Higher for longer interest rates 2025 deepen global sovereign debt stress as refinancing costs rise. Fiscal buffers continue to shrink, while repayment burdens expand across regions. This blog analyzes the structural forces reshaping global debt sustainability. It draws on indicators, expert commentary, and cross-regional assessments. The analysis evaluates refinancing pressure, fiscal fragility, market volatility, liquidity tightening, and systemic risk transmission under prolonged restrictive financial conditions.

INTRODUCTION

The higher for longer interest rates 2025 environment marks a fundamental shift in global financial conditions. Central banks maintain restrictive policies to counter persistent inflation and anchored expectations. As a result, borrowing costs rise sharply across sovereign, corporate, and household sectors. Refinancing pressure intensifies in economies that previously relied on low interest rate environments.

Global liquidity continues to tighten. Debt vulnerabilities become more pronounced, especially in emerging and frontier markets with limited fiscal capacity. In the higher for longer interest rates 2025 landscape, global sovereign debt stress accelerates. Elevated bond yields intersect with widening fiscal deficits and slowing economic growth. At the same time, USD strength increases repayment burdens for countries with high external debt exposure.

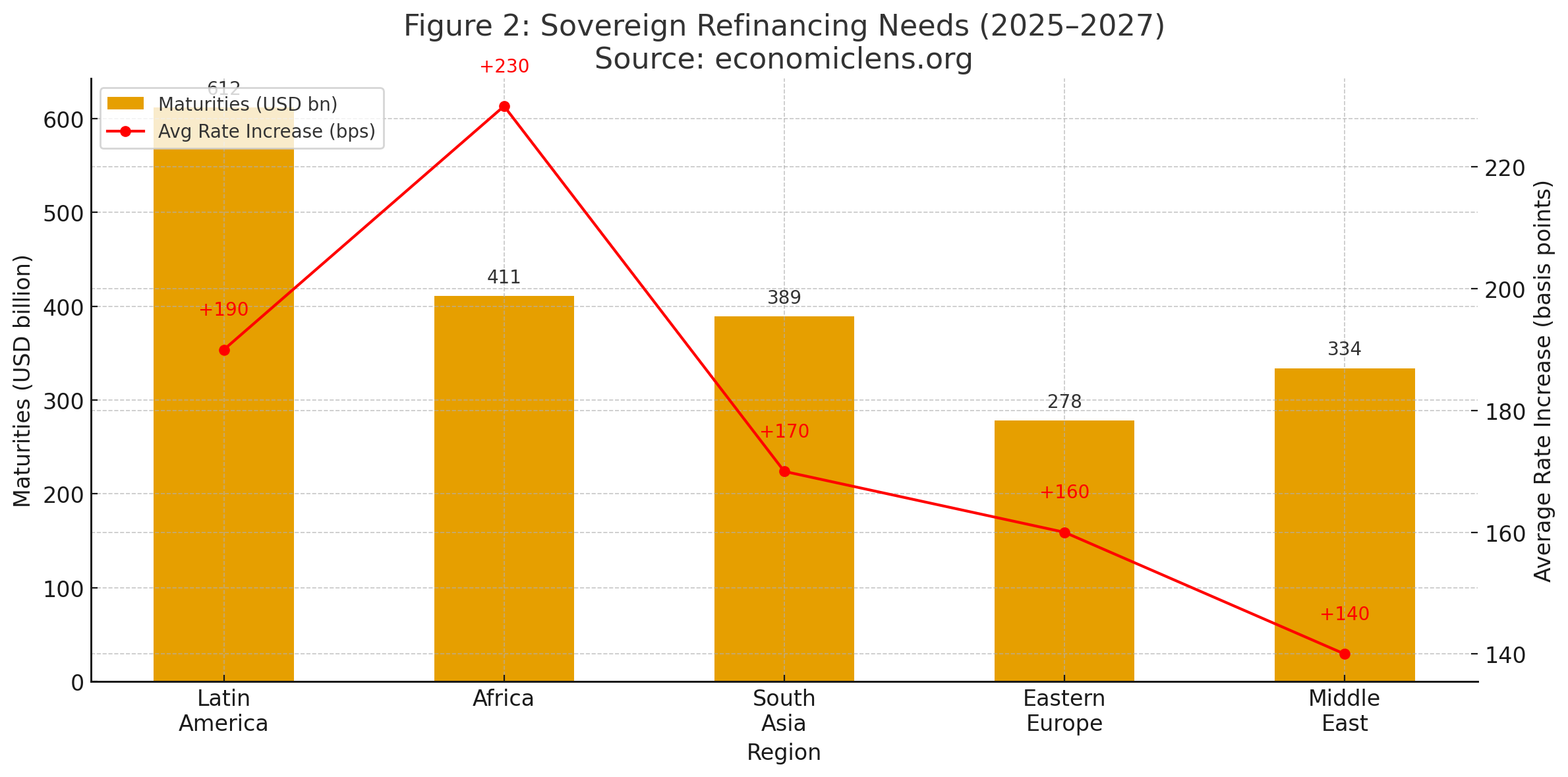

Refinancing cycles between 2025 and 2027 are especially heavy. These maturities represent the largest rollover wave in two decades. As a result, rollover risk increases across both large and small economies.

