Global migration economics 2025 evolves amid demographic imbalance, labor shortages and rising remittance dependence. This blog explains how aging populations, migrant outflows, labor market mismatches and currency pressures reshape fiscal stability, global supply chains and economic resilience across advanced and emerging economies.

INTRODUCTION

The global migration economics 2025 landscape reflects a world shaped by demographic decline, labour shortages and rising dependence on migrant incomes. Advanced economies face ageing populations and shrinking domestic workforces. Therefore, emerging economies rely increasingly on remittances to stabilize fiscal accounts amid currency pressures and weak job creation. Consequently, migration patterns become a critical driver of macroeconomic performance and social resilience.

In global migration economics 2025, structural imbalances widen as labour demand in Europe, North America and East Asia outpaces domestic supply. Meanwhile, South Asia, Africa and Latin America experience significant migrant outflows driven by economic stagnation, climate stress and low job absorption. Additionally, remittance dependent economies face volatility as host country labour policies tighten. Currency depreciation also affects real income flows.

This blog analyzes the forces shaping global migration economics 2025 through demographic data, cross-border labour movements, remittance trends and fiscal implications. Furthermore, it integrates expert insights and 2024–2025 reports to evaluate systemic risks and long term stability challenges.

“In global migration economics 2025, these pressures shape labour markets and external stability worldwide.”

