Egypt currency devaluation explains how foreign exchange shortages, rising debt, and delayed adjustment triggered a persistent inflation spiral. This data-driven analysis examines causes, IMF interventions, social costs, and lessons for emerging economies facing currency stress.

Introduction

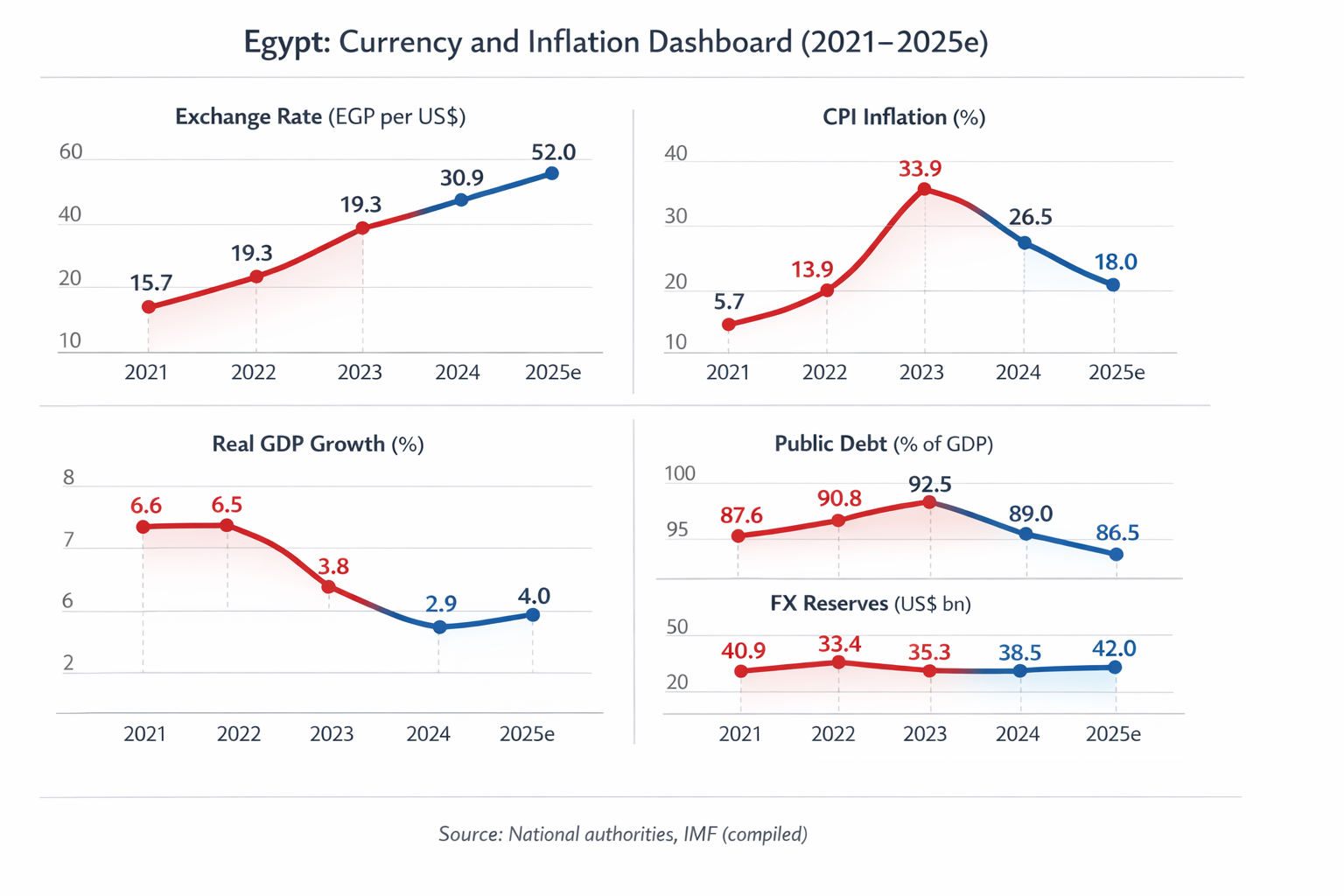

The Egypt currency devaluation is one of the clearest recent examples of how foreign exchange shortages, rising debt pressure, and delayed policy adjustment can evolve into a sustained inflation spiral. Since 2022, Egypt has devalued its currency multiple times under IMF-supported programs. Each devaluation aimed to restore competitiveness and unlock external financing. However, inflation surged, real incomes fell, and social pressure intensified. Although short-term stabilization appeared periodically, structural vulnerabilities persisted.

