The global economic outlook 2025 points to slower growth, persistent inflation and rising debt risks across advanced and emerging markets. This blog explains how monetary tightening, supply chain shifts, geopolitical tensions and structural weaknesses reshape global projections for 2025 and 2026.

Introduction: Global Economic Outlook 2025 Key Trends

The global economic outlook 2025 reflects a world confronting multiple interconnected pressures, including slow growth, persistent inflation and rising debt burdens. These forces combine to shape a challenging macroeconomic environment marked by tighter financial conditions, subdued investment and lingering supply chain disruptions. Consequently, both advanced and emerging markets face renewed uncertainty as structural weaknesses interact with cyclical stress.

In the global economic outlook 2025, growth momentum remains fragile due to geopolitical fragmentation, weak trade elasticity, energy volatility and productivity limitations. Meanwhile, inflation moderates but remains above targets in many economies due to broad price stickiness and service sector pressures. Additionally, emerging markets experience stronger inflation pass through due to currency depreciation and import dependence, creating complex policy trade offs.

This blog analyzes the evolving global landscape across growth, inflation, trade, debt and risk dimensions. Furthermore, it integrates data, expert assessments and 2025–2026 projections to provide a comprehensive understanding of the forces shaping the global economic trajectory.

1. Slow Growth in the Global Economic Outlook 2025

The global economic outlook 2025 reflects a broad deceleration in world growth as tightening financial conditions, weak trade volumes and prolonged geopolitical fragmentation weigh on output. Additionally, structural headwinds such as declining productivity, aging demographics and subdued investment aggravate the slowdown in both advanced and emerging economies. Consequently, policymakers face a challenging environment where fiscal space is limited, inflation remains elevated and external financing costs continue to rise. These intertwined constraints define the central narrative for growth projections heading into 2026.

Expert Insight & Global Report Signals

IMF Chief Economist Pierre Olivier Gourinchas notes that global momentum remains weaker than expected due to persistent supply constraints and subdued consumer spending. Furthermore, OECD Chief Economist Clare Lombardelli states that real interest rates remain restrictive and continue to suppress investment appetite. Additionally, S&P Global Market Intelligence highlights that uncertainty in China’s property sector and Europe’s industrial slowdown dampen confidence across major regions.

