Semiconductor export controls are reshaping global chip supply and intensifying strategic competition among major powers. These restrictions influence lithography access, chip production and research capability. As nations pursue sovereignty and security, global chip supply tensions rise, reshaping innovation, manufacturing and long term economic strategy.

INTRODUCTION

Semiconductor export controls have become one of the strongest forces shaping global technology and geopolitical competition. These controls determine which countries can access advanced chips, high precision lithography tools and powerful design software. Because these technologies support artificial intelligence, military systems, telecommunications and industrial automation, nations now treat semiconductor regulation as a core component of their security and economic strategy. As a result, semiconductor export controls influence national planning, supply chain design and long term industrial performance.

Moreover, tightening restrictions affect firms that depend on advanced chips for production and innovation. Companies respond by diversifying suppliers, increasing inventory and adjusting investment plans. Countries that depend on imported chips introduce new incentives to support domestic fabrication and research. Consequently, global chip supply tensions continue to rise as nations compete for technological advantage.

The strategic rivalry between the United States and China accelerates this shift. Export rules, investment restrictions and procurement policies increasingly shape research, trade routes and industrial cooperation. Meanwhile, emerging economies seek greater control over semiconductor ecosystems to reduce vulnerability and secure future competitiveness.

Since chips underpin nearly every modern technology, understanding how semiconductor export controls reshape markets and alliances is essential. Businesses, governments and investors must prepare for a more fragmented and competitive environment where technology access determines economic strength and global influence.

1. Semiconductor Export Controls and the Rise of Strategic Technology Power

Semiconductor export controls now guide the strategic direction of global technology and national security. These controls determine which nations can obtain advanced chips, high end lithography machines and sophisticated design tools. Because these technologies shape artificial intelligence, defense platforms and industrial automation, governments place increasing importance on semiconductor policy. Therefore, export restrictions have become central to national strategy and long term industrial development.

Furthermore, semiconductor export controls influence corporate operations and investment. Firms redesign supply chains, expand fabrication partnerships and diversify suppliers. Countries that depend on imported chips launch research incentives and build new fabrication capacity. Consequently, the global race for semiconductor capability accelerates as governments compete for leadership.

Although semiconductor trade was once more open, expanding restrictions mark a structural shift. Export rules now influence innovation cycles, investment decisions and research collaboration. Additionally, the growth of advanced semiconductor restrictions highlights the strong connection between technology access and geopolitical influence.

Since global chip supply tensions continue to rise, understanding the impact of semiconductor export controls is essential. Firms, policymakers and investors must prepare for an environment in which access to critical technologies shapes competitiveness, resilience and strategic outcomes.

