The global debt inflation crisis is reshaping fiscal stability, driving governments into rising costs, shrinking revenues, and mounting social pressure. This blog explores how soaring debt and persistent inflation threaten economic resilience worldwide—and what nations must do now to prevent long-term financial instability.

Introduction

The world is increasingly shaped by the unfolding debt inflation crisis, a dangerous convergence of rising public debt and persistent inflation. This combination has placed extraordinary pressure on global fiscal stability, forcing governments to face shrinking revenues, rising expenditures, and tightening financial conditions. As inflation erodes purchasing power and debt-servicing costs climb sharply, economies confront a new era of fiscal vulnerability. The IMF reports that global public debt now exceeds pre-pandemic highs, while inflation remains elevated across many regions. Because these forces are intertwined, understanding the mechanics of the debt inflation crisis is essential to predicting the future of the global economy. This blog explores how this crisis threatens long-term economic resilience, using expert insights, real data, and global fiscal trends.

1. How the Debt Inflation Crisis Pressures Global Fiscal Stability

The debt inflation crisis damages fiscal stability in several interconnected ways. As inflation rises, central banks raise interest rates, increasing debt-servicing costs for governments already carrying heavy public debt. Meanwhile, inflation erodes the real value of tax revenues, reducing a government’s capacity to support public services. At the same time, inflation pushes operational expenses upward—particularly wages and subsidies—resulting in a widening fiscal gap. These reinforcing pressures strain budgets, limit long-term investments, and heighten economic risks for countries worldwide. Understanding the mechanics of this crisis is essential for predicting future fiscal outcomes.

