Energy subsidy reform is critical for fiscal stability and efficient energy markets. This policy note examines fiscal costs, reform pathways, and global signals shaping energy pricing reform in emerging economies, while showing how governments can protect vulnerable households and finance clean energy transitions.

Introduction

Energy subsidy reform has become a defining policy challenge for emerging economies facing persistent fiscal pressure, volatile global energy prices, and rising social expectations. Governments often rely on energy subsidies to absorb price shocks and reduce political pressure. However, broad and untargeted subsidies weaken fiscal discipline, distort energy prices, and delay productive investment. As fiscal space tightens, energy subsidy reform is increasingly necessary for macroeconomic stability.

Across many economies, delayed energy subsidy reform has amplified budget deficits, increased exposure to external shocks, and crowded out spending on health, education, and infrastructure. At the same time, poorly designed reform risks social resistance if distributional impacts are ignored. This policy note examines why energy subsidy reform matters, how it affects public finances and energy markets, and which reform pathways can protect vulnerable households while restoring policy credibility.

1. Policy Context: Energy Subsidy Reform and Fiscal Stability

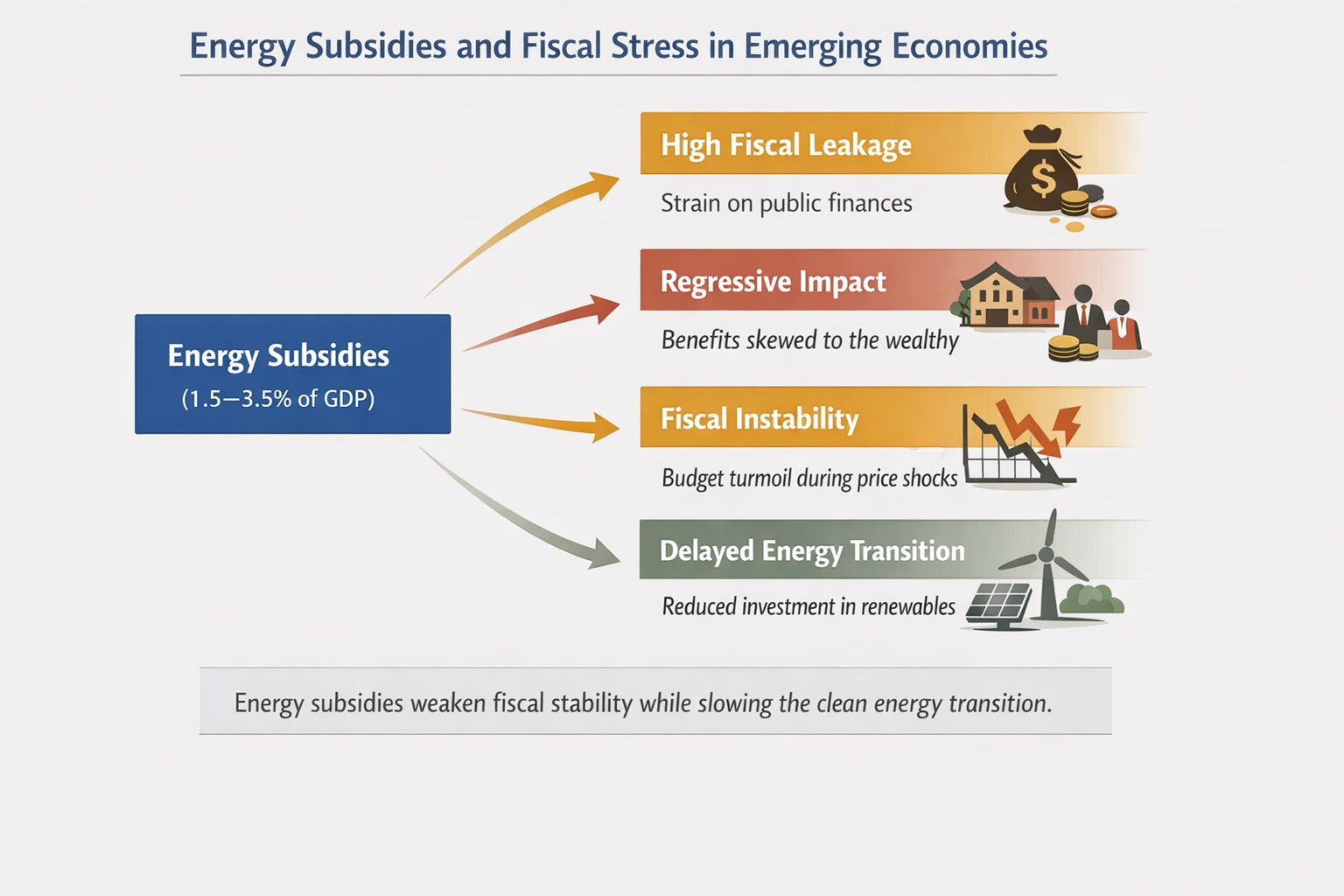

Energy subsidies are often presented as social protection tools. In practice, they function as blunt fiscal instruments with high leakage and weak targeting. IMF assessments on fossil fuel pricing show that subsidies remain widespread despite their inefficiency and fiscal risk, as documented in IMF climate and energy pricing analysis (https://www.imf.org/en/topics/climate-change/energy-subsidies).

Delayed adjustments increase fiscal vulnerability during global price shocks and exchange rate depreciation. When international prices rise, subsidy costs expand rapidly, forcing governments into reactive fiscal management. In this sense, pricing reform is not merely a budgetary adjustment but a structural requirement for fiscal sustainability.

