Fragmented globalization is reshaping the world economy as trade, finance, and supply chains reorganize into regional blocs. This editorial explains why globalization is not ending, but evolving through security-driven integration, economic fragmentation, and geopolitical realignment.

Introduction

Fragmented globalization is reshaping the world economy rather than ending it. While headlines often claim that globalization is collapsing, economic evidence tells a different story. Global trade, finance, and production networks remain active across borders. However, they are reorganizing along political, regional, and security-driven lines.

Globalization today is no longer universal. It is selective, strategic, and bloc-oriented. Fragmented globalization now defines how countries, firms, and markets interact in an era marked by geopolitical uncertainty.

Fragmented Globalization and the Myth of Deglobalization

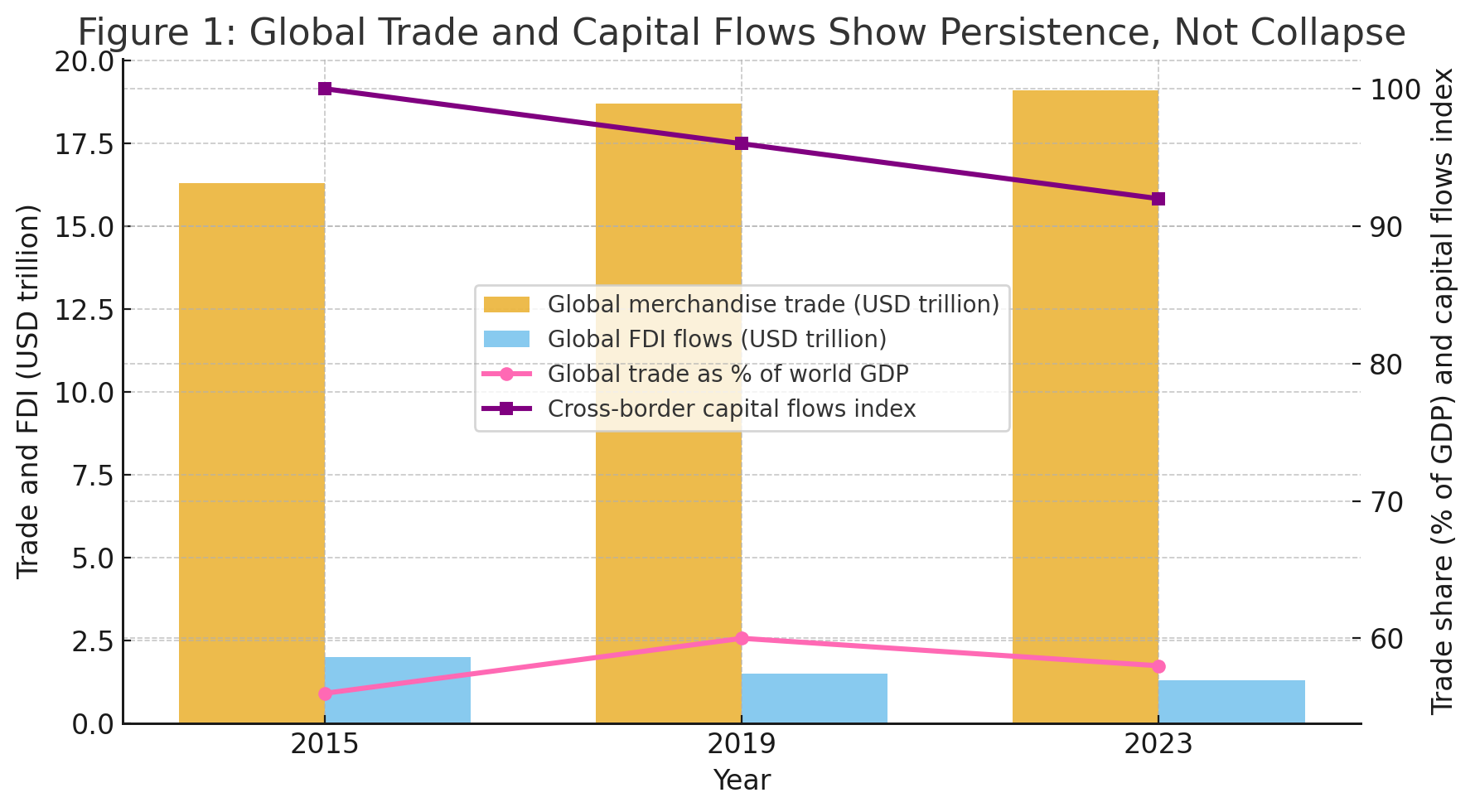

Many policymakers argue that the global economy is retreating inward. However, trade data contradicts this claim. Global merchandise trade remains resilient despite repeated shocks.

