The Red Sea shipping crisis has become one of the most serious shocks to global trade in recent years. Consequently, attacks on commercial ships, rising maritime threats and abrupt rerouting decisions have turned a vital sea corridor into a high-risk passage. Nearly twelve percent of global trade moves through this corridor, so disruptions quickly raise prices and delay essential goods. Moreover, these delays increase inflation risk across major import-dependent regions. Meanwhile, as traffic slows in the Red Sea and Suez Canal, vessels reroute around the Cape of Good Hope. This longer path increases fuel costs, extends delivery times and places pressure on already stretched supply chains. Therefore, this blog provides a data-driven analysis of the crisis, its global fallout and the policy responses shaping future maritime trade.

Introduction

The Red Sea shipping crisis has become one of the most serious shocks to global trade in recent years. Attacks on commercial ships, heightened maritime security threats and abrupt rerouting decisions by major carriers have turned a vital sea corridor into a high-risk passage. As traffic through the Red Sea and Suez Canal slows, vessels are forced to sail thousands of extra kilometres around the Cape of Good Hope, driving up fuel costs, extending delivery times and increasing pressure on already stretched supply chains. Because nearly twelve percent of global trade and a large share of Asia–Europe container traffic pass through this corridor, disruptions here quickly translate into higher prices, delayed goods and renewed inflation risks worldwide. This blog provides a data-driven, section-by-section analysis of the Red Sea shipping crisis, its global fallout and the emerging policy responses shaping the future of maritime trade.

1. The Red Sea Shipping Crisis: Triggers, Escalation and Global Exposure

The Red Sea maritime corridor connects the Indian Ocean to the Mediterranean through key chokepoints, making it a highly sensitive route. Consequently, the current Red Sea shipping crisis stems from a sharp rise in attacks on commercial vessels. Moreover, geopolitical tensions around Yemen and nearby regions have intensified the threat environment. In addition, the growing use of drones and precision missiles has increased the technical risk to ships. As risk levels rose, shipping companies reassessed the route’s safety and insurers increased war-risk pricing. Cargo owners also began demanding safer alternative options. As a result, a regional security disruption evolved into a global shipping shock with wide economic consequences.

Houthi Attacks and Immediate Route Reassessment

In late 2023 and throughout 2024, Houthi forces carried out drone and missile attacks on vessels in the southern Red Sea. Several ships reported near misses or damage, and one vessel was temporarily seized. Consequently, these incidents pushed shipping lines to conduct urgent risk assessments. The strikes showed clear intent and growing technical capability. Meanwhile, insurers issued higher risk classifications for voyages through the region. Shipowners also faced pressure from crews and cargo owners to avoid dangerous waters. As a result, many operators paused transits or shifted to longer Cape of Good Hope routes. This shift marked the start of a broad reconfiguration of global shipping flows.

