The Pakistan debt crisis is intensifying as the country faces rising default risk, shrinking fiscal space, and repeated dependence on IMF bailouts. This blog examines Pakistan’s external debt burden, macroeconomic instability, IMF conditionalities, currency pressures, social impacts of austerity, and the structural reforms needed for long-term recovery.

Introduction

The Pakistan debt crisis has entered a severe phase as the nation struggles with soaring external liabilities, declining reserves, and persistent macroeconomic instability. Because global interest rates remain elevated and the domestic financing system is strained, Pakistan’s reliance on IMF bailouts has deepened, transforming temporary stabilization tools into recurring necessities. Simultaneously, structural weaknesses—low tax capacity, energy circular debt, and climate-exposed agriculture—have created a fragile foundation that amplifies economic shocks. As inflation surges, the rupee depreciates, and fiscal deficits widen, Pakistan confronts a challenging intersection of economic pressures. Therefore, understanding the layers of the crisis—including Pakistan default risk, IMF program impacts, fiscal constraints, and social pressures—is crucial for mapping a viable recovery path.

This blog unpacks the crisis through a structured five-part analysis, concluding with policy reforms and a forward-looking outlook.

1. Pakistan Debt Crisis: Rising Fiscal Stress & External Vulnerabilities

The Pakistan debt crisis has escalated rapidly as fiscal constraints and currency pressures expose deep vulnerabilities. Because Pakistan relies heavily on external borrowing to finance essential imports, fluctuations in global markets quickly intensify domestic stress. The fiscal deficit remains elevated, driven by interest payments, energy subsidies, and weak revenue performance. These factors combine to create an environment of growing Pakistan default risk and greater reliance on external partners for stabilization.

Former State Bank economist Dr. Ishrat Hussain explains: “Pakistan’s debt problem is not only about numbers—it is about structural weaknesses that limit economic resilience and magnify every shock.”

According to the IMF’s 2024 Article IV Report on Pakistan, external financing needs exceeded $25 billion annually, while reserves fell below 1.5 months of import cover at several points in 2023–2024. These pressures intensified the Pakistan external debt burden and increased the need for emergency IMF disbursements.