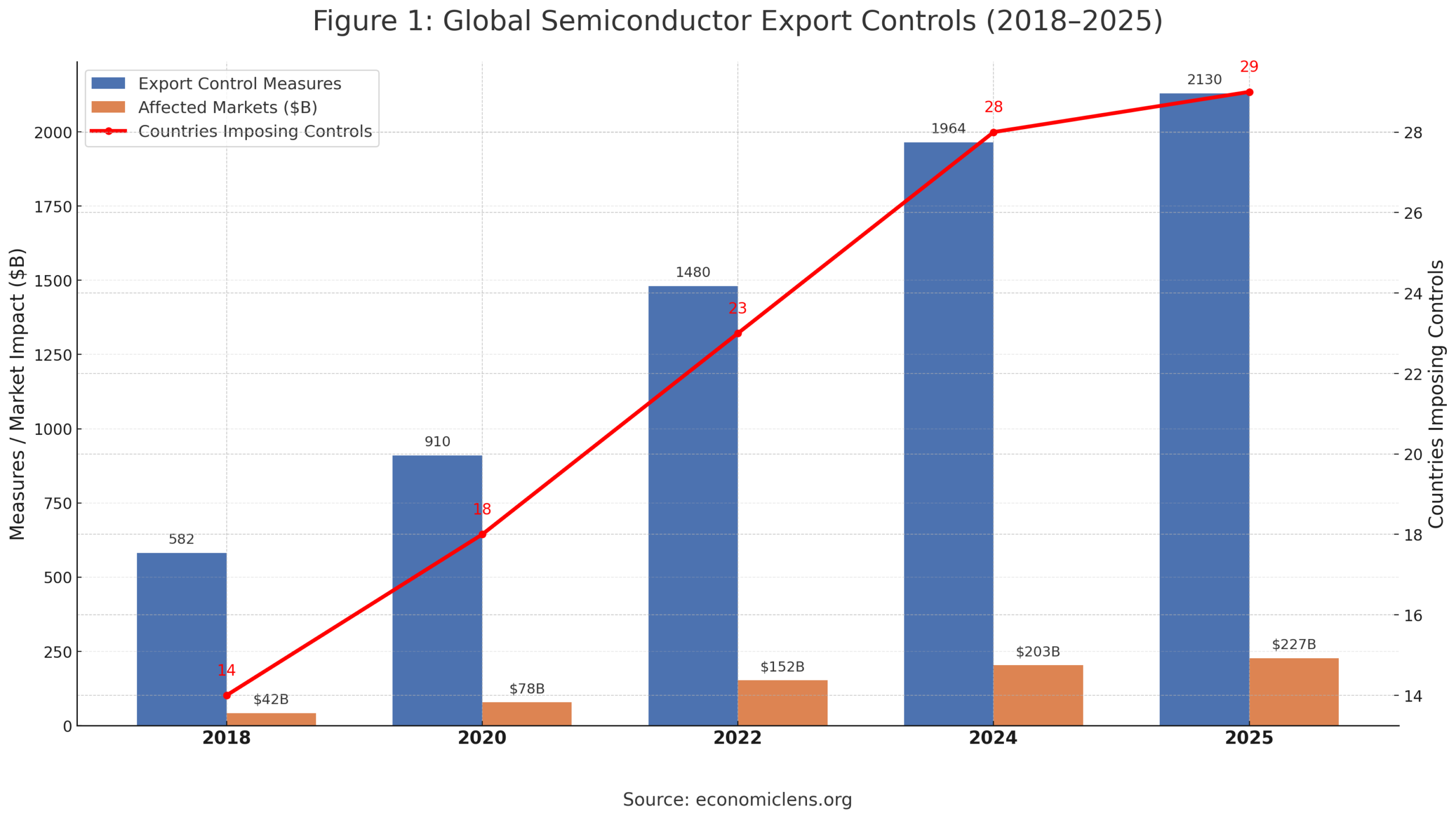

Expert Insight and Global Report Signals

CSIS expert Gregory Allen (https://www.csis.org/programs/technology-and-national-security-program) explains how semiconductor export controls now function as strategic instruments influencing national capability. The WTO Technology Restrictions Review (https://www.wto.org/english/res_e/reser_e/tech_restrictions_report2024_e.htm) shows that semiconductor related export measures increased from 582 in 2018 to more than 1,960 in 2024. The Semiconductor Industry Association reports (https://www.semiconductors.org/wp-content/uploads/2025/07/SIA-State-of-the-Industry-Report-2025.pdf) that advanced semiconductor restrictions influence more than 230 billion dollars in annual trade.

For deeper context on how export controls shape global power, see our related analysis on AI export restrictions: (https://economiclens.org/the-new-tech-cold-war-how-ai-export-controls-are-redrawing-global-power/)

The data confirms that semiconductor controls have expanded rapidly, with more countries targeting AI grade GPUs, advanced lithography machines, chip design software and semiconductor materials. Measures now affect nearly 230 billion dollars in trade.

Japan’s Chemical Controls, Photolithography Delays and Chip Export Restriction Pressures

Japan tightens regulations on high purity chemicals needed for photolithography processes. Korean and Taiwanese fabrication plants report slower shipments, additional compliance steps and frequent delivery interruptions. These delays add pressure to regions already affected by advanced semiconductor restrictions. Consequently, manufacturing hubs adjust production schedules and prepare for continued global chip supply tensions.

“Nations that control semiconductor access today will shape the future of power and innovation.”

2. Global Chip Supply Tensions Under Expanding Chip Export Restrictions

Global chip supply tensions continue to rise as expanding chip export restrictions reshape production networks, logistics routes and investment priorities. Nations rely heavily on advanced chips for automobiles, telecommunications equipment, industrial machinery and consumer electronics. Therefore, disruptions in access to fabrication tools or materials influence several industries at once. As these pressures increase, governments reassess supplier concentration and pursue diversification strategies to reduce national vulnerability.

