Red Sea shipping disruptions caused by regional conflict and maritime insecurity are intensifying Suez Canal disruptions, creating a global shipping shock that is reshaping supply routes, freight markets, and international trade. This analysis examines the data behind rerouting, costs, delays, and supply chain disruptions affecting global commerce.

Introduction

The surge in Red Sea shipping disruptions has become one of the most severe challenges facing global trade in recent years. As maritime insecurity and regional instability continue to escalate, Suez Canal disruptions have intensified, forcing shipping companies to reroute vessels through longer and costlier passages. Consequently, global supply routes are being reshaped, producing a mounting global shipping shock that affects freight markets, container schedules, and energy shipments. Moreover, these disruptions are creating ripple effects throughout the world economy: rising transport costs, delayed manufacturing cycles, longer delivery windows, and increased vulnerability to supply chain disruptions. Because nearly 12% of global trade and 30% of global container traffic pass through the Red Sea–Suez corridor, even a small interruption carries massive global consequences.

This blog offers a comprehensive, data-driven evaluation of the crisis, blending expert commentary, quantitative tables, geopolitical context, and actionable policy pathways.

1. Red Sea Shipping Disruptions: Maritime Insecurity & Global Exposure

The escalation of attacks on commercial vessels in the Red Sea has disrupted one of the world’s busiest maritime corridors. This region links Asia, the Middle East and Europe, so any instability creates immediate stress across global shipping networks. The risks to vessels are serious, and uncertainty also acts as a cost multiplier. Insurance premiums rise as carriers reassess risk. Shipping firms reroute vessels to longer paths. Ports experience congestion because schedules become difficult to manage. These pressures combine to create delays, higher freight rates and growing volatility in global supply chains.

