The global recession risk index 2025–2026 measures where the next global economic shock will most likely turn into a full-scale emerging-market crisis. Recessions do not begin with falling GDP numbers. They begin with funding stress, currency instability, and capital flight. For this reason, the global recession risk index 2025–2026 tracks the financial channels that transmit global stress into domestic collapse.

As global monetary conditions tighten and growth slows across advanced economies, financial pressure spreads toward weaker balance sheets. The International Monetary Fund reports that global growth will slow into 2026 while debt levels remain historically high (https://www.imf.org). Emerging markets now face slower export demand, higher interest costs, and fragile investor confidence. The global recession risk index 2025–2026 captures this risk by tracking sovereign debt, foreign-exchange stability, and capital flows.

Global macro forces that emerge in late 2025 often turn into crises by 2026. Higher global interest rates raise refinancing costs. Slower trade cuts foreign-currency earnings. These forces pressure currencies and government budgets at the same time. As a result, the global recession risk index 2025–2026 serves as an early-warning system for rising systemic stress.

Why the Emerging Market Recession Risk Index Matters

The emerging-market recession risk index matters because modern financial crises follow capital flows, not trade cycles. A country can post GDP growth and still collapse if foreign investors pull out. For this reason, the global recession risk index 2025–2026 tracks vulnerability instead of headline growth.

The World Bank reports that many developing economies now spend more on debt service than they receive in new financing (https://www.worldbank.org). This imbalance creates a severe liquidity squeeze. Governments lose fiscal space just when they need it most. EconomicLens explains this trap in detail in its 2026 debt-risk analysis: https://economiclens.org/global-debt-risks-2026-will-debt-trap-growth/. Countries with high external debt and weak revenue growth now face rising exposure to sudden crises.

Global growth also continues to weaken. Major economies now move through a synchronized slowdown. Export demand falls while financial conditions tighten. EconomicLens documents this shift in its stagnation study: https://economiclens.org/global-growth-slowdown-2025-2026-are-major-economies-sliding-into-a-synchronized-stagnation/. As capital inflows shrink and refinancing costs rise, risk builds across emerging markets. This is why the global recession risk index 2025–2026 has become a critical tool for identifying where the next crisis will strike.

Why Debt Stress Is Critical for the Global Recession Risk Index 2025–2026

Debt stress is one of the most important indicators in the global recession risk index 2025–2026 because it shows how well a government can respond to financial shocks. When governments carry high debt, they lose the ability to absorb external pressure such as a global slowdown or rising interest rates. Countries with high external debt face even greater danger because they must earn foreign currency to meet obligations. Default risk rises when debt-servicing costs grow faster than government revenue. Many developing economies now face this problem.

The IMF’s World Economic Outlook reports that many emerging markets have seen sharp increases in debt-to-GDP ratios in recent years (https://www.imf.org/en/Publications/WEO). High debt makes refinancing harder when global conditions tighten. It also limits the ability to support growth through fiscal policy. The World Bank reports that many low-income countries now spend a large share of their budgets on debt service (https://www.worldbank.org). This trend leaves little room for infrastructure or social investment. Debt payments now crowd out productive spending and increase economic fragility.

Short-term external debt adds another layer of risk. The Bank for International Settlements tracks these obligations and shows how they become unstable when global liquidity tightens (https://www.bis.org/statistics). Countries that must roll over large volumes of debt within a year face severe liquidity pressure. When lenders pull back, these countries struggle to refinance. The debt burden then becomes harder to manage. This situation raises default risk and strengthens the case for crisis conditions in 2025 and 2026.

