PIA privatization reform highlights how prolonged losses, rising fiscal exposure, and weak productivity can force decisive policy change. While repeated bailouts delayed collapse, inefficiencies deepened. This chart-based visual story explains why Pakistan International Airlines reached a breaking point and how the Rs135bn bid reshaped Pakistan’s reform path, as detailed in EconomicLens’ full analysis of the transaction at https://economiclens.org/pia-privatization-arif-habib-wins-rs135-billion-bid/.

Introduction: Why PIA Privatization Reform Matters

PIA privatization reform has been debated for more than a decade. However, delays allowed losses to compound even when passenger demand recovered. As a result, financial stress intensified.

This chart-based analysis tracks PIA’s financial deterioration, fiscal burden, and operational retreat from FY2018 to FY2023. Similar patterns have emerged globally, as seen in airline restructurings following COVID-19 shocks documented by the International Air Transport Association at https://www.iata.org/.

Persistent Financial Losses Under PIA Privatization Auction

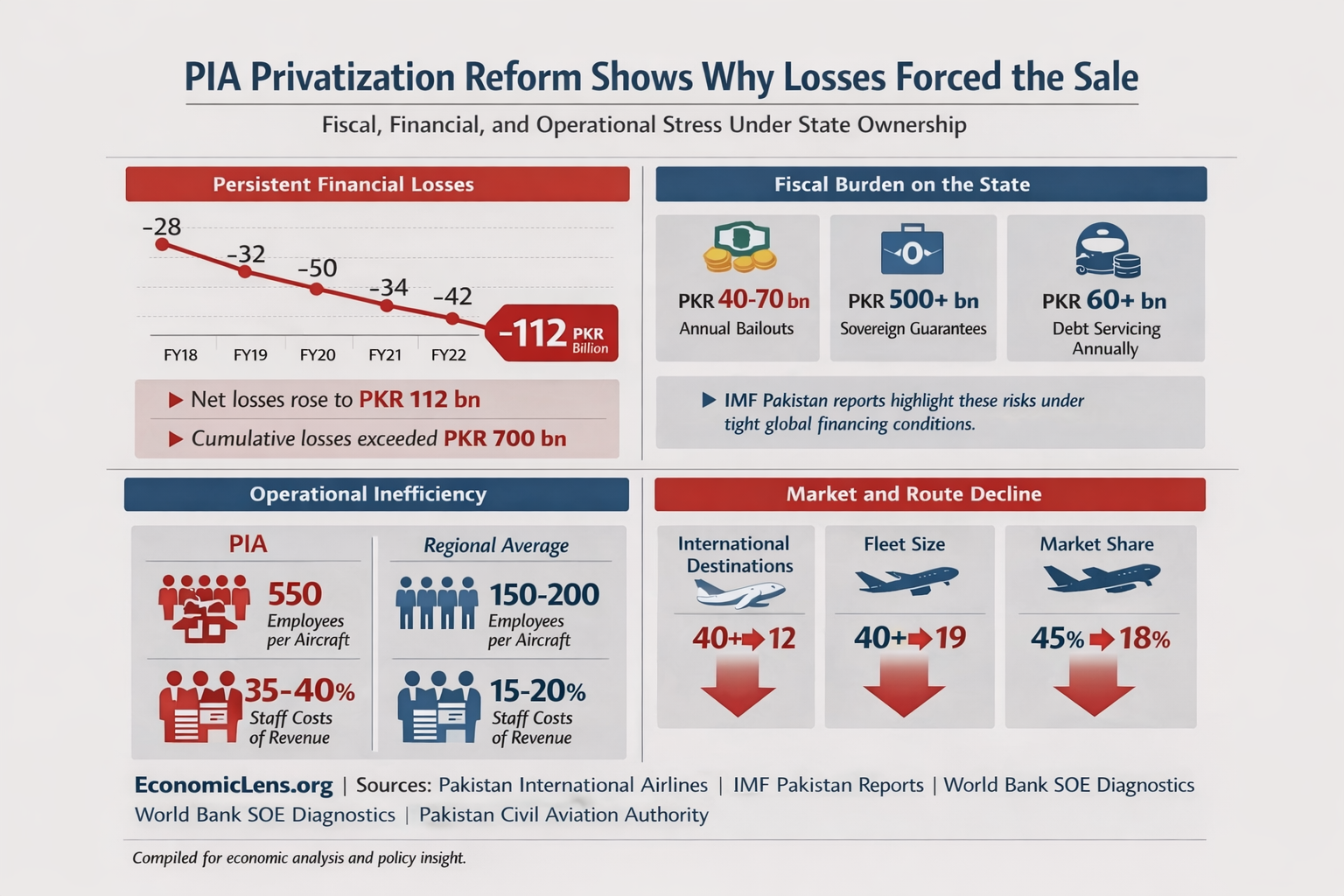

PIA privatization reform became unavoidable as losses widened year after year. The chart shows net losses rising steadily, reaching PKR 112 billion by FY2023, based on data from Pakistan International Airlines’ disclosures at https://www.piac.com.pk/.

Moreover, cumulative losses exceeded PKR 700 billion. Operating margins remained negative throughout the period. Therefore, core operations failed to cover costs. Total liabilities crossed PKR 800 billion, confirming structural weakness rather than a temporary shock.

PIA Privatization Fiscal Burden on the State

Financial deterioration quickly translated into fiscal pressure. Under PIA privatization reform analysis, the chart highlights repeated government support.

Annual budgetary transfers of PKR 40 to 70 billion were required to sustain operations, according to Pakistan’s Ministry of Finance budget documents at https://www.finance.gov.pk/. In addition, sovereign guarantees exceeded PKR 500 billion, while debt servicing surpassed PKR 60 billion annually.

Consequently, the International Monetary Fund repeatedly flagged SOE losses as a macro-fiscal risk for Pakistan under its lending programmes, as noted in IMF country reports at https://www.imf.org/en/Countries/PAK.

Operational Inefficiency and Productivity Gaps