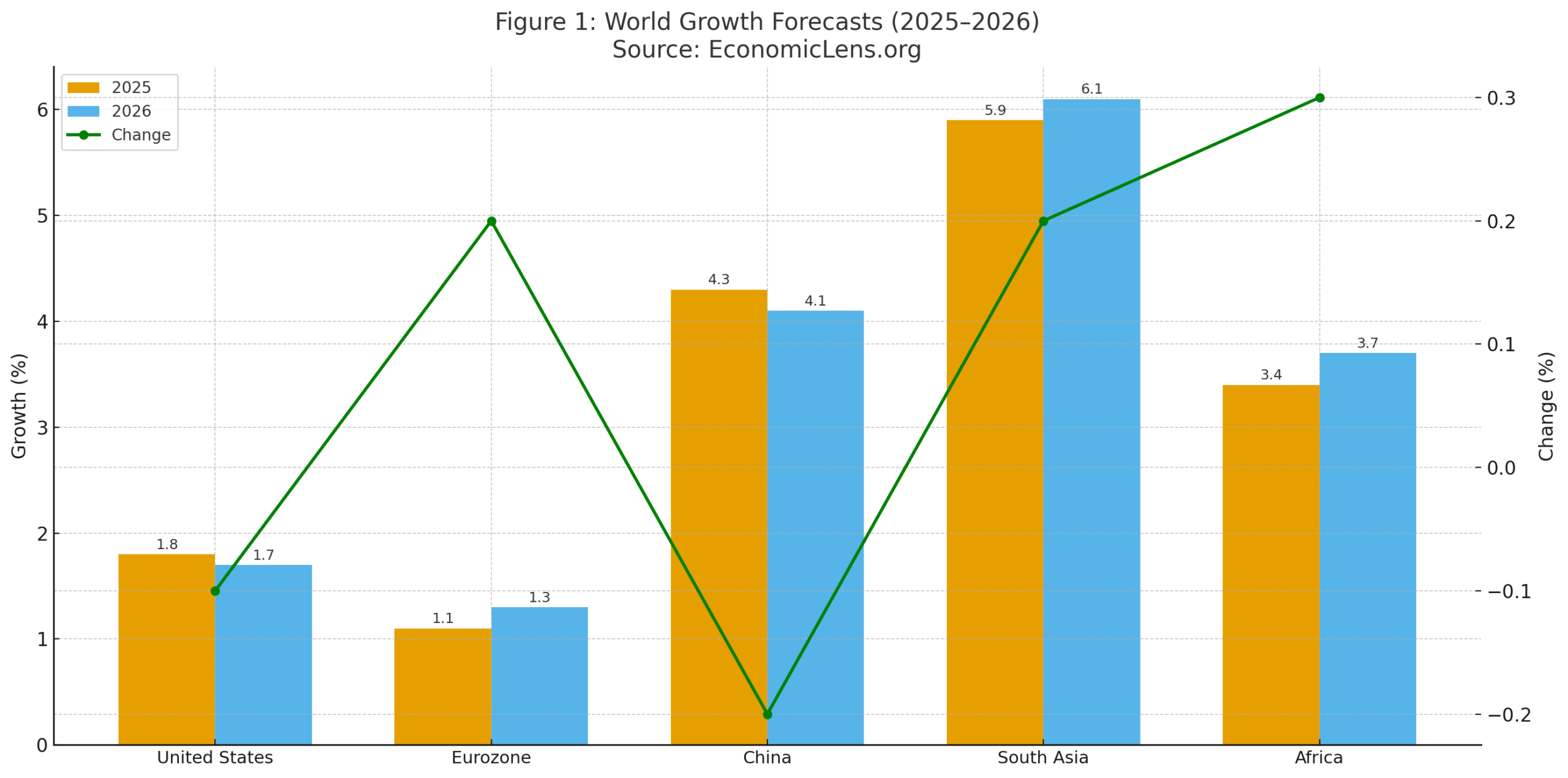

The IMF World Economic Outlook 2025 forecasts global GDP growth at 2.7 percent in 2025, slightly below long term averages. Meanwhile, the OECD Global Outlook projects continued weakness in Europe and moderate resilience in North America. In contrast, UN DESA World Economic Situation Report 2025 expects slower growth in China due to structural consumption and property constraints. The IMF World Economic Outlook 2025 (https://www.imf.org/en/Publications/WEO) highlights persistent slow growth, weak productivity and tightening financial conditions across major economies.

Growth forecasts show mild improvement in South Asia and Africa, while advanced economies remain constrained by low investment and high borrowing costs. Consequently, global output remains below trend for a second consecutive year.

Growth Stress Spotlight: China’s Property Drag Deepen

China’s property sector continues to face severe distress as stalled construction projects, rising defaults and weak homebuyer sentiment restrict domestic demand. According to Bloomberg, real estate related activity accounts for nearly one fourth of China’s GDP when upstream and downstream sectors are included. As a result, global commodity demand for steel, copper and cement remains subdued, affecting exporters across Latin America, Africa and Australia. Additionally, weaker Chinese consumption dampens global tourism recovery and reduces demand for high value goods from Europe and Japan. Consequently, China’s structural slowdown is a central factor shaping the global economic outlook 2025.

“Growth weakens not because one region slows, but because vulnerabilities link economies together.”

