PIA privatization crisis is not only about selling a loss-making airline. It also raises a deeper question about whether the state transferred a strategic national asset only after years of policy failure had already destroyed its value. Before the sale, the government absorbed PIA’s legacy debt and fiscal liabilities, shifting the burden directly onto taxpayers. Officials then sold the airline in a distressed condition. Aircraft, international routes, landing slots, infrastructure, and brand value failed to command their full market worth. This sequence matters because it shows that prolonged misgovernance, not transparent asset valuation, shaped the final price. The state exited after eroding the airline’s economic potential.

Pakistan Airline Privatization Crisis and Institutional Breakdown

The Pakistan airline privatization crisis reflects governance collapse rather than reform success. Pakistan International Airlines once symbolized state capacity and regional connectivity. Political leaders now justify its sale as efficiency driven reform. However, decades of institutional decay explain the outcome far more clearly.

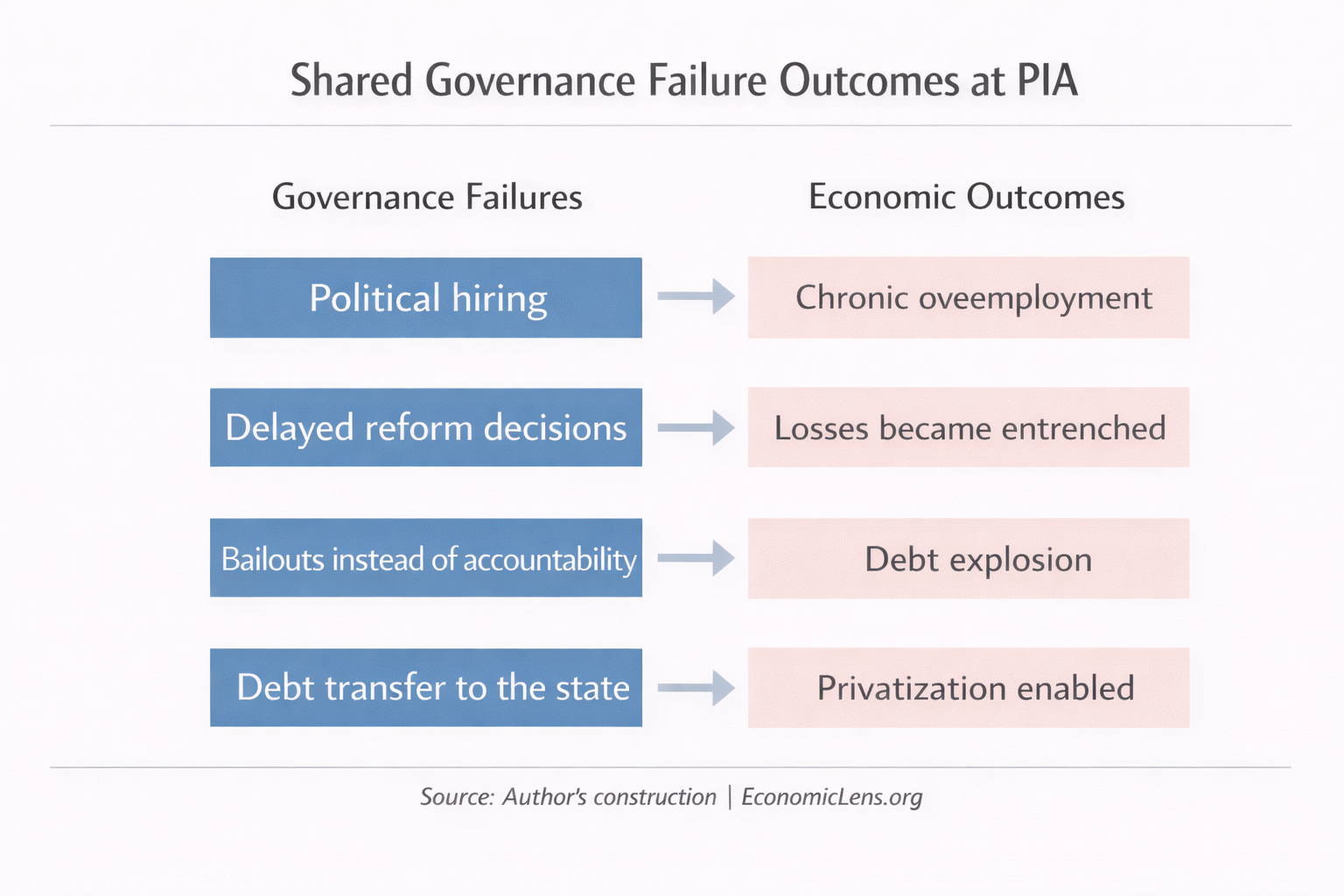

Corruption, political interference, and weak oversight hollowed out the airline. Successive governments postponed accountability and relied on fiscal support instead. Taxpayers absorbed the losses while operational capacity continued to deteriorate. This trajectory made privatization inevitable, not visionary.

This editorial explains how the PIA privatization crisis unfolded and why state failure left policymakers with no credible alternatives.

