The global food supply crunch is reshaping world markets as climate shocks, export bans and supply disruptions tighten food availability and drive inflation risk. This blog explains how weather volatility, trade restrictions, infrastructure stress and market fragmentation are converging into a systemic food security threat through 2025 and beyond.

INTRODUCTION

The global food supply crunch has become one of the most urgent economic threats of 2025, as climate shocks, export bans and trade disruptions converge to tighten global food availability. Consequently, rising food inflation, shrinking buffers and market instability are reshaping economic risk across regions. Additionally, governments now operate with limited fiscal space just as weather volatility intensifies, making the global food supply crunch a structural threat rather than a temporary shock. As a result, this blog analyzes the drivers, market responses and risk pathways shaping the next phase of global food insecurity through eight structured sections.

1. Climate Shocks and the Global Food Supply Crunch

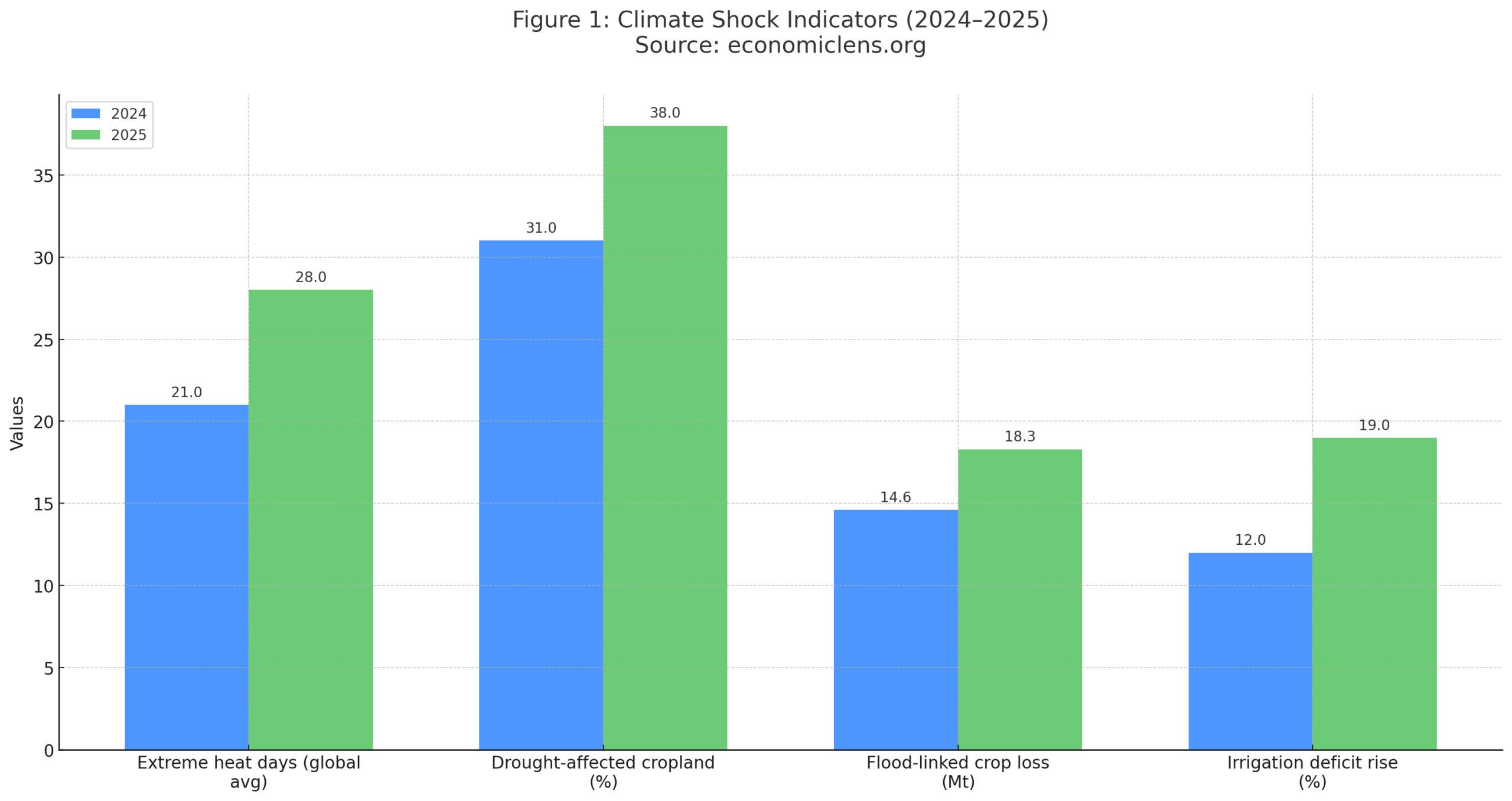

Climate volatility is accelerating faster than global adaptation capacity. Severe droughts, heatwaves and floods are simultaneously reducing yields across key producers. Consequently, tight supply conditions are emerging in wheat, rice and maize, reinforcing the global food supply crunch. Furthermore, the narrowing gap between shocks leaves economies with little time to rebuild resilience.