2. Sticky Inflation in the Global Economic Outlook 2025

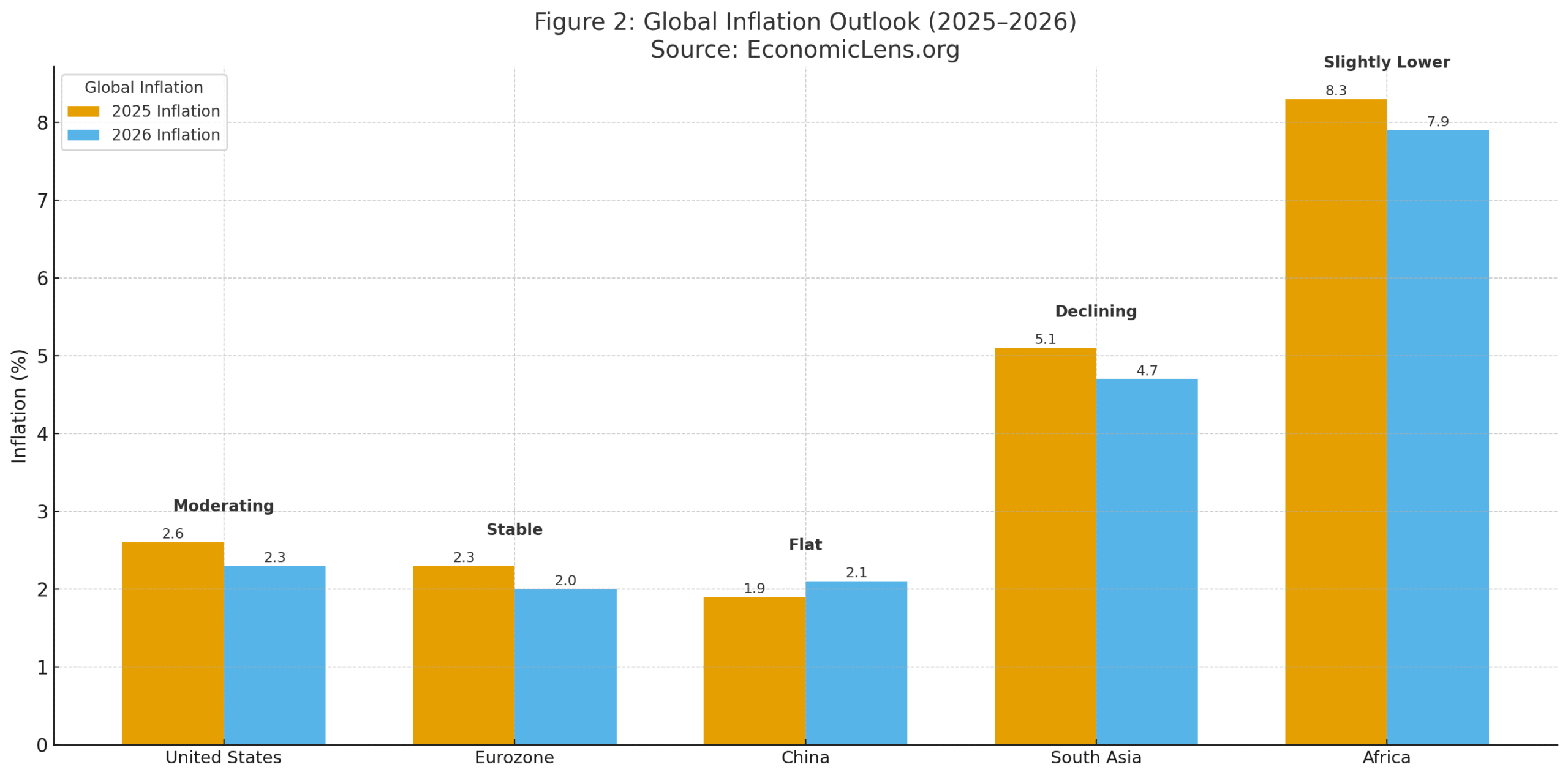

Inflation continues to pose significant challenges in the global economic outlook 2025 as supply chain fragmentation, tariff escalation and elevated energy prices broaden price pressures. While headline inflation has moderated in advanced economies, core inflation remains above target due to persistent service sector costs and wage adjustments. Meanwhile, emerging markets face stronger inflation pass through due to currency depreciation and import dependence. Consequently, central banks maintain cautious stances and delay interest rate cuts.