This episode unfolded in a global environment where inflation has remained sticky rather than temporary, as analyzed in (https://economiclens.org/the-high-rate-shockwave-a-world-trapped-in-persistent-sticky-inflation/).

1. Why Egypt Currency Devaluation Matters for Emerging Economies

The Egypt currency devaluation matters because it reflects a wider emerging-market dilemma. Governments delay adjustment to avoid immediate pain. Meanwhile, foreign exchange shortages deepen. Once adjustment begins, inflation accelerates sharply. Social costs appear before economic benefits.

Egypt relied heavily on portfolio inflows, bilateral deposits, and external financing to stabilize the pound. When global interest rates rose, capital outflows intensified. Reserve pressure mounted. Devaluation became unavoidable. This pattern is increasingly common in an environment of slow growth and high debt, as discussed in (https://economiclens.org/global-economic-outlook-2025-2026-slow-growth-sticky-inflation-rising-debt/). The IMF Global Financial Stability Report (https://www.imf.org/en/Publications/GFSR) also highlights how capital flow volatility now amplifies currency risk across emerging markets.

World Bank and IMF country data show repeated devaluations alongside persistently high inflation. This pattern signals delayed adjustment rather than a one-off shock. It also fits the broader global debt-inflation interaction described in (https://economiclens.org/the-global-debt-clock-is-ticking-why-borrowing-has-no-off-ramp/).

Debt Structure and External Financing Dependence in Egypt

Egypt’s vulnerability is rooted in its external financing model. Although most public debt is domestic, external stability depends heavily on short-term portfolio inflows and bilateral deposits. These inflows are highly sensitive to global rates and risk sentiment.

The World Bank notes that heavy reliance on volatile capital inflows heightens currency stress even in the absence of sovereign default, as weak rollover capacity and short maturity profiles amplify exchange rate vulnerability (World Bank debt overview: https://www.worldbank.org/en/topic/debt/overview). Egypt’s experience illustrates how repeated dependence on refinancing can trigger successive rounds of currency instability.

Crisis Timeline and Trigger Stack Behind Egypt Currency Devaluation

The Egypt currency devaluation unfolded through a layered trigger stack. Pandemic shocks weakened tourism and service exports. The Ukraine war raised food and energy import costs. Global interest rate hikes triggered portfolio outflows. FX shortages intensified. Parallel market premiums widened. Authorities delayed adjustment. Once devaluation occurred, inflation surged rapidly.

This sequence explains why inflation remained persistent even after exchange rate moves and why credibility mattered as much as price adjustment.

2. What Caused the Egypt Currency Devaluation and Inflation Spiral

Foreign Exchange Crisis in Egypt and Managed FX Regime

The Egypt currency devaluation was driven by prolonged foreign exchange shortages. A managed exchange rate masked pressure rather than resolving it. Import backlogs accumulated. Parallel markets expanded. Once adjustment began, pent-up pressure was released abruptly.

The IMF (https://www.imf.org/en/Countries/EGY) emphasizes that credible exchange rate flexibility is essential to prevent reserve loss and market distortions. Egypt’s delayed flexibility magnified inflation pass-through.

Inflation Transmission Through Imports and Expectations

The Egypt inflation spiral intensified because of import dependence. Food, fuel, and intermediate goods prices rose sharply after devaluation. Inflation expectations adjusted upward. Wage pressures followed.