According to agricultural economist Dr. Paul Rivlin, climate-driven agricultural losses are now “synchronized across continents”, meaning shocks that once offset each other now compound globally. He argues that the global food supply crunch reflects both declining yields and structural gaps in climate adaptation investments. The 2025 UN FAO Climate Stress Outlook (https://www.fao.org/climate-change/en/) highlights that 42 percent of global cropland is exposed to moderate or severe climate risk, compared with 28 percent a decade ago. Moreover, FAO notes that heat-induced crop loss has doubled since 2010.

Rising heat, drought and flood intensity show that climate volatility is accelerating faster than agricultural adaptation. These pressures directly tighten global supply and heighten systemic food insecurity.

India’s Rice Export Restrictions and the Global Food Supply Crunch

India’s tightening of rice export rules in late 2024 and early 2025 became one of the most disruptive global food shocks. With India supplying over 40 percent of global rice exports, the restrictions led to price surges across Africa, the Middle East and Southeast Asia. Consequently, import-dependent economies faced double-digit food inflation. The episode demonstrated how one country’s domestic political pressure can trigger a worldwide price ripple, deepening the global food supply crunch.

“Every climate shock is now a supply shock, and every supply shock reshapes the global food equation.”

2. Export Bans and Global Food Supply Strain

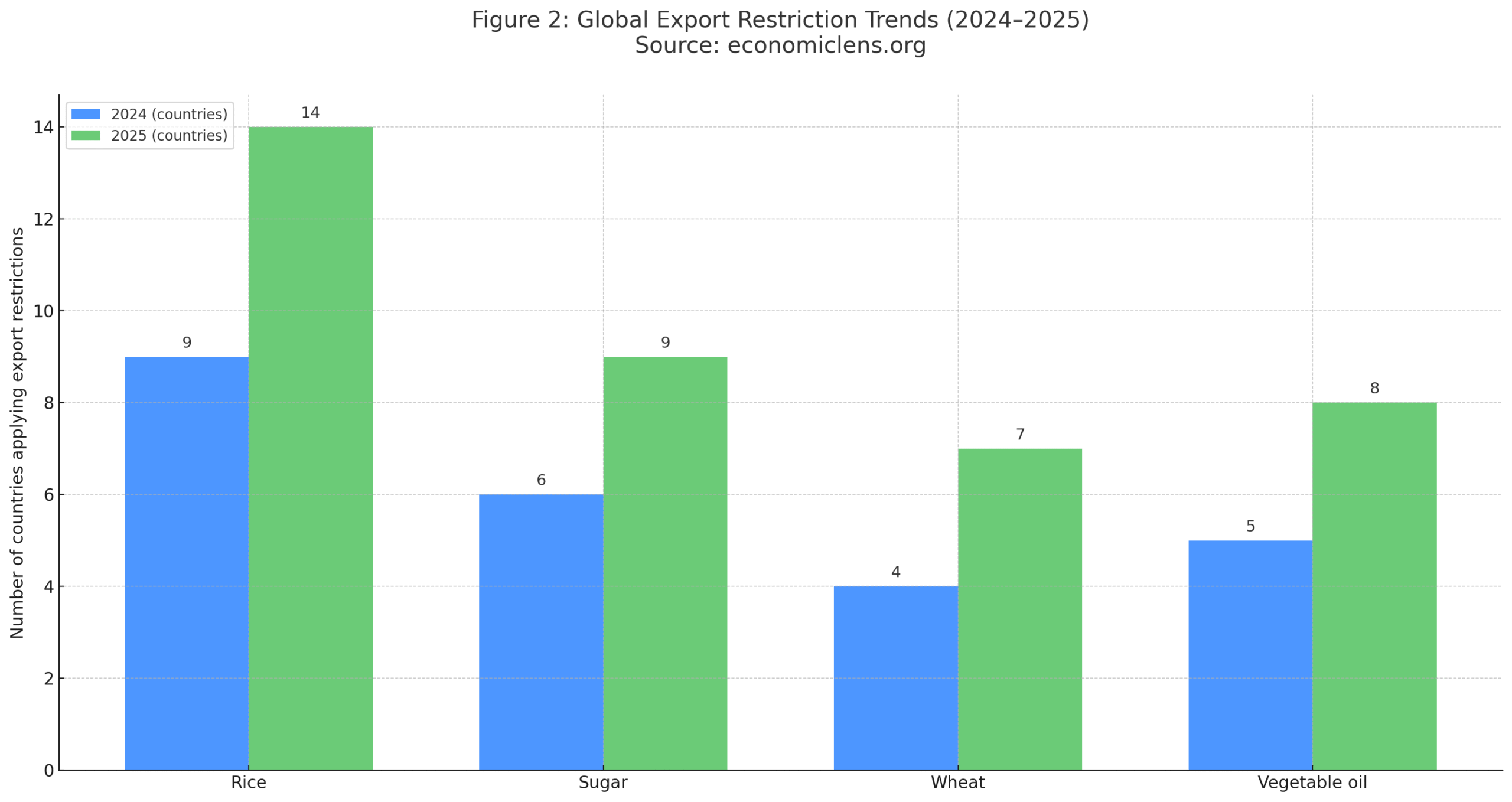

Export bans have become a widespread political response to domestic shortages. Consequently, markets face reduced predictability and greater volatility. The tightening of grain, sugar and rice exports has accelerated the global food supply crunch by limiting global circulation of essential commodities. Additionally, countries that rely on imports face amplified inflation pressures.

