Oil shipping vulnerability in the Middle East is emerging as a major risk for global energy markets in 2026. In particular, this Global Economic Spotlight explains how maritime chokepoints, Red Sea disruptions, and Strait of Hormuz tensions amplify oil price volatility, intensify inflationary pressures, and generate macroeconomic spillovers.

Introduction

As 2026 approaches, Middle East oil shipping vulnerability is becoming a defining risk for global energy markets. At the same time, escalating regional conflict is colliding with fragile maritime supply chains. As a result, oil prices are increasingly shaped by transport insecurity rather than production shortages alone.

In recent years, oil markets have reacted more quickly to threats than to realized disruptions. Even when oil fields continue producing at stable levels, prices rise if tankers face elevated operational risk. Therefore, shipping routes now matter as much as oil output itself. In particular, narrow maritime corridors near conflict zones are especially exposed.

Moreover, geopolitical escalation has already embedded a persistent risk premium into oil prices. EconomicLens has shown in its analysis of the Middle East energy warfront that conflict expectations alone can move global oil markets even without sustained supply losses

https://economiclens.org/energy-warfront-middle-east-escalation-global-oil-market-volatility/

Against this background, this Global Economic Spotlight examines maritime oil chokepoints, explains how conflict transmits into oil prices, and outlines plausible price shock scenarios for 2026.

1. Why Middle East Oil Shipping Vulnerability Is Route-Driven

For decades, oil crises were primarily driven by supply cuts or embargoes. Today, however, the structure of Middle East oil shipping vulnerability has shifted. Production can remain stable. Nevertheless, markets may still experience sharp price shocks.

The underlying reason lies in logistics. Oil must move through fixed shipping corridors that cannot be easily substituted. When security risks rise, shipping slows and insurance premiums increase. Consequently, delivered oil prices rise even if physical supply remains unchanged.

This transmission mechanism is already visible across global trade. EconomicLens has documented how Red Sea shipping disruptions have pushed global freight costs higher and intensified inflationary pressure across supply chains

https://economiclens.org/red-sea-shipping-disruptions-drives-global-freight-costs/

In oil markets, these effects are amplified because energy is a critical input for transport, food systems, and industrial production.