Expert Insight & Global Report Signals

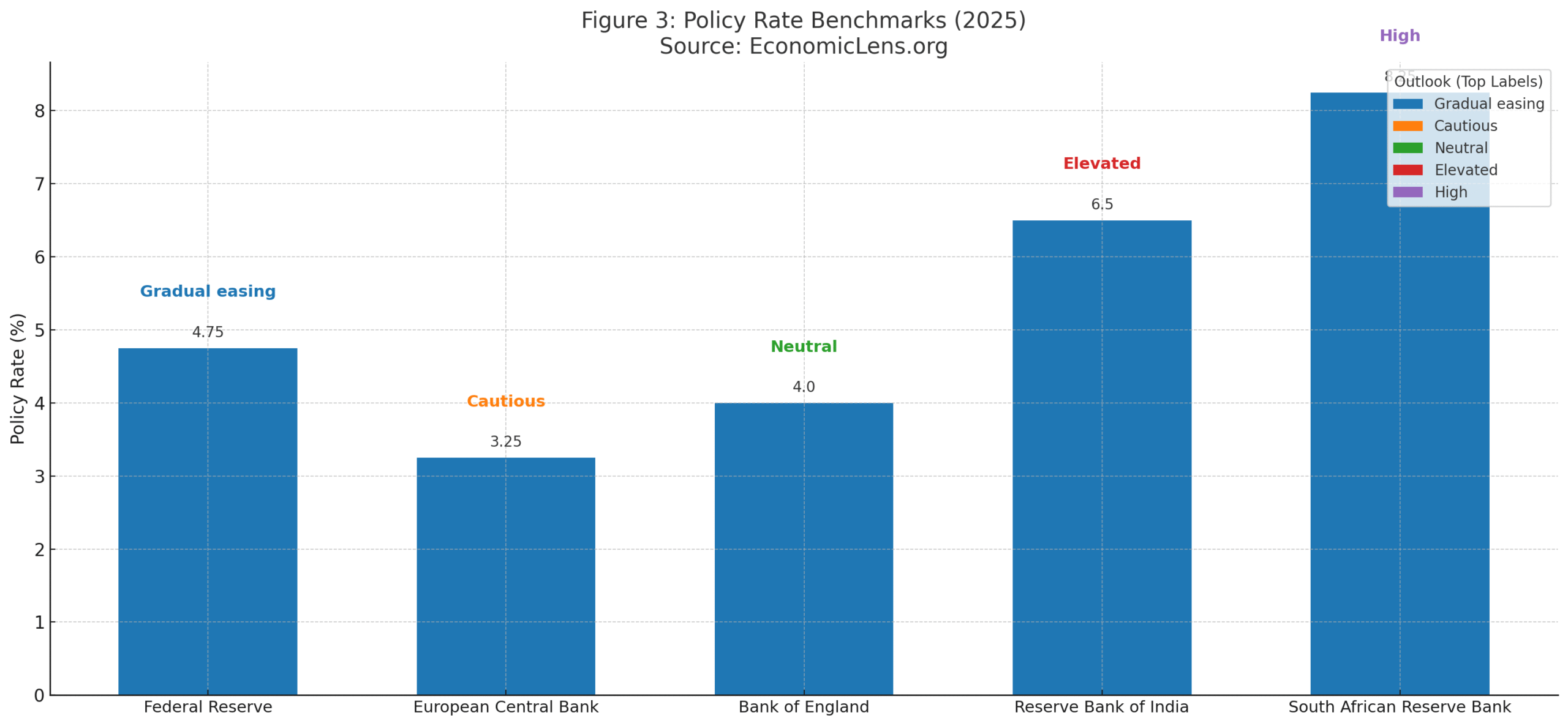

Federal Reserve Board analysts indicate that inflation remains sticky due to resilient labor markets and service price persistence. Meanwhile, ECB Chief Economist Philip Lane highlights that monetary easing must proceed carefully to prevent renewed inflation spikes. In contrast, Reserve Bank of India warns that global food and energy volatility could reaccelerate inflation in developing economies.

The World Bank Food and Commodity Outlook 2025 points to renewed instability in grain and energy prices due to climate events and shipping disruptions. Furthermore, OECD Inflation Monitoring 2025 shows service inflation stabilizing slowly. Additionally, the IMF Monetary Conditions Survey finds real policy rates remain positive across most advanced economies. The OECD Economic Outlook 2025 (https://www.oecd.org/economic-outlook/) provides detailed assessments of inflation persistence and policy tightening across advanced economies.

Inflation moderates in advanced markets but remains elevated in emerging economies due to currency depreciation and import exposure. As a result, policymakers continue to balance growth risks against inflation control.

Policy rates remain historically high across major economies, reflecting ongoing efforts to control inflation. Consequently, tighter financial conditions restrain investment and consumption.

Energy Market Shock Brief: Oil Volatility Returns

Global oil markets experienced renewed turbulence in 2025 as OPEC Plus extended coordinated production cuts while geopolitical tensions disrupted flows in the Middle East and West Africa. According to S&P Global Commodity Insights, Brent prices fluctuated within a wide band from USD 78 to USD 96 per barrel over the first three quarters, adding uncertainty to inflation projections. Meanwhile, supply chain rerouting due to Red Sea tensions amplified freight costs for energy shipments. Consequently, global energy inflation remains a key risk in the global economic outlook 2025.

“Inflation fades slowly when energy, wages and supply chains all demand a larger share of global prices.”