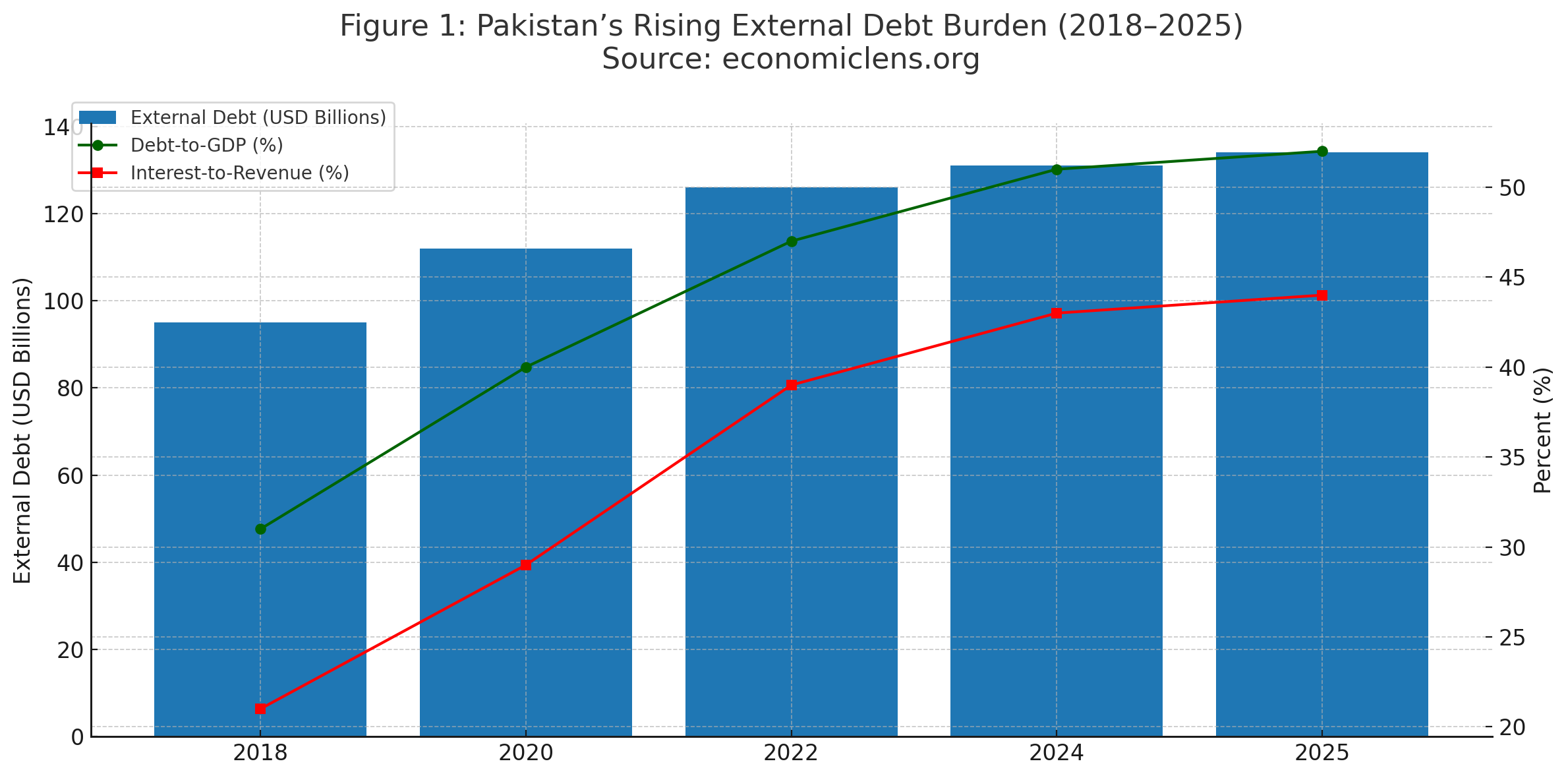

The table shows a steady rise in Pakistan’s external debt burden, with debt-to-GDP increasing from 31% in 2018 to over 50% by 2025. Interest payments now consume nearly half of government revenues, leaving little fiscal space for development projects, subsidies, or climate adaptation. This trajectory underscores the worsening Pakistan debt crisis and highlights why the country remains dependent on IMF programs for liquidity.

“Pakistan stands at a financial crossroads. Early action today can prevent deeper crises tomorrow.”

