Pakistan Energy Crisis analysis shows how oil import dependence, exchange rate pressure, and inflation pass through create a self reinforcing loop. It explains why energy shocks drain reserves, worsen fiscal stress, and keep inflation elevated, and why structural energy reform is essential for stability.

Introduction

The Pakistan Energy Crisis is not a temporary fuel price issue. Instead, it is a structural macroeconomic problem that links oil import dependence, exchange rate weakness, inflation persistence, and fiscal stress into a repeating cycle. Because energy sits at the center of Pakistan’s external and domestic price system, every global shock transmits rapidly into inflation and balance of payments pressure.

At the same time, Pakistan energy vulnerability has increased as global oil markets have become more volatile and external financing conditions tighter. As a result, stabilizing inflation or rebuilding foreign exchange reserves has become increasingly difficult.

Pakistan Energy Crisis and Import Dependence

Why oil imports define Pakistan energy vulnerability

Pakistan imports most of its crude oil, refined petroleum products, and LNG. These imports are priced in dollars, which immediately exposes the economy to exchange rate movements. Consequently, even when global oil prices remain stable, rupee depreciation raises domestic energy costs.

Moreover, energy demand is difficult to compress in the short run. Power generation, transport, and industry require fuel regardless of economic conditions. Therefore, the Pakistan Energy Crisis creates a persistent floor under the current account deficit.

Global oil price volatility has intensified due to geopolitical risks in the Middle East, which has kept energy markets exposed to sudden disruptions (https://economiclens.org/energy-warfront-middle-east-escalation-global-oil-market-volatility/). International oil supply and pricing trends further reinforce this exposure (https://www.eia.gov/international/).

Pakistan Energy Crisis and Inflation Transmission

How Pakistan energy vulnerability turns fuel shocks into inflation

Energy prices transmit into inflation faster in Pakistan than in many peer economies. Fuel price increases raise transport costs, which then feed directly into food prices and consumer goods inflation. Electricity tariff adjustments affect households and firms simultaneously, amplifying the inflation impact.

As a result, the Pakistan Energy Crisis plays a central role in keeping headline inflation elevated. According to global research on commodity price pass through, energy driven inflation tends to be more persistent in developing economies with weak shock absorbers (https://www.worldbank.org/en/research/commodity-markets).

In addition, supply chain disruptions raise landed energy costs. Shipping risks in the Red Sea have increased freight and insurance costs, further worsening imported inflation pressures (https://economiclens.org/red-sea-shipping-inflation-and-global-trade-stability/).

Pakistan Energy Crisis and Fiscal Stress

Subsidies, circular debt, and policy constraints

Fiscal pressure is a defining feature of Pakistan energy vulnerability. When fuel and electricity prices are adjusted fully, inflation accelerates and growth slows. However, when prices are suppressed, subsidies rise and arrears accumulate in the power sector.

This dilemma contributes to the expansion of circular debt, weakens fiscal credibility, and raises financing needs. Over time, these pressures reduce investor confidence and raise sovereign risk premiums. The International Monetary Fund consistently highlights energy sector inefficiencies as a core fiscal risk for Pakistan (https://www.imf.org/en/Countries/PAK).

Pakistan Energy Crisis as a Feedback Loop

The self reinforcing macroeconomic cycle

The most damaging feature of the Pakistan Energy Crisis is its feedback loop. Oil price shocks raise energy costs. Higher energy costs fuel inflation. Inflation triggers tighter monetary policy and fiscal stress. Slower growth and wider deficits weaken confidence. Foreign exchange reserves fall. The rupee depreciates. Energy imports become even more expensive.