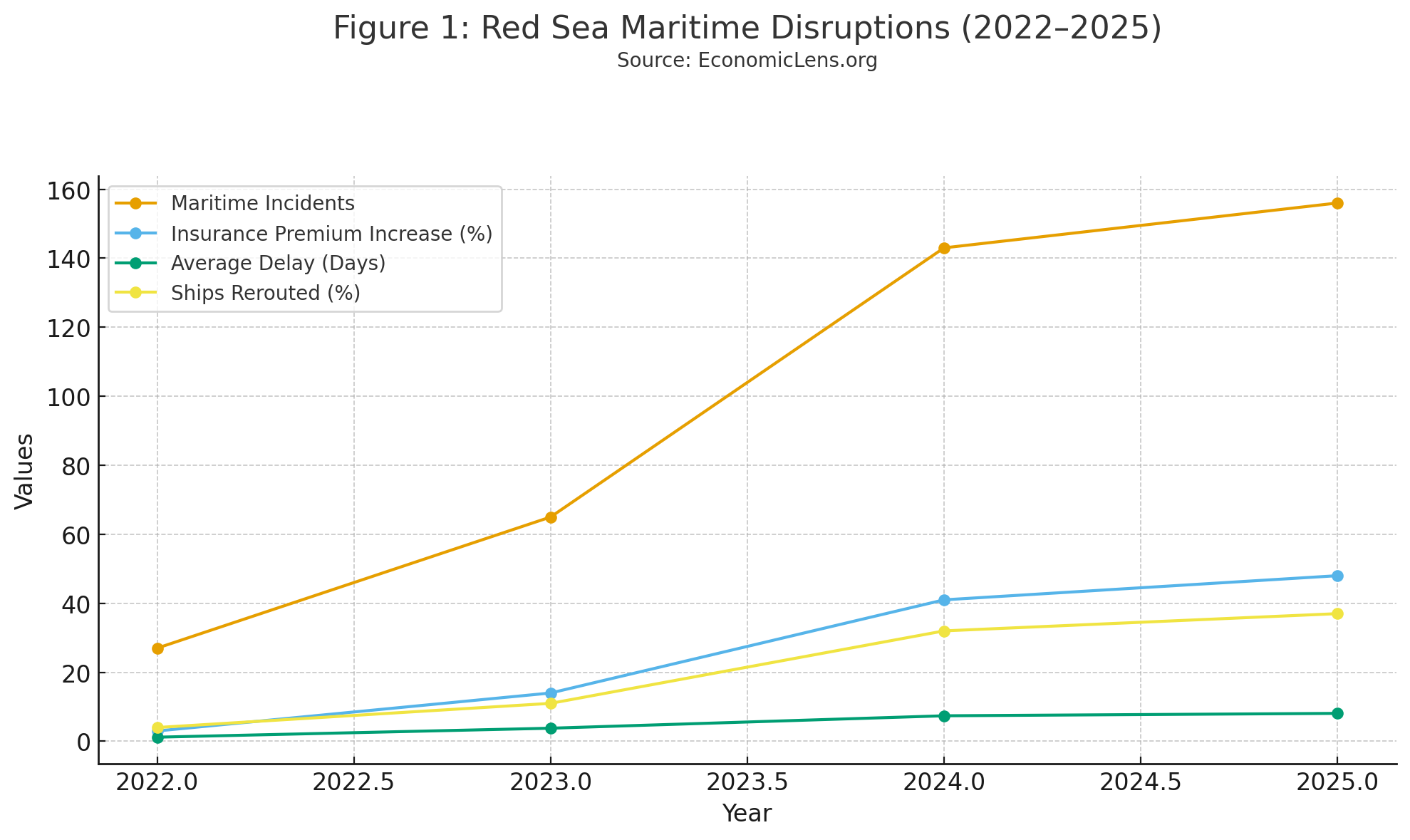

Daniel Yergin, global energy expert, states: “Disruptions in the Red Sea do not stay in the Red Sea, they travel across the world economy.” According to Lloyd’s List Intelligence, maritime incidents in the Red Sea increased from 27 in 2022 to 143 in 2024. This figure reflects a 430 percent surge in insecurity reports.

To explore a detailed breakdown of these disruptions, see our in-depth analysis on the Red Sea shipping crisis:

https://economiclens.org/red-sea-shipping-crisis-global-trade-fallout-inflation-pressure-and-supply-chain-turmoil/

The data shows a steep upward trajectory of maritime insecurity. Delays nearly tripled, and rerouting rose almost tenfold between 2022 and 2025.

“When the sea turns risky, the world’s supply lines tremble.”

2. Suez Canal Disruptions: Rerouting, Delays & Cost Inflation

As Red Sea dangers intensify, ships are increasingly avoiding the Suez Canal. Many vessels now choose longer routes around the Cape of Good Hope. This shift adds several thousand miles to major Asia Europe and Asia United States shipping lanes. As a result, companies face higher fuel use and longer crew hours. Vessel wear and tear also increases due to extended sailing. Shipping operators report higher labor expenses and additional carbon output because every voyage takes more time. These factors create a strong upward push on freight rates across global markets.