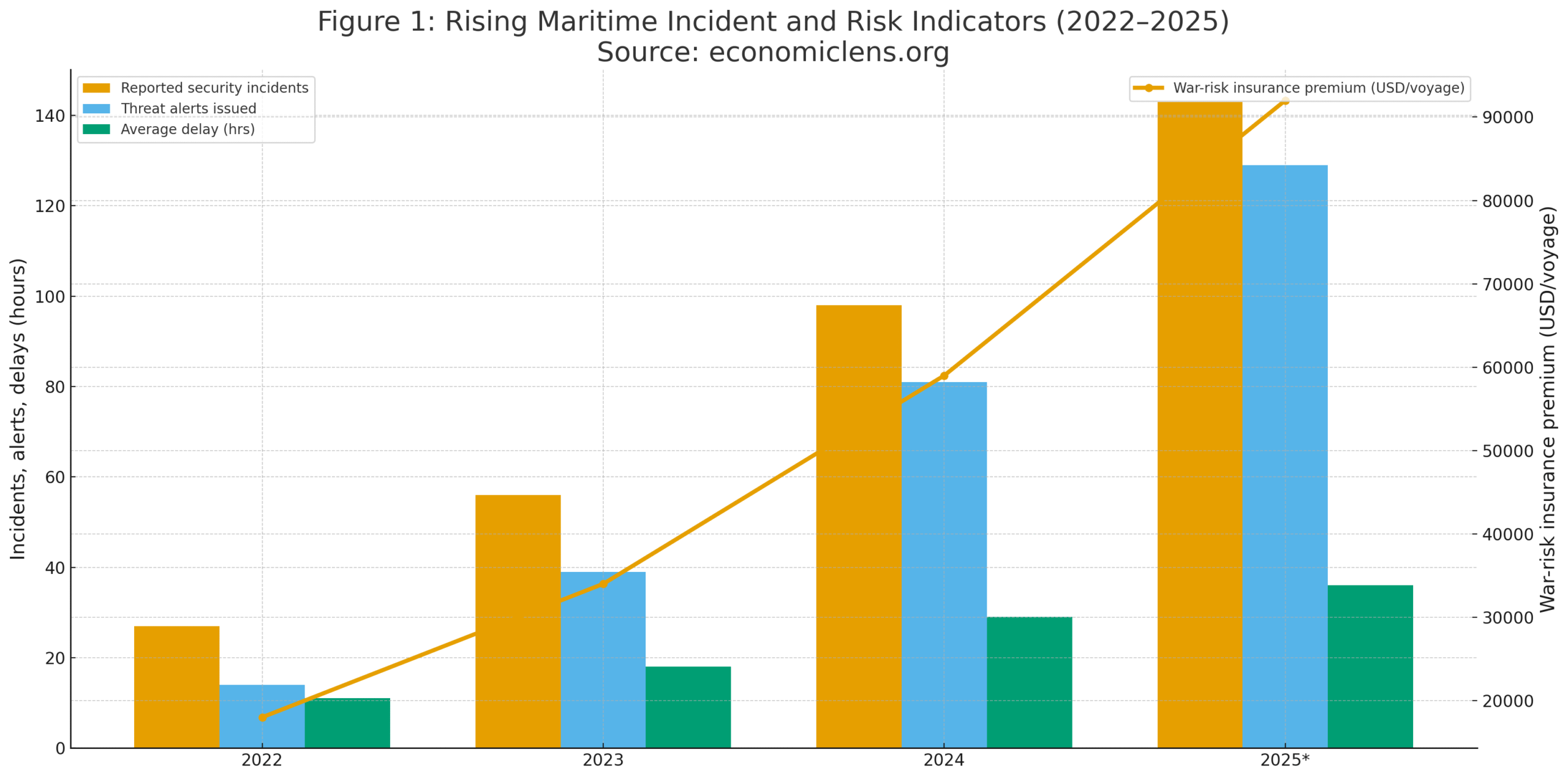

Latest Report Analysis on Incident Growth

Energy historian and strategist Daniel Yergin has argued that insecurity in chokepoints like the Red Sea has outsized effects because it simultaneously influences energy shipments, container flows and investor sentiment around global trade reliability. For him, what happens in these narrow waters never stays local; it travels through oil prices, shipping costs and inflation readings across multiple regions. UNCTAD’s recent maritime update notes that reported security incidents in the Red Sea and neighbouring waters have increased sharply since 2023, leading to what it describes as a “structural re-rating of risk” for that corridor. Shipping advisories from UKMTO and other maritime security bodies record persistent threat levels, prompting many companies to incorporate longer, safer alternative routes into their operating plans.

The data highlights how quickly a localized conflict translated into systemic risk. Rising incidents and threat alerts pushed insurers to raise premiums and forced carriers to build security delays into voyage planning.

“When maritime risks escalate in one narrow corridor, the shockwaves spread across the entire map of global trade.”

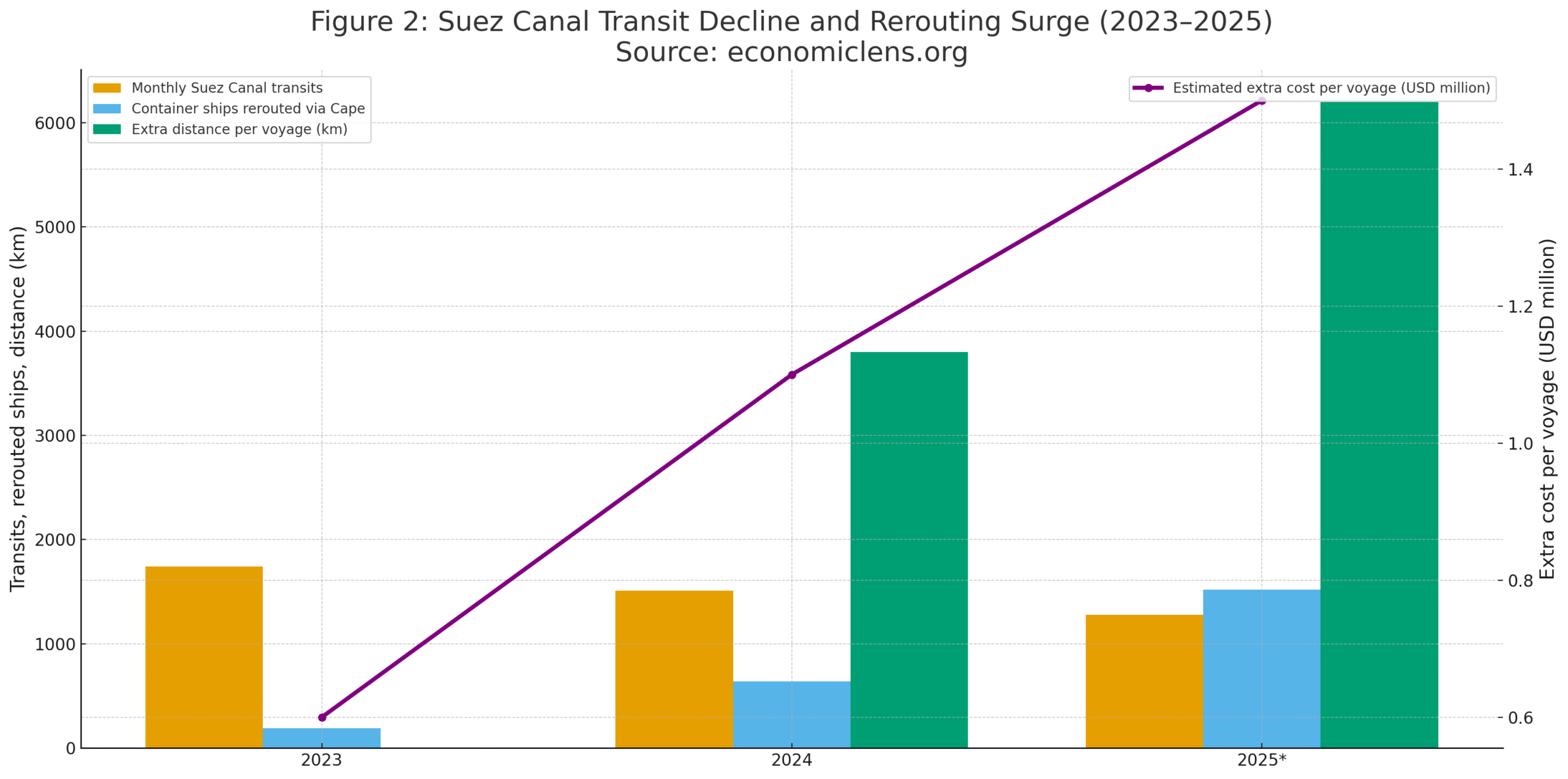

2. Suez Canal Shipping Slowdown: Rerouting, Transit Declines and Cost Pressure

As the Red Sea maritime crisis intensified, traffic through the Suez Canal fell sharply. Consequently, carriers that depended on this route began rerouting ships around the Cape of Good Hope. This decision added distance but reduced perceived security risks. For Egypt, fewer Suez transits reduced canal revenue and increased fiscal pressure. Moreover, shippers and consumers faced higher transport costs and more volatile delivery times. As a result, uncertainty around future freight pricing increased for firms that rely on predictable supply chains.