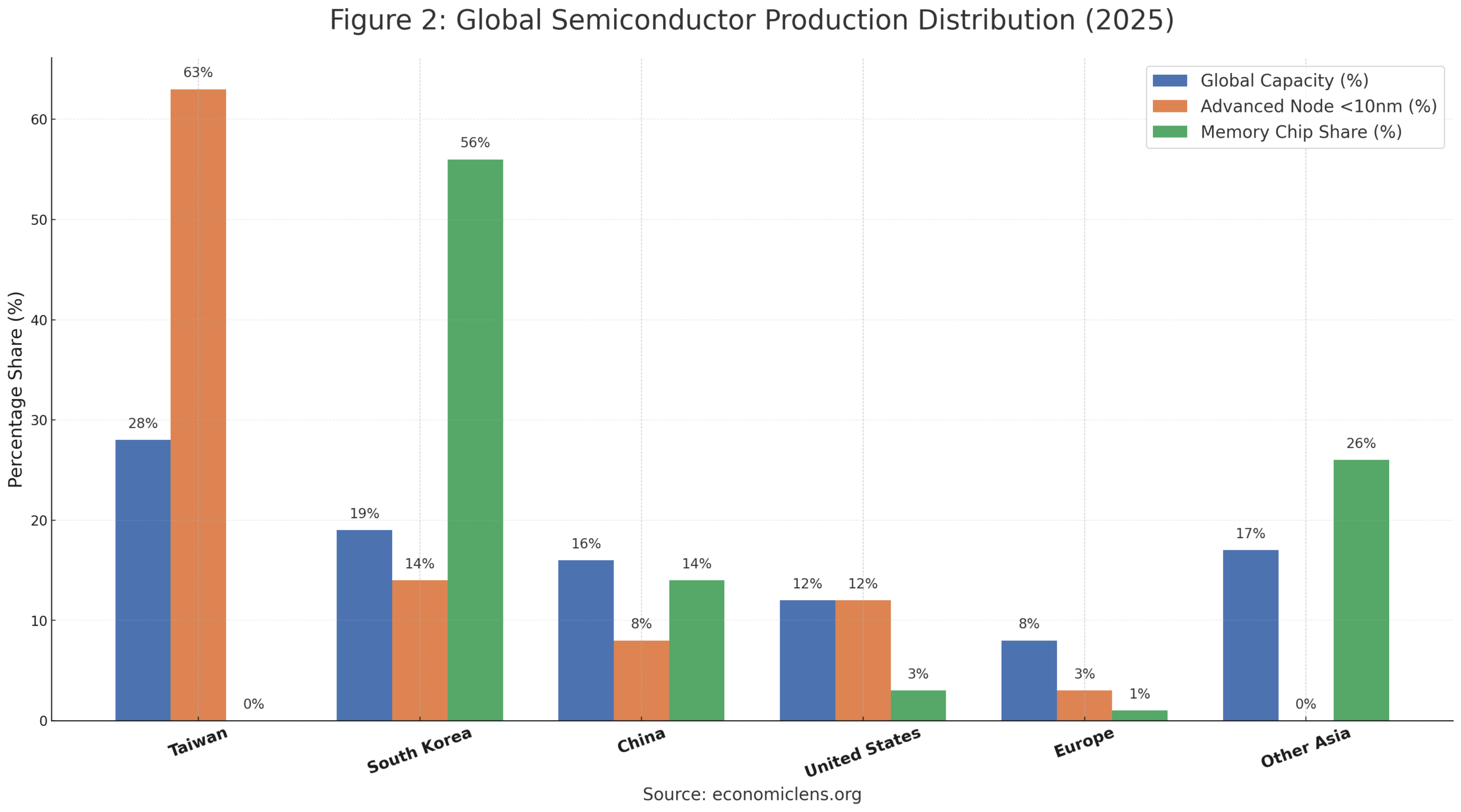

Additionally, the heavy concentration of advanced semiconductor manufacturing in East Asia intensifies risk. Taiwan maintains a dominant position in advanced node logic chips, while Korea leads memory chip production. The United States and Europe depend on imported chips, a dependence that increases exposure during geopolitical friction. Consequently, global chip supply tensions grow whenever export restrictions affect essential tools, materials or design software.

Firms respond by securing alternative sources, negotiating long term supplier contracts and building larger safety inventories. These adjustments offer short term stability; however, they also highlight long term structural constraints. Moreover, emerging economies expand investments in new fabrication facilities to reduce dependence on advanced hubs. As a result, competition for fabrication capacity, engineering talent and specialized inputs continues to accelerate.

Given these dynamics, global chip supply tensions now shape production schedules, economic planning and investment outlooks. Firms and governments must anticipate sustained pressure and prepare for unpredictable disruptions across semiconductor value chains.