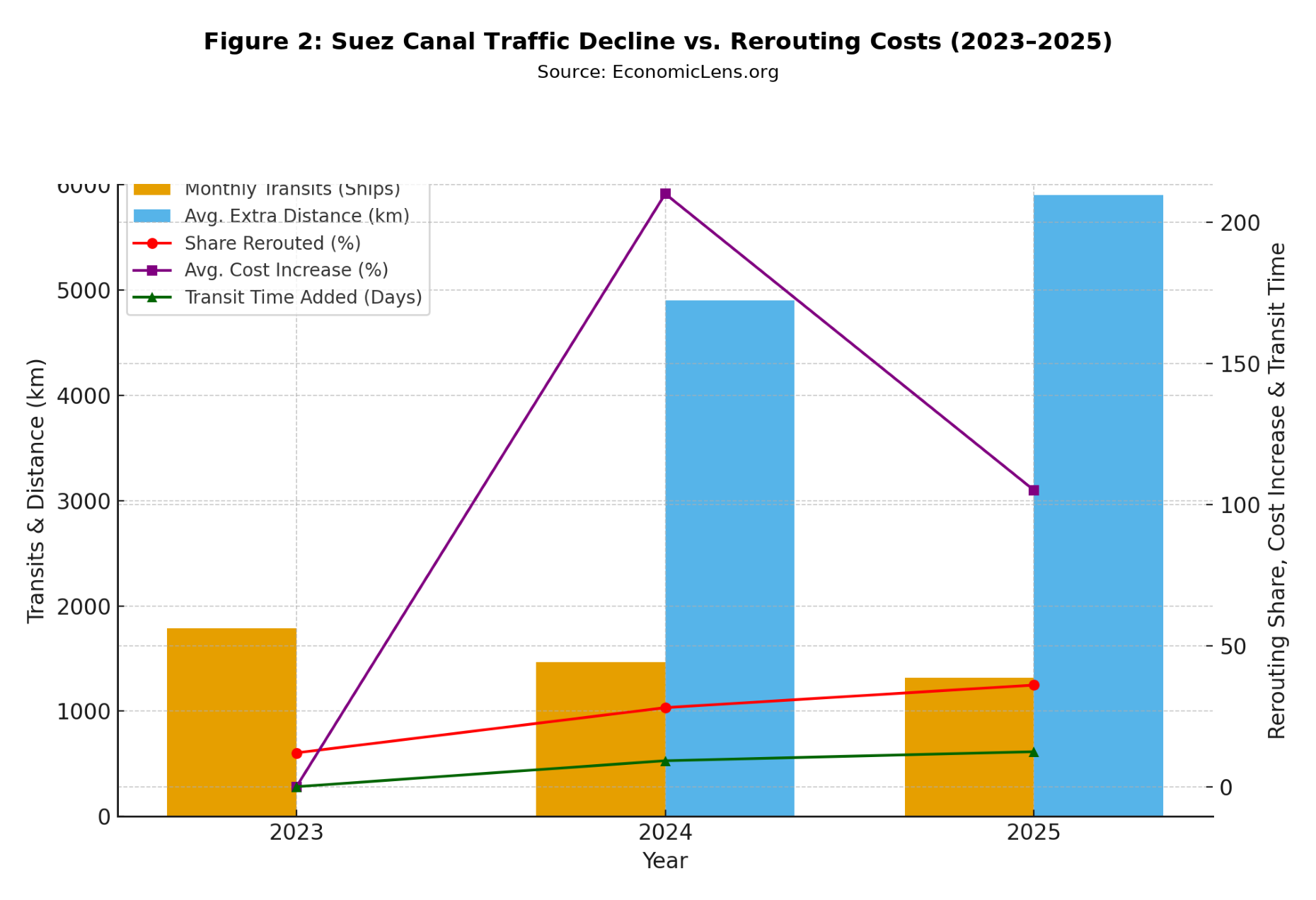

The shift away from the Suez Canal has created severe disruptions for Egypt. Canal traffic has fallen, and transit revenues have dropped as shipping firms delay or cancel planned passages. Ports along the Mediterranean and Red Sea now face schedule uncertainty. This affects container availability, storage management and cargo turnover. The cumulative effect is a broad slowdown in regional trade efficiency. These pressures are reinforcing the economic ripple effects already visible across global supply chains.

S&P Global Shipping analyst Peter Sand notes: “Rerouting from the Suez Canal is the most expensive supply chain detour in decades” (source: https://www.spglobal.com/). The Suez Canal Authority reported a decline of nearly 26 percent in monthly vessel transits in early 2025 (official report: https://www.suezcanal.gov.eg/).

Rerouting has become financially unsustainable for many carriers, with additional expenses reaching $1.5 million per trip in 2025.

“When the Suez slows, global trade pays the price.”

3. Global Shipping Shock: Freight Spikes, Container Crunch & Supply Slowdowns

Disruptions to the Red Sea Suez route have triggered a widespread global shipping shock. This shock is reshaping trade flows across Asia, Europe and North America. Freight rates have surged as vessels avoid the Suez Canal. Many ships now shift to longer and more expensive routes around the Cape of Good Hope. Charter costs for bulk carriers and container ships have increased as vessel availability tightens. Insurance premiums have also climbed due to higher security risks. Container shortages are intensifying across major ports, especially in Asia. Exporters face growing delays when securing equipment for scheduled shipments. Since 90 percent of global goods move by sea, even small increases in cost or time can amplify inflation and weaken supply chain confidence.

