The global housing affordability crisis 2025 intensifies as rising rents, higher mortgage costs and stagnant incomes strain households. This blog evaluates the underlying drivers of the affordability crisis through comparative indicators, regional analysis, expert commentary and policy pathways. Furthermore, it offers insights into the structural changes reshaping global housing markets and the implications for long term urban stability.

Introduction

The global housing affordability crisis 2025 intensifies as rising rents, elevated mortgage costs and stagnant incomes converge to strain household budgets across major cities. Affordability challenges deepen due to limited housing supply, high land prices and structural inequality within urban markets. Consequently, both advanced and emerging economies confront a mounting imbalance between income growth and the cost of securing adequate housing.

In the global housing affordability crisis 2025, urbanization accelerates demand while construction slows due to higher financing costs and labor constraints. Meanwhile, investor activity increases competition for limited housing stock, amplifying price pressures and widening access gaps. Additionally, mortgage stress rises as interest rates remain elevated, reducing homeownership affordability for middle and lower income households.

1. Global Housing Affordability Crisis 2025 and Rising Housing Costs

The global housing affordability crisis 2025 reflects a severe imbalance between income growth and urban housing costs. Rising interest rates, stagnating wages and escalating land prices squeeze households across advanced and emerging economies. Meanwhile, the mismatch between rapid urbanization and insufficient construction accelerates rental inflation. Additionally, investor driven housing demand intensifies competition for limited supply. Consequently, affordability deteriorates in both rental and owner markets, widening inequality and straining household budgets.

Expert Commentary and Report Analysis

OECD Housing Analyst Christian Hilber notes in the OECD Housing Market Overview 2025 (https://www.oecd.org/housing/) that rising borrowing costs reduce purchasing power even for middle income households, weakening affordability across advanced economies. Meanwhile, World Bank urban development experts, drawing on findings from the World Bank Urbanization Review (https://www.worldbank.org/en/topic/urbandevelopment), highlight that supply side bottlenecks push urban rents higher across Asia and Africa. Additionally, IMF macro analysts, in their Housing Stability Assessment 2025 (https://www.imf.org/en/Publications/GFSR), emphasize that real estate price pressures persist despite slower economic growth due to structural demand factors.

The OECD Housing Market Overview 2025 (https://www.oecd.org/housing/) shows affordability deteriorating across 33 member states as rent to income ratios and mortgage burdens rise simultaneously. Meanwhile, the World Bank Urbanization Review (https://www.worldbank.org/en/topic/urbandevelopment/overview) finds that major cities in South Asia and Africa experience the fastest rent increases due to rapid urban population growth and insufficient housing supply. Furthermore, the IMF Housing Stability Assessment 2025 (https://www.imf.org/en/Publications/GFSR) highlights that interest rate burdens remain high relative to income, reinforcing the global housing affordability crisis 2025.