2. Maritime Oil Chokepoints and Middle East Oil Shipping vulnerability

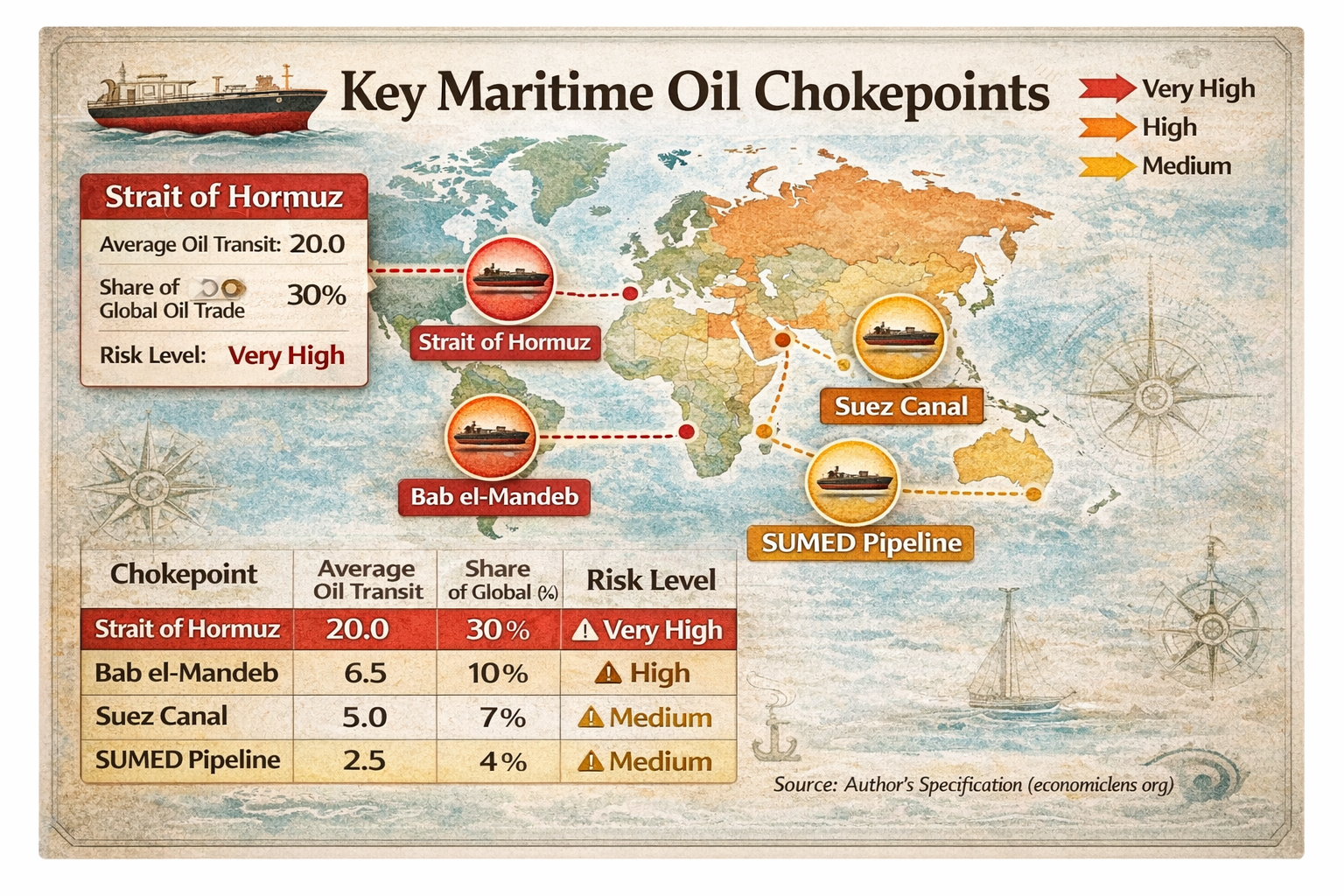

Middle East Oil Shipping vulnerability is concentrated in a small number of maritime chokepoints. These routes carry a disproportionate share of global oil trade. Any disruption therefore has immediate global consequences.

Together, the Strait of Hormuz and Bab el-Mandeb handle nearly 40 percent of global seaborne oil flows. This concentration explains why oil prices react sharply to Middle East tensions.

According to the US Energy Information Administration, the Strait of Hormuz remains the world’s most important oil transit chokepoint because of its narrow width and heavy traffic (https://www.eia.gov/international/analysis/regions-of-interest/Strait_of_Hormuz).

As geopolitical tensions intensify across the Middle East and adjacent waterways, increasingly several oil transit corridors face distinct yet interconnected risk profiles. Taken together, these vulnerabilities are reshaping global energy security dynamics, simultaneously influencing freight behavior and oil market expectations as 2026 approaches. Importantly, disruptions in one corridor rarely remain isolated. Instead, stress tends to spill over across routes, thereby amplifying systemic exposure.

3.1 Strait of Hormuz Oil Risk

At the core of these risks, the Strait of Hormuz represents the highest level of Middle East oil shipping vulnerability heading into 2026. Notably, roughly one-fifth of global oil consumption transits this narrow corridor. As a consequence, any escalation involving Iran or Gulf states would transmit rapidly into higher oil prices across both spot and futures markets.

Crucially, oil markets do not wait for physical closures. Rather, even credible threats raise war-risk insurance premiums, in turn slowing tanker movements and discouraging transit. As a result, effective supply tightens and price pressures emerge well before any formal disruption occurs. Ultimately, this sensitivity reflects the lack of viable short-term alternatives for rerouting large volumes of Gulf oil exports.

3.2 Red Sea Oil Shipping Crisis and Bab el-Mandeb

Meanwhile, Bab el-Mandeb has evolved from a temporary flashpoint into a persistent structural vulnerability. In response, shipping companies increasingly reroute vessels to avoid the Red Sea altogether. Consequently, transport costs rise, delivery times lengthen, and fuel consumption increases, all of which feed directly into higher landed oil prices.

Moreover, the Red Sea oil shipping crisis extends well beyond energy markets alone. As documented by EconomicLens, prolonged insecurity contributes to global trade disruptions, thereby intensifying inflationary pressure and destabilizing supply chains across multiple sectors

https://economiclens.org/red-sea-shipping-crisis-global-trade-fallout-inflation-pressure-and-supply-chain-turmoil/

In this context, European energy security in 2026 remains especially sensitive due to this corridor’s direct link with the Suez Canal and its role in connecting Middle Eastern supplies with European refineries.

3.3 Suez Canal and SUMED Pipeline Exposure

By contrast, although Egypt remains relatively stable, spillover risks nevertheless persist across the Suez Canal and the SUMED pipeline system. Specifically, traffic diversion from the Red Sea increases congestion and operational strain along the Suez corridor. Over time, this congestion raises the probability that even minor incidents could generate disproportionate effects.