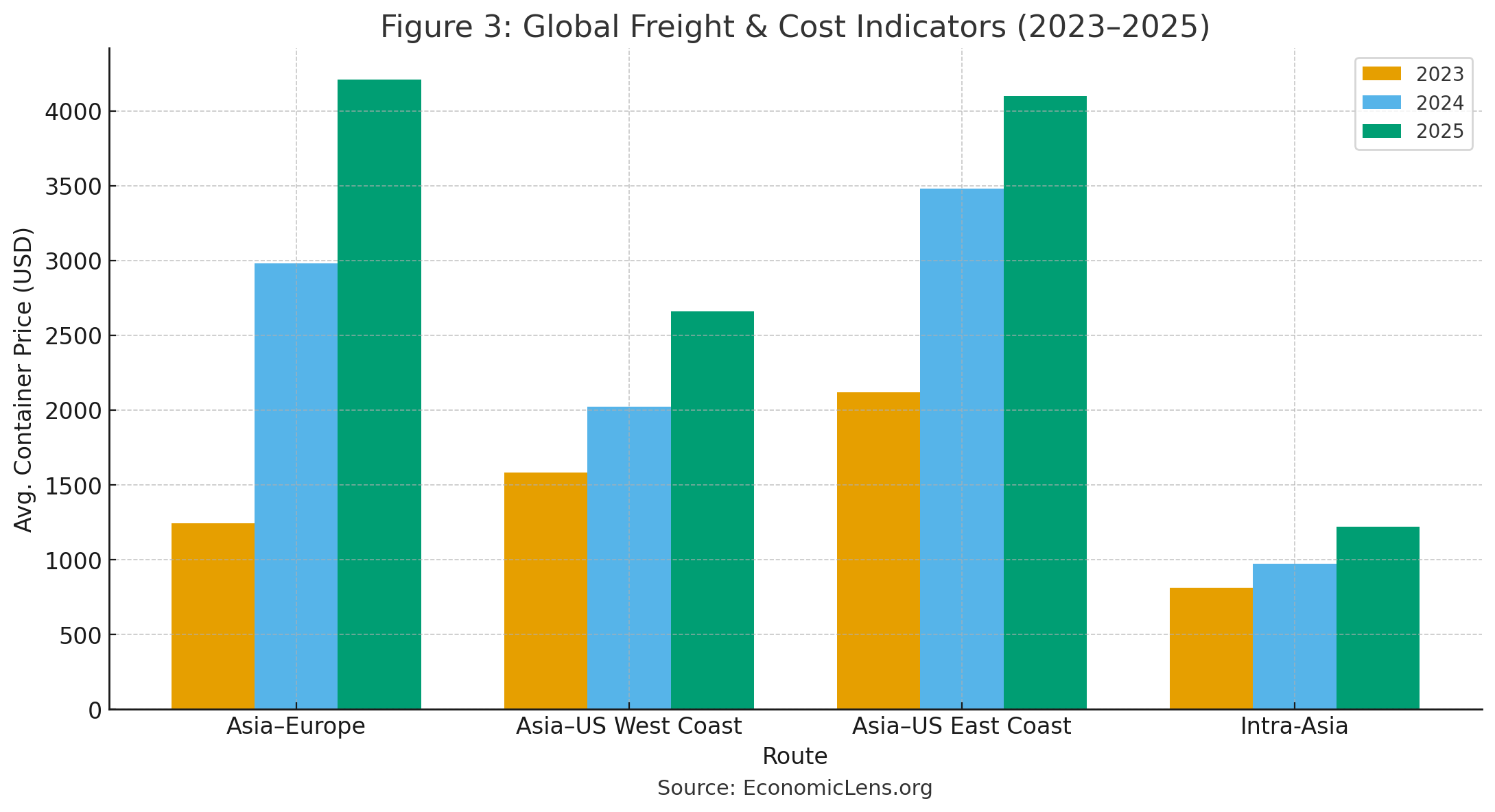

UNCTAD maritime economist Jan Hoffmann explains: “A shock in shipping markets is never isolated, it cascades across every industry” (source: https://unctad.org/). Freightos and Drewry indices show sharp price spikes on Asia Europe routes. Container prices increased by more than 240 percent between 2023 and 2025 (Freightos index: https://fbx.freightos.com/ Drewry index: https://www.drewry.co.uk/).