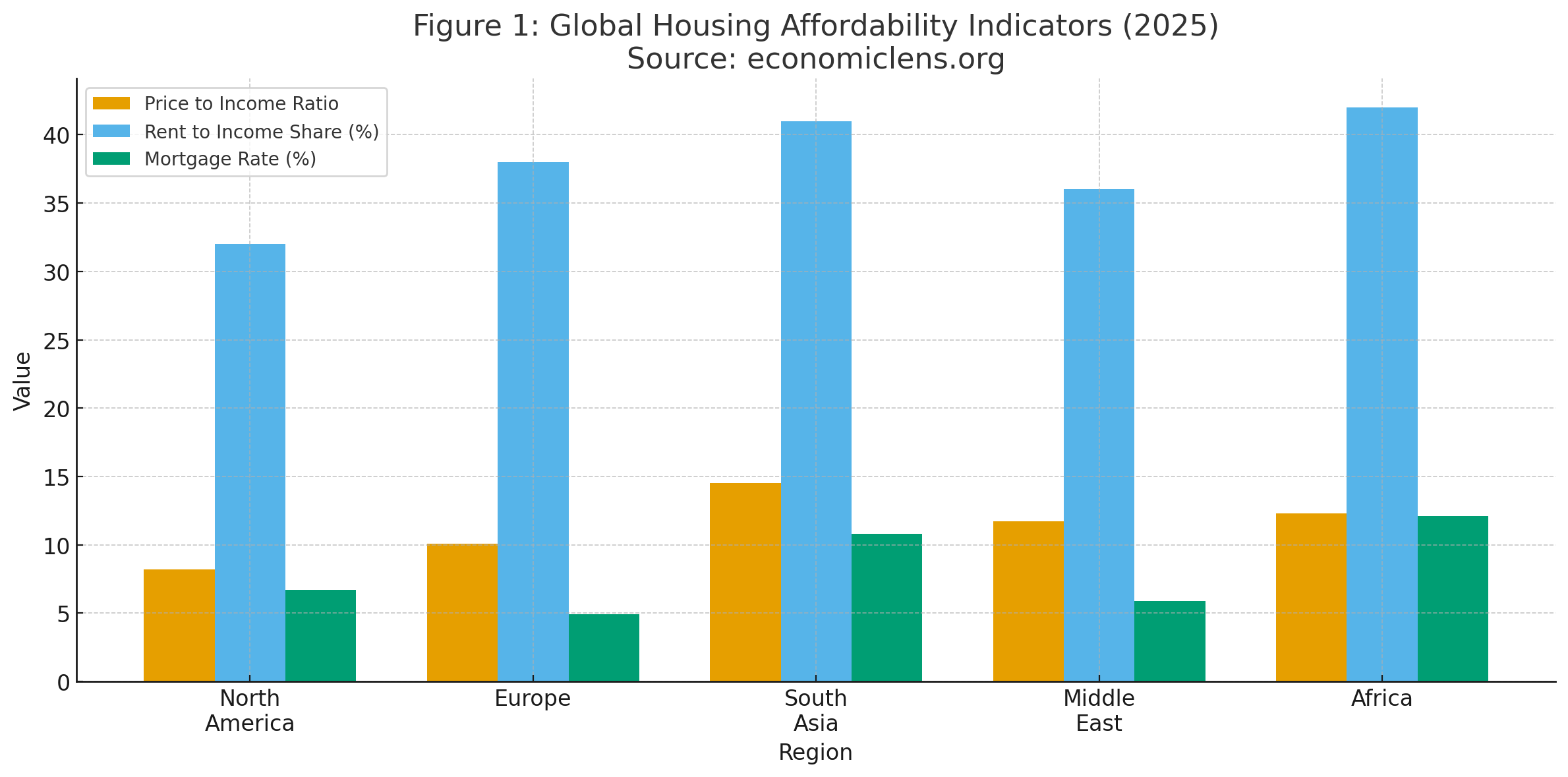

Affordability indicators show that households across regions face severe pressure from rising rents and elevated mortgage rates. Consequently, ownership becomes inaccessible for many while rental burdens intensify urban inequality.

London, Toronto and Sydney Face Record Rent Inflation

Major global cities experience historic rent surges in 2025 driven by limited supply, higher mortgage rates and investor competition. According to Knight Frank, rents in London climbed by 11 percent in 12 months, while Toronto recorded a 9 percent jump and Sydney nearly 12 percent. Additionally, limited new construction due to higher financing costs reduces vacancy rates. Consequently, young households and new immigrants face steep affordability barriers, pushing demand into peripheral suburbs.

“Housing stress becomes structural when incomes stagnate but costs continue rising without pause.”

2. Interest Rates and Mortgage Stress in the Global Housing Affordability Crisis 2025

High interest rates remain a central driver of the global housing affordability crisis 2025, increasing monthly mortgage repayments and shrinking purchasing power. As refinancing costs rise, households experience greater financial strain while banks tighten lending conditions. Additionally, inflation resilient sectors such as real estate attract investors, pushing prices higher. Consequently, ownership becomes more difficult as affordability falls to multi decade lows in many markets.

For broader macroeconomic context on how high interest rates and slow growth strain households worldwide, see “Global Economic Outlook 2025–2026: Slow Growth, Sticky Inflation & Rising Debt” (https://economiclens.org/global-economic-outlook-2025-2026-slow-growth-sticky-inflation-rising-debt/).

Expert Commentary and Report Analysis

Bank for International Settlements analysts note in their housing and credit assessments (https://www.bis.org/publ/arpdf/ar2024e.htm) that mortgage resilience has weakened as interest burdens rise faster than incomes. Meanwhile, Moody’s housing credit researchers warn in their mortgage risk outlook (https://www.moodys.com/web/en/us/insights/topics/housing.html) that delinquency rates may increase in economies with a high share of variable rate mortgages. Additionally, ING Global Housing Strategy analysis (https://think.ing.com/) indicates that mortgage lock in effects limit household mobility, worsening mismatches in housing allocation.