1. Higher for Longer Interest Rates and Global Debt Repricing

The higher for longer interest rates cycle triggers broad debt repricing across markets. Borrowing costs rise in both advanced and emerging economies. Bond yields adjust upward, while refinancing burdens expand. Sovereign risk premiums also widen.

Governments now face tighter fiscal conditions amid slow growth. This combination increases the likelihood of debt stress in vulnerable economies.

Expert Insights & Latest Report Signals

IMF Chief Economist Pierre-Olivier Gourinchas stresses that real interest rates remain well above pre-pandemic levels. This creates long-term refinancing concerns for sovereign borrowers (https://www.imf.org/en/Blogs/Articles). BIS analysts also warn that global debt stocks accumulated during low-rate periods face sharply higher servicing costs (https://www.bis.org/publ/arpdf/ar2024e.htm). JP Morgan Global Markets notes that fiscal stability increasingly depends on rollover conditions through 2025 as maturity walls approach (https://www.jpmorgan.com/insights/research).

The IMF Global Financial Stability Report 2025 identifies elevated bond yields as a primary source of sovereign stress (https://www.imf.org/en/Publications/GFSR). The World Bank Debt Transparency Review shows that interest payments now absorb a record share of government revenue in several regions (https://www.worldbank.org/en/topic/debt/brief/debt-transparency). The OECD Fiscal Outlook confirms that higher interest costs continue to crowd out development spending (https://www.oecd.org/economy/public-finance/).