The freight surge reveals a clear geographic pattern: routes dependent on the Suez Canal have experienced the sharpest increases, confirming the structural impact of Red Sea shipping disruptions.

“When ships slow down, global inflation speeds up.”

4. Supply Chain Disruptions: Manufacturing, Energy & Critical Goods

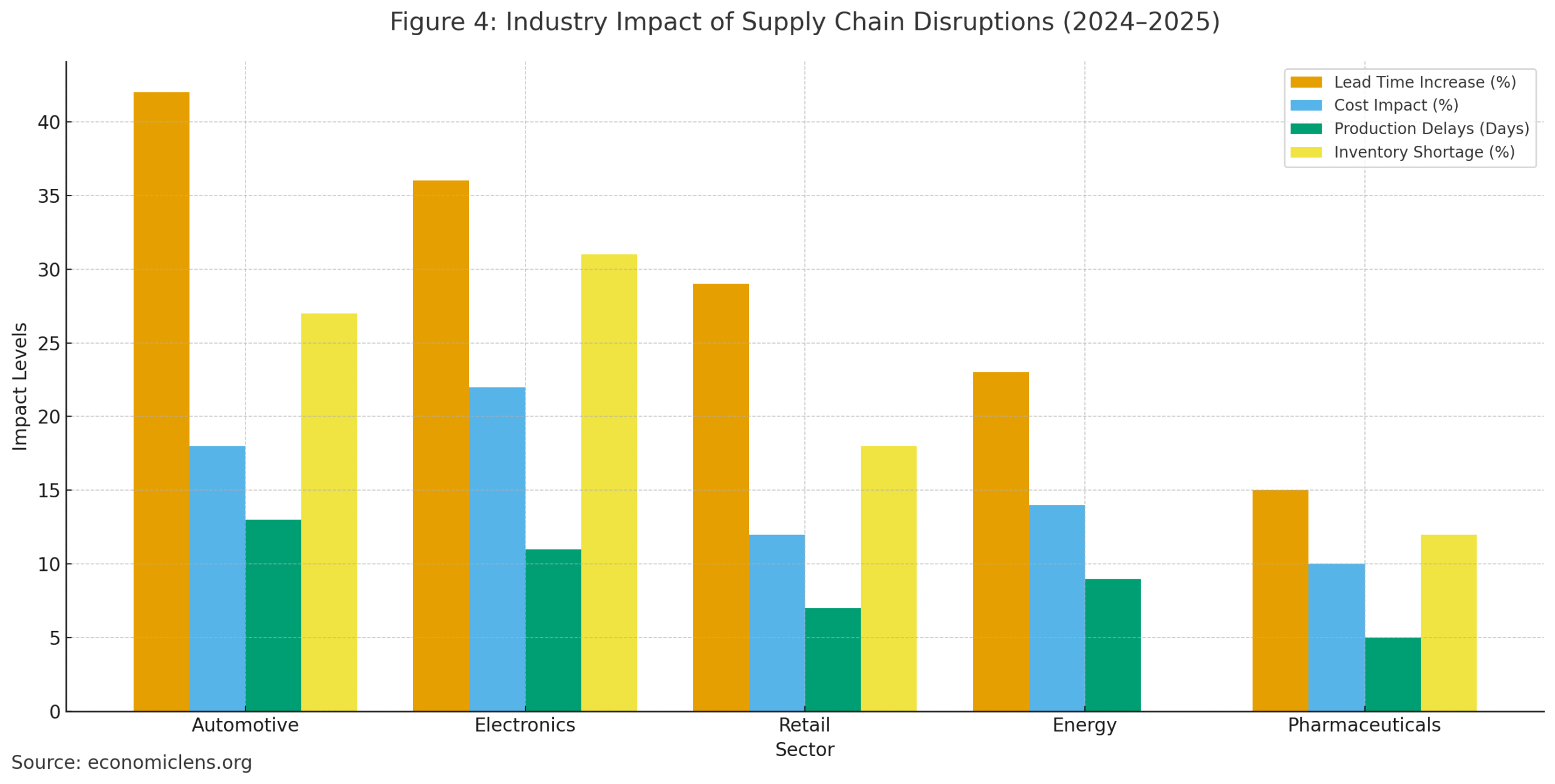

The intensification of supply chain disruptions has affected multiple industries across several continents. Manufacturing sectors that rely on just in time logistics now face persistent component shortages. These shortages force factories to slow production or adjust output cycles. Energy markets are also seeing longer delivery times for crude and refined products. This creates uncertainty for refineries and electricity producers that depend on predictable shipping schedules. Retailers and automakers also report repeated delays that threaten seasonal inventories and new model launches. These patterns reveal how fragile global supply chains have become whenever key maritime routes face prolonged instability.