The IMF Global Financial Stability Update 2025 (https://www.imf.org/en/Publications/GFSR) highlights rising mortgage risk in countries with elevated household debt levels and prolonged high interest rates. Meanwhile, the OECD Financial Conditions Index (https://www.oecd.org/economy/financial-conditions-index.htm) confirms that borrowing constraints remain tight across advanced economies. Furthermore, the World Bank Credit Access Survey (https://www.worldbank.org/en/topic/financialsector/brief/financial-access-survey) identifies reduced mortgage access across emerging markets, reinforcing stress within the global housing affordability crisis 2025.

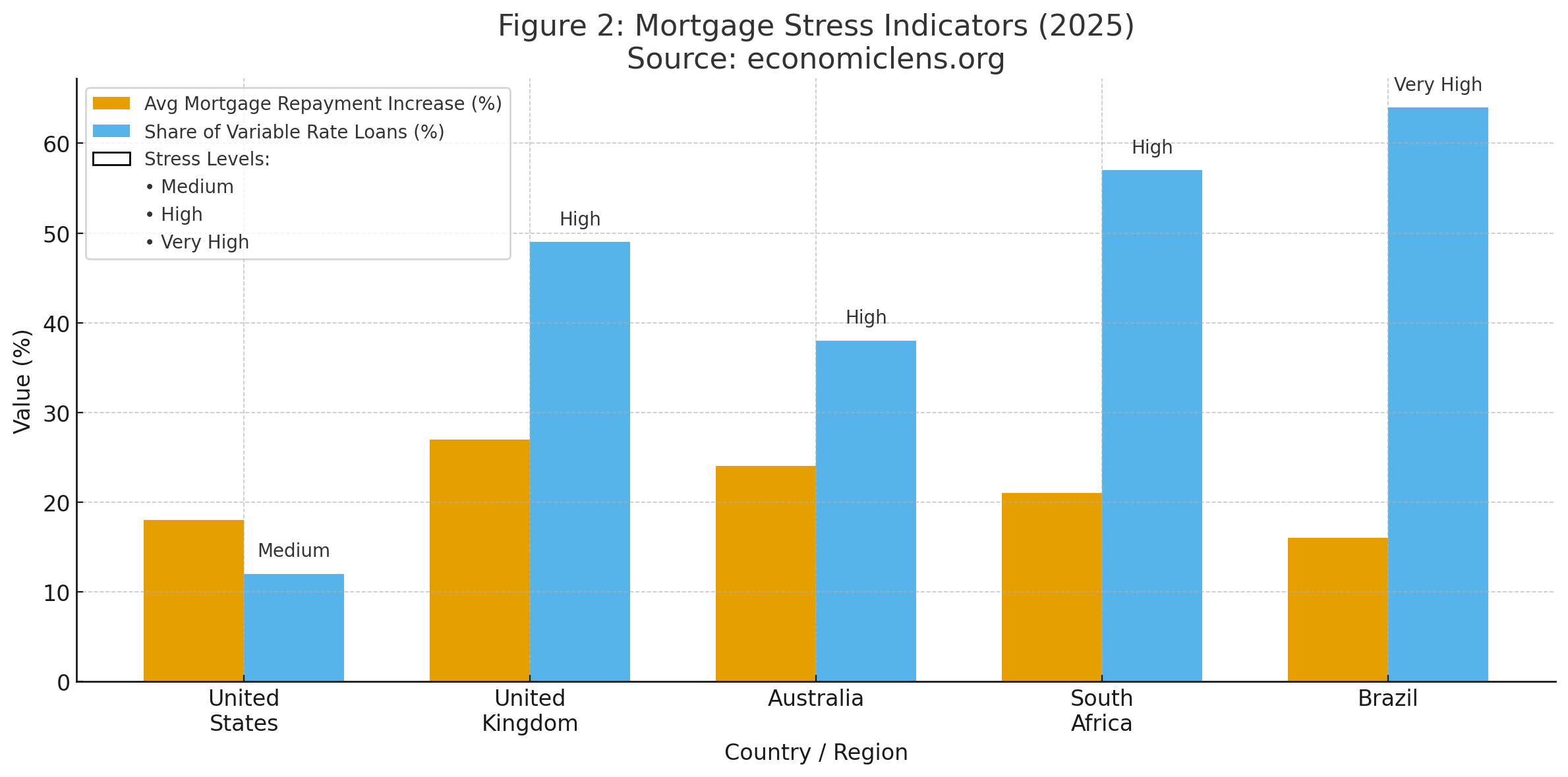

Mortgage stress rises sharply in economies with high variable rate exposure. Consequently, repayment burdens intensify and constrain household consumption.

