Pakistan minerals economy is gaining global attention as demand for copper, lithium, and rare earths rises. This Weekly Economic Brief examines mineral reserves, global demand trends, weak value chains, regional risks, and macroeconomic relevance to assess whether Pakistan can convert mineral wealth into sustainable growth.

Introduction: Pakistan Critical Minerals Economy at a Strategic Juncture

Pakistan minerals economy is entering a decisive phase as global demand for copper, lithium, gold, and rare earth elements accelerates. As countries pursue clean energy targets, these minerals have become central to industrial policy and energy security. Consequently, Pakistan’s untapped reserves are drawing renewed foreign interest. However, weak institutions, limited value addition, and regional grievances continue to constrain long-term economic gains.

Pakistan Minerals Economy and Resource Base

Pakistan mining economy rests on a diverse geological base that remains unevenly developed. Large deposits exist, yet many remain underexplored or inactive. Meanwhile, global competition for these resources is intensifying. The international surge in demand is examined in https://economiclens.org/the-green-metals-boom-why-critical-minerals-are-fueling-the-next-climate-gold-rush/

Governance challenges surrounding flagship projects illustrate deeper structural risks. These issues are explored in https://economiclens.org/reko-diq-copper-gold-project-wealth-potential-governance-gaps-pakistans-resource-paradox/

Global Demand Trends Shaping Pakistan Mining Economy

Global demand for critical minerals is rising sharply. Electric vehicles, renewable power systems, and digital infrastructure require mineral-intensive inputs. As a result, mineral-rich economies face heightened strategic attention.

These trends explain renewed interest in Pakistan’s mineral base. However, demand alone does not guarantee development outcomes.

Pakistan Mining Economy and Economic Contribution

Despite strategic relevance, Pakistan mining economy remains marginal within national output. Mining contributes little to exports, employment quality, or fiscal revenue. Moreover, much of the workforce remains informal. These weaknesses are visible in resource-rich regions such as Khyber Pakhtunkhwa, discussed in https://economiclens.org/khyber-pakhtunkhwa-economy-why-this-resource-rich-region-is-pakistans-most-overlooked-goldmine/

Value Chain Gaps in Pakistan Mining Economy

The largest economic gains lie beyond extraction. However, Pakistan remains concentrated at the lowest value stage.

Without downstream investment, mineral exports will continue to generate limited productivity gains and weak industrial spillovers.

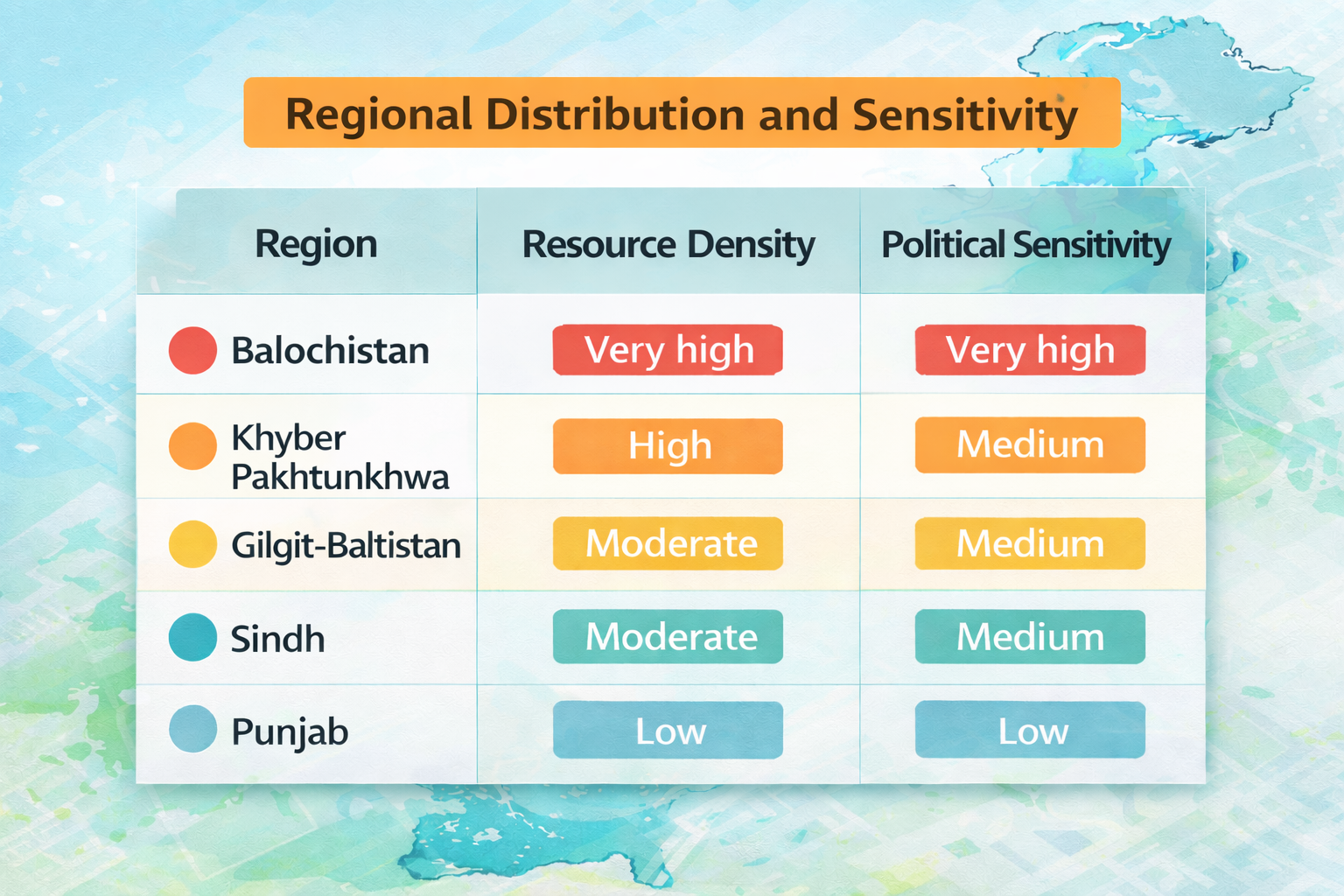

Regional Concentration and Political Economy Risks

Mineral resources are concentrated in politically sensitive regions. Therefore, governance failures carry higher social and security costs.

Without credible benefit-sharing frameworks, large-scale mining risks deepening inequality and instability.

Macroeconomic Relevance of Pakistan Minerals Economy

Minerals are often framed as a short-term macro solution. In practice, impacts materialize slowly and remain conditional.

For broader fiscal context, see IMF analysis on public debt dynamics https://www.imf.org/en/Topics/debt

Bottom Line

Pakistan mining economy presents both opportunity and risk. Global demand is strong, yet weak value addition, limited institutional capacity, and regional tensions threaten durable gains. Therefore, mineral development must move beyond extraction toward governance reform, downstream integration, and local inclusion. Otherwise, Pakistan risks reinforcing extractive dependence rather than achieving sustainable economic transformation.