World Bank analysis (https://www.worldbank.org/en/topic/macroeconomics/brief/inflation-and-poverty) confirms that exchange rate pass-through is strongest in import-dependent economies. Egypt fits this pattern closely, especially for food prices.

Debt and Interest Burden Amplified the Inflation Spiral

Higher interest rates sharply increased Egypt’s debt service costs. Interest payments absorbed a rising share of fiscal revenues. This constrained the government’s ability to protect households from inflation.

The IMF Fiscal Monitor (https://www.imf.org/en/Publications/FM) shows that rising interest burdens now limit fiscal space across emerging markets. Egypt’s inflation spiral cannot be separated from this fiscal squeeze.

3. IMF Program in Egypt and Stabilization Attempts

Egypt entered IMF-supported programs to restore confidence and unlock financing. Exchange rate adjustment, fiscal consolidation, and structural reforms formed the core. Financing helped stabilize reserves temporarily.

The IMF (https://www.imf.org/en/Countries/EGY) notes that program success depends on sustained exchange rate flexibility and reduced state dominance. Without these reforms, pressures tend to return.

4. Social Impact of Egypt Currency Devaluation

The Egypt currency devaluation imposed severe social costs. Food inflation surged. Real wages declined. Poverty risks increased. Subsidy systems softened the shock but did not eliminate hardship.

World Bank poverty assessments (https://www.worldbank.org/en/country/egypt/overview) show that inflation disproportionately harmed lower-income households. This explains growing resistance to further adjustment.

5. Post-Devaluation Growth and Remaining Fragility

Growth slowed during adjustment. Investment weakened. Confidence recovered unevenly. External shocks remain a risk.

Reuters reporting highlights Egypt’s ongoing foreign exchange sensitivity and continued reliance on external financing flows (https://www.reuters.com/world/africa/). OECD research warns that growth episodes driven by narrow sectors and limited diversification remain structurally fragile and vulnerable to external shocks (https://www.oecd.org/economy/resilience/).

6. Political Economy and Reform Durability in Egypt

The Egypt currency devaluation also exposes political economy constraints. Inflation erodes trust quickly. Reform fatigue grows. Authorities face pressure to stabilize prices fast, even if credibility suffers.

This tension explains why currency adjustment cycles repeat across emerging economies.

7. Lessons from Egypt Currency Devaluation for Emerging Economies

Egypt’s currency devaluation offers several important lessons for emerging economies navigating external imbalances. First, the experience shows that delayed foreign exchange adjustment significantly raises inflationary costs, as accumulated pressure is ultimately released through sharper and more disruptive price spikes. Second, it demonstrates that heavy reliance on short-term capital inflows and episodic financing arrangements magnifies macroeconomic vulnerability, leaving economies exposed when global liquidity conditions tighten. Third, Egypt’s case confirms that exchange rate flexibility must be credible and continuous, rather than intermittent or administratively managed, to anchor expectations and prevent repeated devaluation cycles. Fourth, the episode underscores that inflation control is central to social stability, as sustained price increases erode real incomes, deepen inequality, and strain political legitimacy. Finally, the experience shows that IMF-supported programs deliver durable outcomes only when structural reforms persist beyond financing cycles, particularly in areas such as FX market liberalization, fiscal discipline, and institutional credibility.

Counterargument Acknowledgment

Some argue currency devaluation quickly restores competitiveness, but Egypt’s experience shows that without credibility and reform, devaluation mainly fuels inflation.

Policy Implication Box

Policy implication: Egypt’s currency devaluation shows that emerging economies must treat exchange rate policy, external financing, debt management, and inflation control as one integrated system. Managed FX regimes delay adjustment but raise eventual costs. Short-term inflows increase rollover risk. Inflation undermines reform legitimacy. Sustainable stabilization requires credible flexibility, diversified exports, prudent debt management, and targeted social protection alongside IMF support.

1 thought on “Egypt Currency Devaluation and Inflation Spiral Explained”

whoah this weblog is magnificent i love studying your posts. Keep up the great work! You realize, lots of people are searching around for this information, you could aid them greatly.