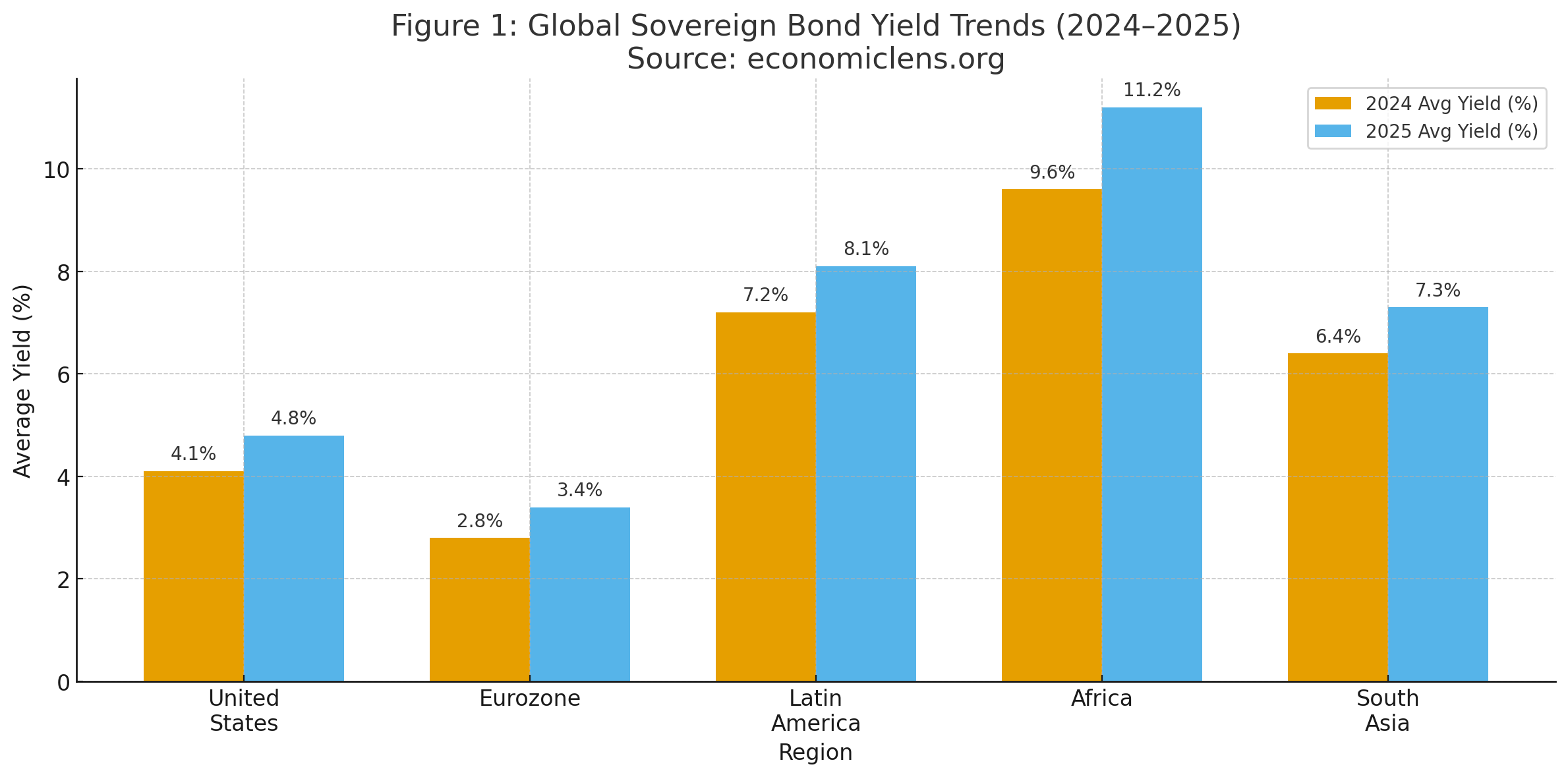

Bond yields increase across all regions as higher for longer interest rates 2025 reshape financing conditions. Consequently, debt servicing becomes more costly, especially in emerging markets with high refinancing needs.

US Treasury Yields Hit Multi-Decade Highs

US Treasury yields rise as markets adjust to persistent inflation and prolonged restrictive monetary policy. According to Bloomberg market data and analysis (https://www.bloomberg.com/markets/rates-bonds), the 10-year US Treasury yield has reached levels not seen since 2007, reflecting expectations of higher-for-longer interest rates. Meanwhile, global bond markets reprice in response, tightening financial conditions worldwide. Consequently, emerging markets experience spillover stress as higher borrowing costs and capital outflows intensify financing pressures.

“A global debt cycle strains most when the cost of waiting becomes greater than the cost of borrowing.”

2. Global Sovereign Debt Stress 2025 and Refinancing Burdens

Rollover burdens intensify under the higher for longer interest rates 2025 environment. Large volumes of sovereign debt mature between 2025 and 2027. Countries with short maturity structures must refinance at much higher rates. Default risk increases as a result.

Frontier economies face additional pressure. Many struggle with limited access to international capital markets. Structural shocks further amplify fragility (https://economiclens.org/ai-stock-market-bubble-2025-big-tech-concentration-global-market-risk/).

Global Sovereign Debt Stress and Refinancing Risk Signals

Moody’s Sovereign Risk Unit warns that refinancing costs will rise sharply for countries reliant on short-term issuance (https://www.moodys.com/web/en/us/insights/topics/sovereign-risk.html). S&P Global Ratings highlights that external debt burdens increase as USD financing remains expensive (https://www.spglobal.com/ratings/en/research-insights/sovereigns). Fitch Macro Research identifies elevated risk clusters across Africa and South Asia where refinancing needs coincide with weak fiscal buffers (https://www.fitchratings.com/research/sovereigns).