McKinsey supply chain expert Knut Alicke notes: “Supply chain resilience is no longer a competitive advantage, it is a necessity” (source: https://www.mckinsey.com/). His conclusion reflects a growing view that companies must redesign logistics systems to withstand repeated shocks. According to the IMF, delays from Red Sea detours have increased manufacturing lead times by 31 percent across Europe. This rise shows how disruptions in one corridor can spread rapidly through wider production networks (IMF reference: https://www.imf.org/).

Industry Level Effects of Supply Chain Disruptions 2024 to 2025The manufacturing and electronics sectors show the largest vulnerability, highlighting how deeply global industries rely on stable maritime connectivity.

“A broken link in supply chains becomes a broken promise in global commerce.”

5. Economic Shockwaves: Inflation, Trade Slumps & Regional Inequalities

The combined effects of Red Sea shipping disruptions and Suez Canal delays have created visible economic stress across global markets. Import dependent regions now face higher consumer prices as freight surcharges and insurance premiums rise. Rerouting costs pass directly into retail inflation and make essential items more expensive. Export driven economies are also struggling to maintain delivery schedules. These delays lead to lost orders, production cuts and widening trade deficits. The pressures intensify existing inequalities between advanced economies and low income states. Many low income regions rely heavily on single corridor supply chains and therefore face deeper vulnerabilities.