Maersk and MSC’s Historic Cape Shift

In late 2024, Maersk and MSC suspended most transits through the Red Sea and Suez Canal. They instead routed many services around the Cape of Good Hope. This shift followed several high-profile security incidents near Bab al-Mandeb. Moreover, insurers and customers were unwilling to accept rising maritime risks. As a result, the diversion added six to twelve days to many Asia–Europe voyages. It also increased port calls and refuelling demand in southern Africa. Consequently, the sector viewed this shift as proof that Red Sea disruptions had reached a more severe phase.

Expert View on Cost Burden

Shipping analysts at Xeneta and other freight intelligence firms described the Suez avoidance as an expensive collective rerouting decision. Moreover, they noted that this shift affected cost structures, network design and schedule reliability for major carriers. Recent Suez Canal Authority data showed a clear decline in monthly vessel transits after large-scale rerouting. International financial institutions also warned that sustained canal revenue losses could increase pressure on Egypt’s already stretched public finances. As a result, freight costs continued rising on routes that most relied on Suez access. Consequently, the sector viewed this trend as evidence that global shipping networks were adjusting to a new risk environment.

The surge in Cape rerouting reflects a fundamental shift in shipping risk perception. What was once an exceptional detour has become a standard operating choice, with major implications for cost and timing.

“When the Suez corridor narrows under risk, the rest of the world pays in longer voyages and higher prices.”

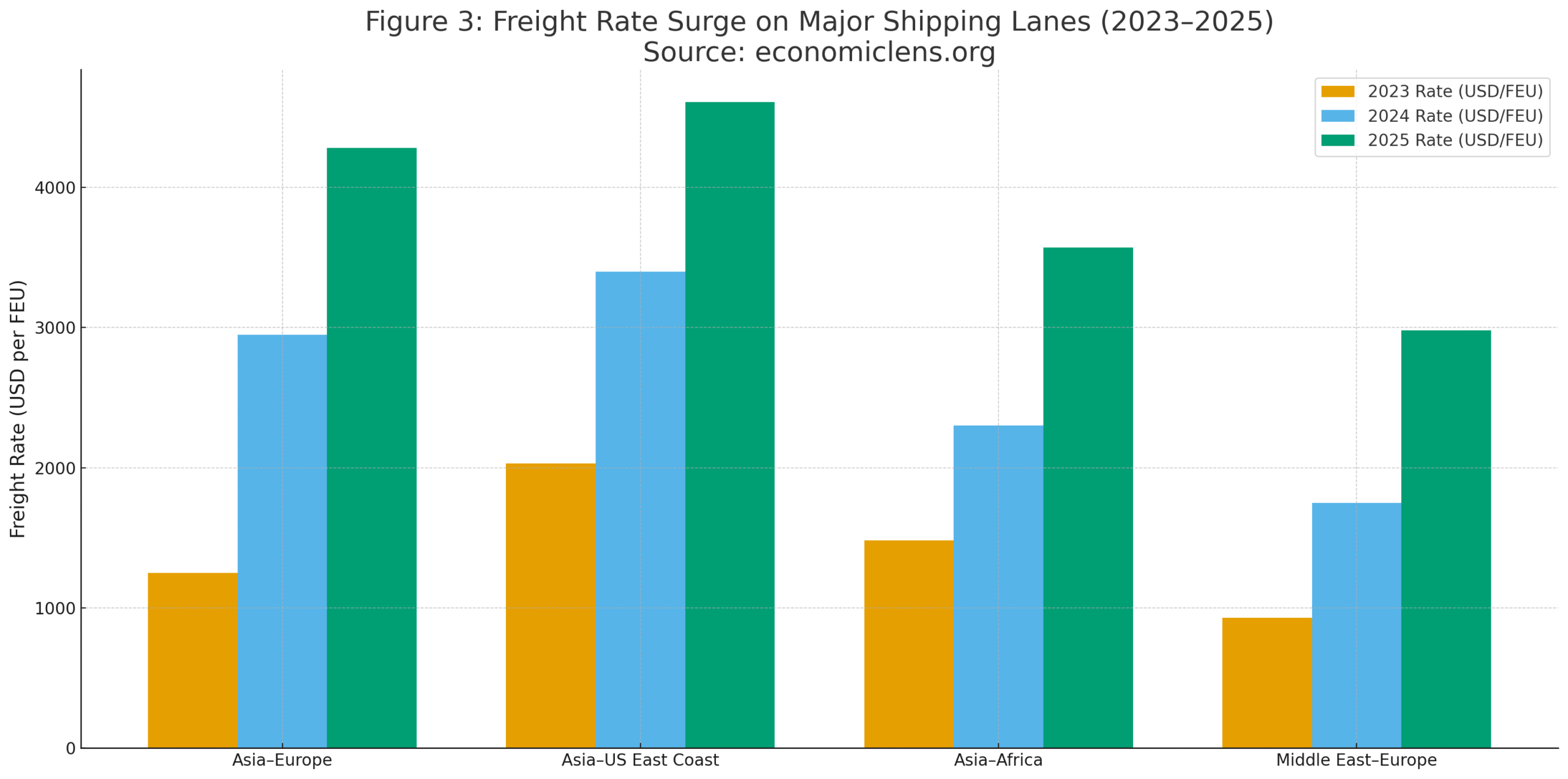

3. Global Shipping Shock: Freight Surges and Delivery Delays

The rerouting of vessels and the slowdown in Suez traffic created a global shipping shock. Consequently, freight rates surged, containers became scarce and delivery delays increased. Longer routes required more fuel and more crew time, which raised operating costs. Moreover, disrupted container circulation caused equipment shortages in key ports. Some ports faced congestion as rerouted vessels arrived at similar times. As a result, logistics planning became harder for retailers, manufacturers and commodity traders. This new strain increased volatility across major supply chains.

Container Shortages and Port Congestion

By mid-2024, European and North American importers began reporting widespread container shortages and extended transit times on Asia–Europe and Asia–US East Coast lanes. Because ships were sailing longer distances around Africa, the turnaround time for containers increased, reducing the number of round trips per year that a typical vessel could perform. Empty containers became scarcer in major Asian export hubs, forcing some shippers to delay cargo or pay premium surcharges to secure equipment. At the same time, ports in southern Africa and parts of the Mediterranean experienced congestion as rerouted vessels bunched up around limited berthing windows and refuelling capacity. These imbalances contributed to higher logistics costs and amplified volatility in delivery schedules.

