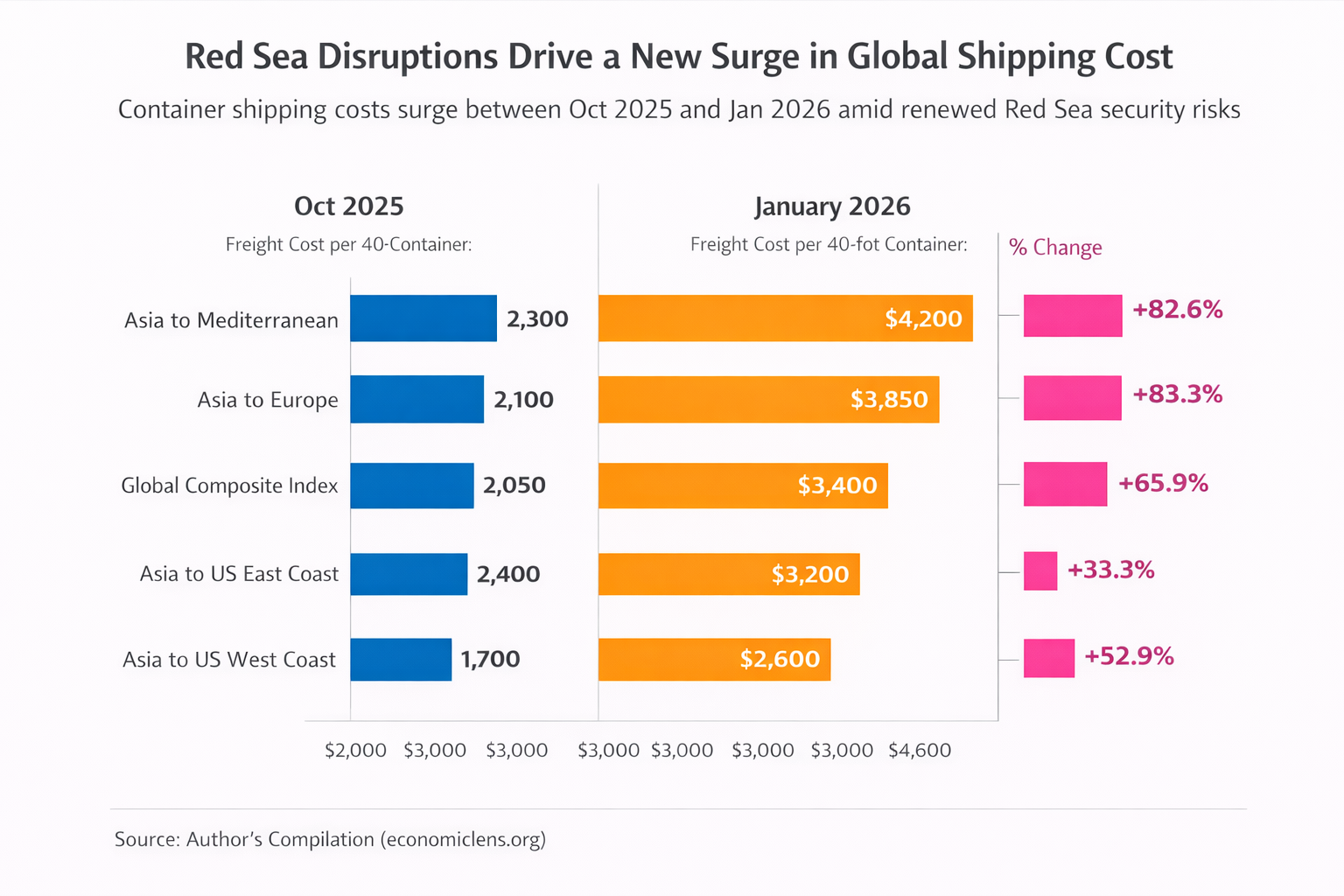

The Red Sea shipping cost surge has emerged as one of the most consequential trade developments in early 2026. As this Chart of the Week shows, container freight rates climbed sharply between October 2025 and January 2026. This escalation coincides with renewed security risks in the Red Sea and ongoing disruptions in the Suez Canal corridor. As a result, global shipping markets are once again pricing geopolitical instability directly into freight costs.