Trade specialist Dr. Anna Mitchell explains that export bans trigger “self-reinforcing scarcity cycles”, as each ban encourages additional restrictions across other producers. This systemic fragmentation undermines global trust and raises transaction costs. The 2025 WTO Trade Stability Review (https://www.wto.org/) notes that food-related export restrictions increased by 61 percent since 2022, with major interventions in South Asia, Southeast Asia and Latin America.

Expanding export bans across core staples reduce global availability and increase volatility. These restrictions amplify market fear, deepen supply tightness and drive higher import costs.

Red Sea Rerouting Crisis and Global Food Market Disruption

The continued instability around the Red Sea forced ships to reroute via the Cape of Good Hope, adding up to 4,000 nautical miles for key food shipments. Consequently, African and Middle Eastern importers faced extended shortages and price hikes. This demonstrated how geopolitical shocks directly fuel the global food supply crunch.

“When nations close their granaries, the world enters a new era of fragile interdependence.”

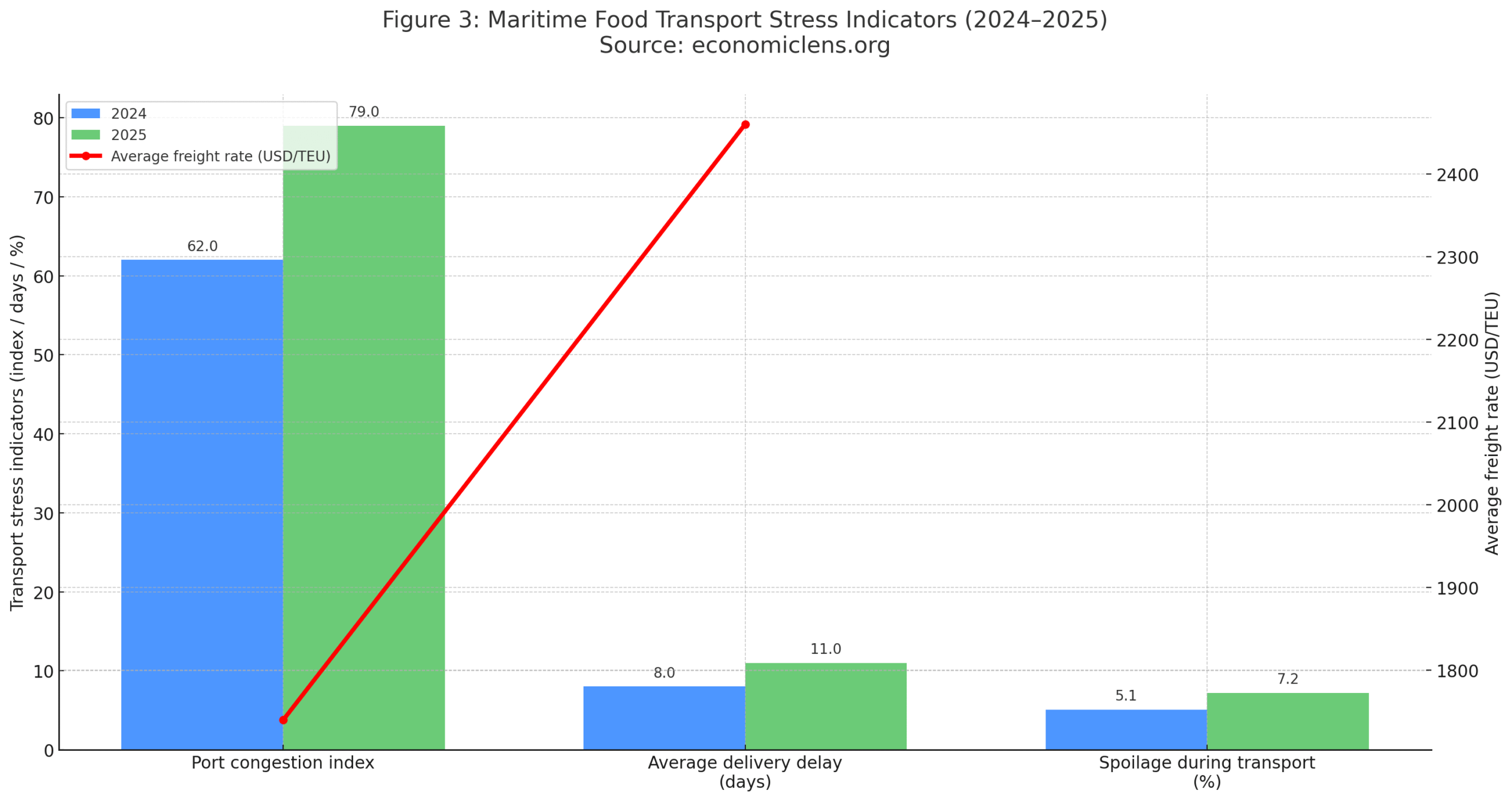

3. Maritime Disruptions and the Global Food Supply Crunch

Maritime trade disruptions intensified in 2025 as Red Sea instability, longer rerouting and port congestion created shipment delays. As a result, essential food staples arrived late and at higher freight costs, worsening the global food supply crunch for vulnerable importers.

Logistics analyst Mark Elwood states that maritime disruptions now “amplify food crises faster than traditional drought cycles,” because transport bottlenecks hit multiple supply nodes at once. UNCTAD’s 2025 Maritime Cost Tracker shows that the average cost of shipping food containers increased 41 percent year-on-year, while average delivery delays extended by 7 to 11 days.