2. Pakistan Default Risk: Currency Depreciation & Macroeconomic Instability

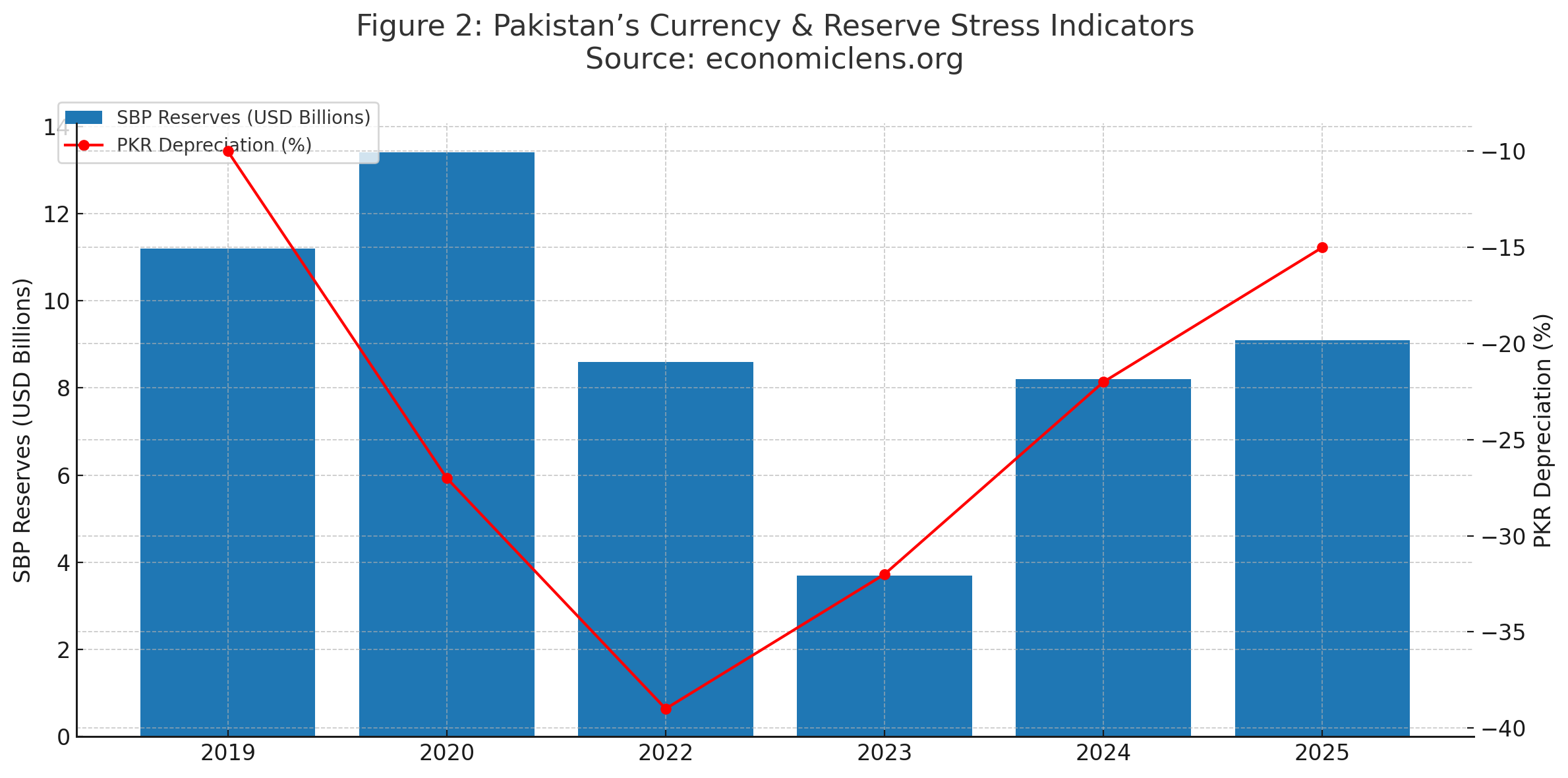

Pakistan’s default risk has risen sharply due to chronic currency volatility, insufficient reserves, and global tightening. The rupee’s persistent depreciation has increased the cost of servicing foreign debt, while rising import bills have strained the current account. Because much of Pakistan’s borrowing is denominated in foreign currencies, exchange rate instability directly worsens debt sustainability.

Former SBP Governor Reza Baqir notes: “Sovereign default risk increases when countries lose the ability to stabilize their currency. Pakistan’s challenge is both external and structural.”

The BIS Emerging Market Stress Index identifies Pakistan among the top five economies vulnerable to currency-driven default episodes due to reserve volatility and limited fiscal buffers.

Sharp deviations in the rupee’s value, alongside low reserves, amplify Pakistan default risk. Even temporary improvements in reserves remain insufficient to offset heavy external payments. This volatility feeds into Pakistan economic instability and undermines investor confidence.

“Stabilizing the rupee isn’t just an economic need—it’s a national priority for long-term resilience.”