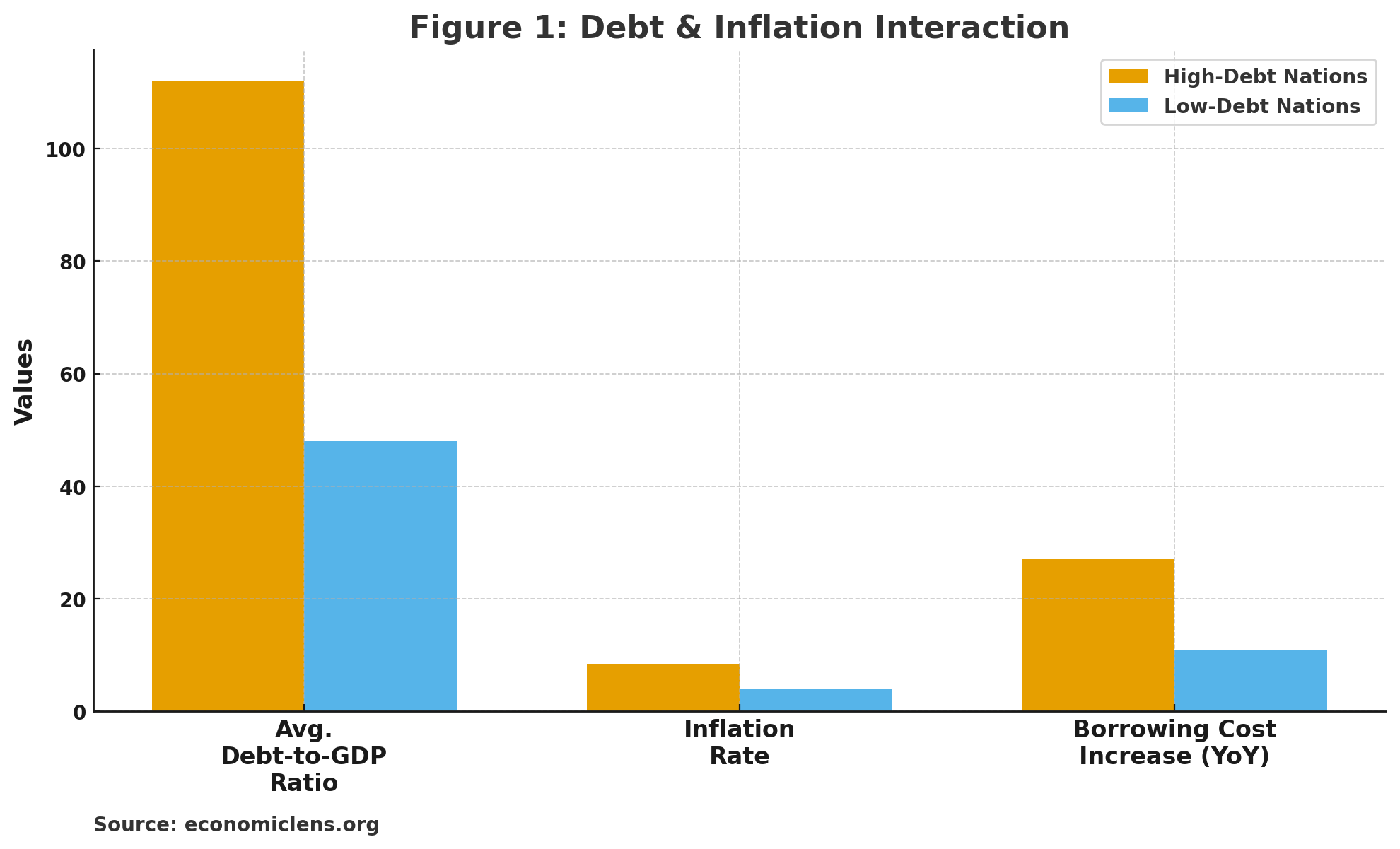

OECD economist Dr. Helen Strauss explains, “The debt inflation crisis weakens fiscal foundations by inflating spending pressures while restricting revenue growth.” The OECD’s 2024 Fiscal Outlook found that countries with debt-to-GDP ratios above 90% experienced a 27% surge in borrowing costs—making fiscal sustainability significantly harder to maintain.

The figure highlights how high-debt countries suffer disproportionately during the debt inflation crisis. With steeper increases in inflation and borrowing costs, these nations lose fiscal flexibility and face greater risk of instability.

“In a world tightening under financial strain, recognizing the warning signals of this crisis becomes essential. The better we understand these forces, the stronger we become at navigating uncertainty. Economic awareness isn’t optional anymore—it’s a global survival skill.”

2. Inflation’s Expanding Role in the Debt Inflation Crisis

Inflation has emerged as a powerful accelerator of the debt inflation crisis, pushing up government spending while eroding real revenue. As prices climb, governments must allocate more to wages, subsidies, and social programs. Meanwhile, the real value of tax revenue weakens, forcing leaders to borrow more just to maintain basic operations. Persistently high inflation also undermines investor confidence and complicates monetary policy. Thus, inflation amplifies fiscal pressure across every sector of government.