Higher freight rates, worsening congestion and longer delays push food prices upward while reducing timely access for import-dependent regions. Maritime stress is now a critical inflation driver.

Russia-Ukraine Fertilizer Supply Disruptions

Sanctions, supply restrictions and port blockages linked to the Russia-Ukraine conflict have sharply constrained global fertilizer flows. Since Russia is a major nitrogen and potassium exporter, these constraints have pushed global prices higher and reduced access for developing economies. Consequently, fertilizer shortages in East Africa and South Asia have lowered planting intensity, deepening the global food supply crunch.

A related analysis on climate-driven supply chain stress and global chokepoints appears in “Global Water Stress: Canal Bottlenecks, Hydropower Losses & Supply Chain Risk” (https://economiclens.org/global-water-stress-canal-bottlenecks-hydropower-losses-supply-chain-risk/).

“When ships slow down, inflation speeds up.”

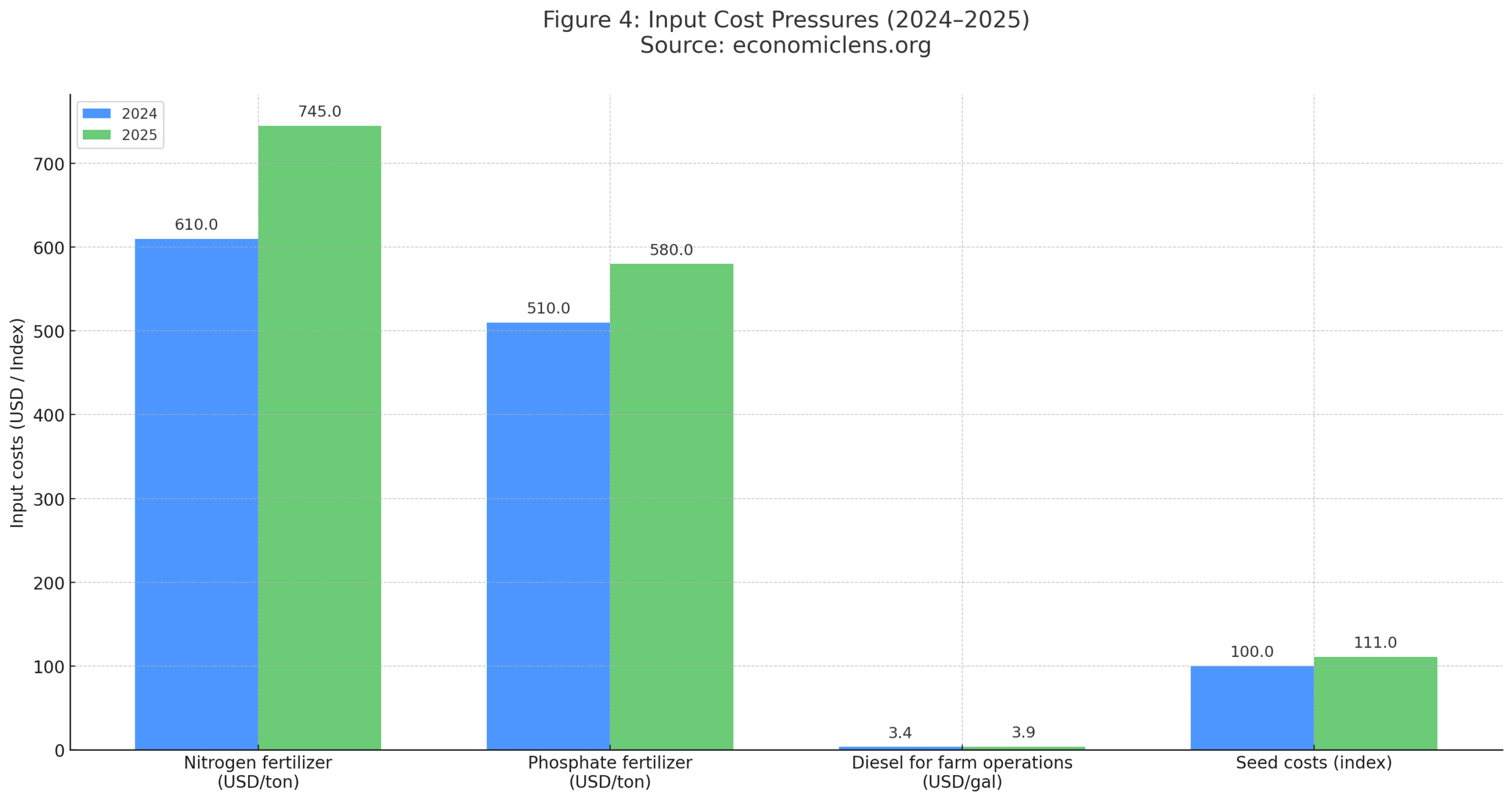

4. Fertilizer Costs and Rising Global Food Supply Strain

Global fertilizer markets remain highly volatile due to gas price swings, supply bottlenecks and sanctions on key producers. Consequently, rising input costs translate into higher production costs, deepening the global food supply crunch.

Agronomist Dr. Michael Hansen notes that “fertilizer volatility creates multi-year impacts,” since reduced application lowers yields long after prices normalize. The 2025 OECD Input Cost Review shows nitrogen fertilizer prices increased 22 percent in early 2025 due to energy volatility and export restrictions.