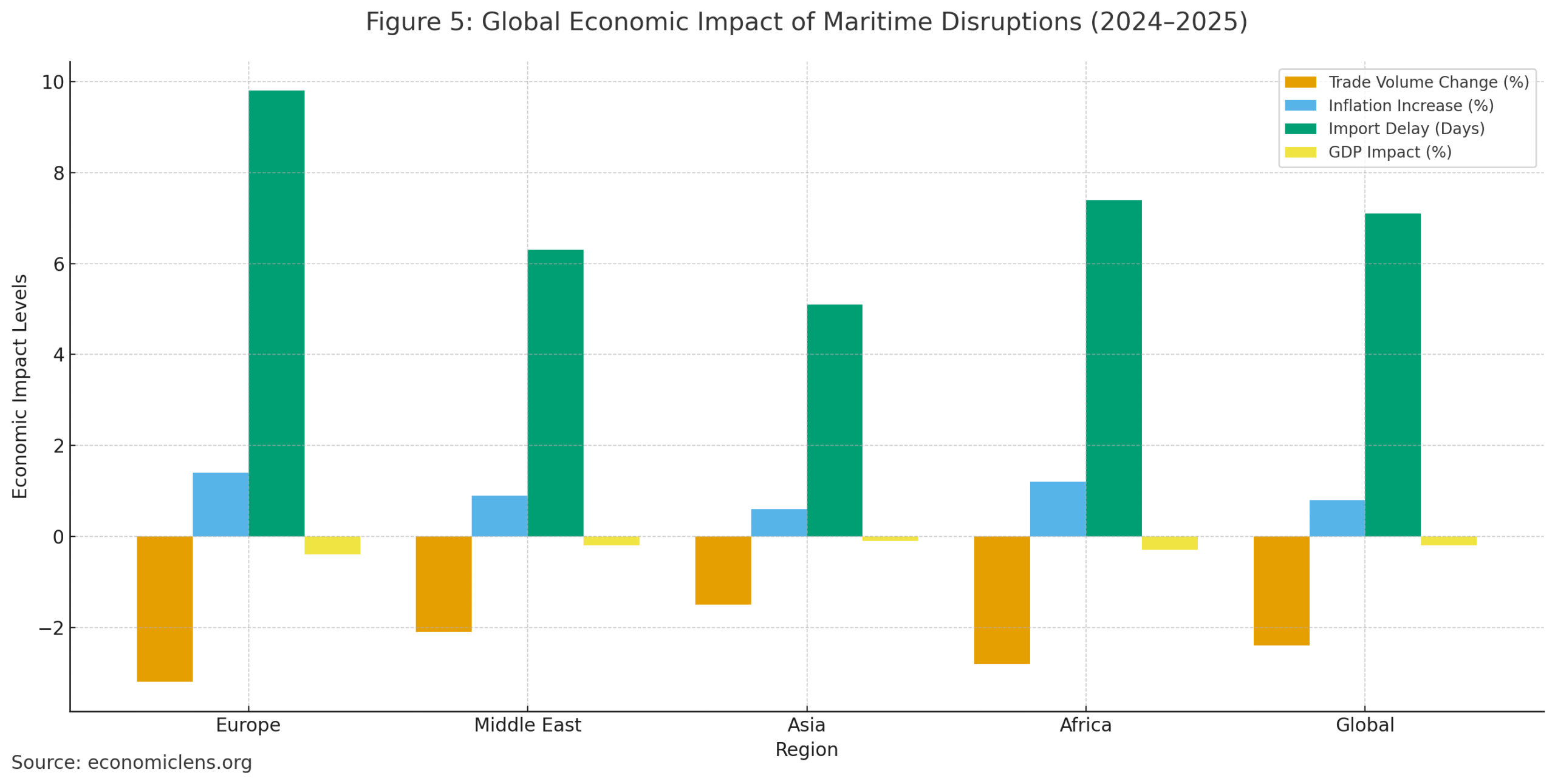

World Bank economist Ayhan Kose explains: “Shipping shocks transmit inflation faster than most policymakers anticipate” (source: https://www.worldbank.org/). This rapid pass through effect is now visible in food markets and essential goods. It is also affecting intermediate inputs used by manufacturing sectors across several continents. OECD data shows global trade volumes contracted by 2.4 percent in early 2025 due to maritime disruptions. This decline signals that prolonged instability is reshaping trade flows and weakening market confidence (OECD trade data: https://www.oecd.org/).

Europe faces the harshest impact due to its heavy dependence on Suez Canal transit for goods from Asia. Emerging markets face disproportionate inflation exposure.

“When global shipping falters, entire economies lose their rhythm.”