Expert Insight and Global Report Signals

McKinsey’s Semiconductor Industry Perspective (https://www.mckinsey.com/industries/semiconductors/our-insights) highlights that more than 72 percent of global semiconductor manufacturing is concentrated in East Asia, creating systemic vulnerability. The OECD Science, Technology and Innovation Outlook (https://www.oecd.org/sti/oecd-science-technology-and-innovation-outlook-25186167.htm) identifies fragmentation and capacity concentration as major risks to global technology stability. TSMC founder Morris Chang (https://www.tsmc.com/english) notes that semiconductor globalization is weakening, increasing reliance on a small number of fabrication hubs.

This manufacturing imbalance intensifies global chip supply tensions. Advanced node concentration in Taiwan and Korea increases systemic risk in scenarios involving geopolitical conflict, natural disasters or export restrictions.

Taiwan Flood Disruptions, Factory Shutdowns and Global Chip Supply Tension Escalation

Severe flooding in southern Taiwan forces temporary shutdowns at major fabrication plants. Water damage, blocked transport routes and delayed equipment deliveries disrupt production. These interruptions intensify global chip supply tensions and slow shipments to automotive, smartphone and cloud computing firms. Consequently, companies adjust output schedules and prepare for further volatility.

“When production depends on a few regions, even one disruption can shift the global economy.”

3. U.S.–China Chip War Pressures and Technology Export Limit Dynamics

The U.S.–China chip war has become one of the most influential forces shaping global semiconductor strategy. The United States aims to restrict China’s access to advanced chips, GPU accelerators, lithography systems and specialized EDA software. China responds by expanding domestic chipmaking, developing alternative architectures and building parallel supply routes. Because these moves influence research, industrial automation and military capability, the U.S.–China chip war reshapes global power relationships. Consequently, technology export limits function as strategic tools that guide economic and geopolitical competition.

Export controls on AI chips, lithography equipment and high performance compute systems limit China’s access to frontier technologies. These restrictions slow high end research cycles and increase reliance on domestic substitutes. China expands subsidies, accelerates fabrication construction and strengthens procurement policies. As a result, the push for chip sovereignty becomes a national priority.

Meanwhile, U.S. firms adjust supply chains and diversify production by partnering with allied countries. Multinational corporations review geopolitical risks and relocate manufacturing segments to reduce exposure. Moreover, these adjustments reshape global trade routes and alter investment decisions.

Because the U.S.–China chip war defines the pace of technology competition, export limits and retaliatory measures will likely intensify. Understanding these dynamics is essential for firms and policymakers preparing for a more divided global landscape.

Expert Insight and Global Report Signals

The WTO World Trade Outlook 2025 (https://www.wto.org) reports that technology export controls and geopolitical tension continue to reshape global supply routes for advanced manufacturing. The IMF External Sector Report 2025 (https://www.imf.org/en/publications) notes widening current account pressures for economies dependent on semiconductor imports and technology intensive goods. The U.S. CHIPS Act (https://www.commerce.gov/chips) updates from the Commerce Department highlight accelerating domestic investment as firms respond to strategic constraints.

For deeper macroeconomic context, see our related analysis “AI Capital Frenzy: The 2025 Global Power Shift”: (https://economiclens.org/ai-capital-frenzy-the-2025-global-power-shift/)

Trade flows between the United States and China have weakened as both sides expand technology controls. Producers reroute sensitive components through Southeast Asia, although these hubs face rising compliance requirements. European exporters also report lower demand for advanced machinery. Consequently, the trade effects extend beyond U.S.–China channels and influence global production networks.