3. Trade Contraction and Supply Chain Shifts in the Global Economic Outlook 2025

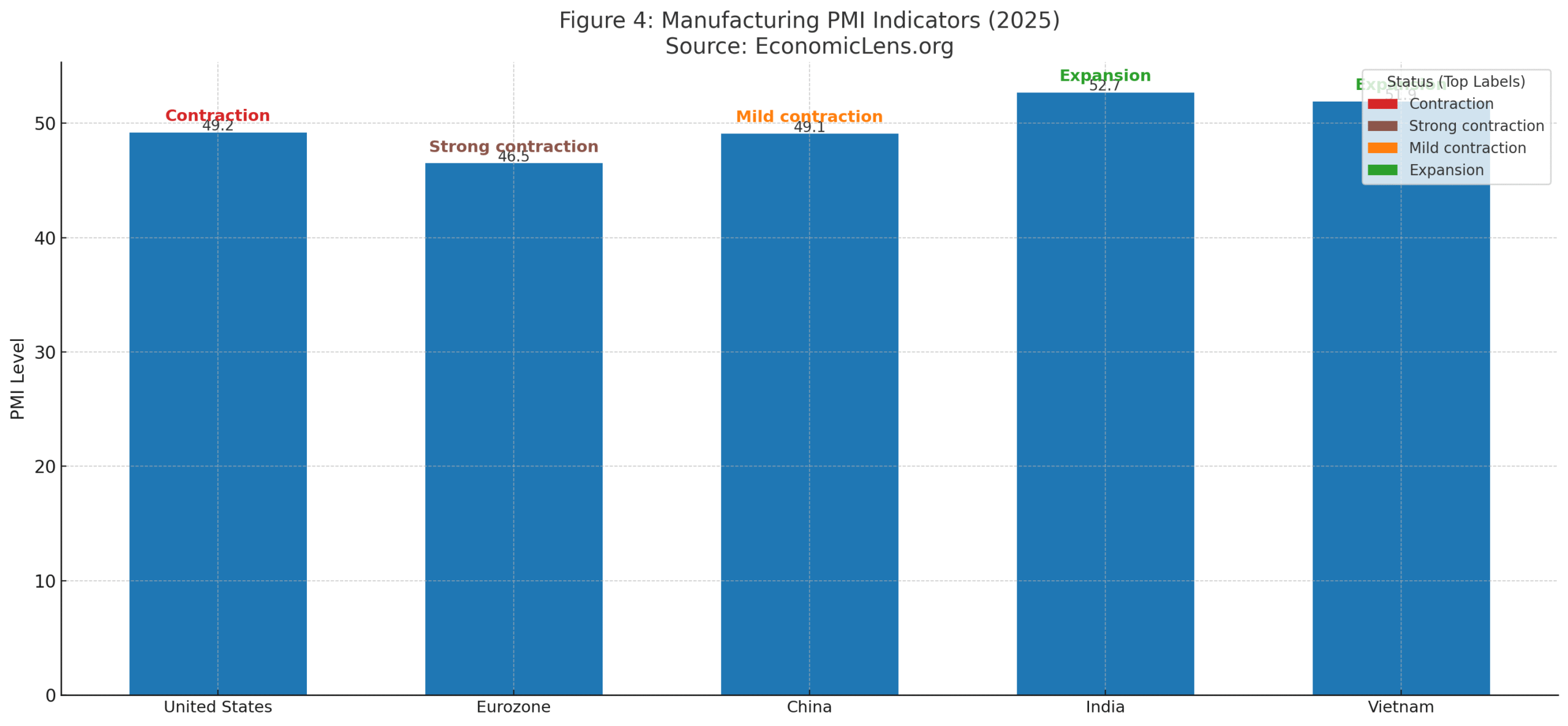

Global trade volumes continue to underperform in the global economic outlook 2025 due to tariff escalation, trade fragmentation and weak industrial demand. Manufacturing PMIs across Europe, China and parts of East Asia remain below the neutral 50 threshold, reflecting persistent contraction. Additionally, supply chains realign toward diversified hubs in Southeast Asia, India and Mexico. As a result, patterns of global production are shifting in ways that will influence competitiveness for years to come.

Expert Insight & Global Report Signals

WTO economists emphasize that global trade elasticity has weakened as firms restructure supply chains. Meanwhile, IHS Markit manufacturing specialists report declining export orders across major Asian hubs. Additionally, Lloyd’s shipping analysts warn that logistics costs remain elevated due to rerouting and geopolitical risks.