UK Mortgage Holders Face Sharp Payment Increases

The United Kingdom confronts one of the harshest adjustments as nearly half of all mortgages are variable rate. According to the Bank of England, more than one million households face payment increases exceeding 29 percent by the end of 2025. Meanwhile, first time buyers struggle to qualify due to tighter affordability tests. Consequently, the UK housing market experiences deep stress, reinforcing the global housing affordability crisis 2025 narrative.

“When borrowing becomes a burden, stability weakens and the dream of ownership drifts out of reach.”

3. Global Rent Surge 2025, Supply Shortages and Urban Housing Inequality

Rental markets face acute pressure as limited housing supply collides with expanding urban populations. Construction activity declines due to higher financing costs, material inflation and labor shortages. Meanwhile, investor purchases reduce the stock of available long term rentals. Consequently, rents rise rapidly, especially in global cities where demand significantly exceeds supply. The urban housing inequality 2025 trend becomes more pronounced as lower income households face displacement from central districts.

A related analysis on global stress factors affecting vulnerable regions is available in “Global Water Stress: Canal Bottlenecks, Hydropower Losses & Supply Chain Risk” (https://economiclens.org/global-water-stress-canal-bottlenecks-hydropower-losses-supply-chain-risk/).

Expert Commentary and Report Analysis

UN-Habitat housing experts note in their urban housing analysis (https://unhabitat.org/topic/housing) that rapidly expanding cities in Africa and Asia face the steepest rental pressures as population growth outpaces supply. Meanwhile, JLL Real Estate analysts, in their global residential outlook (https://www.jll.com/insights), highlight that scarcity of build-to-rent units worsens affordability in major metropolitan markets. Additionally, CBRE researchers, drawing on construction sector assessments (https://www.cbre.com/insights/books/global-market-outlook), emphasize that global construction backlogs delay new housing supply, intensifying price pressures.

The UN Housing and Urbanization Outlook 2025 (https://unhabitat.org/urban-outlook) finds that rent inflation increased in 89 percent of major metropolitan regions as urban demand accelerates. Meanwhile, the OECD Rental Affordability Study (https://www.oecd.org/social/affordable-housing-database/) confirms that wage growth consistently lags rental prices across advanced economies. Additionally, World Bank Urban Housing Diagnostics (https://www.worldbank.org/en/topic/urbandevelopment/brief/urban-housing) show that slum expansion accelerates in fast-growing cities due to limited affordable housing. The OECD Housing Market Overview 2025 (https://www.oecd.org/housing/) provides further detailed evidence on affordability deterioration across major economies.