Expert Commentary on Freight Surges

Analysts at Drewry and Freightos stressed that longer voyages and disrupted repositioning pushed several lanes toward a higher-cost equilibrium. Moreover, they cautioned that some pricing and schedule effects may persist even if security improves. Recent S&P Global and UNCTAD updates showed that Asia–Europe freight rates more than doubled. They also reported a sharp decline in schedule reliability, even months after the first rerouting wave.

Freight rate increases are most pronounced on lanes that rely on the Red Sea and Suez Canal. Higher shipping costs are already feeding into producer prices and, eventually, consumer prices across many markets.

“When ships travel farther for the same cargo, every extra mile shows up in the final price tag.”

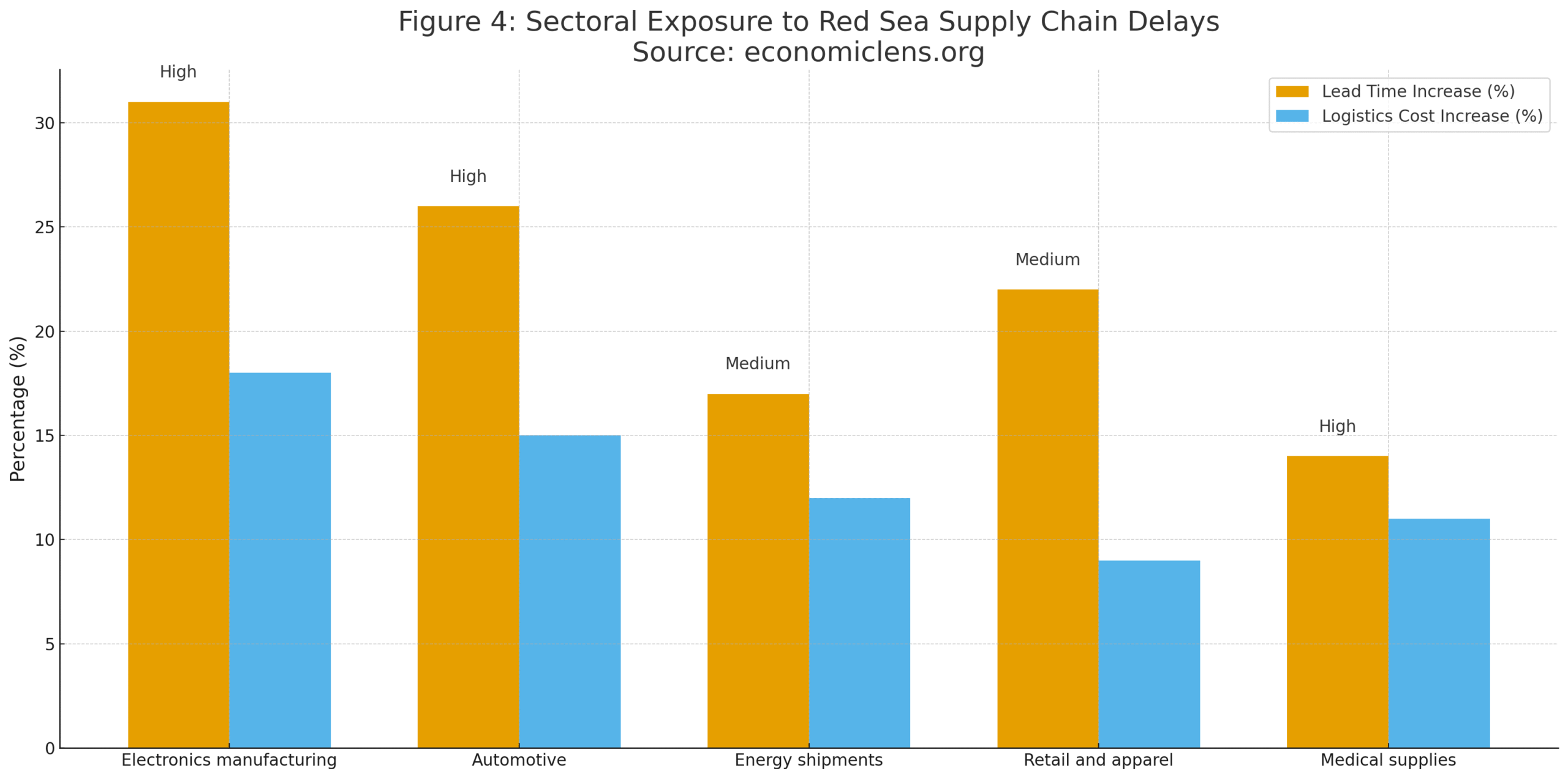

4. Red Sea Maritime Crisis: Sectoral Impact Across Key Industries

The Red Sea shipping crisis created uneven but significant impacts across sectors. Manufacturing firms faced delays in intermediate goods that support electronics and automotive production. Energy markets saw longer voyage times for crude and refined products, which complicated inventory planning. Moreover, retailers encountered late deliveries of seasonal goods, while medical shipments faced delays with serious social consequences. As a result, many companies reevaluated sourcing strategies and reconsidered just-in-time logistics models.

Electronics and Automotive Manufacturers Face Critical Delays

In 2024, major electronics assemblers and car manufacturers in Europe and Asia began flagging the Red Sea shipping disruptions as a material risk to production. Firms in Germany, Italy, South Korea and Japan reported shipment delays for components sourced from East and Southeast Asia that traditionally travelled via Suez. With voyages extended and freight capacity stretched, delivery windows for semiconductors, wiring harnesses, batteries and high-value modules became less predictable. Some automakers were forced to slow or temporarily halt specific production lines because key parts arrived late. Electronics producers similarly reported longer lead times and higher logistics costs, particularly for consumer devices that rely on tightly integrated global supply chains.

Expert Insight on Lean Supply Chains

Supply chain specialists such as Knut Alicke observe that the crisis exposes the vulnerability of lean, globally dispersed production networks. They argue that sectors most committed to just-in-time inventory strategies are now under the greatest pressure to build resilience through diversification and strategic stockpiles. Recent IMF and OECD updates on global value chains highlight that shipping disruptions in the Red Sea have contributed to increased supplier delivery times in Europe’s manufacturing surveys, particularly in autos and electronics. While not the sole driver of delays, the crisis acts as a clear amplifying factor.

