Discover how to finance the green energy transition from oil to solar and why solar should lead the way as the main power source by 2025

Introduction

The financing the green energy transition is rapidly becoming a defining challenge of our time. With global dependence on oil still significant, the move to solar energy isn’t just an environmental necessity—it’s a financial test. This blog unpacks whether we can really afford to finance the shift from oil to solar energy, and what it will take to make solar the dominant power source by 2025.

“Every dollar invested today in clean energy is a step toward securing a sustainable tomorrow”.

1. The Need for the Green Energy Transition

Why Shift from Oil to Solar?

Oil continues to drive a large share of global carbon emissions and presents geopolitical and environmental risks. Solar power offers cleaner, more sustainable energy with long‑term economic advantages.

According to the International Energy Agency’s (IEA) World Energy Investment 2023 report, investments in clean energy technologies like solar energy are expected to grow rapidly. However, fossil fuel investments still dominate. The report emphasizes that energy investments in solar, while growing, need to accelerate to meet net‑zero goals by 2050. This is why the green energy transition, particularly solar energy, is crucial for meeting global climate targets.

The Current Energy Landscape

Global energy markets are evolving: oil demand remains high in many regions, but renewable energy growth, especially in solar, is accelerating. International agreements like the Paris Agreement underline the urgency of decarbonizing the energy system.

The Global Solar Demand Forecast by BloombergNEF reveals that the solar energy market will account for nearly 25% of the global power generation capacity by 2025. The report notes that solar installations are growing rapidly in both developed and emerging markets, but significant investment is required to meet this goal, especially in developing economies.

“The shift is happening now—and stepping toward solar means stepping into a future worth building.”

2. Financial Challenges in Financing the Green Transition

High Initial Costs of Solar Infrastructure

While solar offers major benefits over time, the upfront costs of solar farms, storage, grid upgrades, and installation remain heavy.

The National Renewable Energy Laboratory (NREL) 2023 Report on Solar Financing Options found that initial capital costs for solar projects can be up to 50% higher than fossil fuel‑based alternatives. This is due to infrastructure requirements, storage solutions, and grid modernizations necessary to accommodate large solar installations. The report emphasizes that financial institutions must work to reduce these initial costs to make solar more accessible.

Investment Gaps and the Need for Green Finance

There remains a substantial gap between the scale of investment needed for the transition and the current levels of funding. Public funds, private capital, green bonds, and new financing mechanisms must fill that gap.

“Bridging the investment gap isn’t optional—it’s essential if we want the green energy transition to succeed.”

