The green energy transition is redefining global growth as renewables surpass coal in electricity generation. This in-depth analysis explores clean energy economics, investment flows, regional dynamics, job creation, and policy priorities shaping a net zero development model.

Introduction

The green energy transition has entered a decisive phase as renewable energy overtakes coal in global electricity generation for the first time. This moment is not symbolic alone. Rather, it marks a structural shift in how modern economies generate power, sustain growth, and manage long-term risk.

Historically, energy transitions unfolded slowly. Coal replaced biomass over decades, while oil displaced coal through gradual industrial change. However, the current green energy transition is unfolding faster because it is driven by both climate constraints and economic incentives. Consequently, growth is increasingly decoupled from emissions rather than constrained by them.

From an economic perspective, this shift aligns with theories of absolute decoupling and endogenous growth. Clean innovation now raises productivity while reducing environmental damage. As a result, investment in renewable systems is strengthening competitiveness, fiscal stability, and resilience, as emphasized by the World Bank’s energy and growth framework (https://www.worldbank.org/en/topic/energy).

Why Coal Is Losing Its Role in a Post-Coal Energy Transition

The declining role of coal is the clearest indicator of the green energy transition in action. Once the backbone of industrial electricity, coal is steadily losing relevance as renewables expand across power systems worldwide.

This decline is not accidental. Instead, it reflects rising costs, regulatory pressures, and financial risk. At the same time, renewable power has become cheaper, cleaner, and easier to deploy. Therefore, utilities and investors are shifting away from coal at an accelerating pace.