PIA Privatization Governance Failure Through Political Hiring

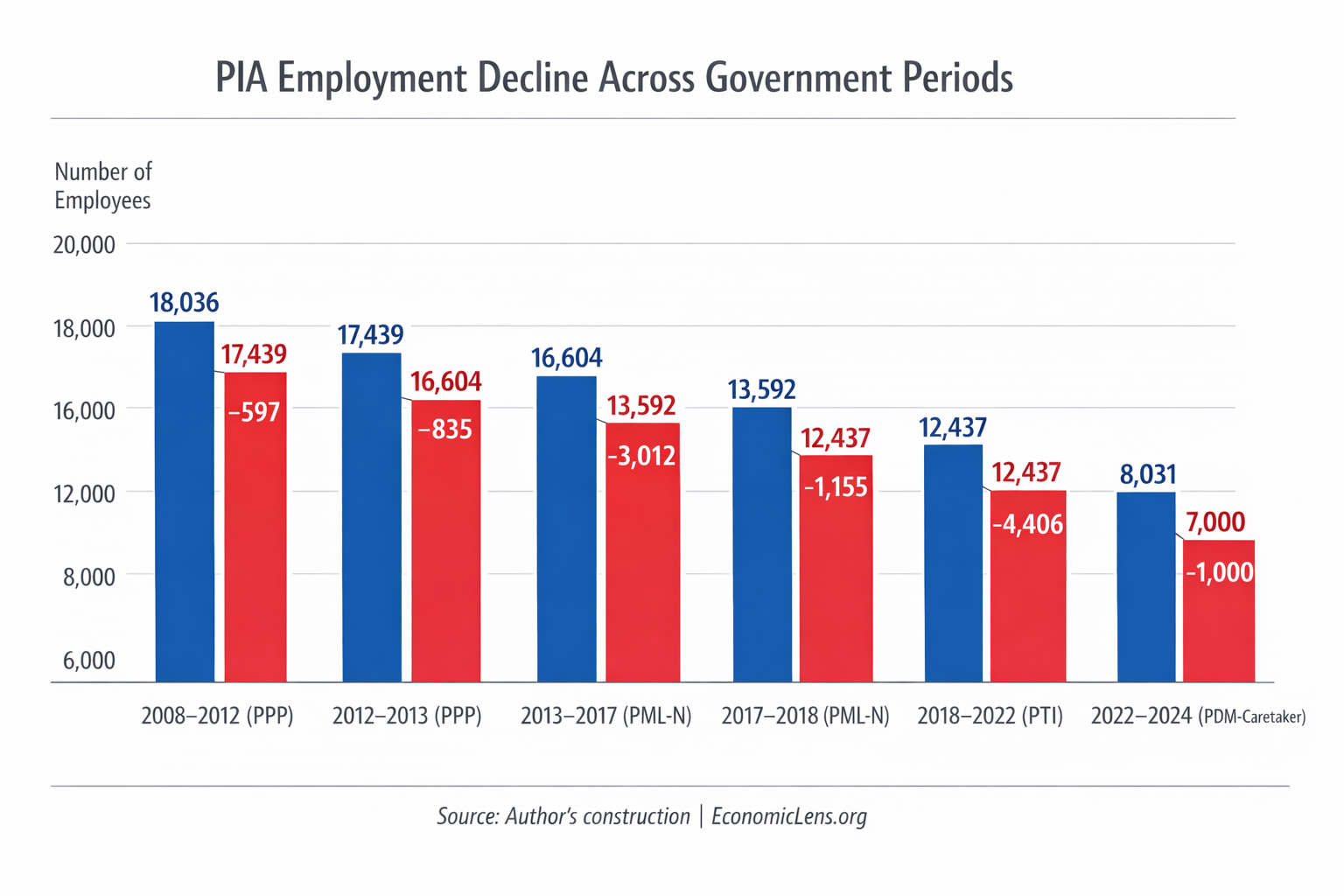

Political hiring damaged PIA long before privatization entered the policy debate. Governments filled positions based on patronage instead of operational need. Productivity declined while wage costs expanded.

Leadership delayed corrective action for years. When downsizing finally began, the airline had already lost financial stability and market competitiveness. This pattern defines the PIA privatization governance failure and explains why reforms failed to reverse decline.

Employment fell sharply after 2018. Yet losses continued to rise. This contradiction lies at the center of the PIA privatization crisis.