4. IMF Bailouts in Pakistan: Relief or Crisis Multiplier?

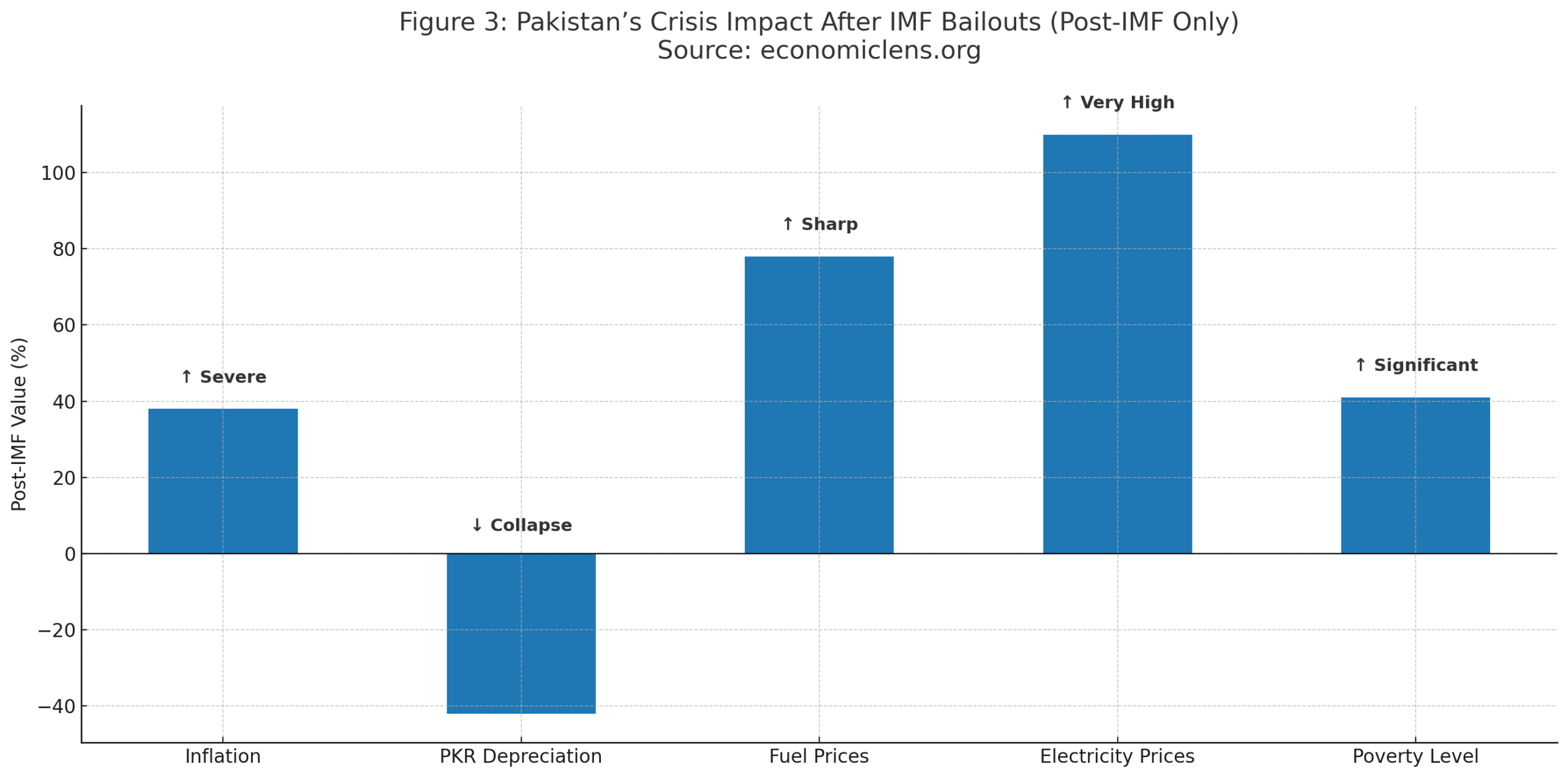

Pakistan’s relationship with the IMF spans 23 programs in 75 years, making it one of the most bailout-dependent nations globally. While these programs provide urgent liquidity, they often bring difficult conditions that heighten short-term economic pain. Because adjustments involve subsidy removal, taxation, and exchange-rate liberalization, IMF bailouts frequently trigger inflation surges and social stress, contributing to Pakistan economic instability.

