The Eastern Mediterranean gas dispute is intensifying as overlapping EEZ claims, offshore drilling, and naval deployments collide. From Israel Lebanon maritime tensions to Turkey Cyprus disputes and Gaza’s frozen gas fields, rising security risks threaten energy investment, trade routes, and long term regional stability

Introduction

The Eastern Mediterranean gas dispute has transformed offshore energy into a central security and economic challenge. What began as technical disagreement over maritime boundaries now shapes alliances, naval deployments, and investor confidence. As a result, each exploration move carries political and strategic consequences.

Rising naval pressure in contested waters reflects a wider regional energy conflict, similar to how escalation across the Middle East is already feeding into global oil market volatility and pricing uncertainty (https://economiclens.org/energy-warfront-middle-east-escalation-global-oil-market-volatility/). Global energy agencies also warn that conflict driven supply risks amplify price instability and planning uncertainty (https://www.iea.org/reports/world-energy-outlook-2024). Therefore, the Eastern Mediterranean gas dispute is no longer only about extraction. It is about stability, deterrence, and macroeconomic risk.

1. Eastern Mediterranean Gas Dispute Origins and Historical Fault Lines

Long standing political divisions laid the groundwork for the Eastern Mediterranean gas dispute. The Cyprus division, unresolved Israel Lebanon maritime claims, and the frozen Palestinian question created weak maritime governance. When offshore discoveries followed, these unresolved disputes shifted from land to sea.

Academic assessments argue that gas did not create conflict but intensified existing fault lines tied to sovereignty and identity (https://www.chathamhouse.org/2023/energy-security-eastern-mediterranean). European Union maritime governance reviews also note the absence of binding regional mechanisms to manage overlapping EEZ claims (https://www.europarl.europa.eu/thinktank/en/document/EPRS_BRI(2023)739347). Consequently, states relied on unilateral actions, which deepened mistrust and increased miscalculation risk.

This timeline shows how offshore discoveries raised economic stakes while governance lagged. Each milestone deepened mistrust and pushed unresolved political disputes into maritime space, turning energy exploration into a persistent security challenge.

“History does not stay on land, because unresolved disputes resurface at sea and shape every energy decision that follows.”

2. Mediterranean EEZ Conflict and Strategic Gas Stakes

The core of the Eastern Mediterranean gas dispute lies in overlapping EEZ claims. Small boundary shifts can move entire gas fields. Therefore, mapping disputes carry fiscal and political consequences.

Resource estimates from the US Geological Survey confirm significant hydrocarbon potential in the Levant Basin (https://pubs.usgs.gov/fs/2010/3014/pdf/FS10-3014.pdf). However, international lenders, including the European Bank for Reconstruction and Development (EBRD), caution that legal ambiguity and security risks deter long term investment (https://www.ebrd.com/what-we-do/economic-research-and-data/regional-economic-prospects.html). As a result, production remains uneven across the basin.

The table highlights uneven gas development across the basin. Israel produces and exports, while Cyprus, Lebanon, and Palestine remain stalled. This imbalance intensifies political pressure, raises security risks, and sharpens competition over contested maritime zones.

“When energy wealth is uneven, maritime lines harden, and compromise becomes politically expensive.”

3. Israel Lebanon Maritime Boundary and Offshore Risk

The Israel Lebanon case shows how technical boundaries evolve into security threats within the Eastern Mediterranean gas dispute. Slight changes in line interpretation affect access to Karish and Qana. Therefore, offshore infrastructure becomes a deterrence symbol.

Detailed explanations of the maritime agreement and its limitations show how fragile the arrangement remains (https://www.aljazeera.com/news/2022/10/14/what-to-know-about-the-israel-lebanon-maritime-border-deal). Legal analysts also note that revenue sharing mechanisms reduce tension but do not resolve sovereignty claims (https://www.spglobal.com/energy/en/research-analytics/the-israelilebanese-border-agreement-a-legal-analysis).

This offshore tension cannot be separated from wider regional instability, especially as post Gaza risks reshape diplomatic alignments and strategic fault lines across the Middle East (https://economiclens.org/abraham-accords-post-gaza-risks-strategic-fault-lines-and-regional-power-shifts/).

The table shows how EEZ disputes persist because sovereignty narratives dominate legal compromise. Field proximity and drilling rights turn technical boundaries into strategic flashpoints, making escalation risks high even when cooperation appears rational.

“Where borders remain contested, offshore platforms become political symbols rather than economic assets.”