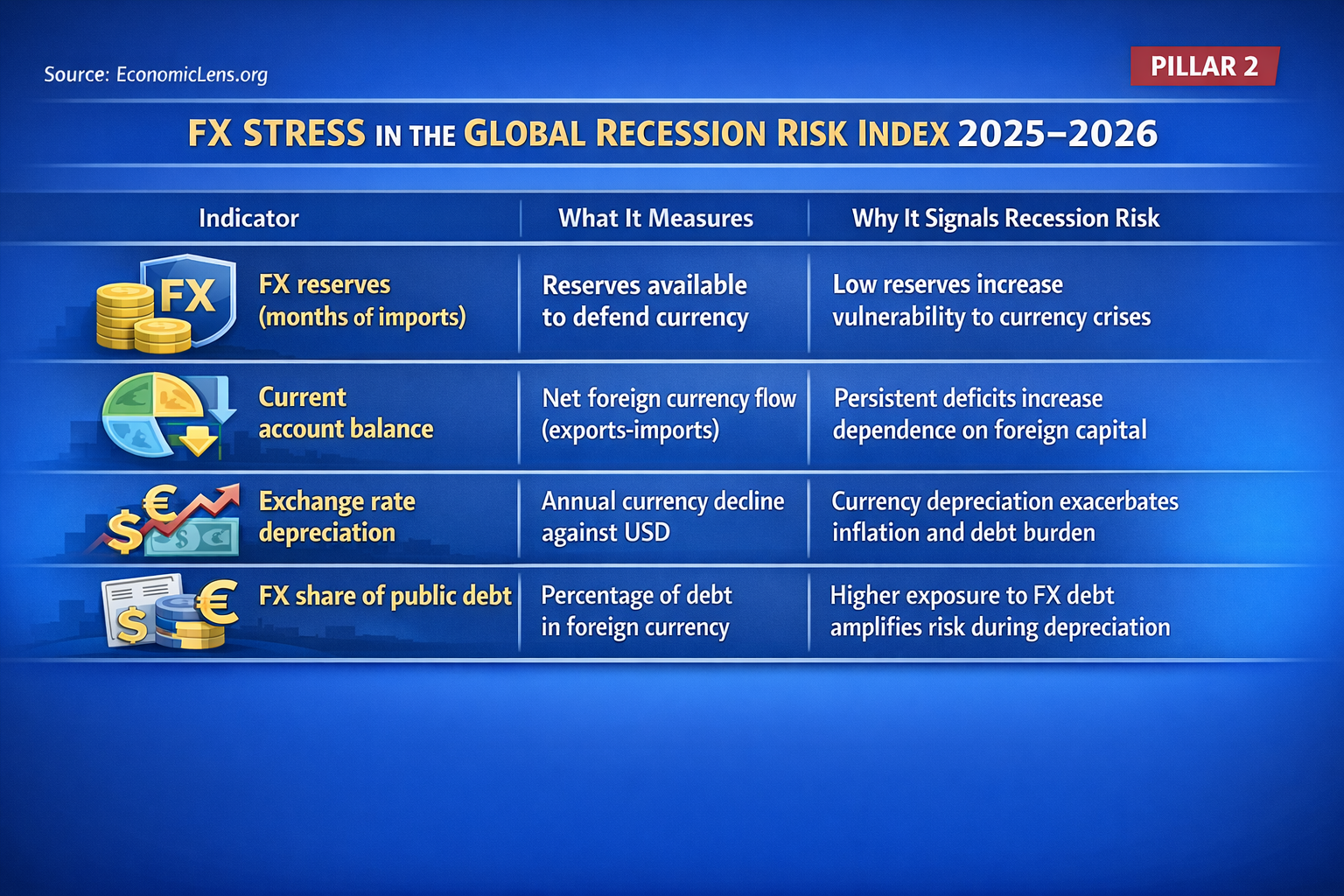

Why FX Stress Matters in the Global Recession Risk Index 2025–2026

FX stress is a critical pillar in the global recession risk index 2025–2026 because it tracks the ability of countries to maintain currency stability in the face of global shocks. Emerging markets that rely on external financing in foreign currencies face a higher risk of financial instability during global recessions. When a country’s currency depreciates, it makes foreign debt more expensive to service, leading to inflationary pressures and a squeeze on real income.

The IMF (https://data.imf.org) tracks how reserves provide a buffer against such shocks. A country with low reserves is vulnerable to currency crises, especially during periods of global financial instability. When a country’s currency depreciates and reserves are insufficient to stabilize the market, it can lead to spiraling inflation and reduced purchasing power. This phenomenon is particularly dangerous for countries heavily dependent on imported goods and energy, where price hikes can push inflation higher.