Container Shipping Cost Increase Across Asia–Europe Routes

The Red Sea shipping cost surge is most pronounced across major Asia-linked trade routes. Freight costs from Asia to the Mediterranean rose from roughly $2,300 per 40-foot container in October 2025 to about $4,200 by January 2026. Similarly, Asia to Europe rates increased from $2,100 to nearly $3,850 during the same period.

At the global level, the composite shipping index climbed by almost 66 percent. This increase confirms that the shock is systemic rather than route-specific. As EconomicLens has previously analyzed in Red Sea shipping disruptions drives global freight costs (https://economiclens.org/red-sea-shipping-disruptions-drives-global-freight-costs/), interruptions in key maritime corridors often propagate across multiple trade routes. Moreover, these dynamics align with earlier concerns highlighted in Red Sea shipping inflation and global trade stability (https://economiclens.org/red-sea-shipping-inflation-and-global-trade-stability/).

Global Shipping Cost Surge Driven by Red Sea Freight Disruption

The global shipping cost surge reflects the strategic importance of the Red Sea corridor. This route handles nearly 12 percent of global trade volumes, including energy shipments and manufactured goods (https://unctad.org). When vessels divert away from the Suez Canal, sailing distances lengthen significantly. Therefore, fuel usage rises, vessel utilization tightens, and delivery schedules become less reliable.

Moreover, shipping companies have reintroduced war-risk premiums and security surcharges. These adjustments elevate freight rates well beyond the immediate conflict zone. As explained in Red Sea turmoil, Suez Canal disruptions and the global shipping shock (https://economiclens.org/red-sea-turmoil-suez-canal-disruptions-and-the-global-shipping-shock/), elevated logistics costs generate spillovers across shipping lanes worldwide. According to World Bank logistics assessments (https://www.worldbank.org), such pressures often persist even after operational conditions stabilize.

Maritime Trade Disruption and US Shipping Lanes

Although the Red Sea shipping cost surge primarily affects Europe-bound lanes, US routes have also absorbed indirect pressure. Asia to US East Coast freight rates rose by about 33 percent, while Asia to US West Coast rates increased by nearly 53 percent. These movements reflect vessel reallocation rather than direct exposure to Red Sea risks.

In particular, shipping firms prioritize longer European routes due to higher margins. Consequently, capacity tightens on trans-Pacific lanes. According to port performance studies by the OECD (https://www.oecd.org), congestion and vessel delays amplify freight inflation even when trade volumes remain stable. This mechanism explains why US importers face rising logistics costs despite limited regional disruption.

Shipping Inflation Pressure and Supply Chain Pass-Through

The Red Sea shipping cost surge carries significant inflationary consequences. Shipping costs feed directly into landed import prices. Therefore, higher freight rates increase production costs for manufacturers and retailers. Over time, these pressures pass through to consumer inflation.

Importantly, this episode unfolds while global inflation remains vulnerable to supply-side shocks. The International Monetary Fund has repeatedly emphasized that geopolitical disruptions can delay disinflation trends (https://www.imf.org). As a result, central banks face added complexity when balancing growth support and inflation control. These channels are explored further in Red Sea shipping crisis, global trade fallout, inflation pressure and supply chain turmoil (https://economiclens.org/red-sea-shipping-crisis-global-trade-fallout-inflation-pressure-and-supply-chain-turmoil/).

Red Sea Freight Disruption and Emerging Market Exposure

Emerging economies face heightened exposure to the Red Sea freight disruption. Many depend heavily on imported fuel, food, and intermediate goods. Rising freight costs widen trade deficits and intensify foreign exchange pressures.

For South Asia, Africa, and the Middle East, these effects intersect with currency depreciation and fiscal constraints. UNCTAD research shows that logistics costs already represent a larger share of import prices in developing economies (https://unctad.org). Consequently, shipping shocks translate more rapidly into macroeconomic stress.

What This Chart Signals for Global Trade Stability in 2026

The Red Sea shipping cost surge highlighted in this Chart of the Week underscores the fragility of global trade systems. Even limited maritime disruptions can trigger disproportionate cost responses. As firms reroute shipments and rebuild inventories, efficiency losses become embedded in supply chains.

Looking ahead, sustained insecurity would likely keep freight rates elevated. Conversely, credible stabilization could ease costs relatively quickly. However, recent experience suggests that shipping markets now price geopolitical risk more aggressively than before. This shift may represent a structural change in global trade dynamics rather than a temporary fluctuation.