1. Demographic Imbalance and Global Labour Gaps In Global Migration Economics 2025

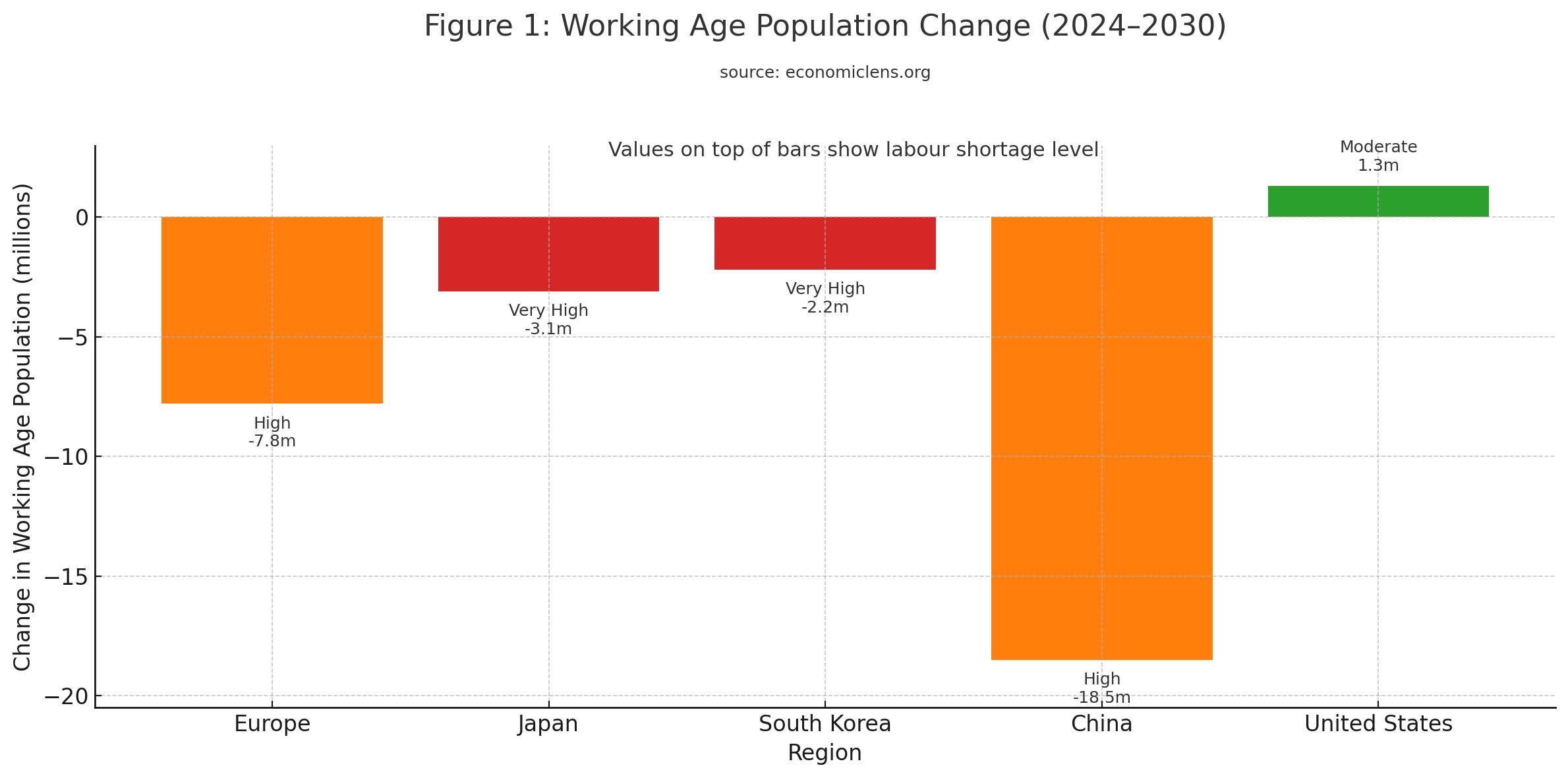

Demographic imbalance and global migration flows 2025 becomes a defining factor in global migration economics 2025 as aging populations reshape labour markets in advanced economies. Fertility decline accelerates workforce contraction across Europe, Japan, South Korea and China. Consequently, labour shortages increase demand for migrant workers across health care, logistics, manufacturing and agriculture.

A related analysis of how structural labour shortages and demographic pressures reshape global employment is discussed in “Global Youth Unemployment 2025: AI Disruption, Skills Gaps & the Gen Z Jobs Crunch” (https://economiclens.org/global-youth-unemployment-2025-jobs-skills-outlook/).

Expert Insight & Global Report Signals

Expert commentary on global migration economics 2025 highlights OECD labour economists noting that ageing reduces the working age population by more than 11 million across member states by 2030. Meanwhile, UN Population Division analysts note that fertility decline in East Asia occurs faster than anticipated. Additionally, European labour mobility experts emphasize that migrant inflows will remain essential for sustaining productivity.

The UN World Population Prospects 2025 (https://population.un.org/wpp/) confirms accelerating demographic decline across Europe and East Asia. Meanwhile, ILO labour market assessments identify healthcare and eldercare as sectors facing the highest vacancy rates. Furthermore, OECD Skills Outlook warns of rising long term productivity risks.

Working age populations decline sharply across Europe and East Asia. Consequently, labour shortages intensify and migrant inflows become increasingly central to sustaining output.

Japan’s Skilled Migration Lessons For Global Migration Economics 2025

Japan accelerates reforms to attract foreign workers as labour shortages intensify across the economy. According to the Ministry of Labour, vacancy rates in care services, construction and agriculture exceed 35 percent. As a result, policymakers expand skilled visa categories to stabilize workforce participation and support long term productivity. This experience shows how advanced economies in global migration economics 2025 increasingly depend on targeted migration pathways to offset demographic decline and sustain essential sectors.

“When populations shrink faster than jobs evolve, migration becomes the bridge sustaining economic momentum.”