Distorted pricing also keeps fossil fuels artificially competitive, delaying clean energy adoption and weakening investment incentives. These affordability dynamics are explored in an EconomicLens article on the cost gap between renewables and fossil fuels (https://economiclens.org/why-green-energy-needs-to-be-cheaper-than-fossil-fuels-the-future-of-affordable-sustainability/).

2. The Policy Challenge

Fiscal pressure under energy pricing adjustments

Energy subsidies expand sharply during global price shocks and currency depreciation. This volatility widens fiscal deficits and undermines medium-term budget planning. World Bank analysis shows that unstable subsidy spending reduces governments’ ability to allocate resources efficiently, as discussed in its energy policy research.

Regressive outcomes from untargeted fuel support

Energy consumption rises with income, allowing higher-income households to capture a disproportionate share of benefits. IMF research confirms that fuel subsidies are among the least effective instruments for poverty reduction (https://www.imf.org/external/pubs/ft/sdn/2015/sdn1506.pdf).

Market distortions from delayed price correction

Artificially low prices weaken efficiency incentives and suppress private investment in renewables. According to the International Energy Agency, distorted pricing slows clean energy deployment and increases import dependence, as highlighted in its global outlook (https://www.iea.org/reports/world-energy-outlook-2024).

3. Evidence Snapshot Supporting Energy Subsidy Reform

The evidence shows that energy subsidies impose material fiscal costs while delivering weak social targeting. High leakage, regressive incidence, and investment distortion explain why energy subsidy reform has become a structural priority rather than a discretionary policy choice.

4. Evidence and Institutional Constraints

Adjusting energy prices often raises inflation concerns and public resistance. IMF analysis shows that abrupt price changes without compensation increase the risk of reversal, as explained in its guidance on public support (https://www.imf.org/en/Blogs/Articles/2023/06/27/how-to-build-public-support-for-energy-subsidy-reforms).

Institutional capacity also matters. Many economies lack strong social registries and digital targeting systems. Research from the Inter-American Development Bank shows that public acceptance improves when fiscal trade-offs are clearly communicated (https://publications.iadb.org/en/increasing-the-acceptance-of-energy-subsidy-reforms).

5. Policy Options

Targeted income support during subsidy phase-out

Redirecting savings into income-tested cash transfers improves equity and fiscal efficiency. Indonesia’s experience illustrates how targeted transfers protected household welfare during fuel price adjustment (https://www.worldbank.org/en/news/feature/2015/12/22/indonesia-fuel-subsidy-reform).

Transparent pricing under liberalization

Linking domestic prices to international benchmarks reduces uncertainty and smooths inflation pass-through. Morocco’s gradual liberalization approach shows how communication supports durability (https://www.worldbank.org/en/country/morocco/overview).

Transparency and public communication

Publishing subsidy costs, beneficiary incidence, and timelines anchors expectations. IMF research shows transparency is as important as compensation (https://www.imf.org/en/Blogs/Articles/2023/06/27/how-to-build-public-support-for-energy-subsidy-reforms).

Efficiency investment and clean transition financing

Pricing reform is more durable when paired with efficiency investment. IEA analysis shows that efficiency gains reduce household exposure to higher prices (https://www.iea.org/reports/energy-efficiency-2024).

Fiscal space created through reform can also support clean infrastructure investment, as discussed in EconomicLens’ analysis on green transition financing (https://economiclens.org/green-energy-transition-can-we-finance-the-green-energy-transition-by-2025/).

6. Global Signals Reinforcing Energy Subsidy Reform

A convergence of global economic and energy trends has intensified the urgency of energy subsidy reform. International Energy Agency analysis shows that global clean energy investment is rising rapidly, favoring economies with credible energy pricing frameworks and predictable policy signals. Countries delaying energy subsidy reform risk losing investment momentum and competitiveness (https://www.iea.org/reports/world-energy-investment-2025).

IMF-supported programs increasingly embed energy pricing reform as a core fiscal benchmark, reflecting recognition that untargeted subsidies undermine macroeconomic stability and credibility (https://www.imf.org/en/Topics/imf-and-climate-change). OECD analysis highlights renewed momentum around carbon pricing, signaling a global shift away from blanket subsidies toward price-based instruments (https://www.oecd.org/climate-change/carbon-pricing/).

IEA assessments on energy efficiency show that distorted prices continue to encourage wasteful consumption, increasing long-term adjustment costs (https://www.iea.org/topics/energy-efficiency). These pressures are compounded by tight global financial conditions. IMF World Economic Outlook analysis shows reduced fiscal buffers in emerging markets, increasing the risks of delayed reform (https://www.imf.org/en/Publications/WEO).

7. Risks and Trade-offs in Energy Subsidy Reform

Energy subsidy reform involves short-term inflation pressures and political resistance. However, delaying reform increases fiscal exposure and magnifies future adjustment costs. IMF analysis shows postponement often leads to sharper price corrections and weaker policy credibility (https://www.imf.org/en/Publications/WP/Issues/2023/09/19/Global-Fossil-Fuel-Subsidies-Stay-Large-An-Update-Based-on-Country-Level-Data-539010).

The real choice is between managed energy subsidy reform and disorderly correction.

Conclusion

Energy subsidy reform is no longer a narrow fiscal adjustment. It is a cross-cutting policy decision shaping fiscal sustainability, energy security, market efficiency, and institutional credibility. Persisting with broad and poorly targeted subsidies increases vulnerability to shocks and limits investment capacity.

Successful energy subsidy reform requires credible communication, institutional capacity, and visible protection for vulnerable households. When designed as a phased and transparent process, energy subsidy reform stabilizes public finances, improves market signals, and aligns domestic energy systems with long-term economic and environmental objectives.