If disruptions were to occur, tankers would be forced to reroute around the Cape of Good Hope. In practice, such detours would add weeks to delivery times, therefore increasing shipping costs substantially and reducing tanker availability elsewhere in the market. Consequently, stress along the Suez route functions as a force multiplier, ultimately transmitting Red Sea insecurity into broader global oil price volatility.

4. How Middle East Oil Shipping Vulnerability Translates into Price Shocks

Middle East oil shipping vulnerability affects oil prices through several reinforcing channels. First, physical disruptions reduce effective supply. Second, war-risk insurance premiums increase. Third, freight rerouting raises transport costs. In addition, importers engage in precautionary stockpiling, while financial markets amplify price movements through speculative and hedging behavior.

Because these forces operate simultaneously, oil prices often rise far more than physical supply losses alone would imply. This interaction explains the elevated volatility and asymmetric price risks expected in global oil markets in 2026.

5. Oil Price Shock Scenarios from Middle East Oil Shipping vulnerability in 2026

Looking ahead to 2026, oil market expectations are shaped by three plausible disruption scenarios linked to Middle East shipping vulnerabilities. Each scenario reflects a different intensity of geopolitical stress and its transmission to global energy prices.

Among these outcomes, prolonged Red Sea instability currently appears the most likely, given ongoing security risks and limited prospects for rapid de-escalation. While this scenario implies sustained upward pressure on oil prices, the Hormuz escalation shock would generate far more severe global consequences, triggering sharp inflationary spillovers, financial market volatility, and recession risks for energy-importing economies.

6. Macroeconomic Spillovers from Oil Shipping Route Disruptions

Rising oil prices quickly transmit into domestic inflation across both advanced and emerging economies. First, higher fuel costs raise transport and logistics expenses across shipping, aviation, and road networks. Next, food prices increase as energy-intensive agricultural systems and distribution chains adjust. Over time, higher energy inputs push up manufacturing costs, which reinforce second-round inflationary pressures across industrial sectors.

As a consequence, central banks face renewed policy constraints heading into 2026. Instead of responding to slowing growth with monetary easing, policymakers often delay interest rate cuts or maintain restrictive financial conditions. Through this channel, oil shipping disruptions prolong inflation cycles even in economies where domestic demand remains weak.

At the same time, oil-importing developing economies experience disproportionate exposure to these spillovers. In particular, higher energy import bills place immediate pressure on foreign exchange reserves and widen current account deficits. Moreover, fiscal balances deteriorate as governments attempt to cushion households and firms through fuel subsidies, tax relief, or expanded social transfers. When fuel and food prices rise simultaneously, social pressures intensify, which raises political instability and macroeconomic fragility.

Accordingly, the World Bank emphasizes that energy price shocks remain a persistent source of macroeconomic instability in import-dependent economies, especially where policy buffers, reserve adequacy, and access to external financing remain limited

https://www.worldbank.org/en/research/brief/energy-price-shocks

7. Policy Limits and Strategic Petroleum Reserves

Policymakers often view strategic petroleum reserves as a primary stabilization tool. In the short term, these reserves mitigate temporary supply disruptions by smoothing physical availability and reducing immediate market panic. However, their effectiveness declines sharply when shipping routes remain insecure for extended periods.

Under conditions of prolonged route disruption, strategic reserves cannot eliminate the risk premia embedded in oil prices. Consequently, markets continue to price uncertainty related to transit security, insurance costs, and delivery reliability. Even when headline supply volumes appear sufficient, volatility persists because expectations, rather than shortages, drive pricing behavior.

This limitation, therefore, reveals a broader reality for 2026. Energy security can no longer rely solely on production capacity, reserve accumulation, or inventory management. Instead, maritime security, protected transit corridors, and resilient shipping routes now play an equally decisive role in stabilizing global energy markets.

Conclusion

Middle East oil shipping vulnerability constitutes a structural risk to the global energy system in 2026. At its core, the threat does not stem from oil scarcity. Rather, oil insecurity drives the risk through fragile logistics, contested waterways, and persistent geopolitical tension.

Even limited disruptions trigger disproportionately large price responses. In practice, logistics constraints, rising insurance costs, and market expectations amplify shocks beyond their physical scale. As a result, oil price volatility is evolving into a persistent feature of the global economy rather than a temporary disturbance.

For policymakers, investors, and oil-importing economies, the implication is clear. Energy security must incorporate maritime risk management alongside traditional supply planning. Ultimately, governments and markets must prepare for recurring, conflict-driven oil price shocks to preserve macroeconomic stability, financial resilience, and social cohesion in 2026 and beyond.