4. Gaza Offshore Energy Crisis and Blocked Development

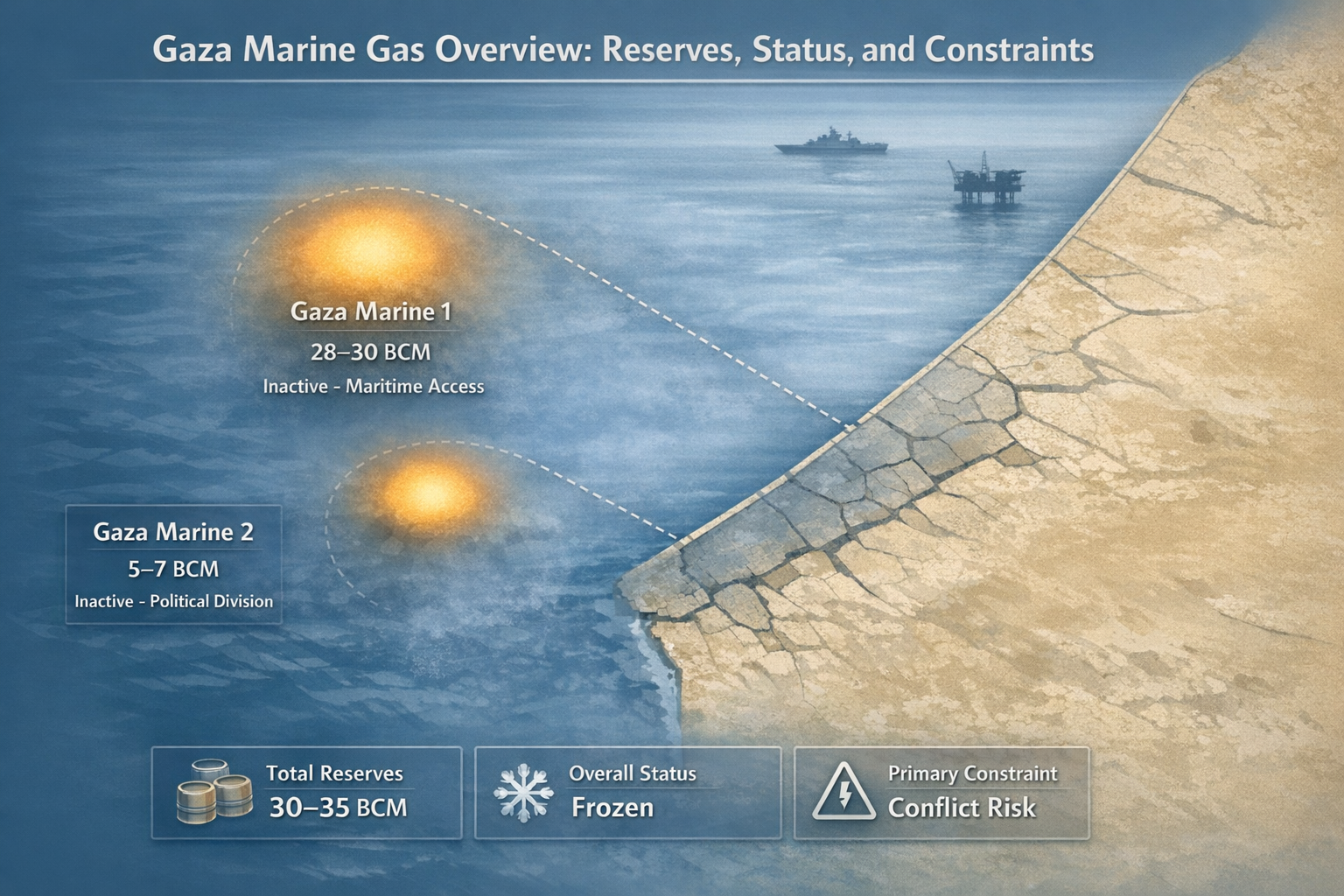

The Eastern Mediterranean gas dispute also includes Gaza’s frozen offshore potential. Gaza Marine could ease energy shortages and support recovery. Yet political division, access restrictions, and security concerns have stalled development for decades.

World Bank and UN linked assessments show that Gaza Marine could significantly reduce dependence on imported fuel (https://documents.worldbank.org/en/publication/documents-reports/documentdetail/396951468763843900). However, environmental damage and infrastructure degradation further complicate development prospects (https://www.unep.org/resources/report/environmental-impact-conflict-gaza-preliminary-assessment-environmental-impacts).

Gaza holds meaningful gas reserves, yet development remains frozen. The gap between ownership and access reflects how conflict, restrictions, and political division prevent energy resources from supporting recovery or reducing long term vulnerability.

“When resources stay unreachable, potential turns into prolonged economic suspension.”