A persistent current account deficit increases the vulnerability to FX stress because it signifies that the country is relying on external capital to finance its economic activities. According to the World Bank (https://databank.worldbank.org), this type of dependency leaves emerging markets exposed to sudden shifts in investor sentiment. When global risk increases, capital tends to exit these markets, worsening the currency depreciation and financial stress.

Countries with significant amounts of foreign currency debt are particularly vulnerable to these risks. As the BIS (https://www.bis.org/statistics/eer.htm) reports, when the local currency weakens, the burden of repaying foreign currency debt increases, leading to a vicious cycle of debt strain, inflation, and capital flight. This risk of FX mismatch is a major indicator for forecasting financial crises in emerging markets by 2026.

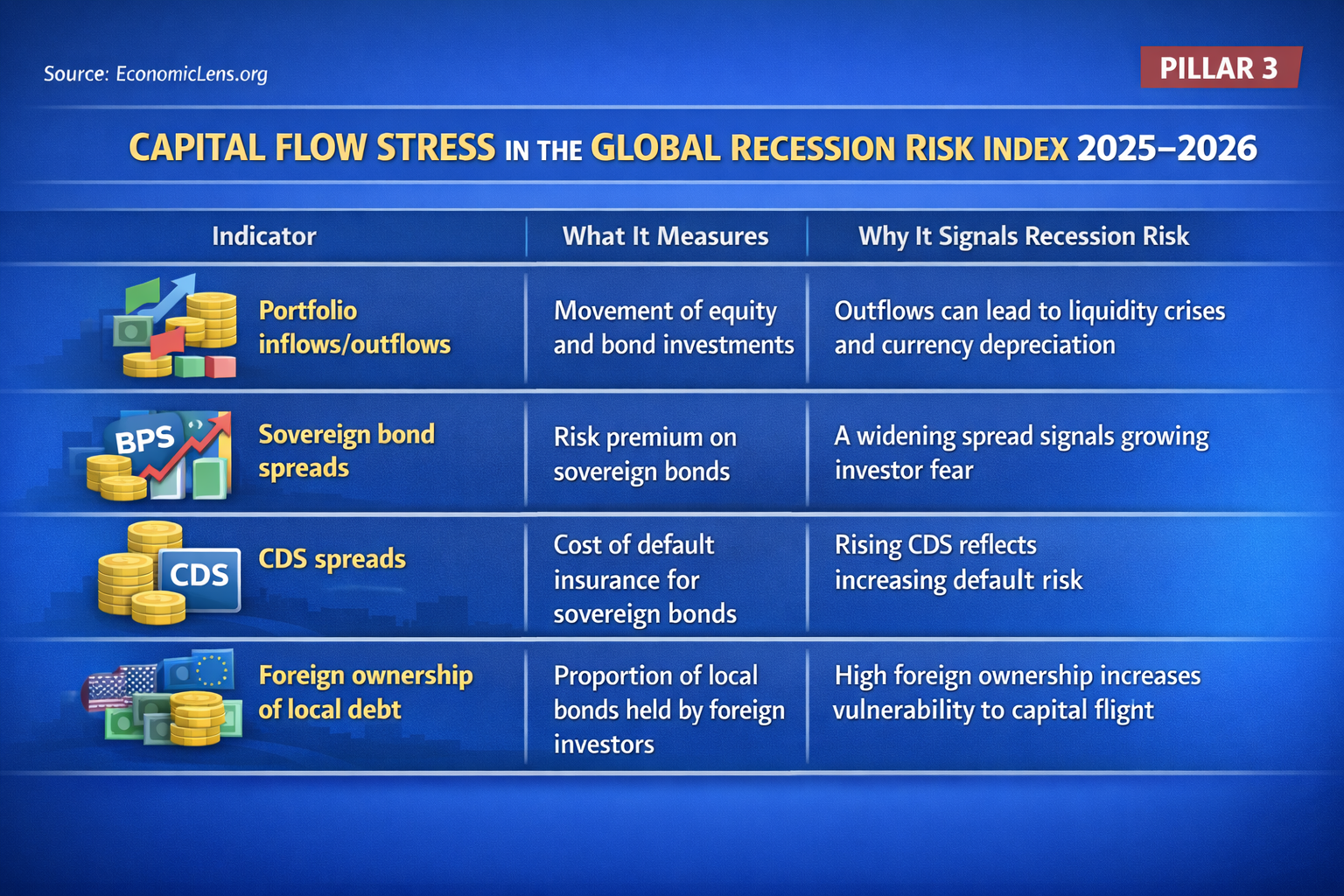

Why Capital Flow Stress Is Vital for the Global Recession Risk Index 2025–2026

Capital flow stress plays a central role in the global recession risk index 2025–2026 because it tracks how foreign investors move money into and out of emerging markets. A sudden reversal in capital flows, especially in portfolio investment, can trigger a liquidity crisis. It drains reserves and weakens currencies. Emerging markets face greater danger because they depend on foreign capital to finance growth and development.

The IIF Capital Flows Tracker shows that portfolio inflows into emerging markets can stop quickly during periods of global stress (https://www.iif.com/Research/Capital-Flows-and-Debt). When this happens, countries lose access to external funding. Global slowdowns and rising interest rates make this risk worse. Investors become more cautious and pull money out of higher risk economies.

Rising sovereign bond spreads and CDS spreads also signal growing fear. The JPMorgan EMBI tracks sovereign bond spreads, which widen when investors sense higher default risk (https://www.imf.org). Wider spreads mean investors demand higher returns to hold government debt. This shift reflects rising concern about repayment ability. Higher CDS spreads show that markets expect a greater chance of default. Both indicators point to growing capital flight.

The Bank for International Settlements reports that countries with high foreign ownership of bonds face greater exposure to shifts in global risk sentiment (https://www.bis.org/statistics/secstats.htm). When investors exit these markets, liquidity tightens. This pressure can trigger financial instability and lead to a broader crisis.