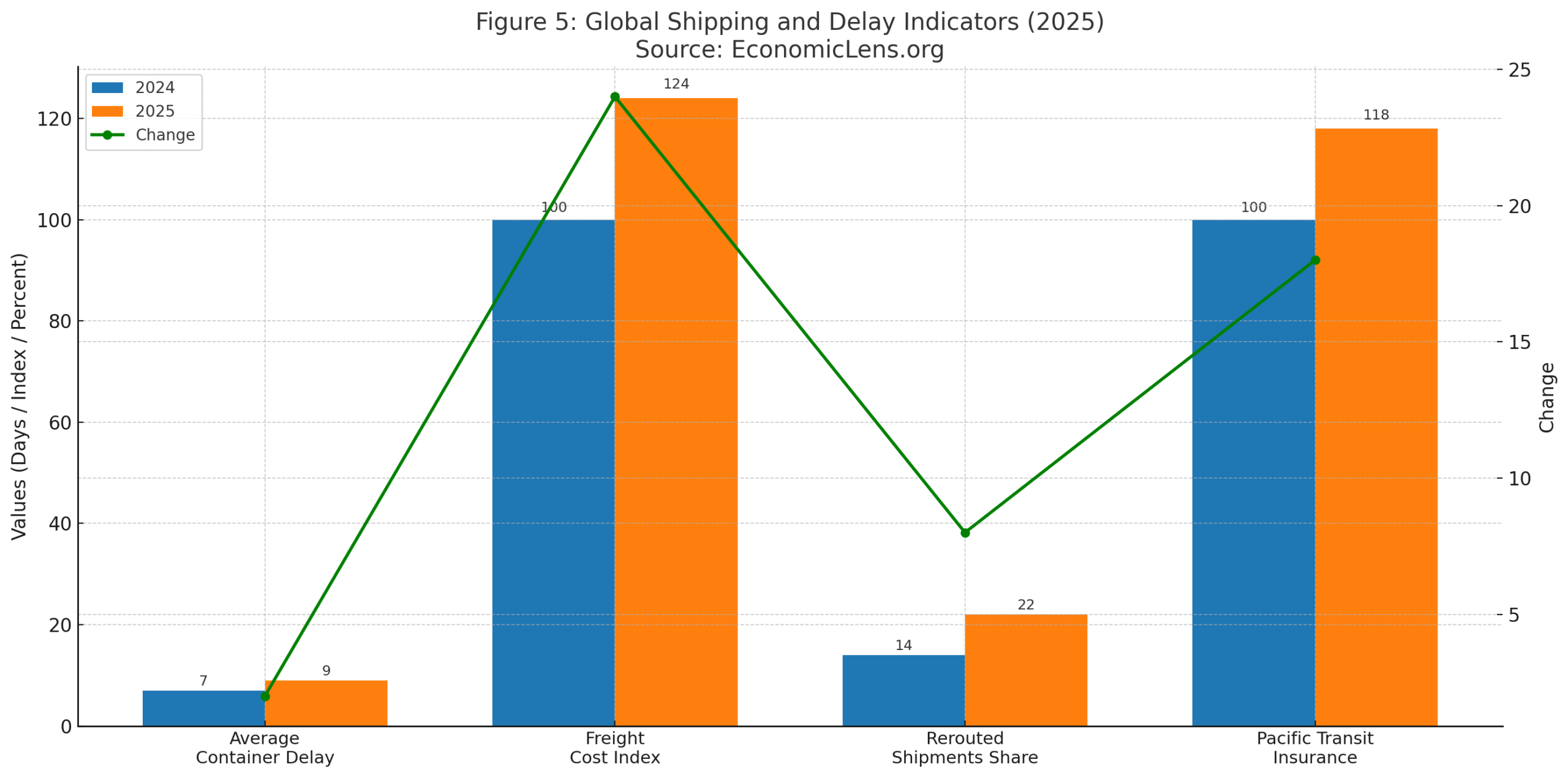

The WTO Trade Outlook 2025 projects global goods trade growth at 2.2 percent, much below historical standards. Furthermore, UNCTAD Global Shipping Review finds a 14 percent increase in global freight delays. Meanwhile, OECD Supply Chain Monitor confirms a growing shift toward nearshoring in North America.

Manufacturing PMIs highlight persistent weakness in advanced economies, while India and Vietnam sustain moderate expansion due to stronger domestic demand and supply chain gains.

Global shipping metrics indicate intensifying disruptions, increasing freight costs and lengthening delivery times. Consequently, businesses face planning challenges and supply uncertainty.

Industrial Slowdown Insight: Germany’s Export Engine Stall

Germany’s manufacturing sector continues to struggle as weak Chinese demand, high energy prices and global trade fragmentation reduce export orders. According to the Ifo Institute, industrial sentiment fell to its lowest level since 2020, driven by declining machinery and auto component shipments. Meanwhile, German ports report reduced throughput as Asian shipments reroute toward Southeast Asian hubs. Consequently, Europe’s industrial core faces structural challenges that weigh heavily on the global economic outlook 2025.

“Trade contraction is not a short cycle event; it is a structural recalibration of global production.”

