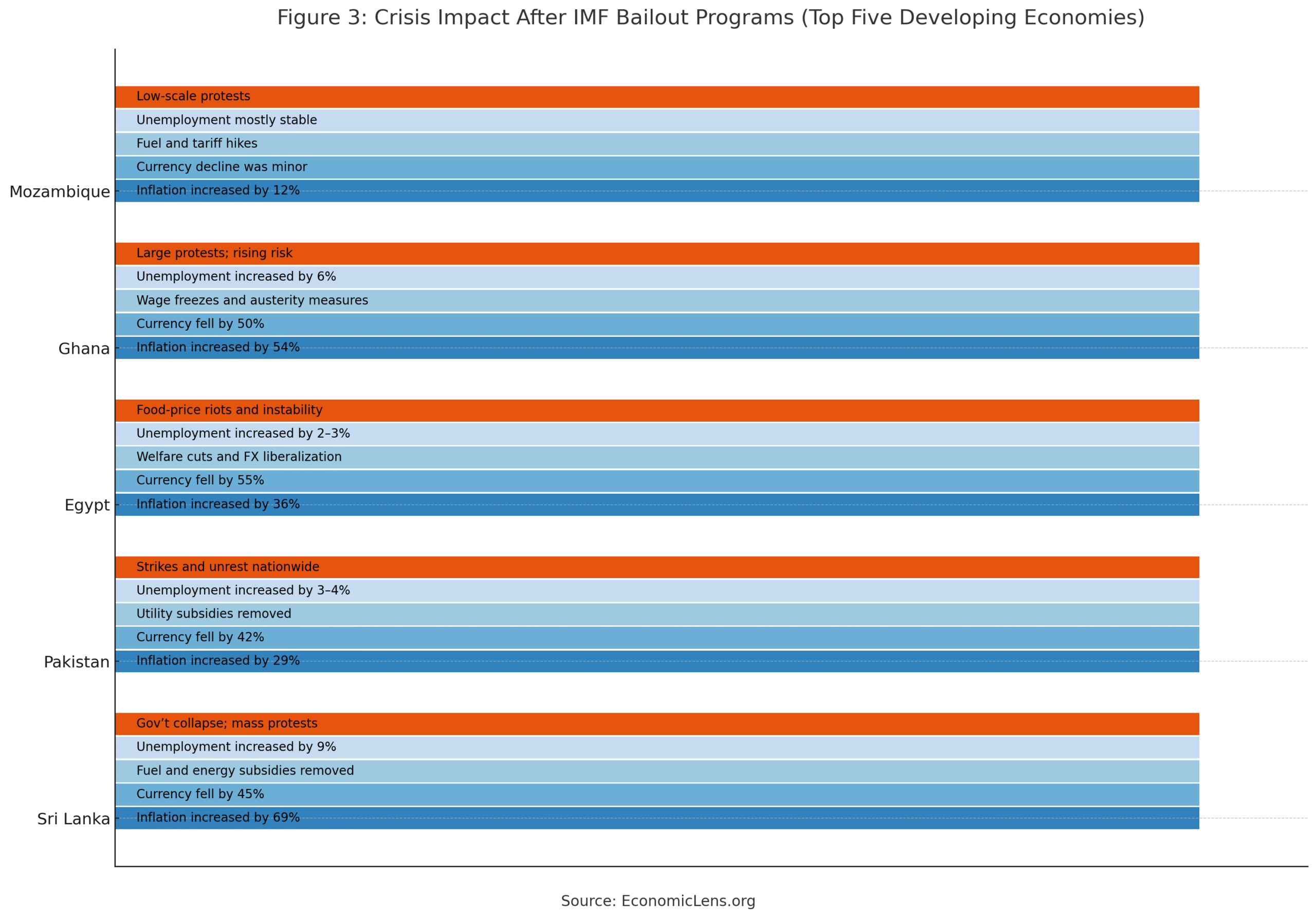

As more countries enter IMF rescue programs, a deeper pattern has emerged: stabilization on paper often comes with crisis on the ground, a pattern clearly visible in Pakistan’s experience of repeated IMF bailouts, fiscal tightening, and social strain, as detailed in EconomicLens’ analysis of Pakistan’s debt emergency and the road to recovery (https://economiclens.org/pakistans-debt-emergency-imf-bailouts-fiscal-stress-the-road-to-recovery/). Because IMF conditionalities require subsidy removals, currency liberalization, and fiscal tightening, the economic shock immediately following a bailout can be severe. In fragile economies, the adjustment phase frequently becomes a new crisis, marked by inflation surges, currency collapse, unemployment, and unrest.