Input prices continue to rise across fertilizer, fuel and seeds, increasing production costs for farmers. This sustained cost pressure reduces planting incentives and weakens yield stability.

Argentina’s 2025 Food Price Surge and Social Unrest

Argentina experienced one of the steepest food price increases in 2025 due to severe drought, shrinking reserves and a sharp peso depreciation. Consequently, households faced extreme affordability gaps that triggered street protests and emergency stabilization policies. The crisis became a global warning sign of how quickly food inflation can destabilize economic and political systems.

“Production begins long before harvest, and every cost increase shapes tomorrow’s scarcity.”

5. Inflation Dynamics Reinforcing the Global Food Supply Crunch

Persistent food inflation has become a structural economic challenge, particularly for low-income economies where food consumes a large share of household budgets. Consequently, inflation volatility reinforces the global food supply crunch by reducing purchasing power.

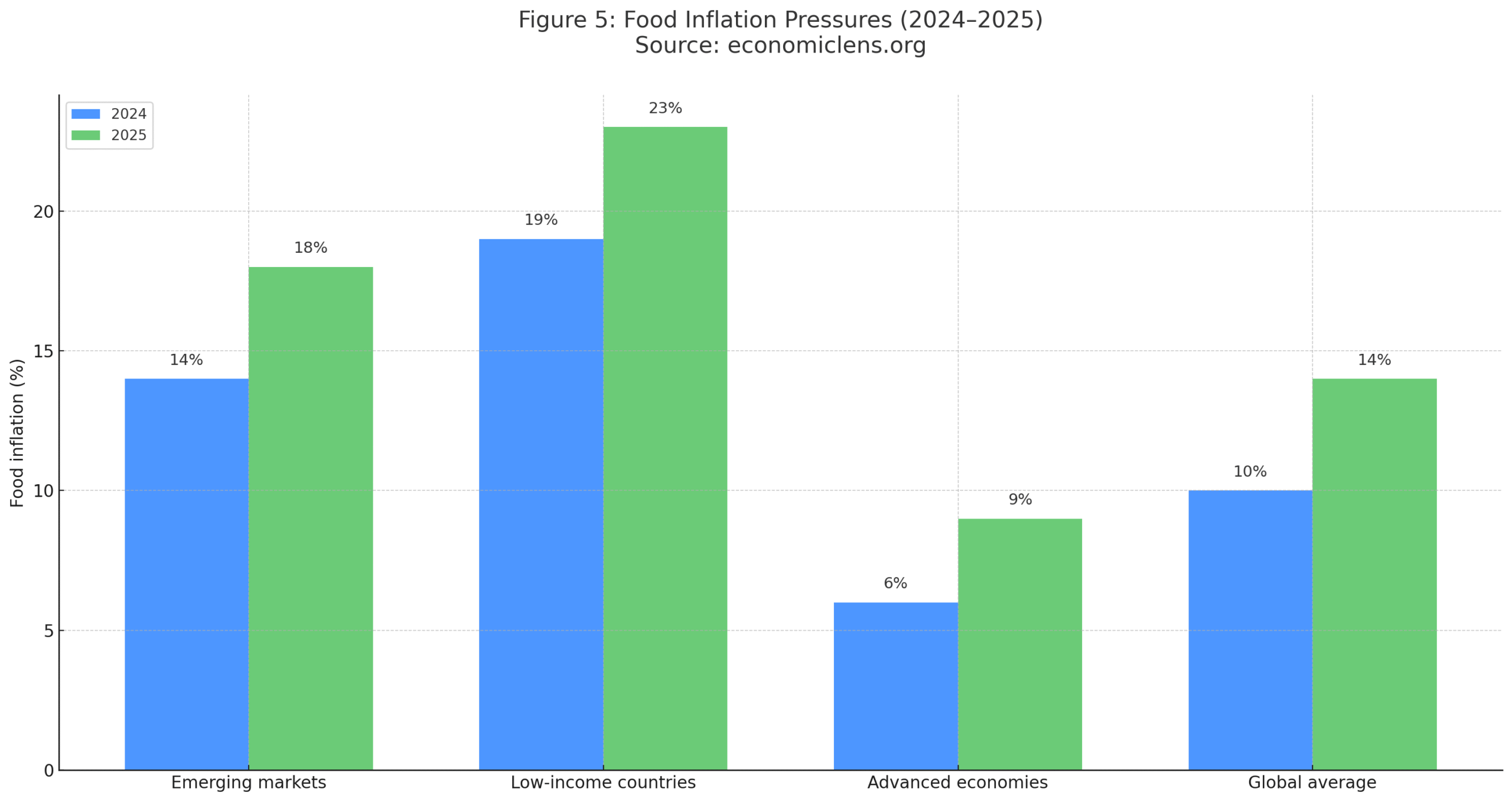

Macro strategist Dr. Lina Qureshi argues that “food inflation has become the new anchor of global inflation expectations,” influencing wage negotiations and monetary policy. The 2025 IMF Inflation Monitor notes that food prices in emerging markets rose 18 percent year-on-year, compared with 9 percent in advanced economies.

Food inflation disproportionately affects low-income and emerging economies, where households spend more on staples. Rising prices erode purchasing power and intensify vulnerability.