Employment Decline and the Pakistan Airline Privatization Crisis

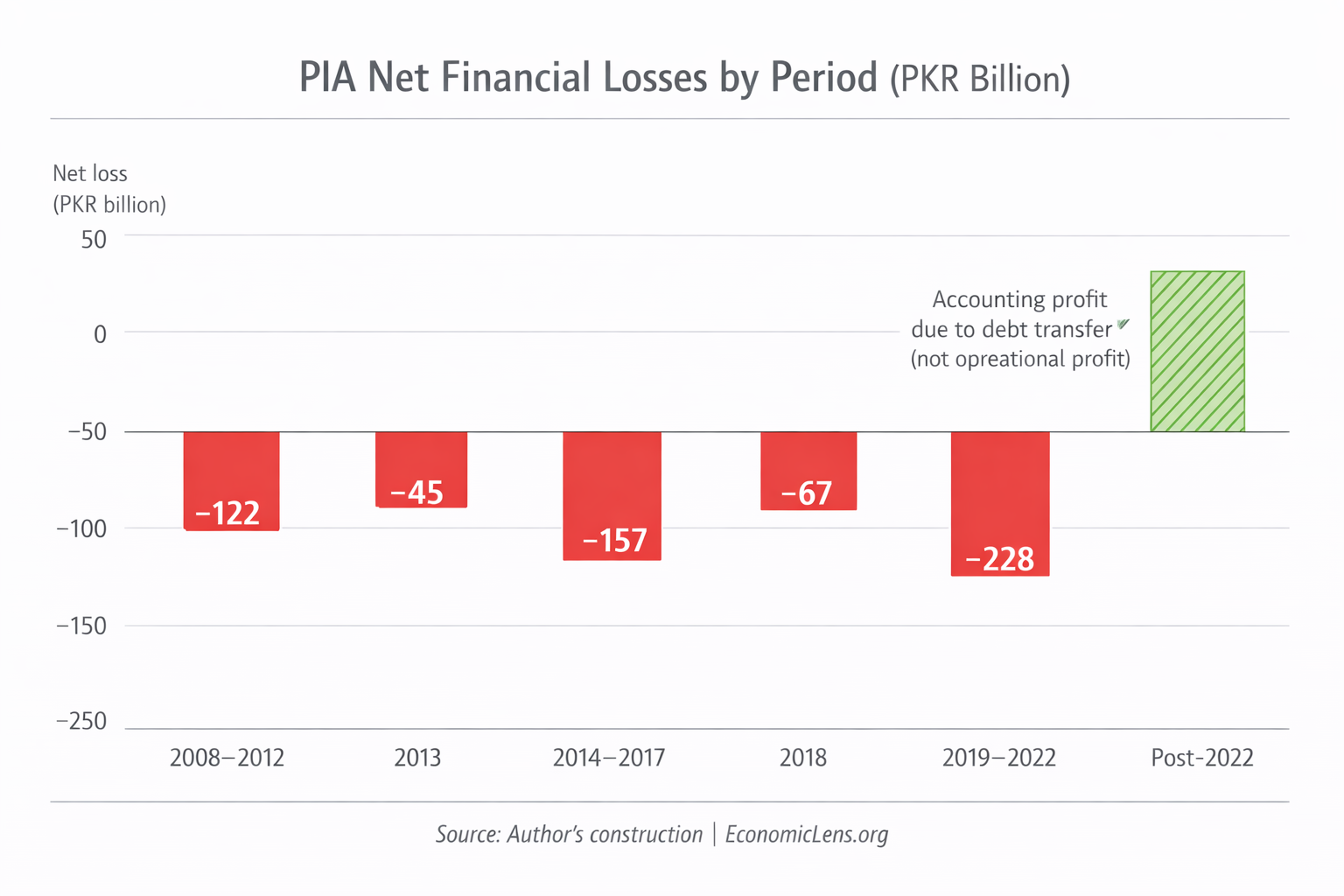

PIA’s workforce shrank steadily across successive governments. Employment fell sharply after 2018, yet losses continued to rise. This contradiction sits at the core of the Pakistan airline privatization crisis.

If overstaffing alone had caused the losses, workforce reductions should have improved financial performance. They did not.

More than PKR 550 billion in losses accumulated before privatization became unavoidable. This pattern is visually explained in the PIA privatization reform deal visual policy explainer, which shows how losses persisted despite employment cuts: https://economiclens.org/pia-privatization-reform-deal-visual-policy-explainer/