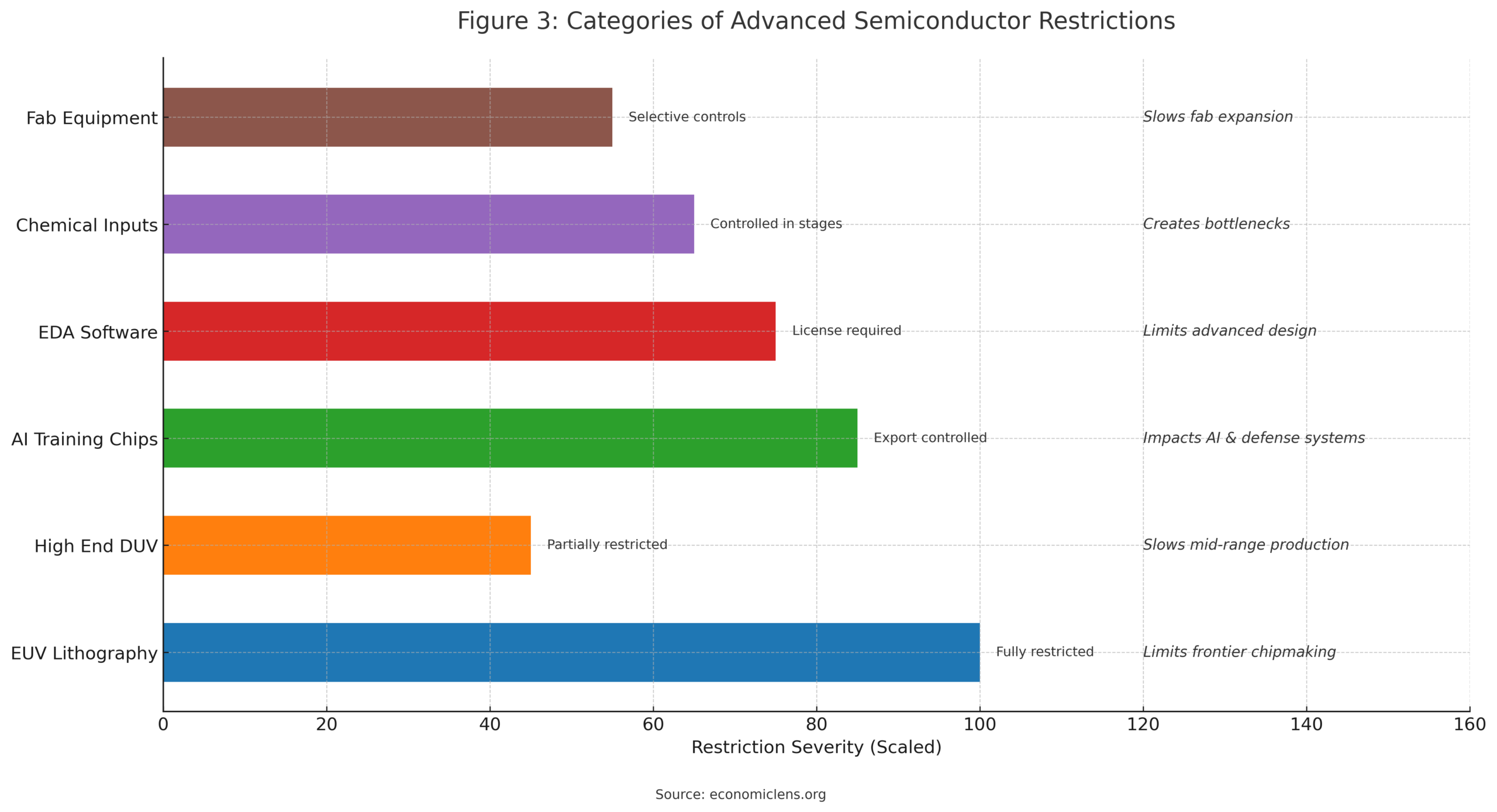

The table clarifies how advanced semiconductor restrictions control crucial elements of next generation chip production. Export controls in these categories are designed to inhibit China’s ability to compete at the technological frontier.

China’s Rare Earth Controls, Component Tightness and U.S.–China Chip War Escalation

China strengthens oversight of rare earth exports used in chip components, EV motors and advanced electronics. Firms report tight supply conditions, higher procurement costs and longer contract negotiations. These measures signal strategic escalation within the U.S.–China chip war. Consequently, companies diversify sourcing, build larger inventories and reassess long term supplier relationships.

“When technology rivalry defines global power, every chip becomes a strategic asset.”