6. Policy Pathways

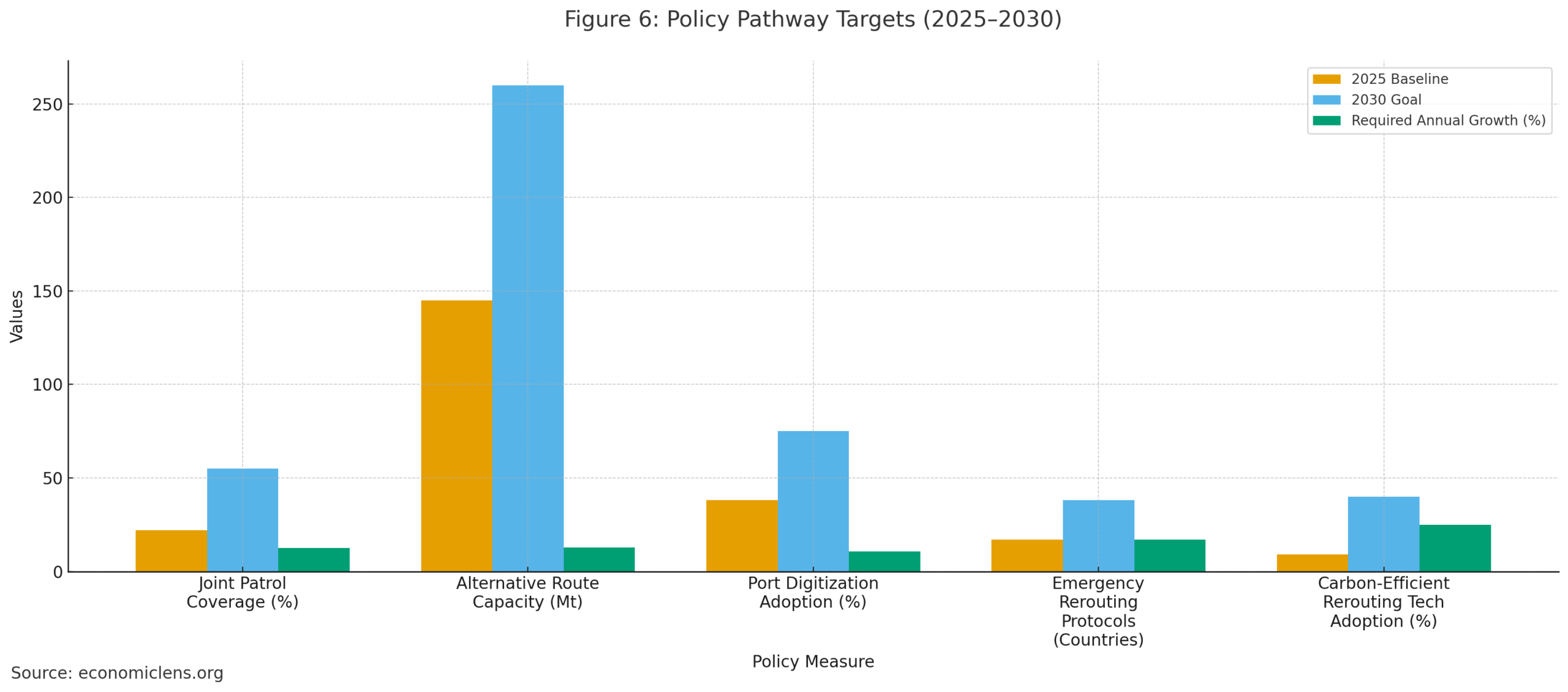

To contain the long term fallout from Red Sea shipping disruptions, governments must adopt a broader and more coordinated policy approach. Strengthening maritime security is essential, but it must be supported with diversified shipping routes, expanded port capacity, modern vessel monitoring systems, and crisis protocols that activate quickly during any escalation. Countries along the Arabian Sea, Mediterranean, East Africa and the Indo Pacific are increasingly recognising that shipping stability depends on shared responsibility rather than isolated national responses.

Former NATO maritime strategist James Stavridis argues: “Maritime chokepoints are global vulnerabilities, only collective security can protect them” (reference: https://www.nato.int/). This view aligns with recent multilateral assessments. OECD’s Trade Security Outlook 2025 stresses the need for joint naval patrols, alternative trade corridors and real time shipping intelligence systems to limit the spread of disruptions into global manufacturing networks (OECD reference: https://www.oecd.org/). The combined evidence shows that long term resilience will depend on regional coordination, transparent data sharing and the development of redundant routes that reduce dependence on a single maritime corridor.

Achieving these targets will require coordinated investment from governments, ports, and private shipping companies.

“Preparedness today prevents paralysis tomorrow.”

Future Outlook

By 2030, the maritime security landscape may stabilize if security coalitions strengthen and if alternative corridors—such as India–Middle East–Europe routes—continue to develop. However, vulnerabilities at critical chokepoints will persist.

Conclusion

The intensification of Red Sea shipping disruptions underscores the fragility of global maritime trade. The world depends on a handful of chokepoints, rendering international commerce highly sensitive to regional instability. Data from freight rates, rerouting patterns, and cargo delays confirms the magnitude of the current global shipping shock. Yet long-term solutions exist through investment, diversification, and coordinated maritime policy. Stable shipping is essential to global economic health. As long as the Red Sea and Suez Canal remain vulnerable, the world must prepare for periodic waves of supply chain disruptions.

Call to Action

Countries must invest in maritime security, diversify shipping corridors, modernize ports, and build rapid-response systems. Businesses should adopt robust risk strategies to manage delays, inflation, and volatility in transport markets.

“The stability of global trade rests on the waves; guard them well.”

3 thoughts on “Red Sea Turmoil: Suez Canal Disruptions and the Global Shipping Shock”

Pingback: Decks and Deals Weekly #19 - GeoTrends

A one

Great job Sir 👍👏