Operational inefficiency reinforced financial losses. PIA employed nearly 550 workers per aircraft, far above regional benchmarks of 150 to 200. Staff costs absorbed up to 40 percent of revenue.

Such gaps weakened competitiveness. Similar inefficiencies have plagued state-owned carriers globally, including South African Airways and Alitalia, as reviewed in World Bank SOE diagnostics at https://www.worldbank.org/en/topic/stateownedenterprises.

Route Contraction and Market Share Decline

As losses persisted, PIA’s market presence shrank. International routes fell from over 30 destinations to just 12. Fleet size declined sharply. Market share dropped from around 45 percent to below 20 percent.

This contraction reduced revenue further. Meanwhile, low-cost carriers expanded across South Asia, reflecting global aviation trends reported by Airbus market outlooks at https://www.airbus.com/.

Data from the Pakistan Civil Aviation Authority confirms this sustained decline under state ownership at https://caapakistan.com.pk/.

Why PIA Privatization Auction Became Unavoidable

Taken together, losses, fiscal exposure, inefficiency, and market retreat explain why PIA privatization reform shifted from debate to necessity. The chart consolidates these pressures into a single narrative.

Globally, governments facing similar pressures have pursued privatization or restructuring, including recent reforms in India’s Air India sale, reported by Bloomberg at https://www.bloomberg.com/.

PIA Privatization Auction Outcome and Reform Signal

The Rs135bn bid by the Arif Habib-led consortium exceeded the government’s reference price. It marked Pakistan’s first major privatization in nearly two decades.

According to Dawn’s coverage of the live auction in Islamabad at https://www.dawn.com/news/1962791, multiple bidders participated. Reuters also noted that the sale occurred amid cautious global investor sentiment at https://www.reuters.com/world/asia-pacific/.

Conclusion

PIA privatization reform reflects a broader lesson in public sector economics. When losses become structural and fiscal exposure grows unchecked, reform becomes unavoidable.

This chart shows how prolonged state ownership eroded financial stability, operational efficiency, and market share. Ultimately, the success of this reform will shape investor confidence and Pakistan’s wider SOE transformation.

1 thought on “PIA Privatization Reform Shows Why Losses Forced the Sale”

Well explained