The World Bank International Debt Report 2025 shows record refinancing requirements for developing economies (https://www.worldbank.org/en/topic/debt/brief/international-debt-statistics). The IMF Debt Sustainability Framework also flags heightened stress in economies with weak growth and narrow buffers (https://www.imf.org/en/Topics/debt-sustainability).

Refinancing needs rise sharply as large maturities converge with high interest rate conditions. Consequently, default risk intensifies, particularly for emerging markets with limited fiscal buffers.

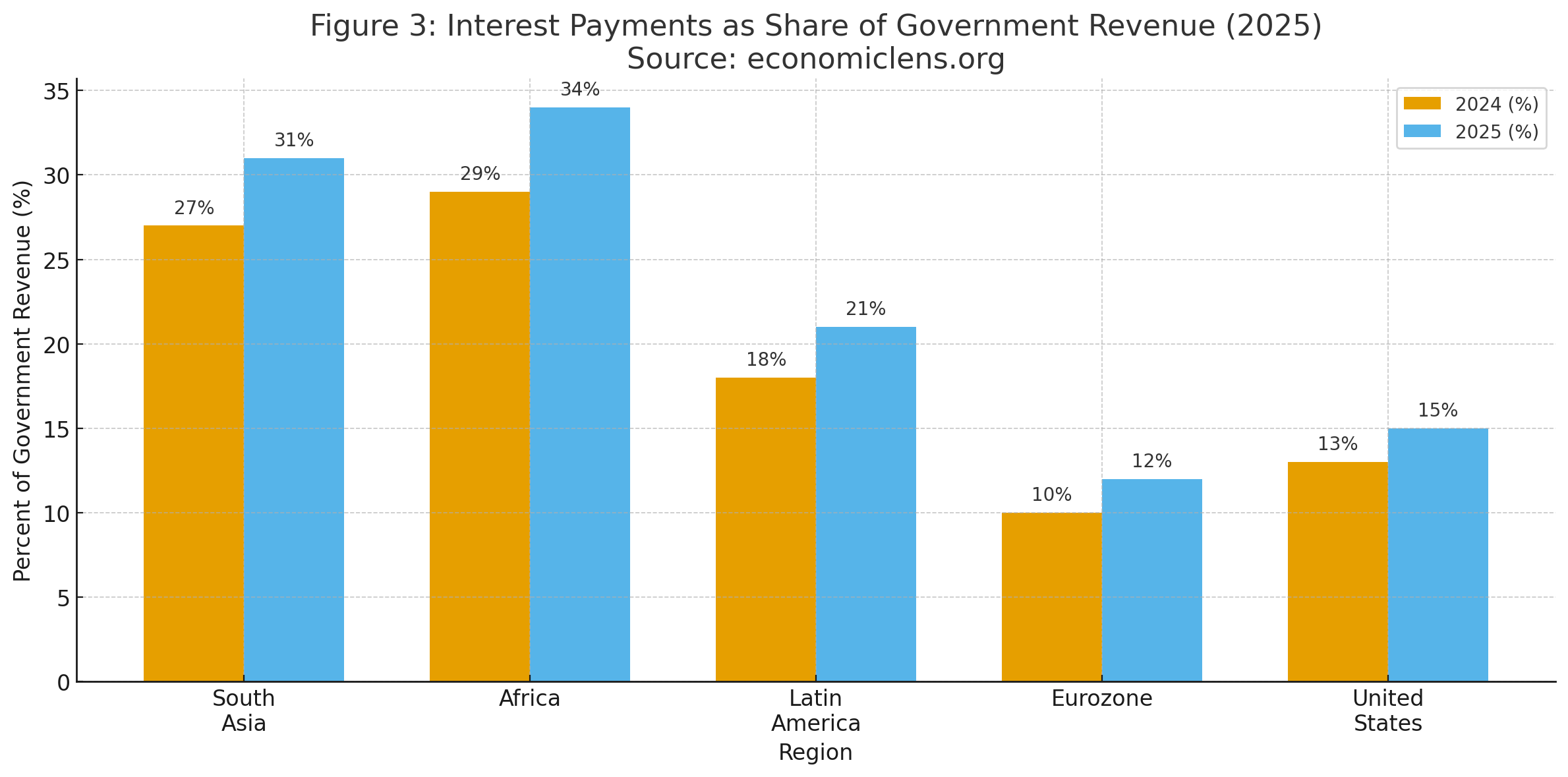

Interest burdens increase significantly across developing economies, limiting fiscal space and raising liquidity needs. Consequently, sovereign vulnerability deepens in markets facing limited revenue growth.