Economist Dr. Hafiz Pasha observes: “IMF programs offer stabilization, but their short-term shock frequently intensifies economic hardship for millions of Pakistanis.”

The IMF’s 2024 Extended Fund Facility Review shows Pakistan faced the sharpest post-bailout inflation spike among all South Asian economies, driven by energy price adjustments and currency realignment.

Post-IMF adjustment periods created a cascade of economic hardship. Inflation nearly tripled, electricity prices doubled, and the rupee collapsed. These conditions deepened the Pakistan debt crisis instead of alleviating it in the short run, underscoring the need for better-designed programs that protect vulnerable households.

“A bailout can stabilize—but only reform can transform Pakistan’s economy.”

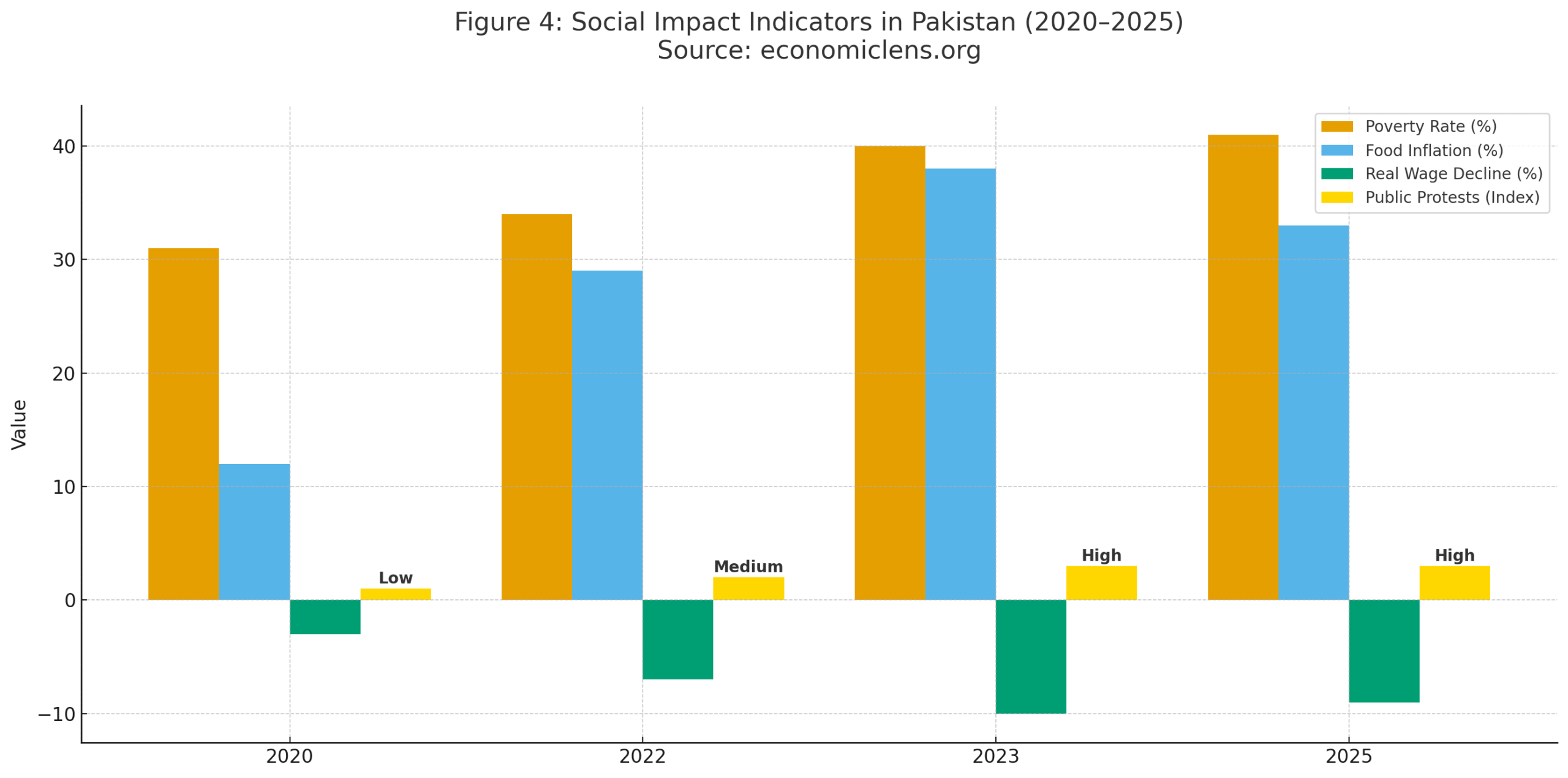

4. Social Impact: Austerity, Cuts & Rising Hardship

Austerity measures linked to IMF programs—such as subsidy removal and higher energy taxes—have had profound social consequences. As inflation rises and real incomes decline, millions of Pakistanis face heightened economic insecurity.

UN economist Dr. Samar Abbas states: “Austerity without safety nets turns financial stabilization into human hardship.”

UNDP’s Pakistan Development Stress Report 2024 notes Pakistan experienced a 7% increase in poverty following successive price adjustments and fiscal tightening.

The social toll of austerity is clear: rising poverty, high food inflation, and increasing political unrest. These pressures weaken social cohesion and deepen Pakistan economic instability.

“Economic stabilization means little if citizens cannot afford to live securely.”