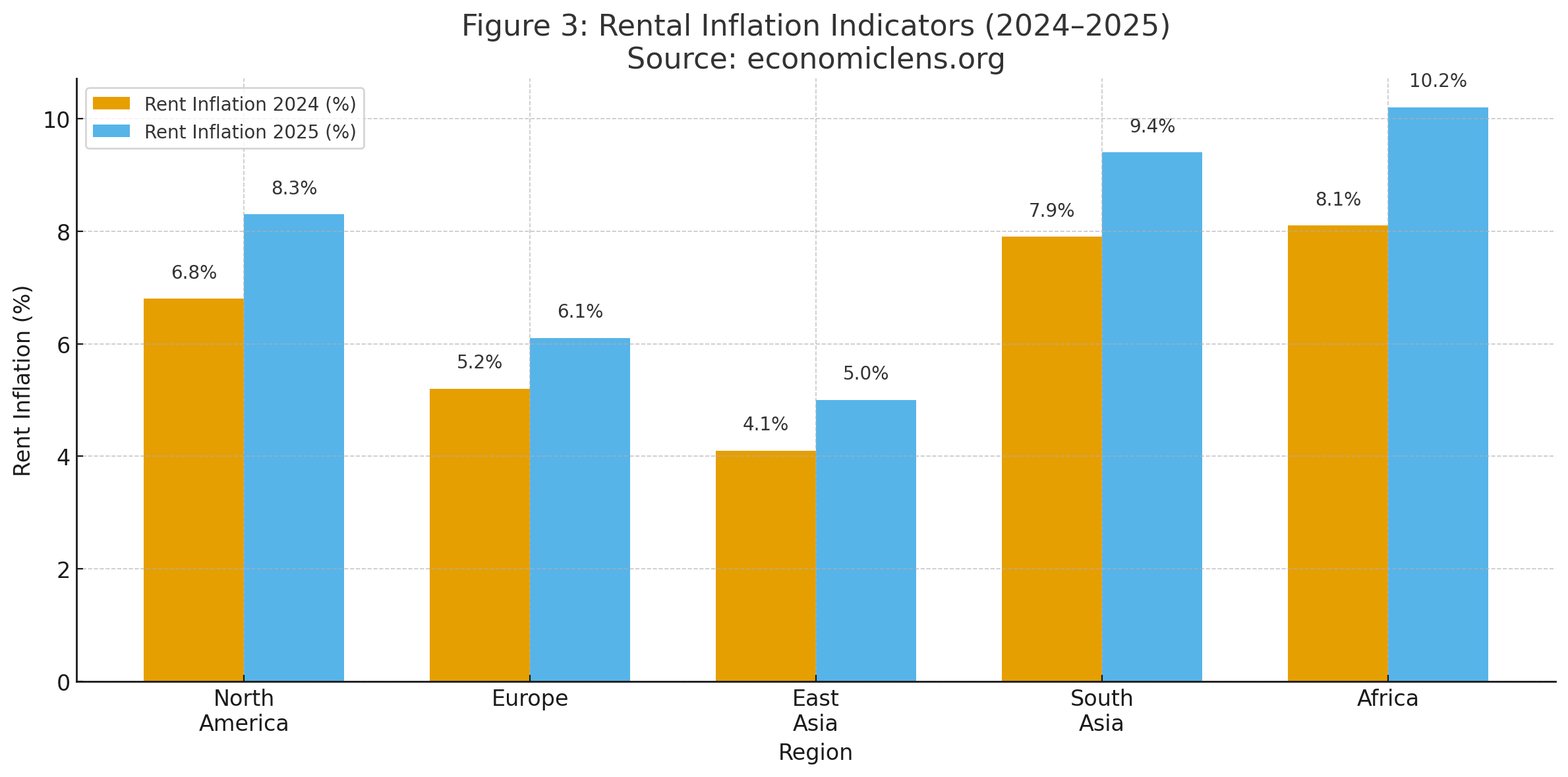

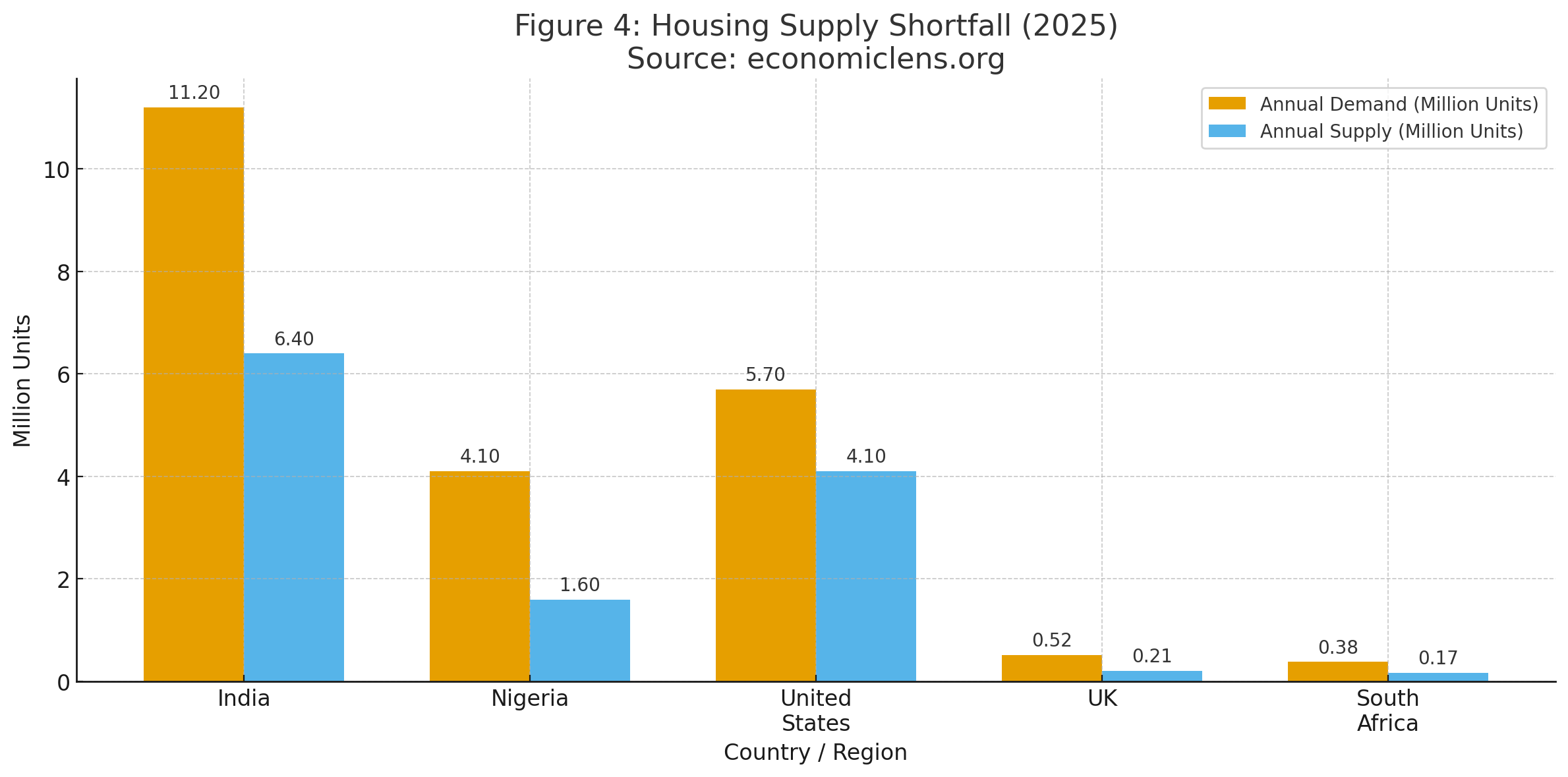

Rent inflation accelerates across all regions, with Africa and South Asia facing the sharpest increases. Consequently, housing stress becomes a defining feature of urban life.

Severe supply shortages across large economies intensify rental inflation and urban crowding. Consequently, long term affordability deteriorates further.

India’s Urban Housing Gap Widens Rapidly

India faces one of the world’s largest housing shortfalls as rapid urbanization outpaces construction. According to the Ministry of Housing, more than four million affordable units are required annually to stabilize the market. Meanwhile, construction delays and financing constraints hinder supply expansion. Consequently, major cities including Mumbai, Delhi and Bengaluru report double digit rent increases in 2025.

“Housing becomes unaffordable when cities grow faster than the structures built to shelter them.”

4. Investor Activity and Urban Housing Inequality in the Global Housing Crisis

Investor activity plays a critical role in shaping the global housing affordability crisis 2025 as institutional buyers expand their footprint in urban markets. Rising investment demand raises prices for owner occupied units and reduces rental stock. Meanwhile, high net worth investors seek property as a hedge against inflation. Consequently, price pressures intensify, especially in metropolitan regions where supply is constrained. Inequality widens as households compete with large capital in both rental and ownership markets.

Expert Commentary and Report Analysis

The Harvard Joint Center for Housing Studies highlights in its housing market research (https://www.jchs.harvard.edu/) that investor purchases influence pricing dynamics more strongly than in previous housing cycles. Meanwhile, UBS Global Real Estate analysts, drawing on global market assessments (https://www.ubs.com/global/en/wealth-management/insights/real-estate.html), warn that speculative investment increases price volatility in major cities. Additionally, OECD researchers, in their housing and inequality analysis (https://www.oecd.org/housing/), note that investment-driven housing markets amplify urban inequality and crowd out owner-occupiers.