2. Migration Corridors and Global Migration Flows 2025

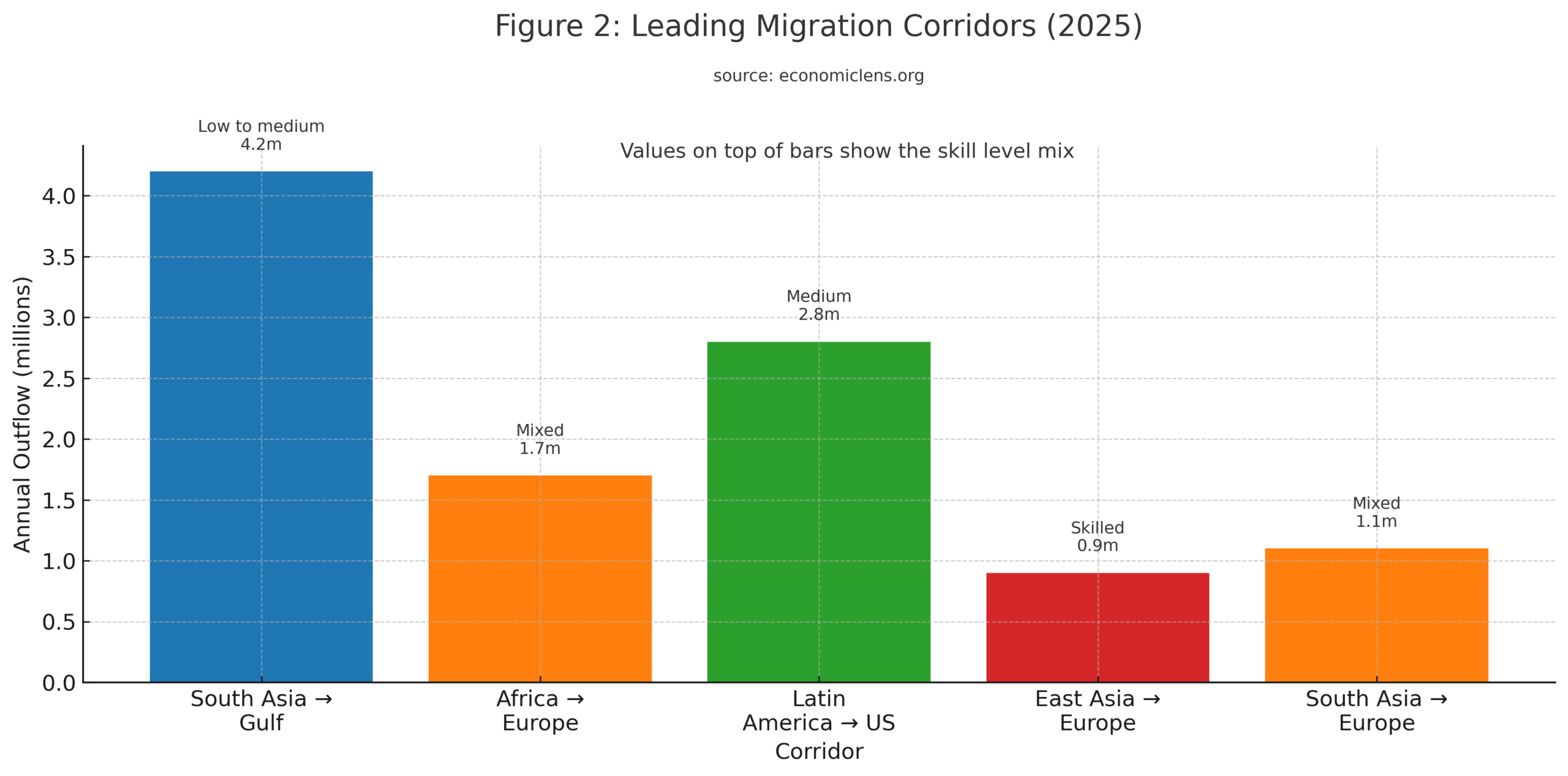

Migration corridors and global migration flows 2025 reshape global migration economics 2025 as South Asia, Africa and Latin America experience high outward mobility. Workers seek opportunities in Europe, North America and the Gulf due to domestic job scarcity and low wage growth. Consequently, cross-border labour mobility rises even as host countries tighten immigration frameworks.

Expert Insight & Global Report Signals

IOM mobility experts note that outward migration from South Asia reaches a decade high. Meanwhile, World Bank labour analysts emphasize the importance of migration corridors linking sending and receiving regions. Additionally, Brookings migration economists highlight rising skill-based migration demand.

The IOM Global Migration Report 2025 (https://www.iom.int/global-migration-report) identifies 289 million international migrants worldwide. Meanwhile, ILO migration diagnostics show increased mobility in construction, care work and logistics sectors. Furthermore, OECD migration policy review highlights rising digital skills migration to developed economies. The UN IOM Global Migration Report 2025 provides detailed evidence on cross-border labour mobility.

Migration outflows rise across major corridors due to labour gaps and economic stagnation in sending regions. Consequently, remittance dependence increases.

Gulf Labour Intake As A Mirror For Global Migration Flows 2025

Gulf economies expand migrant intake as megaproject activity accelerates and service sector demand rises across the region. Regional labour ministries report that new visa issuance now exceeds pre pandemic levels, which reflects sustained demand for foreign workers. As a result, South Asian migrants dominate incoming labour flows and corridor dependence grows stronger. This pattern mirrors global migration flows 2025, where labour shortages in receiving economies continue to pull workers from regions facing weak job creation and persistent income gaps.

“Mobility accelerates when global opportunity meets domestic stagnation and rising demographic needs abroad.”