4. Semiconductor Supply Chain Fragmentation and Global Economic Spillovers

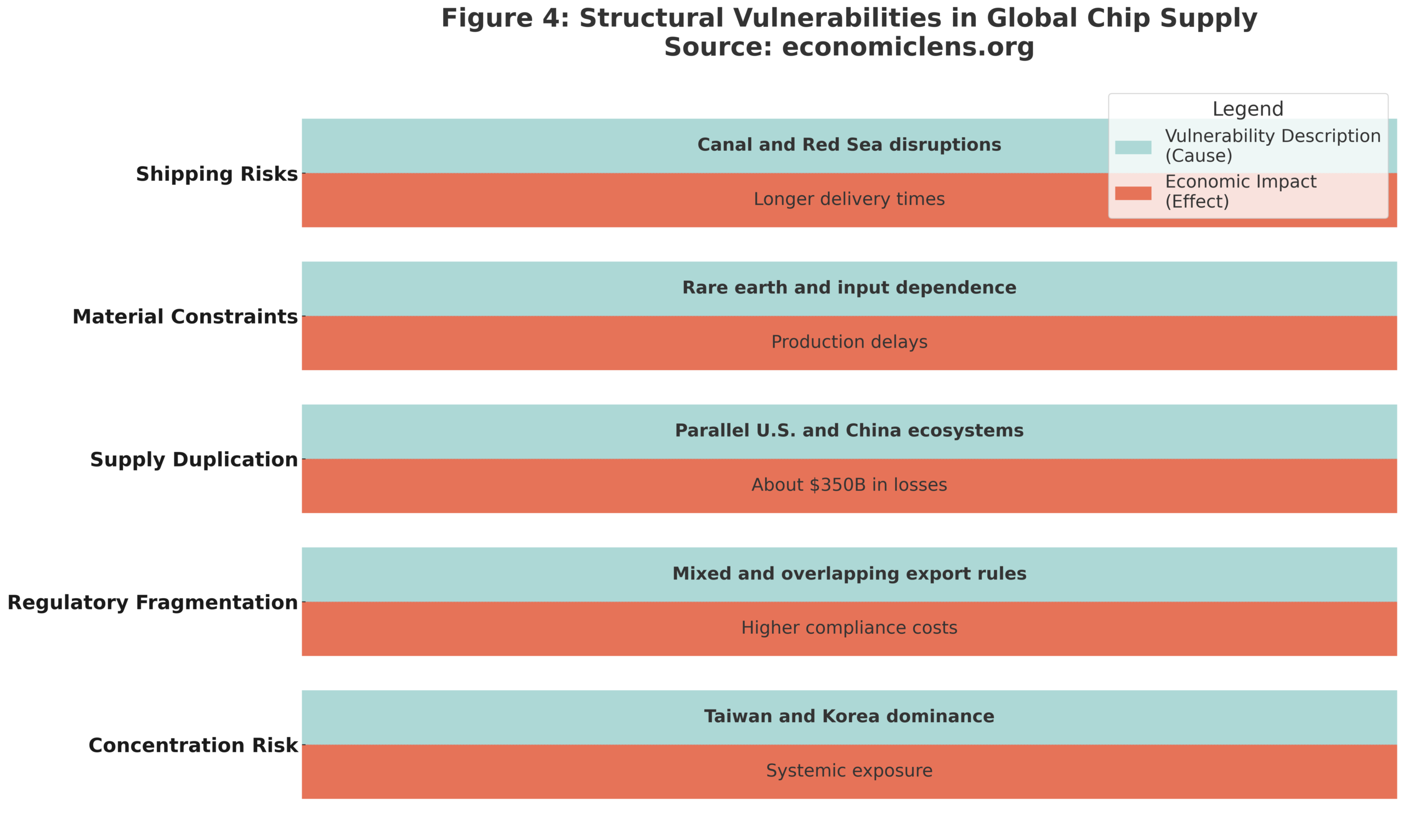

Semiconductor supply chain fragmentation is becoming one of the most significant structural risks facing global manufacturing. Fragmentation occurs when nations impose export controls, duplicate semiconductor production lines or redirect critical technology flows. Because semiconductor export controls limit access to essential tools and materials, fragmentation spreads across economies that rely on stable chip supplies. As these pressures intensify, firms face higher procurement costs, more frequent delays and increased operational uncertainty.

Semiconductors are foundational to vehicles, electronics, medical devices, energy systems and defense applications. Therefore, interruptions in chip production create ripple effects that influence multiple industries. Companies respond by redesigning supply chains, increasing inventory and expanding supplier networks. Consequently, supply chain fragmentation increases financial strain and reduces efficiency.

Moreover, duplicating semiconductor ecosystems significantly raises global costs. McKinsey estimates that fragmentation and duplication may add more than 350 billion dollars to global semiconductor expenses over the next decade. These burdens fall unevenly, widening gaps between advanced economies and countries with limited production capacity. As a result, fragmentation reshapes global trade routes, investment strategies and industrial competitiveness.

Given these pressures, stronger resilience strategies are essential. Nations must consider joint research platforms, coordinated investment frameworks and regional partnerships that reduce long term vulnerability. Without cooperation, global chip supply tensions are likely to continue rising.