4. Debt Accumulation and Financial Fragility in the Global Economic Outlook 2025

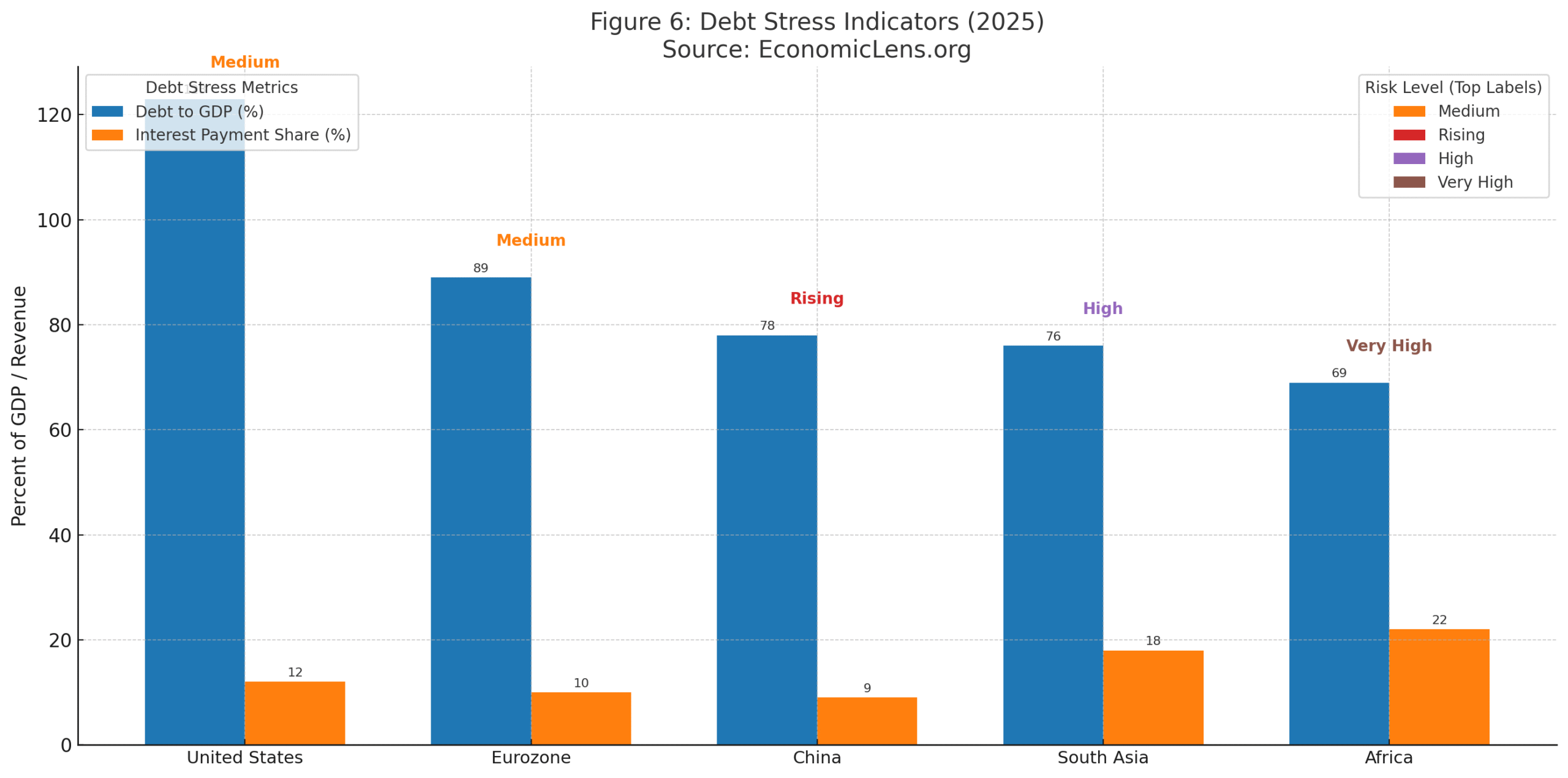

Rising debt burdens constitute one of the most pressing risks in the global economic outlook 2025. Higher interest rates, slower growth and tighter financial conditions strain sovereign budgets in emerging markets and advanced economies alike. Additionally, rollover needs surge as large volumes of debt mature between 2025 and 2027. Consequently, countries face elevated borrowing costs, weakened fiscal flexibility and greater exposure to external shocks.

A connected analysis examining high interest rates, refinancing pressures and fiscal strain appears in “Pakistan’s Debt Emergency: IMF Bailouts, Fiscal Stress & the Road to Recovery” (https://economiclens.org/pakistans-debt-emergency-imf-bailouts-fiscal-stress-the-road-to-recovery/)

Expert Insight & Global Report Signals

IMF Debt Office warns that over 40 percent of low income countries face high debt distress. Meanwhile, Moody’s Sovereign Ratings indicates that fiscal consolidation is slowing due to political constraints. Furthermore, Barclays Global Research notes that debt markets remain sensitive to shifts in US monetary policy, amplifying volatility in emerging markets.

The IMF Fiscal Monitor 2025 highlights sharp increases in interest payments as a share of revenue for developing economies. Meanwhile, World Bank Debt Report 2025 identifies record levels of short term external debt. In addition, OECD Sovereign Borrowing Outlook warns that refinancing risks persist due to elevated global yields.

Debt indicators show heightened vulnerability in regions with narrow fiscal space and high interest burdens. As a result, refinancing challenges intensify and limit policy flexibility.

Sovereign Risk Spotlight: Frontier Markets Near Default Lines

Frontier economies across Africa and South Asia face rising default risk as interest costs surge and global investors demand higher risk premiums. Ghana and Ethiopia remain engaged in restructuring negotiations, while Pakistan and Kenya confront elevated external financing needs. According to the Institute of International Finance, net capital flows to developing economies declined sharply in mid 2025 as market sentiment weakened. Consequently, fiscal stress amplifies sovereign risk across weaker economies.

“Debt becomes a crisis not when it rises, but when the cost of carrying it overwhelms the space to adjust.”