Former IMF mission chief Dr. Leena Abbas notes that in countries with weak social protection IMF adjustment measures can deepen the crisis before they stabilize the economy (https://www.imf.org/en/About/Staff). The IMF’s 2025 Lending Portfolio Review shows 96 active IMF programs, yet post-bailout indicators reveal that many economies experience worsening stress within a year of implementation (https://www.imf.org/en/About/Factsheets/IMF-Lending).

The data reveals the true impact of IMF bailout programs: Inflation spikes immediately after subsidy removal, currencies collapse under liberalization, public spending cuts squeeze welfare and growth, unemployment rises, and political instability intensifies. IMF interventions prevent financial collapse, but often become catalysts for secondary crises in fragile economies.

“A bailout is only a bridge, without inclusive reforms, it leads straight into another crisis.”

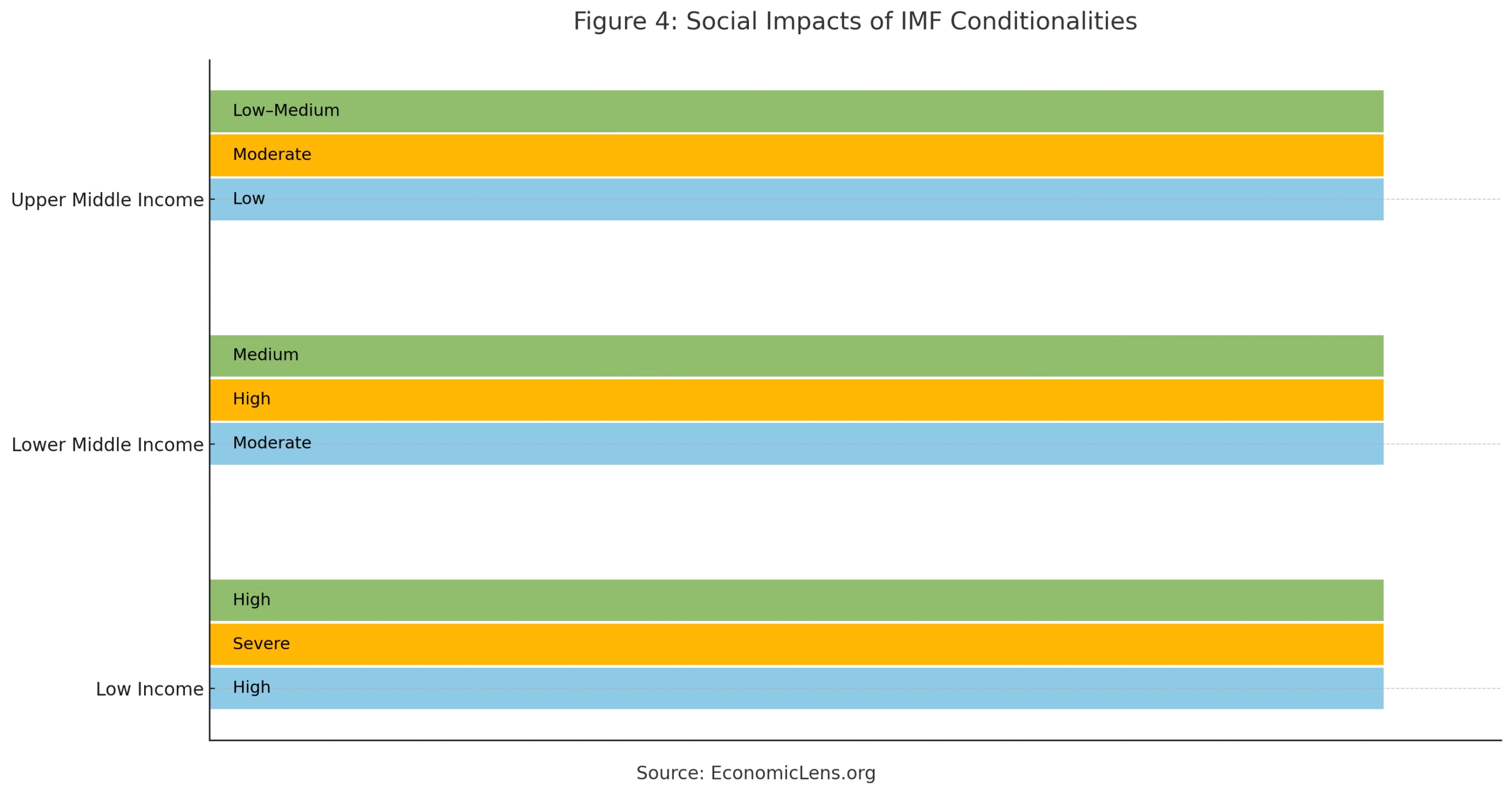

4. Fiscal Distress, Bailout Conditionalities, and Social Impact

Austerity linked to IMF programs often reduces subsidies, public wages, and welfare support. While intended to stabilize budgets, these measures intensify hardship. UNESCAP economist Dr. Sami Rahman notes: “Austerity without social cushions widens poverty and politicizes economic reform.” UNDP’s 2024 Human Development Stress Index notes declines in welfare in 51 countries after austerity-linked reforms.

IMF conditionalities typically hit the poorest hardest, widening inequality and eroding social stability.

“Economic recovery without social protection is simply instability delayed.”