Expert Insight and Global Report Signals

The WTO World Trade Outlook 2025 (https://www.wto.org) notes that supply chain disruptions linked to technology restrictions continue to slow the movement of high value goods. The IMF External Sector Report 2025 (https://www.imf.org/en/publications) highlights rising external imbalances in economies dependent on imported semiconductors. The OECD Technology Governance Outlook (https://www.oecd.org/technology) shows that fragmented semiconductor ecosystems increase systemic risk by raising compliance costs and slowing technology transfer.

Trade activity in Southeast Asia continues to rise as producers reroute goods through Vietnam, Thailand and Malaysia. However, these hubs face higher compliance burdens and limited capacity. European exporters also report weaker demand for precision machinery and industrial inputs. Consequently, supply chain fragmentation affects global production networks far beyond the semiconductor industry.

China remains heavily dependent on foreign AI chip architecture but continues to scale domestic alternatives. U.S. export controls have slowed but not halted Chinese advancement.

Vietnam Power Outages, Packaging Delays and Semiconductor Supply Chain Fragmentation

A multi day power outage in northern Vietnam shuts down packaging and testing facilities that support major electronics brands. These disruptions delay shipments of components used in consumer devices and cloud servers. The event exposes the vulnerability of downstream operations. Consequently, firms accelerate diversification plans for assembly and testing hubs.

“A fragmented chip ecosystem creates vulnerabilities that shape global winners and losers.”

5. Chip Sovereignty and Policy Pathways for Reducing Semiconductor Export Control Vulnerabilities

Chip sovereignty has become a central priority for governments seeking to reduce reliance on foreign suppliers and strengthen national technology resilience. Semiconductor export controls accelerate this shift by limiting access to advanced chips, lithography systems and specialized materials. Because these technologies underpin artificial intelligence, defense capability and advanced manufacturing, nations now frame semiconductor strategy as a foundation of long term economic security. Consequently, investments in domestic fabrication, talent development and upstream material production continue to expand across major economies.

At the same time, semiconductor export controls expose weaknesses in global governance. Countries face rising compliance burdens, fragmented licensing rules and inconsistent technology classifications. Therefore, policy pathways must balance national sovereignty with international cooperation. Without alignment, overlapping export controls may increase costs, disrupt innovation and deepen supply chain fragmentation.