Sectors with complex, cross-border supply chains and high value components are most exposed to Red Sea shipping disruptions. Electronics, autos and medical goods sit at the top of the vulnerability ladder.

“When one corridor fails, it is the most interconnected sectors that feel the strain first.”

5. Red Sea Shipping Disruptions: Inflation Pass-Through and Trade Stress

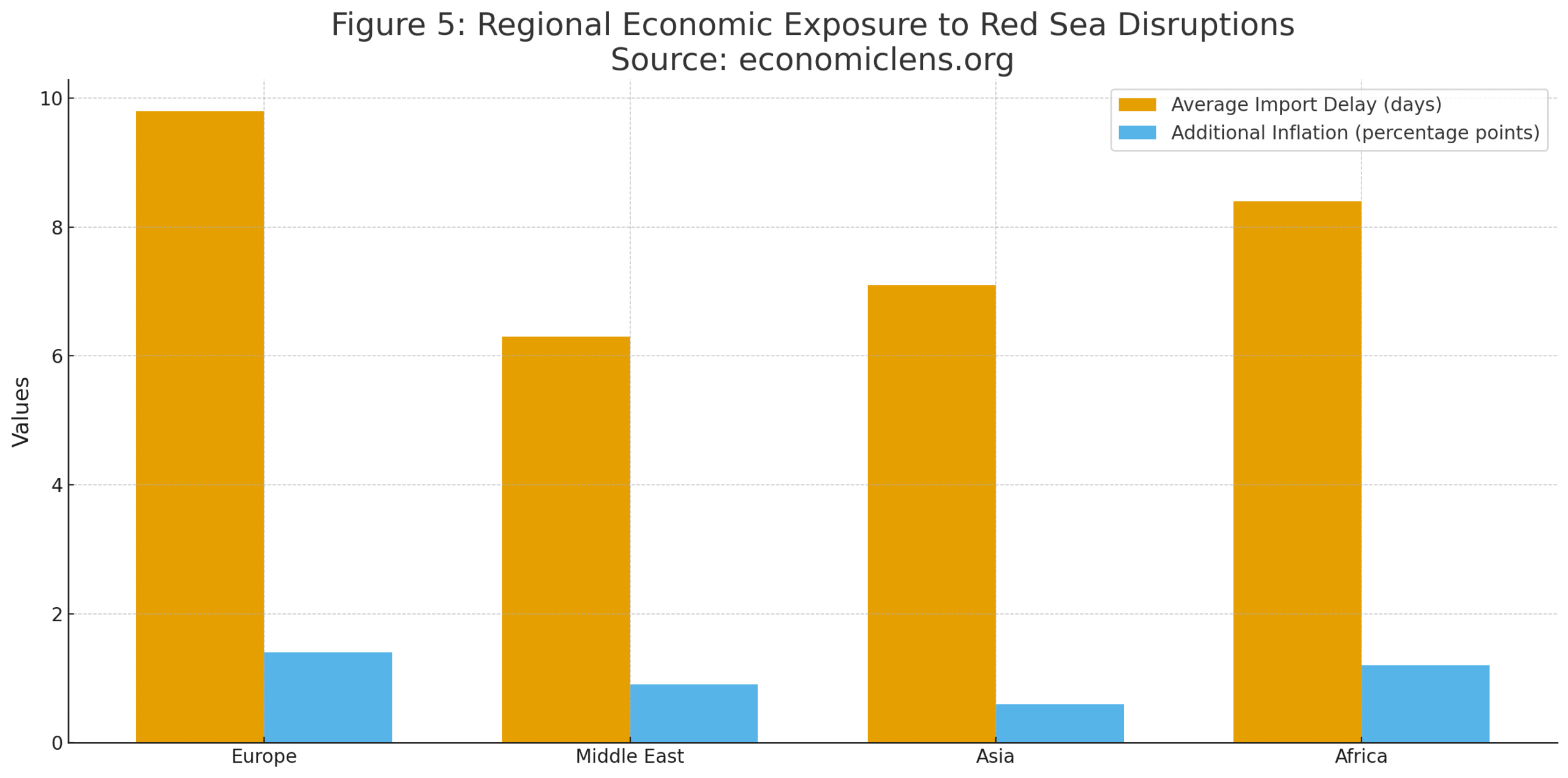

Rising shipping costs and delays appeared clearly in inflation data and trade metrics. Import-dependent regions faced higher landed prices for manufactured goods and some food items. Moreover, exporters struggled with reliability and order fulfilment due to unpredictable delivery windows. Europe, Africa and the Middle East remained highly exposed because they relied heavily on Suez-linked supply chains. As a result, trade volumes softened across several Asia–Europe corridors.

EU Inflation Rises as Shipping Routes Break Down

By early 2025, European policymakers directly linked part of inflation pressures to higher shipping costs. Import price indices showed clear increases tied to freight surcharges and longer delivery times. Business surveys in Germany, France and Italy highlighted extended supplier delays. Moreover, Eurostat data recorded moderate declines in trade volumes as firms rerouted or postponed orders. Although not the sole driver of inflation, the crisis served as a clear transmission channel between maritime risk and consumer prices.

These transmission effects echo patterns documented in our analysis of the climate-induced food inflation crisis (https://economiclens.org/climate-induced-food-inflation-global-food-supply-shocks-shipping-delays-and-inflation-risk/), where global shipping delays and freight-cost spikes directly lifted import prices. A similar mechanism appears in the global food supply crunch study (https://economiclens.org/global-food-supply-crunch-weather-shocks-export-bans-shipping-delays-and-food-inflation/), which shows how maritime and trade disruptions tighten supply availability and intensify inflationary waves across multiple regions.

Expert Commentary and Latest Global Trade Reporting

World Bank and IMF economists have warned that supply chain disruptions of this kind can be particularly damaging for low-income and emerging economies that rely heavily on imported food, fuel and intermediate goods. They note that even modest increases in shipping costs can compound existing inflation and external financing pressures. Recent World Bank trade updates and OECD economic outlooks highlight the Red Sea maritime disruptions as a key downside risk to global trade recovery. They estimate that if current conditions persist, global trade volumes could remain weaker than previously forecast, especially for Europe and parts of Africa.

