PIA privatization marks a major reform milestone as the Arif Habib consortium secures a Rs135bn bid. This data-driven analysis explains the fiscal losses, operational inefficiencies, and economic impact behind the sale of Pakistan International Airlines.

Introduction

The PIA privatization process reached a decisive stage when a consortium led by the Arif Habib Group secured a Rs135 billion bid. The offer was for a 75 percent stake in Pakistan International Airlines. The televised auction marked Pakistan’s first major privatization in nearly two decades. Dawn

The urgency of PIA privatization is closely linked to broader macroeconomic fragilities. These risks are highlighted in EconomicLens’ analysis of Pakistan’s structural economic instability at

https://economiclens.org/pakistan-economic-instability-a-structural-diagnosis/. The study examines weak governance and persistent fiscal imbalances in detail.

As a result, this transaction stands as one of Pakistan’s most consequential state-owned enterprise reforms.

1. Fiscal, Financial, and Operational Pressures Behind PIA Privatization

PIA privatization has been debated for more than a decade. Repeated delays, however, steadily worsened the airline’s financial position.

Fiscal data from Pakistan’s Ministry of Finance shows that PIA ranked among the largest loss-making SOEs. Operational performance weakened year after year. Consequently, continued public ownership became fiscally unsustainable. This was especially true under tighter global financing conditions.

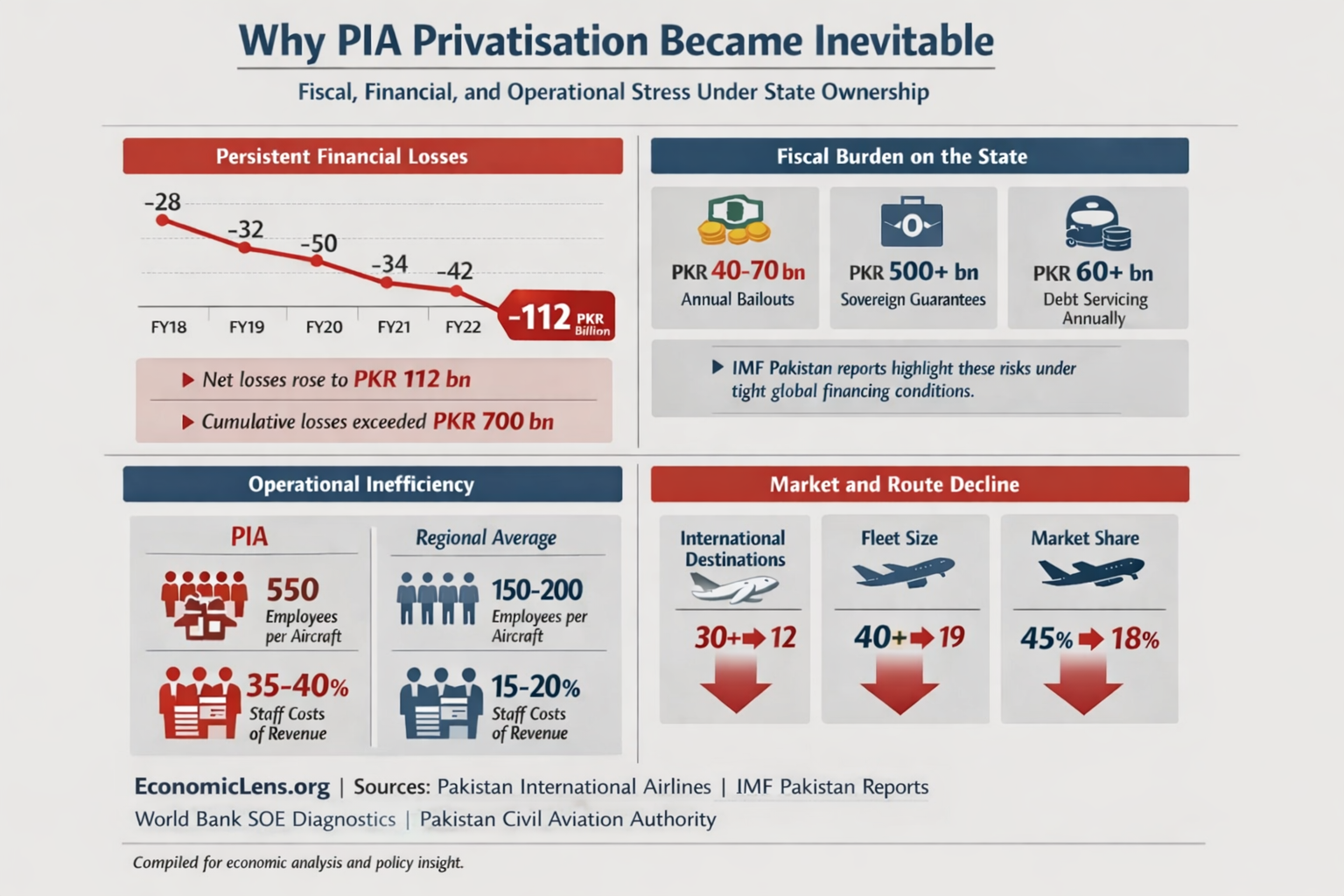

Persistent losses, rising fiscal burdens, operational inefficiency, and market decline made PIA privatization unavoidable.