According to the World Trade Organization (https://www.wto.org), international trade volumes have adjusted but not reversed.

The figure indicates that global integration remains resilient. Trade levels are near historic highs and merchandise trade continues to expand, while weaker FDI and capital flows reflect adjustment rather than retreat. The crunch signals fragmented globalization, not deglobalization.

Regionalized Global Trade Is Replacing Universal Integration

Fragmented globalization increasingly favors regional supply chains. Asia trades more within Asia. Europe strengthens internal sourcing. North America promotes near-shoring strategies.

These shifts are not accidental. They reflect deliberate policy choices to reduce exposure to geopolitical risk while preserving cross-border production. This transition is explored in The Future of International Trade: How Economic Blocs Are Reshaping the Global Economy, which explains how trade blocs reorganize global commerce rather than dismantling it (https://economiclens.org/the-future-of-international-trade-how-economic-blocs-are-reshaping-the-global-economy/).

The figure indicates that trade is becoming more regionalized and politicized. Stronger intra-Asian trade signals regional consolidation, while sanctions, export controls, and friend-shoring reflect security-driven fragmentation. Globalization persists, but through regions and alliances rather than a single, unified marketplace.

Economic Blocs Are Driving Fragmented Globalization

Economic bloc globalization is accelerating. Governments prioritize supply security and strategic autonomy over cost efficiency. Export controls, industrial subsidies, and investment screening reshape trade flows.

The Organisation for Economic Co-operation and Development documents a sharp rise in trade intervention since 2019, particularly across energy, technology, and advanced manufacturing sectors (https://www.oecd.org). Recent developments reinforcing this fragmentation include US and EU semiconductor export controls, the expansion of BRICS intra-bloc trade, and strategic reshoring policies in advanced economies. Together, these trends deepen fragmented globalization rather than reversing global integration.

Financial Fragmentation Without Financial Collapse

Global finance reflects similar patterns. The US dollar remains dominant, yet diversification is underway. Local currency settlements are rising, and alternative payment infrastructure is expanding. According to IMF reserve data, diversification remains gradual and controlled, reflecting cautious adjustment rather than abrupt shifts (https://www.imf.org).

The Bank for International Settlements confirms that financial globalization is fragmenting into parallel systems rather than collapsing, as cross-border finance increasingly reorganizes along geopolitical and regulatory lines (https://www.bis.org).

Why Full Economic Sovereignty Remains Unrealistic

Political narratives often promise total economic self-reliance. However, modern production still depends on global inputs, technology, and finance. The International Monetary Fund warns that aggressive reshoring raises costs, fuels inflation, and weakens productivity, making full economic separation economically costly and inefficient (https://www.imf.org). Fragmented globalization therefore reflects compromise rather than retreat.

Winners and Losers in a Fractured Global Economy

Fragmented globalization redistributes economic power unevenly. Large economies with diversified markets gain leverage. Smaller trade-dependent economies face higher exposure to shocks. Firms with flexible supply networks adapt more easily than those locked into single production corridors.

Economic diplomacy now plays a decisive role in growth outcomes.

Editorial Verdict

Trade volumes have not collapsed. Supply chains have not disappeared. Financial flows have not reversed. What has changed is the architecture of global integration.

Globalization is no longer governed by a single logic of efficiency. It is increasingly shaped by security considerations, political alignment, and strategic resilience. This shift does not mark the end of globalization. It marks its fragmentation.

Understanding this distinction is critical. Policies designed for a world of retreat will fail in a world of reconfiguration. Those who recognize fragmented globalization, and adapt to its realities, will shape the next global economic order.