Europe and Africa face a combination of higher import delays and inflation pressures. The Middle East and Asia are less affected in aggregate but still experience measurable trade and price effects.

“When freight costs rise and ships arrive late, inflation does not stay offshore; it docks in every import-dependent economy.”

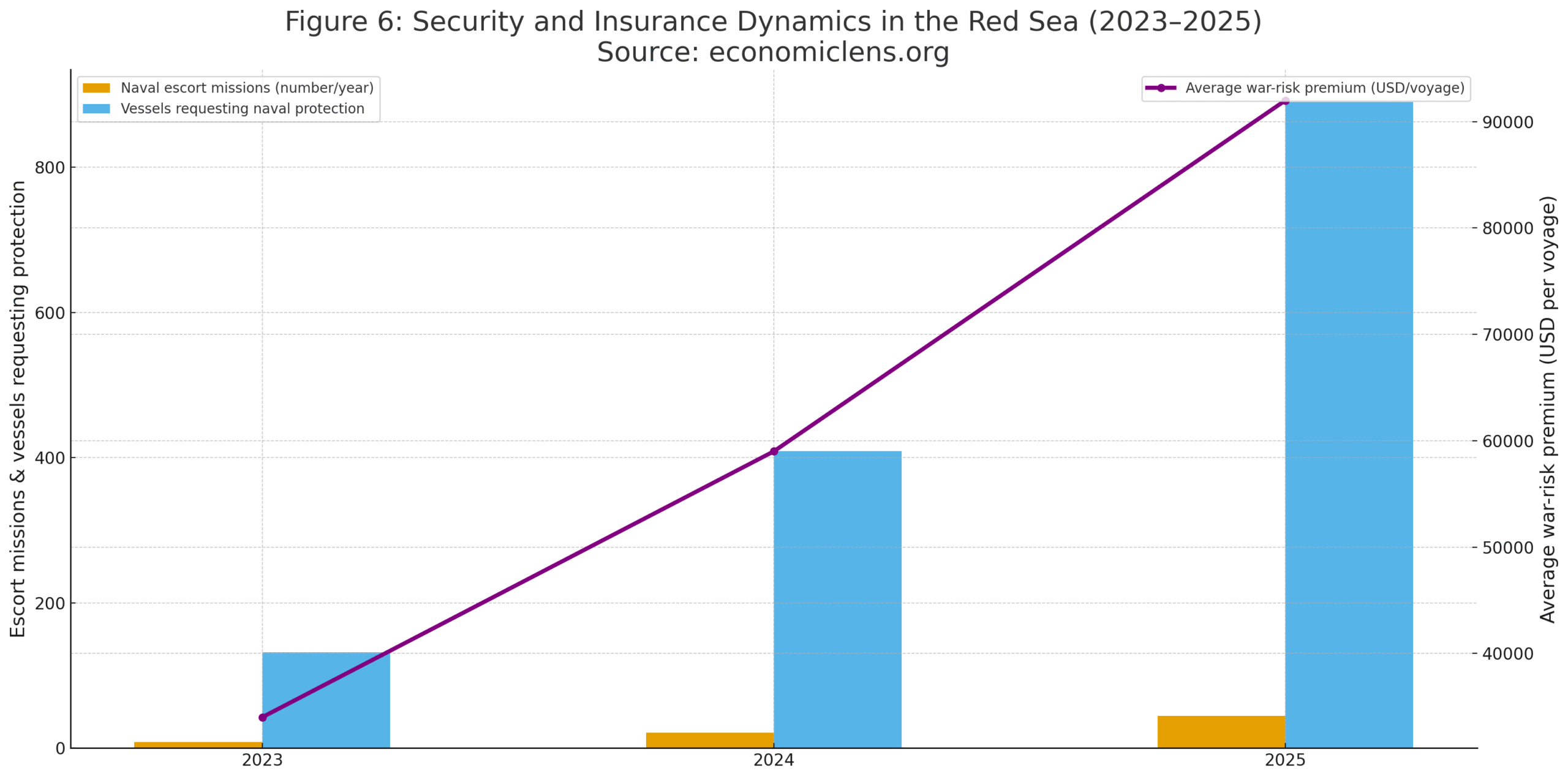

6. Security Dynamics Amid the Red Sea Shipping Crisis

Security dynamics in the Red Sea have become increasingly complex as regional actors, external powers and non-state groups contest influence over critical waterways. In response to the heightened risk environment, naval coalitions have expanded patrols and escort missions aimed at protecting commercial vessels. However, the persistence of attacks and threats means that war-risk premiums remain elevated and that carriers cannot fully rely on military protection alone. The Red Sea maritime crisis has therefore become a test case for how effectively global security cooperation can safeguard economic lifelines in contested regions.

US–UK Naval Strikes and Escorted Transits

In late 2024 and early 2025, US and UK forces conducted strikes against Houthi assets after repeated attacks. The operations sought to reduce the militants’ ability to target commercial traffic. Moreover, multinational naval missions expanded escort capacity along the corridor. These actions lowered some immediate risks but did not fully restore confidence. Maritime advisories still classified much of the corridor as high-risk, so many carriers maintained their detours.

Expert Commentary and Latest Security and Insurance Data

Retired naval officers and maritime security analysts note that while naval patrols can lower the probability of successful attacks, they cannot fully eliminate the threat as long as underlying conflicts remain unresolved. Consequently, risk premiums and cautious routing decisions are likely to persist even with robust military engagement. Insurance industry updates and Lloyd’s List Intelligence data show that war-risk premiums for Red Sea passages have more than tripled compared with pre-crisis norms. Meanwhile, security bulletins from the US Fifth Fleet and other naval commands continue to advise heightened vigilance for vessels transiting the region.

Security measures have expanded, but rising premiums and growing demand for naval escorts show that the perception of risk remains acute. The market still prices the Red Sea as a high-risk corridor.

“Even when warships patrol the horizon, economic stability depends on how safe traders believe the sea truly is.”