East African Transport Disruptions After 2025 Floods

Record-breaking floods destroyed bridges and roads across Kenya, Tanzania and Ethiopia, disrupting domestic food transport and import distribution. Consequently, staple availability collapsed in some regions despite adequate national stocks. The episode showed how infrastructure fragility accelerates the global food supply crunch.

For broader economic context on how inflation, weak growth and global shocks interact with food prices, see “Global Economic Outlook 2025–2026: Slow Growth, Sticky Inflation & Rising Debt” (https://economiclens.org/global-economic-outlook-2025-2026-slow-growth-sticky-inflation-rising-debt/).

“When food becomes expensive, everything else becomes uncertain.”

6. Infrastructure Fragility and Worsening Global Food Supply Strain

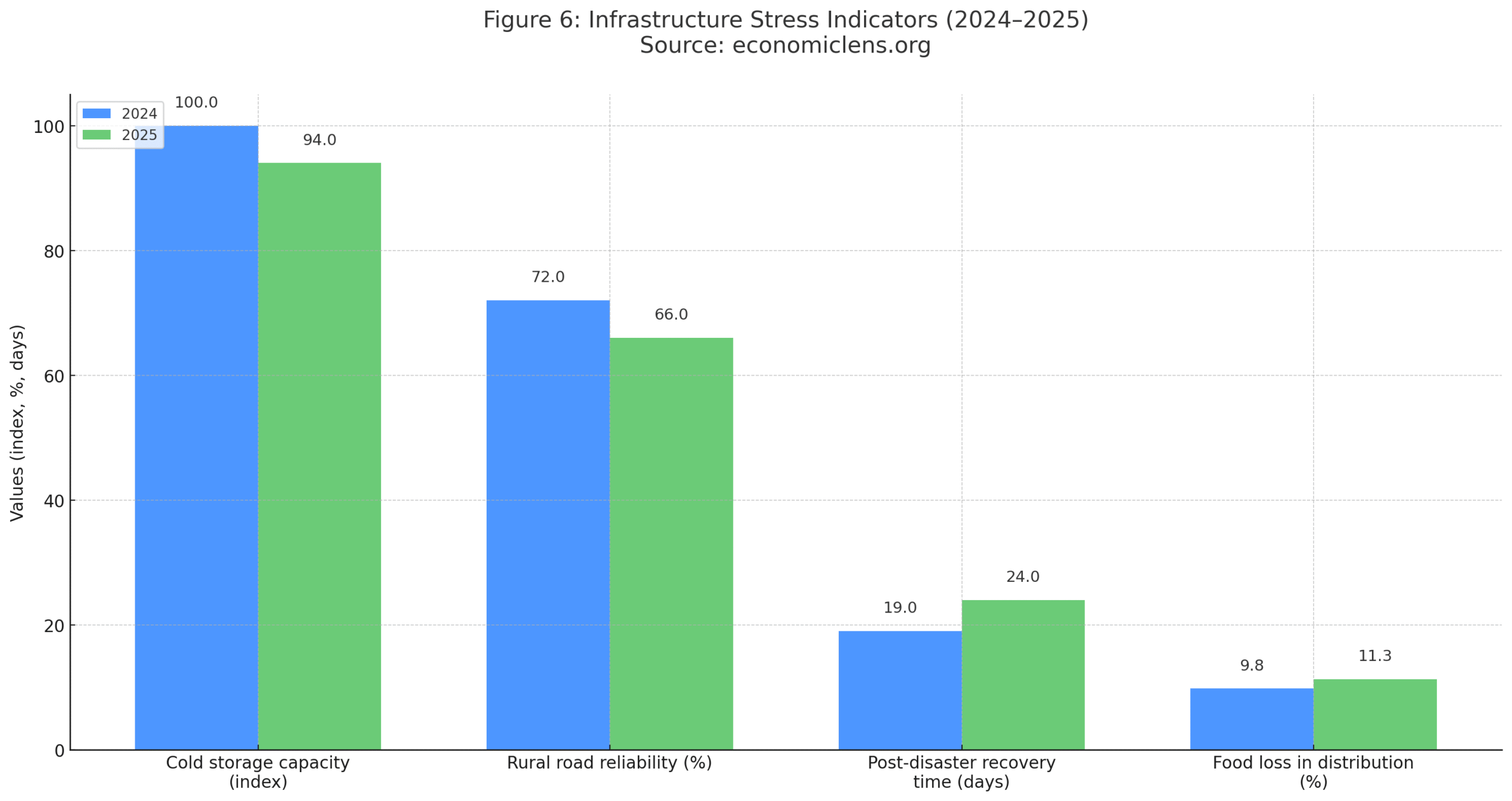

Aging storage systems, weak transport corridors and limited cold chain infrastructure make distribution inefficiencies a major contributor to the global food supply crunch. Additionally, post-disaster disruptions often break local supply chains for weeks.

Infrastructure specialist Dr. Omar Siddiqui emphasizes that “once food reaches ports, the real bottlenecks begin,” because inland logistics lag behind maritime upgrades. The World Bank’s 2025 Logistics Resilience Index shows that 62 countries saw deteriorating food transport reliability due to poor infrastructure and climate damage.

Weak logistics systems increase loss, slow recovery and reduce reliability. The resulting inefficiencies shrink effective supply even when stocks are adequate.