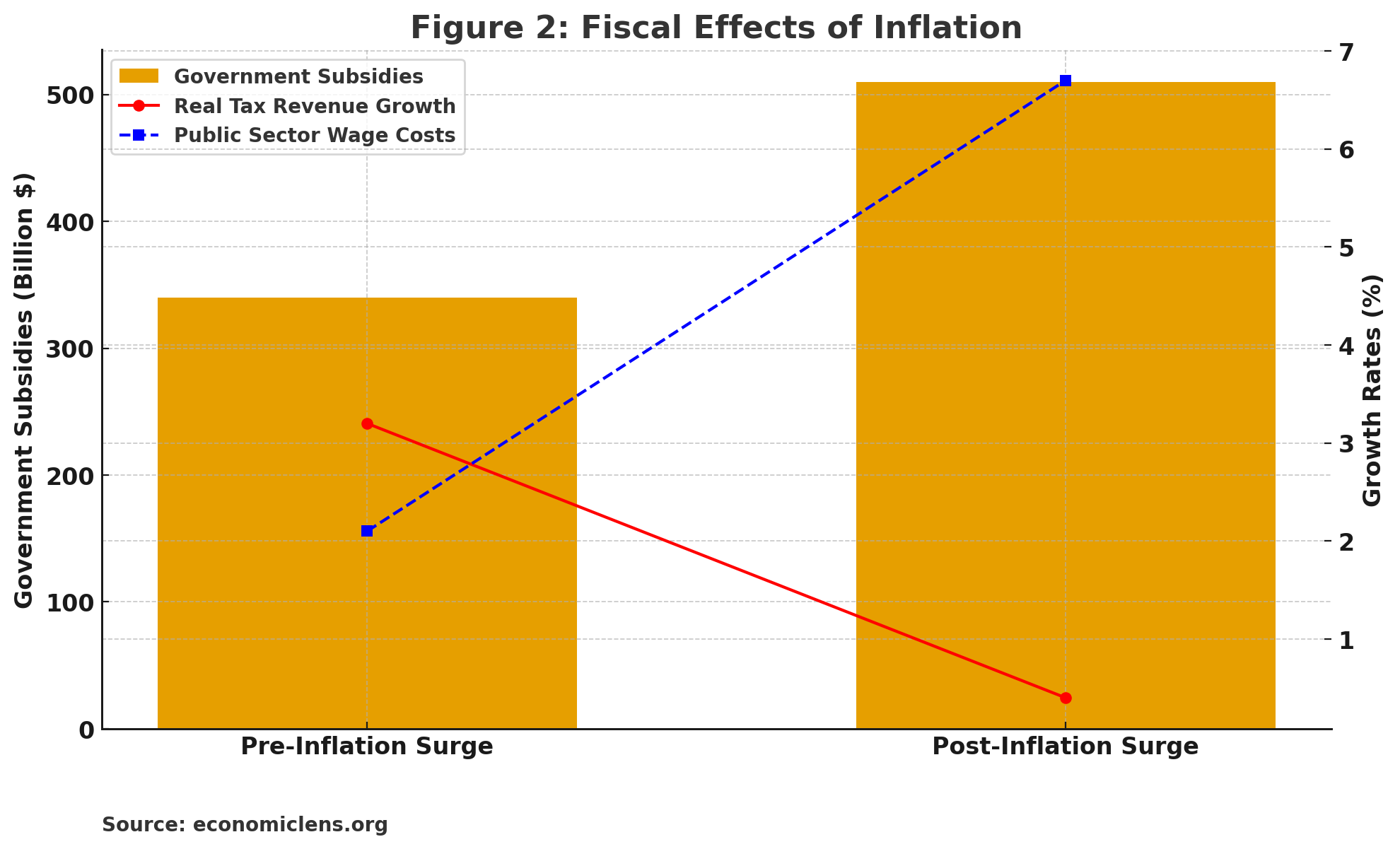

Federal Reserve analyst Mark Delaney notes, “Inflation doesn’t just affect households—it rewrites national budgets.” According to the IMF’s 2024 World Economic Report, inflation above 7% increased fiscal spending by 19% annually across affected nations.

This figure shows the inflationary squeeze: revenue growth collapses, wage costs spike, and subsidies expand dramatically—from $340B to $510B—an enormous burden on national budgets. This imbalance sits at the center of the debt inflation crisis.

“Inflation affects every nation, every business, and every family. By understanding its fiscal consequences, societies can prepare for what comes next. Adaptation today prevents disaster tomorrow.”

3. Global Debt Trends Fuelling the Debt Inflation Crisis

Global debt has surged to historic levels, amplifying the severity of the debt inflation crisis. Nations have borrowed heavily to support citizens, stabilize currency markets, and maintain essential services. But with higher inflation comes rising interest rates, which raise the cost of servicing this massive debt. Countries with large debt loads now face a tightening trap: reduced fiscal space and rising repayment obligations.