Why Employment Cuts Failed During the PIA Privatization Crisis

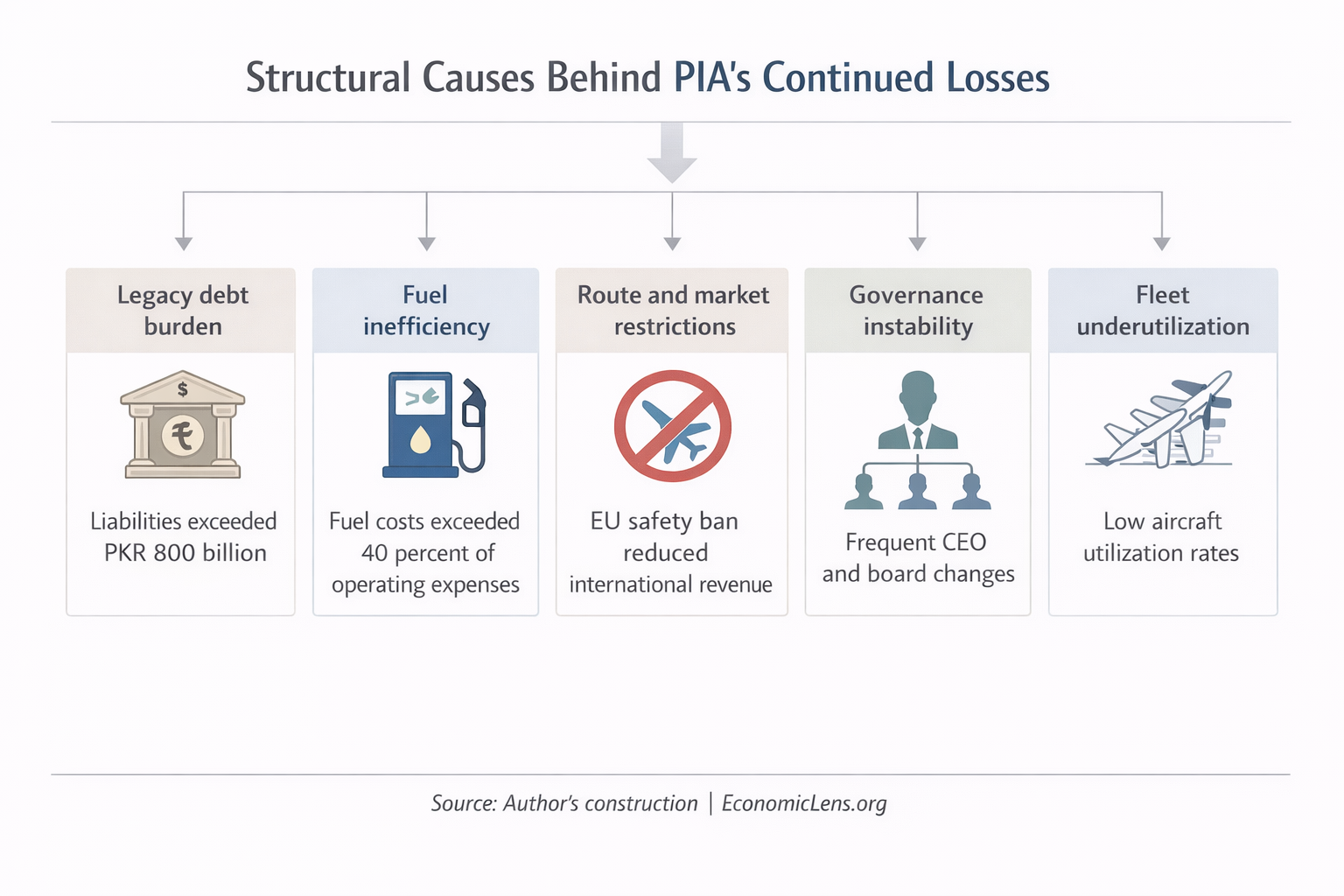

Downsizing alone could not repair institutional collapse. Structural weaknesses remained unresolved.

As detailed in why losses ultimately forced the PIA sale, reform arrived only after damage became irreversible:

https://economiclens.org/pia-privatization-reform-shows-why-losses-forced-the-sale/

PIA Losses and Government Bailouts Over Time

PIA accumulated losses despite repeated employment cuts. More than PKR 550 billion in losses built up before policymakers acknowledged that privatization had become unavoidable. The PIA privatization reform deal visual policy explainer shows how losses persisted even as staffing declined: https://economiclens.org/pia-privatization-reform-deal-visual-policy-explainer/

Downsizing alone could not repair institutional collapse. Structural weaknesses in procurement, fleet management, route planning, and governance remained unresolved.