“The distance between ports and markets can decide who eats and who does not.”

7. Market Concentration and Strategic Stockpiling

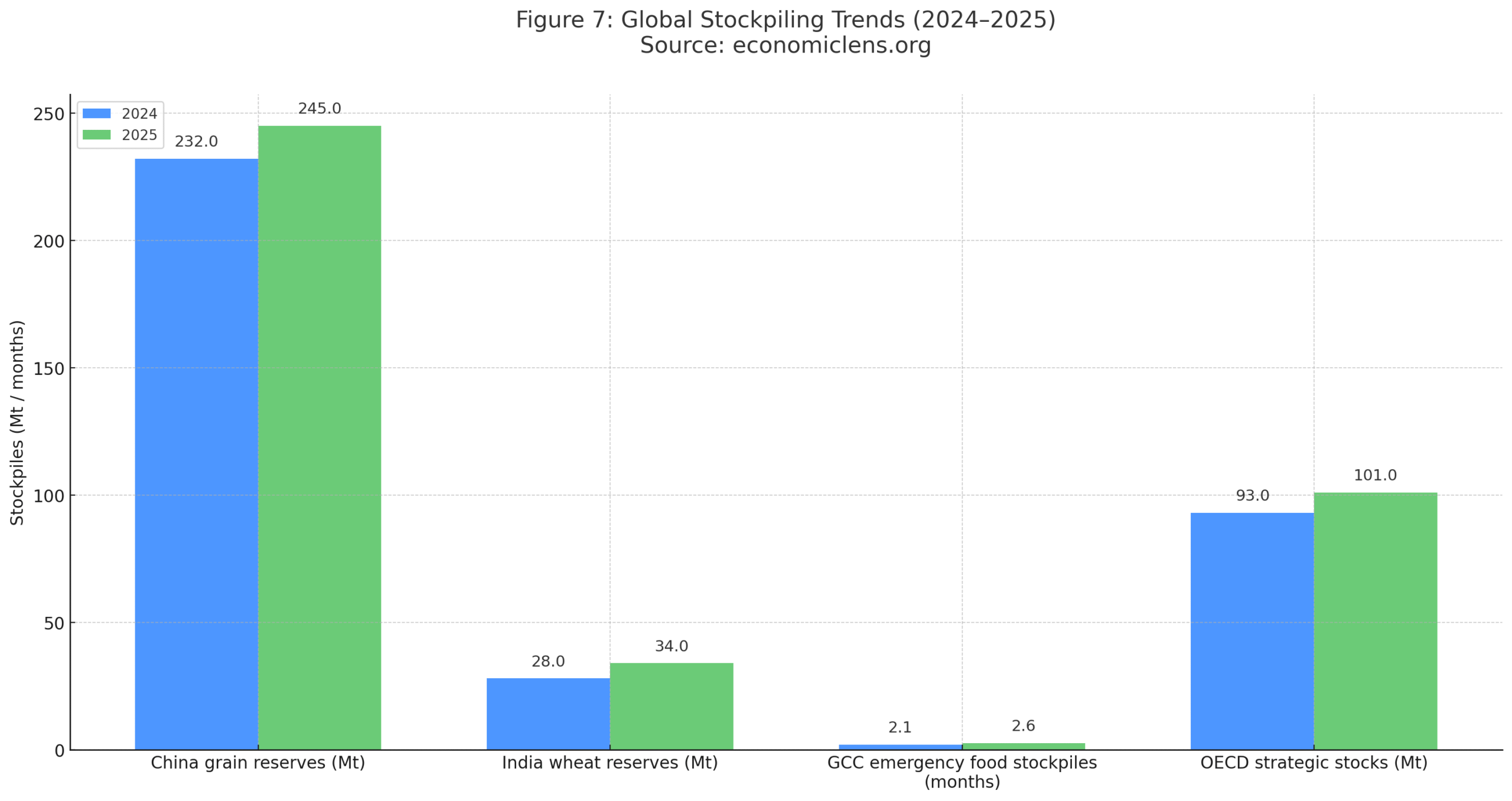

A small number of countries dominate global grain exports, making the market highly sensitive to domestic shocks and policy moves. Additionally, rising stockpiling by major economies has reduced global liquidity.

Commodity analyst Dr. Samira Vance warns that concentrated supply chains create “single-point-of-failure risks” where disruptions in one region cascade worldwide. S&P Global’s 2025 Grain Market Concentration Report states that the top five wheat exporters control 72 percent of global shipments, up from 64 percent a decade ago.

Growing reserves among major economies limit global liquidity and reduce market circulation. Concentrated stockpiling heightens scarcity risk for import-dependent nations.

“When a few nations hold the world’s food, scarcity becomes a strategic tool.”