5. Mediterranean Security Escalation and Crowded Naval Space

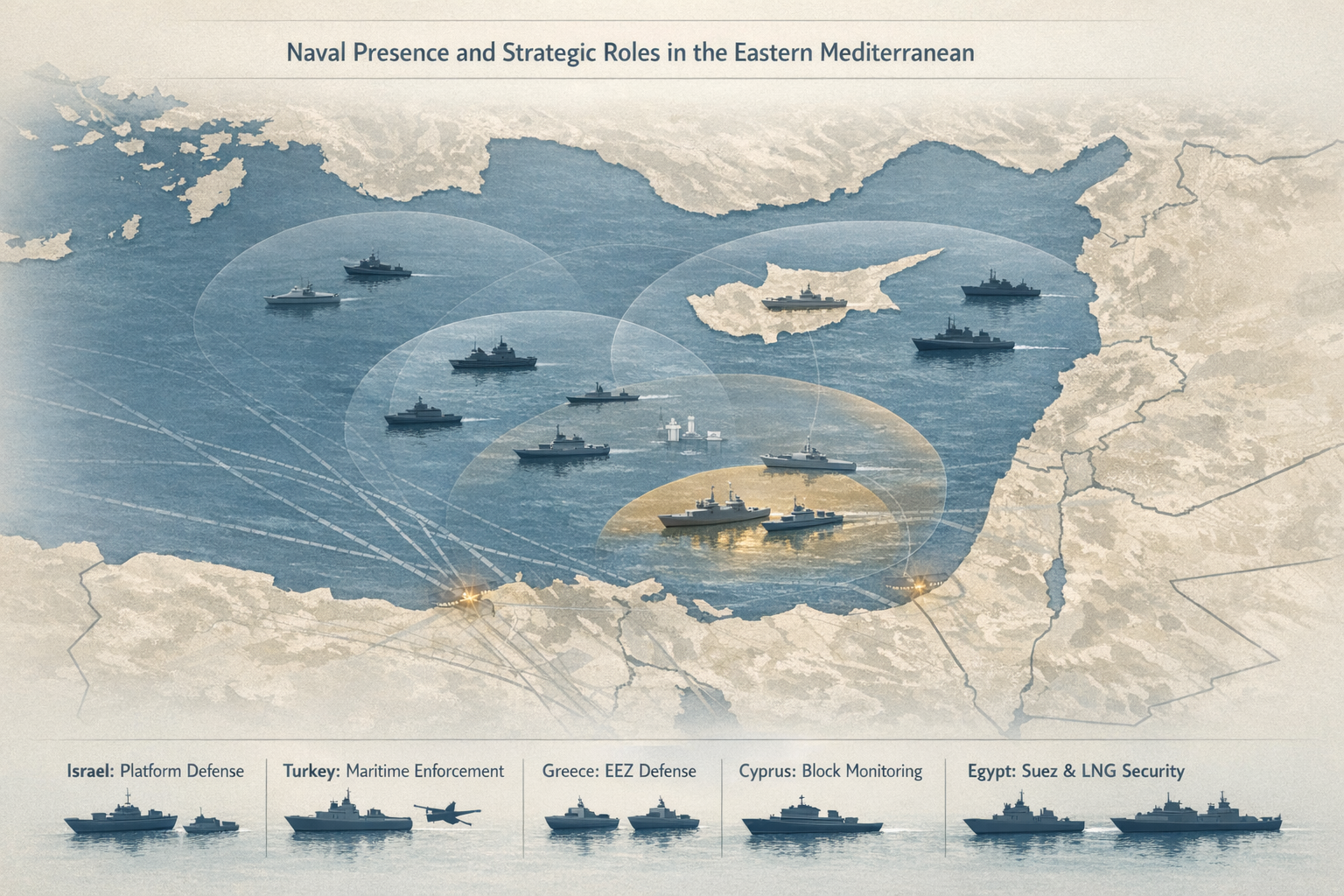

Offshore gas has militarized the Eastern Mediterranean gas dispute. States deploy escorts, drones, and patrols to protect assets. External powers also maintain presence. Consequently, the sea has become crowded.

Strategic studies warn that dense naval activity increases accident risk and escalation probability (https://www.rand.org/pubs/perspectives/PE221.html). This congestion also compounds global trade vulnerability, much like the disruption of shipping routes during Red Sea turmoil and Suez Canal disruptions exposed how regional conflict can quickly shock supply chains (https://economiclens.org/red-sea-turmoil-suez-canal-disruptions-and-the-global-shipping-shock/).

The table reveals a crowded naval environment where multiple fleets operate near disputed zones. Without clear rules or coordination, routine patrols increase accident risk and raise the likelihood of rapid escalation during periods of tension.

“In crowded waters, missteps matter more than intentions.”

6. Eastern Mediterranean Stability Framework and Future Scenarios

The future of the Eastern Mediterranean gas dispute depends on whether states manage risk or allow incidents to dictate outcomes. Most dangers stem from accidents, not deliberate war.

Security analysts warn that drone incidents, naval collisions, and proxy actions are the most likely escalation triggers (https://www.brookings.edu/articles/the-eastern-mediterranean-security-dilemma/). NATO assessments similarly stress the need for de escalation mechanisms in contested maritime zones

(https://www.nato.int/cps/en/natohq/topics_48818.htm).

The scenarios show that medium to high probability risks dominate the region’s outlook. Drone incidents, naval collisions, and proxy actions are the most likely triggers, while cooperative outcomes remain constrained by weak political conditions.

“The greatest risk is not intent, but miscalculation in a compressed decision space.”

Conclusion

The Eastern Mediterranean gas dispute is a test of whether energy wealth fuels cooperation or conflict. Offshore gas has amplified old divisions, militarized maritime space, and raised economic uncertainty. Yet pathways to stability still exist.

Progress requires de escalation mechanisms, interim economic arrangements, and long term legal clarity. Without them, the Eastern Mediterranean gas dispute risks turning shared resources into recurring flashpoints, with spillovers for energy markets, trade routes, and geopolitical balance.