3: Remittance Dependent Economies 2025 And Income Volatility

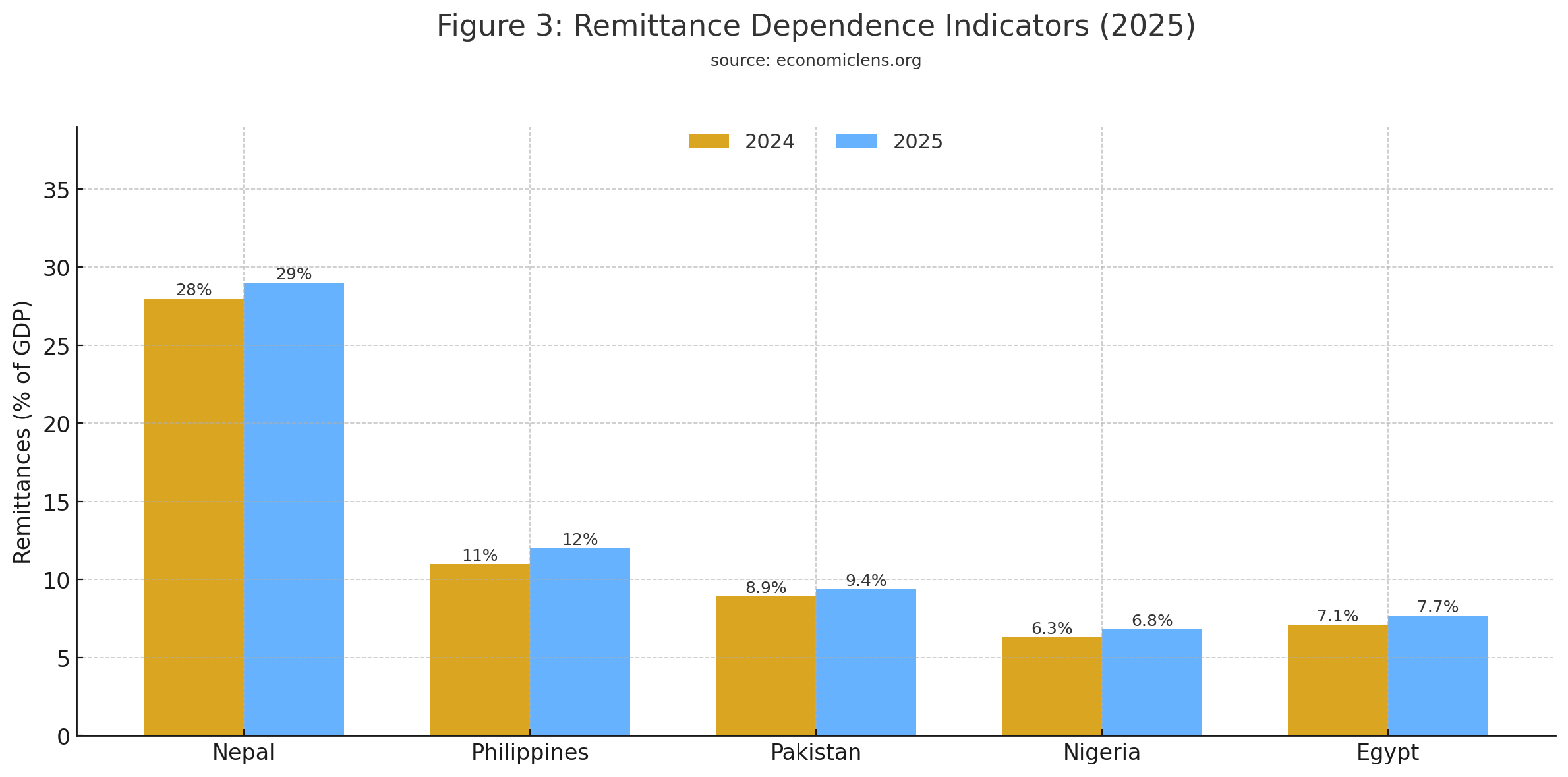

Remittance dependent economies 2025 and income volatility become a central feature of global migration economics 2025 as emerging economies rely heavily on migrant earnings to stabilize external balances. Currency depreciation, inflation and domestic fiscal deficits increase pressure on remittance flows. Consequently, external income volatility rises.