Emerging Market Sovereign Debt Stress in Kenya and Pakistan

Both Kenya and Pakistan confront severe refinancing pressure as large external debt obligations mature in 2025 amid higher global interest rates. According to the IMF’s country surveillance and debt assessments (https://www.imf.org/en/Countries), both economies face an increased risk of market access loss as financing conditions tighten and rollover costs rise. Consequently, reliance on multilateral financing grows as domestic revenues remain insufficient to absorb elevated debt servicing burdens.

“Debt stress emerges fastest when maturities rise during a period of tightened financial conditions.”

3. High Interest Rate Debt Stress, USD Strength and External Vulnerabilities

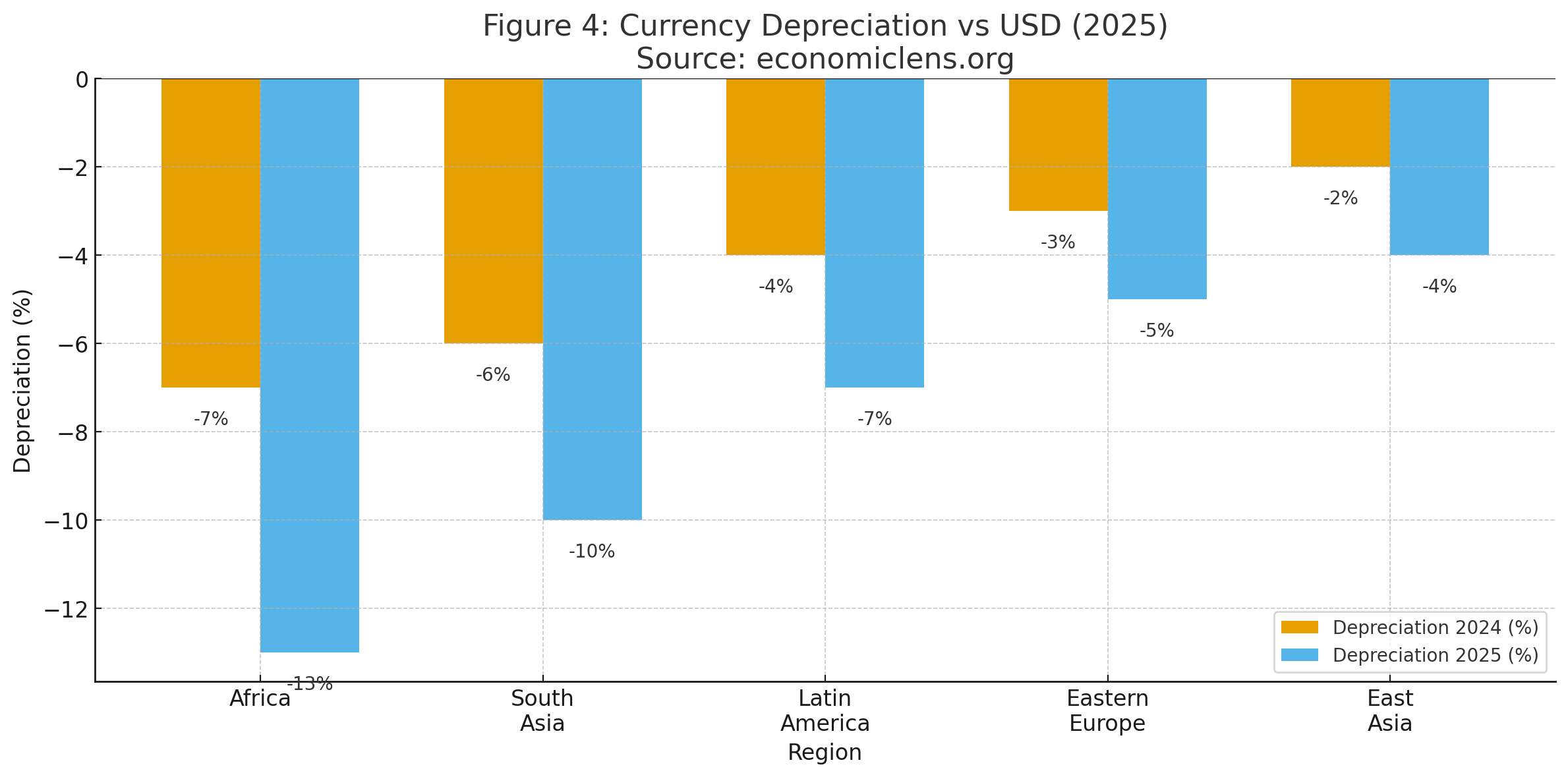

USD strength amplifies external debt burdens under the higher for longer interest rates 2025 scenario as emerging markets confront currency depreciation and widening spreads. Countries with high external debt stocks experience higher repayment costs, increasing risk of balance of payments stress. Consequently, FX volatility interacts with interest rate cycles to elevate systemic risk.

Expert Insights & Latest Report Signals

Barclays FX Strategy highlights in its global currency outlook (https://www.barclays.com/insights/investment-insights/foreign-exchange/) that USD resilience increases external vulnerability for low-reserve economies by raising debt servicing and import costs. Meanwhile, Standard Chartered Global Macro, through its macroeconomic research platform (https://www.sc.com/en/global-research/), notes rising hedging costs for sovereign borrowers as global interest rates remain elevated. Additionally, Nomura EM Watch, in its emerging market analysis (https://www.nomuraconnects.com/focused-thinking/), identifies increased exposure to imported inflation as currency depreciation feeds through to domestic prices.

The IMF External Sector Report 2025 (https://www.imf.org/en/Publications/ESR) shows elevated real effective exchange rate pressures across Africa and South Asia, reflecting persistent USD strength and capital flow volatility. Meanwhile, the World Bank Currency Fragility Index, discussed within its financial sector diagnostics (https://www.worldbank.org/en/topic/financialsector), highlights high FX risk clusters in frontier economies, reinforcing external vulnerability under the higher for longer interest rates 2025 environment.