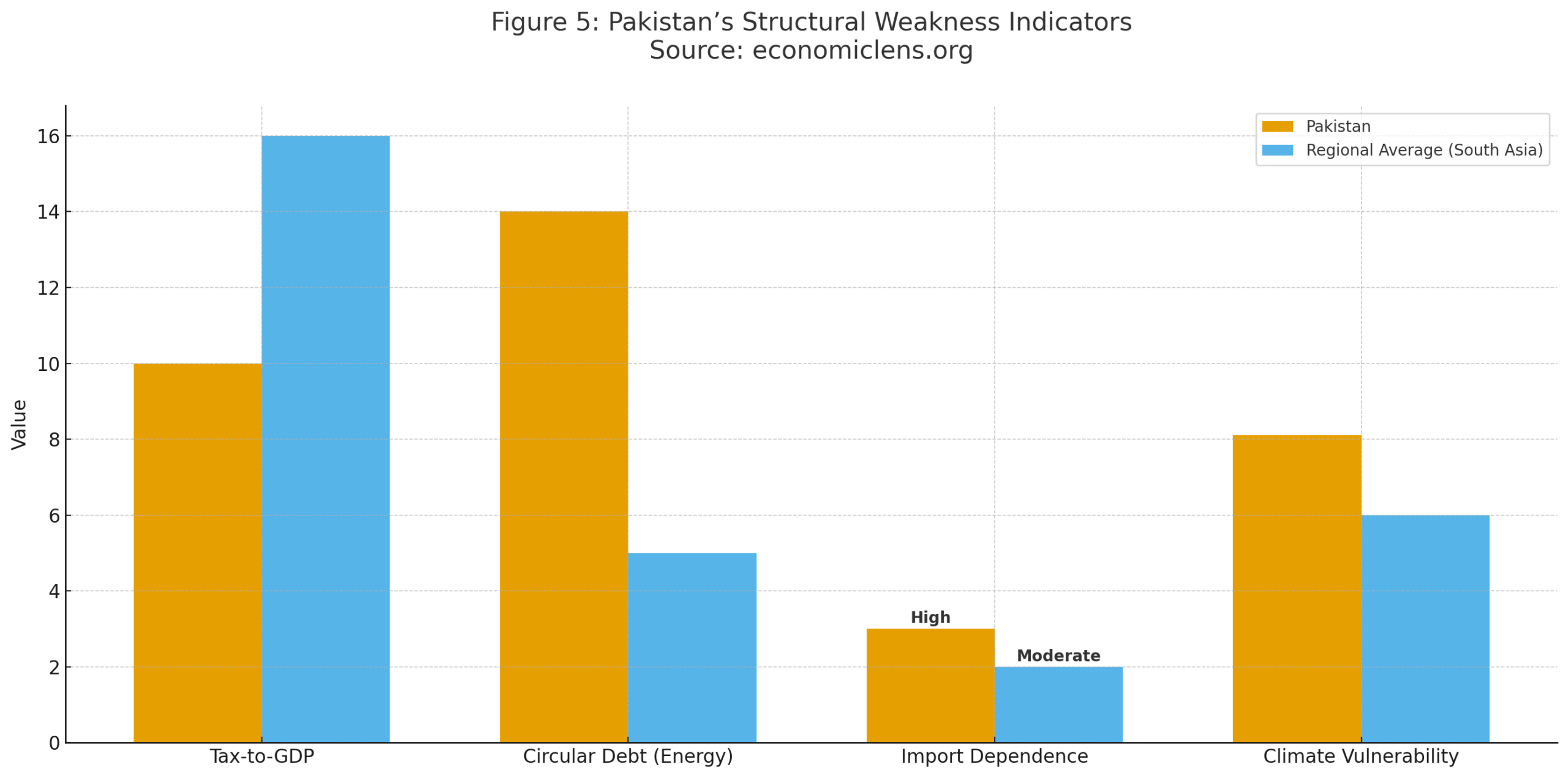

5. Structural Weaknesses: Why Pakistan Keeps Returning to the IMF

Pakistan’s repeated return to the IMF is rooted in structural constraints—low tax revenue, energy inefficiency, import dependence, and climate vulnerability. These weaknesses limit growth and magnify external pressures.

OECD analyst Dr. Mariana Lopez notes: “Without structural reform, IMF programs become band-aids rather than solutions.”

OECD’s 2025 Fiscal Stability Review shows Pakistan’s tax-to-GDP ratio remains among the lowest in Asia.

Low revenue capacity, chronic circular debt, and climate exposure create long-term drag on stability. Until these issues are addressed, the Pakistan debt crisis will remain cyclical.

“Lasting stability requires fixing the roots, not the symptoms.”

Future Outlook

Over the next two years, Pakistan’s economic outlook will depend on its ability to stabilize reserves, implement reforms, and negotiate sustainable debt relief. Inflation is expected to moderate gradually, but Pakistan economic instability will persist unless structural issues—tax reform, energy pricing, and climate resilience—are addressed comprehensively.

Policy Implications

Pakistan must prioritize debt restructuring that reduces repayment burdens rather than postponing them. IMF programs should include social protection to prevent austerity from worsening human hardship. Strengthening tax administration, reducing energy circular debt, and promoting exports are essential for building resilience. Additionally, climate-resilient development planning must be embedded into fiscal policy since climate shocks increasingly affect Pakistan’s economic trajectory. Transparent governance and credible institutions remain foundational for restoring investor confidence and stabilizing the Pakistan debt crisis.

“Bold, coordinated reforms can turn Pakistan’s debt emergency into an opportunity for renewal.”

Conclusion

The Pakistan debt crisis reflects decades of structural imbalances, rising external liabilities, and recurring shocks. While IMF bailouts offer temporary breathing space, the path to recovery requires structural reform, social protection, and a long-term commitment to fiscal discipline. With decisive action, Pakistan can move from crisis management toward sustainable growth.

Call to Action

Support transparent governance, sustainable fiscal reforms, and inclusive economic policies. Pakistan’s future stability depends on choices made today.