8. Policy Gaps and the Path to Food Security Stability

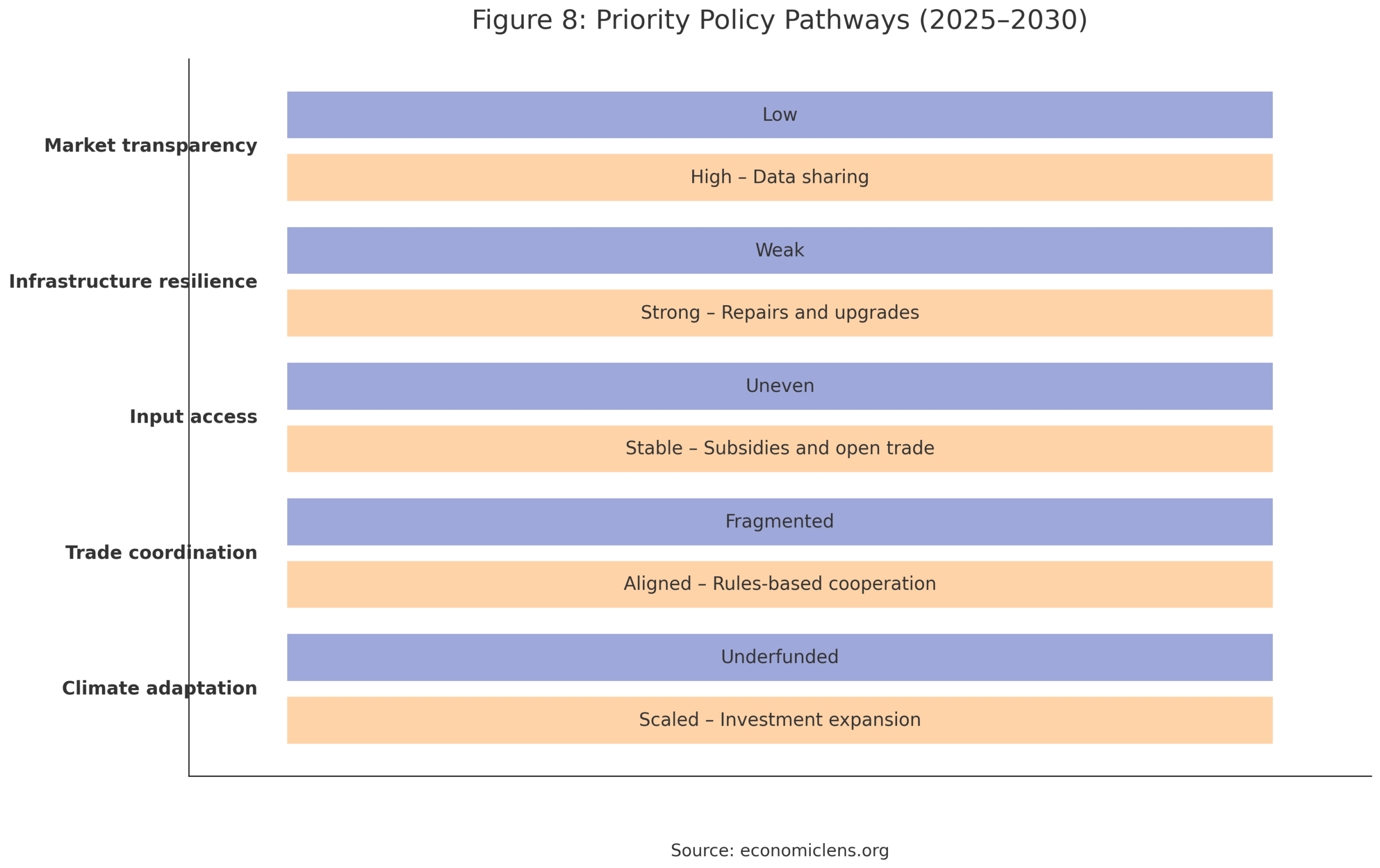

Policy fragmentation remains a critical weakness. While some countries invest in climate-smart agriculture, others react with short-term measures such as export bans. Consequently, the global food supply crunch persists due to lack of coordination.

Policy analyst Dr. Elena Marcos argues that the world needs “integrated climate-food-finance frameworks” to avoid cyclical crises. The 2025 UN Escap Food Systems Report emphasizes that without accelerated adaptation investments, global yield losses could reach 9 percent by 2030.

Clear policy gaps slow global progress toward food system resilience. Coordinated reforms are essential to improve stability and reduce exposure to recurring shocks.

“Food security is not achieved by chance but by coordinated global intent.”

CONCLUSION

The food supply crunch is no longer a temporary disruption but a structural macroeconomic challenge shaped by climate volatility, trade restrictions, infrastructure fragility and rising input costs. These pressures tighten supply, fuel food inflation and expose vulnerable populations to heightened economic shocks. Additionally, maritime disruptions, market concentration and strategic stockpiling have deepened fragmentation across global food systems. As a result, global markets face synchronized risks that require coordinated policy action rather than isolated national responses. Effective solutions include greater investment in climate-resilient agriculture, enhanced transparency in stock levels, improved maritime reliability, strengthened infrastructure resilience and rules-based approaches to trade. Without these steps, volatility will continue to redefine food security, elevate inflation risk and challenge both social stability and long-term economic planning. Ultimately, the global food supply crunch reflects a deeper need for coherent global governance at the intersection of climate risk, food systems and economic resilience.

CALL TO ACTION

Strengthening global food security requires evidence-based policy, resilient trade flows and strategic investment in climate adaptation. Governments, institutions and markets must act collaboratively to prevent recurring shortages and rising inflation risk.

“The next chapter of global stability will be written by how the world manages food scarcity, not merely by how it responds to it.”

3 thoughts on “Global Food Supply Crunch: Climate Shocks, Export Bans and Inflation Risk”

Good Work 👏👍

Useful for students

Excellent 👌