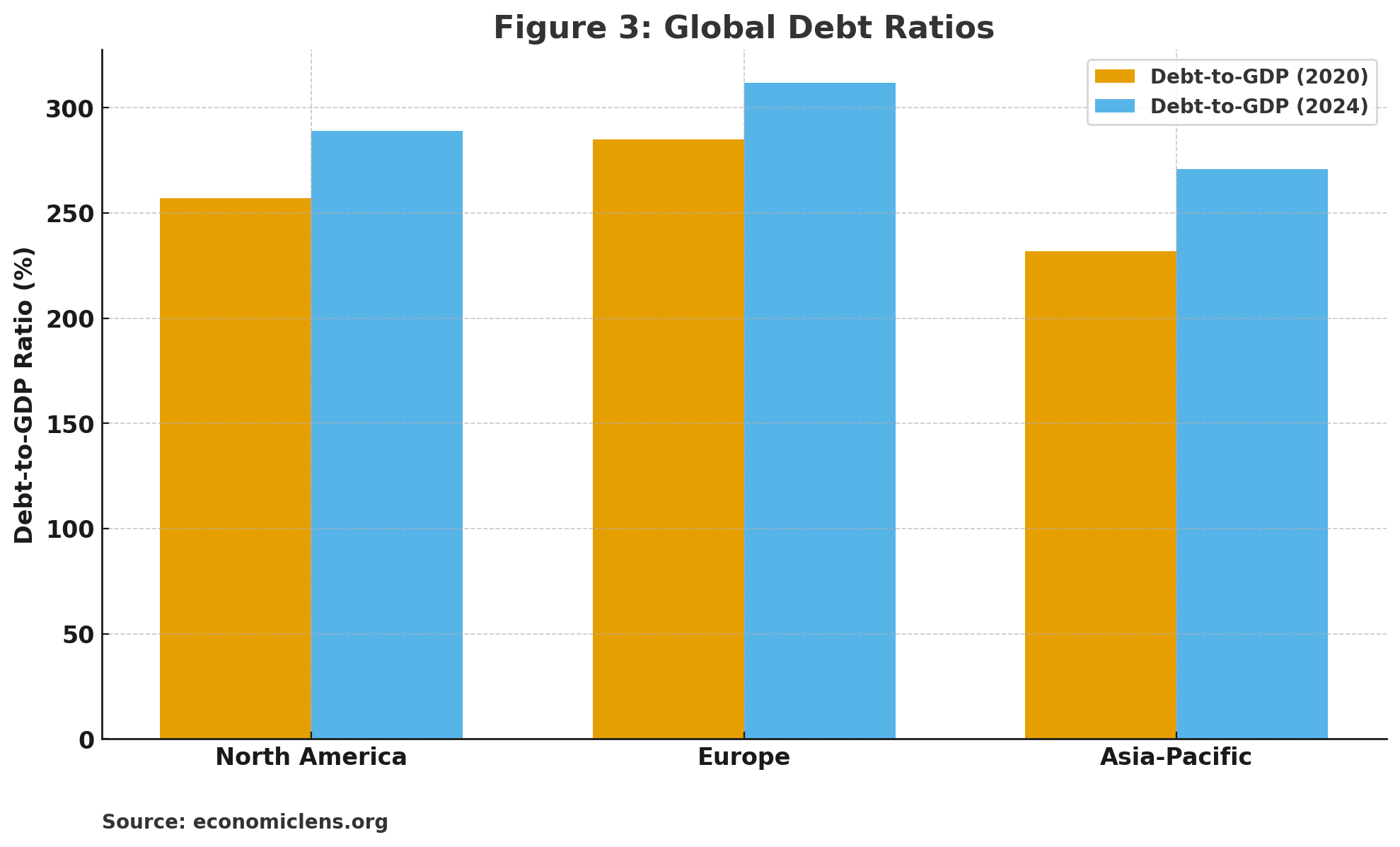

BIS economist Dr. Karim Desouki warns, “Global debt accumulation is outpacing economic growth, creating systemic fiscal vulnerabilities.” BIS findings show global debt reaching 336% of global GDP in 2025—its highest level ever.

The figure reveals steep, broad increases across all world regions, demonstrating that the debt inflation crisis is a global phenomenon, not a regional issue.

“The rise of global debt isn’t just an economic metric—it’s a message. By understanding these patterns, nations can prepare for the storms ahead. The future rewards countries that address debt challenges before crisis strikes.”