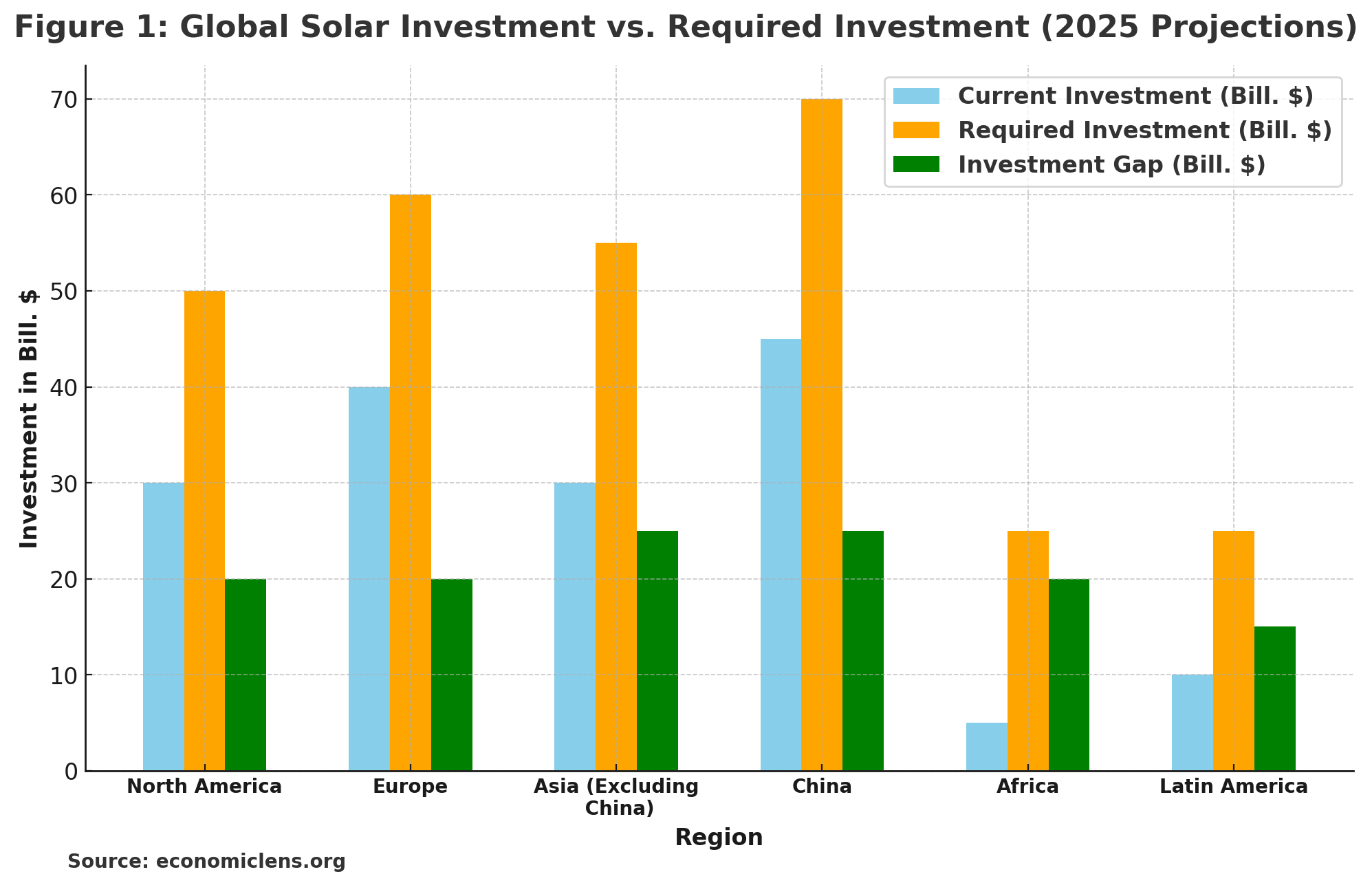

According to the 2023 Global Solar Demand Forecast by BloombergNEF, the table above illustrates the investment gap between current levels of funding and the required investment needed to meet solar energy targets by 2025. The gap is particularly wide in emerging markets like Africa and Asia (excluding China), indicating significant room for growth and international financing support.

Barriers to Financing in Emerging Economies

Emerging and developing countries face added hurdles: higher cost of capital, regulatory risk, weaker institutions, and less robust financing markets. The IEA points out that regulatory, currency and off‑taker risks are major constraints in reducing the cost of capital for clean energy projects in such economies.

The World Bank 2023 Report on Financing Solar Projects in Developing Countries highlights the financing challenges that developing nations face, including the cost of capital, lack of infrastructure, and unstable political climates. The report suggests that international climate finance and public‑private partnerships are key to overcoming these barriers.

“Supporting emerging markets in the solar transition is about global fairness—and securing our collective future.”

3. Financing Mechanisms for the Solar Transition

Green Bonds and Green Investments

Green bonds have become a significant financing tool for renewable energy projects. These bonds raise capital specifically for environmental projects, including solar energy infrastructure. Many countries and private companies are now issuing green bonds to fund their solar energy initiatives.