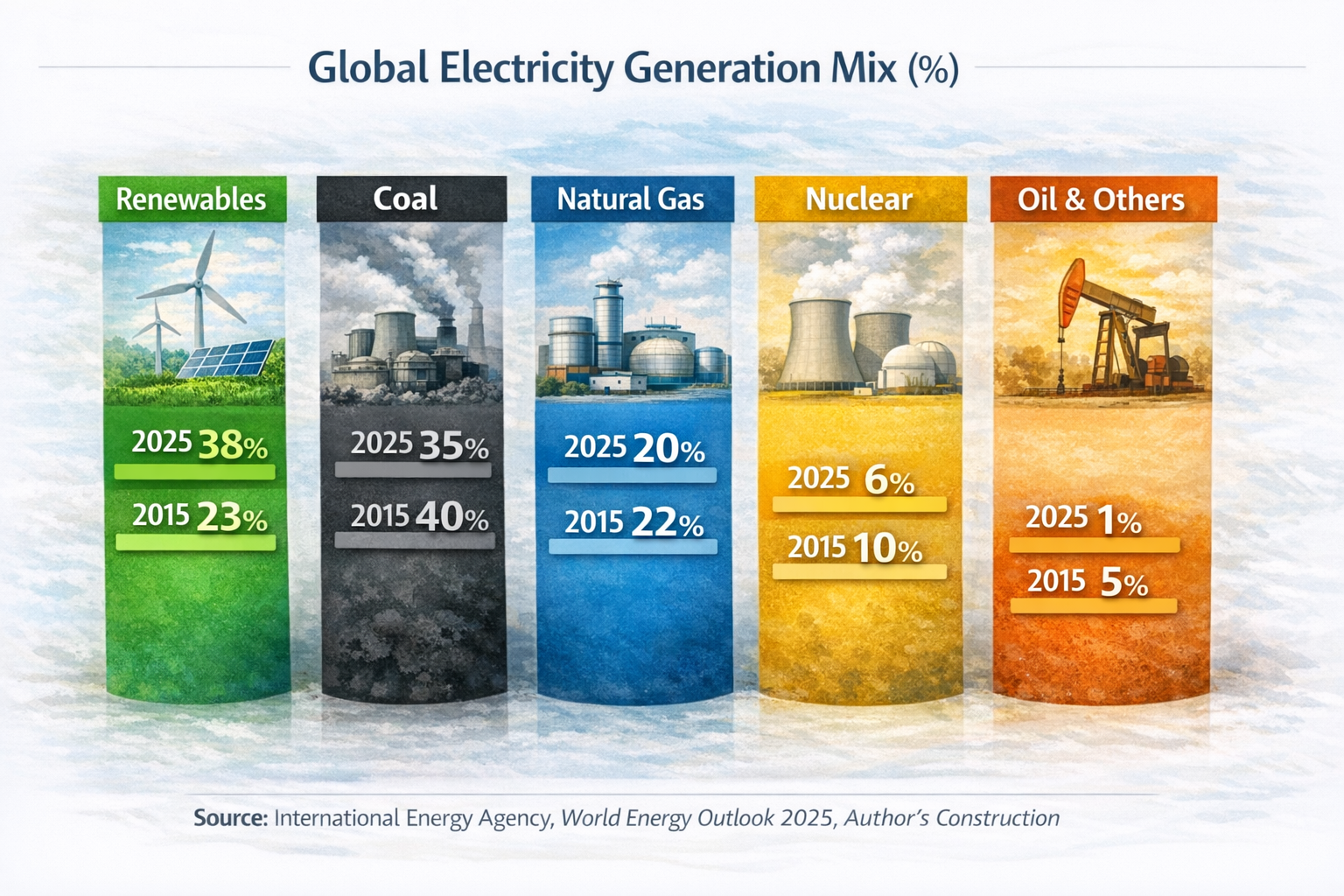

As the table shows, renewables gained roughly 15 percentage points in just one decade. Consequently, solar and wind are now the cheapest sources of new electricity generation in more than two-thirds of global markets.

Cost Dynamics and Market Forces Behind the Clean Energy Transition

The renewable energy transition is fundamentally an economic story. Cost reductions, scale effects, and learning curves have reshaped global power markets.

Since 2010, solar and wind costs have fallen by more than 80 percent. As a result, renewables now outperform fossil fuels even without subsidies. This confirms that the green energy transition succeeds only when clean power consistently undercuts fossil fuels on price and reliability. https://economiclens.org/why-green-energy-needs-to-be-cheaper-than-fossil-fuels-the-future-of-affordable-sustainability/

Moreover, improvements in battery storage, grid digitalization, and carbon pricing have strengthened system stability. According to the International Monetary Fund, clean energy investment now supports productivity growth rather than fiscal risk (https://www.imf.org/en/Topics/climate-change).

Therefore, decarbonization is no longer a trade-off. Instead, it has become a driver of efficiency, innovation, and long-term growth.

Clean Energy Transition and Global Power Markets

The clean energy transition is also reshaping global power relations. Energy influence is gradually shifting away from fossil fuel exporters toward countries with renewable capacity, industrial scale, and mineral access.

Previously, oil supply shocks shaped inflation, trade balances, and political leverage. However, repeated instability in traditional energy corridors now highlights the economic vulnerability of fossil dependence (https://economiclens.org/energy-warfront-middle-east-escalation-global-oil-market-volatility/).

Consequently, the clean energy transition reduces external risk while improving macroeconomic stability.

Regional Dynamics of the Green Energy Transition

Although the green energy transition is global, its pace differs across regions. Geography, policy frameworks, and finance shape distinct outcomes.

Europe’s progress reflects regulatory certainty. Asia benefits from scale and manufacturing depth. Meanwhile, Africa’s decentralized solar systems directly link clean energy expansion with inclusion and poverty reduction.

Financing Pathways for the Net Zero Energy Transition

Financing determines the speed and equity of the net zero energy transition. Although technology costs have declined, capital access remains uneven.