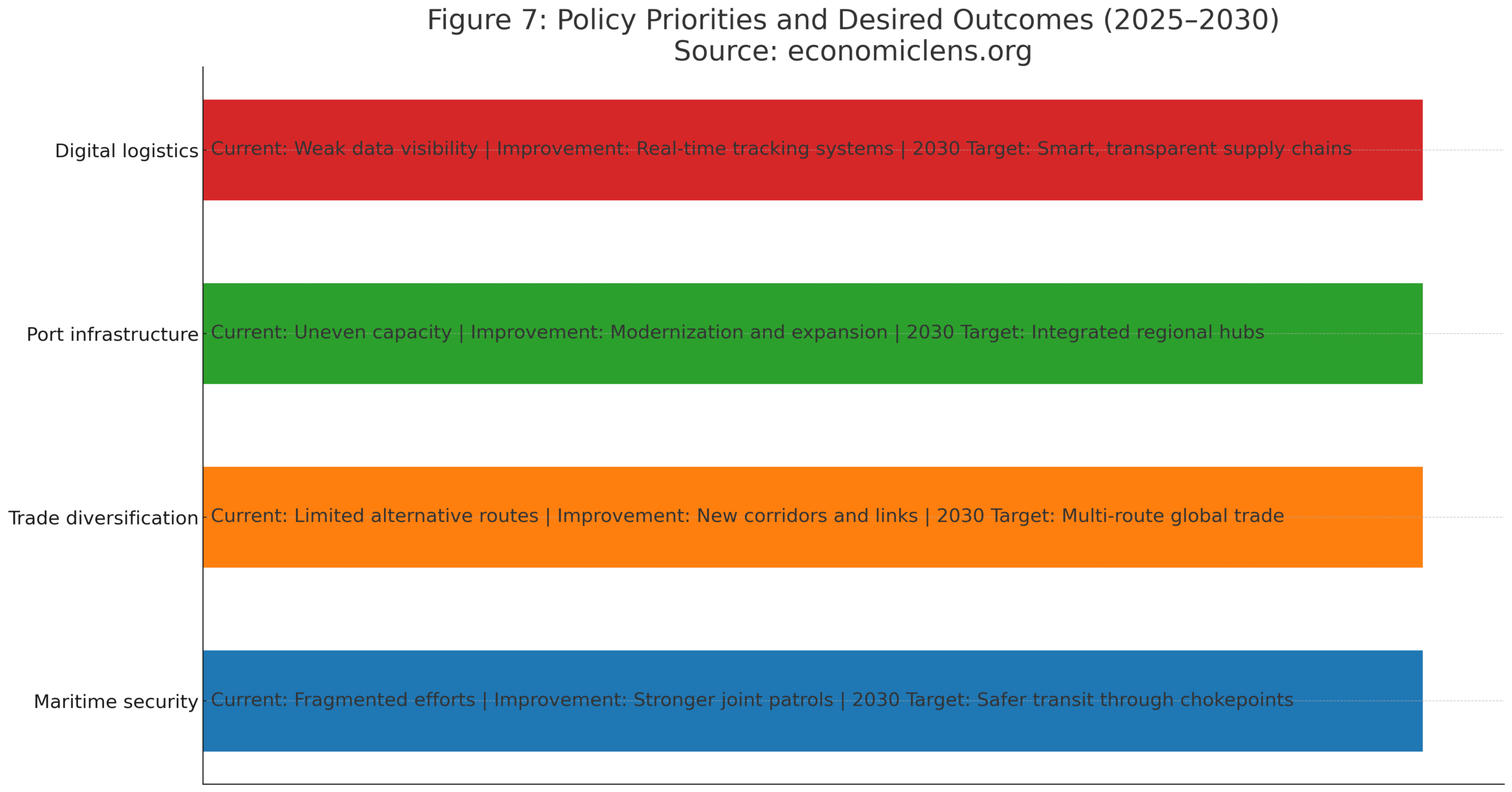

7. Policy Pathways: Global Coordination, Trade Diversification and Supply Chain Resilience

Governments and global institutions searched for policies to manage disruptions and strengthen long-term resilience. Debates focused on security cooperation, trade diversification and investment in modern port infrastructure. Moreover, planners highlighted the need for stronger digital visibility across supply chains. One major proposal involved the India–Middle East–Europe Corridor, which aimed to provide a partial alternative to Suez routes. Feasibility studies showed that it could shorten transit times and diversify routing options. However, progress would take years. Trade experts stressed that diversification should create layered networks, not replace existing ones. OECD and World Bank analyses emphasized the need for smarter ports and flexible logistics systems to absorb future shocks.

The India–Middle East–Europe Corridor Gains Momentum

One of the most discussed strategic responses has been the proposal for an India–Middle East–Europe Economic Corridor linking Indian ports to Gulf hubs and onward to European markets through a combination of rail, port and digital infrastructure. Announced with high-level political support, the corridor is intended to provide a partial alternative to traditional Red Sea and Suez routes for some categories of trade. Feasibility studies suggest that, once operational, it could reduce transit times for certain goods and diversify routing options for supply chain planners. While the project will take years to develop, its emergence underscores how the current crisis is accelerating interest in alternative corridors that reduce dependence on vulnerable maritime chokepoints.

Expert Commentary and Latest Policy and Logistics Reports

Trade experts argue that diversification efforts should not be seen as replacing existing routes, but rather as creating layered networks that can absorb shocks. They stress that resilience comes from having multiple paths available, not from abandoning traditional ones altogether. OECD and World Bank analyses of trade resilience emphasize the importance of investing in infrastructure, smart ports and digital logistics systems. They recommend that countries exposed to Red Sea shipping disruptions develop contingency planning frameworks and encourage private sector participation in building more flexible supply chains.

Effective policy responses require simultaneous progress on security, diversification, infrastructure and digital tools. Focusing on only one dimension will leave the system exposed to future shocks.

“Resilient trade is not built on a single strong corridor, but on many reliable options.”