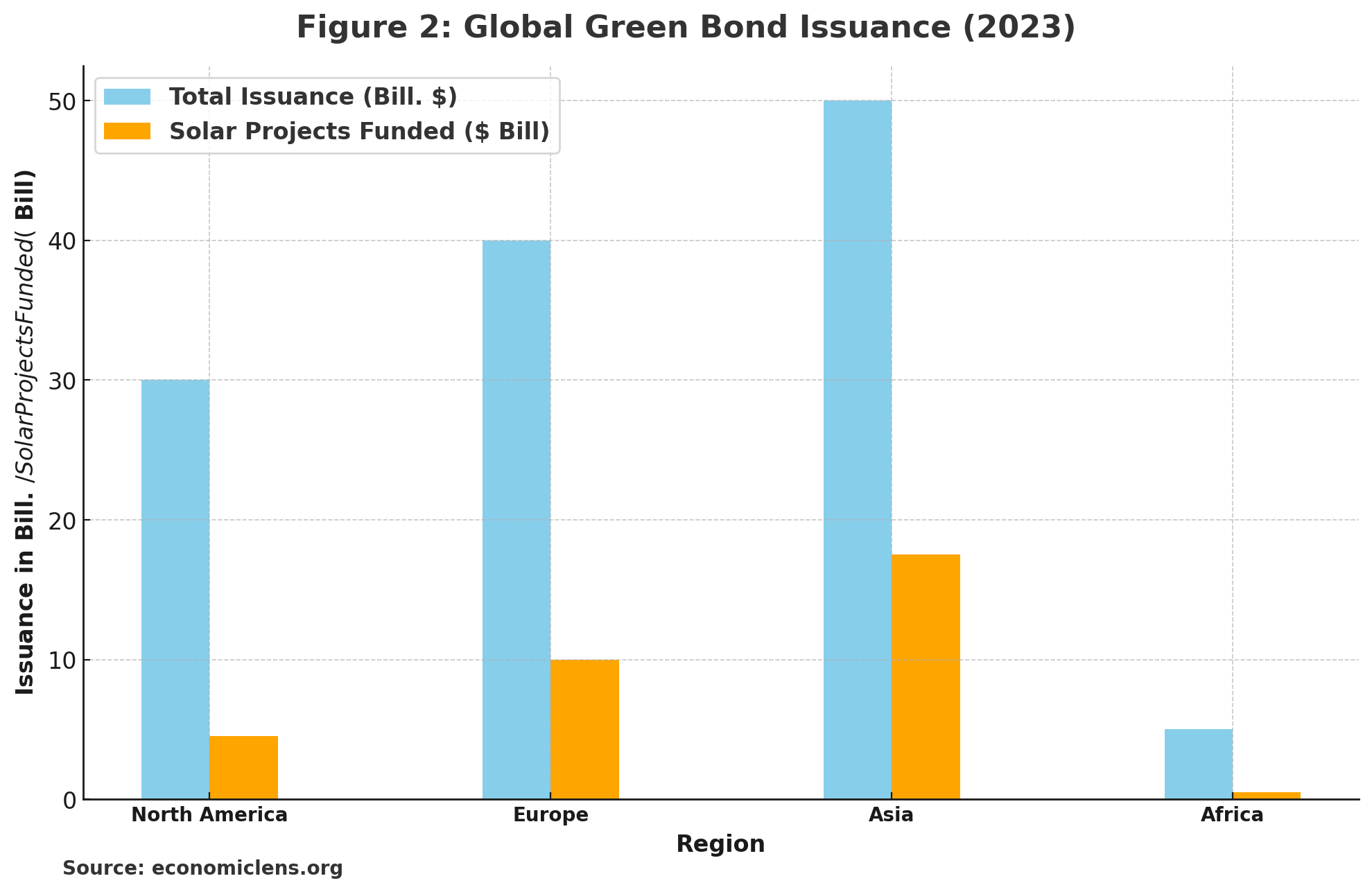

According to the 2023 Green Bond Market Report by BloombergNEF, global green bond issuance hit a record $400 billion in 2022, with solar projects making up a significant portion of the investments. The report emphasizes that despite the growth, more investment is needed to meet climate goals.

“Every green bond issued is a vote of confidence in a brighter, cleaner tomorrow.”

Public and Private Sector Collaboration

Government policies, tax incentives, subsidies, and public‑private partnerships are critical in enabling large‑scale solar investments. Strong policy frameworks reduce investor risk and encourage private capital.

International Support and Climate Financing

Institutions like the World Bank, regional development banks, and climate funds are instrumental in supporting the financing of solar energy projects in developing countries. They provide grants, loans, and risk‑mitigation instruments.