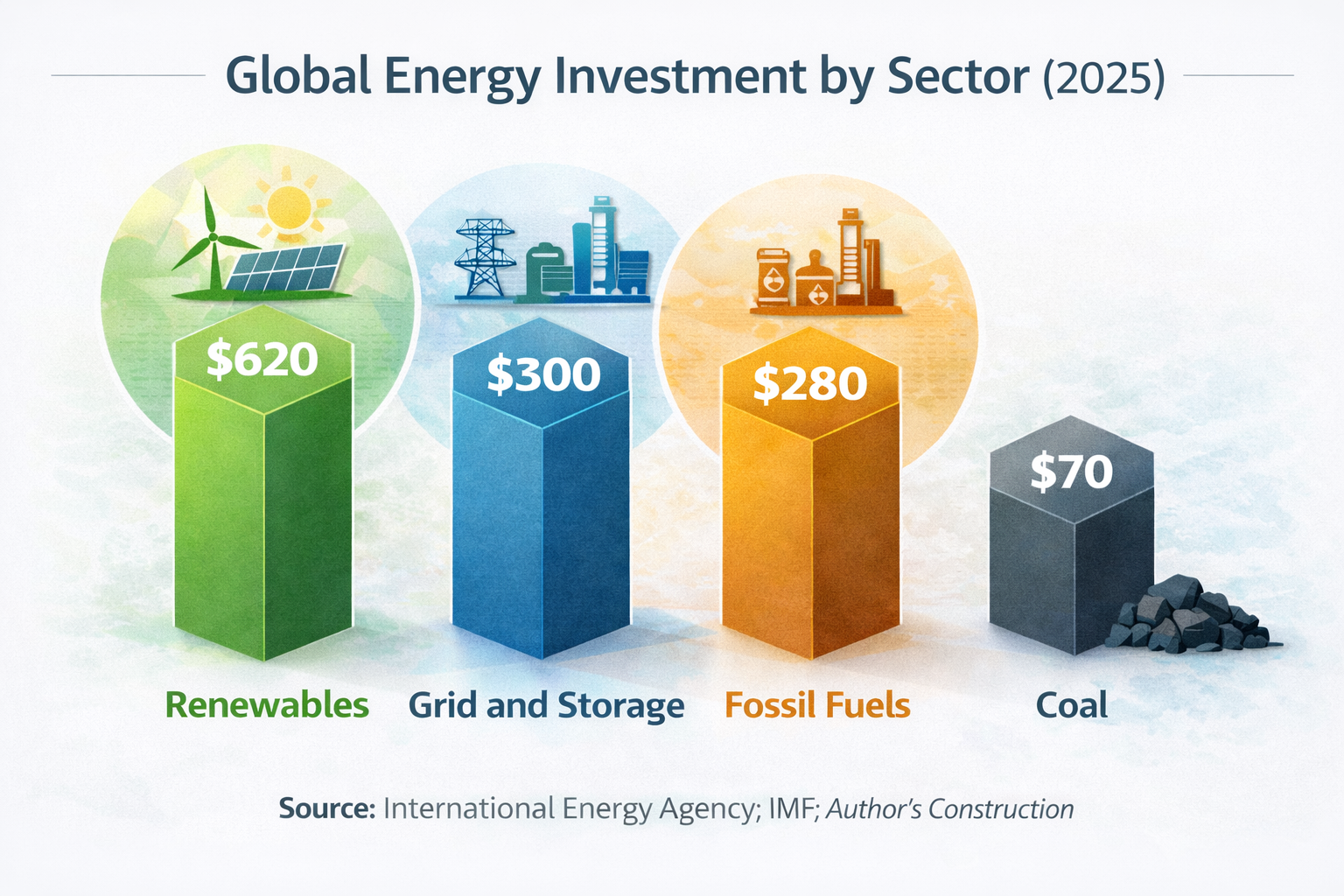

Global renewable investment reached approximately $620 billion in 2025. However, most of this capital flowed to advanced economies.

As a result, financing gaps persist in emerging markets. This raises concerns about whether current flows can sustain a truly global green energy transition (https://economiclens.org/green-energy-transition-can-we-finance-the-green-energy-transition-by-2025/).

Therefore, concessional finance, blended instruments, and subsidy reform remain essential.

Critical Minerals in a Decarbonized Energy Transition

The decarbonized energy transition depends critically on access to minerals such as lithium, cobalt, nickel, copper, and rare earth elements. These inputs are essential for batteries, wind turbines, grid expansion, and large-scale energy storage. As renewable deployment accelerates, mineral availability has therefore shifted from a secondary concern to a central economic and geopolitical constraint.

According to the International Energy Agency, demand for these minerals could quadruple by 2040 under a net zero pathway. Consequently, countries with underdeveloped but resource-rich mineral bases face a dual challenge. They must manage supply risks while capturing new growth opportunities. This dynamic is particularly relevant for Pakistan, where gaps in extraction capacity, governance, and value-chain integration coexist with significant long-term potential in a post-coal global economy, as examined in Pakistan’s critical minerals economy: risks, gaps, and growth potential (https://economiclens.org/pakistan-critical-minerals-economy-risks-gaps-and-growth-potential/).

Consequently, recycling, diversification, and strong governance are necessary to avoid replacing fossil dependence with mineral dependence.

Labor Markets and Distributional Effects of Energy Transformation

The green energy transition is also a labor market transformation. Renewable sectors are expanding rapidly, while fossil-based regions face adjustment pressures.

Renewables now employ more workers globally than fossil fuels combined. However, without retraining and income protection, social resistance could slow the transition.

The Economic Payoff of Net Zero Pathways

Beyond emissions reduction, the green energy transition generates a measurable economic dividend. This includes productivity gains, avoided climate damages, and improved health outcomes.

Increasingly, decarbonization is understood as a growth strategy rather than a constraint. Green investment now enhances competitiveness and fiscal stability (https://economiclens.org/decarbonization-and-green-investments-unlocking-a-profitable-and-sustainable-future/).

Policy Choices That Will Shape the Energy Transition Outcome

Governments must align fiscal, industrial, and trade policies with green energy transition goals. Climate finance should prioritize developing economies. Workforce transition policies must safeguard inclusion. At the same time, critical mineral supply chains require coordinated global governance.

Final Word

The green energy transition marks a defining moment in economic history. Growth and environmental responsibility now reinforce each other rather than conflict. Countries leading this transition are redefining prosperity itself.

As the International Energy Agency concludes, the energy race of the twenty-first century will be won not by those who extract the most carbon, but by those who generate the most clean power.

1 thought on “Renewables Overtake Coal as the Green Energy Transition Reshapes Global Growth”

Great I learned a lot from this blog keep growing and shining 🌟