FX depreciation accelerates due to USD strength and global risk aversion. Consequently, economies with large external debt stocks face rising repayment burdens.

Nigeria, Ghana and Egypt Face FX Pressure Under Dollar Strength

Dollar strength deepens currency pressure across African economies, raising import costs and increasing the local currency burden of external debt. According to Fitch Ratings sovereign analysis (https://www.fitchratings.com/research/sovereigns), external repayment burdens rise significantly as FX reserves remain thin and access to foreign currency tightens. Consequently, regional debt fragility increases as higher servicing costs intersect with weaker growth and constrained fiscal space.

“A strong dollar strains economies whose stability relies on affordable foreign currency financing.”

4. Fiscal Fragility in the High Rate Era and Market Access Stress

Fiscal fragility becomes more pronounced under the higher for longer interest rates 2025 cycle as governments struggle to manage widening deficits, high interest costs and slower growth. Countries with weak tax bases and rising subsidy burdens face particular strain. Additionally, market access deteriorates for economies with high perceived risk.

Fiscal Fragility in the High Rate Era: Expert and Market Signals

The OECD Fiscal Policy Office stresses in its fiscal governance analysis (https://www.oecd.org/gov/budgeting/) that fiscal consolidation often faces strong political resistance, particularly during periods of slow growth and elevated interest costs. Meanwhile, the IMF Fiscal Affairs Department, through its public finance surveillance work (https://www.imf.org/en/Topics/Fiscal-Policy), highlights rising interest-to-revenue ratios as a key risk metric for assessing sovereign vulnerability. Additionally, Morgan Stanley Sovereign Research, in its global rates and debt outlook (https://www.morganstanley.com/ideas/global-sovereign-debt), notes that bond markets increasingly penalize weak fiscal performers through wider spreads and tighter financing conditions.