For broader context on how weak growth and global economic pressures affect remittance-dependent economies, see “Global Economic Outlook 2025–2026: Slow Growth, Sticky Inflation & Rising Debt” (https://economiclens.org/global-economic-outlook-2025-2026-slow-growth-sticky-inflation-rising-debt/)

Expert Insight & Global Report Signals

World Bank remittance economists (https://www.worldbank.org/en/topic/migrationremittancesdiasporaissues) note that inflows remain critical for South Asia, the Philippines, Nigeria and Egypt. Meanwhile, IMF fiscal analysts emphasize that remittance income stabilizes consumption during economic downturns. Additionally, ADB development specialists warn that host country slowdowns may suppress remittance growth.

The World Bank Migration and Remittances Outlook 2025 shows rising remittance dependence in low income countries. Meanwhile, the IMF external sector report notes increased FX sensitivity to remittance inflows. The World Bank report highlights rising external income volatility across emerging economies.

Remittance dependence increases across emerging economies due to weak domestic job markets and rising external vulnerabilities. Consequently, macroeconomic stability becomes linked to migrant earnings.

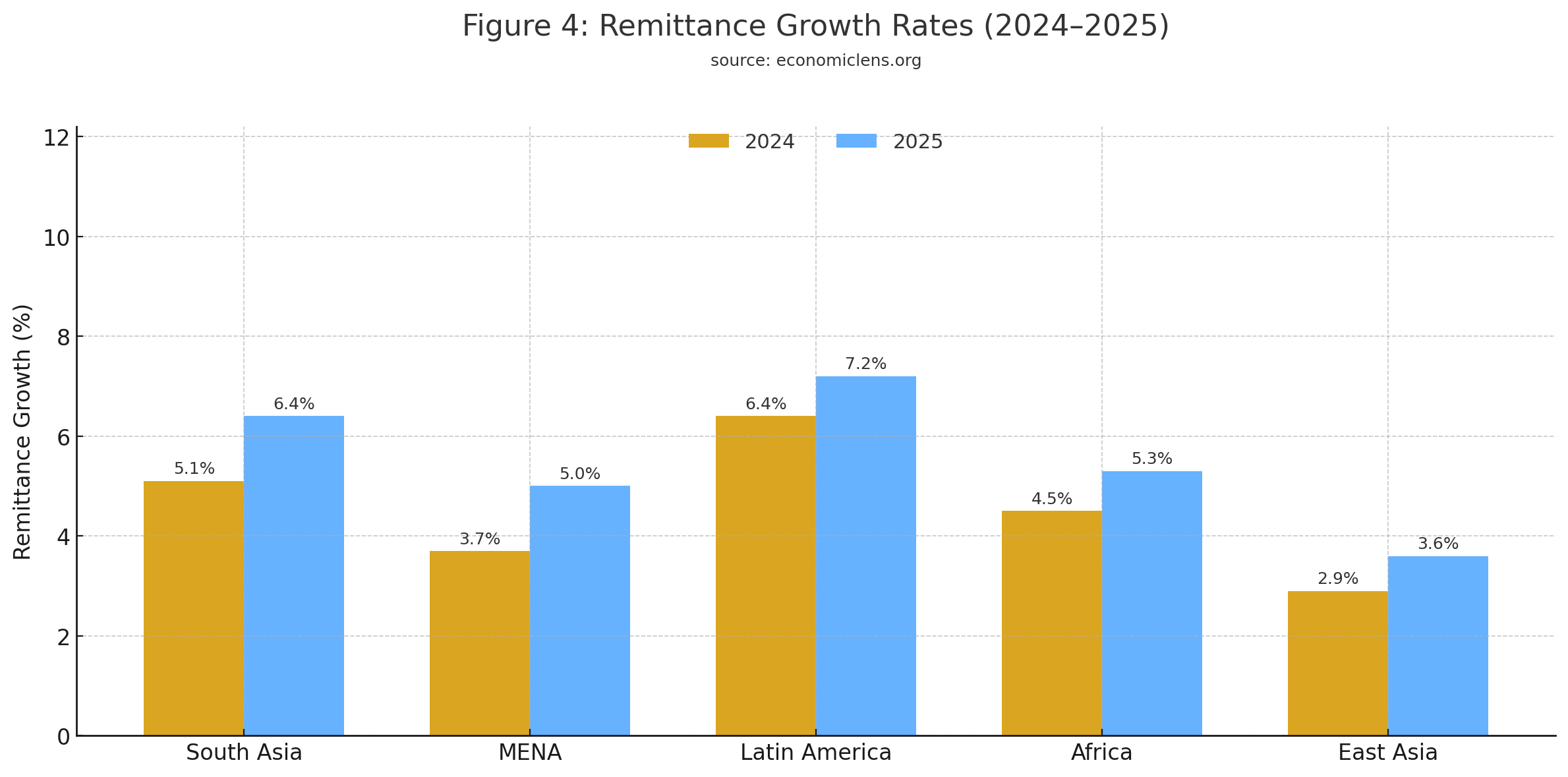

Remittance growth accelerates across all regions as outward migration increases. Consequently, household consumption stabilizes despite domestic economic pressure.