The UBS Global Real Estate Bubble Index 2025 (https://www.ubs.com/global/en/wealth-management/insights/real-estate/bubble-index.html) identifies vulnerability in cities including Hong Kong, Amsterdam and Vancouver as valuation risks intensify. Meanwhile, the Knight Frank Capital Flow Review (https://www.knightfrank.com/research) notes increased global allocation to residential assets amid financial market uncertainty. Additionally, IMF Housing Market Stability Metrics, discussed within the Global Financial Stability framework (https://www.imf.org/en/Publications/GFSR), show higher risk in markets overwhelmed by speculative demand, reinforcing the global housing affordability crisis 2025.

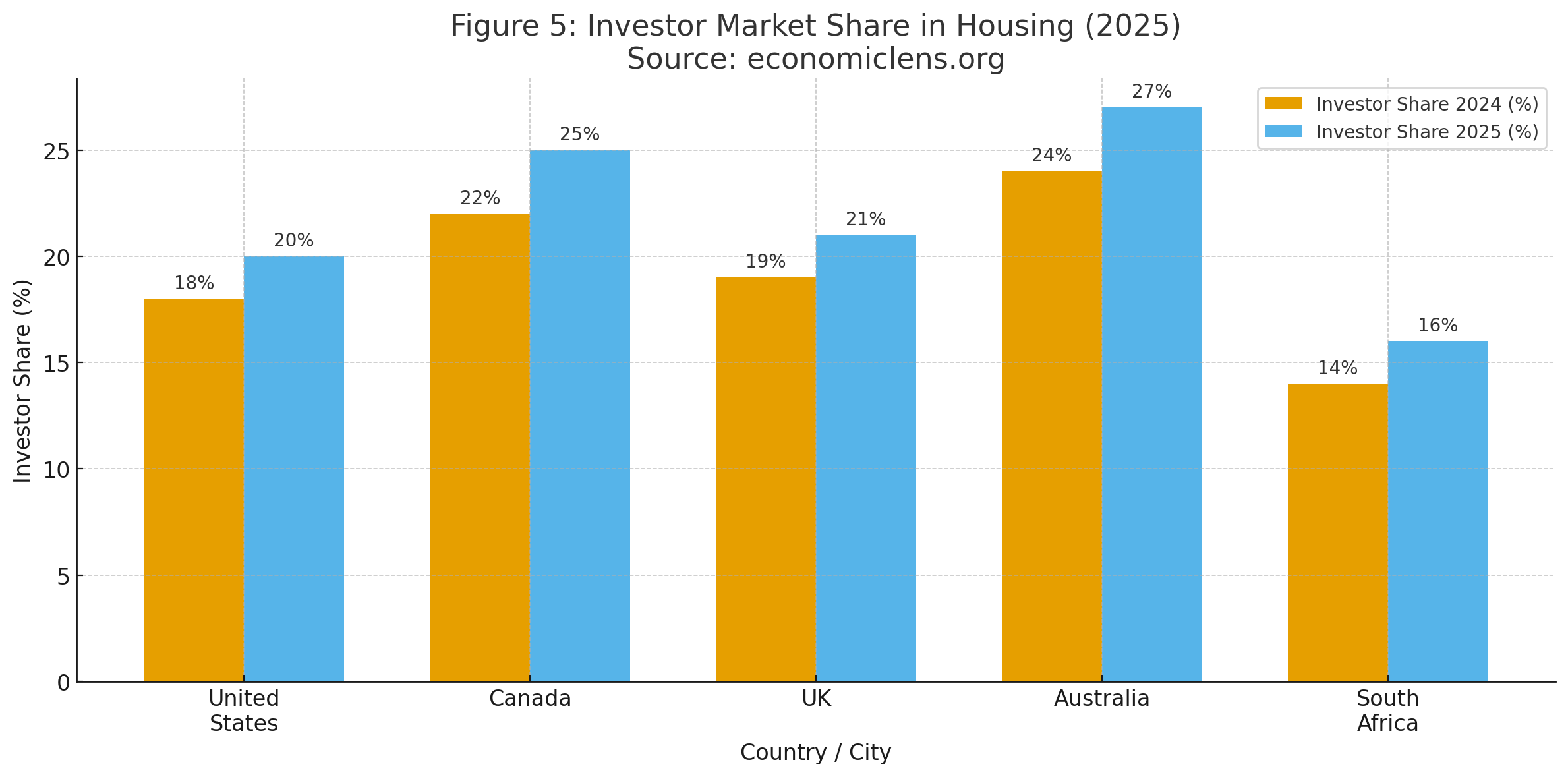

Investor participation continues rising across major markets, crowding out lower income households. Consequently, ownership and rental affordability deteriorate simultaneously.