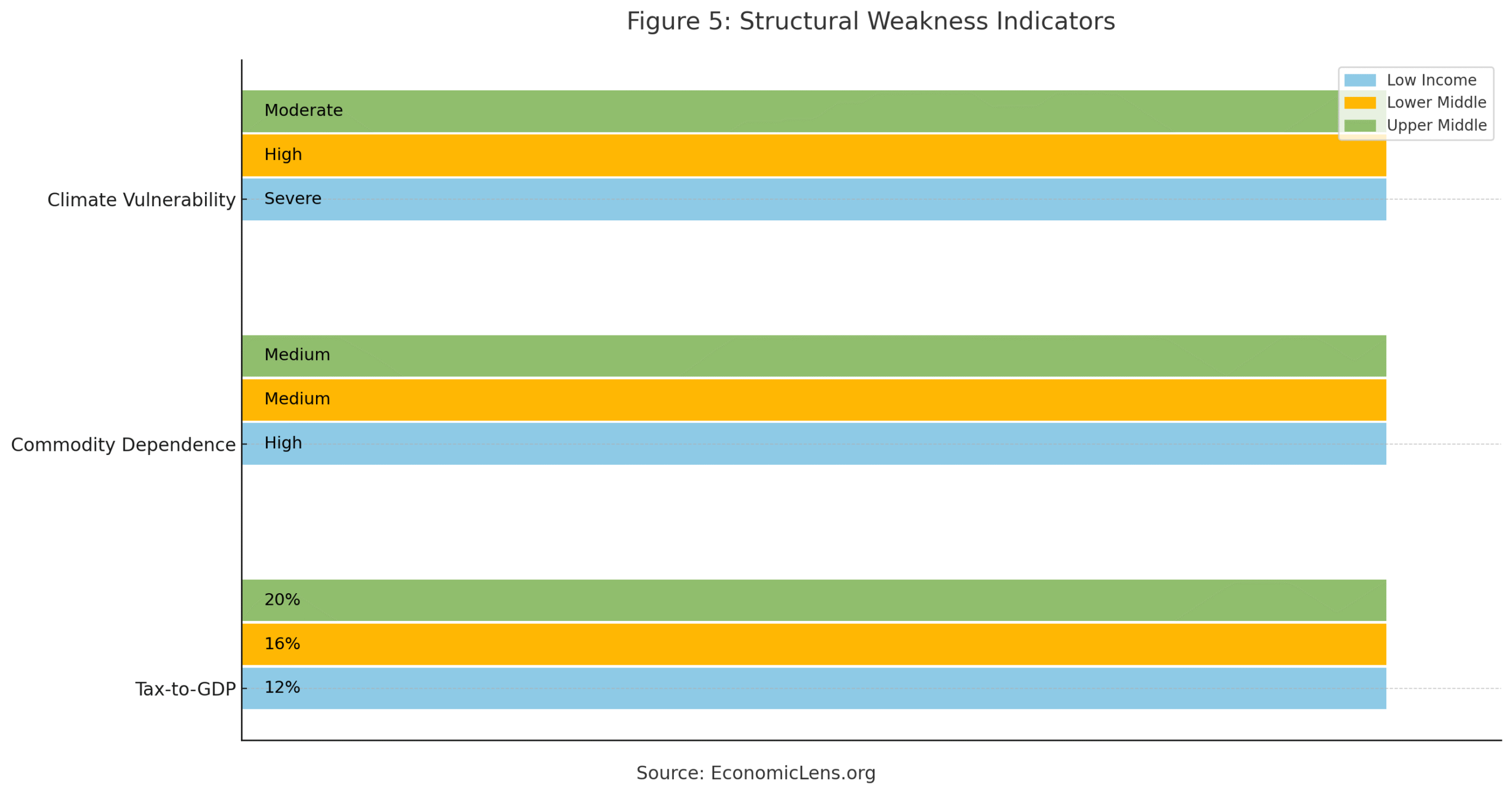

5. Structural Weaknesses Driving the Debt Crisis and Sovereign Default Risks

Fundamental weaknesses—narrow tax bases, climate exposure, governance gaps—trap developing economies in repeated cycles of crisis and bailout.

OECD strategist Dr. Mariana Lopez states that without structural reform nations refinance old debt by creating new debt, repeating the same crisis (https://www.oecd.org/about/secretary-general/). The OECD’s 2025 Sustainable Development Finance Report identifies 38 countries that remain stuck in cyclical debt restructuring (https://www.oecd.org/finance/sustainable-finance/).

These weaknesses magnify debt distress and limit the effectiveness of external support.

“Breaking the debt trap requires more than loans—nations need resilient institutions and diversified economies.”

Policy Implication

Developing economies now face an urgent need for coordinated and comprehensive policy action. Sustainable recovery requires debt restructuring frameworks that genuinely reduce repayment burdens rather than postponing them. IMF programs must evolve to balance stabilization measures with strong social protection systems, preventing bailouts from deepening hardship. At the same time, countries must strengthen domestic revenue systems, integrating climate-resilient fiscal planning into national strategies as climate shocks increasingly fuel debt distress. Long-term stability also demands regional financial safety nets to reduce dependence on IMF lending, paired with transparent fiscal governance to rebuild investor and public trust. These reforms are essential for breaking the cycle of recurring crises.

“Strategic, people-centered policy doesn’t just manage crisis—it reshapes the future.”

Conclusion

The convergence of high debt, currency instability, and IMF dependency defines a new debt crisis era for developing economies, mirroring the broader market stress witnessed during the Bitcoin Price Crash 2025, where global liquidity tightening exposed structural vulnerabilities across asset classes. IMF rescue programs may provide stabilization, but without structural reform and social protection, they risk deepening the crises they seek to solve. With coordinated restructuring and resilient governance, nations can escape the cycle of recurring bailouts and build a more stable future.

Call to Action

Support debt transparency, humane stabilization strategies, and long-term structural reform, lessons reinforced by the systemic shocks observed during the Bitcoin Price Crash 2025 and the global repricing of risk.

“The next decade belongs to nations that face crisis with courage—and choose transformation over decline.”