5. Strategic Risks and Policy Pathways in the Global Economic Outlook 2025

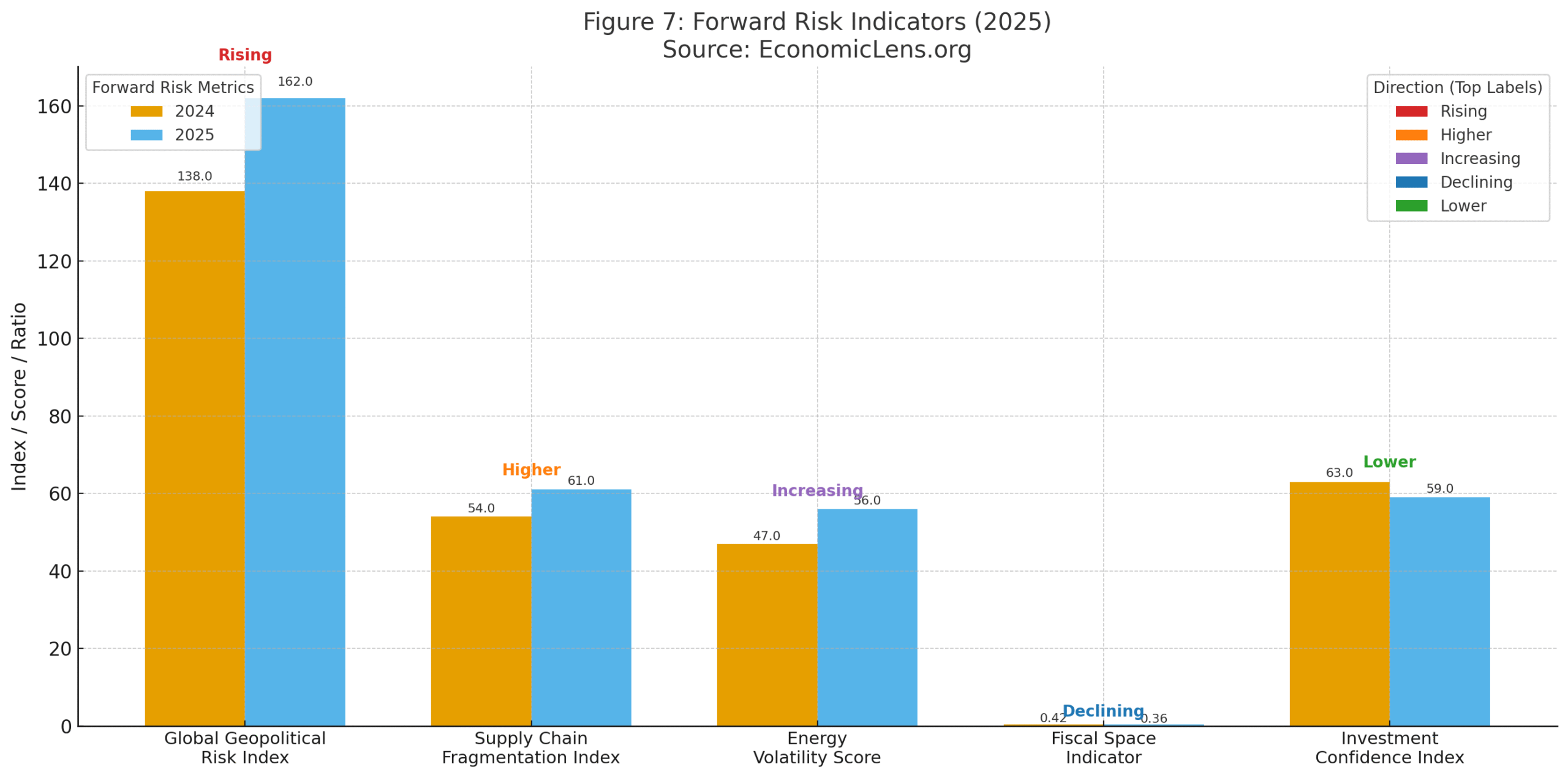

The global economic outlook 2025 presents a complex landscape for policymakers as shifting trade patterns, persistent inflation and rising debt reshape global priorities. Consequently, governments must adapt strategies that enhance economic resilience, strengthen fiscal management and support structural reforms. Additionally, geopolitical tensions and climate related shocks require integrated responses to safeguard growth prospects. The need for coordinated global action is increasingly apparent as fragmentation threatens long term stability.

A related deep-dive into global supply chain vulnerabilities and climate-driven disruptions is available in “Global Food Supply Crunch: Climate Shocks, Export Bans and Inflation Risk” (https://economiclens.org/global-food-supply-crunch-climate-shocks-export-bans-and-inflation-risk/).

Expert Insight & Global Report Signals

Chatham House analysts emphasize that policy fragmentation undermines global coordination on trade and investment. Meanwhile, WEF economists stress the importance of digital infrastructure and human capital investment to sustain medium term growth. Additionally, OECD fiscal analysts highlight the need for targeted support to vulnerable sectors without compromising long term fiscal sustainability.

The UN Global Risk Outlook 2025 identifies climate, energy and geopolitical tensions as top disruptors of medium term growth. Meanwhile, IMF Structural Reform Scorecard shows slow progress on productivity enhancing reforms across major economies. Additionally, World Bank Governance Review notes increasing political polarization that complicates economic decision making.

Forward risk indicators highlight rising uncertainty across geopolitical, fiscal and supply chain domains. Consequently, global economic stability remains fragile as multiple risks interact.

Geopolitical Realignment Insight: North America’s Reshoring Momentum

Reshoring momentum strengthens across North America with significant investment inflows into manufacturing hubs in Mexico and the southern United States. According to KPMG analysis, nearshoring projects grew by 28 percent in 2025 as firms diversify away from Asia. Additionally, semiconductor and automotive firms accelerate capacity expansion due to domestic incentives. Consequently, North America emerges as a key beneficiary of global supply chain realignment and contributes to shifting the global economic outlook 2025.

“The future is shaped by how economies navigate uncertainty while building foundations for resilience.”

Conclusion

The global economic outlook 2025 reflects a complex interplay of slow growth, persistent inflation, rising debt burdens and shifting geopolitical conditions. Supply chain realignments, demographic challenges and structural weaknesses further constrain global momentum, while financial tightening limits policy options in both advanced and emerging economies. Furthermore, climate volatility and energy uncertainty intensify disruptions across key sectors, adding to the fragility of global projections. Yet opportunities remain visible in regions benefiting from supply chain diversification, digital transformation and targeted industrial strategies. The challenge for policymakers will be to navigate these trends with balanced approaches that support sustainable growth while maintaining fiscal discipline. Ultimately, the global economy enters 2025 with significant risks, but also with avenues for strategic adaptation that could support stability over the medium term.

Call to Action

Stability in 2025 will depend on coordinated policy frameworks, strategic investment planning and targeted reforms that address key structural weaknesses. Governments, firms and institutions must strengthen resilience to manage an increasingly fragmented global environment.

1 thought on “Global Economic Outlook 2025–2026: Slow Growth, Sticky Inflation & Rising Debt”

Great job Sir 👏👍