How the Sovereign Vulnerability Index Is Calculated

The global recession risk index 2025–2026 combines three pillars: Debt Stress, FX Stress, and Capital Flow Stress. Each pillar carries a weight based on its impact on financial stability. Debt Stress receives the highest weight because it directly affects government solvency.

Pillar Weights

Debt Stress = 40%

FX Stress = 35%

Capital Flow Stress = 25%

Each pillar receives a score from 0 to 100 based on percentile rankings across emerging markets. Countries with higher debt ratios or weaker reserves score closer to 100. These scores then combine through a weighted formula to produce the final index value.

Final Index Formula

Global Recession Risk Index = (0.40 × Debt Stress) + (0.35 × FX Stress) + (0.25 × Capital Flow Stress)

Interpreting Index Scores

0 to 29: Low risk

30 to 49: Watch

50 to 69: High risk

70 to 100: Critical

Countries above 50 face elevated danger. Scores near 100 signal a high probability of financial crisis.

Policy Implications and Recommendations

Policymakers can use the global recession risk index 2025–2026 to detect stress before it turns into crisis. Countries with high debt stress should extend maturities, restructure debt, and rebuild fiscal buffers. Strong foreign exchange reserves also protect against external shocks.

Emerging markets that depend on capital inflows must reduce exposure to short term foreign funding. They can do this by expanding domestic savings and improving access to long term finance. These steps reduce vulnerability to sudden capital outflows.

International institutions also play a key role. The IMF and World Bank provide financial support and policy guidance to high risk countries (https://www.imf.org). Their programs help stabilize economies and restore market confidence.

Conclusion

The global recession risk index 2025–2026 offers a powerful framework for identifying where the next crisis may emerge. It combines debt stress, FX vulnerability, and capital flow pressure into a single risk signal. This structure highlights where fragility is building.

Global financial conditions continue to shift. Emerging markets must remain alert. Governments and investors can use the global recession risk index 2025–2026 to anticipate threats and reduce damage before shocks strike.

For deeper analysis of how emerging markets compare with advanced economies, see Global Growth Divergence 2026: Emerging vs Advanced Economies at

https://economiclens.org/global-growth-divergence-2026-emerging-vs-advanced-economies/