South Asian Remittance Patterns And Lessons For Remittance Dependent Economies 2025

Remittance inflows in Pakistan and Bangladesh increase as worker placements in Gulf states continue to rise. World Bank data shows that these transfers grow even in periods of domestic inflation, which highlights the stabilizing role of migrant earnings. As a result, both fiscal and external positions remain closely tied to labour demand in destination economies. This experience offers important lessons for remittance dependent economies 2025, where long term stability depends on diversified labour markets abroad and resilient migration corridors.

“When economies depend on workers abroad, resilience is shaped by factors far beyond domestic control.”

4. Fiscal Stability Pressures In Global Migration Economics 2025

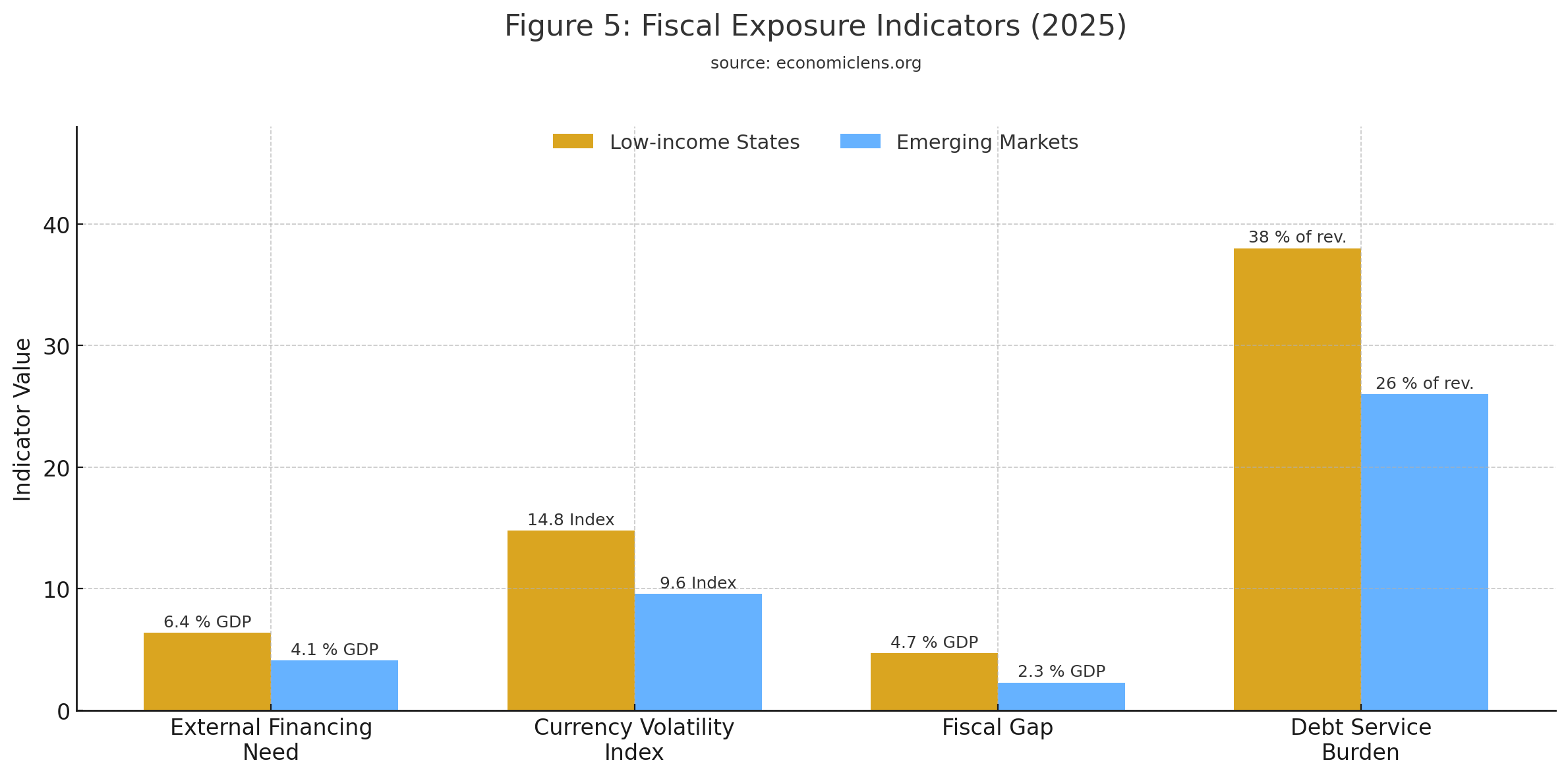

Fiscal exposure in global migration economics 2025 becomes more complex as governments face rising social expenditure and limited domestic job creation. Remittance inflows support consumption. However, they do not fully offset structural weaknesses. Additionally, currency depreciation increases external vulnerabilities.

Expert Insight & Global Report Signals

IMF fiscal stability analysts highlight that high remittance dependence can mask structural fiscal gaps. Meanwhile, OECD public finance experts note rising pressure on education and healthcare systems. Additionally, World Bank currency risk specialists emphasize the importance of diversified external income sources.

The IMF Fiscal Monitor 2025 (https://www.imf.org/en/Publications/FM) identifies external shocks as a key risk for remittance dependent economies. Meanwhile, World Bank FX vulnerability indicators show rising currency sensitivity to external income flows.

Fiscal indicators weaken across several economies due to external shocks and currency pressures. Consequently, fiscal resilience remains limited.

Egypt’s FX Pressures As A Warning For Remittance Dependent Economies 2025

Egypt faces severe currency depreciation even as remittance inflows continue to rise. IMF assessments show that external liabilities and elevated import costs grow faster than incoming foreign earnings, which weakens overall financial stability. As a result, fiscal and external pressures remain persistent and difficult to manage. This situation serves as a clear warning for remittance dependent economies 2025, where reliance on overseas income cannot cushion the effects of structural imbalances, high debt exposure and volatile exchange markets.

“Fiscal weakness deepens when external income rises but structural reforms lag behind economic needs.”