Persistent Financial Losses Under State Ownership

Pakistan International Airlines entered the privatization phase after years of deep financial losses. These losses reflected structural weaknesses rather than temporary shocks. As shown in the accompanying figure, net losses widened steadily after FY2018. Losses reached PKR 112 billion by FY2023.

Over time, annual deficits compounded into cumulative losses exceeding PKR 700 billion. This placed severe pressure on the airline’s balance sheet.

Financial deterioration was accompanied by consistently negative operating margins. Core operations failed to generate enough revenue to cover costs. At the same time, total liabilities expanded sharply and crossed PKR 800 billion.

This pattern shows that PIA’s crisis was structural. It was rooted in cost structure, governance failures, and the operational model under state ownership.

Rising Fiscal Burden on Public Finances

As PIA’s finances weakened, the burden shifted to the public sector. The figure highlights the scale of fiscal exposure faced by the government. Annual budgetary support ranged between PKR 40 and 70 billion.

Sovereign guarantees exceeded PKR 500 billion. Government-backed debt servicing surpassed PKR 60 billion annually. These obligations amplified risks to public finances.

PIA became one of the largest contributors to aggregate SOE losses. International institutions, including the IMF, repeatedly flagged this exposure as a macro-fiscal risk. These warnings were issued amid tight global financing conditions.

Under such constraints, continued state support became difficult to justify. This accelerated the push toward privatization.

Operational Inefficiency and Productivity Gaps

Financial losses were reinforced by persistent operational inefficiencies. As shown in the infographic, PIA employed around 550 workers per aircraft. This was far above the regional benchmark of 150 to 200 employees.

Overstaffing translated into elevated costs. Staff expenses absorbed roughly 35 to 40 percent of total revenue. Regional peers typically operate within a 15 to 20 percent range.

These productivity gaps weakened PIA’s competitiveness. This remained true even on routes with strong demand. World Bank SOE diagnostics show that such inefficiencies persist without structural reform or ownership change.

Route Contraction and Market Share Decline

Operational weaknesses eventually reduced PIA’s market presence. The figure shows international destinations falling from over 30 routes to just 12. The operational fleet was nearly halved.

Market share declined from about 45 percent to 18 percent. This contraction reduced revenue potential further. A negative feedback loop emerged between shrinking operations and worsening finances.

Data from the Pakistan Civil Aviation Authority confirms that this was a sustained decline. Similar patterns are observed in other distressed public airlines globally.

Why Privatization Became Unavoidable

Persistent losses, rising fiscal costs, inefficiency, and market retreat made privatization unavoidable. The visual summary consolidates these dynamics into a single narrative. It shows how firm-level stress translated into macro-fiscal risk.

Privatization emerged as a necessity rather than a policy preference. Its aim was to halt further losses and restore operational viability.

2. PIA Privatization Auction and Arif Habib Consortium Victory

The PIA privatization auction was structured with multiple pre-qualified bidders, including groups led by Lucky Cement and Arif Habib, with Airblue initially participating before exiting early in the process, according to Dawn reporting on the live auction in Islamabad. Dawn

During the first round, Lucky Cement bid Rs101.5 billion and Arif Habib bid Rs115 billion, after which the government set a reference price that guided the subsequent competitive bidding. Dawn

According to reporting by Reuters at https://www.reuters.com/world/asia-pacific/, the Rs135bn bid submitted by the Arif Habib-led consortium exceeded the government’s minimum valuation and secured the transaction.

This occurred at a time when global investors remain cautious due to geopolitical tensions and slower global growth, making the outcome notable.

3. Economic Impact of PIA Privatization

Following are the economic impacts of PIA privatization:

3.1 Fiscal Relief and Reform Credibility

First, PIA privatization reduces the need for repeated government bailouts. Second, it strengthens Pakistan’s reform credibility under IMF-supported programmes.

Members of the federal cabinet and senior ministers described the sale as a “historic milestone” and expressed confidence that the transaction will bring private investment and help cut fiscal losses. Dawn

Aviation, Trade, and Tourism Effects

Furthermore, improved airline performance can enhance connectivity. Better connectivity supports tourism flows, trade facilitation, and overseas travel demand, particularly as global travel recovers after recent disruptions.

In remarks after the auction, business leaders associated with the winning consortium said they plan to expand PIA’s fleet from its existing deployment to a larger scale in phases, which they expect will attract further investment and help PIA regain market share. Dawn

Risks After PIA Privatization

Despite progress, challenges remain. Political resistance, labour rigidities, and regulatory delays could weaken outcomes. Therefore, sustained governance discipline and operational autonomy will be essential for success.

Conclusion

The PIA privatization deal marks a structural reset for Pakistan International Airlines. Years of losses, fiscal strain, and operational inefficiency made reform unavoidable. If implemented effectively, PIA privatization can reduce fiscal risks and restore competitiveness.

Ultimately, the success of this transaction will shape the credibility of Pakistan’s wider SOE reform agenda and influence investor confidence in future public asset sales.