Vancouver Faces Renewed Speculative Pressure

Vancouver’s housing market experiences renewed speculative activity as global investors return to residential property amid financial market volatility. According to CMHC, investor share of transactions rose to 27 percent in 2025. Meanwhile, affordability declines further due to limited supply and strong capital inflows. Consequently, policymakers debate stricter taxation and ownership rules.

“Housing markets strain when capital competes with households for the same finite space.”

5. Policy Responses to the Global Housing Affordability Crisis 2025

Addressing the global housing affordability crisis 2025 requires coordinated policy action focused on supply expansion, regulatory reform and targeted subsidies. Governments must accelerate construction through faster permitting, public private partnerships and incentives for affordable housing. Additionally, rental market regulation and tax reforms can mitigate investor driven distortions. Consequently, long term strategies must prioritize resilient urban planning and inclusive growth.

Expert Commentary and Report Analysis

World Bank housing specialists, in their affordable housing policy guidance (https://www.worldbank.org/en/topic/housing), recommend expanding low-cost housing through coordinated national programs that align financing, land use and delivery mechanisms. Meanwhile, UN-Habitat urban policy researchers, drawing on global urban planning frameworks (https://unhabitat.org/topic/urban-planning), highlight the importance of transit-oriented development to reduce household cost burdens and improve access to employment. Additionally, OECD fiscal experts, in their housing and public finance analysis (https://www.oecd.org/housing/), stress that housing subsidies must be carefully targeted and fiscally sustainable to avoid long-term budget distortions.

The UN Affordable Housing Roadmap 2025 (https://unhabitat.org/affordable-housing) outlines critical reforms for construction, financing and zoning to address structural supply gaps. Meanwhile, the IMF Fiscal Strategy Review (https://www.imf.org/en/Publications/Fiscal-Monitor) warns that poorly targeted housing subsidies can increase fiscal pressure without improving affordability outcomes. Furthermore, the World Bank Urban Equity Report (https://www.worldbank.org/en/topic/urbandevelopment) highlights that integrated housing and transport policy is a key factor in reducing urban inequality. The UN-Habitat Urban Housing & Cities Dashboard (https://unhabitat.org/) further shows how rapid urbanization and housing shortages intensify inequality and rental stress across major cities.

Policy response indicators show modest improvements in zoning reform and construction incentives. Consequently, the pace of affordability recovery remains slow, requiring stronger action.

Japan Accelerates Housing Redevelopment Amid Aging Demographics

Japan launches major redevelopment projects to convert vacant properties into affordable units for younger households. According to the Ministry of Land and Infrastructure, more than 150,000 units are targeted for refurbishment by 2026. Meanwhile, regional governments promote migration from major cities through housing incentives. Consequently, Japan’s strategy offers an alternative model for addressing the global housing affordability crisis 2025.

“Policy determines whether housing becomes a burden or a foundation for inclusive urban growth.”

Conclusion

The global housing affordability crisis 2025 reveals deep structural imbalances driven by slow wage growth, high interest rates, supply shortages and rising investor activity. Households across advanced and emerging economies face intensified pressure as rents and mortgage costs consume larger shares of income. Urbanization accelerates demand for limited housing stock, while construction constraints hinder supply expansion. Additionally, speculative investment distorts pricing in major cities, magnifying inequality and reducing accessibility for lower and middle income groups. Although governments introduce policy measures aimed at expanding supply and regulating markets, progress remains uneven. Long term solutions require integrated approaches that prioritize affordable housing construction, zoning reform, public transit alignment and inclusive urban planning. Without decisive action, affordability pressures will continue shaping economic and social outcomes across global cities.

Call to Action

Effective housing policy must align supply expansion with equitable urban planning and targeted financial reforms. Governments and institutions must act decisively to prevent affordability from becoming a long term structural barrier to inclusive growth.

“Housing affordability will define the economic landscape of 2025. Resilient cities will be built not by chance but by strategic choices that shape opportunity and strengthen social stability”