The IMF Fiscal Monitor 2025 (https://www.imf.org/en/Publications/FM) reports rising fiscal deficits across developing economies as higher borrowing costs and weaker revenues strain budgets. Meanwhile, the World Bank Public Expenditure Review framework (https://www.worldbank.org/en/topic/publicexpenditure) highlights persistent inefficiencies in subsidy frameworks, limiting governments’ ability to stabilize finances under the higher for longer interest rates 2025 environment.

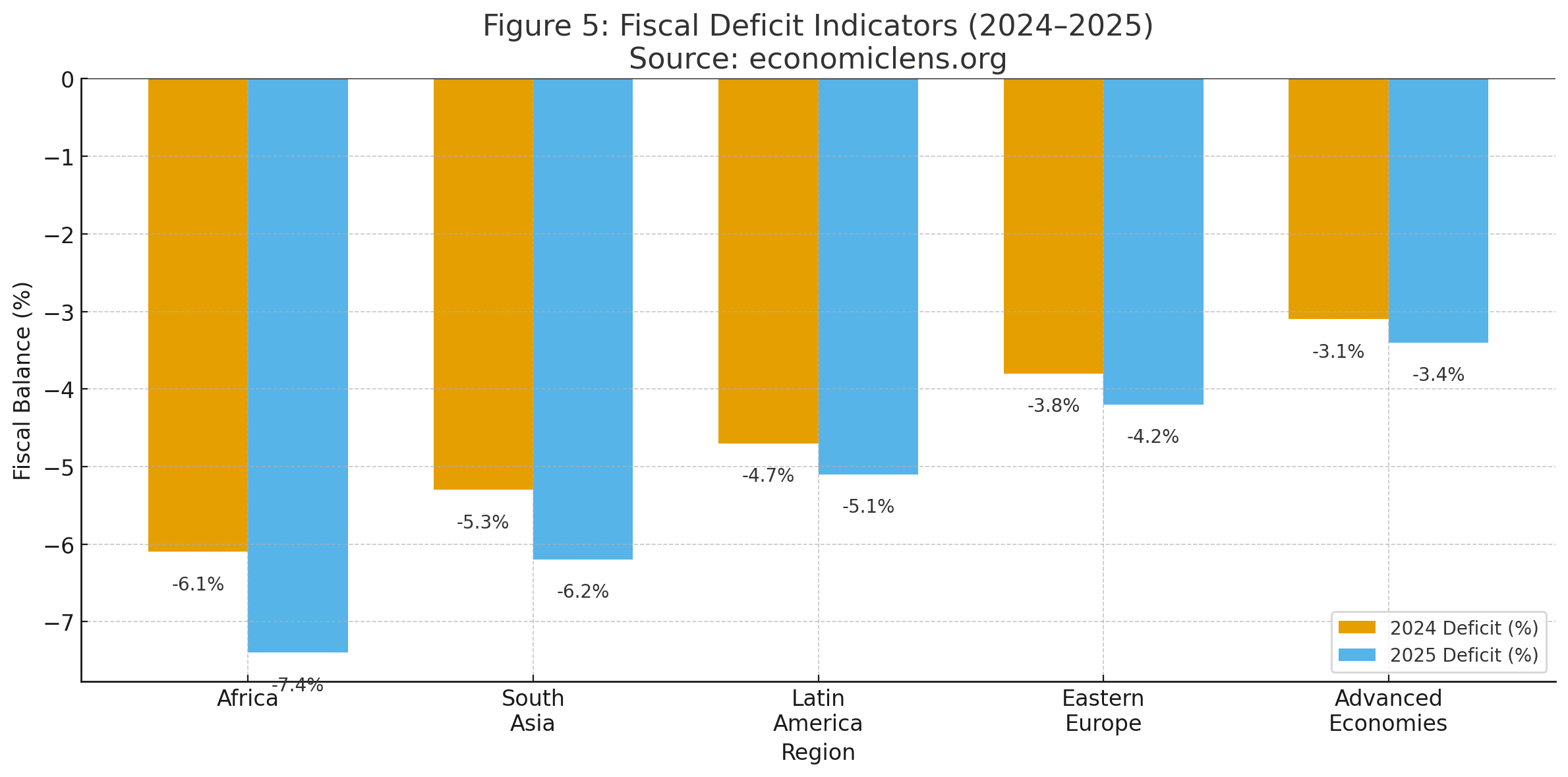

Fiscal deficits widen due to higher interest costs and slower revenue growth. Consequently, fiscal stress deepens in vulnerable regions with limited consolidation space.