4. Policy Responses to the Debt Inflation Crisis

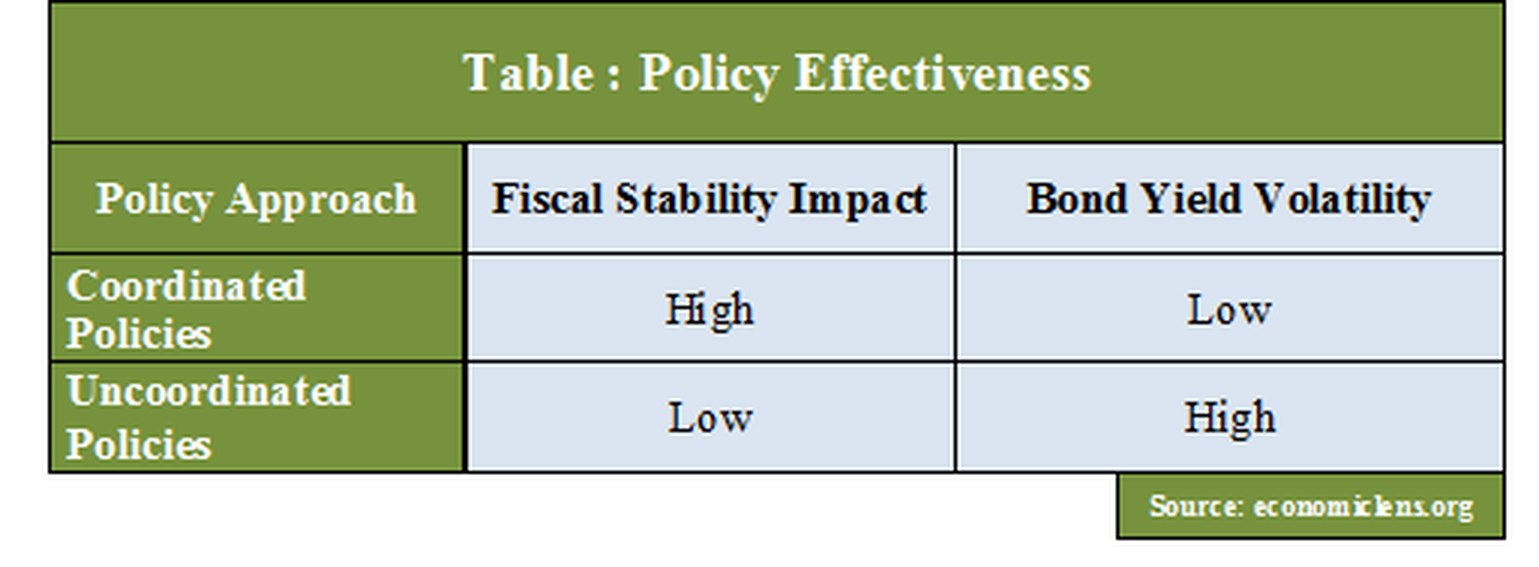

Governments face the difficult task of combating inflation while maintaining fiscal discipline. Coordinated fiscal and monetary policy frameworks—where central banks and governments operate in alignment—have proven far more effective than isolated actions. Policies that are synchronized reduce volatility, stabilize markets, and strengthen long-term fiscal outlooks.

World Bank strategist Dr. Alicia Morano states, “Effective policy coordination is the backbone of fiscal resilience.” According to the Global Fiscal Review, coordinated fiscal-monetary action reduced bond yield volatility by 35%.

The data makes it clear: countries with coordinated policy strategies strengthen fiscal stability significantly more than those acting independently. Coordination is not just beneficial—it’s essential in a debt inflation crisis.

“When nations act together, they choose stability over chaos. Today’s policies become tomorrow’s economic safety nets. True leadership is measured by the courage to act before crisis erupts.”