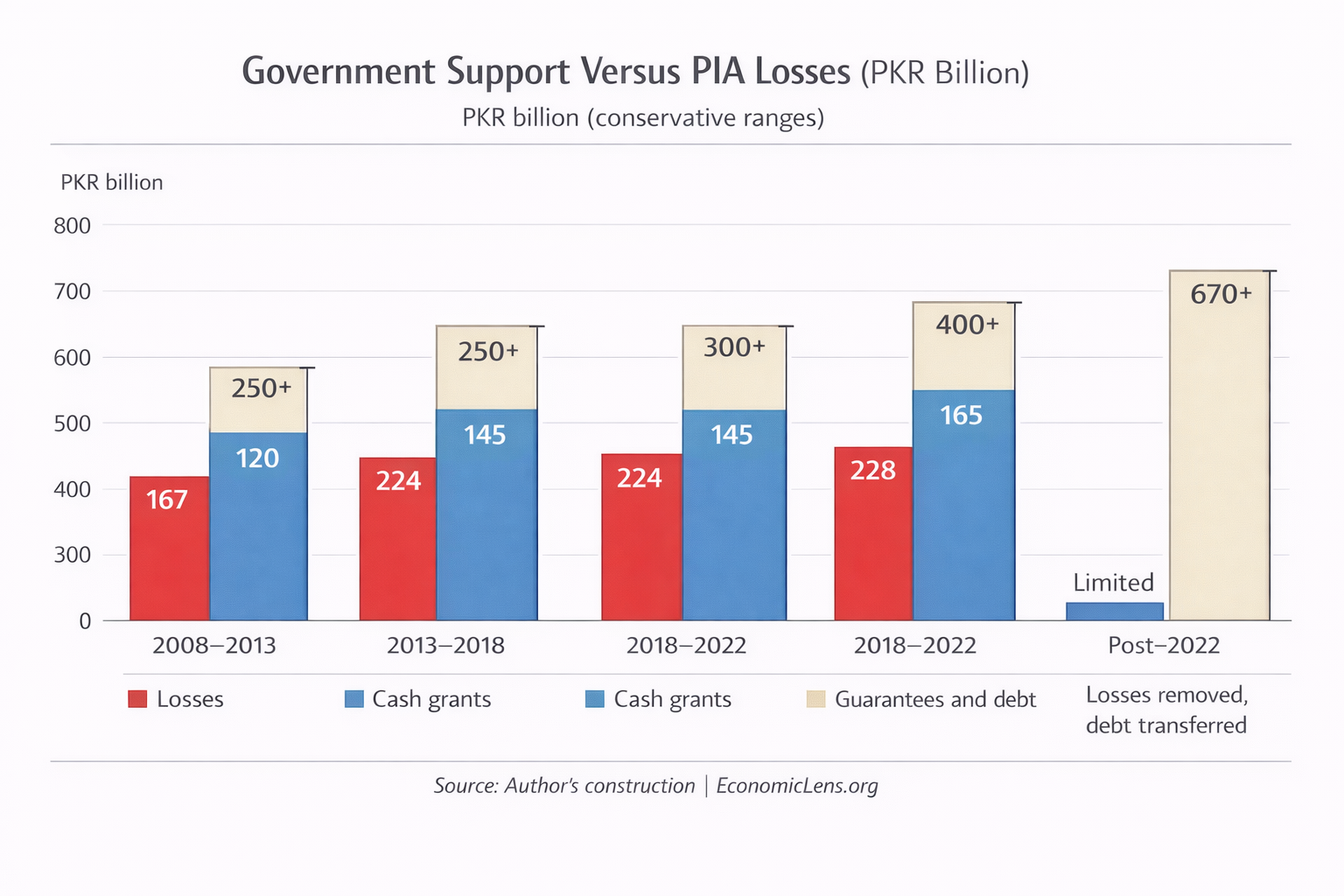

These bailout patterns align with IMF state-owned enterprise assessments that document how Pakistan repeatedly socialized SOE losses: https://www.imf.org/en/Publications/CR/Issues/2023/06/30/Pakistan-Request-for-an-Extended-Arrangement-Under-the-Extended-Fund-Facility-534160

They are also consistent with PIA’s published financial reports: https://www.piac.com.pk/financial-reports.

State Failure Behind the PIA Sale and Persistent Bailouts

Instead of absorbing losses internally, governments transferred them to the public balance sheet. Cash injections, guarantees, and debt rollovers became routine policy responses.

Public support expanded alongside persistent airline losses. IMF state-owned enterprise assessments document how Pakistan repeatedly socialized SOE losses rather than enforcing reform: https://www.imf.org/en/Publications/CR/Issues/2023/06/30/Pakistan-Request-for-an-Extended-Arrangement-Under-the-Extended-Fund-Facility-534160

PIA’s own financial disclosures confirm this pattern: https://www.piac.com.pk/financial-reports

The Sale That Followed the PIA Privatization Crisis

Officials now present privatization as a policy success. Yet the PIA privatization deal at Rs 135 billion reflects fiscal reality and reform risk, not institutional recovery. The Arif Habib-led consortium secured the winning bid only after the state transferred massive legacy liabilities to taxpayers.

PIA reported a profit in 2024 only after authorities shifted debt off its balance sheet. Reuters confirmed that this outcome reflected accounting cleanup rather than operational revival: https://www.reuters.com/world/asia-pacific/pakistans-national-airline-posts-first-annual-profit-two-decades-2024

This was balance sheet repair, not reform.

Accountability Gaps in the PIA Privatization Crisis

Governance failures translated directly into economic collapse. No senior official faced legal consequences. Authorities imposed no penalties for illegal hiring or procurement failures. Political actors escaped accountability while taxpayers absorbed the costs.

2 thoughts on “PIA Privatization Crisis Behind Pakistan’s Airline Sale”

Mass failure of the government

Good job