Argentina and Egypt Face Deepening Fiscal Stress

Argentina and Egypt report widening fiscal deficits as high interest payments and currency depreciation increase pressure on public finances. According to the IMF’s fiscal surveillance and country assessments (https://www.imf.org/en/Countries), both countries require strict fiscal adjustments to stabilize debt trajectories and restore investor confidence. Consequently, market access remains fragile, reinforcing reliance on multilateral financing and policy discipline to contain sovereign risk.

“Fiscal fragility grows when governments borrow to survive instead of borrowing to invest.”

5. Systemic Risks and Policy Paths Under Prolonged High Interest Rates

Systemic risks escalate under the higher for longer interest rates 2025 environment as global markets navigate liquidity tightening, valuation corrections and fiscal strain. Policymakers confront a complex landscape where financial stability, debt sustainability and growth dynamics overlap. A related examination of how elevated financial pressures and weak growth reshape global risk conditions is provided in “Global Economic Outlook 2025–2026: Slow Growth, Sticky Inflation & Rising Debt” (https://economiclens.org/global-economic-outlook-2025-2026-slow-growth-sticky-inflation-rising-debt/).

Expert Insights & Latest Report Signals

The BIS Systemic Risk Unit highlights in its global financial stability analysis (https://www.bis.org/publ/arpdf/ar2024e.htm) that cross-market contagion potential is rising as higher interest rates transmit stress across bond, currency and equity markets. Meanwhile, World Economic Forum global risk experts, through their systemic risk assessments (https://www.weforum.org/reports/global-risks-report-2025/), emphasize the need for coordinated liquidity support to prevent localized sovereign stress from escalating into broader financial instability. Additionally, UNCTAD economists, in their macroeconomic and inequality analysis (https://unctad.org/topic/macroeconomics), warn that fiscal consolidation pressures risk amplifying income and regional inequality, particularly in developing economies.

The IMF 2025 Systemic Risk Map, discussed within the Global Financial Stability framework (https://www.imf.org/en/Publications/GFSR), identifies sovereign stress as one of the top global threats as refinancing pressures intensify. Meanwhile, the OECD Global Outlook, published under its economic surveillance work (https://www.oecd.org/economy/outlook/), warns that global funding conditions are likely to remain tight through 2026, reinforcing downside risks to growth and financial stability.

Systemic stress indicators signal rising fiscal fragility and debt vulnerability in 2025Systemic indicators show rising fragility due to elevated rates, tighter liquidity and limited fiscal space. Consequently, global financial stability becomes more vulnerable.

IMF Prepares for Higher Demand for Emergency Financing

The IMF anticipates an increase in requests for emergency credit lines as sovereign stress builds under higher global interest rates, a risk highlighted in its financial stability surveillance (https://www.imf.org/en/Publications/GFSR). Refinancing cycles and tighter financial conditions push several emerging and frontier economies toward greater vulnerability, particularly those with high external debt and limited fiscal buffers. As borrowing costs remain elevated and market access tightens, precautionary financing and multilateral support become increasingly important to prevent liquidity stress from turning into deeper debt crises.

“In a high rate world, stability depends on resilience built long before the cycle tightens.”

Conclusion

The higher for longer interest rates 2025 environment reshapes global debt dynamics. Borrowing costs remain elevated, while refinancing pressure intensifies. USD strength further strains external balances. Sovereign debt stress deepens across emerging markets with limited fiscal space.

Advanced economies also face rising interest burdens and slower growth. Fiscal deficits widen, and dependence on multilateral support increases. As global liquidity tightens, systemic fragility grows across bond, currency, and fiscal channels. Stronger fiscal frameworks and better debt management are essential to navigate the high-rate era.

Call to Action

Global policymakers must prepare for sustained financial tightening by strengthening fiscal frameworks, improving debt management systems and expanding resilience measures. Stability in 2025 will depend on disciplined policy choices and coordinated international support.