5. Social Consequences of the Debt Inflation Crisis

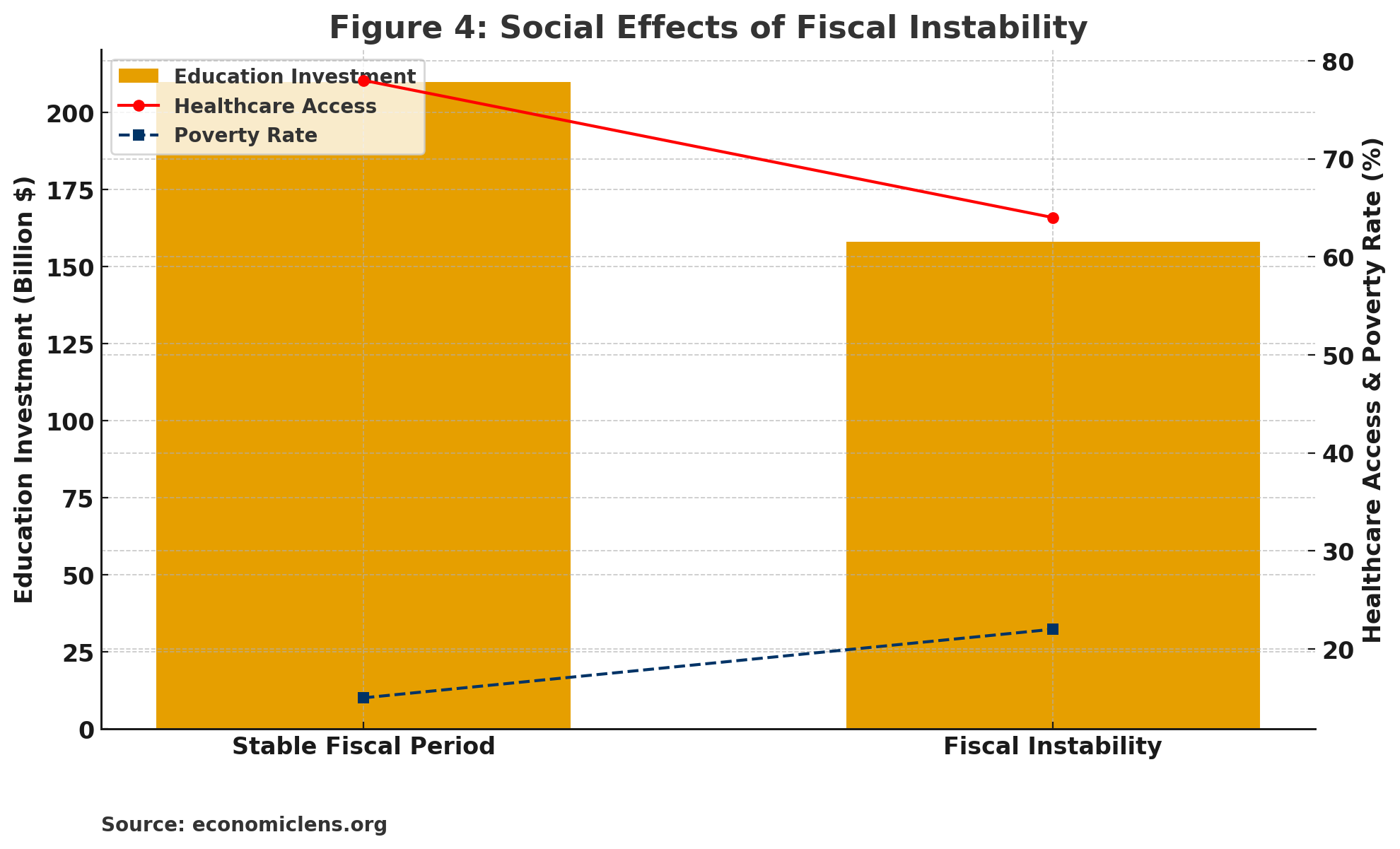

Fiscal instability has profound social consequences. Rising inflation weakens purchasing power, reduces access to essential services, and widens inequality. Funding cuts caused by rising debt costs often hit healthcare, education, and welfare systems first. As a result, vulnerable populations suffer the greatest harm.

UNDP economist Rina Satou emphasizes, “Fiscal crises deepen inequality, threatening long-term human development.” The UNDP Human Impact Report shows essential service availability falling 14% during fiscal crises.

The figure illustrates the human cost of the debt inflation crisis: reduced healthcare access, falling education investment, and rising poverty. Fiscal instability affects people before it affects markets.

“Economic instability is felt not only in budgets, but in homes, schools, and hospitals. Protecting fiscal stability means protecting opportunity and dignity for all. A stronger tomorrow begins with the society we safeguard today.”

Future Outlook

Debt levels will likely continue increasing, and inflation may remain stubborn in many regions. The world’s fiscal health depends on structural reforms, strategic policy coordination, and long-term investment in growth and resilience.

Conclusion

The debt inflation crisis is reshaping global economic realities, influencing everything from national budgets to household finances. Nations must act strategically, balancing immediate needs with long-term stability. Fiscal stability is the foundation upon which opportunity and development are built.

“The world is entering a new economic era—one defined not by fear, but by readiness. Choosing stability today builds prosperity for future generations. The decisions made now will become tomorrow’s economic legacy.”

Call to Action

Stay informed. Demand transparency. Support policies that strengthen fiscal health. Every decision contributes to a more stable global economy.