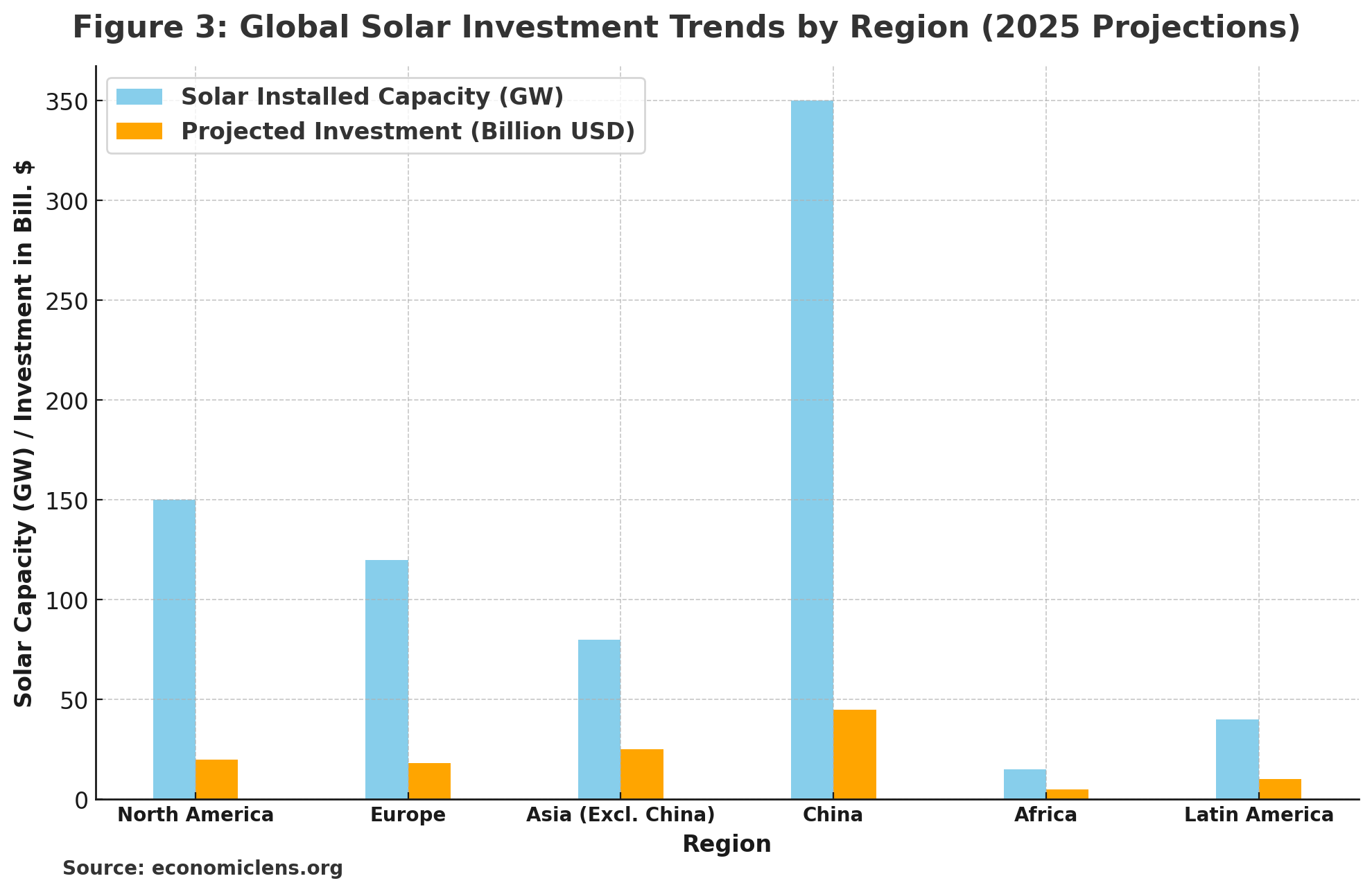

According to the 2023 Global Solar Demand Forecast by BloombergNEF, solar energy investments are projected to rise significantly by 2025. While China remains the leader in installed capacity and investment, Africa is expected to see the fastest growth rate. This data highlights emerging markets, like Africa, where investment opportunities are rapidly increasing.

“Every solar project funded today is an investment in a cleaner, more sustainable future for all regions of the world.”

4. The Future of Solar Energy Financing by 2025

Innovations in Financing Solar Energy

Solar leasing, crowdfunding, and green fintech platforms are new and emerging financing models that are making solar energy more accessible. These innovations are helping individuals and small businesses invest in solar power, while reducing reliance on traditional financial institutions.

The IEA’s 2023 Cost of Capital Survey highlights that innovations like solar leasing and fintech platforms are critical to democratizing solar access. These models reduce the upfront cost of solar panels for individuals and small businesses, making solar energy more accessible to all.

“Innovation in finance means more people and countries can join the solar revolution.”

The Role of Policy in Financing Solar Projects

National and international policies will play a key role in scaling solar energy projects. Clear regulations, carbon pricing, and renewable energy targets will provide the incentives needed to attract more investment in solar infrastructure.

“Strong policy isn’t just paperwork—it’s the foundation of a solar‑powered future.”

Key Players in Solar Finance

Several key players, including solar companies, venture capitalists, financial institutions, and governments, are driving solar energy investments. Collaboration among these groups is crucial for the widespread adoption of solar energy.

“If we align the strengths of every stakeholder, a solar‑dominated world is within reach.”

5. The Challenges Ahead and the Path Forward

Challenges to Overcome

Despite progress, barriers remain: high cost of capital in some markets, energy storage limitations, regulatory uncertainty, transmission infrastructure, and lack of access in emerging economies.

What Needs to Be Done?

- Mobilize public and private capital at scale

- Strengthen policy frameworks and reduce regulatory risk

- Improve financing access in emerging economies

- Encourage innovation in financing models

- Build infrastructure (storage, grids) to support solar expansion

5. Conclusion

The financing the green energy transition from oil to solar is one of the defining challenges of our era. While there are significant financial hurdles and complex risks—especially in emerging markets—innovative financing mechanisms, robust policy frameworks, and global cooperation are driving real progress. By staying committed to scaling solar infrastructure and reducing risks, we can make the shift from oil to solar by 2025 not just aspirational, but achievable.

Call to Action

Let’s engage—share what you think are the biggest financial challenges or opportunities in regulating the solar transition. Your voice matters in making the green energy shift happen.