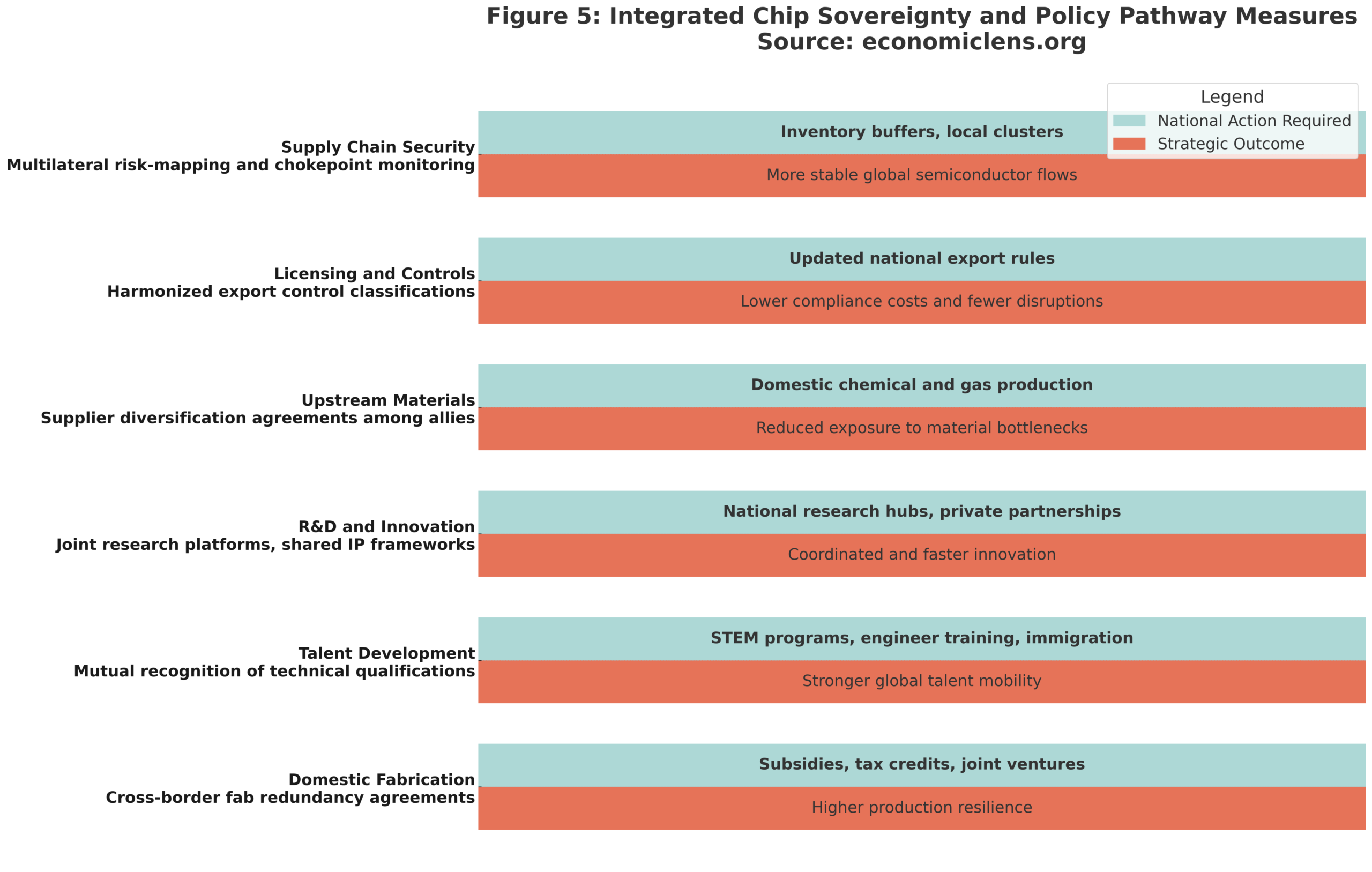

A successful approach requires two layers of action. The first layer focuses on internal capability. Governments invest in fabrication plants, subsidize research centers, improve STEM pipelines and secure upstream supply agreements. These measures strengthen national preparedness for geopolitical shocks. The second layer focuses on shared governance. Nations coordinate export licensing, harmonize technology rules, expand joint research programs and develop transparent risk-mapping frameworks. These steps help reduce global friction and stabilize long term semiconductor flows.

As export controls intensify, nations that integrate both domestic sovereignty plans and cooperative policy pathways will strengthen their competitiveness. Those that overlook either dimension risk greater vulnerability, slower innovation and reduced strategic influence.

Expert Insight and Global Report Signals

The WTO World Trade Outlook 2025 (https://www.wto.org) notes that technology restrictions have accelerated the need for domestic semiconductor capability across advanced economies. The IMF Industrial Policy Review 2025 (https://www.imf.org/en/publications) highlights expanding public investment aimed at lowering vulnerability to foreign technology supply shocks. The OECD Science, Technology and Innovation Outlook (https://www.oecd.org/sti) emphasizes that coordinated policy frameworks, shared R&D structures and transparent licensing rules are essential for semiconductor resilience.

Europe advances its Chips Act to reinforce sovereignty, while Japan expands cooperation agreements for advanced manufacturing. These developments show how sovereignty and international alignment now evolve together.

Structural risks amplify global chip supply tensions. Taiwan’s vulnerability remains the most significant systemic exposure for advanced node production.

India’s Semiconductor Mission, Global Partnerships and Policy Momentum

India expands its national semiconductor mission with new incentives for fabrication, packaging and compound semiconductor research. Several global firms express interest in joint ventures focused on design and advanced nodes. Foreign partners highlight India’s improving policy transparency and strong engineering talent pool. These developments indicate a growing role for India in both domestic capability building and coordinated regional supply chain planning. Consequently, the country strengthens its position in emerging semiconductor ecosystems while reducing reliance on external suppliers.

“Nations that combine sovereignty with cooperation will define the next technological era.”

CONCLUSION: The Strategic Future of Semiconductor Export Controls

Semiconductor export controls now shape the direction of global technology, security and economic competition. As nations tighten access to advanced chips, lithography tools and design software, supply chains become more fragmented and innovation cycles slow for countries facing restrictions. At the same time, countries with access to advanced systems strengthen their competitive position. Because chips are central to artificial intelligence, defense systems, automation and communication networks, semiconductor policy will continue to influence global power dynamics.

Ultimately, the nations that combine strong domestic manufacturing with smart partnerships and resilient supply chains will define the next wave of technological leadership.

CALL TO ACTION

Policymakers, firms and investors must recognize that semiconductor export controls will shape global competitiveness for many years. Therefore, the time to strengthen supply security, invest in talent and build diversified ecosystems is now.

Every country, company and institution must choose whether to lead, adapt or fall behind in the next era of technological competition.