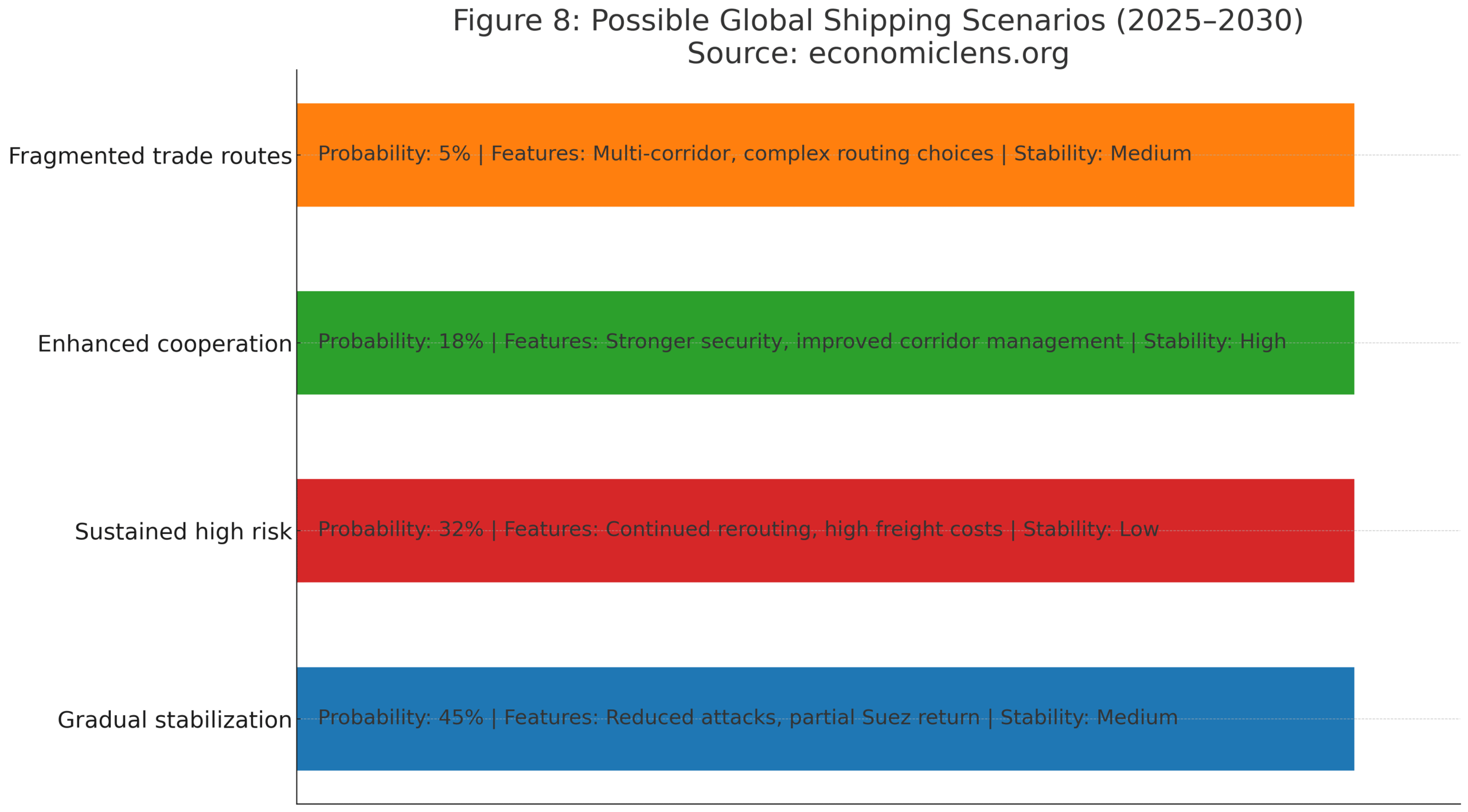

8. Future Outlook: Global Routes, Trade Corridors and Post-Crisis Scenarios

The future impact of the crisis will depend on security conditions, diplomacy and market incentives. Shipping firms are already adjusting to a world where the Red Sea may not remain a default route. Moreover, new infrastructure projects and alternative corridors are gaining strategic importance. Maritime economists noted that shipping networks often remain locked into new patterns once they shift. Recent scenario studies suggested futures where risk either eases, remains high or reshapes logistics permanently. As a result, planners emphasized preparation for uncertainty rather than assuming a return to old structures.

Expert Commentary and Latest Scenario Assessments

Maritime economists note that once shipping networks adjust to new patterns, they do not always revert fully to previous structures even when conditions improve. Path dependence and sunk investments in alternative routes can lock in more diversified configurations. Scenario analysis from think tanks and international agencies outlines plausible futures in which Red Sea risk either eases, remains elevated or triggers more permanent shifts in global logistics. These studies stress the importance of planning for uncertainty rather than assuming a quick return to pre-crisis norms.

The baseline expectation is gradual stabilization, but not a full return to the old status quo. Elevated risk and diversified routes are likely to remain part of the global shipping landscape.

For global shipping insights, the World Bank’s Global Trade Update and UNCTAD’s Maritime Transport Review provide timely assessments of trade disruptions and freight volatility (https://www.worldbank.org/en/research and https://unctad.org/publications). These sources help contextualize how the Red Sea shipping crisis is reshaping global maritime flows.

“Future trade stability will depend on how well governments and markets learn from this crisis, not on whether it simply fades from the headlines.”

Conclusion

The Red Sea shipping crisis has exposed how concentrated and vulnerable some of the world’s most important trade corridors have become. Rising security incidents, rerouting around the Cape of Good Hope, surging freight rates, container imbalances, sector-specific supply chain disruptions and measurable inflation pressures all point to the same conclusion: maritime chokepoints are global economic risk multipliers. At the same time, the crisis has pushed policymakers, businesses and international institutions to think more seriously about resilience, diversification and coordinated maritime security. Whether the coming years bring stabilization or prolonged uncertainty, the lessons from this episode will shape how the world approaches global trade, infrastructure investment and supply chain design.

Call to Action

Countries, shipping firms and supply chain leaders must act together to secure maritime corridors, invest in alternative routes, modernize ports and deploy real-time logistics technologies. Building resilience today is the only way to protect global trade from tomorrow’s disruptions.

1 thought on “Red Sea Shipping Crisis: Global Trade Fallout, Inflation Pressure and Supply Chain Turmoil”

Very good 👍😊