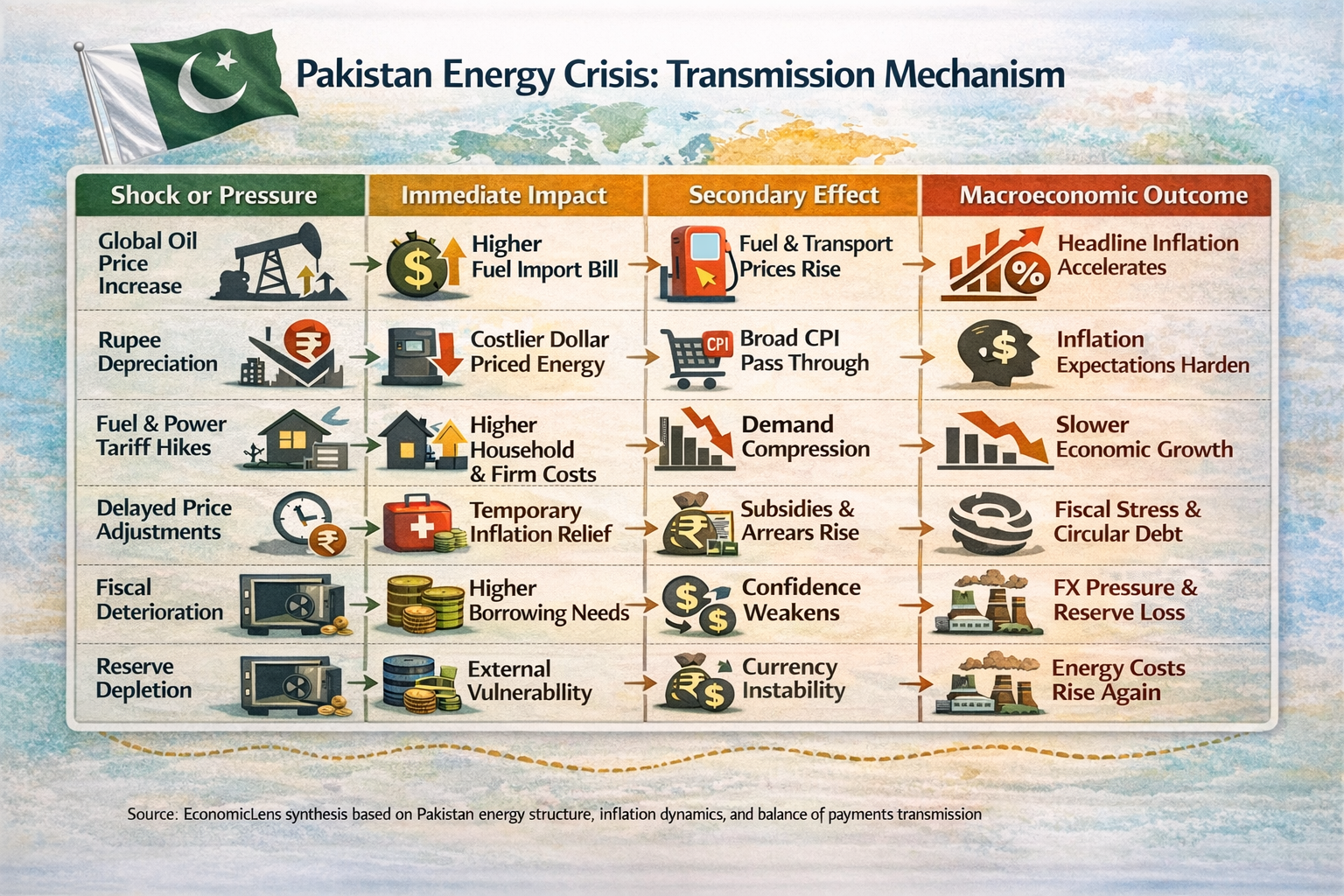

To clarify this mechanism, the table below summarizes how the Pakistan Energy Crisis propagates across the economy.

This figure highlights why energy shocks in Pakistan rarely remain sector specific and instead evolve into economy wide instability.

Pakistan Energy Crisis and Foreign Exchange Reserves

Why reserves remain fragile

Foreign exchange reserves are highly sensitive to energy payments. Oil and LNG imports require immediate dollar settlement, while exports, remittances, and external financing adjust with a lag. Consequently, energy shocks drain reserves quickly.

As reserves decline, confidence weakens and exchange rate pressure intensifies. This dynamic reinforces Pakistan energy vulnerability and pushes the economy back into inflationary stress. Official reserve and balance of payments data confirm the central role of energy imports in external pressure (https://www.sbp.org.pk/ecodata/index2.asp).

Breaking Pakistan Energy Vulnerability

What would actually reduce risk

Breaking the Pakistan Energy Crisis requires coordinated structural reform rather than short term fixes. First, reducing oil import dependence through domestic and renewable energy investment is essential. Second, credible and automatic pricing mechanisms are needed to limit fiscal uncertainty. Third, stronger reserve buffers can improve shock absorption.

Most importantly, long term stability depends on making clean energy cheaper and more reliable than fossil fuels, not simply subsidized (https://economiclens.org/why-green-energy-needs-to-be-cheaper-than-fossil-fuels-the-future-of-affordable-sustainability/).

Conclusion

The Pakistan Energy Crisis remains the economy’s most powerful transmission channel for external shocks. Because oil imports, currency pressure, inflation, and fiscal stress reinforce each other, energy shocks rarely remain sector specific.

Until Pakistan energy vulnerability is addressed through structural reform, stronger buffers, and reduced oil dependence, external shocks will continue to return as domestic inflation and balance of payments crises.

1 thought on “Pakistan Energy Crisis: Oil, Currency and Inflation Loop”

Great 👍