5: Long Term Global Migration Dynamics 2025 To 2035

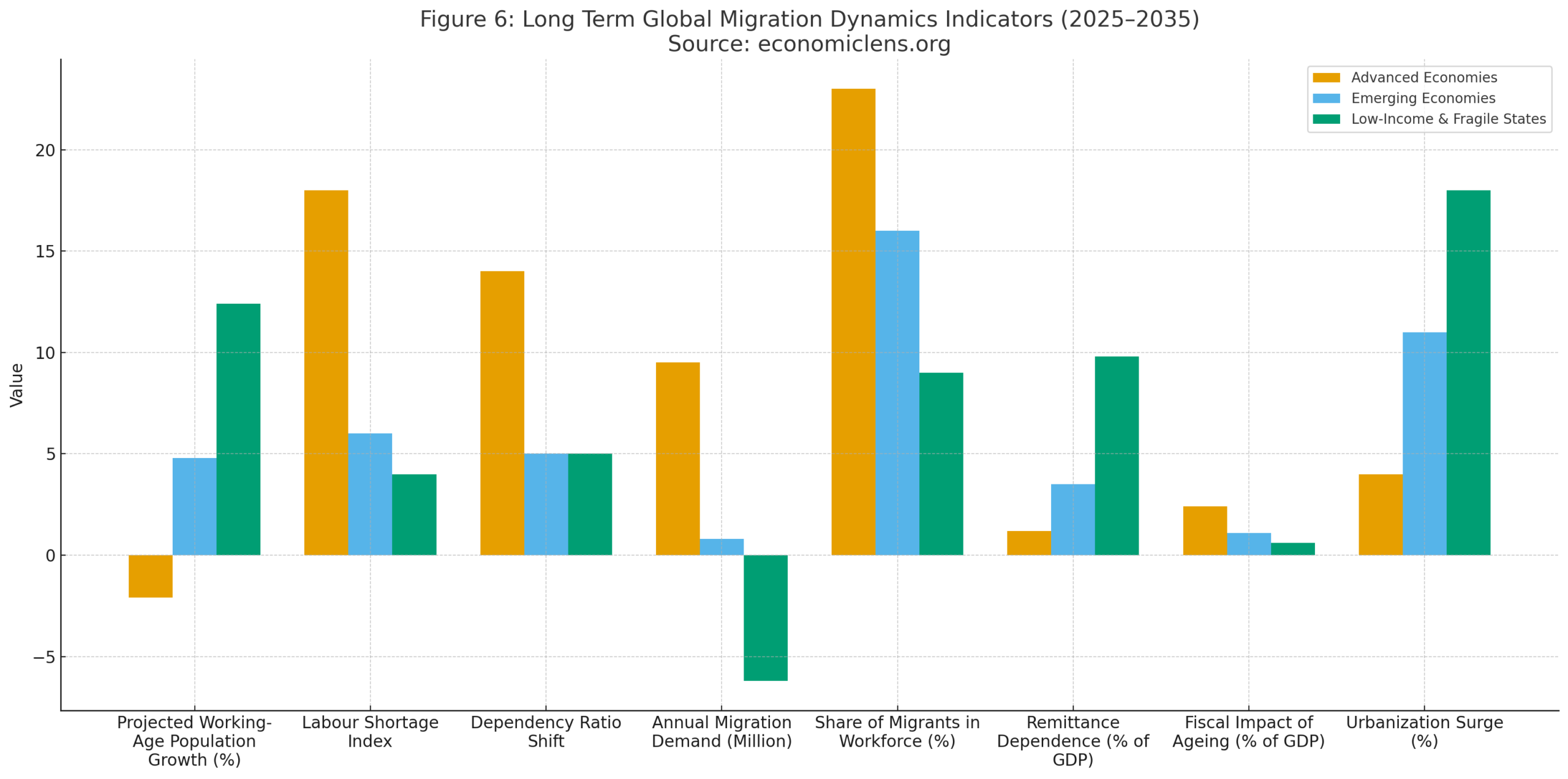

Long term global migration dynamics 2025–2035 highlight demographic, labour market and fiscal trends that will shape economic resilience. Advanced economies will increasingly rely on migrant workers to fill critical labour shortages. Meanwhile, emerging economies must balance remittance inflows with domestic job creation.

Expert Insight & Global Report Signals

UN DESA population specialists (https://www.un.org/development/desa) stress that demographic decline will intensify demand for migrants through 2035. Meanwhile, ILO labour economists highlight rising mismatch between skill supply and labour market needs. Additionally, World Bank development experts emphasize the importance of managed migration pathways.

The UN Migration Outlook 2025 identifies long term structural drivers of cross-border mobility. Meanwhile, IMF global risk assessments warn of rising inequality across sending and receiving states.

Long term indicators reveal sharp workforce decline in advanced economies and strong outward migration pressure across emerging and low income regions. Consequently, cross border mobility will continue as a structural driver of global labour and economic dynamics.

Germany’s Labour Shortages As A Model For Global Migration Economics 2025

Germany reports record job vacancies across health care, engineering and manufacturing as workforce aging accelerates. Federal Labour Agency data shows that sustained economic output increasingly depends on steady migrant inflows, particularly in essential and high skill occupations. As a result, policymakers expand skill based immigration pathways to meet long term labour demand and support productivity. This experience acts as a model for global migration economics 2025, where advanced economies must align demographic realities with targeted migration systems to maintain growth and competitiveness.

“The future of global labour markets will be shaped by how nations manage movement, not how they restrict it.”

Conclusion

Global migration economics 2025 illustrates how demographic imbalance, labour shortages and remittance dependence reshape global economic stability. Advanced economies face accelerated population aging and widening labour gaps. Therefore, they increasingly depend on migrant workers across essential sectors. Meanwhile, emerging economies rely heavily on remittance inflows to stabilize consumption, external balances and fiscal positions amid weak domestic job creation. Although migration flows support short term resilience, long term sustainability challenges persist due to structural weaknesses, currency risk and limited diversification. The interaction between demographic decline, labour mobility and external income dependence creates complex policy trade offs. Consequently, these dynamics will shape global development trajectories through the next decade.

Call to Action

Policymakers need to strengthen migration governance, expand skill development systems and diversify economic structures to reduce long term vulnerability. Effective strategies must connect demographic realities with economic opportunity, ensuring that labour mobility supports stability, productivity and inclusive growth. Sustainable progress will depend on policies that balance domestic needs with the evolving pressures shaping global migration economics 2025.

1 thought on “Global Migration Economics 2025: Demographic Imbalance & Remittance Dependence”

Superb